Professional Documents

Culture Documents

Press Release Fortune Stones Limited: Details of Instruments/facilities in Annexure-1

Press Release Fortune Stones Limited: Details of Instruments/facilities in Annexure-1

Uploaded by

Ravi BabuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Press Release Fortune Stones Limited: Details of Instruments/facilities in Annexure-1

Press Release Fortune Stones Limited: Details of Instruments/facilities in Annexure-1

Uploaded by

Ravi BabuCopyright:

Available Formats

Press Release

Fortune Stones Limited

March 19, 2021

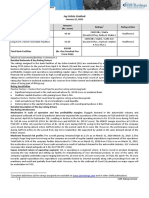

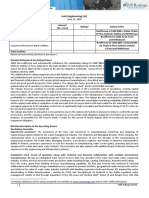

Rating

Amount

Facilities/Instruments Ratings Rating Action

(Rs. crore)

Long Term / Short Term Bank CARE BBB; Stable / CARE A3+

1.50 Assigned

Facilities (Triple B; Outlook: Stable/ A Three Plus)

Long Term / Short Term Bank CARE BBB; Stable / CARE A3+ Revised from CARE A3+

27.50

Facilities (Triple B; Outlook: Stable/ A Three Plus) (A Three Plus)

Long Term Bank Facilities - - Withdrawn

29.00

Total Bank Facilities (Rs. Twenty-Nine

Crore Only)

Details of instruments/facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The ratings assigned to the bank facilities of Fortune Stones Limited (FSL) continue to derive strength from extensive

experience of promoters in the stone mining industry, long term mining rights providing revenue visibility and long-standing

relation with clients, self-owned fleet of mining equipment, adequate logistic connectivity of mines and comfortable financial

risk profile marked by low gearing and healthy debt metrics. The ratings are however constrained by export regulation risks

with major portion of exports being made to China, susceptibility of FSL’s margin to foreign exchange fluctuation risk and

regulatory risk related to mining sector. The ratings also take cognizance of decline in total operating income and profitability

margins during FY20 (refers to period from April 01 to March 31) and the company’s efforts to diversify its exports to countries

other than China.

The rating assigned to the long term facilities has been withdrawn on an account of repayment of outstanding term loan.

Rating Sensitivities

Positive: (Factors that could lead to positive rating action/upgrade)

Increase in total operating income above Rs.200.0 crore while sustaining profit margins

Negative: (Factors that could lead to negative rating action/downgrade)

Decline in total operating income below Rs.100.0 crore and deterioration in PBILDT margin below 15%.

Weakening of capital structure to 1.00x.

Detailed description of the key rating drivers

Key Rating Strengths

Experienced promoters with established track record in mining of granite stone

Fortune Stones Limited (FSL) was established in 1996 as a joint venture between Bhardwaj family and M.P. State Mining

Corporation Ltd (MPSMC). Mr. Nivedan Bhardwaj, an MBA from Simon School of Business, University of Rochester, is the

Managing Director of FSL. He has more than two decades of experience in the stone mining industry and is involved in overall

strategic decision making. The company has established track record of more than 2 decades in the mining business.

Mining rights till 2028 providing long term revenue visibility: FSL has mining lease valid till 2028 to extract granite stones from

the Kathera mines. In FY16 (refers to period from April 01 to March 31), the company received consent from the Madhya

Pradesh Pollution Control Board to expand the production capacity from 18,000 CBM to 60,000 CBM.

Long standing relation with clientele: FSL has long standing relations with clientele in international market ranging from 5

years to 20 years. The trend in FSL’s production over the years has been towards export grade granite. Contribution over the

years from export grade granite has been around 80% while the rest is sold domestically.

Self-owned fleet of modern equipment and good connectivity: FSL is equipped with self-owned modern machinery for the

efficient extraction of granite. Self-owned fleet of equipment ensures timely availability of machinery and efficient extraction

of granite. The mine of the company has good road and rail connectivity. Granite blocks extracted are transported to Kandla

port either by road or via railways via the Khajurao-Mohaba rail line located 35 Kilometres away.

Comfortable financial risk profile: The capital structure represented by overall gearing continues to remain at below unity at

0.14x as on March 31, 2020 against 0.11x as on March 31, 2019. The moderation is on an account of operating lease obligation

categorized as debt. Further, the company has also fully paid its outstanding term loan. The total debt to GCA stood at 0.66x

during FY20 against 0.34x during FY19. The moderation is on an account of decline in GCA level from Rs. 23.39 crore in FY19 to

Rs.17.05 crore in FY20.

Key Rating Weaknesses

Decline in total operating income and profitability margins: The company witnessed decline in total operating income to Rs.

113.81 crore in FY20 against Rs.138.68 crore in FY19 registering y-o-y de growth of 17.93%. This is on an account in decline in

export sales which contributed to around 80% of total sales. The decline is due to technical challenges faced and lockdown

1 CARE Ratings Limited

Press Release

during last days of March 2020 due to COVID. FSL faced technical challenges w.r.t delay in receipt of e-pass which resulted in

stock piling up. In line with decline in total operating income, PBILDT level also declined from Rs.31.78 crore in FY19 to Rs.21.70

crore in FY20 which resulted in decline in PBILDT margin to 19.06% in FY20 vis-vis 22.92% in FY20. The PAT margin also declined

to 9.68% in FY20 against 13.07% in FY19.

During H1FY21, the company reported total operating income of Rs.63.40 crore. As on February 2021, the company reported

total operating income of Rs.127.0 crore.

Export regulation risk and geographic concentration: The major portion of exports is made to China and Hong-Kong, exposing

it to policies pertaining to export and import of granite in India and China. Granite is exported from India in two forms: raw

granite and polished granite. China procures raw stones from the international market, cuts and polishes the same and re-

exports them to European countries. FSL’s large chunk of income is through the export channel which is concentrated to China

and Hong-Kong thereby exposing the company to geographical concentration risk. However, the company had also initiated

production of granite slabs in FY19 for which it has already ventured into exports to Vietnam and Bulgaria, which is now

contributing to approx. 14% of the sales in current financial year. Going forward, it shall remain crucial for the company to

reduce dependence on China for its exports.

Susceptibility to foreign exchange risk: During FY20, approximately 82% (PY:89%) of its total operating income was from

exports while domestic sales accounted for around 18% (PY:11%). The company is exposed to foreign exchange risk to the

extent of its open position. The company does not hedge its foreign exchange receivables since it has natural hedge to some

extent in terms of payments related to packing credit in foreign currency. The company also imports equipment from foreign

countries which provides for a natural hedge against foreign exchange risk. FSL has earned an income of Rs. 1.10 crore in FY20

(PY: Rs.0.77 cr.) on account of foreign exchange fluctuations.

Regulatory risk related to the mining sector: Mining industry in the country is largely regulated by the government which

coupled with obtaining land for mining poses a major entry barrier. The mining industry is highly susceptible to the changes in

the regulations by the government (changes in royalty, export duty, ban on mining etc.) which exposes players like FSL to

regulatory risks.

Prospects: The granite industry is highly fragmented with presence of large number of organized and unorganized player.

Indian granite exporters face competition from growing preference of engineered stone and Brazilian granite industry. Granite

being a natural stone the key demand drivers for Indian granites worldwide depend on availability of new deposits of granites

with new colors and texture, as the same is not available in other countries. The granite export industry has moved from an

order driven market to a stock-and-sell market. This has impacted the dynamics of the industry and increased the working

capital requirements. The granite industry is primarily dependant upon demand from real estate, infrastructure and

construction sector across globe. Infrastructure sector is as growing sector despite the adverse movement in the

macroeconomic factors, infrastructure growth requirement universally remains high and in turn does not adversely affect

business of FSL

Strong Liquidity: The current ratio of the company remained comfortable at 2.19x as on March 31, 2020 (PY: 2.11x). The

average month end working capital utilizations of the company remain low at 17.59% for trailing 12 months ending December

2020. The liquidity profile is further strengthened by free cash and bank balance of Rs. 25.84 crore as on March 31, 2020 (PY:

Rs. 12.77 crore). Thus, the company had not opted for covid-19 related moratorium on debts. During FY21, FSL is expected to

report GCA of Rs 23.78 crore. It has already repaid its term loans and its capex requirements are modular in nature which are

expected to be met through internal accruals.

Analytical approach: Standalone

Applicable criteria –

Rating Outlook and Credit Watch

CARE’s Policy on Default Recognition

Financial ratios-Non-Financial Sector

Liquidity analysis -Non-Financial Sector

Criteria for Short Term Instruments

Rating Methodology-Service Sector

About the Company

FSL was established as MP Fortune Mining Limited on January 5, 1996, as a joint venture between the current promoters

(Bharadwaj family) and the Madhya Pradesh government through Madhya Pradesh State Mining Corporation Ltd (MPSMCL).

The name of the entity was thereafter changed to Fortune Stones Limited on June 8, 2000. FSL was established as a 100%

export-oriented unit (EOU) and was granted a lease license for extraction of red granite stones from the Kathera Mines on July

3, 1998 for a period of 10 years which was renewed in 2008 for next 20 years. FSL is involved in the selling of raw granite slabs

and blocks.

2 CARE Ratings Limited

Press Release

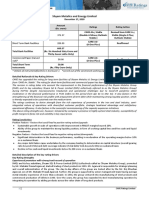

Brief Financials (Rs. crore) FY19 (A) FY20 (A)

Total operating income 138.68 113.81

PBILDT 31.78 21.70

PAT 18.15 11.04

Overall gearing (times) 0.11 0.14

Interest coverage (times) 36.16 42.50

A: Audited;

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Covenants of rated facilities: Detailed explanation of covenants of the rated instruments/facilities is given in Annexure-3

Annexure-1: Details of Instruments/Facilities

Name of the Date of Coupon Maturity Size of the Issue Rating assigned along

Instrument Issuance Rate Date (Rs. crore) with Rating Outlook

Withdrawn

Fund-based - LT-Term Loan - - - 0.00

CARE BBB; Stable /

Fund-based - LT/ ST-Packing Credit in

- - - 27.50 CARE A3+

Foreign Currency

CARE BBB; Stable /

Non-fund-based - LT/ ST-Letter of

- - - 1.50 CARE A3+

credit

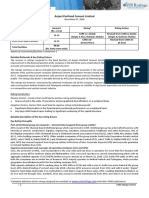

Annexure-2: Rating History of last three years

Current Ratings Rating history

Name of the Type Rating Date(s) & Date(s) & Date(s) & Date(s) &

Sr. Amount

Instrument/Bank Rating(s) Rating(s) Rating(s) Rating(s)

No. Outstanding

Facilities assigned in assigned in assigned in assigned in

(Rs. crore)

2020-2021 2019-2020 2018-2019 2017-2018

1)CARE

BBB; Stable

(28-Mar- 1)CARE

20) BBB; Stable

1. Fund-based - LT-Term Loan LT - - - -

2)CARE (05-Apr-18)

BBB; Stable

(04-Apr-19)

1)CARE

CARE A3+

BBB; (28-Mar- 1)CARE

Fund-based - LT/ ST-Packing Stable / 20) A3+

2. LT/ST 27.50 - -

Credit in Foreign Currency CARE 2)CARE (05-Apr-18)

A3+ A3+

(04-Apr-19)

CARE

BBB;

Non-fund-based - LT/ ST- Stable /

3. LT/ST 1.50 - - - -

Letter of credit CARE

A3+

Annexure-3: Detailed explanation of covenants of the rated instruments/facilities – Not Applicable

3 CARE Ratings Limited

Press Release

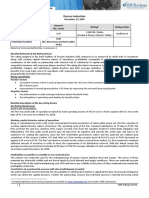

Annexure 4: Complexity level of various instruments rated for this Company

Sr. No. Name of the Instrument Complexity Level

1. Fund-based - LT-Term Loan Simple

2. Fund-based-LT/ST-PCFC Simple

3. Non-fund-based-LT/ST-LC Simple

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity. This

classification is available at www.careratings.com. Investors/market intermediaries/regulators or others are welcome to write

to care@careratings.com for any clarifications.

Contact us

Media Contact

Mradul Mishra

Contact no. – +91-22-6837 4424

Email ID – mradul.mishra@careratings.com

Analyst Contact

Name: Mr. Ajay Dhaka

Tel: 011-45333218

Mobile: 8826868795

Email: ajay.dhaka@careratings.com

Business Development Contact

Name: Ms Swati Agarwal

Contact no. : 011-45333200

Email ID: swati.agarwal@careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading credit

rating agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also recognized as an

External Credit Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of its rightful place in the

Indian capital market built around investor confidence. CARE Ratings provides the entire spectrum of credit rating that helps the

corporates to raise capital for their various requirements and assists the investors to form an informed investment decision

based on the credit risk and their own risk-return expectations. Our rating and grading service offerings leverage our domain and

analytical expertise backed by the methodologies congruent with the international best practices.

Disclaimer

CARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not

recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security.

CARE’s ratings do not convey suitability or price for the investor. CARE’s ratings do not constitute an audit on the rated

entity. CARE has based its ratings/outlooks on information obtained from sources believed by it to be accurate and

reliable. CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not

responsible for any errors or omissions or for the results obtained from the use of such information. Most entities whose

bank facilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bank

facilities/instruments. CARE or its subsidiaries/associates may also have other commercial transactions with the entity. In

case of partnership/proprietary concerns, the rating /outlook assigned by CARE is, inter-alia, based on the capital deployed

by the partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo change in

case of withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financial

performance and other relevant factors. CARE is not responsible for any errors and states that it has no financial liability

whatsoever to the users of CARE’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve

acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and if triggered, the

ratings may see volatility and sharp downgrades.

4 CARE Ratings Limited

You might also like

- Bridging The Credit Gap For MSMEsDocument31 pagesBridging The Credit Gap For MSMEsRavi BabuNo ratings yet

- Case Study - Financial ServiceDocument5 pagesCase Study - Financial ServiceNia ニア Mulyaningsih0% (1)

- Swift PMPG Guidelines Mt202cov 0Document12 pagesSwift PMPG Guidelines Mt202cov 0Benedict Wong Cheng WaiNo ratings yet

- Forfeiture of SharesDocument6 pagesForfeiture of Sharesshriyanka dashNo ratings yet

- Licensing HandbookDocument88 pagesLicensing HandbookajoiNo ratings yet

- Tab India Granites Private Limited-02-07-2020Document6 pagesTab India Granites Private Limited-02-07-2020Puneet367No ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- PSK Engineering Construction & Co-08-06-2020Document5 pagesPSK Engineering Construction & Co-08-06-2020The JdNo ratings yet

- Super Spinning Mills Limited-09-08-2020Document4 pagesSuper Spinning Mills Limited-09-08-2020Positive ThinkerNo ratings yet

- Satya Stone Exports-01!24!2020Document4 pagesSatya Stone Exports-01!24!2020vasfee.7172No ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- MRF Limited - R - 30112020Document7 pagesMRF Limited - R - 30112020deepal patilNo ratings yet

- Ginni Filaments Limited-09!07!2020Document4 pagesGinni Filaments Limited-09!07!2020Saurabh AgarwalNo ratings yet

- MRF LimitedDocument6 pagesMRF LimitedIshan GuptaNo ratings yet

- Signode India Financial ReportDocument5 pagesSignode India Financial Reportsaikiran reddyNo ratings yet

- Press Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- Balkrishna Industries - The Tyres Roll Faster From JainMatrix InvestmentsDocument3 pagesBalkrishna Industries - The Tyres Roll Faster From JainMatrix InvestmentsPunit JainNo ratings yet

- Saakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedDocument4 pagesSaakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedRanib SainjuNo ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- Mamta Transformers-R-19102020Document7 pagesMamta Transformers-R-19102020DarshanNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- Sugna-Metals-30Oct2020 Financial ReportDocument9 pagesSugna-Metals-30Oct2020 Financial Reportsaikiran reddyNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Bhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREDocument4 pagesBhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREPuneet367No ratings yet

- CHW Forge Feb 2019 ICRADocument7 pagesCHW Forge Feb 2019 ICRAPuneet367No ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Press Release Udaipur Cement Works LimitedDocument6 pagesPress Release Udaipur Cement Works Limitedflying400No ratings yet

- Press Release Anjani Portland Cement LimitedDocument5 pagesPress Release Anjani Portland Cement LimitedSandy SanNo ratings yet

- Globus Spirits LimitedDocument5 pagesGlobus Spirits LimitedHarminder Singh BajwaNo ratings yet

- Epicenter Technologies Private - R - 11082020Document7 pagesEpicenter Technologies Private - R - 11082020Shawn BlazeNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- INEOS Styrolution India Limited-12-23-2020Document5 pagesINEOS Styrolution India Limited-12-23-2020P KNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- Sanghi Jewellers PVT - R - 20102020Document7 pagesSanghi Jewellers PVT - R - 20102020DarshanNo ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet

- Buy Aditya Birla Capital EDEL 9.11.2019 PDFDocument24 pagesBuy Aditya Birla Capital EDEL 9.11.2019 PDFKunalNo ratings yet

- Press Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1ArunVenkatachalamNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Capital Goods: Gujarat Apollo Industries LTDDocument20 pagesCapital Goods: Gujarat Apollo Industries LTDcos.secNo ratings yet

- J.K. Cement LimitedDocument7 pagesJ.K. Cement LimitedPRAKHAR JAINNo ratings yet

- Eurotex Industries and Exports Limited: Summary of Rated InstrumentsDocument7 pagesEurotex Industries and Exports Limited: Summary of Rated InstrumentsHari KrishnanNo ratings yet

- PR Baidyanath 19dec22Document6 pagesPR Baidyanath 19dec22tusharj0934No ratings yet

- Blend Q4 Fy20Document6 pagesBlend Q4 Fy20Ni007ckNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Piramal Capital & Housing Finance - R - 12102020Document9 pagesPiramal Capital & Housing Finance - R - 12102020Rohit ShroffNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- L.G. Balakrishnan & Bros Limited: Summary of Rating ActionDocument7 pagesL.G. Balakrishnan & Bros Limited: Summary of Rating ActionChromoNo ratings yet

- Loyal Textile Mills Financial ReportDocument5 pagesLoyal Textile Mills Financial Reportsaikiran reddyNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- Avanti Feeds Limited: Largest Shrimp Feed Manufacturer of IndiaDocument12 pagesAvanti Feeds Limited: Largest Shrimp Feed Manufacturer of IndiaRavi BabuNo ratings yet

- The Evolution of Neobanks in India - 1Document34 pagesThe Evolution of Neobanks in India - 1Ravi BabuNo ratings yet

- 44 PharmaYadgirDocument42 pages44 PharmaYadgirRavi BabuNo ratings yet

- Press Release: R B Construction CompanyDocument4 pagesPress Release: R B Construction CompanyRavi BabuNo ratings yet

- E Commerce January 2020Document30 pagesE Commerce January 2020Ravi BabuNo ratings yet

- Aquaculture: Scenario Building Post COVID-19Document7 pagesAquaculture: Scenario Building Post COVID-19Ravi BabuNo ratings yet

- Press Release New Sapna Granite Industries: Details of Instruments/facilities in Annexure-1Document3 pagesPress Release New Sapna Granite Industries: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- Sara International Private Limited May 19, 2020: RatingsDocument6 pagesSara International Private Limited May 19, 2020: RatingsRavi BabuNo ratings yet

- Press Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- q1 2021 Deal ListDocument49 pagesq1 2021 Deal ListRavi BabuNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Press Release Gem Granites: Facilities/Instruments Amount (Rs. Crore) Ratings Rating ActionDocument4 pagesPress Release Gem Granites: Facilities/Instruments Amount (Rs. Crore) Ratings Rating ActionRavi BabuNo ratings yet

- Outsourced Service ProvidersDocument1 pageOutsourced Service ProvidersRavi BabuNo ratings yet

- Namaste India 2020Document228 pagesNamaste India 2020Ravi BabuNo ratings yet

- Deploying Sustainable Aviation Fuels at Scale in IndiaA Clean Skies For Tomorrow PublicationDocument62 pagesDeploying Sustainable Aviation Fuels at Scale in IndiaA Clean Skies For Tomorrow PublicationRavi BabuNo ratings yet

- Protecting Legacy The Value of A Family OfficeDocument25 pagesProtecting Legacy The Value of A Family OfficeRavi BabuNo ratings yet

- 12Document26 pages12Ravi BabuNo ratings yet

- Emerging Trends and Opportunities in Roads and Highways SectorDocument36 pagesEmerging Trends and Opportunities in Roads and Highways SectorRavi BabuNo ratings yet

- (July 2020) GS India Internet - A Closer Look Into The FutureDocument108 pages(July 2020) GS India Internet - A Closer Look Into The FutureRavi BabuNo ratings yet

- Indias Top 100 Women in Finance 2020 2Document72 pagesIndias Top 100 Women in Finance 2020 2Ravi BabuNo ratings yet

- List of Recovery AgencyDocument49 pagesList of Recovery AgencyRavi BabuNo ratings yet

- 4 Doubts - BatchPCB1 - 13-07 - 6PM - To - 20-07-20 - upto6PMDocument112 pages4 Doubts - BatchPCB1 - 13-07 - 6PM - To - 20-07-20 - upto6PMAlokranjan MishraNo ratings yet

- AccountDocument74 pagesAccountlolitaferozNo ratings yet

- Unitech 11 12Document148 pagesUnitech 11 12Ankit VasaNo ratings yet

- Rel PetroleumDocument217 pagesRel Petroleumsanty333No ratings yet

- Statements PDFDocument14 pagesStatements PDFJonathan Seagull LivingstonNo ratings yet

- Kavey 5kDocument7 pagesKavey 5kKaveyarason AnamanNo ratings yet

- Investor Presentation: Q4FY15 UpdateDocument34 pagesInvestor Presentation: Q4FY15 UpdateAditya NagpalNo ratings yet

- Su JokDocument6 pagesSu JokK AnjaliNo ratings yet

- Tax Havens and Its Effect On Global Economy: Economics ProjectDocument20 pagesTax Havens and Its Effect On Global Economy: Economics ProjectSushil JindalNo ratings yet

- Financing Technology Entrepreneurs in Developing CountriesDocument103 pagesFinancing Technology Entrepreneurs in Developing CountriesNgoan TranNo ratings yet

- App For MIE PDFDocument9 pagesApp For MIE PDFBilal Ahmed BarbhuiyaNo ratings yet

- Terms and Conditions Governing Internet Banking Service of DCBDocument6 pagesTerms and Conditions Governing Internet Banking Service of DCBChalsy BansalNo ratings yet

- Islamic Micro Finance To Micro Entrepreneurs - 26112009sdnDocument19 pagesIslamic Micro Finance To Micro Entrepreneurs - 26112009sdnsaebani hardjono100% (1)

- BAFL Audited Report For Dec 2020Document98 pagesBAFL Audited Report For Dec 2020MdZahidul IslamNo ratings yet

- Revised Implementing Rules and Regulations (IRR) of The Agricultural Guarantee Fund Pool (AGFP)Document16 pagesRevised Implementing Rules and Regulations (IRR) of The Agricultural Guarantee Fund Pool (AGFP)Sheena Reyes-BellenNo ratings yet

- Service Provided by Rastriya Banijya BankDocument36 pagesService Provided by Rastriya Banijya Bankbishnu paudelNo ratings yet

- MBA - Time TableDocument6 pagesMBA - Time TablesravsofficalNo ratings yet

- Arvind CV NewDocument3 pagesArvind CV NewAnsh SainiNo ratings yet

- BBFS (R-3)Document4 pagesBBFS (R-3)Mohammed ShoaibNo ratings yet

- QuiChap012 PDFDocument108 pagesQuiChap012 PDFIvan YaoNo ratings yet

- Dual Aspect Concept: Convention of DisclosureDocument3 pagesDual Aspect Concept: Convention of DisclosurePayal MaskaraNo ratings yet

- Rakesh Mohan On Indian Financial MarketsDocument23 pagesRakesh Mohan On Indian Financial MarketsRosie_89No ratings yet

- Convention CentreDocument21 pagesConvention CentrerootofsoulNo ratings yet

- Important Banking TermsDocument11 pagesImportant Banking TermsIndu GuptaNo ratings yet

- Nafcub ProfileDocument43 pagesNafcub ProfileB2B InfomediaNo ratings yet

- FX4Cash Currency Guide 2022Document144 pagesFX4Cash Currency Guide 2022tamer abdelhadyNo ratings yet