Professional Documents

Culture Documents

Bitcoin, Gold and Long Bonds May Rule 2H

Bitcoin, Gold and Long Bonds May Rule 2H

Uploaded by

Soren K. GroupCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Solution Manual Research Methods For Business A Skill Building Approach 7th Edition Uma SekaranDocument3 pagesSolution Manual Research Methods For Business A Skill Building Approach 7th Edition Uma SekaranRamji Gautam67% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Manual MAM MB33 EnglDocument9 pagesManual MAM MB33 EnglDavid Arboleya DiazNo ratings yet

- The Great Tech Rivalry: China Vs The U.S.: Graham Allison Kevin Klyman Karina Barbesino Hugo YenDocument52 pagesThe Great Tech Rivalry: China Vs The U.S.: Graham Allison Kevin Klyman Karina Barbesino Hugo YenSoren K. GroupNo ratings yet

- The Anguish of Central Bankers 1979Document57 pagesThe Anguish of Central Bankers 1979Soren K. Group100% (1)

- Facts and Fantasies About Commodity Futures Ten Years LaterDocument31 pagesFacts and Fantasies About Commodity Futures Ten Years LaterSoren K. GroupNo ratings yet

- Bridgewater Daily ObservationsDocument11 pagesBridgewater Daily ObservationsSoren K. GroupNo ratings yet

- Tax Cuts and Jobs Act - Full TextDocument429 pagesTax Cuts and Jobs Act - Full TextWJ Editorial Staff0% (1)

- Bridgewater The Changing World Order - The New ParadigmDocument27 pagesBridgewater The Changing World Order - The New ParadigmSoren K. Group100% (1)

- Bridgewater The Changing World Order - The New ParadigmDocument27 pagesBridgewater The Changing World Order - The New ParadigmSoren K. Group100% (1)

- Focus: U.S. Stock Market, Especially The Narrow Leaders-New NumbersDocument8 pagesFocus: U.S. Stock Market, Especially The Narrow Leaders-New NumbersSoren K. GroupNo ratings yet

- UraniumDocument11 pagesUraniumSoren K. GroupNo ratings yet

- Decreasing Metal Ore Grades - CopperDocument14 pagesDecreasing Metal Ore Grades - CopperSoren K. GroupNo ratings yet

- A Differend Kind of Recovery 20211216Document60 pagesA Differend Kind of Recovery 20211216Soren K. GroupNo ratings yet

- Bear Marke - CorrecDocument30 pagesBear Marke - CorrecSoren K. GroupNo ratings yet

- Don't Fight The Fed: Bloomberg Intelligence: Commodity OutlookDocument17 pagesDon't Fight The Fed: Bloomberg Intelligence: Commodity OutlookSoren K. GroupNo ratings yet

- Weekend Report: New Month, New Numbers: Gold Weekly With 3-Mo. AvgDocument7 pagesWeekend Report: New Month, New Numbers: Gold Weekly With 3-Mo. AvgSoren K. GroupNo ratings yet

- Ray Dalio I Have Some BitcoinDocument4 pagesRay Dalio I Have Some BitcoinSoren K. GroupNo ratings yet

- Is The Market About To CrashDocument21 pagesIs The Market About To CrashSoren K. GroupNo ratings yet

- CRB, Wtic & GoldDocument25 pagesCRB, Wtic & GoldSoren K. GroupNo ratings yet

- Forecasting Crude Oil and Natural Gas VolatilityDocument76 pagesForecasting Crude Oil and Natural Gas VolatilitySoren K. GroupNo ratings yet

- Kraken Intelligence's The Rise of Central Bank Digital CurrenciesDocument27 pagesKraken Intelligence's The Rise of Central Bank Digital CurrenciesSoren K. GroupNo ratings yet

- April Commodity OutlookDocument18 pagesApril Commodity OutlookSoren K. Group100% (1)

- Yale Paper June 04Document42 pagesYale Paper June 04tej7No ratings yet

- May 2021 Money LetterDocument26 pagesMay 2021 Money LetterSoren K. GroupNo ratings yet

- Market Maps Jan 2021Document14 pagesMarket Maps Jan 2021Soren K. Group100% (1)

- JPM Guide To Market Q1 2021Document86 pagesJPM Guide To Market Q1 2021Soren K. GroupNo ratings yet

- Precious Metal Report Jan 11Document73 pagesPrecious Metal Report Jan 11Soren K. GroupNo ratings yet

- To The Goldfix CommunityDocument2 pagesTo The Goldfix CommunitySoren K. GroupNo ratings yet

- Working Paper Series: Overcoming The Zero Bound On Interest Rate PolicyDocument54 pagesWorking Paper Series: Overcoming The Zero Bound On Interest Rate PolicySoren K. GroupNo ratings yet

- Precious Metals & Minerals Weekly Valuation Tables: Chart of The Week: Sustaining FCF Margins Vs AISC MarginsDocument18 pagesPrecious Metals & Minerals Weekly Valuation Tables: Chart of The Week: Sustaining FCF Margins Vs AISC MarginsSoren K. GroupNo ratings yet

- Gender and Women's History in America Reading List (2019)Document5 pagesGender and Women's History in America Reading List (2019)Abby GruberNo ratings yet

- Bath Authority v. Aston Global - ComplaintDocument136 pagesBath Authority v. Aston Global - ComplaintSarah BursteinNo ratings yet

- Assignment MSL CaseDocument8 pagesAssignment MSL CasejenniferNo ratings yet

- 2305 JULIA QUINN Vicontele Care Ma IubeaDocument184 pages2305 JULIA QUINN Vicontele Care Ma IubeaDumitrescu Alina87% (38)

- International Humanitarian Law and POWDocument5 pagesInternational Humanitarian Law and POWAbhay TiwariNo ratings yet

- SL Biology Syllabus NotesDocument52 pagesSL Biology Syllabus NotesRyel MuchunkuNo ratings yet

- Diction Literary TermDocument2 pagesDiction Literary Termbeautifullife never giveupNo ratings yet

- Budget NotesDocument17 pagesBudget NotesHeer SirwaniNo ratings yet

- The PhantasmDocument9 pagesThe PhantasmRiccardo Francesco Pio SecuroNo ratings yet

- The Rise and Fall of Baly Keds AssignmentDocument8 pagesThe Rise and Fall of Baly Keds AssignmentN HNo ratings yet

- Summary: Oedipus Rex by SophoclesDocument4 pagesSummary: Oedipus Rex by SophoclesGuilliane GallanoNo ratings yet

- Thoracic Outlet SyndromeDocument16 pagesThoracic Outlet SyndromeDeepak RajNo ratings yet

- Syllabus DJT 50110Document3 pagesSyllabus DJT 50110Sharizal SanikNo ratings yet

- Negro y AzulDocument3 pagesNegro y AzulDado TopicNo ratings yet

- History of Fashion - Indus VallyDocument3 pagesHistory of Fashion - Indus VallyShAiShahNo ratings yet

- Scoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuDocument4 pagesScoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuGianina EneNo ratings yet

- UCHEOMA's Project StartDocument105 pagesUCHEOMA's Project StartSudheer Kumar NadukuditiNo ratings yet

- Square or Quadrille.: Classifications of Folk Dance A. Geographical Origin D. FormationDocument6 pagesSquare or Quadrille.: Classifications of Folk Dance A. Geographical Origin D. FormationchrstnmrsgnNo ratings yet

- FemaleAccountant 1 To 271 14 02 2020Document67 pagesFemaleAccountant 1 To 271 14 02 2020Stigan India100% (1)

- Medical Problem That Needs Antibiotic ProphylaxisDocument6 pagesMedical Problem That Needs Antibiotic ProphylaxisPing KyNo ratings yet

- LRN Level C2 January 2016Document4 pagesLRN Level C2 January 2016pumpboygrNo ratings yet

- Thesis The Relationship Between LeadershDocument80 pagesThesis The Relationship Between LeadershsegunNo ratings yet

- Mastery Test in Physical Science - Gr.11Document3 pagesMastery Test in Physical Science - Gr.11kert mendozaNo ratings yet

- Robustness 2Document18 pagesRobustness 2Jovenil BacatanNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- University Urdaneta City: Speed of Writing Activity #5Document4 pagesUniversity Urdaneta City: Speed of Writing Activity #5TIPAY, EMELIE L.No ratings yet

- Press Maintenance Troubleshooting AND "Pressroom Safety" ManualDocument45 pagesPress Maintenance Troubleshooting AND "Pressroom Safety" ManualArturo de la VegaNo ratings yet

- Regarr Product CatalogDocument18 pagesRegarr Product Catalognook_34859No ratings yet

Bitcoin, Gold and Long Bonds May Rule 2H

Bitcoin, Gold and Long Bonds May Rule 2H

Uploaded by

Soren K. GroupCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bitcoin, Gold and Long Bonds May Rule 2H

Bitcoin, Gold and Long Bonds May Rule 2H

Uploaded by

Soren K. GroupCopyright:

Available Formats

This document is being provided for the exclusive use of MIKE MCGLONE at BLOOMBERG/ INTELLIGENCE NEW YORK.

Not for redistribution.

Bitcoin, Gold and Long Bonds May Rule 2H

BI Commodities, Global Dashboard

Mike McGlone

Team: Strategy

BI Commodity Strategist

Bitcoin, Gold & Long Bonds: Three Amigos for 2H Appreciation?

(Bloomberg Intelligence) -- The U.S. Treasury 30-year yield sustaining below 2% has bullish

implications for gold and Bitcoin. Unlike the stock market, the old analog store-of-value and new

digital version share substantial corrections within enduring bull markets, dynamics that we see

tilting the trio toward the top of 2H performers. (08/23/21)

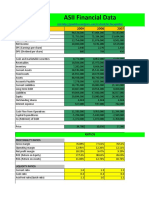

1. `TINA' May Be Shining on Bitcoin and Gold

Gold and Bitcoin have high potential to continue advancing in price, notably if U.S. Treasury yields

resume their enduring downward trajectories, following Japan and most of Europe. We believe the

mantra "There is no alternative" -- or TINA -- that's been keeping the market afloat may be losing

some luster to assets that are more likely to appreciate on the back of entrenched trends amid

rising quantitative easing and debt-to-GDP levels. Our graphic depicts the Bitcoin-Gold-Bond index

outperforming the S&P 500 since the end of 2015, notably from the start of 2020, along with the

rapidly rising level of G4 central-bank balance sheets.

The Bitcoin-Gold-Bonds index includes the Grayscale Bitcoin Trust (GBTC), SPDR Gold Shares (GLD)

and iShares 20+ T-Bond ETF (TLT). The index rebalances quarterly to equal weights. (08/23/21)

Bitcoin-Gold-Bonds; Advancing Alternatives?

Source: Bloomberg Intelligence

2. This May Be the Only Chart That Matters in 2H

Bitcoin, gold and long bonds are top assets set to outperform in 2H, we believe. The fact that the

metal and Treasury bond prices have been advancing for decades and recently dipped enhances

their relative value, yet gold appears increasingly exposed if not paired with Bitcoin. The crypto

represents rapidly advancing technology pressuring inflation and supporting quantitative easing,

which buoys the stock market. Our graphic depicts Bitcoin potentially reasserting its leadership

status in 2021, with a 2H gain of about 40% to Aug. 20.

Juxtaposed are crude oil down about 14% and rising Treasury bond prices. Copper and crude may

have peaked in 1H, and high correlations indicate greater downside risks if the stock market

falters. (08/23/21)

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and

distributed locally by Bloomberg Finance LP ("BFLP") and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India,

Japan and Korea (the ("BFLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg LP ("BLP"). BLP provides BFLP with all the global

marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP

subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice, and nothing herein shall constitute an offer

of financial instruments by BFLP, BLP or their affiliates.

Bloomberg® 08/23/2021 06:45:10

This document is being provided for the exclusive use of MIKE MCGLONE at BLOOMBERG/ INTELLIGENCE NEW YORK. Not for redistribution.

Enduring Bull Markets - Bitcoin, Gold, Bonds

Source: Bloomberg Intelligence

3. Bitcoin the Reserve Asset and Dollar Currency

The dollar's more than 300% advance vs. peers since President Richard Nixon ended the gold peg

in 1971 is evidence the greenback is the least-worst currency, but we believe Bitcoin represents

the digital future. The first-born crypto may have solved the age-old problem of a global reserve

asset that's easily transportable and transactionable, has 24/7 price discovery, is relatively scarce

and is nobody's liability or project. Our graphic depicts the upward trajectory of the trade-weighted

broad dollar, which has regained buoyancy with the advent of Bitcoin.

It's not a spurious connection, as evidenced by the about $110 billion market cap of digital-dollar

crypto tokens, noted at Bretton Woods: The Realignment. We foresee a future of Bitcoin, the digital

reserve asset, complementing the dollar reserve currency. (08/16/21)

Free Markets, Digitalization and Bitcoin

Source: Bloomberg Intelligence

4. Gold Underpinnings and Declining Bond Yields

The increasing probability that U.S. Treasury bond yields are a stock bear-market away from

following Japan and Europe into negative territory is a primary bullish factor for gold, in our view.

The metal was one of the worst-performing major assets in 1H, but is poised to resume its

enduring bull market in 2H. Underpinnings for gold will gain strength, particularly if bond yields

have peaked. Our graphic depicts the yield on the U.S. Treasury long bond on track to catch up to

the German 30-year. It's a question of what forces -- all have mostly low probabilities -- might

reverse the downward migration.

It was when the long bond breached 2% support in 2020 that solidified the gold breakaway above

$1,400 an ounce. At about 1.9% on July 29, trends appear favorable for the metal. (07/30/21)

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and

distributed locally by Bloomberg Finance LP ("BFLP") and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India,

Japan and Korea (the ("BFLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg LP ("BLP"). BLP provides BFLP with all the global

marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP

subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice, and nothing herein shall constitute an offer

of financial instruments by BFLP, BLP or their affiliates.

Bloomberg® 08/23/2021 06:45:10

This document is being provided for the exclusive use of MIKE MCGLONE at BLOOMBERG/ INTELLIGENCE NEW YORK. Not for redistribution.

Minus U.S. Yields May Be Stock Bear-Market Away

Source: Bloomberg Intelligence

To contact the analyst for this research:

Mike McGlone at mmcglone8@bloomberg.net

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and

distributed locally by Bloomberg Finance LP ("BFLP") and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India,

Japan and Korea (the ("BFLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg LP ("BLP"). BLP provides BFLP with all the global

marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP

subsidiary in the BLP Countries. BFLP, BLP and their affiliates do not provide investment advice, and nothing herein shall constitute an offer

of financial instruments by BFLP, BLP or their affiliates.

Bloomberg® 08/23/2021 06:45:10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Solution Manual Research Methods For Business A Skill Building Approach 7th Edition Uma SekaranDocument3 pagesSolution Manual Research Methods For Business A Skill Building Approach 7th Edition Uma SekaranRamji Gautam67% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Manual MAM MB33 EnglDocument9 pagesManual MAM MB33 EnglDavid Arboleya DiazNo ratings yet

- The Great Tech Rivalry: China Vs The U.S.: Graham Allison Kevin Klyman Karina Barbesino Hugo YenDocument52 pagesThe Great Tech Rivalry: China Vs The U.S.: Graham Allison Kevin Klyman Karina Barbesino Hugo YenSoren K. GroupNo ratings yet

- The Anguish of Central Bankers 1979Document57 pagesThe Anguish of Central Bankers 1979Soren K. Group100% (1)

- Facts and Fantasies About Commodity Futures Ten Years LaterDocument31 pagesFacts and Fantasies About Commodity Futures Ten Years LaterSoren K. GroupNo ratings yet

- Bridgewater Daily ObservationsDocument11 pagesBridgewater Daily ObservationsSoren K. GroupNo ratings yet

- Tax Cuts and Jobs Act - Full TextDocument429 pagesTax Cuts and Jobs Act - Full TextWJ Editorial Staff0% (1)

- Bridgewater The Changing World Order - The New ParadigmDocument27 pagesBridgewater The Changing World Order - The New ParadigmSoren K. Group100% (1)

- Bridgewater The Changing World Order - The New ParadigmDocument27 pagesBridgewater The Changing World Order - The New ParadigmSoren K. Group100% (1)

- Focus: U.S. Stock Market, Especially The Narrow Leaders-New NumbersDocument8 pagesFocus: U.S. Stock Market, Especially The Narrow Leaders-New NumbersSoren K. GroupNo ratings yet

- UraniumDocument11 pagesUraniumSoren K. GroupNo ratings yet

- Decreasing Metal Ore Grades - CopperDocument14 pagesDecreasing Metal Ore Grades - CopperSoren K. GroupNo ratings yet

- A Differend Kind of Recovery 20211216Document60 pagesA Differend Kind of Recovery 20211216Soren K. GroupNo ratings yet

- Bear Marke - CorrecDocument30 pagesBear Marke - CorrecSoren K. GroupNo ratings yet

- Don't Fight The Fed: Bloomberg Intelligence: Commodity OutlookDocument17 pagesDon't Fight The Fed: Bloomberg Intelligence: Commodity OutlookSoren K. GroupNo ratings yet

- Weekend Report: New Month, New Numbers: Gold Weekly With 3-Mo. AvgDocument7 pagesWeekend Report: New Month, New Numbers: Gold Weekly With 3-Mo. AvgSoren K. GroupNo ratings yet

- Ray Dalio I Have Some BitcoinDocument4 pagesRay Dalio I Have Some BitcoinSoren K. GroupNo ratings yet

- Is The Market About To CrashDocument21 pagesIs The Market About To CrashSoren K. GroupNo ratings yet

- CRB, Wtic & GoldDocument25 pagesCRB, Wtic & GoldSoren K. GroupNo ratings yet

- Forecasting Crude Oil and Natural Gas VolatilityDocument76 pagesForecasting Crude Oil and Natural Gas VolatilitySoren K. GroupNo ratings yet

- Kraken Intelligence's The Rise of Central Bank Digital CurrenciesDocument27 pagesKraken Intelligence's The Rise of Central Bank Digital CurrenciesSoren K. GroupNo ratings yet

- April Commodity OutlookDocument18 pagesApril Commodity OutlookSoren K. Group100% (1)

- Yale Paper June 04Document42 pagesYale Paper June 04tej7No ratings yet

- May 2021 Money LetterDocument26 pagesMay 2021 Money LetterSoren K. GroupNo ratings yet

- Market Maps Jan 2021Document14 pagesMarket Maps Jan 2021Soren K. Group100% (1)

- JPM Guide To Market Q1 2021Document86 pagesJPM Guide To Market Q1 2021Soren K. GroupNo ratings yet

- Precious Metal Report Jan 11Document73 pagesPrecious Metal Report Jan 11Soren K. GroupNo ratings yet

- To The Goldfix CommunityDocument2 pagesTo The Goldfix CommunitySoren K. GroupNo ratings yet

- Working Paper Series: Overcoming The Zero Bound On Interest Rate PolicyDocument54 pagesWorking Paper Series: Overcoming The Zero Bound On Interest Rate PolicySoren K. GroupNo ratings yet

- Precious Metals & Minerals Weekly Valuation Tables: Chart of The Week: Sustaining FCF Margins Vs AISC MarginsDocument18 pagesPrecious Metals & Minerals Weekly Valuation Tables: Chart of The Week: Sustaining FCF Margins Vs AISC MarginsSoren K. GroupNo ratings yet

- Gender and Women's History in America Reading List (2019)Document5 pagesGender and Women's History in America Reading List (2019)Abby GruberNo ratings yet

- Bath Authority v. Aston Global - ComplaintDocument136 pagesBath Authority v. Aston Global - ComplaintSarah BursteinNo ratings yet

- Assignment MSL CaseDocument8 pagesAssignment MSL CasejenniferNo ratings yet

- 2305 JULIA QUINN Vicontele Care Ma IubeaDocument184 pages2305 JULIA QUINN Vicontele Care Ma IubeaDumitrescu Alina87% (38)

- International Humanitarian Law and POWDocument5 pagesInternational Humanitarian Law and POWAbhay TiwariNo ratings yet

- SL Biology Syllabus NotesDocument52 pagesSL Biology Syllabus NotesRyel MuchunkuNo ratings yet

- Diction Literary TermDocument2 pagesDiction Literary Termbeautifullife never giveupNo ratings yet

- Budget NotesDocument17 pagesBudget NotesHeer SirwaniNo ratings yet

- The PhantasmDocument9 pagesThe PhantasmRiccardo Francesco Pio SecuroNo ratings yet

- The Rise and Fall of Baly Keds AssignmentDocument8 pagesThe Rise and Fall of Baly Keds AssignmentN HNo ratings yet

- Summary: Oedipus Rex by SophoclesDocument4 pagesSummary: Oedipus Rex by SophoclesGuilliane GallanoNo ratings yet

- Thoracic Outlet SyndromeDocument16 pagesThoracic Outlet SyndromeDeepak RajNo ratings yet

- Syllabus DJT 50110Document3 pagesSyllabus DJT 50110Sharizal SanikNo ratings yet

- Negro y AzulDocument3 pagesNegro y AzulDado TopicNo ratings yet

- History of Fashion - Indus VallyDocument3 pagesHistory of Fashion - Indus VallyShAiShahNo ratings yet

- Scoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuDocument4 pagesScoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuGianina EneNo ratings yet

- UCHEOMA's Project StartDocument105 pagesUCHEOMA's Project StartSudheer Kumar NadukuditiNo ratings yet

- Square or Quadrille.: Classifications of Folk Dance A. Geographical Origin D. FormationDocument6 pagesSquare or Quadrille.: Classifications of Folk Dance A. Geographical Origin D. FormationchrstnmrsgnNo ratings yet

- FemaleAccountant 1 To 271 14 02 2020Document67 pagesFemaleAccountant 1 To 271 14 02 2020Stigan India100% (1)

- Medical Problem That Needs Antibiotic ProphylaxisDocument6 pagesMedical Problem That Needs Antibiotic ProphylaxisPing KyNo ratings yet

- LRN Level C2 January 2016Document4 pagesLRN Level C2 January 2016pumpboygrNo ratings yet

- Thesis The Relationship Between LeadershDocument80 pagesThesis The Relationship Between LeadershsegunNo ratings yet

- Mastery Test in Physical Science - Gr.11Document3 pagesMastery Test in Physical Science - Gr.11kert mendozaNo ratings yet

- Robustness 2Document18 pagesRobustness 2Jovenil BacatanNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- University Urdaneta City: Speed of Writing Activity #5Document4 pagesUniversity Urdaneta City: Speed of Writing Activity #5TIPAY, EMELIE L.No ratings yet

- Press Maintenance Troubleshooting AND "Pressroom Safety" ManualDocument45 pagesPress Maintenance Troubleshooting AND "Pressroom Safety" ManualArturo de la VegaNo ratings yet

- Regarr Product CatalogDocument18 pagesRegarr Product Catalognook_34859No ratings yet