Professional Documents

Culture Documents

Central Banking: Institute of Bankers of Sri Lanka

Central Banking: Institute of Bankers of Sri Lanka

Uploaded by

Gayan De SilvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Banking: Institute of Bankers of Sri Lanka

Central Banking: Institute of Bankers of Sri Lanka

Uploaded by

Gayan De SilvaCopyright:

Available Formats

Central Banking

Lecture 2 :Introduction to Central Banking

Google Classroom S D Nilanka Chamindani

Institute of Bankers of Sri Lanka Google Classroom

Introduction

What is Central Banking?

It is the apex institution in the financial system of a nation. Because it performs a unique

function of maintaining a monetary and financial system to support real sector performance.

In overall, it facilitates economic activities and efficient allocation of resources in the

economy and foster sustainable growth.

Institute of Bankers of Sri Lanka Google Classroom

Introduction

Why Central Bank is important?

The importance of a central bank can be assessed by examining its responsibilities. They have

evolved as specific to central banks, as no any other institution to discharge such

responsibilities better.

The history of the evolution of Central Banks is the history of the evolution of their

responsibilities, which were added from time to time to address the issues related to money

and finance.

Producing and distributing money became the main responsibility of central banks.

Accordingly, core responsibilities of central banks are also associated with those main areas of

using money.

Institute of Bankers of Sri Lanka Google Classroom

Responsibilities of Central Banks

Responsibilities of the Central Bank of Sri Lanka (CBSL) are two Types;

a. Core Responsibilities

• Maintaining Stable Money

• Maintaining Stable Monetary System and Stable Financial System

• Maintaining a Stable Banking System

• Maintaining a Secure Payment System

• Ensuring Secure Cash

b. Other Responsibilities

All other responsibilities other than core responsibilities, are basically the

agency functions on behalf of the Government

Institute of Bankers of Sri Lanka Google Classroom

Core Responsibilities : Maintaining Stable Money

• The Stability of Money is measured in terms of its purchasing power, which has two sides,

Internal Value: is measured in terms of the capacity of a given volume of currency to purchase a given

units of goods and services. Maintaining internal value of money is maintaining a low and stable rate

of inflation and it is knows as maintaining price stability (Related economic terms : Price Indices,

Inflation and Deflation )

• Why it is important to maintain Price Stability?

Economic agents plan for their future consumption, production and investment and take decisions to

manage their cash flow in an unforeseen future. Prices that matter for such decisions in one of the

most important factors. Hence, only if the price changes are low and behave in a predictable manner,

they can take rational decisions and implement them with confidence. Then only the economic activity

becomes dynamic and support sustainable grow

Institute of Bankers of Sri Lanka Google Classroom

Core Responsibilities : Maintaining Stable Money

External Value: is measured in terms of the number of units of a given foreign currency that one unit of

domestic currency can purchase. It capacity of the domestic currency a given volume of money to purchase a

given units of goods and services (Related economic terms : Exchange Rate

Depreciation and Devaluation Appreciation and Revaluation)

Maintaining external value of money is maintaining a realistic and stable exchange rate

• Why it is important to maintain Exchange Rate Stability?

An open economy experiences continuous inflows and outflows of foreign exchange. Such flows are

associated with the various economic activities and are reflected in the Balance of Payments (BOP)

Account. Exchange rate matters for every transaction involving a foreign currency and domestic currency .

A highly volatile exchange rate can harm business activities and affect the position of the BOP. Hence the

CBSL can help the external sector economic activities by maintaining a stable exchange rate.

Institute of Bankers of Sri Lanka Google Classroom

Core Responsibilities : Maintaining Stable Monetary System and

Stable Financial Systems

Monetary System: It is a set of institutions and relationships associated with the production,

distribution and management of money (Liquidity)

Stability in the monetary system is an environment that facilitates efficient management to ensure optimal

level of the money supply

Financial System: It is a set of institutions and relationships associated with mobilization of financial

resources among different sectors of the economy

Stability in the financial system is an environment where users of the services of financial institutions do not

lose the confidence they have in the institutions and the system as a whole

With stable and smooth functioning of monetary and financial system, economic agents can focus

on their economic activities without any doubts and make the economy more dynamic

Institute of Bankers of Sri Lanka Google Classroom

Core Responsibilities : Maintaining Stable Banking System

• Stable Banking System is an environment where all banks (Commercial and Specialized) are

resilient individually and as a system to shocks emanating from both within the domestic

economy and from rest of the world

• Banking system is the dominant sub sector in the entire financial system. It is the strongest pillar.

Hence, stability of the banks, specially commercial banks, is vital for the stability of the entire

financial system

• If banking system is stronger, it can act as a shield for non bank financial institutions as well

when they are under financial stress

• Accordingly, the Central Bank gives special emphasize to the banking system in its efforts to

maintain financial system stability to facilitate economic activities move smoothly

Institute of Bankers of Sri Lanka Google Classroom

Core Responsibilities : Maintaining Secure Payment System

• When legal tender is used as the intermediary tool for the payment, the settlements also take

place at the same time or in real time

• However, this can be different when modes of payments, such as cheques, credit and debit cards

and electronic fund transfers are used. In such as environment, a third party, a payment and

settlement system is involved. Compared to a cash payment where paying and receiving parties

are visible, part of the payments and settlements through a system is invisible. This where the

trust in the system matters

• Rational and risk averse economic agents tend to avoid inviable systems, if they are doubtful

about the security they have for their hard-earned money when they use a payment and

settlement system. If a payment and settlement system fails to build confidence among users, it

collapse and the economic activities fail to function smoothly

• Hence, the Central Bank has the responsibility of ensuring a secure payment and settlement

system for the financial sector and economic activities to function smoothly

Institute of Bankers of Sri Lanka Google Classroom

Core Responsibilities : Ensuring Secure Cash

• The important characteristic of cash, either in the form of coins or notes, is the general

acceptance in exchange of goods, services and assets. It depends on the trust the users have on

the genuineness of cash

If counterfeit coins and notes are in circulation, it affect the trust and general acceptance of cash

resulting in people abandoning them and moving an inefficient mode of barter in their exchange

• Therefore, the Central Bank as the sole legal authority of producing and distributing legal tender

or fiat money has the responsibility of ensuring a security of cash in circulation to facilitate

exchange of goods and service for the economy to function smoothly

Institute of Bankers of Sri Lanka Google Classroom

Other Responsibilities

• All Non-Core responsibilities of the CBSL fall under other responsibilities. There are generally

referred to as Agency Functions as most of them are entrusted on the CBSL to perform on behalf

of the Government. Following are such responsibilities of the CBSL

a. Management of Public Debt

b. Management of Foreign Exchange

c. Management of the Employees’ Provident Fund

d. Promoting Financial Inclusion

e. Proving Financial Intelligent Services

• Central Bank responsible in the above are they are entrusted by the government to facilitate a

better economic management.

Institute of Bankers of Sri Lanka Google Classroom

Lecture 2 : Functions of the Central Bank

• Core Functions of the Central Bank

• Agency Functions of the Central Bank

Institute of Bankers of Sri Lanka Google Classroom

You might also like

- S3 - Geo - 2nd Term Exam Revision IndustryDocument7 pagesS3 - Geo - 2nd Term Exam Revision IndustryBilly Lau100% (1)

- Internship Report Deposit Mobilization of NCC BankDocument74 pagesInternship Report Deposit Mobilization of NCC BankSauron88850% (2)

- Updated Module Finman 4 PDFDocument59 pagesUpdated Module Finman 4 PDFNherwin OstiaNo ratings yet

- Loan Management SystemDocument58 pagesLoan Management SystemTamboli Iqbal75% (8)

- Central Banking: S D Nilanka ChamindaniDocument7 pagesCentral Banking: S D Nilanka ChamindaniGayan De SilvaNo ratings yet

- BLO3405 - s4681214 - Assignment 2, Part ADocument6 pagesBLO3405 - s4681214 - Assignment 2, Part Amajmmallikarachchi.mallikarachchiNo ratings yet

- 1 Background To The StudyDocument4 pages1 Background To The StudyNagabhushanaNo ratings yet

- Functions of Central BankDocument6 pagesFunctions of Central Bankshaan19No ratings yet

- Lutfiana Nanda Putri - MN18I - Tugas ArtikelDocument16 pagesLutfiana Nanda Putri - MN18I - Tugas ArtikelLutfiana Nanda PutriNo ratings yet

- Intro Paper PDFDocument35 pagesIntro Paper PDFDeshi GamerNo ratings yet

- Project Work On Remittance Service of Kumari BankDocument40 pagesProject Work On Remittance Service of Kumari BankRegan CapichinoNo ratings yet

- The Impact of Financial Management Practices On The Performance of Kenyan BanksDocument38 pagesThe Impact of Financial Management Practices On The Performance of Kenyan BanksAmiani 'Amio' DavidNo ratings yet

- Impact of Liquidity On Profitability of NMBDocument28 pagesImpact of Liquidity On Profitability of NMBkanchan BogatiNo ratings yet

- Repoprt On Loans & Advances PDFDocument66 pagesRepoprt On Loans & Advances PDFTitas Manower50% (4)

- Examination of Monetary Policy and Financial Performance of Deposit Money Bank in NigeriaDocument71 pagesExamination of Monetary Policy and Financial Performance of Deposit Money Bank in NigeriaDaniel ObasiNo ratings yet

- ReportDocument56 pagesReportMd Khaled NoorNo ratings yet

- Chapter-I: Background of StudyDocument19 pagesChapter-I: Background of StudyGanga RamNo ratings yet

- A Study On The Effectiveness of Remedies AvailableDocument35 pagesA Study On The Effectiveness of Remedies AvailableMitali ChaureNo ratings yet

- Research PDFDocument13 pagesResearch PDFZEKERIASASSEFANo ratings yet

- 1.1 Background of The StudyDocument6 pages1.1 Background of The StudySocialist GopalNo ratings yet

- CAMELSDRAFTVIJAIDocument49 pagesCAMELSDRAFTVIJAIMurali Balaji M CNo ratings yet

- Liquidity NICDocument26 pagesLiquidity NICsaurav75% (8)

- Anil Jamarkattel - Intern Report, Pratima Adhikari, Roll No. 22, DayDocument28 pagesAnil Jamarkattel - Intern Report, Pratima Adhikari, Roll No. 22, DayInternship ReportNo ratings yet

- Exm - 26842 Financial ManagementDocument20 pagesExm - 26842 Financial ManagementAbdul AshrafNo ratings yet

- Docu 2Document28 pagesDocu 2Angbuhang Sushil LeembooNo ratings yet

- Basic ConceptsDocument30 pagesBasic Conceptsjoslin12100% (1)

- Treasury Management-ShrutiDocument17 pagesTreasury Management-ShrutishrutimalNo ratings yet

- Anand Final ReportDocument89 pagesAnand Final ReportAnand Mishra100% (1)

- Treasury ManagementDocument70 pagesTreasury ManagementSoumik Banerjee50% (2)

- New One PDFDocument39 pagesNew One PDFDeshi GamerNo ratings yet

- Paper 2 Advanced Financial Management (May 2020)Document979 pagesPaper 2 Advanced Financial Management (May 2020)C PandaNo ratings yet

- Lecturer: Mohamed Shibiin Master of Economics and Master of Bank ManagementDocument39 pagesLecturer: Mohamed Shibiin Master of Economics and Master of Bank ManagementU A CNo ratings yet

- Bank Profitability and Liquidity Management: A Case Study of Selected Nigerian Deposit Money BanksDocument24 pagesBank Profitability and Liquidity Management: A Case Study of Selected Nigerian Deposit Money BanksSangam NeupaneNo ratings yet

- Non Performing Assets of Himalayan Bank LiitedDocument6 pagesNon Performing Assets of Himalayan Bank LiitedSantosh ChhetriNo ratings yet

- Liquidity Management in BanksDocument28 pagesLiquidity Management in BanksvanvunNo ratings yet

- BBS ReportDocument27 pagesBBS ReportGoogle UserNo ratings yet

- Uco BankDocument77 pagesUco BankSankalp PurwarNo ratings yet

- Roles and Functions: Central Bank of Malaysia Act 2009Document3 pagesRoles and Functions: Central Bank of Malaysia Act 2009Khairy IsmailNo ratings yet

- Credit Management of BankDocument83 pagesCredit Management of BankNil DasNo ratings yet

- From-Nikunjkumar Sanghavi ROLL NO.140 Sybba C'Document18 pagesFrom-Nikunjkumar Sanghavi ROLL NO.140 Sybba C'Nik SanghviNo ratings yet

- SBL Internship ReportDocument30 pagesSBL Internship ReportPrajwol ThapaNo ratings yet

- Abhi PCK LTD Kottayam Project FinanceDocument48 pagesAbhi PCK LTD Kottayam Project Financeabhishekjayakumar63No ratings yet

- Significance of The StudyDocument2 pagesSignificance of The StudyRoy PondaneraNo ratings yet

- Chapter 1: IntroductionDocument21 pagesChapter 1: IntroductionRawmess PanditNo ratings yet

- Getachew Abay: Advisor NameDocument12 pagesGetachew Abay: Advisor Namemuradhalid08No ratings yet

- Century Bank - I II IIIDocument33 pagesCentury Bank - I II IIIMADHU KHANALNo ratings yet

- Xii - Economics - Money and Banking Notes - Part 2Document2 pagesXii - Economics - Money and Banking Notes - Part 2rajputsyonaNo ratings yet

- Executive SummaryDocument56 pagesExecutive SummaryMurali Balaji M CNo ratings yet

- Miran KhanDocument5 pagesMiran Khan2224019.khan.miranNo ratings yet

- Md. Towfiqul IslamDocument36 pagesMd. Towfiqul IslamTopuNo ratings yet

- Dissert Chapter OneDocument78 pagesDissert Chapter OneAmidu MansarayNo ratings yet

- Diskusi 1Document2 pagesDiskusi 1clarisaNo ratings yet

- Bharat Yadav ThesisDocument41 pagesBharat Yadav Thesisशुन्य बिशालNo ratings yet

- Deposit Collection at BOKDocument34 pagesDeposit Collection at BOKKrishna Bahadur ThapaNo ratings yet

- Role of Banks in Indian EconomyDocument19 pagesRole of Banks in Indian EconomySan GeethaNo ratings yet

- Va Sudha ProjectDocument28 pagesVa Sudha ProjectPranjal SrivastavaNo ratings yet

- Asset-Liability Management in Banking SectorDocument7 pagesAsset-Liability Management in Banking SectorsukanyaNo ratings yet

- Credit ManagementDocument36 pagesCredit ManagementMd Kawsar0% (1)

- 1.1 Background of The Financial AnalysisDocument36 pages1.1 Background of The Financial AnalysisBishal ChaliseNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Problem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreDocument17 pagesProblem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreMark Angelo BustosNo ratings yet

- Course PRINCIPLES OF ECONOMICSDocument4 pagesCourse PRINCIPLES OF ECONOMICSftn sukriNo ratings yet

- CH 09 MBADocument20 pagesCH 09 MBAManvitha ReddyNo ratings yet

- 1 SMDocument14 pages1 SMMuhammad Fathur RizqiNo ratings yet

- Company Law Marathon Latest 2022 PPT NOTESDocument888 pagesCompany Law Marathon Latest 2022 PPT NOTESyashNo ratings yet

- Sakambari BillDocument3 pagesSakambari BillMd Zeeshan AhmedNo ratings yet

- Editor Sfjd,+Art.+003+SFJDDocument27 pagesEditor Sfjd,+Art.+003+SFJDMLW BDNo ratings yet

- GST Tax Invoice Format For GoodsDocument3 pagesGST Tax Invoice Format For GoodsYaser Ali TariqNo ratings yet

- Money and BankingDocument17 pagesMoney and Bankingmuzzammil4422No ratings yet

- Handout 1 - Nonprofit Organizations - RevisedDocument10 pagesHandout 1 - Nonprofit Organizations - RevisedPaupauNo ratings yet

- Happy Family Floater Policvy-2015 Premium Sheet - 290920Document1 pageHappy Family Floater Policvy-2015 Premium Sheet - 290920BalaNo ratings yet

- Infrastructure Development Within The Context of Africa's Cooperation With New and Emerging Development PartnersDocument106 pagesInfrastructure Development Within The Context of Africa's Cooperation With New and Emerging Development PartnersKadmiri. SNo ratings yet

- Bcoc 136Document4 pagesBcoc 136piyushsinha9829No ratings yet

- Account Movements DetailDocument2 pagesAccount Movements Detailandy sandoval guardiaNo ratings yet

- Hosteller 4 TH 5 THDocument4 pagesHosteller 4 TH 5 THDhriti AgarwalNo ratings yet

- Accounting Standard - 11: Accounting For The Effects of Changes in Foreign Exchange RatesDocument10 pagesAccounting Standard - 11: Accounting For The Effects of Changes in Foreign Exchange RatesAkash ChavdaNo ratings yet

- MegabookDocument23 pagesMegabookHuynh KhuongNo ratings yet

- Invoice - Ptron Bassbuds Pro (New)Document1 pageInvoice - Ptron Bassbuds Pro (New)Jee AdvancedNo ratings yet

- B2B Marketing - Shivam KumarDocument7 pagesB2B Marketing - Shivam KumarShivam KumarNo ratings yet

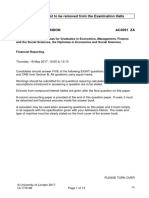

- This Paper Is Not To Be Removed From The Examination HallsDocument54 pagesThis Paper Is Not To Be Removed From The Examination HallskikiNo ratings yet

- SPPTChap 006Document16 pagesSPPTChap 006iqraNo ratings yet

- Chapter 8 HomeworkDocument7 pagesChapter 8 Homeworkklm klm100% (1)

- Sem - Output.cad 313Document7 pagesSem - Output.cad 313ladynian115No ratings yet

- GayathriDocument2 pagesGayathrishaikhNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument8 pagesMonthly Statement: Name Address Account Number Statement PeriodAzeez AyomideNo ratings yet

- Financial Accounting-I Sem-1 (GU-DEC-2014)Document12 pagesFinancial Accounting-I Sem-1 (GU-DEC-2014)Ekta RanaNo ratings yet

- Ar 2003Document45 pagesAr 2003karmen kiwanNo ratings yet

- Ramesh Singh Indian Economy Class 17Document66 pagesRamesh Singh Indian Economy Class 17Abhijit NathNo ratings yet

- ERP 2024-2026 Approved 15 JanDocument56 pagesERP 2024-2026 Approved 15 JanZiarul de GardăNo ratings yet