Professional Documents

Culture Documents

Answer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS Preparation

Answer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS Preparation

Uploaded by

kakaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS Preparation

Answer (Question) Module 4 Quiz 1 Adjusting Entries, Worksheet, FS Preparation

Uploaded by

kakaoCopyright:

Available Formats

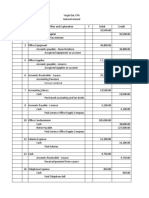

Module 4 Quiz 1 Adjusting entries, Worksheet, FS preparation

The accounts and their balances in the ledger of Gray Company on December 31, 2019 are as follows

GRAY COMPANY

Trial Balance

December 31, 2019

Cash P 72,000 P

Accounts Receivable 331,000

Prepaid insurance 48,000

Supplies 125,000

Land 170,000

Building 850,000

Accumulated Depreciation-building 230,000

Computer Equipment 620,000

Accumulated Depreciation-computer equipment 106,000

Notes Payable 550,000

Accounts Payable 143,000

Salaries Payable

Interest Payable

Utilities Payable

Unearned Computer-Aided Design Revenue

Mortgage Payable 470,000

Gray, Capital 310,000

Gray, Withdrawal 250,000

Computer-Aided Design Revenue 1,470,000

Salaries Expense 813,000

Insurance Expense

Supplies Expense

Depreciation Expense-building

Depreciation Expense-Computer equipment

Utilities Expense

Interest Expense _________ ________

Totals P 3,279,000 P

3,279,000 The following information pertaining to the year-end adjustments is available:

a. Interest expense incurred but not paid at Dec. 31, P 23,000

b. Insurance expired during the year is P12,000.

c. Supplies on hand at December 31, are P72,000.

d. Depreciation of building for the year is P15,000.

e. Depreciation of computer equipment for the year is P18,000.

f. Accrued salaries amounted to P72,000.

g. Unpaid utilities bill at year end amounted to P9,000

h. Unearned Computer-Aided Design Revenue totaled P30,000 at year end.

Required:

1. Journalize the adjusting entries.

2. Prepare a 10-column worksheet.

3. Prepare the income statement, a statement of changes in equity and a balance sheet.

You might also like

- Chapter 07, Modern Advanced Accounting-Review Q & ExrDocument32 pagesChapter 07, Modern Advanced Accounting-Review Q & Exrrlg481476% (17)

- Saet Work AnsDocument5 pagesSaet Work AnsSeanLejeeBajan89% (27)

- Salvacion CapistranoDocument14 pagesSalvacion CapistranoHazel Ann DuermeNo ratings yet

- FAR Chapt 11 Answer KeyDocument19 pagesFAR Chapt 11 Answer KeyJerickho JNo ratings yet

- Problem #7: Recording Transactions in A Financial Transaction WorksheetDocument17 pagesProblem #7: Recording Transactions in A Financial Transaction Worksheetfabyunaaa100% (1)

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Worksheet MerchandisingDocument6 pagesWorksheet MerchandisingLyca Mae CubangbangNo ratings yet

- 2021 IFRS 1 First-Time Adoption of International Financial Reporting Standards - FinalDocument48 pages2021 IFRS 1 First-Time Adoption of International Financial Reporting Standards - FinalLuisa LuiNo ratings yet

- Assignment Adjusting EntriesDocument2 pagesAssignment Adjusting EntriesKim Patrick VictoriaNo ratings yet

- Answer Key - Exercises - Adjusting EntriesDocument4 pagesAnswer Key - Exercises - Adjusting EntriesAlexa AbaryNo ratings yet

- Financial WorksheetDocument6 pagesFinancial WorksheetCelyn DeañoNo ratings yet

- 14 AdjustmentsssDocument7 pages14 AdjustmentsssZaheer Ahmed SwatiNo ratings yet

- Kingfishe R Abm Cup: (Gr. 11 Edition)Document72 pagesKingfishe R Abm Cup: (Gr. 11 Edition)Mikay Torio100% (1)

- Exercise - Accounting - Worksheet - Historia CompanyDocument15 pagesExercise - Accounting - Worksheet - Historia Companytristan ignatiusNo ratings yet

- Arima Kousei QuizDocument2 pagesArima Kousei QuizKen Alob100% (1)

- Chapter 1Document13 pagesChapter 1JacobMauckNo ratings yet

- Study Guide Chap 09Document29 pagesStudy Guide Chap 09Ahmed RawyNo ratings yet

- ACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsDocument1 pageACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsMiguel Lulab100% (1)

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Simple and Compound EntryDocument4 pagesSimple and Compound EntryJezeil DimasNo ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- Financial Statemtents ShortDocument7 pagesFinancial Statemtents Shortgk concepcionNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting Entriesitsayuhthing100% (1)

- Seatwork 03 - DingcongDocument8 pagesSeatwork 03 - DingcongJheilson S. DingcongNo ratings yet

- Luyong - 4TH Q - Fabm1Document3 pagesLuyong - 4TH Q - Fabm1Jonavi LuyongNo ratings yet

- Exercise Periodic and PerpetualDocument4 pagesExercise Periodic and PerpetualYally100% (1)

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- Accounting Worksheet Problem 4Document19 pagesAccounting Worksheet Problem 4RELLON, James, M.100% (1)

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- Accounting Cycle 1 768 290 Worksheet BSDocument27 pagesAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoNo ratings yet

- AccountingDocument5 pagesAccountingAbe Loran PelandianaNo ratings yet

- 600 Assembly Work: 2x + 6y 480Document5 pages600 Assembly Work: 2x + 6y 480John Louie DungcaNo ratings yet

- Castro Company ZABALLADocument11 pagesCastro Company ZABALLAHelping Five (H5)No ratings yet

- Adjusting Entries Prob 3 4Document4 pagesAdjusting Entries Prob 3 4Jasmine ActaNo ratings yet

- City Laundry: Chart of Account Assets LiabilitiesDocument6 pagesCity Laundry: Chart of Account Assets LiabilitiesGina Calling DanaoNo ratings yet

- Fabm 1 ReviewDocument28 pagesFabm 1 ReviewDia Did L. RadNo ratings yet

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- Practice Problem Jenny Light AccountantDocument17 pagesPractice Problem Jenny Light AccountantFranco James Sanpedro100% (1)

- Chart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeDocument44 pagesChart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeJireh RiveraNo ratings yet

- Trucking and StorageDocument2 pagesTrucking and StorageMichael San Luis100% (1)

- Adjusting Entries For StudentsDocument57 pagesAdjusting Entries For Studentsselvia egayNo ratings yet

- 6 AccountingDocument5 pages6 AccountingRenz MoralesNo ratings yet

- Accounting Tutorials Day 1Document8 pagesAccounting Tutorials Day 1Richboy Jude VillenaNo ratings yet

- ACCTG 1 Week 2-3 - Accounting in BusinessDocument13 pagesACCTG 1 Week 2-3 - Accounting in BusinessReygie FabrigaNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument31 pagesAccounting Cycle of A Merchandising BusinessAresta, Novie Mae100% (1)

- General Journal: Date Account Titles and Explanation Debit Credit Posting ReferenceDocument9 pagesGeneral Journal: Date Account Titles and Explanation Debit Credit Posting ReferenceCherrie Mae BanaagNo ratings yet

- Worksheet AssignmentDocument2 pagesWorksheet AssignmentLyca MaeNo ratings yet

- Cost of Goods Sold WorksheetDocument2 pagesCost of Goods Sold Worksheetbutch listangcoNo ratings yet

- I. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1Document3 pagesI. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1HLeigh Nietes-GabutanNo ratings yet

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- Chapter 3 Basic AccountingDocument35 pagesChapter 3 Basic AccountingDeanna LuiseNo ratings yet

- ACEFIAR Quiz No. 7Document2 pagesACEFIAR Quiz No. 7Marriel Fate CullanoNo ratings yet

- Bondoc Johnpaulo Act2b Accounting Module6Document8 pagesBondoc Johnpaulo Act2b Accounting Module6Joeces Ian DizonNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- XYZ CompanyDocument8 pagesXYZ CompanyLala Bub100% (1)

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditJessie ForpublicuseNo ratings yet

- Fabm2 Q2 M4 - 4 CsefDocument20 pagesFabm2 Q2 M4 - 4 CsefZeus MalicdemNo ratings yet

- Accounting 101Document17 pagesAccounting 101Jenne Santiago BabantoNo ratings yet

- Balance Sheet Only-Agatha TradingDocument1 pageBalance Sheet Only-Agatha TradingJasmine Acta0% (1)

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- Financial Ratio Analysis-LiquidityDocument30 pagesFinancial Ratio Analysis-LiquidityZybel RosalesNo ratings yet

- FAR 1 - Midterm - Practice Questions 2Document2 pagesFAR 1 - Midterm - Practice Questions 2Yanela YishaNo ratings yet

- IFRS IAS SummaryDocument9 pagesIFRS IAS SummaryLin AungNo ratings yet

- Daftar Account PD - SuburDocument1 pageDaftar Account PD - SuburMuhamad Anjar SatriaNo ratings yet

- Lego Group Annual Report 2015Document72 pagesLego Group Annual Report 2015Josue Teni BeltetonNo ratings yet

- Parcor Proj (Version 1)Document45 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- Balance Sheet: Forever YoungDocument2 pagesBalance Sheet: Forever YoungJulie Ann BonNo ratings yet

- Adj. EntriesDocument41 pagesAdj. EntriesElizabeth Espinosa Manilag100% (2)

- Accounting Cycle: Service BusinessDocument16 pagesAccounting Cycle: Service BusinessMavie PhotographyNo ratings yet

- PB SQP 12th ACC (SS) 2023-24Document14 pagesPB SQP 12th ACC (SS) 2023-24aanchal prasad100% (4)

- ACC 307 Final Project Workbook CompleteDocument15 pagesACC 307 Final Project Workbook CompleteKathleen BantaNo ratings yet

- Accounting Test Bank - 1Document12 pagesAccounting Test Bank - 1Christine Jane AbangNo ratings yet

- Statement of Financial PositionDocument30 pagesStatement of Financial Positionyulina eviNo ratings yet

- Business Finance - Chapter 2 Assessment 1 - Rudsan T.Document3 pagesBusiness Finance - Chapter 2 Assessment 1 - Rudsan T.Rudsan TurquezaNo ratings yet

- What Is Thwe Difference Between Vertical Analysis and Horizontal AnalysisDocument16 pagesWhat Is Thwe Difference Between Vertical Analysis and Horizontal AnalysisZohaib Javed SattiNo ratings yet

- Ayu Wulan Suci Ramdhani - 20221390 - 1EB09 - Tugas M3 Akuntansi Keuangan Menengah 1A - B PDFDocument3 pagesAyu Wulan Suci Ramdhani - 20221390 - 1EB09 - Tugas M3 Akuntansi Keuangan Menengah 1A - B PDFrully movizarNo ratings yet

- Cornerstones of Financial Accounting Canadian 1st Edition Rich Test BankDocument72 pagesCornerstones of Financial Accounting Canadian 1st Edition Rich Test Banktaradavisszgmptyfkq100% (13)

- Part Iv - AnnexesDocument40 pagesPart Iv - AnnexesAlicia NhsNo ratings yet

- Balance Carry-Forward and Closing Fiscal Year - SAP BlogsDocument3 pagesBalance Carry-Forward and Closing Fiscal Year - SAP BlogsSaurabh GuptaNo ratings yet

- Allyn Powerpoint PresentationDocument6 pagesAllyn Powerpoint PresentationdyianneNo ratings yet

- Quiz Conso FSDocument3 pagesQuiz Conso FSMark Joshua SalongaNo ratings yet

- Statement of Changes in EquityDocument12 pagesStatement of Changes in Equitymaricar reyesNo ratings yet

- Austindo Nusantara Jaya TBKDocument3 pagesAustindo Nusantara Jaya TBKHarjasa AdhiNo ratings yet

- Exercises/Assignments Answer The Following ProblemsDocument22 pagesExercises/Assignments Answer The Following ProblemsLuigi Enderez BalucanNo ratings yet

- International Accounting StandardsDocument10 pagesInternational Accounting StandardsRameshwar FundipalleNo ratings yet

- Chapter 1Document21 pagesChapter 1marieieiemNo ratings yet