Professional Documents

Culture Documents

H1 Results 2021: Alexander Von Witzleben Daniel Wüest

H1 Results 2021: Alexander Von Witzleben Daniel Wüest

Uploaded by

Miguel Couto RamosCopyright:

Available Formats

You might also like

- Life Cycle of SecurityDocument40 pagesLife Cycle of SecurityPuneet Sachdeva50% (2)

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- TSLA Q1 2022 UpdateDocument29 pagesTSLA Q1 2022 UpdateSimon Alvarez100% (1)

- Aelfriccolloquy TranslationDocument26 pagesAelfriccolloquy TranslationMiguel Sossa100% (1)

- The Wolf of Wall Street 2013Document313 pagesThe Wolf of Wall Street 2013AshokNo ratings yet

- Danone Year Results 2022Document12 pagesDanone Year Results 2022celinemaillard65No ratings yet

- Presentation H1 2022Document43 pagesPresentation H1 2022Tran Thi ThuongNo ratings yet

- Results FY2021 Release FINALDocument8 pagesResults FY2021 Release FINALRiston Belman SidabutarNo ratings yet

- Nikon 2021 Fiscal Year Financial ReportDocument48 pagesNikon 2021 Fiscal Year Financial ReportNikonRumorsNo ratings yet

- Q1 FY23 Financial TablesDocument11 pagesQ1 FY23 Financial TablesDennis AngNo ratings yet

- 2022 FY Presentation 0Document42 pages2022 FY Presentation 0latcarmaintl3No ratings yet

- Business Results For The Fiscal Year Ended March 31, 2023 and Overview of Management StrategyDocument42 pagesBusiness Results For The Fiscal Year Ended March 31, 2023 and Overview of Management StrategyIqbal FahmiNo ratings yet

- SamsungSecIR 4Q21 Eng FinalDocument16 pagesSamsungSecIR 4Q21 Eng FinalHardik SharmaNo ratings yet

- AFFLE - Investor Presentation - FY21Document19 pagesAFFLE - Investor Presentation - FY21Abhishek MurarkaNo ratings yet

- SGL Carbon H1 2021 EN 12 08 2021 SDocument32 pagesSGL Carbon H1 2021 EN 12 08 2021 SAhmed ZamanNo ratings yet

- Finance Report 2023Document201 pagesFinance Report 2023robertjuleswhiteNo ratings yet

- En2023q4 PresentationDocument42 pagesEn2023q4 PresentationfondationibdaaNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Accounting Project 2Document8 pagesAccounting Project 2api-661554832No ratings yet

- Alpha-Win: Company Research ReportDocument6 pagesAlpha-Win: Company Research Reportchoiand1No ratings yet

- AFFLE - Investor Presentation - 05-Feb-22 - TickertapeDocument26 pagesAFFLE - Investor Presentation - 05-Feb-22 - TickertapebhanupalavarapuNo ratings yet

- Aeon en DL 01Document43 pagesAeon en DL 01N.a. M. TandayagNo ratings yet

- CP Resultats FY2019 GB - DocxDocument30 pagesCP Resultats FY2019 GB - DocxPaula Andrea GarciaNo ratings yet

- Hindustan Foods Ltd. (519126)Document35 pagesHindustan Foods Ltd. (519126)MNM MahmuddinNo ratings yet

- Adecco Group Q3 2021 Press ReleaseDocument15 pagesAdecco Group Q3 2021 Press ReleaseKanikaNo ratings yet

- Q3 2021 RESULTS: Profitable Growth and Record Gross MarginDocument15 pagesQ3 2021 RESULTS: Profitable Growth and Record Gross MarginKanikaNo ratings yet

- Q2'20 UpdateDocument26 pagesQ2'20 UpdateFred Lamert100% (2)

- Tsla q4 and Fy 2021 UpdateDocument37 pagesTsla q4 and Fy 2021 UpdateFred Lamert100% (2)

- Consolidated Financial StatementsDocument16 pagesConsolidated Financial StatementsMku MkuNo ratings yet

- Earnings Estimates Answer q3 2021Document1 pageEarnings Estimates Answer q3 2021LT COL VIKRAM SINGH EPGDIB 2021-22No ratings yet

- Q12022 Results Press ReleaseDocument30 pagesQ12022 Results Press ReleaseMahesh ShelkeNo ratings yet

- Sulzer Midyear Report 2023 PresentationDocument18 pagesSulzer Midyear Report 2023 Presentationbg2gbNo ratings yet

- Kering 2021 Financial Document ENGDocument110 pagesKering 2021 Financial Document ENGrroll65No ratings yet

- Finance Report 2022Document191 pagesFinance Report 2022Cam TuNo ratings yet

- Q4 FY22 Financial TablesDocument11 pagesQ4 FY22 Financial TablesDennis AngNo ratings yet

- Kering Press Release 2021 FY Results 17022022 19cf2236a3Document17 pagesKering Press Release 2021 FY Results 17022022 19cf2236a3zinzin shoonletNo ratings yet

- Opportunity Day EPG: Financial Results Q3 2022/23Document21 pagesOpportunity Day EPG: Financial Results Q3 2022/23sozodaaaNo ratings yet

- EricssonDocument47 pagesEricssonRafa Borges100% (1)

- Sulzer Annual Report 2022 PresentationDocument30 pagesSulzer Annual Report 2022 Presentationbg2gbNo ratings yet

- Vertical Analysis of Income Statement Excel TemplateDocument5 pagesVertical Analysis of Income Statement Excel TemplateAngelica MijaresNo ratings yet

- Affle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451Document23 pagesAffle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451stockengageNo ratings yet

- M004/CL02 Managerial Finance Coursework 1 Assignment Brief Guidelines and RubricDocument10 pagesM004/CL02 Managerial Finance Coursework 1 Assignment Brief Guidelines and RubricPooja thangarajaNo ratings yet

- Earnings Estimates Answer q1 2021Document1 pageEarnings Estimates Answer q1 2021rdtuf ddkdkdNo ratings yet

- Quarterly Update Q4FY20: Visaka Industries LTDDocument10 pagesQuarterly Update Q4FY20: Visaka Industries LTDsherwinmitraNo ratings yet

- Dwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFDocument35 pagesDwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFbrumfieldridleyvip100% (12)

- invitation-annual-general-meeting-gea-2024Document54 pagesinvitation-annual-general-meeting-gea-2024RafuxNo ratings yet

- V-Guard-Industries - Q4 FY21-Results-PresentationDocument17 pagesV-Guard-Industries - Q4 FY21-Results-PresentationanooppattazhyNo ratings yet

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- 2018 Financial Review - IBDocument4 pages2018 Financial Review - IBNicolas SuarezNo ratings yet

- Adecco Group Q3 2022 Results Business Update PresentationDocument44 pagesAdecco Group Q3 2022 Results Business Update PresentationJigar VikamseyNo ratings yet

- Earnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - NsDocument34 pagesEarnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - Nssunil.dasarath jadhavNo ratings yet

- Fraport Interim Report q2 6m 2018Document36 pagesFraport Interim Report q2 6m 2018TatianaNo ratings yet

- GEA Annual-Report-2020-En - tcm11-82597Document220 pagesGEA Annual-Report-2020-En - tcm11-82597geniusMAHINo ratings yet

- Orange Financial Results: 16 February 2023Document30 pagesOrange Financial Results: 16 February 2023Umar MasaudNo ratings yet

- Alpha-Win: Company Research ReportDocument5 pagesAlpha-Win: Company Research Reportchoiand1No ratings yet

- Finance Assignment 1Document7 pagesFinance Assignment 1Nienke OzingaNo ratings yet

- Investors - Presentation - 11-02-2021 Low MarginDocument32 pagesInvestors - Presentation - 11-02-2021 Low Marginravi.youNo ratings yet

- FY23 Q3 Financial Results: Open Up Group Inc. May 12, 2023Document35 pagesFY23 Q3 Financial Results: Open Up Group Inc. May 12, 2023Tran Thi ThuongNo ratings yet

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Quails: ScriptDocument4 pagesThe Quails: ScriptAnnisa Septiani SyahvianaNo ratings yet

- Title of ResearchDocument5 pagesTitle of ResearchChahil BapnaNo ratings yet

- Japan Secuireties 2018Document381 pagesJapan Secuireties 2018TôThànhPhongNo ratings yet

- 101 RPA Bots by ElectroNeekDocument116 pages101 RPA Bots by ElectroNeekMAURICIOMVNo ratings yet

- EPM 11.1.2.4 Download SummaryDocument3 pagesEPM 11.1.2.4 Download SummaryBalaji VarathriNo ratings yet

- For Many Persons Science Is Considered The Supreme Form of All KnowledgeDocument13 pagesFor Many Persons Science Is Considered The Supreme Form of All KnowledgeMidz SantayanaNo ratings yet

- "Must Contain An Unconditional Promise or Order To Pay A Sum Certain in Money.". ContinuedDocument4 pages"Must Contain An Unconditional Promise or Order To Pay A Sum Certain in Money.". ContinuedAhmad NaqiuddinNo ratings yet

- Department of Education: Undersecretary For Curriculum and InstructionDocument2 pagesDepartment of Education: Undersecretary For Curriculum and InstructionJessie Ann CabanganNo ratings yet

- Paragon 2013Document37 pagesParagon 2013England Dan EstacionNo ratings yet

- Attire Guide Dress Codes From Casual To White TiDocument2 pagesAttire Guide Dress Codes From Casual To White TimattwyattNo ratings yet

- JK Lakshmi Cement PDFDocument2 pagesJK Lakshmi Cement PDFShashank ChauhanNo ratings yet

- Half Nelson - Mandela de Beers DiamondDocument3 pagesHalf Nelson - Mandela de Beers Diamonddouglas rodriguesNo ratings yet

- Ucsp Hard CopyyyyDocument5 pagesUcsp Hard CopyyyySanorjo MallicNo ratings yet

- Rpt-Sow Form 3 2024Document6 pagesRpt-Sow Form 3 2024g-16025707No ratings yet

- Internationalist Perspective 57Document36 pagesInternationalist Perspective 57SubproleNo ratings yet

- Inside The Social Media Cult That Convinces Young People To Give Up Everything - OneZeroDocument41 pagesInside The Social Media Cult That Convinces Young People To Give Up Everything - OneZeroAndrew EdisonNo ratings yet

- Queenie BalagDocument4 pagesQueenie Balagapi-276829441No ratings yet

- Strategic ManagementDocument33 pagesStrategic ManagementNaresh KuntiNo ratings yet

- Macr 009Document1 pageMacr 009Graal GasparNo ratings yet

- Bruno Latour AIR SENSORIUMpdfDocument4 pagesBruno Latour AIR SENSORIUMpdfAura OanceaNo ratings yet

- Luxury Wine Case StudyDocument14 pagesLuxury Wine Case Studyapi-308966986No ratings yet

- Ujian Mid Semester Genap Bing Paket BDocument3 pagesUjian Mid Semester Genap Bing Paket BLiNo ratings yet

- Single Judge - Delhi High CourtDocument16 pagesSingle Judge - Delhi High CourtnishantpratyushNo ratings yet

- Phrasal AdverbsDocument20 pagesPhrasal AdverbsOmar H. AlmahdawiNo ratings yet

- Celiac Disease Paper 1Document21 pagesCeliac Disease Paper 1M SalmanNo ratings yet

- Slat Flap Control Computer (SFCC) - Interchangeability & MixabilityDocument10 pagesSlat Flap Control Computer (SFCC) - Interchangeability & MixabilityJivendra KumarNo ratings yet

- Selected Student List For Reporting (A Unit) Reporting Date: 15/01/2023 and 16/01/2023 Published Date: 14/01/2023Document19 pagesSelected Student List For Reporting (A Unit) Reporting Date: 15/01/2023 and 16/01/2023 Published Date: 14/01/2023いずちあさみNo ratings yet

H1 Results 2021: Alexander Von Witzleben Daniel Wüest

H1 Results 2021: Alexander Von Witzleben Daniel Wüest

Uploaded by

Miguel Couto RamosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

H1 Results 2021: Alexander Von Witzleben Daniel Wüest

H1 Results 2021: Alexander Von Witzleben Daniel Wüest

Uploaded by

Miguel Couto RamosCopyright:

Available Formats

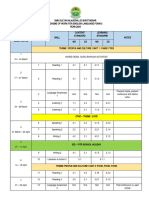

H1 results 2021

Alexander von Witzleben

Daniel Wüest

Overview H1 2021

Key metrics (CHF M), continuing operations as reported1

Net revenues EBITDA Capex

EBITDA margin

+11.2% 8.4% 9.2% 11.5%

+19.5%

+51.5%

589 +49.0% -13.0%

529 493

+6.9%

68

45 45 43 37

35

H1 2019 H1 2020 H1 2021 H1 2019 H1 2020 H1 2021 H1 2019 H1 2020 H1 2021

Strong revenue growth H1 2020 to Despite higher raw material prices Increased capex compared to H1

H1 2021 of +19.5% (+16.5% strong increase of EBITDA and 2020 due to accelerated capex

organic) but also compared to H1 margin compared to H1 2020 and program on back of announced

2019 (+11.2%; +14.5% organic) H1 2019 due to increase of sale of Windows Division

productivity

Strong revenue growth and increase of profitability

compared to H1 2020 but also H1 2019

1 H1 2019 net revenues and EBITDA calculated on a pro forma basis

H1 results 2021 | 24th August 2021 2

Agenda

1. Group results H1 2021

2. Construction environment

3. Divisional highlights H1 2021 and outlook

4. Guidance

Questions

H1 results 2021 | 24th August 2021 3

Income Statement

As reported, continuing operations

In CHF M H1 2021 in % H1 2020 in % I Net revenues (+20%)

Net revenues 588.6 100.0 492.5 100.0 Increasing raw material

I prices offset by price

Cost of material and goods -264.9 -45.0 -221.5 -45.0 increases and productivity

I gains (relative lower

Personnel expenses -189.0 -32.1 -171.4 -34.8 personnel expense ratio)

I

Other operating expenses -78.0 -13.3 -70.6 -14.3 II EBITDA (+49%)

II

EBITDA 67.6 11.5 45.3 9.2 EBITDA up 49.0%,

Depreciation, amortisation -25.0 -4.2 -23.1 -4.7 margin increase of

2.3%-points

EBITA 42.6 7.2 22.3 4.5 Margin increase at or

PPA amortisation -7.7 -1.3 -7.4 -1.5 above 11% across all

Divisions

III

EBIT 34.9 5.9 14.9 3.0

IV III EBIT (+135%)

Net financial result -2.5 -0.4 -7.1 -1.4

EBIT up 134.7% despite

Group result before income tax 32.4 5.5 7.8 1.6 higher D&A

Income tax expense -8.8 -1.5 -1.9 -0.4 IV Net financial result

V

Group result from contin. operations 23.6 4.0 5.9 1.2 Positive impact due to

Group result from discont. operations 13.3 2.3 -1.3 -0.3 positive FX effects and

lower financing costs

Group result 36.9 6.3 4.6 0.9 V Net profit (+300%)

Net profit quadrupled

H1 results 2021 | 24th August 2021 4

Overview H1 2021

Performance by Division, continuing operations3

All figures

in CHF M1 Arbonia Sanitary

Group HVAC Equipment Doors Windows

+11%

+11% +12%

+20% +8%

+8%

+24% +15% +13%

+13%

529.1 492.5 588.6

Net 274.6 246.1 304.9 182.8 178.0 203.9 159.3 152.4 171.6

71.7 68.5 77.7

revenues

+52%

+66% +38% +397%

+49% +45%

+58% +32% +103%

+54%

67.6

44.6 45.3 33.6

20.2 21.3 22.4 23.4 30.8 9.1 18.4

EBITDA2 6.5 6.2 9.5 3.7

15.1%

12.2% 13.2%

11.5% 11.0% 12.2%

8.4% 9.2% 7.4% 8.7% 9.0% 9.0% 10.7%

EBITDA 6.0%

margins2 2.3%

1 Not currency adjusted – for adjustments see slide “Organic growth”

2 EBITDA figures with one-time effects (as reported) H1 2019 H1 2020 H1 2021

3 H1 2019 Arbonia Group net revenues and EBITDA calculated on a pro forma basis

H1 results 2021 | 24th August 2021 5

Net revenues by Division and Region

Germany largest market with over 50% share while base effect in Southern

Europe after sale of Windows Division as reported, continuing operations

Net revenues by Division Net revenues by Region

12% 13%

(12%) (14%)

35% 9%

(36%) (6%)

52% 8%

(50%) (8%)

7%

(7%)

51%

13%

(54%)

(14%)

HVAC Switzerland

Sanitary Equipment Germany

Doors Eastern Europe1

Benelux

Southern Europe2

The figures in brackets show the values of the previous year

RoW

1 Eastern Europe: PL, CZ, SK and RU

2 Southern Europe: IT and ES

H1 results 2021 | 24th August 2021 6

Organic growth

Organic growth mainly driven by volume but also price effects

As reported, continuing operations

Net revenues as Δ

reported Currency Acquis. Organic

H1 2021 H1 2020 Year

continuing operations effects effect growth1

total

in CHF M

Arbonia Group 588.6 492.6 +19.5% -2.2% -0.8% +16.5%

HVAC 304.9 246.1 +23.9% -2.4% -0.7% +20.9%

Sanitary Equipment 77.7 68.5 +13.5% -2.3% +11.2%

Doors 203.9 178.0 +14.5% -2.2% +12.4%

1 Adjusted for currency and acquisition effects

H1 results 2021 | 24th August 2021 7

Overview organic revenue growth H1 2019, H1 2020

and H1 2021

In CHF M, continuing operations

+14.5%

+16.5%

675 1.8x Strong organic growth since 2019 despite

606

600 1.6x negative impact due to COVID-19 in 2020

529 520

525 1.4x Growth H1 2019 to H1 2021 based on

450 1.2x volume and price effects

375 1.0x

300 0.8x

225 0.6x

150 0.4x

75 0.2x

H1 2019 H1 2020 H1 2021

Net revenues

H1 results 2021 | 24th August 2021 8

Balance sheet

In CHF M, including discontinued operations

2′000

1′662 I Assets

1′535

1′500

30.3% 42.1% Higher absolute asset base mainly due to

1′000 increased operative activities, capex and

positive FX translation effects (EUR, CZK,

500 69.7% 57.9% RUB)

CHF 315 M of assets allocated to Windows

0 Division in current assets and classified as

30.06.2020 30.06.2021 "available for sale"

Current assets Non-current assets

II Liabilities and shareholders' equity

2′000

1′662 Higher liability base due to increased operating

1′535 activities and FX translation effects

1′500 25.6%

24.2% Increased equity base of CHF 928 M

1′000 21.1% 18.6% (2020: 840 M) or 55.8% (2020: 54.7%) of total

balance sheet

500 55.8%

54.7% CHF 111 M of liabilities allocated to Windows

0 Division and classified as "available for sale"

30.06.2020 30.06.2021

Current liabilities Non-current liabilities Shareholders′ equity

H1 results 2021 | 24th August 2021 9

Net debt as of June 2021

In CHF M, including discontinued operations

225 3.0x I Net debt

199

Decrease of net debt by CHF 15 M compared

184 2.6x

to H1 2020

2.4x

60 2.2x Increase compared to M12 2020 mainly due to

150 141 59 2.0x dividend payments, purchase of treasury

shares and acquisition of Cicsa

1.8x

1.51

1.6x II Leverage ratio

59

1.4x

Leverage ratio below 1.00x leads to favourable

0.97 1.2x financing conditions

75 1.0x

139

125 0.8x

0.89

82 0.6xIII Real estate and land

0.4x

Surplus real estate and land reserves not

0.2x

reflected in net debt calculation

H1 2020 2020 H1 2021

Leverage ratio

(incl. Lease liabilities)

Lease liabilities

Net debt

H1 results 2021 | 24th August 2021 10

Cash flow statement

In CHF M, including discontinued operations

I Cash flow from operating activities

+30.6 M Substantial increase of cash flow from operating

141.3 activities due to better operational performance

150

and …

100 …despite slight increase of NWC

51.6

50 21.0

0

06 2020 12 2020 06 2021

II Free cash flow1

Significant improvement of free cash flow due to

+21.0 M

60 higher cash flow from operating activities

40 compared to H1 2020 and …

52.5 …despite higher capex and acquisition of Cicsa

20 6.7

0

-14.4

-20

06 2020 12 2020 06 2021

1 Free cash flow: cash flow from operating and investing activities

H1 results 2021 | 24th August 2021 11

Agenda

1. Group results H1 2021

2. Group

Construction

resultsenvironment

2020

3. Divisional highlights H1 2021 and outlook

4. Guidance

Questions

H1 results 2021 | 24th August 2021 12

Construction environment and key drivers

Growth drivers and external challenges

Construction environment "EU Green Deal1" – External

Climate neutrality by 2050 challenges

Mega

Improving the energy-

trends Low interest rates efficiency of buildings through Shortage of selected

components and systems raw materials

- Availability

Energy efficiency /

Carbon neutrality Migration and Subsidy programs for public

demand for more Delay of construction

and private buildings (new

living space projects due to

construction and renovation)

temporary increase of

Urbanisation construction prices

Further build-up of

Demographic Raw material prices

renovation backlog

change

Digitisation

and automation Limited stocking-up

Energy efficient and

modern production footprint

Housing shortage as basis for sustainable Capacity bottlenecks

competitiveness in the skilled crafts

sector

Ø GDP growth2 2 – 3% Long-term, additional growth

on top of GDP

1 Source: European Commission – COM(2020) 662 | 2 Blend of Arbonia's key markets 2022 – 2023, source: 91th Euroconstruct Report 2021

H1 results 2021 | 24th August 2021 13

Construction environment

Migration and demographic change1 Housing emergency and capacity limitations2

In thousands In thousands

~300-400 1'000

750

240 245 251 256 250

500

250

0

Demand 2016 2017 2018 2019 2020 2008 2010 2012 2014 2016 2018 2020

Flats completed Required flats p.a. Number of open permits for flats

300-400k new flats are needed annually to keep up Number of building permits for flats has increased to

with demand in Germany new record high in 2020 (~780'000 flats awaiting

Continued urbanisation and high demand in suburbs construction)

with fast connections to the city center Demand remains strong for construction of new

Large cities are not able to keep up with demand housing and public works

Need for new construction keeps rising to a backlog of Capacity bottlenecks led to a lack of renovation and

c. one million flats substantial backlog in the past years

With increased age, changing family situations and Order backlog and limited number of craftsmen as

higher incomes people require more sqm per person basis for long term above average growth

while the number of people per household decreases

1 Source: ifo Insitut, DIW Berlin, Claus Michelsen, Institut der deutschen Wirtschaft Köln, Press release Deutscher Mieterverbund

2 Source: Statistisches Bundesamt, EY Hochbauprognose 2021

H1 results 2021 | 24th August 2021 14

EU "Green Deal"

Development of investment volume in green Buildings are responsible for 1/3 of energy-

buildings 2014 - 20201 (EUR million) consumption and CO2 emissions in Germany

Other

Heating systems (Buildings)

22.2%

21.1% 20.4% 21.9% 22.6% 22.4% 7%

19.0% 18.9% 21%

39%

16.2%

Mobility 39% 11% Insulation (Buildings)

22%

Process heat

2012 2013 2014 2015 2016 2017 2018 2019 2020 Annual CO2 savings potential in Germany2

Green buildings Share of green buildings Up to 3.5 million tons through

Not certified

optimisation of room

temperature control

75% of existing buildings in the EU are not energy Up to 5.5 million tons

efficient, yet only 1% are renovated each year through optimisation of Up to 35 million tonnes

heat transfer through the replacement of

Buildings currently account for 40% of energy

inefficient heat generators

consumption and 36% of greenhouse gas emissions

in the EU

The share of green buildings is increasing only slowly

By modernising heat generation and heat transfer, a

CO2 savings potential of up to 41 million tons per

1 Source: BNP Paribas (2021) year could be realised.

2 Bundesverband der Deutschen Heizungsindustrie (2021)

H1 results 2021 | 24th August 2021 15

EU "Green Deal"

Overview of subsidy rates (exemplary)

Germany Switzerland

Building Heating Indoor climate Heating Building Stationary Air-to-water Sole

envelope components system 1 optimisation envelope battery storage heat pump heat pump

20% 45% 45% 20% 50% 25% CHF 6'000 CHF 16'000

max. subsidies in % for renovation and new construction max. subsidies in % / max. subsidy amount of the total investment for renovation

Source: Bundesamt für Wirtschaft und Ausfuhrkontrolle (BAFA) (16.07.2021) Source: energieheld.ch/renovation/foerderung#nach-kanton-geordnet (16.07.2021)

Belgium Poland

Building Condensing Air-to-water Photovoltaic Air-to-water Ventilation with Photovoltaic

envelope boiler heat pump system heat pump Electric heating heat recovery system

40% 48% 48% 48% 30% 30% 30% 50%

max. subsidies in % of the invoice and per housing unit max. subsidies in of the actual costs incurred

Source: publicaties.vlaanderen.be/view-file/32301 (19.07.2021) Source: czystepowietrze.gov.pl/czyste-powietrze/#do-pobrania (16.07.2021)

H1 results 2021 | 24th August 2021 16

External challenges

Raw material expected to consolidate mid-term

Raw material prices Construction price index Germany3

Development of steel1 and wood2 prices (indexed) Residential new construction (indexed)

120

200 115

110

100 105

100

95

01/20 03/20 05/20 07/20 09/20 11/20 01/21 03/21 05/21 07/21 I II III IV I II III IV I II III IV I II III IV

2018 2019 2020 2021

Steel price Wood Price

Development of steel prices1 (in EUR/t) Raw material prices

Rapid recovery of US and Chinese economy paired with

1’300

lower production capacity drove raw material prices up in

H1 2021

1’100 Steel production capacity slowly to go up to pre-pandemic

levels resulting in decreasing prices for steel futures

900 Wood futures fell sharply in June, due to production

increase and postponement of construction projects

700 Rising construction costs due to increased raw material

prices

Raw material availability

500

01/20 03/20 05/20 07/20 09/20 11/20 01/21 03/21 05/21 07/21 Raw material availability is critical – secured by long term

sourcing contracts

1 Source: MEPS European Steel Review, Cold Rolled Coil | 2 Source: EUWID Wood Index | 3 Source: Destatis Statistisches Bundesamt (2021)

H1 results 2021 | 24th August 2021 17

Agenda

1. Group results H1 2021

2. Construction environment

Strategy highlights H1 2021 and outlook

3. Divisional

4. Guidance

Questions

H1 results 2021 | 24th August 2021 18

Arbonia's footprint

Arbonia has a strong market presence in the growing residential,

health and education construction market

Arbonia's approximate revenue split by segments

New construction

Health and

education

35%

Single-family houses

Industrial

Retail and

Renovation

office

65%

Multi-family houses

Hotels

Residential Non-residential

80% 20%

Expected positive outlook until 2021/22 Expected neutral outlook until 2021/22 Expected negative outlook until 2021/22

Source: 91th Euroconstruct Report (2021)

H1 results 2021 | 24th August 2021 19

Divisional highlights H1 2021 and outlook

HVAC Division

Overview New heat pump factory in CZ

8.7% 11.0%

304.9

246.1

33.6

21.3

H1 2020 H1 2021

Start of construction Start of production

Net revenue EBITDA1 EBITDA margin1 H1 2021 H1 2022

Strong demand of CO2 efficient systems and components

for heat/cold generation and distribution, energy saving

system, air ventilation and air quality for residential as well

as for non-residential buildings Established manufacturer of Spanish distributor of

commercial ventilation with design radiators and

Start construction of the new heat pump factory in CZ to bathroom radiators

European reach

multiply capacity and to address the high demand

Revenues of EUR 15 M and Revenues in the high

Start of production of the new heat pump factory is Q1 2022. single-digit EUR million

double digit EBITDA margin

The production will continuously be ramped up quadrupling range and attractive

(2020)

the production capacity in a first step EBITDA margin (2020)

Extending expertise in indoor

air quality, especially Strengthening DIY and

cleanrooms and geo-graphical online sales channel

footprint (South-Eastern and Geographical expansion

Central Europe)

1 EBITDA and EBITDA margin with one-time effects

H1 results 2021 | 24th August 2021 20

Divisional highlights H1 2021 and outlook

Doors Division

Overview New door frame factory Prüm

1

12.0% 14.3%

281.6 Increase of

capacity by c.

246.5 40% from 1 M

40.3 doors and frames

29.6

p.a. to 1.4 M p.a.

H1 2020 H1 2021

Start of construction Start of production

Net revenue EBITDA EBITDA margin Q1 2020 Q3 2022

Integration of Sanitary E. Division into Doors Division as of Glasverarbeitungs-Gesellschaft Deggendorf (GVG)

1 July 2021 in order to realise synergy potential

Signing on 31 July 2021, closing expected in Q3 2021

Doors Division comprises two Business Units, Wood

Solutions and Glass Solutions (former Sanitary Division) Insourcing of main supplier for processed glass of the

Business Unit Glass Solutions will increase profitability

Wood Solutions Business Unit

Approx. 50% of GVG's revenues are generated with the

Capex spent since 2017 (cf. CHF 130 M) – led to increased Glass Solutions Business Unit

capacities (+25%) from 2.1 M (2017) to 2.6 M (2021E) doors

and particularly higher productivity (EBITDA margin 10.9%, Revenues EUR 19 M (2020)

H1 2017 to 15.1%, H1 2021) Insourcing of glass processing and reducing dependency of

Glass Solution Business Unit material supplier

Strong market position allows to take advantage of Basis to offer a range of additional glass solutions

favourable market conditions

1 Door frame production hall – the highest investment in the capacity expansion program

H1 results 2021 | 24th August 2021 21

Agenda

1. Group results H1 2021

2. Construction environment

3. Highlights H1 2021 and strategic outlook

4. Guidance

Questions

H1 results 2021 | 24th August 2021 22

Adapted Group structure as of 1 July 2021

Two focused divisions1

Chairman

Alexander von Witzleben*

CEO

Alexander von Witzleben*

CFO

Corporate Functions

Daniel Wüest*

Heating, Ventilation and Air Conditioning (HVAC) Division Doors Division

CEO: Alexander Kaiss* CEO: Claudius Moor* and Markus Hütt

Heating, Ventilation and Air Conditioning Wood Solutions Glass Solutions

1 Arbonia Group FY 2021 Annual Report will reflect the adapted Group structure | * Member of the Group Management Board

H1 results 2021 | 24th August 2021 23

Updated Guidance 2021

Heating, Ventilation and

Doors

Air Conditioning (HVAC)

Group

Heating, Ventilation and

Wood Solutions Glass Solutions

Air Conditioning

Organic growth > 9% > 6% 8.0% (4 – 5%)1

EBITDA margin 11% 13% 11.5% (>11%)1

1 in brackets () Arbonia Group guidance March 2021

H1 results 2021 | 24th August 2021 24

Agenda

1. Group results H1 2021

2. Construction environment

3. Highlights H1 2021 and strategic outlook

4. Guidance

Questions

H1 results 2021 | 24th August 2021 25

Disclaimer

Arbonia AG is making great efforts to include accurate and up-to-date information in this document, however we

make no representations or warranties, expressed or implied, as to the accuracy or completeness of the

information provided in this document and we disclaim any liability whatsoever for the use of it.

The information provided in this document is not intended nor may be construed as an offer or solicitation for the

purchase or disposal, trading or any transaction in any Arbonia AG securities. Investors must not rely on this

information for investment decisions.

This presentation may contain certain forward-looking statements relating to the Group’s future business,

development and economic performance. Such statements may be subject to a number of risks, uncertainties and

other important factors, such as but not limited to (1) competitive pressures; (2) legislative and regulatory

developments; (3) global, macroeconomic and political trends; (4) fluctuations in currency exchange rates and

general financial market conditions; (5) delay or inability in obtaining approvals from authorities; (6) technical

developments; (7) litigation; (8) adverse publicity and news coverage, which could cause actual development and

results to differ materially from the statements made in this presentation.

The Arbonia AG assumes no obligation to update or alter forward-looking statements whether as a result of new

information, future events or otherwise.

H1 results 2021 | 24th August 2021 26

Thank you

Appendix

Capital Markets Day

Plattling 26. Oktober 2021

Tagesablauf (Änderungen vorbehalten)

Individuelle Anreise der Teilnehmer, je nach Anmeldung

10.15 – 10.45 Uhr Willkommenskaffee

10.45 – 11.00 Uhr Begrüssung Alexander von Witzleben

(Vorstellung neue operative Führung: Claudius Moor, Alexander Kaiss

und Markus Hütt)

11.00 – 11.30 Uhr Vortrag Alexander Kaiss (Strategie HLK)

11.30 – 12.00 Uhr Vortrag Claudius Moor & Markus Hütt (Strategie Türen)

12.00 – 12.30 Uhr Gruppenstrategie, Mittelfristplanung und -ziele

(Alexander von Witzleben und Daniel Wüest)

12.30 – 13.00 Uhr Q&A-Session

13.00 – 14.00 Uhr Gemeinsames Mittagessen in der Kantine

14.00 – 16.00 Uhr Führung durch das Werk in Gruppen (Fertigung FHK, Fertigung Glaslösungen,

F&E: neue Produkte sowie Energiemanagement- und Wärmepumpensysteme)

16.00 – 16.30 Uhr Kaffee und Kuchen

Ab 16.30 Uhr Transfer per Bus zum Bahnhof Plattling & Flughafen München

H1 results 2021 | 24th August 2021 29

Market environment

Construction market 2021

Residential Non-residential

Central Europe Central Europe

Germany 2.0 % Germany -5.5%

1.0 % -3.0%

-0.1 % 0.7%

Switzerland 0.3 % Switzerland 0.5%

Eastern Europe Eastern Europe

Poland 2.0 % Poland -3.7%

1.4 % 3.2%

1.4 % -1.9%

Czech Republic -4.7 % Czech Republic -3.8%

Slovakia -2.1 % Slovakia -4.5%

14.6 % -3.4%

Southern Europe Southern Europe

7.2 % -1.6%

Italy 13.1 % Italy 2.4%

7.0 % 3.0%

Spain 7.5 % Spain

2.5%

Benelux States Benelux States

Belgium 7.5 % Belgium -4.9%

7.4 % 8.7%

3.0 % -0.3%

Netherlands -2.7 % Netherlands -2.5%

Construction Renovation

Source: 91st Euroconstruct Report 2021

H1 results 2021 | 24th August 2021 30

Market environment

Construction market 2022

Residential Non-residential

Central Europe Central Europe

0.5% 1.0%

Germany -0.5% Germany 1.0%

Switzerland -2.3% Switzerland 0.6%

-1.8% 0.5%

Eastern Europe Eastern Europe

0.0% 1.5%

Poland 3.0% Poland 7.6%

Czech Republic 5.2% Czech Republic 3.6%

3.7% -1.7%

Slovakia 5.2% Slovakia 8.9%

3.3% 4.6%

Southern Europe Southern Europe

2.3% 6.4%

Italy 4.8% Italy

3.7%

6.0% 3.5%

Spain 9.0% Spain

3.0%

Benelux States Benelux States

3.5%

Belgium 3.6% Belgium -4.4% 3.0%

9.5% 1.6%

Netherlands Netherlands 5.0%

3.3%

Construction Renovation

Source: 91st Euroconstruct Report 2021

H1 results 2021 | 24th August 2021 31

Arbonia shareholder structure

As of 30 June 2021

Free float market capitalisation:

CHF 886 M3

22%

3%

3%

72%

Free float1

Artemis Beteiligungen I AG

Leo Looser

Arbonia management2

Tradeable free float of ~72%

1 Every other shareholder with <3% of shares outstanding

2 Members of the Board of Directors, Group Management and upper management of Arbonia Group

3 Based on the closing price of 30 June 2021 and 72.13% of shares outstanding

H1 results 2021 | 24th August 2021 32

Arbonias transformation 2015-2021

Development Key figures, including discontinued operations

AFG in 2015 Arbonia in 20211

Acquisitions 2021 2018 2016

in CHF M 2015 2016 2017 2 2018 2 2019 2 H1 2020 2 2020 2 H1 2021 2

Net revenue 941.4 995.3 1'245.6 1'374.0 1'057.8 492.5 1'038.4 588.6

EBITDA 4 56.7 66.0 101.3 115.1 107.7 45.3 114.5 67.2

EBIT 4 16.5 28.6 42.6 47.8 49.1 14.9 52.1 34.6

Group result 4 -14.5 12.2 22.8 23.8 30.1 5.9 28.1 23.3

Equity ratio 39.1% 47.7% 60.9% 58.7% 56.9% 54.7% 59.0% 55.8%

Net debt 21.7 225.1 43.3 116.8 180.65 198.65 140.65 183.55

CF from op. 54.5 32.0 68.8 69.6 111.8 21.0 141.3 51.6

activities

FCF 16.0 -67.3 190.4 -53.8 8.4 -14.4 52.5 6.7

Capex 21.9 62.1 105.1 134.7 113.0 39.5 95.5 42.0

1 New organisation after the sale of the Windows Division | 2 Continuing operations | 3 Incl. discontinued operations | 4 Without one-time effects | 5 Incl. IFRS 16

H1 results 2021 | 24th August 2021 33

You might also like

- Life Cycle of SecurityDocument40 pagesLife Cycle of SecurityPuneet Sachdeva50% (2)

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- TSLA Q1 2022 UpdateDocument29 pagesTSLA Q1 2022 UpdateSimon Alvarez100% (1)

- Aelfriccolloquy TranslationDocument26 pagesAelfriccolloquy TranslationMiguel Sossa100% (1)

- The Wolf of Wall Street 2013Document313 pagesThe Wolf of Wall Street 2013AshokNo ratings yet

- Danone Year Results 2022Document12 pagesDanone Year Results 2022celinemaillard65No ratings yet

- Presentation H1 2022Document43 pagesPresentation H1 2022Tran Thi ThuongNo ratings yet

- Results FY2021 Release FINALDocument8 pagesResults FY2021 Release FINALRiston Belman SidabutarNo ratings yet

- Nikon 2021 Fiscal Year Financial ReportDocument48 pagesNikon 2021 Fiscal Year Financial ReportNikonRumorsNo ratings yet

- Q1 FY23 Financial TablesDocument11 pagesQ1 FY23 Financial TablesDennis AngNo ratings yet

- 2022 FY Presentation 0Document42 pages2022 FY Presentation 0latcarmaintl3No ratings yet

- Business Results For The Fiscal Year Ended March 31, 2023 and Overview of Management StrategyDocument42 pagesBusiness Results For The Fiscal Year Ended March 31, 2023 and Overview of Management StrategyIqbal FahmiNo ratings yet

- SamsungSecIR 4Q21 Eng FinalDocument16 pagesSamsungSecIR 4Q21 Eng FinalHardik SharmaNo ratings yet

- AFFLE - Investor Presentation - FY21Document19 pagesAFFLE - Investor Presentation - FY21Abhishek MurarkaNo ratings yet

- SGL Carbon H1 2021 EN 12 08 2021 SDocument32 pagesSGL Carbon H1 2021 EN 12 08 2021 SAhmed ZamanNo ratings yet

- Finance Report 2023Document201 pagesFinance Report 2023robertjuleswhiteNo ratings yet

- En2023q4 PresentationDocument42 pagesEn2023q4 PresentationfondationibdaaNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Accounting Project 2Document8 pagesAccounting Project 2api-661554832No ratings yet

- Alpha-Win: Company Research ReportDocument6 pagesAlpha-Win: Company Research Reportchoiand1No ratings yet

- AFFLE - Investor Presentation - 05-Feb-22 - TickertapeDocument26 pagesAFFLE - Investor Presentation - 05-Feb-22 - TickertapebhanupalavarapuNo ratings yet

- Aeon en DL 01Document43 pagesAeon en DL 01N.a. M. TandayagNo ratings yet

- CP Resultats FY2019 GB - DocxDocument30 pagesCP Resultats FY2019 GB - DocxPaula Andrea GarciaNo ratings yet

- Hindustan Foods Ltd. (519126)Document35 pagesHindustan Foods Ltd. (519126)MNM MahmuddinNo ratings yet

- Adecco Group Q3 2021 Press ReleaseDocument15 pagesAdecco Group Q3 2021 Press ReleaseKanikaNo ratings yet

- Q3 2021 RESULTS: Profitable Growth and Record Gross MarginDocument15 pagesQ3 2021 RESULTS: Profitable Growth and Record Gross MarginKanikaNo ratings yet

- Q2'20 UpdateDocument26 pagesQ2'20 UpdateFred Lamert100% (2)

- Tsla q4 and Fy 2021 UpdateDocument37 pagesTsla q4 and Fy 2021 UpdateFred Lamert100% (2)

- Consolidated Financial StatementsDocument16 pagesConsolidated Financial StatementsMku MkuNo ratings yet

- Earnings Estimates Answer q3 2021Document1 pageEarnings Estimates Answer q3 2021LT COL VIKRAM SINGH EPGDIB 2021-22No ratings yet

- Q12022 Results Press ReleaseDocument30 pagesQ12022 Results Press ReleaseMahesh ShelkeNo ratings yet

- Sulzer Midyear Report 2023 PresentationDocument18 pagesSulzer Midyear Report 2023 Presentationbg2gbNo ratings yet

- Kering 2021 Financial Document ENGDocument110 pagesKering 2021 Financial Document ENGrroll65No ratings yet

- Finance Report 2022Document191 pagesFinance Report 2022Cam TuNo ratings yet

- Q4 FY22 Financial TablesDocument11 pagesQ4 FY22 Financial TablesDennis AngNo ratings yet

- Kering Press Release 2021 FY Results 17022022 19cf2236a3Document17 pagesKering Press Release 2021 FY Results 17022022 19cf2236a3zinzin shoonletNo ratings yet

- Opportunity Day EPG: Financial Results Q3 2022/23Document21 pagesOpportunity Day EPG: Financial Results Q3 2022/23sozodaaaNo ratings yet

- EricssonDocument47 pagesEricssonRafa Borges100% (1)

- Sulzer Annual Report 2022 PresentationDocument30 pagesSulzer Annual Report 2022 Presentationbg2gbNo ratings yet

- Vertical Analysis of Income Statement Excel TemplateDocument5 pagesVertical Analysis of Income Statement Excel TemplateAngelica MijaresNo ratings yet

- Affle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451Document23 pagesAffle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451stockengageNo ratings yet

- M004/CL02 Managerial Finance Coursework 1 Assignment Brief Guidelines and RubricDocument10 pagesM004/CL02 Managerial Finance Coursework 1 Assignment Brief Guidelines and RubricPooja thangarajaNo ratings yet

- Earnings Estimates Answer q1 2021Document1 pageEarnings Estimates Answer q1 2021rdtuf ddkdkdNo ratings yet

- Quarterly Update Q4FY20: Visaka Industries LTDDocument10 pagesQuarterly Update Q4FY20: Visaka Industries LTDsherwinmitraNo ratings yet

- Dwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFDocument35 pagesDwnload Full Fundamentals of Corporate Finance 4th Edition Berk Solutions Manual PDFbrumfieldridleyvip100% (12)

- invitation-annual-general-meeting-gea-2024Document54 pagesinvitation-annual-general-meeting-gea-2024RafuxNo ratings yet

- V-Guard-Industries - Q4 FY21-Results-PresentationDocument17 pagesV-Guard-Industries - Q4 FY21-Results-PresentationanooppattazhyNo ratings yet

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- 2018 Financial Review - IBDocument4 pages2018 Financial Review - IBNicolas SuarezNo ratings yet

- Adecco Group Q3 2022 Results Business Update PresentationDocument44 pagesAdecco Group Q3 2022 Results Business Update PresentationJigar VikamseyNo ratings yet

- Earnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - NsDocument34 pagesEarnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - Nssunil.dasarath jadhavNo ratings yet

- Fraport Interim Report q2 6m 2018Document36 pagesFraport Interim Report q2 6m 2018TatianaNo ratings yet

- GEA Annual-Report-2020-En - tcm11-82597Document220 pagesGEA Annual-Report-2020-En - tcm11-82597geniusMAHINo ratings yet

- Orange Financial Results: 16 February 2023Document30 pagesOrange Financial Results: 16 February 2023Umar MasaudNo ratings yet

- Alpha-Win: Company Research ReportDocument5 pagesAlpha-Win: Company Research Reportchoiand1No ratings yet

- Finance Assignment 1Document7 pagesFinance Assignment 1Nienke OzingaNo ratings yet

- Investors - Presentation - 11-02-2021 Low MarginDocument32 pagesInvestors - Presentation - 11-02-2021 Low Marginravi.youNo ratings yet

- FY23 Q3 Financial Results: Open Up Group Inc. May 12, 2023Document35 pagesFY23 Q3 Financial Results: Open Up Group Inc. May 12, 2023Tran Thi ThuongNo ratings yet

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Quails: ScriptDocument4 pagesThe Quails: ScriptAnnisa Septiani SyahvianaNo ratings yet

- Title of ResearchDocument5 pagesTitle of ResearchChahil BapnaNo ratings yet

- Japan Secuireties 2018Document381 pagesJapan Secuireties 2018TôThànhPhongNo ratings yet

- 101 RPA Bots by ElectroNeekDocument116 pages101 RPA Bots by ElectroNeekMAURICIOMVNo ratings yet

- EPM 11.1.2.4 Download SummaryDocument3 pagesEPM 11.1.2.4 Download SummaryBalaji VarathriNo ratings yet

- For Many Persons Science Is Considered The Supreme Form of All KnowledgeDocument13 pagesFor Many Persons Science Is Considered The Supreme Form of All KnowledgeMidz SantayanaNo ratings yet

- "Must Contain An Unconditional Promise or Order To Pay A Sum Certain in Money.". ContinuedDocument4 pages"Must Contain An Unconditional Promise or Order To Pay A Sum Certain in Money.". ContinuedAhmad NaqiuddinNo ratings yet

- Department of Education: Undersecretary For Curriculum and InstructionDocument2 pagesDepartment of Education: Undersecretary For Curriculum and InstructionJessie Ann CabanganNo ratings yet

- Paragon 2013Document37 pagesParagon 2013England Dan EstacionNo ratings yet

- Attire Guide Dress Codes From Casual To White TiDocument2 pagesAttire Guide Dress Codes From Casual To White TimattwyattNo ratings yet

- JK Lakshmi Cement PDFDocument2 pagesJK Lakshmi Cement PDFShashank ChauhanNo ratings yet

- Half Nelson - Mandela de Beers DiamondDocument3 pagesHalf Nelson - Mandela de Beers Diamonddouglas rodriguesNo ratings yet

- Ucsp Hard CopyyyyDocument5 pagesUcsp Hard CopyyyySanorjo MallicNo ratings yet

- Rpt-Sow Form 3 2024Document6 pagesRpt-Sow Form 3 2024g-16025707No ratings yet

- Internationalist Perspective 57Document36 pagesInternationalist Perspective 57SubproleNo ratings yet

- Inside The Social Media Cult That Convinces Young People To Give Up Everything - OneZeroDocument41 pagesInside The Social Media Cult That Convinces Young People To Give Up Everything - OneZeroAndrew EdisonNo ratings yet

- Queenie BalagDocument4 pagesQueenie Balagapi-276829441No ratings yet

- Strategic ManagementDocument33 pagesStrategic ManagementNaresh KuntiNo ratings yet

- Macr 009Document1 pageMacr 009Graal GasparNo ratings yet

- Bruno Latour AIR SENSORIUMpdfDocument4 pagesBruno Latour AIR SENSORIUMpdfAura OanceaNo ratings yet

- Luxury Wine Case StudyDocument14 pagesLuxury Wine Case Studyapi-308966986No ratings yet

- Ujian Mid Semester Genap Bing Paket BDocument3 pagesUjian Mid Semester Genap Bing Paket BLiNo ratings yet

- Single Judge - Delhi High CourtDocument16 pagesSingle Judge - Delhi High CourtnishantpratyushNo ratings yet

- Phrasal AdverbsDocument20 pagesPhrasal AdverbsOmar H. AlmahdawiNo ratings yet

- Celiac Disease Paper 1Document21 pagesCeliac Disease Paper 1M SalmanNo ratings yet

- Slat Flap Control Computer (SFCC) - Interchangeability & MixabilityDocument10 pagesSlat Flap Control Computer (SFCC) - Interchangeability & MixabilityJivendra KumarNo ratings yet

- Selected Student List For Reporting (A Unit) Reporting Date: 15/01/2023 and 16/01/2023 Published Date: 14/01/2023Document19 pagesSelected Student List For Reporting (A Unit) Reporting Date: 15/01/2023 and 16/01/2023 Published Date: 14/01/2023いずちあさみNo ratings yet