Professional Documents

Culture Documents

Cash Hoarding at Infosys Anusree Balakrishnan - BD20011: Case Background

Cash Hoarding at Infosys Anusree Balakrishnan - BD20011: Case Background

Uploaded by

anu balakrishnanCopyright:

Available Formats

You might also like

- Case Study Dominion ResourcesDocument21 pagesCase Study Dominion ResourcesKanoknad KalaphakdeeNo ratings yet

- Group21 ProjectCharterDocument3 pagesGroup21 ProjectCharteranu balakrishnan100% (1)

- TCS HRMDocument2 pagesTCS HRManu balakrishnanNo ratings yet

- Investment Checklist PDFDocument4 pagesInvestment Checklist PDFDeepakNo ratings yet

- SBI Priject Working Capital ManagementDocument58 pagesSBI Priject Working Capital Managementarijit242282% (76)

- Impact of Dividend and Bonus Announcement On Stock PricesDocument17 pagesImpact of Dividend and Bonus Announcement On Stock PricesMohammadimran ShaikhNo ratings yet

- Factors Affecting Dividend PolicyDocument3 pagesFactors Affecting Dividend PolicyAarti TawaNo ratings yet

- Dividend DecisionzxDocument0 pagesDividend Decisionzxsaravana saravanaNo ratings yet

- CTM Tutorial 5Document2 pagesCTM Tutorial 5crsNo ratings yet

- 164 Pdfsam FMDocument1 page164 Pdfsam FMdskrishnaNo ratings yet

- SF Final ProjectDocument9 pagesSF Final ProjectsanaNo ratings yet

- Module 2Document10 pagesModule 2rajiNo ratings yet

- Corporate Finance BasicsDocument27 pagesCorporate Finance BasicsAhimbisibwe BenyaNo ratings yet

- Introduction To Corporate Finance, Megginson, Smart and LuceyDocument6 pagesIntroduction To Corporate Finance, Megginson, Smart and LuceyGvz HndraNo ratings yet

- Eastboro Case Write Up For Presentation1Document4 pagesEastboro Case Write Up For Presentation1Paula Elaine ThorpeNo ratings yet

- Dividend DecisionsDocument32 pagesDividend DecisionstekleyNo ratings yet

- Dividend PolicyDocument35 pagesDividend PolicyVic100% (3)

- Study of Dividend Payout PatternDocument27 pagesStudy of Dividend Payout PatternVivekNo ratings yet

- Dividend Policy: Answers To Concept Review QuestionsDocument6 pagesDividend Policy: Answers To Concept Review Questionsmeselu workuNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyCaptainVipro YTNo ratings yet

- Problem StatementDocument3 pagesProblem StatementLeo Pratama GaniNo ratings yet

- Module4 Dividend PolicyDocument5 pagesModule4 Dividend PolicyShihad Panoor N KNo ratings yet

- Unit 6: Dividend Decisions:: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocument17 pagesUnit 6: Dividend Decisions:: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNo ratings yet

- PDF 1 - DividendDocument11 pagesPDF 1 - Dividendrahul bhilalaNo ratings yet

- Corporate Finance Assignment No. 1 Topic: Factor Affecting Divivdend PlicyDocument7 pagesCorporate Finance Assignment No. 1 Topic: Factor Affecting Divivdend Plicyanum fatimaNo ratings yet

- cm2906 IncreasingDividendDocument4 pagescm2906 IncreasingDividendDhawan SandeepNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 12Document18 pagesFINANCE MANAGEMENT FIN420 CHP 12Yanty IbrahimNo ratings yet

- LinearDocument3 pagesLinearAEKaidarovNo ratings yet

- DividendsDocument6 pagesDividendsAgnes NalutaayaNo ratings yet

- What Retained Earnings Tells YouDocument3 pagesWhat Retained Earnings Tells Youaccounts 3 lifeNo ratings yet

- Dividend Policy NotesDocument6 pagesDividend Policy NotesSylvan Muzumbwe MakondoNo ratings yet

- Dividend Policy - Unit 4 Factors Affecting Dividend Policy of A Firm, Business and Company: External and Internal FactorsDocument4 pagesDividend Policy - Unit 4 Factors Affecting Dividend Policy of A Firm, Business and Company: External and Internal FactorsHimanshuNo ratings yet

- Discuss The Relevance of Dividend Policy in Financial Decision MakingDocument6 pagesDiscuss The Relevance of Dividend Policy in Financial Decision MakingMichael NyamutambweNo ratings yet

- Notes of Dividend PolicyDocument16 pagesNotes of Dividend PolicyVineet VermaNo ratings yet

- Aug 1st 2023 Introduction To Corporate FinanceDocument44 pagesAug 1st 2023 Introduction To Corporate FinanceKunal KadamNo ratings yet

- Dividend Policy of Indian Corporate FirmsDocument19 pagesDividend Policy of Indian Corporate FirmsRoads Sub Division-I,PuriNo ratings yet

- Definition of Dividend Capitalization ModelDocument4 pagesDefinition of Dividend Capitalization Modelnuk.2021018028No ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- A-Passive Residual Theory of Dividends: 1. Explain The Following TermsDocument8 pagesA-Passive Residual Theory of Dividends: 1. Explain The Following TermsJemmy RobertNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Southeastern Steel Company Dividend Policy Financial ManagementDocument24 pagesSoutheastern Steel Company Dividend Policy Financial ManagementJobiCosmeNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- Chapter 14-1Document73 pagesChapter 14-1Naeemullah baigNo ratings yet

- Different Types of Business Financing Case Study On: Great Service Cleaning and Maintenance CompanyDocument9 pagesDifferent Types of Business Financing Case Study On: Great Service Cleaning and Maintenance CompanyElias ChembeNo ratings yet

- Assignment Unit VIDocument21 pagesAssignment Unit VIHạnh NguyễnNo ratings yet

- Free Cash FlowDocument7 pagesFree Cash FlowvishhyNo ratings yet

- FM 006Document6 pagesFM 006Eswara kumar JNo ratings yet

- Dividend Decision by OrganizationsDocument16 pagesDividend Decision by OrganizationsMohitNo ratings yet

- FM Module 4 Capital Structure of A CompanyDocument6 pagesFM Module 4 Capital Structure of A CompanyJeevan RobinNo ratings yet

- Cashflow AnalysisDocument19 pagesCashflow Analysisgl101No ratings yet

- Impact of Dividend Policy On Value of The Final)Document40 pagesImpact of Dividend Policy On Value of The Final)finesaqibNo ratings yet

- Dividend PolicyDocument3 pagesDividend PolicyJaspreet KaurNo ratings yet

- Cash Flow AnalysisDocument19 pagesCash Flow Analysisanwar_pblNo ratings yet

- Fin 4050 Term PaperDocument11 pagesFin 4050 Term PaperMark D. KaniaruNo ratings yet

- Tata Consultancy Services LTD: Size: Amount Size: % of Shares Size: % of Shares PriceDocument9 pagesTata Consultancy Services LTD: Size: Amount Size: % of Shares Size: % of Shares PriceHarshal BhuravneNo ratings yet

- Mai Moyo Theory 2 Fin ManDocument4 pagesMai Moyo Theory 2 Fin Manmarvadomarvellous67No ratings yet

- Warner Body WorksDocument32 pagesWarner Body WorksPadam Shrestha100% (2)

- Sofia Times October 2017Document27 pagesSofia Times October 2017dhanrajkamatNo ratings yet

- Dividend PolicyDocument10 pagesDividend PolicyShivam MalhotraNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Dividend PolicyDocument18 pagesDividend Policybishnu paudelNo ratings yet

- Dividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1From EverandDividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1No ratings yet

- Vendors Retail Stores Buyer: Atypical Retail Business: Functions, Merchandise Flowand StakeholdersDocument20 pagesVendors Retail Stores Buyer: Atypical Retail Business: Functions, Merchandise Flowand Stakeholdersanu balakrishnanNo ratings yet

- BM Delhi 2020 Topic 2Document88 pagesBM Delhi 2020 Topic 2anu balakrishnanNo ratings yet

- Introduction To Retail: Smitu MalhotraDocument29 pagesIntroduction To Retail: Smitu Malhotraanu balakrishnanNo ratings yet

- Lecture - 3: Elasticity: Abdul Quadir XlriDocument38 pagesLecture - 3: Elasticity: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- MLBA Assignment-Anusree Balakrishnan - BD20011 Assignment 1: Data UnderstandingDocument12 pagesMLBA Assignment-Anusree Balakrishnan - BD20011 Assignment 1: Data Understandinganu balakrishnanNo ratings yet

- PJM Simulation: Scenario A Score: 733/1000Document1 pagePJM Simulation: Scenario A Score: 733/1000anu balakrishnanNo ratings yet

- Group4 SecD MLBA ProjectDocument7 pagesGroup4 SecD MLBA Projectanu balakrishnanNo ratings yet

- Lecture - 5: Production and Cost Minimization: Abdul Quadir XlriDocument39 pagesLecture - 5: Production and Cost Minimization: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- Lecture-3: Market Equilibrium and Applications: Abdul Quadir XlriDocument37 pagesLecture-3: Market Equilibrium and Applications: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- Lecture - 4: Production: Abdul Quadir XlriDocument24 pagesLecture - 4: Production: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- BD20011 - Anusree Balakrishnan - MGEAssignmentDocument21 pagesBD20011 - Anusree Balakrishnan - MGEAssignmentanu balakrishnanNo ratings yet

- Class Preparation 1Document5 pagesClass Preparation 1anu balakrishnanNo ratings yet

- Lecture-1: Demand, Supply and Market Equilibrium: Abdul Quadir XlriDocument50 pagesLecture-1: Demand, Supply and Market Equilibrium: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- Anusree Balakrishnan: Recognized For The Dedication and Being Responsive To Customer For FLUENTGRID ProjectDocument1 pageAnusree Balakrishnan: Recognized For The Dedication and Being Responsive To Customer For FLUENTGRID Projectanu balakrishnanNo ratings yet

- Grab The Opportunity-: The Akshaya Nidhi Foundation - in Aid of Akshaya PatraDocument3 pagesGrab The Opportunity-: The Akshaya Nidhi Foundation - in Aid of Akshaya Patraanu balakrishnanNo ratings yet

- Solar Nanoantenna: Design and Technology For Dark FrequencyDocument1 pageSolar Nanoantenna: Design and Technology For Dark Frequencyanu balakrishnanNo ratings yet

- Organizational Structure - TCSDocument2 pagesOrganizational Structure - TCSanu balakrishnan50% (2)

- Asseta $as, Oo o Asseta Liabililoa+ +ouooxs 2auuly AguulyDocument8 pagesAsseta $as, Oo o Asseta Liabililoa+ +ouooxs 2auuly Aguulyanu balakrishnanNo ratings yet

- SolarDocument1 pageSolaranu balakrishnanNo ratings yet

- Eas, Ibo0 X 307) (H) :12240: Coat WWT ODocument6 pagesEas, Ibo0 X 307) (H) :12240: Coat WWT Oanu balakrishnanNo ratings yet

- Macroeconomic PolicyDocument14 pagesMacroeconomic Policyanu balakrishnanNo ratings yet

- MANAC - Chapter 6Document8 pagesMANAC - Chapter 6anu balakrishnanNo ratings yet

- 2013 NGC Annual ReportDocument162 pages2013 NGC Annual ReportCurtis DookieNo ratings yet

- 5Document123 pages5Nikitha AnneNo ratings yet

- Stocks, Stock Valuation, and Stock Market EquilibriumDocument85 pagesStocks, Stock Valuation, and Stock Market EquilibriumshimulNo ratings yet

- TAN KIM KEE Vs CTADocument2 pagesTAN KIM KEE Vs CTACharles Roger RayaNo ratings yet

- Promit Singh Rathore - 20PGPM111Document14 pagesPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNo ratings yet

- RCC - Title I - Week 3 PDFDocument78 pagesRCC - Title I - Week 3 PDFBay Ariel Sto TomasNo ratings yet

- pp16Document64 pagespp16Mousami BanerjeeNo ratings yet

- WCFDocument19 pagesWCFAnkita DasNo ratings yet

- Hashoo GroupDocument19 pagesHashoo GroupMuddassir HussainNo ratings yet

- ALFM Money Market FundDocument47 pagesALFM Money Market FundLemuel VillanuevaNo ratings yet

- Multiple Choice KTQTDocument14 pagesMultiple Choice KTQTLê Thái VyNo ratings yet

- Kalbe Farma TBK Billingual 31 Des 2021 ReleasedDocument163 pagesKalbe Farma TBK Billingual 31 Des 2021 ReleasedNanda IshermawanNo ratings yet

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDocument25 pagesTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNo ratings yet

- FM2Document17 pagesFM2Louie De La TorreNo ratings yet

- Mas - MB (2017)Document9 pagesMas - MB (2017)AzureBlazeNo ratings yet

- Asset-V1 MITx+15.516x+1T2024+type@asset+block@module 5 Lecture Slides 2024Document87 pagesAsset-V1 MITx+15.516x+1T2024+type@asset+block@module 5 Lecture Slides 2024Markus_MardenNo ratings yet

- Oktay Urcan: Financial Accounting: Advanced TopicsDocument39 pagesOktay Urcan: Financial Accounting: Advanced TopicsRishap JindalNo ratings yet

- Sources of Finance BSTDocument9 pagesSources of Finance BSTSailesh GoenkkaNo ratings yet

- Sapm II Internal Test Oct 2021 (10072)Document3 pagesSapm II Internal Test Oct 2021 (10072)Sneha SwamyNo ratings yet

- 1.1 Financial Analytics Toolkit (8 Pages) PDFDocument8 pages1.1 Financial Analytics Toolkit (8 Pages) PDFPartha Protim SahaNo ratings yet

- Mgt-9 and Aoc 2.Xlsx Steel HypermartDocument30 pagesMgt-9 and Aoc 2.Xlsx Steel HypermartSURANA1973No ratings yet

- Chapter 15Document17 pagesChapter 15Ahmed FahmyNo ratings yet

- MB0045 Financial Management Answer KeyDocument21 pagesMB0045 Financial Management Answer Keysureshganji06No ratings yet

- AP 300Q Quizzer On Audit of Liabilities ResaDocument13 pagesAP 300Q Quizzer On Audit of Liabilities Resaryan rosalesNo ratings yet

- Wealthcon Journal - Edition 7Document112 pagesWealthcon Journal - Edition 7Amol WaghmareNo ratings yet

- Answer Paper 4Document18 pagesAnswer Paper 4SomeoneNo ratings yet

- JSW Steel LimitedDocument35 pagesJSW Steel LimitedNeha SinghNo ratings yet

Cash Hoarding at Infosys Anusree Balakrishnan - BD20011: Case Background

Cash Hoarding at Infosys Anusree Balakrishnan - BD20011: Case Background

Uploaded by

anu balakrishnanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Hoarding at Infosys Anusree Balakrishnan - BD20011: Case Background

Cash Hoarding at Infosys Anusree Balakrishnan - BD20011: Case Background

Uploaded by

anu balakrishnanCopyright:

Available Formats

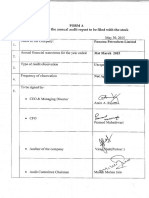

CASH HOARDING AT INFOSYS

Anusree Balakrishnan – BD20011

Case Background

In 2017, Vishal Sikka, Infosys' CEO, and Ranganath D. Mavinakere, the company's CFO, met in Bangalore

to discuss the company's frequent clashes with shareholders over the amount of cash it had on hand,

which totaled Rs. 28,796 crores. Stockholders wanted the company to continue to expand as all seven

promoters retired, and Balakrishnan (Former CFO of Infosys) and Mohandas Pai (Former BOD) stoked

shareholder dissent by demanding that the money be returned rather than wasted.

Problem:

Vishal (CEO) and Ranganath (CFO) had to make a call about how to deal with these issues. Is it a smart

idea for them to start paying investors more money? And, if they are required to return, how much will

they have to pay and how will they pay it? They could make a profit, but they couldn't decide whether

they wanted to make a big, one-time profit or a small profit over time. They can also consider a

repurchase bid for a part or all the purchase prices. They may also sell preferred stock (at a discount) to

any existing holder, entitling that individual to a yearly benefit of Rs. 100. They may decide to keep their

capital, however, due to the need to continue investing in new technology and the vulnerabilities of

their item showcases.

Alternative solutions to be considered.

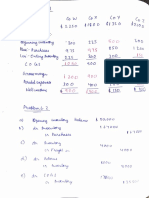

Cash Position

Cash Dividend

Bonus Stock

Criteria used to choose among derivatives:

• Dividend pay-out ratio: This is the proportion of the total amount of dividends paid to shareholders to

the company's net income. It is the percentage of earnings distributed to investors in the form of

dividends.

• Incremental dividend: An incremental dividend is a series of increases in the amount of dividend paid

to shareholders by a company. We've noticed that the number of dividends paid by Infosys hasn't been

steadily rising or decreasing since September 2015.

Analysis and Solution

Growing the dividend, introducing previously deferred wage increases, or making a major acquisition are

all possibilities. Despite the company's weak results since 2016, paying cash dividends to shareholders

would send a message to investors that the company plans to perform well in the future. Investors like

businesses that have a high growth rate and produce a reasonable amount of cash flow.

Unlike Microsoft and other multinational companies, the company has never divided its stock. It had

only done it once before, so it was free to take a different path this time. It will raise its dividend pay-out

ratio by paying dividends, with pay-outs of up to 70% of free cash flow expected in the following

financial year.

One option that the company will follow is cash and stock dividends. If only cash dividends were paid,

the company's cash would be exhausted. The firm, on the other hand, will give shareholders the option

of a cash or stock dividend. Stock dividends are also taxed at a lower rate.

If a non-linear purchase is made, it should be in the $300-400 million range, ideally for a software

product platform. A less expensive purchase would have no effect. Infosys would be able to better

leverage its cash and accelerate its transition to a non-linear model if it were to be acquired (i.e.,

decoupling revenue growth from manpower growth).

Due to the increasing demand for AI-based services such as personalised health, education, and financial

services, the company would rather invest in R&D than buybacks.

A business must earn about 14-15 percent annual returns to justify the cost of equity capital; the cost of

assets on the balance sheet must be equated only with what 'cash' will earn. The rate in India is about 4-

5 percent. Cash just needs too much return to break even. Therefore, it is not an unyielding asset on a

company's balance sheet, contrary to common opinion. To figure out how much capital a company

needs, it must produce a high return on equity by investing it in its operations (so having a lot of cash

isn't a problem).

Buybacks of shares are subject to income tax due to capital gains. Since buying back existing shares, it

couldn't sell new ones for at least six months. DDT had to be charged in the case of dividends, even

though the company was not required to pay any tax on its income.

Investors would rather the business retain the money and reap long-term capital gains if the dividend

tax were higher. As a result, money that would have been invested in small companies in need of

funding is being kept in reserve.

India has a dividend payment tax, which means that companies must pay a 16 percent tax on dividends

paid out, while investors get a tax-free pay-out. The reduction in cash yield and increase in earnings yield

makes a much stronger argument for a share buyback due to a sharp contraction in the price-earnings

ratio. It is now less profitable to keep money in the bank than to purchase stock for a company.

From a shareholder's perspective, the government's tax policy has made buybacks much more

appealing.

You might also like

- Case Study Dominion ResourcesDocument21 pagesCase Study Dominion ResourcesKanoknad KalaphakdeeNo ratings yet

- Group21 ProjectCharterDocument3 pagesGroup21 ProjectCharteranu balakrishnan100% (1)

- TCS HRMDocument2 pagesTCS HRManu balakrishnanNo ratings yet

- Investment Checklist PDFDocument4 pagesInvestment Checklist PDFDeepakNo ratings yet

- SBI Priject Working Capital ManagementDocument58 pagesSBI Priject Working Capital Managementarijit242282% (76)

- Impact of Dividend and Bonus Announcement On Stock PricesDocument17 pagesImpact of Dividend and Bonus Announcement On Stock PricesMohammadimran ShaikhNo ratings yet

- Factors Affecting Dividend PolicyDocument3 pagesFactors Affecting Dividend PolicyAarti TawaNo ratings yet

- Dividend DecisionzxDocument0 pagesDividend Decisionzxsaravana saravanaNo ratings yet

- CTM Tutorial 5Document2 pagesCTM Tutorial 5crsNo ratings yet

- 164 Pdfsam FMDocument1 page164 Pdfsam FMdskrishnaNo ratings yet

- SF Final ProjectDocument9 pagesSF Final ProjectsanaNo ratings yet

- Module 2Document10 pagesModule 2rajiNo ratings yet

- Corporate Finance BasicsDocument27 pagesCorporate Finance BasicsAhimbisibwe BenyaNo ratings yet

- Introduction To Corporate Finance, Megginson, Smart and LuceyDocument6 pagesIntroduction To Corporate Finance, Megginson, Smart and LuceyGvz HndraNo ratings yet

- Eastboro Case Write Up For Presentation1Document4 pagesEastboro Case Write Up For Presentation1Paula Elaine ThorpeNo ratings yet

- Dividend DecisionsDocument32 pagesDividend DecisionstekleyNo ratings yet

- Dividend PolicyDocument35 pagesDividend PolicyVic100% (3)

- Study of Dividend Payout PatternDocument27 pagesStudy of Dividend Payout PatternVivekNo ratings yet

- Dividend Policy: Answers To Concept Review QuestionsDocument6 pagesDividend Policy: Answers To Concept Review Questionsmeselu workuNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyCaptainVipro YTNo ratings yet

- Problem StatementDocument3 pagesProblem StatementLeo Pratama GaniNo ratings yet

- Module4 Dividend PolicyDocument5 pagesModule4 Dividend PolicyShihad Panoor N KNo ratings yet

- Unit 6: Dividend Decisions:: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocument17 pagesUnit 6: Dividend Decisions:: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNo ratings yet

- PDF 1 - DividendDocument11 pagesPDF 1 - Dividendrahul bhilalaNo ratings yet

- Corporate Finance Assignment No. 1 Topic: Factor Affecting Divivdend PlicyDocument7 pagesCorporate Finance Assignment No. 1 Topic: Factor Affecting Divivdend Plicyanum fatimaNo ratings yet

- cm2906 IncreasingDividendDocument4 pagescm2906 IncreasingDividendDhawan SandeepNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 12Document18 pagesFINANCE MANAGEMENT FIN420 CHP 12Yanty IbrahimNo ratings yet

- LinearDocument3 pagesLinearAEKaidarovNo ratings yet

- DividendsDocument6 pagesDividendsAgnes NalutaayaNo ratings yet

- What Retained Earnings Tells YouDocument3 pagesWhat Retained Earnings Tells Youaccounts 3 lifeNo ratings yet

- Dividend Policy NotesDocument6 pagesDividend Policy NotesSylvan Muzumbwe MakondoNo ratings yet

- Dividend Policy - Unit 4 Factors Affecting Dividend Policy of A Firm, Business and Company: External and Internal FactorsDocument4 pagesDividend Policy - Unit 4 Factors Affecting Dividend Policy of A Firm, Business and Company: External and Internal FactorsHimanshuNo ratings yet

- Discuss The Relevance of Dividend Policy in Financial Decision MakingDocument6 pagesDiscuss The Relevance of Dividend Policy in Financial Decision MakingMichael NyamutambweNo ratings yet

- Notes of Dividend PolicyDocument16 pagesNotes of Dividend PolicyVineet VermaNo ratings yet

- Aug 1st 2023 Introduction To Corporate FinanceDocument44 pagesAug 1st 2023 Introduction To Corporate FinanceKunal KadamNo ratings yet

- Dividend Policy of Indian Corporate FirmsDocument19 pagesDividend Policy of Indian Corporate FirmsRoads Sub Division-I,PuriNo ratings yet

- Definition of Dividend Capitalization ModelDocument4 pagesDefinition of Dividend Capitalization Modelnuk.2021018028No ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- A-Passive Residual Theory of Dividends: 1. Explain The Following TermsDocument8 pagesA-Passive Residual Theory of Dividends: 1. Explain The Following TermsJemmy RobertNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Southeastern Steel Company Dividend Policy Financial ManagementDocument24 pagesSoutheastern Steel Company Dividend Policy Financial ManagementJobiCosmeNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- Chapter 14-1Document73 pagesChapter 14-1Naeemullah baigNo ratings yet

- Different Types of Business Financing Case Study On: Great Service Cleaning and Maintenance CompanyDocument9 pagesDifferent Types of Business Financing Case Study On: Great Service Cleaning and Maintenance CompanyElias ChembeNo ratings yet

- Assignment Unit VIDocument21 pagesAssignment Unit VIHạnh NguyễnNo ratings yet

- Free Cash FlowDocument7 pagesFree Cash FlowvishhyNo ratings yet

- FM 006Document6 pagesFM 006Eswara kumar JNo ratings yet

- Dividend Decision by OrganizationsDocument16 pagesDividend Decision by OrganizationsMohitNo ratings yet

- FM Module 4 Capital Structure of A CompanyDocument6 pagesFM Module 4 Capital Structure of A CompanyJeevan RobinNo ratings yet

- Cashflow AnalysisDocument19 pagesCashflow Analysisgl101No ratings yet

- Impact of Dividend Policy On Value of The Final)Document40 pagesImpact of Dividend Policy On Value of The Final)finesaqibNo ratings yet

- Dividend PolicyDocument3 pagesDividend PolicyJaspreet KaurNo ratings yet

- Cash Flow AnalysisDocument19 pagesCash Flow Analysisanwar_pblNo ratings yet

- Fin 4050 Term PaperDocument11 pagesFin 4050 Term PaperMark D. KaniaruNo ratings yet

- Tata Consultancy Services LTD: Size: Amount Size: % of Shares Size: % of Shares PriceDocument9 pagesTata Consultancy Services LTD: Size: Amount Size: % of Shares Size: % of Shares PriceHarshal BhuravneNo ratings yet

- Mai Moyo Theory 2 Fin ManDocument4 pagesMai Moyo Theory 2 Fin Manmarvadomarvellous67No ratings yet

- Warner Body WorksDocument32 pagesWarner Body WorksPadam Shrestha100% (2)

- Sofia Times October 2017Document27 pagesSofia Times October 2017dhanrajkamatNo ratings yet

- Dividend PolicyDocument10 pagesDividend PolicyShivam MalhotraNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Dividend PolicyDocument18 pagesDividend Policybishnu paudelNo ratings yet

- Dividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1From EverandDividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1No ratings yet

- Vendors Retail Stores Buyer: Atypical Retail Business: Functions, Merchandise Flowand StakeholdersDocument20 pagesVendors Retail Stores Buyer: Atypical Retail Business: Functions, Merchandise Flowand Stakeholdersanu balakrishnanNo ratings yet

- BM Delhi 2020 Topic 2Document88 pagesBM Delhi 2020 Topic 2anu balakrishnanNo ratings yet

- Introduction To Retail: Smitu MalhotraDocument29 pagesIntroduction To Retail: Smitu Malhotraanu balakrishnanNo ratings yet

- Lecture - 3: Elasticity: Abdul Quadir XlriDocument38 pagesLecture - 3: Elasticity: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- MLBA Assignment-Anusree Balakrishnan - BD20011 Assignment 1: Data UnderstandingDocument12 pagesMLBA Assignment-Anusree Balakrishnan - BD20011 Assignment 1: Data Understandinganu balakrishnanNo ratings yet

- PJM Simulation: Scenario A Score: 733/1000Document1 pagePJM Simulation: Scenario A Score: 733/1000anu balakrishnanNo ratings yet

- Group4 SecD MLBA ProjectDocument7 pagesGroup4 SecD MLBA Projectanu balakrishnanNo ratings yet

- Lecture - 5: Production and Cost Minimization: Abdul Quadir XlriDocument39 pagesLecture - 5: Production and Cost Minimization: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- Lecture-3: Market Equilibrium and Applications: Abdul Quadir XlriDocument37 pagesLecture-3: Market Equilibrium and Applications: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- Lecture - 4: Production: Abdul Quadir XlriDocument24 pagesLecture - 4: Production: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- BD20011 - Anusree Balakrishnan - MGEAssignmentDocument21 pagesBD20011 - Anusree Balakrishnan - MGEAssignmentanu balakrishnanNo ratings yet

- Class Preparation 1Document5 pagesClass Preparation 1anu balakrishnanNo ratings yet

- Lecture-1: Demand, Supply and Market Equilibrium: Abdul Quadir XlriDocument50 pagesLecture-1: Demand, Supply and Market Equilibrium: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- Anusree Balakrishnan: Recognized For The Dedication and Being Responsive To Customer For FLUENTGRID ProjectDocument1 pageAnusree Balakrishnan: Recognized For The Dedication and Being Responsive To Customer For FLUENTGRID Projectanu balakrishnanNo ratings yet

- Grab The Opportunity-: The Akshaya Nidhi Foundation - in Aid of Akshaya PatraDocument3 pagesGrab The Opportunity-: The Akshaya Nidhi Foundation - in Aid of Akshaya Patraanu balakrishnanNo ratings yet

- Solar Nanoantenna: Design and Technology For Dark FrequencyDocument1 pageSolar Nanoantenna: Design and Technology For Dark Frequencyanu balakrishnanNo ratings yet

- Organizational Structure - TCSDocument2 pagesOrganizational Structure - TCSanu balakrishnan50% (2)

- Asseta $as, Oo o Asseta Liabililoa+ +ouooxs 2auuly AguulyDocument8 pagesAsseta $as, Oo o Asseta Liabililoa+ +ouooxs 2auuly Aguulyanu balakrishnanNo ratings yet

- SolarDocument1 pageSolaranu balakrishnanNo ratings yet

- Eas, Ibo0 X 307) (H) :12240: Coat WWT ODocument6 pagesEas, Ibo0 X 307) (H) :12240: Coat WWT Oanu balakrishnanNo ratings yet

- Macroeconomic PolicyDocument14 pagesMacroeconomic Policyanu balakrishnanNo ratings yet

- MANAC - Chapter 6Document8 pagesMANAC - Chapter 6anu balakrishnanNo ratings yet

- 2013 NGC Annual ReportDocument162 pages2013 NGC Annual ReportCurtis DookieNo ratings yet

- 5Document123 pages5Nikitha AnneNo ratings yet

- Stocks, Stock Valuation, and Stock Market EquilibriumDocument85 pagesStocks, Stock Valuation, and Stock Market EquilibriumshimulNo ratings yet

- TAN KIM KEE Vs CTADocument2 pagesTAN KIM KEE Vs CTACharles Roger RayaNo ratings yet

- Promit Singh Rathore - 20PGPM111Document14 pagesPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNo ratings yet

- RCC - Title I - Week 3 PDFDocument78 pagesRCC - Title I - Week 3 PDFBay Ariel Sto TomasNo ratings yet

- pp16Document64 pagespp16Mousami BanerjeeNo ratings yet

- WCFDocument19 pagesWCFAnkita DasNo ratings yet

- Hashoo GroupDocument19 pagesHashoo GroupMuddassir HussainNo ratings yet

- ALFM Money Market FundDocument47 pagesALFM Money Market FundLemuel VillanuevaNo ratings yet

- Multiple Choice KTQTDocument14 pagesMultiple Choice KTQTLê Thái VyNo ratings yet

- Kalbe Farma TBK Billingual 31 Des 2021 ReleasedDocument163 pagesKalbe Farma TBK Billingual 31 Des 2021 ReleasedNanda IshermawanNo ratings yet

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDocument25 pagesTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNo ratings yet

- FM2Document17 pagesFM2Louie De La TorreNo ratings yet

- Mas - MB (2017)Document9 pagesMas - MB (2017)AzureBlazeNo ratings yet

- Asset-V1 MITx+15.516x+1T2024+type@asset+block@module 5 Lecture Slides 2024Document87 pagesAsset-V1 MITx+15.516x+1T2024+type@asset+block@module 5 Lecture Slides 2024Markus_MardenNo ratings yet

- Oktay Urcan: Financial Accounting: Advanced TopicsDocument39 pagesOktay Urcan: Financial Accounting: Advanced TopicsRishap JindalNo ratings yet

- Sources of Finance BSTDocument9 pagesSources of Finance BSTSailesh GoenkkaNo ratings yet

- Sapm II Internal Test Oct 2021 (10072)Document3 pagesSapm II Internal Test Oct 2021 (10072)Sneha SwamyNo ratings yet

- 1.1 Financial Analytics Toolkit (8 Pages) PDFDocument8 pages1.1 Financial Analytics Toolkit (8 Pages) PDFPartha Protim SahaNo ratings yet

- Mgt-9 and Aoc 2.Xlsx Steel HypermartDocument30 pagesMgt-9 and Aoc 2.Xlsx Steel HypermartSURANA1973No ratings yet

- Chapter 15Document17 pagesChapter 15Ahmed FahmyNo ratings yet

- MB0045 Financial Management Answer KeyDocument21 pagesMB0045 Financial Management Answer Keysureshganji06No ratings yet

- AP 300Q Quizzer On Audit of Liabilities ResaDocument13 pagesAP 300Q Quizzer On Audit of Liabilities Resaryan rosalesNo ratings yet

- Wealthcon Journal - Edition 7Document112 pagesWealthcon Journal - Edition 7Amol WaghmareNo ratings yet

- Answer Paper 4Document18 pagesAnswer Paper 4SomeoneNo ratings yet

- JSW Steel LimitedDocument35 pagesJSW Steel LimitedNeha SinghNo ratings yet