Professional Documents

Culture Documents

Module - 26 Operating Exposure Measurement

Module - 26 Operating Exposure Measurement

Uploaded by

Devraj JosephOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module - 26 Operating Exposure Measurement

Module - 26 Operating Exposure Measurement

Uploaded by

Devraj JosephCopyright:

Available Formats

NPTEL

International Finance

Vinod Gupta School of Management , IIT. Kharagpur.

Module - 26

Operating Exposure Measurement

Developed by: Dr. Prabina Rajib

Associate Professor

Vinod Gupta School of Management

IIT Kharagpur, 721 302

Email: prabina@vgsom.iitkgp.ernet.in

Joint Initiative IITs and IISc – Funded by MHRD -1-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

Lesson - 26

Operating Exposure Measurement

Highlights & Motivation:

Change in the foreigner exchange risk affects firms in many other major ways. Change in

foreign exchange not only affects individual transactions, it affects the firm value as a

whole. Change in the exchange rate can affect the competitiveness of the firm and may

have a bearing on the survival of the firm. The impact of change in foreign exchange rate

on firm value is known as the operating exposure.

Measuring operating exposure is quite difficult as anticipating how a company’s sales,

input prices will be affected due to change in the forex rate. More so quantifying how

competitive scenario for the company will change due to exchange rate thus affecting

future cash flow can be akin a gazing crystal ball!!

Hence companies spend considerable time and effort to measure and manage the operating

exposure.

Learning Objectives:

In this session, the following aspects have been dealt in greater detail:

• Understanding the meaning of operating exposure

• Sources of operating exposure

• Measurement of operating exposure and difficulties associated with the

measurement

• Impact of operating exposure on firm’s cash flow.

Joint Initiative IITs and IISc – Funded by MHRD -2-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

26.1: Introduction.

Sessions 22 and 23 deals with how change in foreign exchanges affects the contractual cash

flows i.e. transaction exposure. Transaction exposure arises due to exchange loss or gain on

foreign currency denominated short term contractual obligations like

• Borrowing or lending in foreign currency

• Purchasing and selling where payment/receipt is denominated in foreign

currency.

• Lease/Rental payment in foreign currency

• Other contractual payments which a firm may have agreed to pay/receive

before the change in exchange rate.

Session 22 and 23 also focus on how companies manage various kinds of transaction

exposure (hedge the risk emanating from change in foreign exchange rate) through

forward and futures contracts, money market and through options contracts.

Change in the foreigner exchange risk affects firms in many other major ways. Change in

foreign exchange not only affects individual transactions, it affects the firm value as a

whole. Change in the exchange rate can affect the competitiveness of the firm and may

have a bearing on the survival of the firm. The impact of change in foreign exchange rate

on firm value is known as the operating exposure.

Translation exposure arises when companies report and consolidate its financial

statements requiring conversion from foreign to local currency for foreign operations.

In this session, how operating and translation exposure are measured and how firms

manage these two exposures are discussed in detail.

Joint Initiative IITs and IISc – Funded by MHRD -3-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

26.2: Defining Operating Exposure:

Operating exposure measures the change the present value of the company due to change in

future cash flows caused by any unexpected change in the foreign exchange rate. The cash

flow pertains to the long-term cash flows which are yet to contracted but would occur as

part of the normal course of the firm’s operation. In other words, operating exposure

measures the changes in long-term cash flows that have not been contracted for but would

be expected in the normal course of future business.

Let us elaborate little more on this aspect even though these have been discussed in greater

detail in Session 22 and 23.

Transaction exposure involves with the cash flows which a company has already contracted

but the value of these cash flows has changed due to change in foreigner exchange. For

example, an Indian company has agreed to supply 2000 units (within in coming 12 months)

of bed linen to Wal-Mart. Wal-Mart has agreed to pay USD20 per piece. On the date of the

contract, the spot rate is INR 45 per USD. It translates to INR 900 per piece. Direct cost per

unit of linen is INR 700. The fixed cost is INR 300,000 per year. For every 1 unit of bed

linen the Indian exporter sells, the contribution margin is Rs. 200. Hence it takes 1500 units

to cover the fixed cost. With a sales figure of 200, 000 units, the Indian company is making

a profit of INR 100,000 (INR 200 per unit * 500 units).

Indian company is happy to receive a gross profit of INR 200 per unit. Indian exporter buys

all raw materials from other Indian companies.

Suppose after supply one lot of 5,000 units, Indian company receives USD 125,000 on 25th

day from agreement. On this date, suppose INR has appreciated to INR 40 per USD. With

this rate, Indian company gross profit reduces to INR 100. Suppose INR still appreciate to

INR 37 USD by the time Indian company receives the payment for second lot export.

Indian company is incurring a loss of INR 60 per piece of bed linen it exports. Transaction

exposure measures the effect of change in cash flow for such kind of transactions. These

cash flows are easy to identify, measure hence manage.

Joint Initiative IITs and IISc – Funded by MHRD -4-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

However, operating exposure measures the impact of foreign exchange on future cashflows

Operating exposure is also known as competitive or strategic exposure. Unexpected change

in exchange rate shifts competitive scenario for a company (may make it more or less

competitive) vis-à-vis its competitors. Hence past cash flows cannot be used as a reference

point to identify and quantify future cash flows. Hence measuring operating exposure is

not straight forward like the measurement of transaction exposure. Operating exposure is

also known as strategic exposure as management of operating exposure requires a

reorientation at a strategic level.

Let us go back to the previous example of Indian exporter exporting bed linen to Wal-Mart.

With INR appreciating, exporting is becoming an unviable proposition for Indian company.

The Indian company may renegotiate raw material price it pays to its suppliers. However,

they may agree provided these suppliers are making enough profit at the renegotiated price.

Indian company may consider revising the price, but there could be some other company

from Bangladesh which is happy to export to Wal-Mart at USD 20. So increasing price it

charges to Wal-Mart is not an option as it makes the Indian exporter uncompetitive. Indian

exporter may start sourcing raw material from other countries. For this it may have to scout

for different vendors, check their quality standard, check whether they have capacity to

deliver raw material as per the requirement. The Indian company also has to consider the

customs duties levied by Indian government to import raw-material to India and political

relationship between the two countries.

On top of this Indian exporter will be exposed to foreign exchange risk from the input side

if it changes the vendor from Bangladesh to let us say Pakistan. Indian company may

consider exporting to another company rather than to Wal-mart.

All these changes may require change in manufacturing process, raw material sourcing

process, getting hang of design trend, basically competing with another set of competitors

who may be having formidable brand names in curtains and durries segment.

The kind of change the Indian exporter decides to bring in requires reorientation at strategic

level and requires a relook at the way the Indian exporter is doing business. Unlike

transaction exposure, which is predominantly managed by the firm’s finance division (of

course with a broad policy direction regarding the types of hedging instruments to be

chosen and the quantum of foreign exposure to be hedged), operating exposure requires

involvement of each and every unit of the firm i.e, marketing , finance, purchase, sales,

manufacturing etc. As the changes required to tackle operating exposure is multifaceted,

projecting future cash flow becomes an extremely difficult proposition if not impossible.

Joint Initiative IITs and IISc – Funded by MHRD -5-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

From the above discussion it is amply clear that quantifying operating exposure is difficult

to measure as well as manage as change in exchange rate affects future cash flows of the

company. Also management of operating exposure is done at operational level as well as at

strategic level.

Operating cash flows can be categorized into two categories i.e, cash flows arise from

intercompany and intracompany receivables and payables, lease, rent and royalty payments

and receipts and financing cash flows. Financing cash flows involve payment and receipt of

loans, equity investments and dividend payments and receipts.

The cash flows occurring between Indian exporter and Wal-mart are categorized as inter-

company cash flow. Suppose Indian company has joint venture with a Srilankan company

and Srilankan Company exports raw material to the Indian company with invoice being in

Srilankan Rupees. When the exchange rate between INR and Srilankan Rupees changes, it

also affects the Indian exporter. This will be an example of intracomapny transfer or

intracompany cashflows.

To sum up, operating exposure measurement requires a company to analyze the following

aspect of its operation.

• From which country/currency the company is generating revenue.

• Who are the main competitors? Are they going to be affected by the currency

risk similar way or not? For example, if the Indian Exporter’s main competitors

are also from India, these competitors are also facing the similar kind of risk.

Competitors will also be affected by the exchange rate movement in a similar

fashion. But if competitors are from other countries, then Indian company is

facing a bigger hurdle.

• How sensitive is the company’s sales volume to price? Can Indian exporter

afford to pass on the exchange rate risk to Wal-mart? If the bed-linen demand is

sensitive to price, then Indian exporter will loose the sales revenue if it increases

the price. In that case what should be the strategy of Indian exporter?

• In which currency the company’s expenses are? Where does the company

produce its goods, source its raw materials? How the input costs change with

the change in exchange rate?

Joint Initiative IITs and IISc – Funded by MHRD -6-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

Now let us focus on what is meant buy unexpected change in exchange rate. As we know,

in an efficient market, that forward rate is an unbiased predictor of futures spot market.

Hence the forward rate can throw light on what is going to be future spot rate. Knowledge

about the futures spot rate would help the companies to plan their pricing and sourcing

strategies to the best possible manner. If exchange rate changes can be anticipated, then

companies plan accordingly. Unexpected changes in exchange rates are what companies

are worried about.

For example on July 12th 2007, Infosys top executives gave the following guidelines (

details given in Box 26.1) for the financial year ending 2007-08. Expecting appreciation of

INR, Infosys has hedged USD revenue at a price of INR 40.58.

Box 26.1: Rupee impact: Infosys cuts earnings guidance.

http://www.thehindubusinessline.com/2007/07/12/stories/2007071252380100.ht

m

Stung by the sharp rise of rupee against dollar, Infosys Technologies Ltd for the first

time ever reduced its profit and revenue outlook for the fiscal 2008.

“The sharp appreciation of the rupee against all major currencies impacted our

operating margins,” said Mr V. Balakrishnan, Chief Financial Officer. “However, our

robust and flexible operating and financial model enabled us to maintain our net

margins while absorbing the impact of appreciating currency, higher wages and visa

costs,” he said.

Further, Mr Balakrishnan said “The downward revision of the earnings guidance

reflects the change in environment caused by the rupee appreciation.” The rupee rose

by 7 per cent against dollar this quarter from 43.10 to 40.66 as of end-June

Infosys was assuming a rate of Rs 40.58 to a dollar in its forecast and has not factored

any large deals. It has hedged $925 million at Rs 40.58, and “if required we will

increase the hedging” Mr Balakrishnan said.

Hence it can be concluded here that if a company knows that fluctuations in currency rates

is going to affect the firm negatively, the company will be able to take proactive action to

protect against such fluctuations.

Joint Initiative IITs and IISc – Funded by MHRD -7-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

26.3: Operating Exposure: Impact on cash flows

Measurement of operating exposure can be done for different scenarios. Let us go back to

the example of Indian exporter exporting to Wal-mart USA.

As mentioned earlier, an Indian company has agreed to supply 2000 units (within in

coming 12 months) of bed linen to Wal-Mart. Wal-Mart has agreed to pay USD20 per

piece. On the date of the contract, the spot rate is INR 45 per USD. It translates to INR 900

per piece. Direct cost per unit of linen is INR 700. The fixed cost is INR 300,000 per year.

For every 1 unit of bed linen the Indian exporter sells, the contribution margin is Rs. 200.

Hence it takes 1500 units to cover the fixed cost. With a sales figure of 200, 000 units, the

Indian company is making a profit of INR 100,000 (INR 200 per unit * 500 units). Let us

term this as base case.

With INR appreciating there could be three scenarios. The Indian exporter can

1. Increase per unit USD price and the company knows that price increase will not

have any impact on volume sales. (Case 1).

2. Increase per unit USD price and the company knows that price increase will

negatively affect the unit sales (Case 2).

3. Decrease price and the company knows price decrease will be accompanied by

volume increase (Case 3).

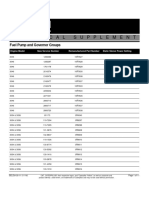

Table 26.1 : Indian exporter’s profit from different scenarios.

Base Case (1) Case (2) ( Case 3)

Case Price increased Price Price

& Volume increased decreased

unchanged & volume & volume

decreased increased

Unit sales 2,000 2000 1800 2200

Unit Price (USD) 20 22 22 18

Exchange Rate 45 40 40 40

Per Unit Revenue 900 880 880 720

realized(INR)

Direct Cost Unit ( INR) 700 700 700 700

Contribution Margin 200 180 180 20

Total Fixed cost 300,000 300,000 300,000 300,000

Breakeven Sales 1500 1667 1667 15000

Total Profit 100,000 60,000 24,000 (256,000)

Joint Initiative IITs and IISc – Funded by MHRD -8-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

Table 26.1 clearly shows profit of Indian exporter can vary from INR 60,000 to a loss of

INR 256000 for the coming year. Depending upon the exchange rate movement,

competitive scenario, cash flows of the company for future years will also be affected.

The impact of foreign exposure will have a multiple dimension if we modify the example

of Indian exporter slightly. The Indian exporter has foreign currency earnings but all other

expenses are incurred in domestic currency i.e. Indian Rupees.

Suppose the Indian exporter not only exports to Wal-mart at USA and to Yaohan, the

Japanese retail chain. Indian exporter receives the export proceedings from in USD and

Japanese Yen. Indian exporter sources the raw material from Srilankan subsidiary and pays

in Srilankan Rupee. It sources special dye from Bangladesh but pays in INR. The Indian

exporter has borrowed Euro to fund its business. Interest and principal payment I has to be

done in Euro. The Indian exporter’s profitability will now be governed by INR/USD,

INR/YEN, INR/Srilankan Rupee and INR/Euro exchange rate movement. If the

Bangladeshi Dye maker demands its payment to be made in Bangladeshi Taka, it adds

another dimension to operating exposure. Indian exporter’s profitability now gets governed

by INR/USD, INR/YEN, INR/Srilankan Rupee, INR/Euro and INR/BTK exchange

rate movement.

The impact of foreign exposure will have a multiple dimension if we modify example of

Indian exporter. The Indian exporter has foreign currency earnings but all other expenses

are incurred in domestic currency i.e. Indian Rupees.

Suppose the Indian exporter not only exports to Wal-mart at USA and to Yaohan, the

Japanese retail chain. Indian exporter receives the export proceedings from in USD and

Japanese Yen. Indian exporter sources the raw material from Srilankan subsidiary and pays

in Srilankan Rupee. It sources special dye from Bangladesh but pays in INR. The Indian

exporter has borrowed Euro to fund its business. Interest and principal payment I has to be

done in Euro. The Indian exporter’s profitability will now be governed by INR/USD,

INR/YEN, INR/Srilankan Rupee and INR/Euro exchange rate movement. If the

Bangladeshi Dye maker demands its payment to be made in Bangladeshi Taka, it adds

another dimension to operating exposure. Indian exporter’s profitability now gets governed

by INR/USD, INR/YEN, INR/Srilankan Rupee, INR/Euro and INR/BTK exchange

rate movement.

The enormity of the foreign exchange exposure increases manifold when a company

operates in multiple countries i.e, selling, raw material sourcing, borrowing, lending, and

having subsidiaries in many countries. In fact, operating exposure management becomes a

big challenge for MNC operating in many countries. The following box, Box 26.2

indicates some interesting facts about Nestle’s global presence, scale of operations and can

throw light on the degree of foreign exchange exposure faced by Nestlé.

Joint Initiative IITs and IISc – Funded by MHRD -9-

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

Box 26.2: Nestle’s global operation

Source: http://www.nestle.com/Resource.axd?Id=602C42FE-04D6-4669-

BEE1-1027492FE5E8

Nestlé is a Swiss company, founded in 1866 by Henri Nestlé. Nestlé markets its

products in 130 countries across the world. Nestlé manufactures around 10,000

different products and employs some 250,000 people. Around 3,500 people from over

50 countries work in Nestlé’s worldwide network of 17 research, development and

product testing centers. To the average number of employees in Nestlé’s factories is

270, and the average number of employees in any single country is around 3,000.

Although Nestlé’s doesn’t have control over the farms, it supports sustainability in the

supply of agricultural raw materials and agricultural best practices. \

To put these words into action, Nestlé’s has 800 of its own agronomists, technical

advisers and field technicians. Their job is to provide technical assistance to more than

400,000 farmers throughout the world to improve their production quality, as well as

their output and efficiency. They do this on a daily basis in as many as 40 countries

including Inner Mongolia, China, Pakistan, Ethiopia and Colombia. Above all,

Nestlé is genuinely international. One simple example is that around 80 different

nationalities are represented among the 1,600 people in Nestlé Head Office.

To summarize, change in foreign exchange rate not only affects a firm’s already committed

foreign currency payables or receivables, but also has a bigger ramification by affecting the

firm’s competitiveness in the long run. Change in foreign exchange rate affects the present

and future cash flows of the company, thus affecting a very survival of a company. Firms

have to continuously evaluate their operating and financing strategy to tackle the negative

impact of forex movement on the firms’ competitiveness. These aspects are discussed in

Sessions 27 and Session 28.

Joint Initiative IITs and IISc – Funded by MHRD - 10 -

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

Questions:

True/False Questions

1. A purely domestic firm with no operations abroad does not face any operating

exposure.

2. Only when a company exports and competes against foreign companies exporting

from other countries face operating exposure.

3. If a firms’ all payables and receivable, borrowing and lending are denominated in

home currency, it does not face operating exposure.

4. Firms enjoying monopolistic power have lesser operating exposure as these firms

can change their pricing policy keeping suiting the exchange arte movement.

5. Firms enjoying monopolistic power have lesser operating exposure if their product

is price inelastic.

Multiple choice questions:

1. The three main types of foreign exchange risk are

a) operating, transaction, and translation.

b) translation, accounting, and operating.

c) transaction, accounting, and translation.

d) operating, currency, and market.

2. Operating exposure is also known as ________ exposure.

a) economic

b) competitive

c) strategic

d) all of the above

3. Risk exposure that measures the change in net present value of a firm due to

changes in future operating cash flows is known as

a) transaction exposure

b) operating exposure

c) translation exposure

d) None of the above

4. If a company believes in efficient market, the company uses ________ exchange

rate as an unbiased predictor of future spot rates to plan for its forex management

activities.

a) the current spot b) the forward rate c) he futures market d) none of the above

Joint Initiative IITs and IISc – Funded by MHRD - 11 -

NPIEL

International Finance

Vinod Gupta School of Management , IIT.Kharagpur.

Answers to TURE/FALSE Questions:

1. False, A purely domestic firm also faces operating exposure as with the change in

exchange rate, it may turn less/more competitive in domestic market.

2. False. Even without exporting the country faces operating exposure.

3. False, A purely domestic firm faces operating exposure.

4. False. Monopolistic power need not necessarily help in reduction of operating

exposure as even while enjoying this power a company may not be able increase the

price, if the product demand is elastic in nature.

5. True, with a price inelastic product, the company will be able to increase the price if

exchange rate moves adversely.

Answers to Multiple Choice Questions:

1. a

2. d

3. b

4. b

References:

1. Operating Exposure, Multinational Business Finance, Eiteman, Moffett, Stonehill

and Pandey, 10th Edition, Pearson Education, ISBN, 81-7758-449-9.

2. Techniques for managing economic exposure, class note by Prof. Gordon Bodnar,

http://finance.wharton.upenn.edu/~bodnarg/courses/readings/hedging.pdf

3. Rupee impact: Infosys cuts earnings guidance.

http://www.thehindubusinessline.com/2007/07/12/stories/2007071252380100.htm

4. Nestle’s global operation, Source:

http://www.nestle.com/Resource.axd?Id=602C42FE-04D6-4669-BEE1-

1027492FE5E8

5. Currency Swap deals by Maruti Udyog Limited,Source: Annual report 2006-07

http://www.marutisuzuki.com/annual-reports-archives.aspx

6. Greece facing Goldman Sachs debt deal scrutiny

http://beta.thehindu.com/news/international/article109067.ece

7. Japan, India agree on $6 bn currency swap deal

http://www.financialexpress.com/news/Japan-India-agree-on-6-bn-currency-

swap-deal/257678/

Joint Initiative IITs and IISc – Funded by MHRD - 12 -

You might also like

- 2023 CFA L2 Book 2 FRA - CI-2Document100 pages2023 CFA L2 Book 2 FRA - CI-2PR100% (2)

- 1 Introduction To The Irish Legal SystemDocument10 pages1 Introduction To The Irish Legal SystemConstantin LazarNo ratings yet

- Module - 27 Operating Exposure Management: at Operational LevelDocument11 pagesModule - 27 Operating Exposure Management: at Operational LevelRasha Srour KreidlyNo ratings yet

- Module 21 PDFDocument10 pagesModule 21 PDFAnonymous unF72wA2JNo ratings yet

- Effect of Ex-Dividend Date On Stock Returns of Nifty Stocks in IndiaDocument16 pagesEffect of Ex-Dividend Date On Stock Returns of Nifty Stocks in IndiaCraft DealNo ratings yet

- Question AnswerDocument36 pagesQuestion AnswerDivyaDesai100% (2)

- 4808 Rishab Bansal LT Word File 39919 1182213924Document51 pages4808 Rishab Bansal LT Word File 39919 1182213924Rishab BansalNo ratings yet

- A Comparative Study On Performance of ITC Hotels and Taj Hotels LTD From 2013-2017 Using Leverage and TrendDocument5 pagesA Comparative Study On Performance of ITC Hotels and Taj Hotels LTD From 2013-2017 Using Leverage and TrendPragya Singh BaghelNo ratings yet

- Module - 30 Translation/Accounting Exposure: Measurement and ManagementDocument13 pagesModule - 30 Translation/Accounting Exposure: Measurement and ManagementRobert MillerNo ratings yet

- MB0045 - Financial Management: Q.1 Write The Short Notes OnDocument5 pagesMB0045 - Financial Management: Q.1 Write The Short Notes OnAnil Kumar ThapliyalNo ratings yet

- FIN Ass MSE 13 AprilDocument5 pagesFIN Ass MSE 13 AprilHarshit gargNo ratings yet

- Financial Ratio Interpretation (ITC)Document12 pagesFinancial Ratio Interpretation (ITC)Gorantla SindhujaNo ratings yet

- A Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesDocument22 pagesA Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesAnkit SarkarNo ratings yet

- The Effect of Book-Tax Diffferences, Cash Flow Volatility, and Corporate Governance On Earning QualityDocument10 pagesThe Effect of Book-Tax Diffferences, Cash Flow Volatility, and Corporate Governance On Earning QualityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- IJCRT2302547Document9 pagesIJCRT2302547Aparna SHARMANo ratings yet

- Translation Exposure Management PDFDocument13 pagesTranslation Exposure Management PDFpilotNo ratings yet

- ShoaibDocument2 pagesShoaibAxam FareedNo ratings yet

- MMPC 14 Solved Assignment Final Zbyn0x (1) 220427 061357Document12 pagesMMPC 14 Solved Assignment Final Zbyn0x (1) 220427 061357yogesh sharmaNo ratings yet

- A Project Report: Arup MajumderDocument5 pagesA Project Report: Arup MajumderArup MajumderNo ratings yet

- (Review Artikel Jurnal) HedgingDocument38 pages(Review Artikel Jurnal) HedgingGusi Putu Pratita IndiraNo ratings yet

- Impact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarDocument8 pagesImpact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarResky Andika YuswantoNo ratings yet

- Master of Business Administration - MBA Semester 4: Chandan Kishore Sharma 510931712 LC CODE: 1799Document5 pagesMaster of Business Administration - MBA Semester 4: Chandan Kishore Sharma 510931712 LC CODE: 1799Chandan KishoreNo ratings yet

- Segment Reporting Practices in India: A Case Study of TCS: Gayatri Guha Roy Bhagaban DasDocument8 pagesSegment Reporting Practices in India: A Case Study of TCS: Gayatri Guha Roy Bhagaban DasHedayatullah PashteenNo ratings yet

- Ratio Analysis of Gokaldas Exports LTDDocument21 pagesRatio Analysis of Gokaldas Exports LTDGreeshmaNo ratings yet

- 1.1) Introduction: Study of Working Capital Management and Financial Planning of Jain Irrigation System LTDDocument39 pages1.1) Introduction: Study of Working Capital Management and Financial Planning of Jain Irrigation System LTDsarvesh.bhartiNo ratings yet

- Week 2Document8 pagesWeek 2Shanley Vanna EscalonaNo ratings yet

- Modified Internal Rate of ReturnDocument5 pagesModified Internal Rate of ReturnGaluh DewandaruNo ratings yet

- Dividend Payouts FinalDocument32 pagesDividend Payouts FinalsubhapallaviNo ratings yet

- PAPER Working Capital Management at TVS Motors, BidarDocument11 pagesPAPER Working Capital Management at TVS Motors, BidarDr Bhadrappa HaralayyaNo ratings yet

- SESSION 1-2 (Autosaved) (Autosaved)Document79 pagesSESSION 1-2 (Autosaved) (Autosaved)Haritika ChhatwalNo ratings yet

- Hedging For Indian IT FirmDocument11 pagesHedging For Indian IT FirmfkkfoxNo ratings yet

- Comprehensive ProjectDocument25 pagesComprehensive ProjectkinjalspataniNo ratings yet

- Financial Management (1 Day, P.M.)Document12 pagesFinancial Management (1 Day, P.M.)simon berksNo ratings yet

- UntitledDocument3 pagesUntitledsam abbasNo ratings yet

- 2015@FM I CH 6-Capital BudgetingDocument16 pages2015@FM I CH 6-Capital BudgetingALEMU TADESSENo ratings yet

- Joint VenturesDocument3 pagesJoint VenturesSoorya HaridasanNo ratings yet

- Mahindra and MahindraDocument60 pagesMahindra and MahindraAparna TumbareNo ratings yet

- Format. Hum - Foreign Exchange Exposure Management in Reliance Industries Limited - 1Document18 pagesFormat. Hum - Foreign Exchange Exposure Management in Reliance Industries Limited - 1Impact JournalsNo ratings yet

- 66 105 1 SMDocument9 pages66 105 1 SMs3979517No ratings yet

- Working Capital Management: A Case Study of OCM: Mr. Rohit KandaDocument12 pagesWorking Capital Management: A Case Study of OCM: Mr. Rohit KandaManpreet Kaur VirkNo ratings yet

- Lec5. Capital BudgetingDocument78 pagesLec5. Capital Budgetingvivek patelNo ratings yet

- Topic: Impact of Covid 19 On Capital MarketsDocument10 pagesTopic: Impact of Covid 19 On Capital MarketsJAY SolankiNo ratings yet

- Intro PDFDocument30 pagesIntro PDFArt KingNo ratings yet

- FM Unit-2Document53 pagesFM Unit-2AjayNo ratings yet

- FM 10 MarksDocument31 pagesFM 10 MarksNamrata JoshiNo ratings yet

- Project Report On:: Changing Profile of Investor Segment in Indian MarketsDocument24 pagesProject Report On:: Changing Profile of Investor Segment in Indian MarketsManav gargNo ratings yet

- Working Capital Management Andprofitability of Manufacturing Companyin IndonesiaDocument17 pagesWorking Capital Management Andprofitability of Manufacturing Companyin IndonesiaMonica NovianiNo ratings yet

- Taiba Investments Co. (A Saudi Joint Stock Company) : Consolidated Financial Statements & Independent Auditor'S ReportDocument66 pagesTaiba Investments Co. (A Saudi Joint Stock Company) : Consolidated Financial Statements & Independent Auditor'S ReportPratheesh PrakashNo ratings yet

- Meaning of Financial Management:-: 1. Public FinanceDocument7 pagesMeaning of Financial Management:-: 1. Public FinancekaRan GUptДNo ratings yet

- Finance and Other Deciplines ComparisonDocument3 pagesFinance and Other Deciplines Comparisonsohamms12No ratings yet

- Report On Impacts of DividendDocument16 pagesReport On Impacts of Dividendtajul1994bd_69738436No ratings yet

- IJRPR7350Document6 pagesIJRPR7350Munna Kumar YadavNo ratings yet

- Research Project SampleDocument20 pagesResearch Project SampleDishank AgrawalNo ratings yet

- Functions of Finance Manager & How They Have Changed in Recent YearsDocument68 pagesFunctions of Finance Manager & How They Have Changed in Recent YearsSuzette NogueiraNo ratings yet

- CH 2 Capital Budgeting FinalDocument21 pagesCH 2 Capital Budgeting FinalSureshArigelaNo ratings yet

- CMA Report On HPCL Cost SheetDocument26 pagesCMA Report On HPCL Cost SheetPrience 1213No ratings yet

- Chapter 1 Multi-National CorporationsDocument60 pagesChapter 1 Multi-National CorporationsSHREYANS PRASHANT ZAMBAD IPM 2020 -25 BatchNo ratings yet

- R03 Introduction To GIPS IFT NotesDocument7 pagesR03 Introduction To GIPS IFT NotesMohammad Jubayer AhmedNo ratings yet

- Mergers and AcquisitionsDocument9 pagesMergers and AcquisitionsrakeshNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Financial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideFrom EverandFinancial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideNo ratings yet

- Atorvastatin (LIPITOR)Document2 pagesAtorvastatin (LIPITOR)Kristine Young100% (1)

- Exercise 1 WorkDocument9 pagesExercise 1 Workعبد الكريم المصطفىNo ratings yet

- Nilai Konversi Uji Kuat Tekan Variasi Bentuk Paving Block Terhadap Bentuk Sampel Uji Sni 03-0691-1996Document9 pagesNilai Konversi Uji Kuat Tekan Variasi Bentuk Paving Block Terhadap Bentuk Sampel Uji Sni 03-0691-1996MiratulHazanahNo ratings yet

- 17 Artikel Analisis Komponen Produk Wisata Di Kabupaten KarawangDocument10 pages17 Artikel Analisis Komponen Produk Wisata Di Kabupaten KarawangPutri NurkarimahNo ratings yet

- ResearchGate PDFDocument3 pagesResearchGate PDFAmrinder SharmaNo ratings yet

- MOD2 Statement of Cash FlowsDocument2 pagesMOD2 Statement of Cash FlowsGemma DenolanNo ratings yet

- Dealing With Mental Health Spiritually by Ife AdetonaDocument46 pagesDealing With Mental Health Spiritually by Ife AdetonaIfeNo ratings yet

- Barangay SinabaanDocument1 pageBarangay SinabaanOmar Dizon IINo ratings yet

- Angular With NodeJS - The MEAN Stack Training Guide - UdemyDocument15 pagesAngular With NodeJS - The MEAN Stack Training Guide - UdemyHarsh TiwariNo ratings yet

- Sep. Gravimetrica - CromitaDocument13 pagesSep. Gravimetrica - Cromitaemerson sennaNo ratings yet

- A Concept Paper About LoveDocument5 pagesA Concept Paper About LoveStephen Rivera100% (1)

- Dishonour of Cheques and Negotiable Instruments - Legalsutra - Law Students' Knowledge-Base - Law School Projects, Moot Court Memorials, Class and Case Notes and More!Document8 pagesDishonour of Cheques and Negotiable Instruments - Legalsutra - Law Students' Knowledge-Base - Law School Projects, Moot Court Memorials, Class and Case Notes and More!Himanshu Mene100% (1)

- Investigative Skills 3Document75 pagesInvestigative Skills 3Keling HanNo ratings yet

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- Experiment 6: Method of Mixture ObjectiveDocument3 pagesExperiment 6: Method of Mixture Objectiveshark eyeNo ratings yet

- Entrepreneurship: Chloe Xu Class 1-June 28 2022Document66 pagesEntrepreneurship: Chloe Xu Class 1-June 28 2022Selina Sofie ArnelundNo ratings yet

- Clone 123C3: Monoclonal Mouse Anti-Human CD56 Code M7304Document3 pagesClone 123C3: Monoclonal Mouse Anti-Human CD56 Code M7304Jaimier CajandabNo ratings yet

- Main Slokas With MeaningDocument114 pagesMain Slokas With MeaningRD100% (1)

- City of Tampa Disparity Study Report 050206 - Vol - 1Document102 pagesCity of Tampa Disparity Study Report 050206 - Vol - 1AsanijNo ratings yet

- Draft of The Newsletter: Trends in LeadershipDocument3 pagesDraft of The Newsletter: Trends in LeadershipAgus BudionoNo ratings yet

- Afroyim vs. RuskDocument34 pagesAfroyim vs. RuskGelle BaligodNo ratings yet

- MYCOBIT Control Objective Assessment FormsDocument5 pagesMYCOBIT Control Objective Assessment FormsRafasaxNo ratings yet

- Demonstrating Value With BMC Server Automation (Bladelogic)Document56 pagesDemonstrating Value With BMC Server Automation (Bladelogic)abishekvsNo ratings yet

- 1.publications All BranchesDocument25 pages1.publications All BranchesNaresh GollapalliNo ratings yet

- CodaDocument15 pagesCodaShashi KartikyaNo ratings yet

- PROCEEDINGS of The Numismatic and Antiquarian Society of PhiladelphiaDocument304 pagesPROCEEDINGS of The Numismatic and Antiquarian Society of PhiladelphiaRichard CastorNo ratings yet

- Keyword: 50s Music Title: Great 50s Songs For Different Moods: ContentDocument1 pageKeyword: 50s Music Title: Great 50s Songs For Different Moods: Contentaditya_bb_sharmaNo ratings yet

- Spsa - Edad 616bDocument18 pagesSpsa - Edad 616bapi-132081358No ratings yet

- Rephrasing Exercises Second TermDocument6 pagesRephrasing Exercises Second TermLulu SancNo ratings yet