Professional Documents

Culture Documents

Answer FOFM

Answer FOFM

Uploaded by

Spandan Thakkar0 ratings0% found this document useful (0 votes)

15 views1 page(1) The document calculates the current assets and current liabilities for a manufacturing company based on production of 1,04,000 units per month. (2) Current assets total Rs. 47,45,000 and include stock, work in progress, finished goods, debtors, and cash. (3) Current liabilities total Rs. 12,10,000 and include creditors and average time lags for payment of overheads and labor. (4) The net working capital is Rs. 35,35,000, calculated as the difference between current assets and current liabilities.

Original Description:

Original Title

Answer FOFM (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document(1) The document calculates the current assets and current liabilities for a manufacturing company based on production of 1,04,000 units per month. (2) Current assets total Rs. 47,45,000 and include stock, work in progress, finished goods, debtors, and cash. (3) Current liabilities total Rs. 12,10,000 and include creditors and average time lags for payment of overheads and labor. (4) The net working capital is Rs. 35,35,000, calculated as the difference between current assets and current liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views1 pageAnswer FOFM

Answer FOFM

Uploaded by

Spandan Thakkar(1) The document calculates the current assets and current liabilities for a manufacturing company based on production of 1,04,000 units per month. (2) Current assets total Rs. 47,45,000 and include stock, work in progress, finished goods, debtors, and cash. (3) Current liabilities total Rs. 12,10,000 and include creditors and average time lags for payment of overheads and labor. (4) The net working capital is Rs. 35,35,000, calculated as the difference between current assets and current liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

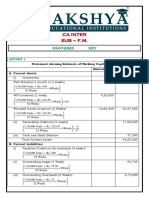

(A) Current assets:

(i) Stock of materials for 1 month: (1,04,000 × Rs 80 × Rs 6,40,000

4/52) (ii) Work-in-progress for 0.5 month:

(a) Material (1,04,000 × Rs 80 × 2/52) × 0.50 1,60,000

(b) Labour (1,04,000 × Rs 30 × 2/52) × 0.50 60,000

(c) Overheads (1,04,000 × Rs 60 × 2/52) × 0.50 1,20,000

(iii) Finished goods for 1 month: (1,04,000 × Rs 170 × 4/52) 13,60,000

(iv) Debtors for 2 months (78,000 × Rs 170 × 8/52) 20,40,000

(v) Cash in hand and at bank 3,65,000

Total investments in current assets 47,45,000

(B) Current liabilities:

(i) Creditors, 1 month’s purchase of raw materials, (i.e. 1,04,000 × Rs.80 × 6,40,000

4/52) (ii) Average time-lag in payment of expenses

(a) Overheads (1,04,000 × Rs 60 × 4/52) 4,80,000

(b) Labour (1,04,000 × Rs 30 × 3/104) 90,000

Total estimate of current liabilities 12,10,000

(C) Net working capital = Current assets – Current liabilities (A – B) 35,35,000

Working Notes and Assumptions

(i) 26,000 units have been sold for cash. Therefore, credit sales pertain to 78,000 units only.

(ii) Year has 52 weeks.

(iii) All overheads are assumed to be variable. Presence of depreciation element in overheads will lower the

working capital requirement.

You might also like

- CHAPTER 13 Solved Problems PDFDocument8 pagesCHAPTER 13 Solved Problems PDF7100507100% (3)

- WORKING CAPITAL Requirement NumericalDocument9 pagesWORKING CAPITAL Requirement Numericalbandgar_00770% (10)

- The Sabat Corporation Manufactures and Sells Two ProductsDocument4 pagesThe Sabat Corporation Manufactures and Sells Two ProductsElliot RichardNo ratings yet

- Working Capital Management 3Document11 pagesWorking Capital Management 3fatimabiriq799No ratings yet

- Working Capital Practical QuestionsDocument8 pagesWorking Capital Practical Questionsfatimabiriq799No ratings yet

- Numericals 1Document6 pagesNumericals 1Amita ChoudharyNo ratings yet

- Working CapitalDocument38 pagesWorking CapitalMonicaNo ratings yet

- Working Capital: R.KasilingamDocument54 pagesWorking Capital: R.Kasilingamvijayadarshini vNo ratings yet

- SBS Mba FM4Document23 pagesSBS Mba FM4deepakNo ratings yet

- Chapter 8 Master BudgetingDocument4 pagesChapter 8 Master BudgetingHanif Khan SrkNo ratings yet

- Ca Inter-F.m.03-07-2023-KeyDocument3 pagesCa Inter-F.m.03-07-2023-KeyChintuNo ratings yet

- BCH 503 SM07Document2 pagesBCH 503 SM07sugandh bajajNo ratings yet

- Financial Management - Notes NumericalsDocument6 pagesFinancial Management - Notes NumericalsSandeep SahadeokarNo ratings yet

- FM New SumsDocument13 pagesFM New SumsINTER SMARTIANSNo ratings yet

- Brewer 6e Practice Exam - Chapter 7Document3 pagesBrewer 6e Practice Exam - Chapter 7real johnNo ratings yet

- GNB14eCh08ExamDocument3 pagesGNB14eCh08ExamFicky ZulandoNo ratings yet

- Net WC QuestionsDocument5 pagesNet WC QuestionsPoonam KhattriNo ratings yet

- Working CapitalDocument3 pagesWorking Capitalfxn fndNo ratings yet

- Existing Working Capital CalculationDocument2 pagesExisting Working Capital CalculationCma Pushparaj KulkarniNo ratings yet

- Solution 6-37Document3 pagesSolution 6-37Tszkwan YuNo ratings yet

- Problems and SolutionsDocument7 pagesProblems and SolutionsMohitAhuja0% (1)

- Dec 21Document26 pagesDec 21Prabhat Kumar GuptaNo ratings yet

- 3 - CostingDocument26 pages3 - Costingamitjaiswal9532No ratings yet

- Solution To WC Requirement Probs On The SlideDocument2 pagesSolution To WC Requirement Probs On The SlideNowshad AyubNo ratings yet

- 18415compsuggans PCC FM Chapter7Document13 pages18415compsuggans PCC FM Chapter7Mukunthan RBNo ratings yet

- Comp. ExamDocument11 pagesComp. ExamProf. Nisaif JasimNo ratings yet

- FN502 Additional ProblemsDocument3 pagesFN502 Additional Problemsdpr7033No ratings yet

- Garrison (Asian Edition) Practice Exam - Chapter 10Document2 pagesGarrison (Asian Edition) Practice Exam - Chapter 10Johnsen PratamaNo ratings yet

- 02 Ratio Analysis Solution FT FileDocument22 pages02 Ratio Analysis Solution FT Filensm2zmvnbbNo ratings yet

- Exercise Working CapitalDocument4 pagesExercise Working CapitalShafiul AzamNo ratings yet

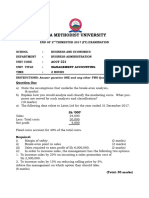

- Management Accounting (Acct 321) P2 PT 2ND Trimester 2017Document5 pagesManagement Accounting (Acct 321) P2 PT 2ND Trimester 2017Nodeh Deh SpartaNo ratings yet

- Intermediate - FM - Suggested Answer PaperDocument4 pagesIntermediate - FM - Suggested Answer Paperchromabooka111No ratings yet

- Estimation of Working Capital Requirement: Vineet Jogalekar 1PT10MBA84Document10 pagesEstimation of Working Capital Requirement: Vineet Jogalekar 1PT10MBA84Vineet JogalekarNo ratings yet

- Assignment 1 SolutionDocument2 pagesAssignment 1 Solutiondivya kalyaniNo ratings yet

- Working Capital Management PDFDocument46 pagesWorking Capital Management PDFNizar AhamedNo ratings yet

- Costing Full Length 2 - May 24 (Solution) 8-4Document16 pagesCosting Full Length 2 - May 24 (Solution) 8-4Jyoti ManwaniNo ratings yet

- 09 Treasury & Cash Management 7CDocument7 pages09 Treasury & Cash Management 7CChartered Accountant YASHNo ratings yet

- (Lower of Production / Market Demand) (I × II) : © The Institute of Chartered Accountants of IndiaDocument14 pages(Lower of Production / Market Demand) (I × II) : © The Institute of Chartered Accountants of IndiaAnkitaNo ratings yet

- MTP 19 53 Answers 1713511058Document19 pagesMTP 19 53 Answers 1713511058prathammishra1809No ratings yet

- 2020-06 Icmab FL 001 Pac Year Question June 2020Document3 pages2020-06 Icmab FL 001 Pac Year Question June 2020Mohammad ShahidNo ratings yet

- Management AccountingDocument7 pagesManagement AccountingNageshwar singhNo ratings yet

- AD32 Fundamentals of Management Accounting - Pilot Question Paper-1Document3 pagesAD32 Fundamentals of Management Accounting - Pilot Question Paper-1benard owinoNo ratings yet

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocument4 pagesFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- IAS 16 MCQs SolutionsDocument3 pagesIAS 16 MCQs SolutionsAhmad SaleemNo ratings yet

- Cost Accounting 2 Fourth Year Second Semester 2020-2021 Review Questions CH (7) & CH (8) Part (Dr. El Ghareeb) (5) Presented By: Dr. Ahmed MokhtarDocument11 pagesCost Accounting 2 Fourth Year Second Semester 2020-2021 Review Questions CH (7) & CH (8) Part (Dr. El Ghareeb) (5) Presented By: Dr. Ahmed Mokhtarمحمود احمدNo ratings yet

- 6a. Cash BudgetDocument4 pages6a. Cash BudgetMadiha JamalNo ratings yet

- BAFINMAX Learning Activity 1 Finals - With Answers - StudentsDocument5 pagesBAFINMAX Learning Activity 1 Finals - With Answers - Studentsfaye pantiNo ratings yet

- Budgets 2 exercisesDocument4 pagesBudgets 2 exerciseshannyhosnyNo ratings yet

- Chapter 4 Management of WCDocument15 pagesChapter 4 Management of WCAbhishek TiwariNo ratings yet

- Working Capital ManagementDocument2 pagesWorking Capital ManagementAnkit ThakkarNo ratings yet

- Uneeso Ent P2Document4 pagesUneeso Ent P2Otai Ezra100% (1)

- Standard CostingDocument1 pageStandard CostingPrasad NaikNo ratings yet

- Ex 5Document9 pagesEx 5farahamin359No ratings yet

- Accountancy Practical 2023-24-1Document2 pagesAccountancy Practical 2023-24-1uzmazeeshan10No ratings yet

- BASTRCSX Learning Activity 5 - With AnswersDocument10 pagesBASTRCSX Learning Activity 5 - With AnswersChel EscuetaNo ratings yet

- Case Analysis (1 30)Document3 pagesCase Analysis (1 30)manishadaaNo ratings yet

- Fofm Word File Roll No 381 To 390Document26 pagesFofm Word File Roll No 381 To 390Spandan ThakkarNo ratings yet

- Economics Word File Roll No 381 To 390Document19 pagesEconomics Word File Roll No 381 To 390Spandan ThakkarNo ratings yet

- Fom Word File of Batch-6Document25 pagesFom Word File of Batch-6Spandan ThakkarNo ratings yet

- Sem 2 - Theory Assgn - 2020-21Document8 pagesSem 2 - Theory Assgn - 2020-21Spandan ThakkarNo ratings yet

- English AssignmentDocument15 pagesEnglish AssignmentSpandan ThakkarNo ratings yet

- Sem-1 Economics (D) 381-390Document25 pagesSem-1 Economics (D) 381-390Spandan ThakkarNo ratings yet

- Pankti Mittal ShethDocument17 pagesPankti Mittal ShethSpandan ThakkarNo ratings yet

- 5 Industrial Report On Cadila HealthDocument50 pages5 Industrial Report On Cadila HealthSpandan ThakkarNo ratings yet

- SpectrumDocument1 pageSpectrumSpandan ThakkarNo ratings yet

- Production Management - Practical AssignmentDocument6 pagesProduction Management - Practical AssignmentSpandan ThakkarNo ratings yet

- Capacitor ManufacturerDocument14 pagesCapacitor ManufacturerSpandan ThakkarNo ratings yet

- Indexing Table ManufacturerDocument8 pagesIndexing Table ManufacturerSpandan ThakkarNo ratings yet

- Income EffectDocument3 pagesIncome EffectSpandan Thakkar100% (1)