Professional Documents

Culture Documents

Gurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019

Gurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019

Uploaded by

praveen chokhaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019

Gurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019

Uploaded by

praveen chokhaniCopyright:

Available Formats

Gurvinder Kaur Bhatia , Indore vs Pr.

Cit-2, Indore on 18 December, 2019

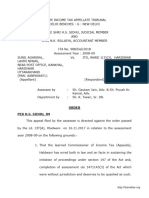

Income Tax Appellate Tribunal - Indore

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

, ,

IN THE INCOME TAX APPELLATE TRIBUNAL,

INDORE BENCH, INDORE

BEFORE SHRI KUL BHARAT, JUDICIAL MEMBER

AND SHRI MANISH BORAD, ACCOUNTANT MEMBER

ITA No.150/Ind/2019

Assessment Years: 2015-16

Smt. Harleen Kaur Bhatia Pr.CIT-2

144, Pipliyarao, Near Vs. Indore

Vishnupuri Colony, A.B. Road,

Indore

(Appellant) (Respondent )

PAN No.AMGPB3531P

ITA No.151/Ind/2019

Assessment Years: 2015-16

Smt. Gurvinder Kaur Bhatia Pr.CIT-2

13-14, Aditya Nagar, Near Vs. Indore

Vishnupuri Colony, A.B. Road,

Indore

(Appellant) (Respondent )

PAN No.AGJPB0037B

Assessee by S/Shri Sumit Nema & Shri

GaganTiwari, ARs

Revenue by Shri S.S. Mantry, CIT-DR

Date of Hearing 15.10.2019

Date of Pronouncement 18.12.2019

ORDER

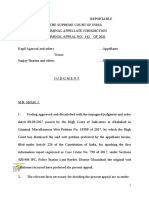

PER MANISH BORAD, AM The above captioned appeals filed at the instance of the different

assessee(s) pertaining to Assessment Year 2015-16 are HarleenKaur Bhatia &GurvinderKaur Bhatia

ITA Nos.150 & 151 /Ind/19 directed against the orders of Pr.Commissioner of Income Tax-2 (in

short 'Pr.CIT'] Indore dated 21.12.2018 & 24.12.2018 passed u/s 263 of the Income Tax Act 1961(In

short the 'Act').

2. Assessee(s) haveraised following grounds of appeals;

ITA No.150/Ind/2019 in case of Smt. HarleenKaur Bhatia 1(a) That, on the facts and

in the circumstances of the case, the learned Pr. CIT grossly erred in invoking the

provisions of section 263 of the Income-Tax Act, 1961 in the appellant's case without

considering the material fact that the Assessment Order passed by the learned

Assessing Officer was neither erroneous nor prejudicial to the interest of the

Revenue.

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 1

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

l(b) That, the learned Pro CIT grossly erred, both on facts and in law, in assuming the

jurisdiction u/s. 263 of the Income-Tax Act, 1961 without considering the material

fact that during the course of the assessment proceedings, the appellant had brought

on record all the materials and evidences relating to the concerning issue and the

same were duly verified by the AO after proper application of his mind.

2.That, without prejudice to the above, the learned Pr.CIT has grossly erred in giving

a direction to the AO to assess the income in the hands of the assessee on account of

maturity receipts of the Keyman Insurance Policy amounting to Rs.6,49,45,7101- and

as also, to examine the treatment of the insurance premiums paid by Shri Amandeep

Singh Bhatia, on behalf of the appellant, after the assignment of the policy to the

appellant.

3.That, the learned Pr. CIT grossly erred in assuming the jurisdiction under s.263 of

the Act without considering and appreciating the material fact that during the course

of the assessment proceedings, the appellant had duly furnished the necessary

particulars and explanation in respect of the subject issue by way of a note while

filing her return of income for the relevant assessment year which was duly examined

and HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 verified

by the learned AO before passing the Assessment Order in the case of the appellant.

4. That, Ld. Pr. CIT grossly erred in invoking provisions of section 263 based merely on 'Change in

Opinion'

5. That, the appellant further craves leave to add, alter and/or amend any of the foregoing grounds

of appeal as and when considered necessary ITA No.151/Ind/2019 in case of Smt. GurvinderKaur

Bhatia 1(a) That, on the facts and in the circumstances of the case, the learned Pr. CIT grossly erred

in invoking the provisions of section 263 of the Income-Tax Act, 1961 in the appellant's case without

considering the material fact that the Assessment Order passed by the learned Assessing Officer was

neither erroneous nor prejudicial to the interest of the Revenue.

l(b) That, the learned Pro CIT grossly erred, both on facts and in law, in assuming the jurisdiction

u/s. 263 of the Income-Tax Act, 1961 without considering the material fact that during the course of

the assessment proceedings, the appellant had brought on record all the materials and evidences

relating to the concerning issue and the same were duly verified by the AO after proper application

of his mind.

2.That, without prejudice to the above, the learned Pr.CIT has grossly erred in giving a direction to

the AO to assess the income in the hands of the assessee on account of maturity receipts of the

Keyman Insurance Policy amounting to Rs.7,29,49,460/- and as also, to examine the treatment of

the insurance premiums paid by Shri Amandeep Singh Bhatia, on behalf of the appellant, after the

assignment of the policy to the appellant.

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 2

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

3.That, the learned Pr. CIT grossly erred in assuming the jurisdiction under s.263 of the Act without

considering and appreciating the material fact that during the course of the assessment proceedings,

the appellant had duly furnished the necessary particulars and explanation in respect of the subject

issue by way of a note while filing her return of income for the HarleenKaur Bhatia &GurvinderKaur

Bhatia ITA Nos.150 & 151 /Ind/19 relevant assessment year which was duly examined and verified

by the learned AO before passing the Assessment Order in the case of the appellant.

4. That, Ld. Pr. CIT grossly erred in invoking provisions of section 263 based merely on 'Change in

Opinion'

5. That, the appellant further craves leave to add, alter and/or amend any of the foregoing grounds

of appeal as and when considered necessary

3. As the issues raised in both these appeals are common, they were heard together and are being

disposed off by this common order for the sake of convenience and brevity. For adjudication

purpose we will take up the facts of the assessee namely Harleen Kaur Bhatia and our decision in the

case of Harleen Kaur Bhatia ITA No.150/Ind/2019 shall apply mutatis mutandis in the case of

Gurvinder Kaur Bhaita in ITANo.151/Ind/2019.

4. Brief facts as culled out from the records are that the assessee is an individual. She filed e-return

of income on 31.03.2016 declaring total income of Rs.78,390/-. Case was selected for scrutiny

through CASS followed by serving of notices u/s 143(2) & 142(1) of the Act. The assessee duly

replied to the questionnaire issued by the Ld. AO. On requisite compliance, written submissions

filed by the assessee and after perusal of records, books of accounts and other documents returned

income was accepted as assessed income. Subsequently, Ld. Pr. CIT within the powers conferred to

him u/s 263 of the Act, observed from the assessment records that assessee received maturity

amount of Insurance Policy at Rs.6,49,45,710/-.

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 This Policy was originally

issued in the year 2005 as Keyman Insurance Policy with an assured return of 5 crores to Bhatia

International Ltd. for its Keyman i.e. Director of the company Mr. Amarjeet Singh Bhatia. Bhatia

International Company (BIC)paid regular premium till assignment and also claimed deduction u/s

37 of the Act as expenditure during the terms of payment. The Keyman insurance policy was

assigned by the company to its Keyman i.e. Mr. A.S. Bhatia (director). Surrender value on the date of

assignment was offered to tax by the company during FY 2011-12. After the assignment the policy

continued as normal Life Insurance Policy and premium was paid. Mr. A.S. Bhatia further assigned

the policy to his wife i.e. the assessee on 30.01.2013 and the assignment was duly recorded by Life

Insurance Corporation of India. This Policy was prematured in February 2015 and the amount was

received from LIC of India. Assessee claimed it as an exempted receipt. Assessee's case was selected

for scrutiny assessment and Ld. Assessing officer after conducting necessary enquiry accepted the

claim of assessee. Subsequently Ld. Pr. CIT on examining the transaction in light of the amendment

brought in by Finance Act 2013 effective from 01.04.2014 in Explanation 1 to section 10(10D) of the

Act was of the view that this amendment is clarificatory in nature and the entire amount received on

maturity is liable to tax. Ld. Pr. CIT, issued show cause notice u/s 263 of the Act calling upon the

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 3

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

assessee as to why assessment order should not be revised and the maturity amount of Insurance

Policy referred above be subjected to tax. In response to the notice assessee filed a HarleenKaur

Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 detailed submissions placing reliance on

various judgments but the same was not found acceptable. Ld. Pr. CIT. after recording detailed

finding, discussing the issues on merits as well as the legal aspect decided to set aside the

assessment order and directed the AO to make afresh assessment order in accordance with law.

5. Aggrieved by this the assessee is in appeal before the Tribunal raising various grounds of appeal

challenging the assuming of jurisdiction u/s.263 of the Act and legality of the order passed u/s 263

of the Act.

6. Ld. Counsel for the assessee reiterated the submissions and various replies given before the Pr.

CIT but the crux of the argument were that the Keyman insurance policy issued to the company

namely BIC was assigned to the assessee's Husband and thereafter to the assessee. As a result the

nature of Policy changed from Keyman Insurance Policy to Life Insurance Policy. Surrender value

on the date of assignment was duly offered to tax by the company namely "BIL". Since the policy

post assignment got converted to Life Insurance Policy, deduction u/s 80C of the Act was claimed by

the assessee. He submitted that the proceeds on the prematurity of the Policy are exempt in view of

various judgments wherein it is held that Keyman Insurance Policies subsequent to their assignment

in favor of Keyman or other person is converted into a simple Life insurance policy and the proceeds

on it maturity or pre-maturity are exempted u/s.10(10D) of the Act. Referring to HarleenKaur

Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 other judgements it was submitted that

since the amendment brought in by Finance Act 2013 in explanation 1 to section 10(10D) of the Act

increases the scope of taxability for the assessee, they are to be treated as prospective in nature and

by no cannon can be treated as retrospective or clarificatory in nature.

7. Ld. counsel for the assessee also submitted that the issue of alleged insurance policy maturity

receipts being exempt stands squarely covered by the judgment of Hon'ble High Court of Bombay in

the case of CIT vs. Prashant J. Agarwalin ITANo.465 of 2014 dated 26.09.2016 wherein after

considering the judgment of Hon'ble High Court of Delhi in the case of CIT vs. Rajan Nanda(2012)

18 taxmann.com 98 Delhi and CIT vs. Rajan Nanda (2013) 37 Taxman.com 335 (Delhi Tribunal.) it

was held that once there is assignment of the employer in favor of individual , the character of the

insurance policy changes and it gets converted into an ordinary policy and the sum received

thereunder would not be subject to tax. He also submitted that the amendment brought in

explanation (1)to section 10(10D) of the Act w.e.f. 01.04.2014 would not apply on the amount

received since the keyman insurance policy was assigned prior to assessment year 2014-15. Ld.

counsel for the assessee also submitted that Ld. Pr. CIT wrongly assumed the jurisdiction u/s 263 of

the Act even when detailed inquiry was conducted by the Ld. AO for the issue raised in the show

cause notice issued by the Ld. Pr. CIT and order u/s 263 of the Act deserves to be quashed. Reliance

place on following judgments:

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19

1. Malabar Industrial Co. Ltd. vs. CIT, 243 ITR 83 (SC)

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 4

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

2. Abhishan Entereprises Vs CIT (2016) 28 ITJ 139 (Trib.-Indore)

3. M/s Gupta Spinning Mills vs. CIT in ITANo.3398/Del/2010

4. CIT vs. Max India Ltd. 295 ITR 282 (SC)

5. CIT vs. Gabriel India Ltd. (1993) 203 ITR 108(Bom)

6.CIT vs. R.K. Construction Co. 313 ITR 65 (Gujarat)

7. CIT vs. Arvind Jewellers (2003) 259 ITR 502(Gujarat)

8.CIT vs. Sunbeam Auto Ltd. (20100 189 Taxman 436 (Del)

8. With regard to the contention that the amendment brought in Finance Act 2013 in Explanation

(1) to section 10(10D) is prospective in nature, assessee relied following judgments:

1. Nirmal Textiles (1997) 224 ITR 378 (Gujarat High Corut)

2. CIT vs. Essar Teleholding Ltd. (2018) 3 SCC 253

3. CIT vs. M/s Shah Sadiq and Sons (1987) 3 SCC 516

4. CIT vs. Vatika Township Private ltd. (2015) 1SCC 1

5. CIT vs. Sarkar Builders (2015) 7 SCC 579

9. Per contra Ld. Departmental Representative(DR) vehemently argued strongly supporting the

detailed finding of Ld. Pr. CIT.

10. We have heard rival contentions and perused the records placed before us and carefully gone

through the judgments referred and relied by the Ld. Counsel for the assessee as well as the

judgments referred in the impugned order passed by the Ld. Pr. CIT. Before deciding the issue

whether the order passed by the Ld. Pr. CIT is HarleenKaur Bhatia &GurvinderKaur Bhatia ITA

Nos.150 & 151 /Ind/19 valid and in accordance with law laid down u/s 263 of the Act, it is necessary

for us to discuss the provisions of section 263 of the Act which empowers the Pr. CIT/CIT to revise

the assessment order:

263. (1) The Principal Commissioner or Commissioner may call for and examine the

record of any proceeding under this Act, and if he considers that any order passed

therein by the Assessing Officer is erroneous in so far as it is prejudicial to the

interests of the revenue, he may, after giving the assessee an opportunity of being

heard and after making or causing to be made such inquiry as he deems necessary,

pass such order thereon as the circumstances of the case justify, including an order

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 5

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

enhancing or modifying the assessment, or cancelling the assessment and directing a

fresh assessment. Explanation 1.--For the removal of doubts, it is hereby declared

that, for the purposes of this sub-section,--

(a) an order passed on or before or after the 1st day of June, 1988 by the Assessing

Officer shall include--

(i) an order of assessment made by the Assistant Commissioner or Deputy

Commissioner or the Income- tax Officer on the basis of the directions issued by the

Joint Commissioner under section 144A;

(ii) an order made by the Joint Commissioner in exercise of the powers or in the

performance of the functions of an Assessing Officer conferred on, or assigned to,

him under the orders or directions issued by the Board or by the Principal Chief

Commissioner or Chief Commissioner or Principal Director General or Director

General or Principal Commissioner or Commissioner authorised by the Board in this

behalf under section 120;

(b) "record" shall include and shall be deemed always to have included all records

relating to any proceeding under this Act available at the time of examination by the

Principal Commissioner or Commissioner;

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19

(c) where any order referred to in this sub-section and passed by the Assessing

Officer had been the subject matter of any appeal filed on or before or after the 1st

day of June, 1988, the powers of the Principal Commissioner or] Commissioner

under this sub-section shall extend and shall be deemed always to have extended to

such matters as had not been considered and decided in such appeal.

Explanation 2.--For the purposes of this section, it is hereby declared that an order passed by the

Assessing Officer shall be deemed to be erroneous in so far as it is prejudicial to the interests of the

revenue, if, in the opinion of the Principal Commissioner or Commissioner,--

(a) the order is passed without making inquiries or verification which should have

been made;

(b) the order is passed allowing any relief without inquiring into the claim;

(c) the order has not been made in accordance with any order, direction or

instruction issued by the Board under section 119; or

(d) the order has not been passed in accordance with any decision which is

prejudicial to the assessee, rendered by the jurisdictional High Court or Supreme

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 6

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

Court in the case of the assessee or any other person.

(2) No order shall be made under sub-section (1) after the expiry of two years from the end of the

financial year in which the order sought to be revised was passed.

(3) Notwithstanding anything contained in sub-section (2), an order in revision under this section

may be passed at any time in the case of an order which has been passed in consequence of, or to

give effect to, any finding or direction contained in an order of the Appellate Tribunal, National Tax

Tribunal, the High Court or the Supreme Court.

Explanation.--In computing the period of limitation for the purposes of sub-section (2), the time

taken in giving an opportunity to the assessee to be reheard under the proviso to section 129 and any

period during which any proceeding HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151

/Ind/19 under this section is stayed by an order or injunction of any court shall be excluded.

11. From perusal of the aforesaid section, it is apparent that there are mainly four features of the

power for revision to be exercised u/s 263 of the Act by the Pr. CIT.

i. The Pr. CIT may call for and examine the records of any proceedings under the Act and for this

purpose he/she need not to show any reason or record any reason to belief as it is required u/s 147

or 148(2) of the Act.

ii. He/She may consider any order passed by the Assessing Officer as erroneous as well as

prejudicial to the interest of the Revenue. This is exercised by calling for and examining the record

available at this stage.

iii. If after calling for and examining the records the Commissioner considers that the order of the

Assessing Officer is erroneous is so far it is prejudicial to the interest of the Revenue, he is bound to

give an opportunity to the assessee of being heard and after that as he/she may deem fit, pass such

order thereon as the circumstances of the case may justify including an order enhancing or

modifying the assessment or cancelling assessment and directing a fresh assessment or make such

enquiries as he deems necessary.

iv. Under the provisions of section 263 of the Act Pr. CIT/CIT can enhance or modify the assessment

as a result of inquiry conducted and hearing of the assessee.

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19

12. It is well settled law that for invoking the provisions of section 263 of the Act both the conditions

that the order must be erroneous and prejudicial to the interest of revenue needs to be satisfied. This

ratio stands laid down by various Hon'ble Courts.

13. Hon'ble Jurisdictional High Court of Madhya Pradesh in the case of H.H. Maharaja Raja Power

Dewas (1983) 15 Taxman 363 in para 10 of this order held that"However, the first argument, viz.,

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 7

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

that an assessment order without compliance with the procedure laid down in section 144B is

erroneous but not prejudicial to the interests of the revenue conferring revisional jurisdiction on the

Commissioner under section 263(1), has force. Under section 263(1) two pre-requisites must be

present before the Commissioner can exercise the revisional jurisdiction conferred on him. First is

that the order passed by the ITO must be erroneous. Second is that the error must be such that it is

prejudicial to the interests of the revenue. If the order is erroneous but it is not prejudicial to the

interests of the revenue, the Commissioner can not exercise the revisional jurisdiction under section

263(1)....................There cannot be any prejudice to the revenue on account of the ITO's failure to

follow the procedure prescribed under section 144B, and unless the prejudice to the interests of the

revenue is shown, the jurisdiction under section 263(1) cannot be exercised by the Commissioner,

even though the order is erroneous. The argument that such an order may possibly be challenged in

appeal by the assessee, and for this reason it is prejudicial to the interests of the HarleenKaur Bhatia

&GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 revenue, has no merit. Section 263(1) clearly

contemplates that the order of assessment itself should be prejudicial to the interests of the revenue

and this prejudice has to be proved by reference to the assessment order only. It cannot be argued

that there is some possibility of the assessment order being challenged or revised in appeal and,

therefore, on account of this contingency, the order becomes prejudicial to the interests of the

revenue." [emphasis supplied]

14. Hon'ble Apex Court in the case of Malabar Industrial Co. Ltd. - [2000] 243 ITR 83 - order

pronounced on 10.02.2000 - HEAD NOTE - "Section 263 of the Income-tax Act, 1961 - Revision - Of

orders prejudicial to interests of revenue - Assessment year 1983-84 - Whether in order to invoke

section 263 Assessing Officer's order must be erroneous and also prejudicial to revenue and if one of

them is absent, i.e., if order of Income-tax Officer is erroneous but is not prejudicial to revenue or if

it is not erroneous but is prejudicial to revenue, recourse cannot be had to section 263(1) - Held, yes

- Whether if due to an erroneous order of ITO, revenue is losing tax lawfully payable by a person, it

will certainly be prejudicial to interests of revenue - Held, yes - Assessee-company entered into

agreement for sale of estate of rubber plantation - As purchaser could not pay installments as

scheduled in agreement, extension of time for payment of installments was given on condition of

vendee paying damages for loss of agricultural income and assessee passed resolution to that effect -

Assessee showed this receipt as agricultural HarleenKaur Bhatia &GurvinderKaur Bhatia ITA

Nos.150 & 151 /Ind/19 income - Resolution passed by assessee was not placed before Assessing

Officer - Assessing Officer accepted entry in statement of account filed by assessee and accepted

same - Commissioner under section 263 held that said amount was not connected with agricultural

activities and was liable to be taxed under head 'Income from other sources' - Whether, where

Assessing Officer had accepted entry in statement of account filed by assessee, in absence of any

supporting material without making any enquiry, exercise of jurisdiction by Commissioner under

section 263(1) was justified - Held, yes

15. Hon'ble Gujarat High Court in the case of Smt. Minalben S. Parikh - [1995] 215 ITR 81 - order

pronounced on 17.10.1994 - Para 12 - "From the aforesaid, it can well be said that the well-settled

principle in considering the question as to whether an order is prejudicial to the interests of the

revenue or not is to address oneself to the question whether the legitimate revenue due to the

exchequer has been realised or not or can be realised or not if his orders under consideration are

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 8

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

allowed to stand. For arriving at this conclusion, it becomes necessary and relevant to consider

whether the income in respect of which tax is to be realised, has been subjected to tax or not or if it

is subjected to tax, whether it has been subjected to tax at a rate at which it could yield the

maximum revenue in accordance with law or not. If income in question has been taxed and

legitimate revenue due in respect of that income had been realised, though as a result of erroneous

order having been made in that respect, in our HarleenKaur Bhatia &GurvinderKaur Bhatia ITA

Nos.150 & 151 /Ind/19 opinion, the Commissioner cannot exercise powers for revising the order

under section 263 merely on the basis that the order under consideration is erroneous. If the

material in that regard is available on the record of the assessee concerned, the Commissioner

cannot exercise his powers by ignoring that material which links the income concerned with the tax

realization made thereon. The two questions are inter-linked and the authority exercising powers

under section 263 is under an obligation to consider the entire material about the existence of

income and the tax which is realizable in accordance with law and further what tax has in fact been

realised under the alleged assessment orders.[emphasis supplied]

16. Hon'ble Karnataka High Court in the case of V. G. Krishnamurthy - [1985] 20 Taxman 65 - order

pronounced on 19.03.1984 - Para 10 - "Section 263 can be invoked by the Commissioner only when

he prima facie finds that the order made by the ITO was erroneous and was prejudicial to the

interests of the revenue. Both these factors must simultaneously exist. An order that is erroneous

must also have resulted in loss of revenue or prejudicial to the interests of the revenue. Unless both

these factors co-exist or exist simultaneously, the Commissioner cannot invoke or resort to section

263. It cannot be exercised to correct every conceivable error committed by an ITO. Before the

suomoto power of revision can be exercised, the Commissioner must at least prima facie find both

the requirements of section 263, namely, that the order sought to be revised is prima facieerroneous

and prejudicial to the interests of the HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 &

151 /Ind/19 revenue. If one of the other factor was absent, the Commissioner cannot exercise the

suomoto power of revision under section 263." [emphasis supplied]

17. Now we proceed to examine the facts of the instant case in the light of the ratio laid down by

Hon'ble Courts so as to examine firstly whether the assessment order passed by the Ld. AO is

erroneous in nature and secondly whether it is prejudicial to the interest of revenue.

18. Firstly, in order to examine that whether the assessment order is erroneous, we observe that Ld.

Pr. CIT within the powers provided in section 263 of the Act issued following show cause notice to

the assessee.

"Please refer to the assessment order dated 15.12.2017 for A.Y. 2015-16 in your case.

On perusal of case record in your case for the A.Y. 2015-16 it is noted that you have

furnished your return of income declaring total income at Rs.78,390/- on 31.03.2016.

Assessment in your case u/s 143(3) of I.T. Act 1961 was completed by the ITO-5(3),

Indore vide order dated 15.12.2017 assessing total income at Rs.78,390/-.

The entire records were gone through by me and on perusal and examination of

records it appears that the order dated 15.12.2017 for A.Y. 2015-16 is erroneous as

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 9

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

also prejudicial to the interest of revenue on account of passing of the order without

making proper enquiries/investigations. As per the information available on records

it is noted that you have received maturity amount of insurance policy to the extent of

Rs.6,49,45,710/-. The company Bhatia International Ltd. in which your husband was

a director, had purchased insurance policy named as JeevanAnand from LIC of India

in April 2005 of the life of your husband, with a sum assurance of Rs.5 crores.

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 Premium thereon was paid

by the company upto Oct, 2010 and claimed deduction thereof, u/s 37 of the Act from its

computation of income.

You have got the ordinary life insurance policy through assignment from your husband sub-sequent

to the payment of surrender value already paid to the company Bhatia International Ltd. for

Rs.1,72,32,045/- dated 31.03.2012 by the husband, as this was a Keyman Policy in his name being

the director of M/s Bhatia International Ltd. the source of premium & surrender value paid in your

hand have been show as gift received from the husband, the assignment is completed in your favour

on 31.03.2013 i.e. before the amendment of section 10(10D) of the I.T. Act LIC has deducted TDS @

2% under section 194DA on maturity value and you have received premature maturity value in Feb,

2015 whereas the actual date of maturity is 28.04.2015. In view of amendment provisions of

explanation (1) of section 10(10D) of the Act, the receipt are taxable in the hands of assignee i.e.

assessee even if they are assigned before the date of said amendment. Although the assignment has

been completed before the amendment date i.e. 31.03.2013, but the same does not change the

nature and character of the receipt, which have been received after the amendment. It appears that

even amended Section. 10(10D) does not make the aforesaid policy exempt from taxation on its

maturity/prematurity receipts. The receipts have taken place subsequent to such amendment,

therefore, the same should have been taxed either in the hands of keyman (the assesseee's husband)

or in the hands of the assessee (the keyman's assigned) but in the present case both have escaped

taxation on the said amount creating detriment to the revenue. Hence this fact should have been

examined.

The AO has not examined this factor and no enquiry/investigation has been made. Therefore, the

assessment order passed by the AO appears to be erroneous in so far as it is prejudicial to the

interest of the revenue. You are, therefore the required to show cause why provision of section 263

be not invoked in your case for the reasons mentioned above."

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19

19. In response to the above notice the sole issue was with regard to the maturity amount received

on the insurance policy by the assessee which was originally taken as a Keyman Insurance Policy by

Bhatia International Ltd but subsequently assigned to the Keyman i.e. Director, Amandeep Singh

Bhatia on 23.02.2012 and further Mr. Amandeep Singh Bhatia assigned policy to his wife Smt.

Harleen Kaur Bhatia on 30.01.2013. Foremost it is to be seen that whether this issue of taxability of

maturity proceeds of the insurance policy came up before the Ld. AO and whether he conducted

sufficient enquiry with regard to this issue.

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 10

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

20. Records show that with the computation of income filed along with return of income on

31.03.2016 assessee gave a detailed note about the amount received from maturity of Insurance

Policy which was originally taken as a Keman Insurance Policy which reads as follows:

During the relevant period assessee received maturity amount of insurance policy of

Rs.6,49,45,710/- and on which assessee has paid assignment value of

Rs.1,72,32,045/- and after assignment premium of Rs.1,61,65,193/- i.e. total amount

of Rs.3,33,97,238/-.

During the relevant period assessee received maturity amount of insurance policy of

Rs.6,49,45,710/-. The company Bhatia International Ltd. in which the assessee's

husband was a director, had purchased insurance policy named as "JeevanAnand"

from LIC of India in April 2005, on the life of the assesseee's husband with a sum

assurance of Rs.5.00 cr. Premium thereon was paid by the company upto Oct. 2010

and claimed deduction thereof, u/s 37 from its computation of income (ie. In P/L

Account).

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 Assesse has

got the ordinary life insurance policy through assignment from her husband on the

payment of surrender value paid to the company Bhatia International ltd. for

Rs.1,72,32,045/- dated 31.03.2012 as this is a Keyman Policy in the name of Bhatia

International Ltd. (Keymanassessee's husband) and 07 years premium paid by the

company(ie from April 2005 to March 2012). Company had assigned this policy to

the Keyman on surrender value & for remaining tenure premium is paid by the

assessee.

The source of premium & surrender value paid in the hand of assessee is gift received

from the husband, the assignment is completed in favour of assessee on 30.01.2013

before the amendment w.e.f 01.04.2014 u/s 10(10D). these amendment is

prospective not retrospective therefore maturity value is fully exempt in the hand of

assessee because these is an ordinary policy. Only due to these amendment assessee

has paid self assessmentchallan, in fact amendment is prospective and no tax is

payable therefore refund is generated. Hence sum of Rs.6,49,45,710/- received from

LIC is claimed as exempt. LIC has deducted TDS @ 2% under section 194DA on

maturity value and assessee has received pre mature maturity value in Feb. 2015

where actual date of maturity value is 28.04.2015.

21. We further observe that Ld. Pr. CIT after considering the submissions, documents and other

relevant details filed by the assessee as well as the correspondence between the assessee and the Ld.

Assessing Officer was not convinced and went ahead to hold that the maturity receipts of the

Keyman Insurance Policy are taxable in the hands of assessee and directed the Ld. Assessing Officer

to reassess the assessee's income observing as follows:

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 11

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

"I have carefully considered the facts of the case, the assessment records and the

written submission given by the assessee. It is noted that the case was selected for

complete HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19

scrutiny through CASS and the reason for selection were mentioned as high ratio of

refund to TDS, delayed payment of tax and ITR filed late and large refund claimed

out of the self-

assessment tax. The records show that the assessee has received payment on account of maturity of

an insurance policy on which the tax has been deducted by the insurance company at the time of

payment of maturity proceeds. The policy was a keyman insurance policy which as assigned to the

husband of the assessee namely ShriAmandeep Bhatia by the employer namely Bhatia International

Ltd. in the month of March, 2012. Shriamandeep Singh Bhatia later on assigned the policy to the

assessee on 30.01.2013. The Policy was encashed before maturity in the month of February 2015

whereas the actual date of maturity was 28.04.2015.

The Assessing Officer issued three notices u/s 142(1) during the course of assessment proceedings.

The first notice was issued on 19.05.2017 in which general details were asked. In the second notice

which as issued on 11.08.2017, the Assessing Officer asked some more questions such as mismatch

the amount paid to related persons, copy of bank account, bill vouchers of sale of jewellery etc.

Another notice was issued on 13.11.2017 there also some sundry question like purchase of share and

source thereof was asked. In none of the notice the Assessing Officer asked about the maturity of the

insurance policy and its treatment thereof. He did not even aske the assessee as to what is the reason

for high refund or refund out of self-assessment tax paid. The order sheet entered also do not show

any questionor query regarding the receipts of maturity amount from LIC. The officer has recorded

some kind of finding on the order sheet towards the end of the proceedings in which he has

reproduced the sequence of events narrated by the assessee in the submissions related to the receipt

of maturity amount of insurance policy. He has accepted the version given by the assessee without

any enquiry regarding the sources of payment of insurance premium, the utilization of the policy

maturity receipts etc. The case laws which has been relied by the assessee before the Assessing

Officer such as Rajan Nanda 18 taxman.com 98 and Prashan J. Agarwal 243 Taxman 119 is

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 no more applicable as the

provision of section 10(10D) of the Income Tax Act has been amended w.e.f. 01.04.2014 in which the

loophole regarding assignment of keyman insurance policy has been plugged. The Assessing Officer

did not make any attempt to make any enquiry on the issue. The sequence of event as narrated by

the assessee before the Assessing Officer clearly show that the policy was assigned to Mr. Bhatia by

Bhatia International Ltd. on the surrendered value of 1.72 crores on 23.02.2012. Subsequently, mr.

Bhatia assigned this policy to his wife as a gift on 30.01.2012. The policy was finally terminated

prematurely in Feb, 2015. These dates clearly show that the date of maturity is after 01.04.2014, the

date from which the amendment in section 10(10D) came into effect. The Assessing Officer should

have examined the whole sequence of event and must have enquired about the motive of the

assessee for showing a gift of the policy the receipt of which was taxable. The Assessing Officer

therefore committed an error by not pursuing the enquiries regarding the policy maturity and

accepting the version of the assessee without application of mind. He did not go through the

provision of section 10(10D) properly and wrongly accepted the claim of the assessee. The policy

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 12

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

was matured after 01.04.2014 and the receipt was clearly taxable as per provision of section

10(10D). There is no question of any other view except bringing the amount to tax. The Assessing

Officer therefore, wrongly applied the provisions of law. The assessee relied on the judgment of

Bombay High Court in the case of Prashant J. Agarwal 243 Taxman 119 and the same was accepted

by the Assessing Officer which was incorrect. In the judgment the assessee had received the

maturity amount during financial year 2009-10 relevant to Assessment year 2010-11. The

assessment was passed by the Assessing Officer after the amendment was brought in the Act. The

court has held that any receipt of maturity amount prior 01.04.2014 would not be accepted by the

amended definition. In the present case the amount has been received on maturity in March 2015

which is clearly after the date from which the amendment was made effective.

During the course of proceedings u/s 263 this officer made HarleenKaur Bhatia &GurvinderKaur

Bhatia ITA Nos.150 & 151 /Ind/19 enquiries with the LIC of India as well as from the assessee

regarding various aspect related to policy. It was found that thought the policy has been purportedly

assigned to the assessee by her husband,the life assured remains the same. The risk of life remained

that of the husband of the assessee. Further the enquiries also revealed that the insurance premium

of the policy, after purported assignment to the assessee, was paid by Mr. Bhatia to whom the policy

was assigned by the company. The Assessing Officer did not make any enquiry about these aspects.

Had he made these enquiries he would have come to know about the correct position of the reasons

of the purported assignment.

The most important point here is that Mr. Bhatia, who had purchased the keyman insurance policy

from the company Bhatia International Ltd. by paying the residuary/surrender value of the policy,

was still the person assured and he had assigned only the receipts of the policy to his wife i.e. the

assessee. The gift is of the maturity proceeds of the policy and not that of the policy itself. There is

the difference between assignment of the Keyman insurance policy by the company to its

keymanMr. Bhatia and subsequent assignment by Mr. Bhatia to his wife. In the first assignment ie.

By the company to thekeyman was for a consideration which was equal to the residual value of the

policy at that time. The character of the policy also changed at that time and it became an assigned

keyman insurance policy the receipts of which were taxable on maturity after 01.04.2014. The

second assignment i.e from Mr. Bhatia (keyman of Bhatia International Ltd.) to his wife i.e. the

assessee is an assignment just to create a camouflage to avoid the taxability of the maturity

proceeds. There is no real purpose of assigning the policy as the annual premium was still being paid

by Mr. Bhatia (keyman of Bhatia International Ltd. ), the assessee took to loan which was again

invested in the business of the Bhatia Group and the life assured or insured remained the same i.e.

Mr. Bhatia. Therefore, the whole pretention of assigning of the policy is merely to avoid the

taxability of the maturity proceeds.

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 It would not be out of place

to reproduce the Explanation 1 to section 10(10D) of the Income Tax Act which read as under:

"Explanation 1. For the purpose of this clause, Keyman insurance policy" means a life insurance

policy taken by a person on the life of another person who is or was the employee of the first

mentioned person or is or was connected in any manner whatsoever with the business of the first

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 13

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

mentioned persona and included such policy which has been assigned to a person, at any time

during the term of the policy, with or without any consideration" Emphasis supplied) The phrase

and included such policy......' has been introduced by the Finance Act 2013 and effective from

01.04.2014. Here, it would also be useful to reproduce the relevant extract of the explanatory notes

to the finance Act 2015:-

5. Keyman insurance policy 5.1 The provision of clause 10(D) of section 10 of the Income Tax Act,

1961 before amendment by the Act, inter alia, exempt any sum received under a life insurance policy

other than a keyman insurance policy. Explanation 1 to the said clause (10D) defines a keyman

insurance policy to mean a life insurance policy taken by a person on the life of another person who

is or was the employee of the first mentioned person or is or was connected in any manner

whatsoever with the business of the first mentioned person.

5.2 It has been noticed that the policies taken a keyman insurance policy are being assigned to the

keyman before its maturity. The keyman pays the remaining premium on the policy and claims the

entire sum received under such policy as exempt on the ground that the policy is no longer a keyman

insurance policy.

5.3 The exemption under section 10(10D) is claimed for policies which were originally keyman

insurance policies but during the term these were assigned to some other person. The courts have

also noticed this loophole in law.

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 5.4 With a view to plug the

loophole and check such practices to avoid payment of taxes, the provisions of clause (10D) of

section 10 of the Income Tax Act, 1961 have been amended to provide that a keyman insurance

policy which has been assigned to any person during its term, with or without consideration, shall

continue to be treated as a keyman insurance policy and consequently would not be eligible for any

exemption under section 10(10D) of the Income Tax Act."

The wording of the explanation also clearly say that if the keyman insurance policy is assigned to "a

person" anytime during the term of the policy with or without consideration the policy would be

considered as keyman insurance policy. The legislature has not use the work 'the' which would have

signified a limited meaning to the assignee. The term used is a "a person" which signify or means

any person which may be other than the keyman person. Therefore, the policy receipts are clearly

taxable as the assignment has not changed the character of receipt. It remains the receipt from a

keyman insurance policy as per the definition given in Explanation 1 to section 10(10D) of the

Income Tax Act. The assignment of the policy for the second time does not change the basic

character of the policy as per the provisions of Income Tax Act.

22. Thereafter, in the impugned order Ld. Pr. CIT rebutted the assessee's submissions which were

running from page 16 to para 19 of the impugned order . Thereafter, the Ld. Pr. CIT treated the

amendment in Explanation (1) section 10(10D) of the Act as curative and merely declaratory in

nature, placing reliance on following judgment:

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 14

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

1. Gold Coin Health Food (P). Ltd. 304 ITR 308 (SC)

2. Reliance Jute & Industries ltd. (1979) 120 ITR 931 (SC)

3. Poddar Cement P. Ltd. (1997) 5 SCC 482 HarleenKaur Bhatia &GurvinderKaur Bhatia ITA

Nos.150 & 151 /Ind/19

4. AnujJayendra Shah, vs. PCIT-35, Mumbai (67 Taxman.com 38)

23. Ld. Pr. CIT also discussed the legal position of power of Commission for revision u/s 263 of the

Act referring to the judgment of Kolkata Tribunal in the case of Subhlakshmi Vinijya(P.) Ltd. 172

TTJ 721(KOL).Thereafter the Pr. CIT placed reliance on the following judgments:

1. CIT vs. Amitabh Bachchan (2016) 384 ITR 200 (Hon'ble Supreme Court)

2. Toyota Motor Corpn. (2008) 174 Taxman 395 (Delhi) Affirmed in (2008) 173

Taxman 458 (SC)

3. Jagdish Kumar Gultai (2204) 139 Taxman 369 (All.)

4. Malabar Industrial Co. Ltd. (2000) 109 Taxman 66 (SC)

5. Crompton Greaves ltd. (2017) 82 Taxmann.com 246 (Mumbai- I.T.A.T., Bench C)

6. CIT vs. Vallabhdas Vithaldas -Gujarat High Court (2002) 253 ITR 543

24. Now in order to examine that whether the assessment order passed by the Ld. Assessing officer

is erroneous or not, we need to examine the fact that whether adequate enquiry was conducted. We

find that during the course of assessment proceedings questionnaire u/s 142(1) of the Act was issued

wherein the Ld. AO asked the assessee to furnish various details about the Insurance Policy for

which the huge maturity receipts were received and claimed as exempted. The assessee made

various submissions dated 15.06.2017, 09.10.2017, 23.10.2017 & 17.11.2017. The HarleenKaur

Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 contents of the submissions made by the

assessee in various dates are reproduced below:

Letter datedJune 15, 2017(Annexure A/6 of PAPER BOOK filed on 07.05.2019) 01]

The assessee has Electronically filed his return of total income for the year under

consideration on 31.03.2016 vide Ack. No. 143045360310316. Copy of

Acknowledgement of said Return along with computation of total income for the year

under consideration are enclosed. Enel.No. 01 to 06.

02] Assessee accounts are not audited U/s 44AB because assesse is not having any

business income and she is not fall in any category of section 44AB.

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 15

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

03] Assessee is an individual, copy of Statement of Affairs &Capital account for last 3

years i.e.AY. 2015-16, 2014-15 &2013-14 are enclosed herewith. Encl. No.07 to 13.

04] Your honour is asked to submit the ,evidence of payment of taxes.

04.1] In this regard we are enclosing here with copy of Form No. 26AS showing

payment of taxes is enclosed herewith. Encl. No.14 to17.

05] Assessee has claimed deduction under chapter VIA for payment of PPF of Rs.

150000/- Copy of the Pass Book is enclosed herewith for your ready reference. Elcl.

No.18 to 19 Letter dated 09.10.2017 (Annexure A/7of PAPER BOOK filed on

07.05.2019)

1. Copy of all bank statements maintained by the assessee along with reconciliation

statements where ever applicable are enclosed herewith HarleenKaur Bhatia

&GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19

2. Your honour is asked to submit the policy copy duly shows assignment clause.

2.1. Where are enclosing here with policy copy along with assignment 2.2 We are also enclosing here

with assignment letter issued by the Life Insurance Corporation of India in favour of assessee. Encl.

NO.32 to 32 Letter dated 23.10.2017( Annexure A/8 of PAPER BOOK filed on 07.05.2019) 01] This

is in continuation to our exemption claim in the return file for the above relevant year. As the return

is not comprised of all the relevant evidentry documents at the time of filing of regular return

therefore for facilitate scrutiny proceedings. We are enclosing here with copy of computation of total

income , acknowledgement along with all necessary evidentry document in support of our

exemption claim u/s 10(1OD). Encl. No. 33 to 35.

02] You honour is asked to submit the complete details of LIC Assignment in favor of beneficiaries

as well as also asked to submit relevant documents.

2.1 We are enclosing here with assignment letter issued by the Life Insurance Corporation of India

in favor of beneficiary along with related documents for your ready reference. Enel. No. 36 to 2.2 We

are also enclosing here with certificate issued by the LIC for payment of guaranteed surrender value

along copy of ledger account of payment of surrender value paid by the beneficiary. Encl. No. 43to

43A.

03J Copy of assignment letter issued by the Life Insurance Corporation of India in favor of assessee

is also enclosed here HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 3.1]

We are also enclosing here with Capital account of Shri A.S. Bhatia shows gift given to Smt. Harleen

Kaur Bhatia (wife) of LIC policy along with gift deed & assessee's Capital account for gift 3.2] We

relied on case law of High Court of Mumbai dated 26.09.2016 ITA No. 46/2014 Commissioner of

Income Tax V s Prashant J Agarwal. Copy of the same is enclosed here with .Enel. No. 57 to 60.

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 16

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

Letter dated 17.11.2017 (Annexure A/9 of PAPER BOOK filed on 07.05.2019)

1. Bhatia International Ltd. "BIL"( Employer) has taken a Keymen Insurance Policy from LIC of

India named as "Jeevan Anand" on life assurance of Director Amandeep S. Bhatia in the Year 2005

(April 2005) with a sum assurance of Rs. 5 crores.

2. Bhatia International Ltd. has regularly paid premium on above plan and claimed in profit &loss

account up to Oct. 2010 &thereafter above plan assign to Mr. Amandeep S. Bhatia on surrendered

value of Rs. 1.72 crores as per certificate dated 23.02.2012. Copy of certificate issued by the LIC of

India for surrender value is enclosed here with. Encl. No .

3. That above surrender value is duly offered by the Company " Bhatia International Ltd." in books

of accounts as income . Copy of the ledger account, profit &loss account along with order passed by

the ITSC are enclosed. Enel.No.

4. Further Mr. A.S.Bhatia has assign policy to his wife Smt. Harleen K. Bhatia on 30.01.2013.

Your honour please note that at the time when the policies were taken, the nature of the policies

were "keyman insurance policies" as defined in section .JO(lOD). The persons on whose life policies

were taken were directors. They were keyman as explained in Boards circular no. 762, dated

February 18, 1998 (supra). When the policies were assigned to them in April 2012, by BIL , they

HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 got converted into ordinary

policy as assignment was accepted by LIC. For this proposition we may derive support from the

decision of Hon'ble Delhi High Court in CIT vs. Rajan Nanda [2012] 18 taxmann.com 98 (Delhi)) .

Later dated 17.11.2017 (Annexure A/10 of PAPER BOOK filed on 07.05.2019) 01] Your honour is

asked to submit the details of share purchase during the year along with source of investments. 1.1]

Statement giving details of the shares purchase along with source of Investment is enclosed. Encl

No.61 1.2] Copy of relevant pages of bank statement of assessee duly highlighting the payment of

shares purchase is enclosed. Encl No.62 to 63.

1.3] Copy of share certificate is enclosed. Encl. No.64.

25. The various replies submitted by the assessee during the course of assessment proceedings u/s

143(3) of the Act mentioned above duly supported by documentary evidences were intended to

convince the Ld. Assessing Officer that the Keyman Insurance Policy taken by the Company namely

"BIC" were assigned to the Mr.A.S. Bhatia thereby the company offered surrender value of the policy

as income in FY 2011-12. This policy was subsequently gifted to assessee by her husband in January

2013. On this assignment the characteristic of the Policy changed from Keyman Insurance Policy to

normal Life Insurance Policy The total formality of the assignment of Insurance Policy is duly

recorded by Life Insurance Corporation of India and it was before 1.4.2014 which was the effective

date of the Amendment brought in Explanation (1) of HarleenKaur Bhatia &GurvinderKaur Bhatia

ITA Nos.150 & 151 /Ind/19 section 10(10D) of the Act by Finance Act 2013 and this amendment was

claimed to be prospective in nature placing reliance on various judgements .These submissions of

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 17

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

the assessee were found to acceptable by the Ld. Assessing Officer and he took one of the

permissible view provided in the law and in the light of the judicial pronouncements accepted the

assessee's claim of the maturity proceeds of LIC Policy (originally taken as Keyman Insurance

Policy) as exempted income.

26. It undoubtedly proves that the assessee had fully demonstrated through various documentary

evidences as can be seen above that Bhatia International Ltd. ( Employer) had taken a Keyman

Insurance Policy from LIC of India named as "JeevanAnand" on life assurance of Director Mr. A.S.

Bhatia in the Year 2005 (April 2005) with a sum assurance of Rs. 5 crores. Premium payment

tenure was 10 years i.e. last payment comes on 01.01.2015.The date of maturity is 28th April 2015.

The due date of premium payment is quarterly for Rs. 14.69 lacs yearly totalling to Rs. 58.76 lacs.

Bhatia International Ltd. had regularly paid premium on above plan and claimed in profit & loss

account & thereafter above plan was assigned to Mr. A.S. Bhatia on surrendered value of Rs. 1.72

crores which has been offered to tax by the Company Bhatia International Ltd. in the profit and loss

account (PB. 184 of the Paper Book dated 07.05.2019).Mr. A.S. Bhatia had then assigned policy to

his wife Smt. H.K. Bhatia on 30.01.2013.Assignee Smt. H.K. Bhatia had taken surrender value

during the month of HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19

February 2015 just before the 2 month of maturity date as maturity date of the policy was April

2015. Surrender Value received in the hands of Smt. H.K. Bhatia was Rs. 6.49 crores after deducting

TDS @ 2% u/s 194DA of Income Tax Act. After verifying the claim of the assessee through various

documentary evidences produced by the assesse and computation of income, replies dated

15.06.2017, 09.10.2017, 23.10.2017 and 17.11.2017 and various judicial pronouncements Ld. AO

formed the opinion that the said claim of the assessee is bonafide. Thus, looking to the facts of the

case we are of the view that sufficient and adequate enquiry was conducted by the Ld. AO before

accepting that the proceeds from prematurity of alleged life insurance policy are exempt from tax

and thus the assessment order passed u/s. 143(3) of the Act, by no stretch can be held to be

erroneous in nature.

27. Now we move on to examine as to whether the assessment order is prejudicial to the interest of

revenue. Issue relates to taxability of proceeds of a LIC policy which before assignment was

originally a keyman Insurance Policy.

28. Key man insurance policies are life insurance policies taken by a company on the life of some of

its keyperson. As per Paragraph 14 of Explanatory Notes to the Finance (No. 2) Act, 1996 issued by

Central Board of Direct Taxes (Circular No. 762, dated February 18, 1998 ([1998] 230 ITR (St.) 12))

akeyman insurance policy of the LIC of India means an insurance policy taken by a business

organisation on the life of an employee, in order to protect the HarleenKaur Bhatia &GurvinderKaur

Bhatia ITA Nos.150 & 151 /Ind/19 business against the financial loss, which may occur from the

employee's premature death. The 'keyman' is defined in the circular as 'an employee or a director,

whose services are perceived to have a significant effect on the profitability of the business'. The

premium paid by the employer on such policy is to be allowed as business expenditure. In case of

keyman policy there are two contracting parties, one is the payer organisation and other is the LIC

(or insurance company), and there are three affected parties, the two being the contracting parties

and the third one is the person on whose life the insurance policy is taken. Thus in Keyman

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 18

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

insurance policy which is accepted as such by LIC, the payer of the premium is the organisation and

life insured is the keyman.

29. Section 10(10D) of Act provides that any sum received under life insurance policy including sum

allocated by way of bonus on such policy will be exempt except in certain cases. One of the

exceptions is that the sum received under keyman insurance policy will not get exemption.

Explanation to that section provides the definition of "Keyman insurance policy", which means a life

insurance policy taken by a person on the life of another person who is, or was his, employee, or is or

was, connected in any manner what so ever with the business of the first mention person.

Expenditure incurred by the organisation by way of premium on keyman insurance policies will be

allowed as deduction u/s 37 in its hands.[Re: CIT v. B.N. Exports [2010] 190 Taxman 325 (Bom.)].

In CIT v. Rajan Nanda [2012] 18 taxmann.com 98 (Delhi)] regarding HarleenKaur Bhatia

&GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 sum received on maturity of keyman insurance

policies, it was held that the Act lays down that such will be taxed u/s 28 as business profits in its

hands or where payment of premium is not part of business expenditure then sum received on

maturity will be taxed u/s 56. Thus when there is "no assignment", Section 37 and Section 28 or

Section 56 of the Act operate in the case of employer.

Now in case there is assignment of the Keyman Insurance Policy

30. A policy initially taken on the life of the keyman of the organisation may be assigned to that

person or to some other person. The premium thereafter has to be paid by that person. No

deduction is allowed as business expenditure in the hands of the organisation in respect of premium

paid after assignment. When the policies is assigned to the employee then surrender value received

from the assignee i.e. employee will be taxed in the hands of the employer u/s 10(10D)(b) of the Act.

Therefore, at the time of assignment if the surrender value of the policy is much less as compared to

the total amount of premium paid by the organisation, then the surrender value received from the

individual (keyman) will be taxable in the hands of the organization as held in the case of ( Dr.

NareshTrehan v. DCIT [2014] 48 taxmann.com 21 (Delhi - Trib.))

31. In case of other persons to whom policies are assigned, which is actually the case we are dealing

in the instant appeal, the organisation will be taxed on the surrender value received from that

assignee (even though it may be less than the premium paid by the HarleenKaur Bhatia

&GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 organisation) which in this case has been done

by "BIL" offering the surrender value of policies on the date of assignment to tax .

32. In the instant case at the time when the policies were taken, the nature of the policies were

"keyman insurance policies" as defined in section 10(10D). The persons on whose life policy was

taken was director and was keyman as explained in Boards circular no. 762, dated February 18, 1998

(supra). When the policy was assigned to him by BIL and later on by the Keyman to his wife , it

apparently got converted into ordinary life insurance policy as assignment was accepted by LIC on

30.01.2013. For this proposition we may derive support from the decision of Hon'ble Delhi High

Court in CIT vs. Rajan Nanda [2012] 18 taxmann.com 98 (Delhi)wherein it was observed as under:

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 19

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

"52. Thus, the issue depends on the question as to whether on assignment of the

insurance policy to the assessee, it changes its character from Keyman insurance also

to an ordinary policy. It is because of the reason that if it remains Keyman insurance

policy, then the maturity value received is subjected to tax as per Section 10(10D) of

the Act. On the other hand, if it had become ordinary policy, the premium received

under this policy, in view of the aforesaid Section 10(10D) itself, the same would not

be subjected to tax.

53. Once there is no assignment of company/employer in favour of the individual, the

character of the insurance policy changes and it gets converted into an ordinary

policy. Contracting parties also change inasmuch as after the assignment which is

accepted by the insurance, the contract is now between the insurance company and

the individual and not the company/employer which initially took the policy. Such

company/employer no more remains the contracting parties. We have to bear in

mind that law permits such an assignment even HarleenKaur Bhatia

&GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 LIC accepted the assignment and

the same is permissible. There is no prohibition as to the assignment or conversion

under the Act. Once there is an assignment, it leads to conversion and the character

of policy changes. The insurance company has itself clarified that on assignment, it

does not remain a keyman policy and gets converted into an ordinary policy. In these

circumstances, it is not open to the Revenue to still allege that the policy in question

is keyman policy and when it matures, the advantage drawn there from is taxable.

One has to keep in mind on maturity, it does not the company but who is an

individual getting the matured value of the insurance."

33. Following this decision the ITAT in DCIT v. Rajan Nanda [2013] 37 taxmann.com 335 (Delhi -

Trib.)held as under:

"9. Thus, the Hon'ble High Court has effectively held in favour of the assessee to the

effect that once there is assignment of the employer in favour of the individual, the

character of the insurance policy changes and it gets converted into an ordinary

policy; that such assignment is duly permitted by law; that even the LIC accepted the

assignment, itself clarifying that on assignment, the policy no longer remains a

Keyman Policy and gets converted into an ordinary policy; that as such, it is not open

to the Department to still allege that the policy is a Keyman Policy and when it

matures, the advantage drawn there from is taxable; that on maturity of the policy, it

is not the employer, but the individual, who is getting the maturity value of the

insurance; that no doubt, the employer as well as the individual take huge benefit by

such assignment, but it cannot be treated as a case of tax evasion, rather it is a case of

arranging the affairs in such a manner as to avail the state exemption as provided in

Section 10 (10D) of the Act; that benefit inured owing to the combined effect of a

prudent investment and the statutory exemption provided u/s 10 (10D) of the Act

does not call for any bifurcation in the amount received on maturity on any basis

whatsoever; and that nothing can be read into Section 10 (10D) of the Act, if it is not

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 20

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

specifically provided therein, since any such attempt would HarleenKaur Bhatia

&GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 tantamount to legislation and not

interpretation. It is on the basis of the above enunciation of law by the Hon'ble High

Court in the assessee's own case, that the Ld. CIT (A) has held and, in our considered

opinion, rightly so, that after assignment of the policy in favour of the assessee, it

changes its character from that of a Keyman Insurance Policy to that of an ordinary

policy and that once it has become an ordinary policy, the proceeds received there

under would not be subject to tax in view of Section 10 (10D) of the Act, due to which

nothing is taxable out of the maturity value received from the insurance policy"

34. Thus after the assignment the policies changed the character to ordinary life insurance policy

and the sum received by the assignees on maturity should not have been taxed in their hand as these

were exempt u/s 10(10D) of the Act. If for the sake of argument the amendment brought in

explanation 1 to section 10(10D) of the Act by Finance Act 2013 is treated as prospective in nature as

has been accepted by Ld. AO then the assessment order in question will not be prejudicial to the

interest of revenue as the Ld. AO adopted one of the permissible view provided in law after

considering the judgements, as has been held by Hon'ble Apex Court in the case of CIT Vs.Max India

Ltd (295 ITR 282).

34A. However, Ld. Pr. CIT while setting aside the assessment order in question took a view that the

amendment brought in by Finance Act 2013 Explanation 1 is retrospective and clarificatory in

nature and thus the alleged maturity proceeds are taxable as they were received subsequent to the

amendment. In order to adjudicate this HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 &

151 /Ind/19 issue ,we find that in the notes on clauses to amendment by Finance Act 2013 it was

observed that:

"5.1 The provisions of clause (10D) of section 10 of the Income Tax Act, 1961 before

amendment by Act, inter alia, exempt any sum received under a life insurance policy

other than a keyman insurance policy. Explanation 1 to the said clause (10D) defines

a keyman insurance policy to mean a life insurance policy taken by a person on the

life of another person who is or was the employee of the first-mentioned person or is

or was connected in any manner whatsoever with the business of the first-mentioned

person.

5.2 It has been noticed that the policies taken as keyman insurance policy are being

assigned to the keyman before its maturity. The keyman pays the remaining premium

on the policy and claims the entire sum received under such policy as exempt on the

ground that the policy is no longer a keyman insurance policy.

5.3 The exemption under section 10(10D) is claimed for policies which were

originally keyman insurance policies but during the term these were assigned to some

other person. The Courts have also noticed this loophole in law.

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 21

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

5.4 With a view to plug the loophole and check such practices to avoid payment of

taxes, the provisions of clause (10D) of section 10 of the Income Tax Act, 1961 have

been amended to provide that a keyman insurance policy which has been assigned to

any person during its term, with or without consideration, shall continue to be

treated as a keyman insurance policy and consequently would not be eligible for any

exemption under section 10(10D) of the Income Tax Act, 1961."

35. Accordingly existing Explanation to section 10(10D) renumbered as Explanation 1, was amended

as under:

[Explanation 1].--For the purposes of this clause, "Keyman insurance policy" means a

life insurance policy taken by a HarleenKaur Bhatia &GurvinderKaur Bhatia ITA

Nos.150 & 151 /Ind/19 person on the life of another person who is or was the

employee of the first-mentioned person or is or was connected in any manner

whatsoever with the business of the first-mentioned person [and includes such policy

which has been assigned to a person, at any time during the term of the policy, with

or without any consideration];]

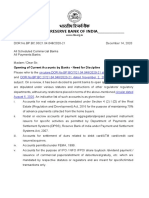

36. The fate of the instant appeal depend a lot on the nature of amendment brought in by Finance

Act 2013 in explanation 1 to section 10(10D) of the Act as to whether it is prospective or

retrospective or clarificatory in nature and the same needs to examined in the light of judicial

pronouncements.

37. Hon'ble Apex court in the case of CIT vs. Essar Teleholding Ltd. (2018) 3 SCC 253 while

adjudicating the issue as to whether the applicability of Rule 8D as inserted by the Notification

dated 24.03.2008 is only prospective in nature held as follows:

Important Principles of Statutory Interpretation

23. The legislature has plenary power of legislation within the fields assigned to

them, it may legislate prospectively as well as retrospectively. It is a settled principle

of statutory construction that every statute is prima facie prospective unless it is

expressly or by necessary implications made to have retrospective operations. Legal

Maxim "nova constitutiofuturisformamimponeredebet non praeteritis", i.e. 'a new

law ought to regulate what is to follow, not the past', contain a principle of

presumption of prospectively of a statute.

24. Justice G.P. Singh in "Principles of Statutory Interpretation" (14th Edition, in Chapter 6) while

dealing with HarleenKaur Bhatia &GurvinderKaur Bhatia ITA Nos.150 & 151 /Ind/19 operation of

fiscal statute elaborates the principles of statutory interpretation in the following words: "Fiscal

legislation imposing liability is generally governed by the normal presumption that it is not

retrospective and it is a cardinal principle of the tax law that the law to be applied is that in force in

the assessment year unless otherwise provided expressly or by necessary implication. The above rule

applies to the charging section and other substantive provisions such as a provision imposing

Indian Kanoon - http://indiankanoon.org/doc/95739707/ 22

Gurvinder Kaur Bhatia , Indore vs Pr. Cit-2, Indore on 18 December, 2019

penalty and does not apply to machinery or procedural provisions of a taxing Act which are

generally retrospective and apply even to pending proceedings. But a procedural provision, as far as

possible, will not be so construed as to affect finality of tax assessment or to open up liability which

had become barred. Assessment creates a vested right and an assessee cannot be subjected to

reassessment unless a provision to that effect inserted by amendment is either is either expressly or

by necessary implication retrospective. A provision which in terms is retrospective and has the effect

of opening up liability which had become barred by lapse of time, will be subject to the rule of strict

construction. In the absence of a clear implication such a legislation will not be given a greater

retrospectivity than is expressly mentioned; nor will it be construed to authorize the Income tax

Authorities to commence proceedings which, before the new Act came into force, had by the expiry

of the period then provided become barred. But unambiguous language must be given effect to, even

if it results in reopening of assessments which had become final after expiry of the period earlier

provided for reopening them. There is no fixed formula for the expression of legislative intent to give

retrospectively to a taxation enactment......" "11. Now it is a well settled rule of interpretation

hallowed by time and sanctified by judicial decisions that, unless the terms of a statute expressly so

provide or necessarily require it, retrospective operation should not be given to a statute so as to

take away or impair an existing right or create a new obligation or impose a new liability otherwise

than as regards matters of procedure. The general rule as stated by Halsbury in Vol. 36 of the Laws

of England (3rdEdn.) and reiterated in several HarleenKaur Bhatia &GurvinderKaur Bhatia ITA

Nos.150 & 151 /Ind/19 decisions of this Court as well as English courts is that "all statutes other than

those which are merely declaratory or which relate only to matters of procedure or of evidence are

prima facie prospective" and retrospective operation should not be given to a statute so as to affect,

alter or destroy an existing right or create a new liability or obligation unless that effect cannot be

avoided without doing violence to the language of the enactment. If the enactment is expressed in

language which is fairly capable of either interpretation, it ought to be construed as prospective only.

38. In the case of Commissioner of Income-tax Vs. Ayodhyakumari (Mrs.) (1985) 154 ITR 604

(Raj):It was held that all provisions are considered to be prospective except when made

retrospective by express words or by necessary intendment. In case of ambiguity, the provisions

should be construed as being prospective.

39. In the case of Controller of Estate Duty Vs. Merchant (M.A.) (1989) 177 ITR 490 (SC) :Hon'ble

Court held that subsequent legislation should not to affect vested rights, unless legislation is made