Professional Documents

Culture Documents

16

16

Uploaded by

Shiva Kumar0 ratings0% found this document useful (0 votes)

12 views17 pagesGhjjk

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGhjjk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

12 views17 pages16

16

Uploaded by

Shiva KumarGhjjk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 17

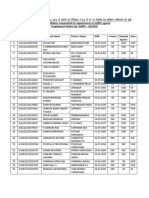

Problem No. 16

A company imported from USA of CIF price is 3300 dollars. From the following

information determine the assessable value and customs duty payable.

a) Freight from America to Indian Airport 330 dollars

b) Insurance 75 dollars

c) Design and development charges paid to consultancy firm in USA 1000 dollars

d) The company also spent an amount of % 6600 in India for installation of

Machine.

e) Exchange rate as notified by CBEC is = 58.50 = 1 dollar

f) BCD payable is 10%

g) IGST at 12%

h) GST compensation cess at 4%

i) Social welfare surcharge as applicable.

Problem No. 16

A company imported from USA of CIF price is 3300 dollars. From the following

information determine the assessable value and customs duty payable.

a)

b)

c)

d)

e)

f)

8)

h)

i)

Freight from America to Indian Airport 330 dollars

Insurance 75 dollars

Design and development charges paid to consultancy firm in USA 1000 dollars

The company also spent an amount of % 6600 in India for installation of

Machine.

Exchange rate as notified by CBEC is 58.50 = 1 dollar

BCD payable is 10 %

IGST at 12%

GST compensation cess at 4%

Social welfare surcharge as applicable.

Calculation of FOB Value

Particulars

CIF Price

Less: Freight 330$

Less: Insurance 755

FOB Value

Dreicie meer Stree e Uae as

Pee trier sid

Pre Arce es)

ena ele)

Solution

Calculation of Assessable Value (1 us $ = 58.5:

cued Amount (%)

FOB Value (2895 x 58.50) 1,69,358

Add: Air Freight (Note — 1) ( 330 X 58.50 ) pick [0-9

Add: Insurance (75 x 58.50) CL 7f

Add: Design and Development Charges (1000 x 58.50) 58,500

pe CRC 2,51,550

Soluti

CONGNEG OO mN M ROU CU CROC Oue Diamar kL (a

Tales

EXC)

Basic Custom duty (2,51,550 x 10%)

Social Welfare Charges (25,155 x 10%)

Sub Total

Add: IGST (2,79,221 x 12%)

Add: GST Compensation Cess (2,79,221 x 4%)

Beet aCe Rett lig]

eter N em Rec ing

Pai eral

33,506

Be 5

3,23,896

Py Aol

33,506

Be 5

epee TTY

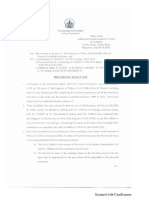

Problem No. 17

Compute the assessable value and custom duty payable from the following

information:

I.

I

Ml.

IV.

Vv.

Vi.

Vil.

Vill.

F.0.B value of the machine — 8000 UK Pounds

Freight paid (Air) — 2500 UK Pounds

Design and development charges paid in UK — 500 UK pounds

Commission paid to local agent at 2% Of FOB in Indian rupee

Date of bill of entry — 24-10-2018 (Rate of BCD 20%, Exchange rate as notified

by CBEC = % 68 per UK Pound)

Date of entry inward 20-10-2018 (Rate of BCD 18%, Exchange rate notified

by CBEC @ 70 per UK Pound)

GST at 12%

Social welfare surcharge as applicable

Insurance charges actually paid but details not available

@

Problem No. 17

Compute the assessable value and custom duty payable from the following

information:

I.

i

MM.

IV.

Vv.

Vi.

Vil.

F.0.B value of the machine — 8000 UK Pounds

Freight paid (Air) — 2500 UK Pounds

Design and development charges paid in UK — 500 UK pounds

Commission paid to local agent at 2% Of FOB in Indian rupee

Date of bill of entry — 24-10-2018 (Rate of BCD 20%, Exchange rate as notified

by CBEC = & 68 per UK Pound)

Date of entry inward 20-10-2018 (Rate of BCD 18%, Exchange rate notified

by CBEC 70 per UK Pound)

GST at 12%

Vill. Social welfare surcharge as applicable

Insurance charges actually paid but details not available

Note :1 Calculation of Air Freight:

1. Actual freight =2500£

2. 20% on FOB (8000 x 20%) = 1600 £

Freight Charges : 1600 £

‘WEL e

IK £

FOB Value (8000 x 68) 8,000

arti lc ed LE aw BA

Insurance (8000 X 1.125%) ( 90 x 68 )

esign and development Charges (500 x 68 )

elling Commission ( 5,44,000 X 2%)

Assessable Value

Soluti

Calculation of total customs value and Custom Duty Payable

Polar

Pee Me Clee iad

Pete AYE AEE

Basic Custom duty (7,03,800 x 20%) pet) 1,40,760

Social Welfare Charges (1,40,760 x 10%) BR) 14,076

Sub Total EAA) bE EEL)

Add: IGST (8,58,636 x 12%) eB Aci} BR Ri 1}

BEA CE Rec m el saucy 9,61,672 2,57,872

Problem No. 18

An importer has imported a machine from Japan at FOB cost of

13,00,000 yens other details as follows:-

a)Freight from Japan to Indian port was 18,000 yens.

b)Transit insurance charges were1.125% of FOB.

c)Design and Development charges of 95,000yens were paid to a

consultancy from Japan for design of machinery.

d) Packing charges of 25,000 yens were extra charged.

e) & 24,000 was spent in design cost on machine in India. e

f) An amount of 95,000 yens was payable to Japanese manufacture

towards charges were installation and commissioning machine in

India.

g) Rate of exchange as announced by RBI was 1yen=& 0.405.

h) Rate of exchange announced by CBEC lyen= & 0.401.

i) BCD at 20%, social welfare charges and IGST at 18%.

Retinrs

Calculation of Assessable Value (1 Yen ¥ = % 68)

VERE ETS oe

§| FOB Value (13,00,000 x 0.401) 13,00,000

UCC ig (18000 x 0.401 ) 18,000

Add: Insurance (13,00,000 X 1.125%) { 14625 x 0.401) bC R717

i Add: Design and development Charges (95000 x 0.40: EAU

Add: Packing Charges (25,000 X 0.401) 25,000

‘Amount (*)

Eye Ret)

7,218

EF)

ES AU}

CR)

Coyne

Calculation of total customs value and Custom Duty Payable

Assessable Value

§| Basic Custom duty (5,82,503 x 20%)

BT RU lire MO are Coe MMSE aa ty

Add: IGST (7,10,653 x 18%}

5,82,503

pee

11,650

1,27,917

pete

11,650

1,27,917

Problem 19 : Compute the duty payable under the Customs Act, 1962 for an imported

equipment based on the following information: Assessable value of the imported equipment US$

10,100. Date of Bill of Entry 25.4.2019. Basic customs duty on this date 15% and exchange rate

notified by the Central Board of Excise and Customs US$ 1 = 65. Date of Entry inwards

21.4.2019. Basic customs duty on this date 16% and exchange rate notified by the Central Board

of Excise and Customs US $ 1 =" 50. Social Welfare Surcharge @ 10% in terms of the Finance

Act, 2018. Make suitable assumptions where required and show the relevant

workings & round off your answer to the nearest Rupee

Solution-16 Computation of Customs Duty

Description Amount Rs ‘Total

Customs Duty

Assessable Value (10,100 x 65) 6,56,500

(BCD) Basic custom duty (6,56,500*.15) 98,475 98,475

Social Welfare Surcharge @ 10% of 98,475 9,847 9,847

Sub-total for IGST 7,64,822.5

IGST- on (7,64,822.5 x 18%) ( not given assumed as 18%) 1,37,668

‘Total Customs Duty 2,45,990

Total duty rounded to 2,45,990

Note: different dates are given, date of entry notified exchange rate should be taken

Example :2

An importer imported some goods for subsequent sale in India at $ 10,000 on assessable value basis. Relevant

exchange rate and rate of duty are as follows:

Particulars

Exchange rate declared | Rate of Basic

by the CBIC Customs Duty

%56/USD 10%

2 58.75/USD 12%

Date of submission of bill of entry 25th February 2018

Date of entry inwards granted fo the vessel Sth March 2018

Calculate Assessable value and Customs Duty in indian rupees?

Answer:

Relevant rate of duty for the imported goods is 12% (i.e. Date of submission of bill of entry or Date of entry inwards

granted to the vessel whichever is later)

Exchange Rate is € 58 per USD (Le. the rate of CBIC as on the date of submission of Bill of Entry by the importer)

Assessable value = 5,80,000 (Le, USD 10,000 x @ 58)

Basic Customs Duty = £69,600 (Le. € 5,80,000 x 12%)

10% Social Welfare Surcharge = 2 6,960 (i.e. % 69,600 x 10%)

IGST (Assume 18%) 1,18,181 (Le., 18% on (580000 + 69600 + 6960)

Total Customs Duty including IGST = 1,94,741/-

Example: 3

An importer imported some goods. Entry inwards granted to the vessel on 7th February, and the goods were

cleared from Chennai port for warehousing on &th February, after assessment. The Bill of Entry was presented on

Ist February for warehousing. Assessable value was US $ 10,000. Assume that no additional duty is payable. The

goods were warehoused at Chennai and were cleared from Chennai warehouse on 4th March. What is the duty

payable while removing the goods from Chennai warehouse on 4th March? Exchange rates and rate of Customs

Duties are as follows:

Particulars Date | Exchange rate declared | Basic Customs

by the CBIC Duty

Date of submission of bill of entry for warehousing | Ist February &55/USD 10%

Date of entry inwards granted to the vessel 7th February &59/USD 15%

Date of clearance of goods from warehouse ‘4th March = 60/USD 12%

Answer:

Relevant rate of duty for the imported goods warehoused is 12% (i.e. Date of submission of sub-bill of entry)

Exchange Rate is = 55 per USD (i.e. the rate of CBIC as on the date of submission of Bill of Entry by the importer)

Assessable value =%5,50,000 (1.e. USD 10,000 x % 55)

Basic Customs Duty =% 66,000 (i.e. & 5,50,000 x 12%)

10% Social Welfare Surcharge = 6,600 (i.e. ¥ 66,000 x 10%)

Total Customs Duty (excluding IGST) * 72,600/-

Example: 4

Compute export duty from the following data:

(FOB price of goods: US $ 1.00.000

(i) Shipping bill presented electronically on 26-02-2018

(ii) Proper officer passed order permitting clearance and loading of goods for export on 01-03-2018.

(iv) Rate of exchange and rate of export duty are as under

Duly Rate of Exchange _| Rate of Export

(On 26-02-2018 TUS $865

Onor-os-2018 | luss=rss |

(¥) Rate of exchange is notified for export by Central Board of Excise and Customs (Make suitable assumptions

wherever required and show the workings)

Answer:

Particulars Valve in? Remarks

FOB 65,00.000| _1,00,000 x 865

Customs Duty 5.20,.000] _%65 lakhs x 8%

Note: Export duty does not carry Social Welfare Surcharge.

Particulars Relevant date

Goods entered for home | Date of presentation of bill of entry

Gonssmion under section oR

Date of entry inwards of the vessel/anival of the aircraft or (vehicle w.e.f. 6-8-

2014)

whichever is later

Goods cleared from | Date of presentation of bill of entry for home consumption.

warehouse under section 68.

Other goods Date of payment of duty

Basic Customs Duty (BCD) on imported goods

Basic Customs

Duty U/s 12

Rate of duty at the time of Rate of duty at the time of entry

submission of Bll of Entry inwards granted to the vesse!

Ls Whichever dates later }#—

Exchange rate for imported goods

e

Exchange of CBE&C More than one exchange of CBE&C

+

Exchange of CBE&C as on the date of

submission of Bill of Entry

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Customs ACT: Dr. Gurumurthy K H Asst. Prof. in Commerce GFGC Magadi 9448226676Document46 pagesCustoms ACT: Dr. Gurumurthy K H Asst. Prof. in Commerce GFGC Magadi 9448226676Shiva KumarNo ratings yet

- !nspiro KAS Prelims 60days Plan: Day S Subjects Portion Daily PracticeDocument10 pages!nspiro KAS Prelims 60days Plan: Day S Subjects Portion Daily PracticeShiva KumarNo ratings yet

- Customs Duty-An OverviewDocument13 pagesCustoms Duty-An OverviewShiva KumarNo ratings yet

- Topics To Be CoveredDocument17 pagesTopics To Be CoveredShiva KumarNo ratings yet

- Vf/Klwpuk La ( K, L-VKB@JSLQC & 02@2018 Ds Varxzr Mi Fujh (Kd@Js-Lq-C-Ds in Ij Fu QFDR GSRQ Lwphcèn Meehnokjksa DH LWPHDocument7 pagesVf/Klwpuk La ( K, L-VKB@JSLQC & 02@2018 Ds Varxzr Mi Fujh (Kd@Js-Lq-C-Ds in Ij Fu QFDR GSRQ Lwphcèn Meehnokjksa DH LWPHShiva KumarNo ratings yet

- Scanned With CamscannerDocument2 pagesScanned With CamscannerShiva KumarNo ratings yet

- 5 6163706673136402740Document4 pages5 6163706673136402740Shiva KumarNo ratings yet

- 5 6246548156960473415Document2 pages5 6246548156960473415Shiva KumarNo ratings yet

- Scanned With CamscannerDocument3 pagesScanned With CamscannerShiva KumarNo ratings yet

- Gdé® Cpáqé ÄDocument19 pagesGdé® Cpáqé ÄShiva KumarNo ratings yet

- 5 6248799956774158532Document71 pages5 6248799956774158532Shiva KumarNo ratings yet

- List of State, Chief Minister and Governer 2020Document2 pagesList of State, Chief Minister and Governer 2020Shiva KumarNo ratings yet

- Vipangoyal13 Vipangoyal13 Vipangoyal13 DR Vipan Goyal: Download Study IQ App To Buy GS Course by DR Vipan GoyalDocument11 pagesVipangoyal13 Vipangoyal13 Vipangoyal13 DR Vipan Goyal: Download Study IQ App To Buy GS Course by DR Vipan GoyalShiva KumarNo ratings yet

- List of Major Folk Dances of All Indian StatesDocument6 pagesList of Major Folk Dances of All Indian StatesShiva Kumar100% (1)

- List of States and Capitals of India 2020Document3 pagesList of States and Capitals of India 2020Shiva KumarNo ratings yet

- Indian Constitution - Parts, Fundamental Rights and SchedulesDocument5 pagesIndian Constitution - Parts, Fundamental Rights and SchedulesShiva KumarNo ratings yet

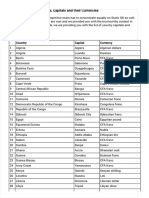

- Important List of Countries, Capitals and Their CurrenciesDocument7 pagesImportant List of Countries, Capitals and Their CurrenciesShiva KumarNo ratings yet