Professional Documents

Culture Documents

Sale and Leaseback

Sale and Leaseback

Uploaded by

Shinny Jewel VingnoCopyright:

Available Formats

You might also like

- TBDocument31 pagesTBBenj LadesmaNo ratings yet

- Answer Key Assignment in Equity Investments - VALIX 2017Document3 pagesAnswer Key Assignment in Equity Investments - VALIX 2017Shinny Jewel VingnoNo ratings yet

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- Balance Sheet Income StatementDocument50 pagesBalance Sheet Income Statementgurbaxeesh0% (1)

- Value Chain Analysis-Mentha Farming & Processing Development ProgrammeDocument16 pagesValue Chain Analysis-Mentha Farming & Processing Development ProgrammeSatyendra Nath PandeyNo ratings yet

- Ch10&11. Shareholders' EquityDocument29 pagesCh10&11. Shareholders' EquityHazell DNo ratings yet

- Sia 3.compound Financial InstrumentDocument11 pagesSia 3.compound Financial InstrumentleneNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Compound Financial InstrumentsDocument12 pagesCompound Financial InstrumentsLoro AdrianNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Employee Benefit Expense 1,650,000Document14 pagesEmployee Benefit Expense 1,650,000Jud Rossette ArcebesNo ratings yet

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Flexible Company Debit Credit 2020Document1 pageFlexible Company Debit Credit 2020AnonnNo ratings yet

- Fair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final ExamDocument2 pagesFair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final Examkaeya alberichNo ratings yet

- Chapter 15,16, & 17 IA Valix Sales Type LeaseDocument15 pagesChapter 15,16, & 17 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Lesson3 - Warranty LiabilityDocument15 pagesLesson3 - Warranty LiabilityCirelle Faye Silva0% (1)

- 21 Financial Assets at Fair Value: Solution 21-1 Answer CDocument30 pages21 Financial Assets at Fair Value: Solution 21-1 Answer CLayNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- 064 PDFDocument9 pages064 PDFWe WNo ratings yet

- Unit CDocument46 pagesUnit CKarl Lincoln TemporosaNo ratings yet

- Acc 224L 1st Laboratory ExamDocument13 pagesAcc 224L 1st Laboratory ExamJuziel Rosel PadilloNo ratings yet

- Acc 3Document2 pagesAcc 3Avox EverdeenNo ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Cabug-Os, Lovely A. (Assignment 9)Document2 pagesCabug-Os, Lovely A. (Assignment 9)Joylyn CombongNo ratings yet

- IA2 Worksheet-BONDS PAYABLE - 101010Document11 pagesIA2 Worksheet-BONDS PAYABLE - 101010aehy lznuscrfbjNo ratings yet

- Audit of Shareholders' Equity - July 22, 2021Document35 pagesAudit of Shareholders' Equity - July 22, 2021Kathrina RoxasNo ratings yet

- Cash Basis, Accrual Basis and Single Entry Method: General ConceptsDocument7 pagesCash Basis, Accrual Basis and Single Entry Method: General ConceptsNhel AlvaroNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Lessor Accounting Quiz PSDocument4 pagesLessor Accounting Quiz PSBeatrice Ella DomingoNo ratings yet

- Kiara Company Provided The Following DataDocument1 pageKiara Company Provided The Following Datadagohoy kennethNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- 221 PrintDocument23 pages221 PrintChara etangNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- Silver Company Provided The Following Information at Year-EndDocument1 pageSilver Company Provided The Following Information at Year-EndKatrina Dela CruzNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- Liabilities and Equity Sample Problems Premiums and Warranty Liability - CompressDocument93 pagesLiabilities and Equity Sample Problems Premiums and Warranty Liability - CompressKiahna Clare ArdaNo ratings yet

- Acctg 4 Quiz 3 Debt Restructuring Payables 1Document11 pagesAcctg 4 Quiz 3 Debt Restructuring Payables 1Competente, Jhonna W.No ratings yet

- Fman April 3,2020 - Operating and Financial LeverageDocument2 pagesFman April 3,2020 - Operating and Financial LeverageAngela Dela PeñaNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Single Entry MethodDocument6 pagesSingle Entry MethodNhel AlvaroNo ratings yet

- CAED101 - DE CASTRO - ACN1 - EOQ ActivityDocument1 pageCAED101 - DE CASTRO - ACN1 - EOQ ActivityIra Grace De CastroNo ratings yet

- Leases Part 3 - Other Accounting IssuesDocument33 pagesLeases Part 3 - Other Accounting IssuesDanica RamosNo ratings yet

- Fixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Document3 pagesFixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Diwakar SHARMANo ratings yet

- C3 - Warranty LiabilityDocument12 pagesC3 - Warranty LiabilityRiza Kristine DaytoNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Problem 5 and 6Document4 pagesProblem 5 and 6Lalaina EnriquezNo ratings yet

- Valuation B and S - Q & ADocument3 pagesValuation B and S - Q & Aaaaaa aaaaaNo ratings yet

- Accounting 132Document2 pagesAccounting 132Anne Marieline BuenaventuraNo ratings yet

- Quiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Document3 pagesQuiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Martin ManuelNo ratings yet

- IAII FINAL EXAM Maual SET ADocument9 pagesIAII FINAL EXAM Maual SET ALovely Anne Dela CruzNo ratings yet

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Seatwork Module 10Document3 pagesSeatwork Module 10Marjorie PalmaNo ratings yet

- Activity 3-4 SB CompensationDocument3 pagesActivity 3-4 SB CompensationNhel Alvaro0% (1)

- Chapter 17Document3 pagesChapter 17Michael CarlayNo ratings yet

- Ae 211 Solutions-PrelimDocument10 pagesAe 211 Solutions-PrelimNhel AlvaroNo ratings yet

- Finance LeaseDocument26 pagesFinance LeaseJudith GabuteroNo ratings yet

- Problem 15 - 1 Books of German CompanyDocument3 pagesProblem 15 - 1 Books of German CompanyCOCO IMNIDANo ratings yet

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoNo ratings yet

- Rizal Life and Works REPORTINGDocument45 pagesRizal Life and Works REPORTINGShinny Jewel VingnoNo ratings yet

- Notes Payable & Debt Restructuring - Valix 2020Document6 pagesNotes Payable & Debt Restructuring - Valix 2020Shinny Jewel VingnoNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Shinny Jewel C. Vingno BSA-2 Problem 1-18Document7 pagesShinny Jewel C. Vingno BSA-2 Problem 1-18Shinny Jewel VingnoNo ratings yet

- Lessor AccountingDocument4 pagesLessor AccountingShinny Jewel VingnoNo ratings yet

- Unit 2 - Income From Other SourcesDocument9 pagesUnit 2 - Income From Other SourcesRakhi DhamijaNo ratings yet

- Salaryslip - Soniya Dhull - For - February - 2023Document1 pageSalaryslip - Soniya Dhull - For - February - 2023Heer BatraNo ratings yet

- Quickie Estate and DonorDocument6 pagesQuickie Estate and DonorDennis Aran Tupaz AbrilNo ratings yet

- 1st Periodical Exam in Fundamentals of Accountancy and Business Management 1 ReviewerDocument9 pages1st Periodical Exam in Fundamentals of Accountancy and Business Management 1 ReviewerJaderick BalboaNo ratings yet

- Adopt-A-School Program Kit 2019Document30 pagesAdopt-A-School Program Kit 2019Winny FelipeNo ratings yet

- Elgi Equipments - Initiating CoverageDocument23 pagesElgi Equipments - Initiating CoveragerabharatNo ratings yet

- Dokumen - Tips Wipro Ratio Analysis 55849d8e50235Document20 pagesDokumen - Tips Wipro Ratio Analysis 55849d8e50235zomaan mirzaNo ratings yet

- Taxation (Malaysia) : September/December 2016 - Sample QuestionsDocument12 pagesTaxation (Malaysia) : September/December 2016 - Sample QuestionsGary Danny Galiyang100% (1)

- Filipino Sa Piling LaranganDocument6 pagesFilipino Sa Piling LaranganIvy Joy AutorNo ratings yet

- Horizontal and Vertical AnalysisDocument28 pagesHorizontal and Vertical AnalysisRachelle78% (9)

- Chapter 2 - Concept Questions and Exercises StudentDocument9 pagesChapter 2 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- GA55 Reportdetail BillwiseDocument2 pagesGA55 Reportdetail BillwiseSmith AgrawalNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- CA23 Financial Reporting and AnalysisDocument5 pagesCA23 Financial Reporting and AnalysisjoanNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Philippine Tax System & Income Tax: LossesDocument50 pagesPhilippine Tax System & Income Tax: LossesSamuel ArgoteNo ratings yet

- SALARYDocument19 pagesSALARYHrishit Raj SardaNo ratings yet

- Business Plan: Trimingle RestaurantDocument36 pagesBusiness Plan: Trimingle RestaurantsaimaNo ratings yet

- Payroll Ref - BUSINESS MATHEMATICS PDFDocument2 pagesPayroll Ref - BUSINESS MATHEMATICS PDFKabayanNo ratings yet

- Equitymaster-Knowledge Centre-Intelligent Investing PDFDocument176 pagesEquitymaster-Knowledge Centre-Intelligent Investing PDFarif420_999No ratings yet

- Quiz 4 Chapter 7 and 8Document5 pagesQuiz 4 Chapter 7 and 8June Antony Lim HechanovaNo ratings yet

- Worldwide VAT, GST and Sales Tax Guide 2015Document1,072 pagesWorldwide VAT, GST and Sales Tax Guide 2015chandra_sekhar_31No ratings yet

- Accounting For Employment Benefits PDF FreeDocument5 pagesAccounting For Employment Benefits PDF FreeTrisha Mae BujalanceNo ratings yet

- Classification of CostDocument5 pagesClassification of CostCharlotte ChanNo ratings yet

- LSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFDocument121 pagesLSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFandry4jcNo ratings yet

- Project Report On Human Resource ManagemDocument17 pagesProject Report On Human Resource ManagemBhagyashreeNo ratings yet

Sale and Leaseback

Sale and Leaseback

Uploaded by

Shinny Jewel VingnoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sale and Leaseback

Sale and Leaseback

Uploaded by

Shinny Jewel VingnoCopyright:

Available Formats

Shinny Jewel C.

Vingno 08-18-2021

BSA-3

Problem 16-1

Fair Value at Sales Price 1,200,000

Cost of the Asset 2,500,000

Carrying Amount of the Asset 100,000

Remaining Useful life 5 years

Annual Rental payable at the beginning of the year 300,000

BOOKS OF GERMAN COMPANY

Cash 1,200,000

Accumulated Depreciation-Equipment 1,500,000

Equipment 2,500,000

Gain on right transferred 200,000

Rent Expense 300,000

Cash 300,000

BOOKS OF STERLING COMPANY

Equipment 1,200,000

Cash 1,200,000

Cash 300,000

Rent Income 300,000

Depreciation Expense 240,000

Accumulated Depreciaiton 240,000

(1,200,000/5)

Problem 16-2

Sales Price 500,000

Machinery 600,000

Accumulated Depreciation 120,000

Remaining life 10

Lease Term 3

Annual rental 100,000

BOOKS OF CANADA COMPANY

1/1/2019 Cash 500,000

Accumulated Depreciation-Machinery 120,000

Machinery 600,000

Gain on right transferred 20,000

12/31/2019 Rent Expense 100,000

Cash 100,000

Shinny Jewel C. Vingno 08-18-2021

BSA-3

BOOKS OF SAIGON COMPANY

1/1/2019 Machinery 500,000

Cash 500,000

12/31/2019 Cash 100,000

Rent Income 100,000

Depreciation Expense 50,000

Accumulated Depreciaiton 50,000

(500,000/10)

Problem 16-3

1. Initial Measurement of lease liability 2,274,600

(600,000*3.791)

2. Cost of ROU Asset 2,047,140

(2,274,600/5,000,000*4,500,000)

3. Sale price 5,000,000

Carrying Amount (4,500,000)

Total gain 500,000

Fair value 5,000,000

Right retained by seller-lessee (2,274,600)

Right transferred to the buyer-lessor 2,725,400

Gain on right to transfer to the buyer-lessor 272,540

(2,725,400/5,000,000*500,000)

4. BOOKS OF JUAN COMPANY

1/1/2019 Cash 5,000,000

Right of use asset 2,047,140

Machinery 4,500,000

Lease Liability 2,274,600

Gain on right to transfer to the buyer-lessor 272,540

12/21/2019 Interest Expense (2,274,600*10%) 227,460

Lease Liability 372,540

Cash 600,000

Depreciation Expense-ROUA 409,428

Accum. Dep. (2,047,140/5) 409,428

Shinny Jewel C. Vingno 08-18-2021

BSA-3

5. BOOKS OF BUYER-LESSOR

1/1/2019 Machinery 5,000,000

Cash 5,000,000

12/31/2019 Cash 600,000

Rent Income 600,000

Depreciation Expense 500,000

Accumulated Depreciaiton 500,000

(5,000,000/10)

Problem 16-4

1. Initial Measurement of lease liability (800,000*3.312) 2,649,600

2. Sale price 6,000,000

Fair value of machinery (5,000,000)

Excess of sale over fv of asset 1,000,000

Initial Measurement of lease liability (800,000*3.312) 2,649,600

additional financing equal excess of sale (1,000,000)

PV of lease liability related to rentals 1,649,600

Cost of ROU Asset 1,484,640

(1,649,600/5,000,000*4,500,000)

3. Fair Value 5,000,000

Carrying Amount (4,500,000)

Adjusted total gain 500,000

Fair value 5,000,000

Right retained by seller-lessee (1,649,600)

Right transferred to the buyer-lessor 3,350,400

Gain on right to transfer to the buyer-lessor 335,040

(3,350,400/5,000,000*500,000)

4. BOOKS OF PEDRO COMPANY

1/1/2019 Cash 6,000,000

Right of use asset 1,484,640

Machinery 4,500,000

Lease Liability 2,649,600

Gain on right to transfer to the buyer-lessor 335,040

12/31/2019 Interest Expense (2,649,600*8%) 211,968

Lease Liability 588,032

Cash 800,000

Shinny Jewel C. Vingno 08-18-2021

BSA-3

Depreciation Expense-ROUA (1,484,640/4) 371,160

Accum. Depreciatrion 371,160

5. BOOKS OF BUYER-LESSOR

1/1/2019 Machinery 5,000,000

Financial Asset 1,000,000

Cash 6,000,000

12/31/2019 Cash 498,068

Rent Income 498,068

Present Value Fraction Allocation

rental Income 1,649,600 1,649.6/2,649.6*800,000 498,068

financial asset 1,000,000 1,000/2,649.6*800,000 301,932

total present value 2,649,600 800,000

Cash 301,932

Financial Asset 221,932

Interest Income (1,000,000*8%) 80,000

Depreciation Expense 500,000

Accumulated Depreciaiton 500,000

(5,000,000/10)

Problem 16-5

1. Initial Measurement of Lease liability (500,000*2.67) 1,335,000

2. Sale price 4,000,000

Fair value of machine (5,000,000)

Excess of fair value over sale price (1,000,000)

PV of rentals (500,000*2.67) 1,335,000

Excess of fair value - prepayment of rental 1,000,000

total lease liability 2,335,000

Cost of ROU Asset 1,634,500

(2,335,000/5,000,000*3,500,000)

3. Fair Value 5,000,000

Carrying Amount (3,500,000)

Adjusted total gain 1,500,000

Fair value 5,000,000

Right retained by seller-lessee (2,335,000)

Right transferred to the buyer-lessor 2,665,000

Gain on right to transfer to the buyer-lessor 799,500

(2,665,000/5,000,000*1,500,000)

Shinny Jewel C. Vingno 08-18-2021

BSA-3

4. BOOKS OF HAZEL COMPANY

1/1/2019 Cash 4,000,000

Right of use asset 1,634,500

Machinery 3,500,000

Lease Liability 1,335,000

Gain on right to transfer to the buyer-lessor 799,500

12/31/2019 Interest Expense (1335000*6%) 80,100

Lease Liability 419,900

Cash 500,000

Depreciation Expense-ROUA (1,634,500/3) 544,833

Accum. Depreciation 544,833

5. BOOKS OF BUYER-LESSOR

1/1/2019 Machinery 4,000,000

Cash 4,000,000

12/31/2019 Cash 500,000

Rent Income 500,000

Depreciation Expense 400,000

Accumulated Depreciaiton 400,000

(4,000,000/10)

Problem 16-6

Sale price at fair value 2,400,000

Building 5,000,000 Carrying Amount (5,000,000-

1,600,000

Accumulated Depreciation 3,400,000 3,400,000)

Remaining useful life 15 years

lease tearm 8 years

Annual payment 300,000

PV of OA of 1 at 6% for 8 6.21

periods

1. Initial Measurement of lease liability 1,863,000

(300,000*6.21)

2. Cost of ROU Asset 1,242,000

(1,863,000/2,400,000*1,600,000)

3. Sale price 2,400,000

Carrying Amount (1,600,000)

Total gain 800,000

Shinny Jewel C. Vingno 08-18-2021

BSA-3

Fair value 2,400,000

Right retained by seller-lessee (1,863,000)

Right transferred to the buyer-lessor 537,000

Gain on right to transfer to the buyer-lessor 179,000

(537,000/2,400,000*800,000)

4. BOOKS OF CUBA COMPANY

1/1/2019 Cash 2,400,000

Right of use asset 1,242,000

Accumulated Depreciation 3,400,000

Building 5,000,000

Lease Liability 1,863,000

Gain on right to transfer to the buyer-lessor 179,000

12/31/2019 Interest Expense (1,863,000*6%) 111,780

Lease Liability 188,220

Cash 300,000

Depreciation Expense-ROUA 155,250

Accum. Dep. (1,242,000/8) 155,250

5. BOOKS OF MEXICO COMPANY

Building 2,400,000

Cash 2,400,000

Cash 300,000

Rent Income 300,000

Depreciation Expense (2,400,000/15) 160,000

Accumulated Depreciaiton 160,000

Problem 16-7

Sale price at fair value 5,000,000

Carrying Amount of Building 6,500,000

Remaining useful life 20 years

lease tearm 4 years

Annual payment 300,000

Implicit interest rate 6%

PV of OA of 1 at 6% for 4 3.465

periods

1. Initial Measurement of lease liability 1,039,500

(300,000*3.465)

Shinny Jewel C. Vingno 08-18-2021

BSA-3

2. Cost of ROU Asset 1,351,350

(1,,039,500/5000,000*6,500,000)

3. Sale price 5,000,000

Carrying Amount (6,500,000)

Total loss (1,500,000)

Fair value 5,000,000

Right retained by seller-lessee (1,039,500)

Right transferred to the buyer-lessor 3,960,500

Loss on right to transfer to the buyer-lessor (1,188,150)

(3960500/5000,000*1,500,000)

4. BOOKS OF WORLD COMPANY

1/1/2019 Cash 5,000,000

Right of use asset 1,351,350

Loss on right to transfer to the buyer-lessor 1,188,150

Machinery(Equipment) 6,500,000

Lease Liability 1,039,500

12/31/2019 Interest Expense (1,039,500*6%) 62,370

Lease Liability 237,630

Cash 300,000

Depreciation Expense-ROUA (1351350/4) 337,838

Accumulated Depreciation 337,838

5. BOOKS OF BUYER-LESSOR

1/1/2019 Machinery 5,000,000

Cash 5,000,000

12/31/2019 Cash 300,000

Rent Income 300,000

Depreciation Expense 250,000

Accumulated Depreciaiton 250,000

(5,000,000/20)

Problem 16-8

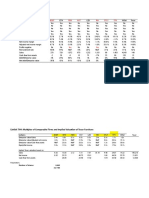

Date Payment Interest Princiopal Present Value

1/1/2019 1,200,000

12/31/2019 500,000 144,000 356,000 844,000

12/31/2020 500,000 101,280 398,720 445,280

12/31/2021 500,000 54,720 445,280 -

Shinny Jewel C. Vingno 08-18-2021

BSA-3

BOOKS OF GLOBE COMPANY

1/1/2019 Cash 1,200,000

Lease Liability 1,200,000

12/31/2019 Interest Expense 144,000

Lease Liability 356,000

Cash 500,000

BOOKS OF Buyer-Lessor

1/1/2019 Lease receivable 1,200,000

Cash 1,200,000

12/31/2019 Cash 500,000

Lease Receivable 356,000

Lease Income 144,000

Shinny Jewel C. Vingno 08-18-2021

BSA-3

Shinny Jewel C. Vingno 08-18-2021

BSA-3

You might also like

- TBDocument31 pagesTBBenj LadesmaNo ratings yet

- Answer Key Assignment in Equity Investments - VALIX 2017Document3 pagesAnswer Key Assignment in Equity Investments - VALIX 2017Shinny Jewel VingnoNo ratings yet

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- Balance Sheet Income StatementDocument50 pagesBalance Sheet Income Statementgurbaxeesh0% (1)

- Value Chain Analysis-Mentha Farming & Processing Development ProgrammeDocument16 pagesValue Chain Analysis-Mentha Farming & Processing Development ProgrammeSatyendra Nath PandeyNo ratings yet

- Ch10&11. Shareholders' EquityDocument29 pagesCh10&11. Shareholders' EquityHazell DNo ratings yet

- Sia 3.compound Financial InstrumentDocument11 pagesSia 3.compound Financial InstrumentleneNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Compound Financial InstrumentsDocument12 pagesCompound Financial InstrumentsLoro AdrianNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Employee Benefit Expense 1,650,000Document14 pagesEmployee Benefit Expense 1,650,000Jud Rossette ArcebesNo ratings yet

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Flexible Company Debit Credit 2020Document1 pageFlexible Company Debit Credit 2020AnonnNo ratings yet

- Fair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final ExamDocument2 pagesFair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final Examkaeya alberichNo ratings yet

- Chapter 15,16, & 17 IA Valix Sales Type LeaseDocument15 pagesChapter 15,16, & 17 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Lesson3 - Warranty LiabilityDocument15 pagesLesson3 - Warranty LiabilityCirelle Faye Silva0% (1)

- 21 Financial Assets at Fair Value: Solution 21-1 Answer CDocument30 pages21 Financial Assets at Fair Value: Solution 21-1 Answer CLayNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- 064 PDFDocument9 pages064 PDFWe WNo ratings yet

- Unit CDocument46 pagesUnit CKarl Lincoln TemporosaNo ratings yet

- Acc 224L 1st Laboratory ExamDocument13 pagesAcc 224L 1st Laboratory ExamJuziel Rosel PadilloNo ratings yet

- Acc 3Document2 pagesAcc 3Avox EverdeenNo ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Cabug-Os, Lovely A. (Assignment 9)Document2 pagesCabug-Os, Lovely A. (Assignment 9)Joylyn CombongNo ratings yet

- IA2 Worksheet-BONDS PAYABLE - 101010Document11 pagesIA2 Worksheet-BONDS PAYABLE - 101010aehy lznuscrfbjNo ratings yet

- Audit of Shareholders' Equity - July 22, 2021Document35 pagesAudit of Shareholders' Equity - July 22, 2021Kathrina RoxasNo ratings yet

- Cash Basis, Accrual Basis and Single Entry Method: General ConceptsDocument7 pagesCash Basis, Accrual Basis and Single Entry Method: General ConceptsNhel AlvaroNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Lessor Accounting Quiz PSDocument4 pagesLessor Accounting Quiz PSBeatrice Ella DomingoNo ratings yet

- Kiara Company Provided The Following DataDocument1 pageKiara Company Provided The Following Datadagohoy kennethNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- 221 PrintDocument23 pages221 PrintChara etangNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- Silver Company Provided The Following Information at Year-EndDocument1 pageSilver Company Provided The Following Information at Year-EndKatrina Dela CruzNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- Liabilities and Equity Sample Problems Premiums and Warranty Liability - CompressDocument93 pagesLiabilities and Equity Sample Problems Premiums and Warranty Liability - CompressKiahna Clare ArdaNo ratings yet

- Acctg 4 Quiz 3 Debt Restructuring Payables 1Document11 pagesAcctg 4 Quiz 3 Debt Restructuring Payables 1Competente, Jhonna W.No ratings yet

- Fman April 3,2020 - Operating and Financial LeverageDocument2 pagesFman April 3,2020 - Operating and Financial LeverageAngela Dela PeñaNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Single Entry MethodDocument6 pagesSingle Entry MethodNhel AlvaroNo ratings yet

- CAED101 - DE CASTRO - ACN1 - EOQ ActivityDocument1 pageCAED101 - DE CASTRO - ACN1 - EOQ ActivityIra Grace De CastroNo ratings yet

- Leases Part 3 - Other Accounting IssuesDocument33 pagesLeases Part 3 - Other Accounting IssuesDanica RamosNo ratings yet

- Fixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Document3 pagesFixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Diwakar SHARMANo ratings yet

- C3 - Warranty LiabilityDocument12 pagesC3 - Warranty LiabilityRiza Kristine DaytoNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Problem 5 and 6Document4 pagesProblem 5 and 6Lalaina EnriquezNo ratings yet

- Valuation B and S - Q & ADocument3 pagesValuation B and S - Q & Aaaaaa aaaaaNo ratings yet

- Accounting 132Document2 pagesAccounting 132Anne Marieline BuenaventuraNo ratings yet

- Quiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Document3 pagesQuiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Martin ManuelNo ratings yet

- IAII FINAL EXAM Maual SET ADocument9 pagesIAII FINAL EXAM Maual SET ALovely Anne Dela CruzNo ratings yet

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Seatwork Module 10Document3 pagesSeatwork Module 10Marjorie PalmaNo ratings yet

- Activity 3-4 SB CompensationDocument3 pagesActivity 3-4 SB CompensationNhel Alvaro0% (1)

- Chapter 17Document3 pagesChapter 17Michael CarlayNo ratings yet

- Ae 211 Solutions-PrelimDocument10 pagesAe 211 Solutions-PrelimNhel AlvaroNo ratings yet

- Finance LeaseDocument26 pagesFinance LeaseJudith GabuteroNo ratings yet

- Problem 15 - 1 Books of German CompanyDocument3 pagesProblem 15 - 1 Books of German CompanyCOCO IMNIDANo ratings yet

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoNo ratings yet

- Rizal Life and Works REPORTINGDocument45 pagesRizal Life and Works REPORTINGShinny Jewel VingnoNo ratings yet

- Notes Payable & Debt Restructuring - Valix 2020Document6 pagesNotes Payable & Debt Restructuring - Valix 2020Shinny Jewel VingnoNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Shinny Jewel C. Vingno BSA-2 Problem 1-18Document7 pagesShinny Jewel C. Vingno BSA-2 Problem 1-18Shinny Jewel VingnoNo ratings yet

- Lessor AccountingDocument4 pagesLessor AccountingShinny Jewel VingnoNo ratings yet

- Unit 2 - Income From Other SourcesDocument9 pagesUnit 2 - Income From Other SourcesRakhi DhamijaNo ratings yet

- Salaryslip - Soniya Dhull - For - February - 2023Document1 pageSalaryslip - Soniya Dhull - For - February - 2023Heer BatraNo ratings yet

- Quickie Estate and DonorDocument6 pagesQuickie Estate and DonorDennis Aran Tupaz AbrilNo ratings yet

- 1st Periodical Exam in Fundamentals of Accountancy and Business Management 1 ReviewerDocument9 pages1st Periodical Exam in Fundamentals of Accountancy and Business Management 1 ReviewerJaderick BalboaNo ratings yet

- Adopt-A-School Program Kit 2019Document30 pagesAdopt-A-School Program Kit 2019Winny FelipeNo ratings yet

- Elgi Equipments - Initiating CoverageDocument23 pagesElgi Equipments - Initiating CoveragerabharatNo ratings yet

- Dokumen - Tips Wipro Ratio Analysis 55849d8e50235Document20 pagesDokumen - Tips Wipro Ratio Analysis 55849d8e50235zomaan mirzaNo ratings yet

- Taxation (Malaysia) : September/December 2016 - Sample QuestionsDocument12 pagesTaxation (Malaysia) : September/December 2016 - Sample QuestionsGary Danny Galiyang100% (1)

- Filipino Sa Piling LaranganDocument6 pagesFilipino Sa Piling LaranganIvy Joy AutorNo ratings yet

- Horizontal and Vertical AnalysisDocument28 pagesHorizontal and Vertical AnalysisRachelle78% (9)

- Chapter 2 - Concept Questions and Exercises StudentDocument9 pagesChapter 2 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- GA55 Reportdetail BillwiseDocument2 pagesGA55 Reportdetail BillwiseSmith AgrawalNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- CA23 Financial Reporting and AnalysisDocument5 pagesCA23 Financial Reporting and AnalysisjoanNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Philippine Tax System & Income Tax: LossesDocument50 pagesPhilippine Tax System & Income Tax: LossesSamuel ArgoteNo ratings yet

- SALARYDocument19 pagesSALARYHrishit Raj SardaNo ratings yet

- Business Plan: Trimingle RestaurantDocument36 pagesBusiness Plan: Trimingle RestaurantsaimaNo ratings yet

- Payroll Ref - BUSINESS MATHEMATICS PDFDocument2 pagesPayroll Ref - BUSINESS MATHEMATICS PDFKabayanNo ratings yet

- Equitymaster-Knowledge Centre-Intelligent Investing PDFDocument176 pagesEquitymaster-Knowledge Centre-Intelligent Investing PDFarif420_999No ratings yet

- Quiz 4 Chapter 7 and 8Document5 pagesQuiz 4 Chapter 7 and 8June Antony Lim HechanovaNo ratings yet

- Worldwide VAT, GST and Sales Tax Guide 2015Document1,072 pagesWorldwide VAT, GST and Sales Tax Guide 2015chandra_sekhar_31No ratings yet

- Accounting For Employment Benefits PDF FreeDocument5 pagesAccounting For Employment Benefits PDF FreeTrisha Mae BujalanceNo ratings yet

- Classification of CostDocument5 pagesClassification of CostCharlotte ChanNo ratings yet

- LSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFDocument121 pagesLSIP - Bilingual - 30 - Sep - 2022 RELEASE PDFandry4jcNo ratings yet

- Project Report On Human Resource ManagemDocument17 pagesProject Report On Human Resource ManagemBhagyashreeNo ratings yet