Professional Documents

Culture Documents

Elements of Financial Reports

Elements of Financial Reports

Uploaded by

ruthu ruthvik0 ratings0% found this document useful (0 votes)

9 views12 pagesThe document discusses the 10 elements of financial statements according to Statement of Financial Accounting Concepts 6. These 10 elements are: assets, liabilities, equity, investments by owners, distributions to owners, revenues, expenses, gains, losses, and comprehensive income. Assets are economic resources owned by a business. Liabilities are amounts owed, while equity represents ownership interest. Revenues and expenses impact profits, and gains/losses arise from irregular transactions. Comprehensive income captures all equity changes from non-owner sources.

Original Description:

Original Title

acc4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the 10 elements of financial statements according to Statement of Financial Accounting Concepts 6. These 10 elements are: assets, liabilities, equity, investments by owners, distributions to owners, revenues, expenses, gains, losses, and comprehensive income. Assets are economic resources owned by a business. Liabilities are amounts owed, while equity represents ownership interest. Revenues and expenses impact profits, and gains/losses arise from irregular transactions. Comprehensive income captures all equity changes from non-owner sources.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views12 pagesElements of Financial Reports

Elements of Financial Reports

Uploaded by

ruthu ruthvikThe document discusses the 10 elements of financial statements according to Statement of Financial Accounting Concepts 6. These 10 elements are: assets, liabilities, equity, investments by owners, distributions to owners, revenues, expenses, gains, losses, and comprehensive income. Assets are economic resources owned by a business. Liabilities are amounts owed, while equity represents ownership interest. Revenues and expenses impact profits, and gains/losses arise from irregular transactions. Comprehensive income captures all equity changes from non-owner sources.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

Elements of Financial Reports

10 elements of financial statements

• Statement of Financial Accounting Concepts (SFAC) 6, governed by

Generally accepted Accounting principles (GAAP), encompasses 10

elements of financial statements which mainly focus on measuring the

performance and ascertaining the financial position of the business

enterprise. The 10 elements included in the financial statements are as

follows:

• Assets

• Liabilities

• Equity

• investments by owners

• Distributions to owners

• Revenues

• Expenses

• Gains

• Losses

• Comprehensive Income Statement

1. ASSETS

Assets are the property or legal rights owned by a business to which money

value can be attached. In other words, it is an item of economic value that is

expected to yield a benefit in the future. Assets can be classified into:

i. Tangible Assets

Tangible Assets are those assets which have physical existence i.e. they can be

seen and touched. Examples are machinery, furniture, building, etc.

ii. Intangible Assets

Intangible assets are those assets which do not have physical existence i.e. they

cannot be touched and seen. Examples are goodwill, patents, trademarks, etc.

iii. Fixed Assets

Fixed Assets are those assets which are put to use for more than one

accounting period and its benefit is derived over a longer period.

For example, computer, machinery, land, etc.

iv. Current assets

Current assets are the assets which are readily convertible into cash and

generally absorbed within one accounting period.

For example, debtors exist to convert them into cash, bills receivable, etc.

2. LIABILITIES

According to IFRS Framework, liability is the amount owed by the

business to the proprietor and to the outsiders.

Liabilities are generally categorised into 2 broad categories i.e. Current

Liabilities and Non Current Liabilities.

i. Current Liabilities: It refers to those obligations or payments

which are repayable during the current financial year. Examples of

current liabilities are Creditors, bills payable.

ii. Non Current Liabilities: It comprises of those payments which are

due for payment over a long period of time and there is no need to

discharge it immediately. For example Debentures, long term loans, etc.

3. EQUITY

• Equity represents ownership interest in a firm

in the form of stock.

• Being precise in the accounting terms, it is the

difference between value of assets and cost of

liabilities of something owned.

• It is mainly a residual amount adjusted by the

assets against liabilities.

4. INVESTMENT BY OWNERS

• It depicts an increase in equity resulting from

transfer of resources in exchange of an

ownership interest .

• It basically describes any owner’s contribution

to the firm.

• Issue of ownership shares of stock by a

company in exchange for cash represents an

investment by owners.

5. DISTRIBUTION TO OWNERS

• It represents a decrease in equity which results

from transfer to owners. It determines the

owners’ withdrawal from ownership interest of

the firm.

• A cash dividend paid by a corporation to its

shareholders is an example of distribution to

owners.

6. REVENUE

• Revenue is the income that a business earns

from its normal business activities. It is an

inflow of assets, which result in an increase in

owner’s equity.

• Exchange of goods and services for money

consideration is an example of revenue.

7. GAINS

• Gain is an increase in owner’s equity from

peripheral transactions which are irregular and

non recurrent in nature.

• For example, Sale of machinery for an amount

greater than its book value (original cost less

depreciation) would result in a gain for an

enterprise which is engaged in the business other

than that of sale and purchase of machinery.

•

8. EXPENSES

• are the gross outflows incurred by the business

enterprise for generating revenues. An expense

is charged to Profit and Loss Account.

9. LOSSES

• Loss is a decrease in owner’s equity from

peripherals transactions which are irregular

and non recurrent in nature.

• For example, Sale of machinery for an amount

lesser than its book value (original cost less

depreciation) would result in a gain for an

enterprise which is engaged in the business

other than that of sale and purchase of

machinery.

10. COMPREHENSIVE INCOME

• Comprehensive income is the change in equity of

a business enterprise from transactions from non

owner sources. It includes all changes in equity of

an enterprise other than those resulting from

investments by owners and distributions to

owners.

Examples of other comprehensive income include:

• Unrealized gains/losses on available-for-sale

investments

• Unrealized gains/losses on hedge/derivative

financial instruments

• Foreign currency translation adjustments

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Financial StatementDocument2 pagesFinancial StatementRobilyn BollosaNo ratings yet

- Lesson 19Document45 pagesLesson 19nabila qayyumNo ratings yet

- Fabm2 1Document17 pagesFabm2 1Jacel GadonNo ratings yet

- Accounting TerminologyDocument37 pagesAccounting Terminologyjhj01No ratings yet

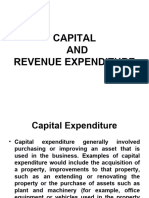

- Revenue ExpendituresDocument8 pagesRevenue ExpendituresAdvertising Alaska Holiday100% (1)

- The Accounting EquationDocument4 pagesThe Accounting EquationjcwimzNo ratings yet

- The Five Major Accounts & The Chart of AccountsDocument29 pagesThe Five Major Accounts & The Chart of AccountsPrecious Leigh VillamayorNo ratings yet

- Financial StatementDocument16 pagesFinancial StatementCuracho100% (1)

- Accounting Principles 10th Chapter 1Document48 pagesAccounting Principles 10th Chapter 1Osama Alvi100% (1)

- Chapter 8-Types of Major AccountsDocument2 pagesChapter 8-Types of Major AccountsRichael Ann Delubio ZapantaNo ratings yet

- Intro To Economics Lecture 1 - Elements of FSDocument28 pagesIntro To Economics Lecture 1 - Elements of FSАлихан МажитовNo ratings yet

- 10 Element of FRDocument12 pages10 Element of FRIloNo ratings yet

- An Introduction To Business and AccountingDocument43 pagesAn Introduction To Business and AccountingKeo VannuthNo ratings yet

- Final Accounts of CompaniesDocument30 pagesFinal Accounts of CompaniesAkanksha GanveerNo ratings yet

- Golis University: Faculty of Business and Economics Chapter Six Balance SheetDocument22 pagesGolis University: Faculty of Business and Economics Chapter Six Balance Sheetsaed cabdiNo ratings yet

- Acc Financial Statement Proj InfoDocument13 pagesAcc Financial Statement Proj InfoSandhya ThaparNo ratings yet

- Assets: Elements of The Financial StatementsDocument5 pagesAssets: Elements of The Financial StatementsSiva PratapNo ratings yet

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Notes-N-Unit-2-Starting To Cash Book (ALL) - .Document93 pagesNotes-N-Unit-2-Starting To Cash Book (ALL) - .happy lifeNo ratings yet

- Accountingnit Jamshedpur NotesDocument47 pagesAccountingnit Jamshedpur NotesSuraj KumarNo ratings yet

- FIN3702 SummaryDocument26 pagesFIN3702 SummaryQuentin SchwartzNo ratings yet

- Financial Accounting and ReportingDocument37 pagesFinancial Accounting and ReportingDevesh GaurNo ratings yet

- CadburyDocument37 pagesCadburyjdh_apsNo ratings yet

- MODULE 5-The Five Major AccountsDocument6 pagesMODULE 5-The Five Major Accountsgerlie gabrielNo ratings yet

- Bunwin Residence: Is The Company Profitable??Document6 pagesBunwin Residence: Is The Company Profitable??Pum MineaNo ratings yet

- Financial Reporting and Analysis - SIGFi - Finance HandbookDocument12 pagesFinancial Reporting and Analysis - SIGFi - Finance HandbookSneha TatiNo ratings yet

- Assets, Liabilities and The Balance SheetDocument13 pagesAssets, Liabilities and The Balance SheetMARIA-MIRUNA IVĂNESCUNo ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Types of Financial StatementsDocument18 pagesTypes of Financial Statementsxyz mah100% (1)

- Cash Flow StatementDocument2 pagesCash Flow Statementmark_torreonNo ratings yet

- Notes For FMDocument12 pagesNotes For FMwoldeamanuelNo ratings yet

- Accounting Cycle GuideDocument12 pagesAccounting Cycle GuideVincent Neil NarvasNo ratings yet

- 08 Revenue, Expense and Capital IssuesDocument35 pages08 Revenue, Expense and Capital Issuesraghavendra_20835414100% (1)

- Financial StatementsDocument24 pagesFinancial StatementsJemarse GumpalNo ratings yet

- Capital & RevenueDocument20 pagesCapital & Revenuebudsy.lambaNo ratings yet

- Unit 1: Overview of Financial AccountingDocument13 pagesUnit 1: Overview of Financial AccountingMukhammadali YuldashovNo ratings yet

- Fabm1 Week 1Document5 pagesFabm1 Week 1camposnenskeynicoleNo ratings yet

- Analusis of Financial StatementDocument28 pagesAnalusis of Financial StatementAjaykumar MauryaNo ratings yet

- Finman CHPT 1Document12 pagesFinman CHPT 1Rosda DhangNo ratings yet

- Finance Ch4Document41 pagesFinance Ch4Tofig HuseynliNo ratings yet

- Business Finance - DocxnotesDocument70 pagesBusiness Finance - DocxnotesKimberly ReignsNo ratings yet

- Finance Terms Everyone Should KnowDocument22 pagesFinance Terms Everyone Should KnowAmit OjhaNo ratings yet

- UntitledDocument3 pagesUntitledLouella SurtinNo ratings yet

- Chapter 3Document39 pagesChapter 3Hibaaq AxmedNo ratings yet

- Chapter - 2 Basic Accounting TermsDocument6 pagesChapter - 2 Basic Accounting TermsChaudhary GaylesabbNo ratings yet

- Flow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atDocument36 pagesFlow of Costs: Module 2 Introducing The Fin Statements, and Transaction Analysis. Start by Looking atLong NguyenNo ratings yet

- FINANCIALSTUDYDocument47 pagesFINANCIALSTUDYoliverreromaNo ratings yet

- Adp CH.2Document11 pagesAdp CH.2RK HassanNo ratings yet

- The ProDocument39 pagesThe Profisho abukeNo ratings yet

- Business Management & MarketingDocument16 pagesBusiness Management & MarketingKofiya WillieNo ratings yet

- Types of Major AccountsDocument30 pagesTypes of Major AccountsEstelle GammadNo ratings yet

- FINANCIAL STATEMENT For PrintDocument4 pagesFINANCIAL STATEMENT For PrintGkgolam KibriaNo ratings yet

- Nism CH 8Document12 pagesNism CH 8Darshan JainNo ratings yet

- New Microsoft Office PowerPoint Presentation (Autosaved)Document23 pagesNew Microsoft Office PowerPoint Presentation (Autosaved)Angelica PagaduanNo ratings yet

- Structural SpecificationDocument19 pagesStructural SpecificationMdNo ratings yet

- What Is Cash FlowDocument31 pagesWhat Is Cash FlowSumaira BilalNo ratings yet

- Capital and Revenue TransactionsDocument23 pagesCapital and Revenue TransactionsRajib Deb100% (1)

- Accounting: 2.financial StatementsDocument4 pagesAccounting: 2.financial StatementsYinan CuiNo ratings yet

- Introducing Financial Statements and Transaction AnalysisDocument64 pagesIntroducing Financial Statements and Transaction AnalysisHazim AbualolaNo ratings yet

- Double Entry AccountingDocument39 pagesDouble Entry Accountingruthu ruthvikNo ratings yet

- Acc 3Document25 pagesAcc 3ruthu ruthvikNo ratings yet

- Acc 7Document4 pagesAcc 7ruthu ruthvikNo ratings yet

- FALLSEM2017-18 BMT1705 TH SJT603 VL2017181006108 Reference Material I An Introduction To Matrix AlgebraDocument10 pagesFALLSEM2017-18 BMT1705 TH SJT603 VL2017181006108 Reference Material I An Introduction To Matrix Algebraruthu ruthvikNo ratings yet

- 8th Annual New York: Value Investing CongressDocument51 pages8th Annual New York: Value Investing CongressVALUEWALK LLCNo ratings yet

- Power Trading Winning Guerrilla Micro and Core Tactics Wiley Trading by Oliver L VelezDocument10 pagesPower Trading Winning Guerrilla Micro and Core Tactics Wiley Trading by Oliver L Velezabhikvisha0% (2)

- DRM Assignment 20 - WeightDocument3 pagesDRM Assignment 20 - Weightrohan agarwalNo ratings yet

- GFM Special Report Cryptocurrency Blockchain 2018Document19 pagesGFM Special Report Cryptocurrency Blockchain 2018Agentia Imobiliara InterestNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- Trade PlanDocument6 pagesTrade PlanFazri Ashari RomadhonNo ratings yet

- Wrigley Case FinalDocument8 pagesWrigley Case FinalNicholas Reyner Tjoegito100% (4)

- Final Project Portfolio Management Workings (IBF-SP-20-MBA-0041) Syed Anees AliDocument19 pagesFinal Project Portfolio Management Workings (IBF-SP-20-MBA-0041) Syed Anees AliSYED ANEES ALINo ratings yet

- Haresham BaharumDocument38 pagesHaresham Baharumjaharuddin.hannoverNo ratings yet

- Raising Capital: Multiple Choice QuestionsDocument40 pagesRaising Capital: Multiple Choice Questionsbaashii4No ratings yet

- G2 - Snowman Logistics LimitedDocument9 pagesG2 - Snowman Logistics LimitedAaryan GuptaNo ratings yet

- UNIT 2 Time and Money RelationshipDocument79 pagesUNIT 2 Time and Money Relationshipcuajohnpaull.schoolbackup.002No ratings yet

- PDF Investments An Introduction 11Th Edition Herbert B Mayo Ebook Full ChapterDocument53 pagesPDF Investments An Introduction 11Th Edition Herbert B Mayo Ebook Full Chapterjennifer.mccrae899100% (5)

- Gemstone KenyaDocument12 pagesGemstone KenyajohnmaunduNo ratings yet

- Corporate Finance (FIN722) Assignment No. 1: Requirement 1Document4 pagesCorporate Finance (FIN722) Assignment No. 1: Requirement 1mudassar saeedNo ratings yet

- Chap 010Document9 pagesChap 010siddharth.savlodhiaNo ratings yet

- Traditional & Modern Theory ApproachDocument12 pagesTraditional & Modern Theory Approachyash shah78% (9)

- MultifamilyDocument4 pagesMultifamilyKevin ParkerNo ratings yet

- Teacher: Sellamuthu Prabakaran Student: Juan David Burbano Benavides 1)Document10 pagesTeacher: Sellamuthu Prabakaran Student: Juan David Burbano Benavides 1)BelikovNo ratings yet

- Securities - Law - PDF ProjectDocument24 pagesSecurities - Law - PDF ProjectPranzalNo ratings yet

- 9a Capital BudgetingDocument29 pages9a Capital BudgetingRonny AsmaraNo ratings yet

- The Crypto OTC Market at A Glance - v5Document3 pagesThe Crypto OTC Market at A Glance - v5Abra ChakraNo ratings yet

- Lic Bonus RatesDocument17 pagesLic Bonus Ratespappu6600No ratings yet

- Risk Analysis of Infrastructure Projects PDFDocument27 pagesRisk Analysis of Infrastructure Projects PDFMayank K JainNo ratings yet

- A Study On Investors' Awareness and Preference Towards Mutual Funds As An Investment OptionDocument5 pagesA Study On Investors' Awareness and Preference Towards Mutual Funds As An Investment OptionAkshay KNo ratings yet

- Business Angel Investment'Document5 pagesBusiness Angel Investment'Oyoo SabareNo ratings yet

- CORPORATIONDocument31 pagesCORPORATIONbelezachebeNo ratings yet

- Forex Market Hours - Forex Market Time ConverterDocument1 pageForex Market Hours - Forex Market Time ConverterIssouf Ernest Junior CisseNo ratings yet

- Getting Out EarlyDocument33 pagesGetting Out EarlyZerohedgeNo ratings yet

- International Financial Managment For OnlineDocument331 pagesInternational Financial Managment For OnlineAmity-elearning75% (4)