Professional Documents

Culture Documents

Hec Group of Institutions, Haridwar Test Series - 1 (2020-2021) Financial Market and Institution

Hec Group of Institutions, Haridwar Test Series - 1 (2020-2021) Financial Market and Institution

Uploaded by

Samarth AgarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hec Group of Institutions, Haridwar Test Series - 1 (2020-2021) Financial Market and Institution

Hec Group of Institutions, Haridwar Test Series - 1 (2020-2021) Financial Market and Institution

Uploaded by

Samarth AgarwalCopyright:

Available Formats

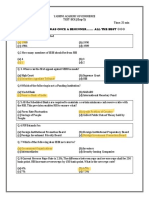

HEC GROUP OF INSTITUTIONS, HARIDWAR

TEST SERIES -1

(2020-2021)

B.COM HONS. VTH SEM

FINANCIAL MARKET AND INSTITUTION

Q.NO. 1 – Which of the following describe financial system.

(A) Various financial institution and markets of a country.

(B) Organised and un – organised sectors.

(C) Central bank of a country.

(D) none of the above.

Q.NO. 2 – Following are given a assertion and a reason choose the correct answer.

STATEMENT (I)- A well structured banking system is necessary for development of a

country. However unorganised institutions are also part of this system.

STATEMENT (II) – A financial system includes both organised and unorganised institution.

(A) Both statements are true.

(B) Statement I is true but II is false

(C) Both statement are false.

(D) Statement II is true but I is false.

Q.NO. 3 – Which of the following are apex institutions of a Indian economy.

(A) RBI, SEBI ,BSE, NHB, IRDA

(B) BSE, NSE, IRDA, NHB, NBFC

(C) A and B both are correct

(D) UTI, NBFC, BSE, FCI, NABARD,

Q.NO.4 – Which of the following are necessary for development of a economy.

(A) A well structured financial system

(B) A group of commercial bank

(C) Stock exchange

(D) None of the above

Q.NO.5 Financial system includes.

(A) central bank of country, banking and non – banking institution and money market.

(B) Apex institutions of country, banking and non – banking institutions and money

market and capital market.

(C) a and b both

(D) option b and unorganised sectors of a country.

Q.NO.6 Name of two important policies that regulate Indian economy.

(A) Fiscal policy, Monetary policy , Five year plans

(B) Monetary policy, Budget of central government, income tax act

(C) only monetary policy and fiscal policy

(D) None of the above

Q.NO.7 Financial intermediaries are :

(A) Banking and non – banking companies

(B) Only financial markets

(C) Money market and capital market and other financial institutions

(D) none of the above

Q.NO. 8 Establishment of RBI.

(A) 1 April 1935

(B) 1 April 1934

(C) 1 April 1933

(D) none of the above

Q.NO. 9 Headquarter of the reserve bank of India

(A) Delhi

(B) Mumbai

(C) Chennai

(D) none of the above

Q.NO. 10 Number of regional offices of RBI.

(A) 15

(B) 4

(C) 19

(D) 3

Q.NO. 11 Which of the following commission is behind the establishment of RBI.

(A) Hilton young commission

(B) Kothari commission

(C) both a and b

(D) none of the above

Q.NO. 12 Assertion (A) – Reserve bank of India is a important institution that control the

activities of FEMA (foreign Exchange management act).

Reason (R) – On the behalf of controller of FEMA and foreign currency RBI has the power

to manage these kind of acts.

Choose the correct option:-

(A) A and R both are true and R is the correct explanation of A.

(B) A and R both are false

(C) A and R both are true but R is not the correct explanation of A.

(D) A is false but R is correct.

Q.NO. 13 National housing bank (NHB) was established in 1987 as wholly owned subsidiary

of which of the following?

(A) State bank of India

(B) Life insurance corporation of India

(C) Reserve bank of India

(D) Industrial finance corporation of India

Q.NO.14 Lender of the last resort is.

(A) RBI

(B) NABARD

(C) SBI

(D) COMMERCIAL BANKS

Q.NO. 15 A sound economic policy of any government ordinarily entails in it.

(A) Welfare of people

(B) Growth of GDP and national income etc.

(C) Fair distribution of wealth

(D) All of the above

Q.NO.16 Which of the following measures is not adopted by RBI for controlling credit in

India?

(A) Cash deposit ratio

(B) Capital adequacy ratio

(C) Cash reserve ratio

(D) Statutory liquidity ratio

Q.NO. 17 The system of note issue adopted by RBI is.

(A) Proportional reserve method

(B) Minimum reserve method

(C) Partly proportional reserve method and partly minimum reserve method

(D) None of the above

Q.NO. 18 monetary policy is prepared and declared by.

(A) Govt. of India

(B) RBI

(C) State govt.

(D) SBI

Q.NO. 19 Which of the following limits the power of credit creation by commercial banks?

(A) Fiscal policy

(B) Banking laws

(C) REPO rates

(D) Monetary policy

Q.NO. 20 Which of the following is not the functions of a central bank?

(A) Monopoly of the issuing currency

(B) Credit creation

(C) Custodian of foreign exchange funds

(D) None of these above

Q.NO. 21 If bank rate is reduced by RBI, credit creation will be

(A) Reduced

(B) Constant

(C) Increased

(D) None of the above

Q.NO.22 Qualitative credit control include.

(A) Bank rate policy

(B)Rationing of credit

(C)Open market operations

(D)None of the above

Q.NO.23 At which of the following rate the central bank lends to banks against governmental

securities.

(A) Repo rate

(B) Bank rate

(C) SLR

(D) Reverse repo rate

Q.NO.24 Which of the following is not the the fund based activity of commercial banks.

(A) Issuing the letter of the credit

(B) Bank overdraft

(C) Acceptance of deposit

(D) RTGS and NEFT

Q.NO. 25 When RBI reduces CRR , it results into :

(A) Increase in lendable resources

(B) Decrease in lendable resources

(C) Decrease in Deposits

(D) Increase in deposits

Q.NO.26 Which one of the following is not the function of the reserve bank of india.

(A) Issue of bank notes

(B) Custodian of cash reserves of commercial banks

(C) Accepting deposits and advancing loans to public

(D) Controller of the credit

Q.NO. 27 Which of the following methods indicates quantitative methods of control of credit

creation practiced by the reserve bank of India.

(A) Bank rate

(B) Open market operations

(C) Variable reserve ratio

(D) Credit rationing

Codes-

(A) a,b,c

(B) a,b,d

(C) b,c,d

(D) a,c,d

Q.NO. 28 Reserve bank of India controls the activities of some of the following banks in

India:

i. Commercial banks

ii. Cooperative banks

iii. Foreign banks

iv. Rural banks

Codes-

(A) i, ii,iii

(B) i,ii,iv

(C) ii,iii,iv

(D) i,ii,iii,iv

Q.NO. 29 The Repo rate and Reverse repo rates are resorted to by the RBI as a tool of

(A) Credit control

(B) Settlement system

(C) Currency Management

(D) Liquidity control

Q.NO.30 Reserve bank of India was nationalized on

(A) January 26 , 1948

(B) January 01, 1949

(C) January 26, 1950

(D) January 01, 1956

Q.NO. 31 Repo rate is the rate on

(A) Commercial banks borrow money from RBI

(B) RBI borrow money from commercial banks

(C) Govt. borrow money from RBI.

(D) One commercial bank lends money to other bank.

Q.NO. 32 In CRR (c) refers to :

(A) Cash

(B) Commission

(C) Customer

(D) Credit

Q.NO.33 Open market operation is the part of :

(A) Fiscal policy

(B) Credit control

(C) Budgetary control

(D) Marketing Policy

Q.NO. 34 Inflation beneficial for:

(A) Business owners

(B) Consumers

(C) A and B both

(D) None of the above

Q.NO. 35 Causes of deflation in economy:

(A) Increase in money supply

(B) Low production

(C) Budget deficit

(D) All of the above

You might also like

- DISMANTLING AND PACKING OF GE Fr.9E Gas Turbine Plant - Eng ProposalDocument6 pagesDISMANTLING AND PACKING OF GE Fr.9E Gas Turbine Plant - Eng Proposalvarun100% (1)

- BS 200Document135 pagesBS 200Anonymous GhWU5YK8No ratings yet

- Hec Group of Institutions, Haridwar Test Series - 2 (2020-2021) Financial Market and InstitutionDocument8 pagesHec Group of Institutions, Haridwar Test Series - 2 (2020-2021) Financial Market and InstitutionSamarth Agarwal0% (1)

- MCQ Financial Regulatory FrameworkDocument13 pagesMCQ Financial Regulatory FrameworkNaziya TamboliNo ratings yet

- Banking Awareness Questions and Answers 2011 For Bank PO and ClerksDocument24 pagesBanking Awareness Questions and Answers 2011 For Bank PO and Clerkspagaldon007No ratings yet

- Banking GKDocument19 pagesBanking GKapi-248451009No ratings yet

- Banking & Insurance MCQsDocument10 pagesBanking & Insurance MCQsjhggNo ratings yet

- Bank of Baroda - General Socio-Economic & Banking AwarenessDocument15 pagesBank of Baroda - General Socio-Economic & Banking Awarenesssubhrajitm47No ratings yet

- All Banking McqsDocument28 pagesAll Banking McqsManoranjan SethiNo ratings yet

- Bank Socio EconomicDocument14 pagesBank Socio EconomicneosapienNo ratings yet

- RBI Placement Papers - RBI Interview Questions and Answers: Author: Administrator Saved FromDocument7 pagesRBI Placement Papers - RBI Interview Questions and Answers: Author: Administrator Saved FromAjay KumarNo ratings yet

- Macro CH 5 & 6 PDFDocument38 pagesMacro CH 5 & 6 PDFAKSHARA JAINNo ratings yet

- Banking Awareness Question: WWW - TNPSCROCK.inDocument11 pagesBanking Awareness Question: WWW - TNPSCROCK.inSenthamil ArasanNo ratings yet

- Important Banking GK PDFDocument26 pagesImportant Banking GK PDFPriya BanothNo ratings yet

- United Bank of India Placement Paper June 2011Document14 pagesUnited Bank of India Placement Paper June 2011Swetha ReddyNo ratings yet

- 1 Banking Awareness MCQs by K KundanDocument28 pages1 Banking Awareness MCQs by K KundanNarendra GuptaNo ratings yet

- 9A0 384 Q&A Demo CertMagicDocument16 pages9A0 384 Q&A Demo CertMagicpaka madhuriNo ratings yet

- CA FDN DEC'21 (July Batch) WE-11 P4 BEBCK (ECO) QP & KEY (18-10-2021)Document5 pagesCA FDN DEC'21 (July Batch) WE-11 P4 BEBCK (ECO) QP & KEY (18-10-2021)tradex1908No ratings yet

- Set 2:-50 MCQS: Mcqs On Banking and FinanceDocument12 pagesSet 2:-50 MCQS: Mcqs On Banking and Financesarita sahooNo ratings yet

- Banking and Finance QuestionsDocument22 pagesBanking and Finance Questionsatul mishraNo ratings yet

- Questions AnswersDocument30 pagesQuestions AnswersIndupal SinghNo ratings yet

- Mock Evaluation Term I (2021-2022) Class - Xii Subject-Economics (Code-030) Time: 90 Mins. + Reading Time: 20 Minutes MM-40 General InstructionsDocument8 pagesMock Evaluation Term I (2021-2022) Class - Xii Subject-Economics (Code-030) Time: 90 Mins. + Reading Time: 20 Minutes MM-40 General Instructionssourav krishnaNo ratings yet

- Bank of Baroda Probationary Officers Exam., 2008 (Held On 5-10-2008) General Socio-Economic and Banking Awareness: Solved PaperDocument9 pagesBank of Baroda Probationary Officers Exam., 2008 (Held On 5-10-2008) General Socio-Economic and Banking Awareness: Solved PaperDharam Raj NirvaanNo ratings yet

- MCQ Financial Regulatory FrameworkDocument13 pagesMCQ Financial Regulatory Frameworkthorat82No ratings yet

- Fundamentals of Banking Multiple Choice Question (GuruKpo)Document18 pagesFundamentals of Banking Multiple Choice Question (GuruKpo)GuruKPO100% (3)

- General Awareness On SocioDocument21 pagesGeneral Awareness On SocioduddysinghNo ratings yet

- Worksheet Money and Banking 2023Document6 pagesWorksheet Money and Banking 2023Reyaz Khan100% (1)

- Banking AwarenessDocument94 pagesBanking Awarenesschandrashekhar prasadNo ratings yet

- Financial-Institutions-And-Markets (Set 1)Document22 pagesFinancial-Institutions-And-Markets (Set 1)medkwn.pbtNo ratings yet

- GS Test 1Document2 pagesGS Test 1Pawan KumarNo ratings yet

- Banking and Finanac PDFDocument28 pagesBanking and Finanac PDFVijendra ThakreNo ratings yet

- MCQ On Central BankDocument2 pagesMCQ On Central Bankabhilash k.bNo ratings yet

- MAMS Sample Pre Board Term 1 2021-22Document16 pagesMAMS Sample Pre Board Term 1 2021-22Pooja BediNo ratings yet

- Ugc Paper-2 Dec 2009Document3 pagesUgc Paper-2 Dec 2009maanikyanNo ratings yet

- (E) All The Above Ans (E)Document25 pages(E) All The Above Ans (E)Shubham JainNo ratings yet

- Banking Quiz (Round 1) : InstructionsDocument10 pagesBanking Quiz (Round 1) : InstructionsRana JamalNo ratings yet

- Objective Type Questions in BankingDocument27 pagesObjective Type Questions in Bankingmidhungbabu81% (31)

- Ibps Free Download IBPS Sample Paper For PO and Clerk: General AwarenessDocument9 pagesIbps Free Download IBPS Sample Paper For PO and Clerk: General AwarenessSripriyaNo ratings yet

- General Socio-Economic & Banking AwarenessDocument4 pagesGeneral Socio-Economic & Banking AwarenessKapil MalikNo ratings yet

- Pre Board Examination - Class 12Document13 pagesPre Board Examination - Class 12GINNI BHULLARNo ratings yet

- List of 50 Important Banking Awareness Questions For Bank PO and Clerk ExamsDocument12 pagesList of 50 Important Banking Awareness Questions For Bank PO and Clerk ExamsSarlaJaiswal100% (2)

- CB MCQDocument11 pagesCB MCQVaishnavi khotNo ratings yet

- Economy: Money and Banking: Previous Year QuestionDocument9 pagesEconomy: Money and Banking: Previous Year Questionabhimmanyu2021No ratings yet

- Multiple Choice QuestionsDocument33 pagesMultiple Choice QuestionsSunil Kumar Gadwal100% (1)

- Banking Awareness 1Document4 pagesBanking Awareness 1Suresh GangavarapuNo ratings yet

- Management Point: Bank PO, ClerkDocument3 pagesManagement Point: Bank PO, ClerkPawan KumarNo ratings yet

- General Awareness For All Competitive ExamsDocument8 pagesGeneral Awareness For All Competitive ExamspummygNo ratings yet

- Banking Questions For IBPS Gr8AmbitionZDocument25 pagesBanking Questions For IBPS Gr8AmbitionZshahenaaz3No ratings yet

- MONEY AND CREDIT Imp QuestionsDocument13 pagesMONEY AND CREDIT Imp QuestionsKartik MishraNo ratings yet

- Economics Study Material Xii 2021-22 Term I-KvsDocument44 pagesEconomics Study Material Xii 2021-22 Term I-KvsShivanshNo ratings yet

- IBPS Bank Examinations - Banking Awareness - Mock Test PapersDocument72 pagesIBPS Bank Examinations - Banking Awareness - Mock Test PapersA. GAURI SANKARNo ratings yet

- Delhi Public School, Chandigarh: Section A (20 Questions Out of 24 Questions Are To Be Attempted)Document13 pagesDelhi Public School, Chandigarh: Section A (20 Questions Out of 24 Questions Are To Be Attempted)Govind AggarwalNo ratings yet

- B & FDocument4 pagesB & FS BhuvaneswariNo ratings yet

- BCK Test Ans (Neha)Document3 pagesBCK Test Ans (Neha)Neha GargNo ratings yet

- Question Paper Central Banking & Commercial Banking (MB3G2B) : October 2008Document16 pagesQuestion Paper Central Banking & Commercial Banking (MB3G2B) : October 2008ppadaliaNo ratings yet

- Indian Overseas Bank - General Awareness Exam - 2009: # Receive # Receive /tips For PreparingDocument7 pagesIndian Overseas Bank - General Awareness Exam - 2009: # Receive # Receive /tips For PreparingNisha LalaNo ratings yet

- EXERCISE Bank Po PreparationDocument91 pagesEXERCISE Bank Po PreparationvirusyadavNo ratings yet

- MCQs 3Document17 pagesMCQs 3James KnotNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesFrom EverandFinancial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesNo ratings yet

- Jenny Louise Cudd - Motion To Sever CaseDocument6 pagesJenny Louise Cudd - Motion To Sever CaseLaw&CrimeNo ratings yet

- Lifting Hazards & Crane SafetyDocument26 pagesLifting Hazards & Crane SafetynincatNo ratings yet

- 0196 - Beo Masbi Makassar - 18 June 2023 - Michelle - ImccDocument1 page0196 - Beo Masbi Makassar - 18 June 2023 - Michelle - ImccJuan AnggriyantoNo ratings yet

- ROSIEN OSENTAL v. PEOPLE OF THE PHILIPPINESDocument4 pagesROSIEN OSENTAL v. PEOPLE OF THE PHILIPPINESJunaid DadayanNo ratings yet

- Matrix On Shipping Lines ChargesDocument7 pagesMatrix On Shipping Lines ChargesPortCallsNo ratings yet

- Phil Steel Coating Corp vs. QuinonesDocument2 pagesPhil Steel Coating Corp vs. QuinonesJennifer ArcadioNo ratings yet

- Response To MotionDocument7 pagesResponse To MotionAnthony WarrenNo ratings yet

- LSS - A Software Presentation For Indian NVOCCsDocument33 pagesLSS - A Software Presentation For Indian NVOCCsSyscon InfotechNo ratings yet

- ADMIN RAP Notes PDFDocument9 pagesADMIN RAP Notes PDFDominique Anne ManaloNo ratings yet

- The Plot To Kidnap Michigan's GovernorDocument56 pagesThe Plot To Kidnap Michigan's GovernorFelix VentourasNo ratings yet

- Javellana v. LedesmaDocument2 pagesJavellana v. LedesmaazuremangoNo ratings yet

- Globetrotter MacOSDocument2 pagesGlobetrotter MacOSFaristakenNo ratings yet

- 005 Palmera v. CSCDocument2 pages005 Palmera v. CSCMoira SarmientoNo ratings yet

- Lift Me Up RihannaDocument5 pagesLift Me Up RihannaCampustar Receptionist71% (7)

- Mary D'OraziO v. Hartford Ins Co, 3rd Cir. (2012)Document6 pagesMary D'OraziO v. Hartford Ins Co, 3rd Cir. (2012)Scribd Government DocsNo ratings yet

- Commissioner of Internal Revenue vs. Citytrust Investment Phils., Inc., G.R. Nos. 139786 & 140857, September 27, 2006Document4 pagesCommissioner of Internal Revenue vs. Citytrust Investment Phils., Inc., G.R. Nos. 139786 & 140857, September 27, 2006xxxaaxxxNo ratings yet

- Spice ORBDocument8 pagesSpice ORBmonaNo ratings yet

- Corporation and Estate Taxation - Sample ProblemDocument5 pagesCorporation and Estate Taxation - Sample Problemwind snip3r reojaNo ratings yet

- 671 - Msds-Cassida Fluid GL 460Document8 pages671 - Msds-Cassida Fluid GL 460Alvin LimlengcoNo ratings yet

- 2020 CBO IRS Enforcement ReportDocument40 pages2020 CBO IRS Enforcement ReportStephen LoiaconiNo ratings yet

- Accounting For Proportional TreatiesDocument35 pagesAccounting For Proportional TreatiesGashawNo ratings yet

- DPS INCIDENT REPORT - OFFICIAL COPY - I100124138 - Redacted PDFDocument3 pagesDPS INCIDENT REPORT - OFFICIAL COPY - I100124138 - Redacted PDFDan LehrNo ratings yet

- Catalog DetailsDocument20 pagesCatalog DetailsFaiyaz AhmedNo ratings yet

- 2016 15th July - Retaintention InstructionDocument2 pages2016 15th July - Retaintention InstructionFOTTOX IMGNo ratings yet

- Ra 9514 Rirr Rule 1-14 Except Rule 10 Version 1 With NotesDocument161 pagesRa 9514 Rirr Rule 1-14 Except Rule 10 Version 1 With NotesMichael Bael100% (1)

- Accounting For Bonus and Right Issue: Topic - 4Document12 pagesAccounting For Bonus and Right Issue: Topic - 4Naga ChandraNo ratings yet

- Appendix 1 AnswersDocument84 pagesAppendix 1 AnswersTiya AmuNo ratings yet

- Mayur Manch MATERIAL/ALOP - 1463295927671Document3 pagesMayur Manch MATERIAL/ALOP - 1463295927671Thanglianlal TonsingNo ratings yet