Professional Documents

Culture Documents

LBO (Leveraged Buyout) Model For Private Equity Firms

LBO (Leveraged Buyout) Model For Private Equity Firms

Uploaded by

Dishant KhanejaCopyright:

Available Formats

You might also like

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- HQ01 Partnership Formation and OperationDocument9 pagesHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- Luc Duy Khanh - EBBA 13.1 - ASSIGNMENT 2Document4 pagesLuc Duy Khanh - EBBA 13.1 - ASSIGNMENT 2Khánh Lục100% (1)

- Atal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Document2 pagesAtal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Rising Star CSC67% (3)

- Managerial Economics II - Demand & SupplyDocument35 pagesManagerial Economics II - Demand & SupplyNikhil PathakNo ratings yet

- Neptune Model CompleteDocument23 pagesNeptune Model CompleteChar_TonyNo ratings yet

- LBO Structuring and Modeling in Practice - CaseDocument11 pagesLBO Structuring and Modeling in Practice - CaseZexi WUNo ratings yet

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- LBO Modeling Test ExampleDocument19 pagesLBO Modeling Test ExampleJorgeNo ratings yet

- LBO Model TemplateDocument67 pagesLBO Model TemplateAlex TovNo ratings yet

- Capital Structure of An LBO PDFDocument3 pagesCapital Structure of An LBO PDFTim OttoNo ratings yet

- Apple & RIM Merger Model and LBO ModelDocument50 pagesApple & RIM Merger Model and LBO ModelDarshana MathurNo ratings yet

- Private Equity Minority Investments: An Attractive Financing Alternative for Family FirmsFrom EverandPrivate Equity Minority Investments: An Attractive Financing Alternative for Family FirmsNo ratings yet

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesFrom EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- $ in Millions, Except Per Share DataDocument59 pages$ in Millions, Except Per Share DataTom HoughNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument10 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatNo ratings yet

- LBO Model - CompletedDocument12 pagesLBO Model - CompletedJennifer HsuNo ratings yet

- Toys R Us LBO Model BlankDocument34 pagesToys R Us LBO Model BlankCatarina AlmeidaNo ratings yet

- Core Lbo ModelDocument25 pagesCore Lbo Modelsalman_schonNo ratings yet

- Merger ModelDocument8 pagesMerger ModelStuti BansalNo ratings yet

- LBO Analysis CompletedDocument9 pagesLBO Analysis CompletedVenkatesh NatarajanNo ratings yet

- Lbo W DCF Model SampleDocument33 pagesLbo W DCF Model Samplejulita rachmadewiNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Lbo W DCF Model SampleDocument43 pagesLbo W DCF Model SamplePrashantK100% (1)

- LBO Completed ModelDocument210 pagesLBO Completed ModelBrian DongNo ratings yet

- Merger Model PP Allocation BeforeDocument100 pagesMerger Model PP Allocation BeforePaulo NascimentoNo ratings yet

- (Company) : Basic Exit Multiples Cash SweepDocument26 pages(Company) : Basic Exit Multiples Cash Sweepw_fibNo ratings yet

- Cheniere Energy Valuation ModelDocument11 pagesCheniere Energy Valuation Modelngarritson1520100% (1)

- Leveraged Buyout ModelDocument31 pagesLeveraged Buyout ModelmilosevNo ratings yet

- ProformaDocument1 pageProformaapi-401204785No ratings yet

- 06 06 Football Field Walmart Model Valuation BeforeDocument47 pages06 06 Football Field Walmart Model Valuation BeforeIndrama Purba0% (1)

- DCF TemplateDocument6 pagesDCF TemplatemichelelinNo ratings yet

- Discussion of Valuation MethodsDocument21 pagesDiscussion of Valuation MethodsCommodityNo ratings yet

- LBO Test - 75Document84 pagesLBO Test - 75conc880% (1)

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojNo ratings yet

- 22 22 YHOO Merger Model Transaction Summary AfterDocument101 pages22 22 YHOO Merger Model Transaction Summary Aftercfang_2005No ratings yet

- Apple Model - FinalDocument32 pagesApple Model - FinalDang TrangNo ratings yet

- Bain CapitalDocument14 pagesBain Capitalw_fibNo ratings yet

- Simple LBO ModelDocument14 pagesSimple LBO ModelSucameloNo ratings yet

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDocument46 pages1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaNo ratings yet

- Capital IQ Excel Plug-In GuideDocument21 pagesCapital IQ Excel Plug-In GuideAndi EjronNo ratings yet

- Investment Banking LBO ModelDocument4 pagesInvestment Banking LBO Modelkirihara95100% (1)

- Valuation+in+the+Context+of+a+Restructuring+ (3 23 10)Document53 pagesValuation+in+the+Context+of+a+Restructuring+ (3 23 10)aniketparikh3100% (1)

- BIWS Atlassian 3 Statement Model - VFDocument8 pagesBIWS Atlassian 3 Statement Model - VFJohnny BravoNo ratings yet

- Mezzanine Finance Draft1Document8 pagesMezzanine Finance Draft1Jyoti Uppal SachdevaNo ratings yet

- LBO Model Template - PE Course (Spring 08)Document18 pagesLBO Model Template - PE Course (Spring 08)chasperbrown100% (11)

- Valuation Cash Flow A Teaching NoteDocument5 pagesValuation Cash Flow A Teaching NotesarahmohanNo ratings yet

- JAZZ Sellside MA PitchbookDocument47 pagesJAZZ Sellside MA PitchbookSamarth MarwahaNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- McKinsey DCF Valuation 2005 User GuideDocument16 pagesMcKinsey DCF Valuation 2005 User GuideMichel KropfNo ratings yet

- Lbo Mechanics New PDFDocument10 pagesLbo Mechanics New PDFPaola Verdi100% (1)

- LBO Blank TemplateDocument15 pagesLBO Blank TemplateBrian DongNo ratings yet

- Goldman - MA Perspectives PDFDocument9 pagesGoldman - MA Perspectives PDFPedro CastilloNo ratings yet

- Precedent Transactions 3E TemplateDocument14 pagesPrecedent Transactions 3E TemplateLohith Kumar ReddyNo ratings yet

- Food Check - Investment Presentation PDFDocument10 pagesFood Check - Investment Presentation PDFFatima Josh SikandarNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- 50 13 Pasting in Excel Full Model After HHDocument64 pages50 13 Pasting in Excel Full Model After HHcfang_2005No ratings yet

- Airports UBSDocument89 pagesAirports UBSWeileWUNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Yardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Document8 pagesYardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Dishant KhanejaNo ratings yet

- MBA 2020-22 Term-V Class ScheduleDocument1 pageMBA 2020-22 Term-V Class ScheduleDishant KhanejaNo ratings yet

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocument5 pagesExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNo ratings yet

- IIM Ranchi - Naman AroraDocument1 pageIIM Ranchi - Naman AroraDishant KhanejaNo ratings yet

- Agile Presentation For IIM Ranchi - V2.2Document46 pagesAgile Presentation For IIM Ranchi - V2.2Dishant KhanejaNo ratings yet

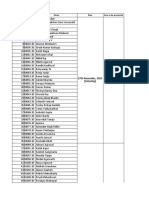

- Sl. Stu ID Name Date Case To Be Presented: 27th November, 2021 (Saturday) New Delhi Water and PowerDocument4 pagesSl. Stu ID Name Date Case To Be Presented: 27th November, 2021 (Saturday) New Delhi Water and PowerDishant KhanejaNo ratings yet

- MIMA - Mid-Term Exam-MBA - 2020-22Document1 pageMIMA - Mid-Term Exam-MBA - 2020-22Dishant KhanejaNo ratings yet

- Indian Institute of Management Ranchi: - Anything Written Beyond ThreeDocument2 pagesIndian Institute of Management Ranchi: - Anything Written Beyond ThreeDishant KhanejaNo ratings yet

- Bank Management Midterm Question Total Mark 70Document2 pagesBank Management Midterm Question Total Mark 70Dishant KhanejaNo ratings yet

- Agile Presentation For IIM Ranchi - V2.2Document46 pagesAgile Presentation For IIM Ranchi - V2.2Dishant KhanejaNo ratings yet

- Session 9-10Document42 pagesSession 9-10Dishant KhanejaNo ratings yet

- National Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDocument17 pagesNational Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDishant KhanejaNo ratings yet

- Nordex Financial StatementsDocument6 pagesNordex Financial StatementsDishant KhanejaNo ratings yet

- Equal Payment SeriesDocument5 pagesEqual Payment SeriesMaya OlleikNo ratings yet

- Franklin Templeton Investment Funds Annual Report (Full)Document478 pagesFranklin Templeton Investment Funds Annual Report (Full)read allNo ratings yet

- Feasibility StudiesDocument60 pagesFeasibility Studiesice100% (2)

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- Short Cases: Business Process ReengineeringDocument9 pagesShort Cases: Business Process ReengineeringNOSHEEN MEHFOOZNo ratings yet

- CA Hema ResumeDocument2 pagesCA Hema Resumeishk1202No ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Amit YearnNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online Billghazanfarhayat000046No ratings yet

- Pleting The CycleDocument21 pagesPleting The CycleAL Babaran CanceranNo ratings yet

- Feasibility Analysis of Broiler Farm With Partnership PatternDocument12 pagesFeasibility Analysis of Broiler Farm With Partnership PatternZohour AfifyNo ratings yet

- Saln CherryDocument3 pagesSaln CherryMARISSA MAMARILNo ratings yet

- PP On Fuel StationDocument20 pagesPP On Fuel StationGurraacha Abbayyaa100% (2)

- Ratio ShreeDocument12 pagesRatio ShreeMandeep BatraNo ratings yet

- Municipal Council of Iloilo v. EvangelistaDocument4 pagesMunicipal Council of Iloilo v. EvangelistaJune Vincent Ferrer IIINo ratings yet

- Coca Cola - Introduction To ManagementDocument24 pagesCoca Cola - Introduction To ManagementUmasha NelumNo ratings yet

- Brick Manufacturing ProcessDocument17 pagesBrick Manufacturing Processprahladagarwal100% (3)

- W11 Module 9-Aggregate and Operations SchedulingDocument11 pagesW11 Module 9-Aggregate and Operations SchedulingDanica VetuzNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- PESTEL Analysis of Sarosh Rice MillDocument2 pagesPESTEL Analysis of Sarosh Rice MillDhanush ShettyNo ratings yet

- SCM Notes Third and Fourth ChaptersDocument27 pagesSCM Notes Third and Fourth ChaptersSameer RaiNo ratings yet

- Will Fin533Document2 pagesWill Fin533Faiz JamalNo ratings yet

- The Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersDocument4 pagesThe Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersSaurabh PantNo ratings yet

- Serghei Merjan CVDocument11 pagesSerghei Merjan CVUNIMEDIANo ratings yet

- Land Line Tariff Plans: ALTTC, GhaziabadDocument66 pagesLand Line Tariff Plans: ALTTC, GhaziabadRajesh KumarNo ratings yet

- Ba 4055 Warehouse ManagementDocument40 pagesBa 4055 Warehouse ManagementDEAN RESEARCH AND DEVELOPMENT100% (1)

- Burfisher - Introduction To CGE ModelsDocument420 pagesBurfisher - Introduction To CGE ModelsEstudiante bernardo david romero torresNo ratings yet

LBO (Leveraged Buyout) Model For Private Equity Firms

LBO (Leveraged Buyout) Model For Private Equity Firms

Uploaded by

Dishant KhanejaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LBO (Leveraged Buyout) Model For Private Equity Firms

LBO (Leveraged Buyout) Model For Private Equity Firms

Uploaded by

Dishant KhanejaCopyright:

Available Formats

Financial Model

Widget Co. Incorporated

August 29, 2021

Cells with a blue background are input cells

Cells with white background are formulas

Model

Widget Co. Incorporated

Levered 5-Year IRR of 31.1%

Sources of Capital Value Operating Model, In Millions 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E 2024E

Equity $44.5

Senior Debt 3.0x EBITDA $47.4 Total Revenue $24.7 $27.4 $29.9 $32.3 $35.3 $38.6 $42.2 $46.1 $50.5 $55.2

Total Sources $91.9 Annual Growth 10.9% 9.1% 8.0% 9.3% 9.3% 9.3% 9.3% 9.3% 9.3%

Uses of Capital Metric Value COGS ($10.0) ($10.5) ($10.5) ($10.5) ($10.5) ($13.6) ($14.9) ($16.3) ($17.8) ($19.4)

Working Capital 0.0% of EV $0.0 % of Revenue 40.5% 38.3% 35.1% 32.5% 29.7% 35.2% 35.2% 35.2% 35.2% 35.2%

Transaction Fees 5.8% of EV $5.0

Enterprise Value 5.5x EBITDA $86.9 Gross Revenue $14.7 $16.9 $19.4 $21.8 $24.8 $25.0 $27.3 $29.9 $32.7 $35.7

Total Uses $91.9 Margin 59.5% 61.7% 64.9% 67.5% 70.3% 64.8% 64.8% 64.8% 64.8% 64.8%

Operating Assumptions SG&A ($5.0) ($6.0) ($7.0) ($8.0) ($9.0) ($8.9) ($9.8) ($10.7) ($11.7) ($12.8)

Revenue, Annual Growth 9.3% % of Revenue 20.2% 21.9% 23.4% 24.8% 25.5% 23.2% 23.2% 23.2% 23.2% 23.2%

COGS % of Revenue 35.2%

SG&A % of Revenue 23.2% EBITDA $9.7 $10.9 $12.4 $13.8 $15.8 $16.1 $17.6 $19.2 $21.0 $23.0

Taxes 15.3% Margin 39.3% 39.8% 41.5% 42.7% 44.8% 41.6% 41.6% 41.6% 41.6% 41.6%

Depreciation & Amortization (% of Sales) 14.7%

Capex (% of Sales) 4.1% Depreciation & Amortization ($4.0) ($4.2) ($4.4) ($4.6) ($4.8) ($5.7) ($6.2) ($6.8) ($7.4) ($8.1)

Net Working Capital (% of Sales) 5.0% EBIT $5.7 $6.7 $8.0 $9.2 $11.0 $10.4 $11.4 $12.4 $13.6 $14.8

Margin 23.1% 24.5% 26.8% 28.5% 31.2% 26.9% 26.9% 26.9% 26.9% 26.9%

Financing Assumptions

Senior Debt Amortization Period 20 Years Taxes ($0.9) ($1.0) ($1.2) ($1.4) ($1.7) ($1.6) ($1.7) ($1.9) ($2.1) ($2.3)

Senior Debt Interest Rate 8.0% Depreciation & Amortization $4.0 $4.2 $4.4 $4.6 $4.8 $5.7 $6.2 $6.8 $7.4 $8.1

Refinanced Debt Year 2022 Capex ($0.9) ($1.0) ($1.2) ($1.4) ($1.7) ($1.6) ($1.7) ($1.9) ($2.1) ($2.3)

Refinanced Debt Multiple 3.0x EBITDA Change in Net Working Capital ($0.4) ($0.6) ($0.8) ($0.9) ($0.1) ($1.9) ($2.1) ($2.3) ($2.5) ($2.8)

Refinanced Debt Amortization Period 20 Years Free Cash Flow $7.5 $8.3 $9.2 $10.1 $12.3 $10.9 $12.0 $13.1 $14.3 $15.6

Refinanced Debt Interest Rate 6.0%

Senior Debt Interest ($3.8) ($3.2) ($2.5) $0.0 $0.0

Salient Details Refinanced Debt Interest $0.0 $0.0 $0.0 ($2.8) ($2.2)

Company Name Widget Co. Incorporated Levered FCF Available for Debt Paydown $7.2 $8.7 $10.6 $11.5 $13.5

Acquisition Year 2019

Exit Year 2024 Senior Debt Mandatory Paydown ($2.4) ($2.4) ($2.4) $0.0 $0.0

Exit Multiple 6.5x EBITDA Senior Debt Optional Paydown ($4.8) ($6.4) ($8.2) $0.0 $0.0

Refinanced Debt Mandatory Paydown $0.0 $0.0 $0.0 ($2.4) ($2.4)

Returns Summary Refinanced Debt Optional Paydown $0.0 $0.0 $0.0 ($9.1) ($11.1)

5-Year IRR 31.1% Levered FCF Before Refinancing & Sale $0.0 $0.0 $0.0 $0.0 $0.0

5-Year MoIC 3.4x

Proceeds From Sale $0.0 $0.0 $0.0 $0.0 $149.2

Senior Debt Payoff From Sale $0.0 $0.0 $0.0 $0.0 $0.0

Refinanced Debt Payoff From Sale $0.0 $0.0 $0.0 $0.0 ($22.5)

Levered FCF $0.0 $0.0 $0.0 $0.0 $126.7

Working Capital $0.0 $0.0 $0.0 $0.0 $0.0

Equity Dividend $0.0 $0.0 $0.0 $0.0 ($126.7)

Ending Cash Balance $0.0 $0.0 $0.0 $0.0 $0.0

Senior Debt Schedule 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E 2024E

Starting Balance $47.4 $40.2 $31.5 $0.0 $0.0

This Period Mandatory Paydown ($2.4) ($2.4) ($2.4) $0.0 $0.0

This Period Optional Paydown ($4.8) ($6.4) ($8.2) $0.0 $0.0

Paydown at Refinancing $0.0 $0.0 ($20.9) $0.0 $0.0

Paydown at Sale $0.0 $0.0 $0.0 $0.0 $0.0

Ending Balance $47.4 $40.2 $31.5 $0.0 $0.0 $0.0

Interest Payment ($3.8) ($3.2) ($2.5) $0.0 $0.0

Refinanced Debt Schedule 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E 2024E

Starting Balance $0.0 $0.0 $0.0 $47.4 $35.9

This Period Mandatory Paydown $0.0 $0.0 $0.0 ($2.4) ($2.4)

This Period Optional Paydown $0.0 $0.0 $0.0 ($9.1) ($11.1)

Paydown at Sale $0.0 $0.0 $0.0 $0.0 ($22.5)

Ending Balance $47.4 $0.0 $0.0 $47.4 $35.9 $0.0

Interest Payment $0.0 $0.0 $0.0 ($2.8) ($2.2)

Levered Returns 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E 2024E

Initial Investment ($44.5) $0.0 $0.0 $0.0 $0.0 $0.0

Proceeds From Refinancing $0.0 $0.0 $0.0 $26.5 $0.0 $0.0

Proceeds From Operations & Sale $0.0 $0.0 $0.0 $0.0 $0.0 $126.7

Levered Returns ($44.5) $0.0 $0.0 $26.5 $0.0 $126.7

You might also like

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- HQ01 Partnership Formation and OperationDocument9 pagesHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- Luc Duy Khanh - EBBA 13.1 - ASSIGNMENT 2Document4 pagesLuc Duy Khanh - EBBA 13.1 - ASSIGNMENT 2Khánh Lục100% (1)

- Atal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Document2 pagesAtal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Rising Star CSC67% (3)

- Managerial Economics II - Demand & SupplyDocument35 pagesManagerial Economics II - Demand & SupplyNikhil PathakNo ratings yet

- Neptune Model CompleteDocument23 pagesNeptune Model CompleteChar_TonyNo ratings yet

- LBO Structuring and Modeling in Practice - CaseDocument11 pagesLBO Structuring and Modeling in Practice - CaseZexi WUNo ratings yet

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- LBO Modeling Test ExampleDocument19 pagesLBO Modeling Test ExampleJorgeNo ratings yet

- LBO Model TemplateDocument67 pagesLBO Model TemplateAlex TovNo ratings yet

- Capital Structure of An LBO PDFDocument3 pagesCapital Structure of An LBO PDFTim OttoNo ratings yet

- Apple & RIM Merger Model and LBO ModelDocument50 pagesApple & RIM Merger Model and LBO ModelDarshana MathurNo ratings yet

- Private Equity Minority Investments: An Attractive Financing Alternative for Family FirmsFrom EverandPrivate Equity Minority Investments: An Attractive Financing Alternative for Family FirmsNo ratings yet

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesFrom EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- $ in Millions, Except Per Share DataDocument59 pages$ in Millions, Except Per Share DataTom HoughNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument10 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatNo ratings yet

- LBO Model - CompletedDocument12 pagesLBO Model - CompletedJennifer HsuNo ratings yet

- Toys R Us LBO Model BlankDocument34 pagesToys R Us LBO Model BlankCatarina AlmeidaNo ratings yet

- Core Lbo ModelDocument25 pagesCore Lbo Modelsalman_schonNo ratings yet

- Merger ModelDocument8 pagesMerger ModelStuti BansalNo ratings yet

- LBO Analysis CompletedDocument9 pagesLBO Analysis CompletedVenkatesh NatarajanNo ratings yet

- Lbo W DCF Model SampleDocument33 pagesLbo W DCF Model Samplejulita rachmadewiNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Lbo W DCF Model SampleDocument43 pagesLbo W DCF Model SamplePrashantK100% (1)

- LBO Completed ModelDocument210 pagesLBO Completed ModelBrian DongNo ratings yet

- Merger Model PP Allocation BeforeDocument100 pagesMerger Model PP Allocation BeforePaulo NascimentoNo ratings yet

- (Company) : Basic Exit Multiples Cash SweepDocument26 pages(Company) : Basic Exit Multiples Cash Sweepw_fibNo ratings yet

- Cheniere Energy Valuation ModelDocument11 pagesCheniere Energy Valuation Modelngarritson1520100% (1)

- Leveraged Buyout ModelDocument31 pagesLeveraged Buyout ModelmilosevNo ratings yet

- ProformaDocument1 pageProformaapi-401204785No ratings yet

- 06 06 Football Field Walmart Model Valuation BeforeDocument47 pages06 06 Football Field Walmart Model Valuation BeforeIndrama Purba0% (1)

- DCF TemplateDocument6 pagesDCF TemplatemichelelinNo ratings yet

- Discussion of Valuation MethodsDocument21 pagesDiscussion of Valuation MethodsCommodityNo ratings yet

- LBO Test - 75Document84 pagesLBO Test - 75conc880% (1)

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojNo ratings yet

- 22 22 YHOO Merger Model Transaction Summary AfterDocument101 pages22 22 YHOO Merger Model Transaction Summary Aftercfang_2005No ratings yet

- Apple Model - FinalDocument32 pagesApple Model - FinalDang TrangNo ratings yet

- Bain CapitalDocument14 pagesBain Capitalw_fibNo ratings yet

- Simple LBO ModelDocument14 pagesSimple LBO ModelSucameloNo ratings yet

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDocument46 pages1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaNo ratings yet

- Capital IQ Excel Plug-In GuideDocument21 pagesCapital IQ Excel Plug-In GuideAndi EjronNo ratings yet

- Investment Banking LBO ModelDocument4 pagesInvestment Banking LBO Modelkirihara95100% (1)

- Valuation+in+the+Context+of+a+Restructuring+ (3 23 10)Document53 pagesValuation+in+the+Context+of+a+Restructuring+ (3 23 10)aniketparikh3100% (1)

- BIWS Atlassian 3 Statement Model - VFDocument8 pagesBIWS Atlassian 3 Statement Model - VFJohnny BravoNo ratings yet

- Mezzanine Finance Draft1Document8 pagesMezzanine Finance Draft1Jyoti Uppal SachdevaNo ratings yet

- LBO Model Template - PE Course (Spring 08)Document18 pagesLBO Model Template - PE Course (Spring 08)chasperbrown100% (11)

- Valuation Cash Flow A Teaching NoteDocument5 pagesValuation Cash Flow A Teaching NotesarahmohanNo ratings yet

- JAZZ Sellside MA PitchbookDocument47 pagesJAZZ Sellside MA PitchbookSamarth MarwahaNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- McKinsey DCF Valuation 2005 User GuideDocument16 pagesMcKinsey DCF Valuation 2005 User GuideMichel KropfNo ratings yet

- Lbo Mechanics New PDFDocument10 pagesLbo Mechanics New PDFPaola Verdi100% (1)

- LBO Blank TemplateDocument15 pagesLBO Blank TemplateBrian DongNo ratings yet

- Goldman - MA Perspectives PDFDocument9 pagesGoldman - MA Perspectives PDFPedro CastilloNo ratings yet

- Precedent Transactions 3E TemplateDocument14 pagesPrecedent Transactions 3E TemplateLohith Kumar ReddyNo ratings yet

- Food Check - Investment Presentation PDFDocument10 pagesFood Check - Investment Presentation PDFFatima Josh SikandarNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- 50 13 Pasting in Excel Full Model After HHDocument64 pages50 13 Pasting in Excel Full Model After HHcfang_2005No ratings yet

- Airports UBSDocument89 pagesAirports UBSWeileWUNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Yardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Document8 pagesYardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Dishant KhanejaNo ratings yet

- MBA 2020-22 Term-V Class ScheduleDocument1 pageMBA 2020-22 Term-V Class ScheduleDishant KhanejaNo ratings yet

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocument5 pagesExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNo ratings yet

- IIM Ranchi - Naman AroraDocument1 pageIIM Ranchi - Naman AroraDishant KhanejaNo ratings yet

- Agile Presentation For IIM Ranchi - V2.2Document46 pagesAgile Presentation For IIM Ranchi - V2.2Dishant KhanejaNo ratings yet

- Sl. Stu ID Name Date Case To Be Presented: 27th November, 2021 (Saturday) New Delhi Water and PowerDocument4 pagesSl. Stu ID Name Date Case To Be Presented: 27th November, 2021 (Saturday) New Delhi Water and PowerDishant KhanejaNo ratings yet

- MIMA - Mid-Term Exam-MBA - 2020-22Document1 pageMIMA - Mid-Term Exam-MBA - 2020-22Dishant KhanejaNo ratings yet

- Indian Institute of Management Ranchi: - Anything Written Beyond ThreeDocument2 pagesIndian Institute of Management Ranchi: - Anything Written Beyond ThreeDishant KhanejaNo ratings yet

- Bank Management Midterm Question Total Mark 70Document2 pagesBank Management Midterm Question Total Mark 70Dishant KhanejaNo ratings yet

- Agile Presentation For IIM Ranchi - V2.2Document46 pagesAgile Presentation For IIM Ranchi - V2.2Dishant KhanejaNo ratings yet

- Session 9-10Document42 pagesSession 9-10Dishant KhanejaNo ratings yet

- National Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDocument17 pagesNational Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDishant KhanejaNo ratings yet

- Nordex Financial StatementsDocument6 pagesNordex Financial StatementsDishant KhanejaNo ratings yet

- Equal Payment SeriesDocument5 pagesEqual Payment SeriesMaya OlleikNo ratings yet

- Franklin Templeton Investment Funds Annual Report (Full)Document478 pagesFranklin Templeton Investment Funds Annual Report (Full)read allNo ratings yet

- Feasibility StudiesDocument60 pagesFeasibility Studiesice100% (2)

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- Short Cases: Business Process ReengineeringDocument9 pagesShort Cases: Business Process ReengineeringNOSHEEN MEHFOOZNo ratings yet

- CA Hema ResumeDocument2 pagesCA Hema Resumeishk1202No ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Amit YearnNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online Billghazanfarhayat000046No ratings yet

- Pleting The CycleDocument21 pagesPleting The CycleAL Babaran CanceranNo ratings yet

- Feasibility Analysis of Broiler Farm With Partnership PatternDocument12 pagesFeasibility Analysis of Broiler Farm With Partnership PatternZohour AfifyNo ratings yet

- Saln CherryDocument3 pagesSaln CherryMARISSA MAMARILNo ratings yet

- PP On Fuel StationDocument20 pagesPP On Fuel StationGurraacha Abbayyaa100% (2)

- Ratio ShreeDocument12 pagesRatio ShreeMandeep BatraNo ratings yet

- Municipal Council of Iloilo v. EvangelistaDocument4 pagesMunicipal Council of Iloilo v. EvangelistaJune Vincent Ferrer IIINo ratings yet

- Coca Cola - Introduction To ManagementDocument24 pagesCoca Cola - Introduction To ManagementUmasha NelumNo ratings yet

- Brick Manufacturing ProcessDocument17 pagesBrick Manufacturing Processprahladagarwal100% (3)

- W11 Module 9-Aggregate and Operations SchedulingDocument11 pagesW11 Module 9-Aggregate and Operations SchedulingDanica VetuzNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- PESTEL Analysis of Sarosh Rice MillDocument2 pagesPESTEL Analysis of Sarosh Rice MillDhanush ShettyNo ratings yet

- SCM Notes Third and Fourth ChaptersDocument27 pagesSCM Notes Third and Fourth ChaptersSameer RaiNo ratings yet

- Will Fin533Document2 pagesWill Fin533Faiz JamalNo ratings yet

- The Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersDocument4 pagesThe Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersSaurabh PantNo ratings yet

- Serghei Merjan CVDocument11 pagesSerghei Merjan CVUNIMEDIANo ratings yet

- Land Line Tariff Plans: ALTTC, GhaziabadDocument66 pagesLand Line Tariff Plans: ALTTC, GhaziabadRajesh KumarNo ratings yet

- Ba 4055 Warehouse ManagementDocument40 pagesBa 4055 Warehouse ManagementDEAN RESEARCH AND DEVELOPMENT100% (1)

- Burfisher - Introduction To CGE ModelsDocument420 pagesBurfisher - Introduction To CGE ModelsEstudiante bernardo david romero torresNo ratings yet