Professional Documents

Culture Documents

BB Questions

BB Questions

Uploaded by

Hari NaamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BB Questions

BB Questions

Uploaded by

Hari NaamCopyright:

Available Formats

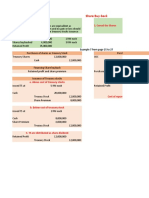

1.

ABC limited decides to buyback 10% of FULLY y paid up equity shares at 25% premium over

the prevailing market price of rupees 40 per share. The paid up equity shares capital of the

company is rupees 500 milliion. The face value per shares is rupees 10. ABC limited balance

sheet before buyback is as follows:

Sources of funds Millions

Paid up share capital 500

General reserve 300

Securities premium 200

Revaluation reserve 150

Loan funds 600

Total 1750

Application of funds

Fixed assets net block 1050

Investments (including non-trade investments of rupees 100 million) 250

Net current assets(including cash and bank balance of rupees 100 million) 450

Total 1750

The company decides to issues 9% preference shares of rupees 80 million and sell all non-

trade investments. The company may also utilize 80% of existing cash and bank balance for

buyback purpose. All non-trade investments cloud be sold at 150 million. Current liabilities

and provisions of the company was rupees 200 million.

Prepare the post buyback balance sheet.

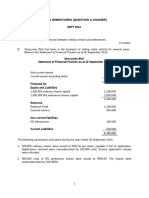

2. A limited wants to buyback 15% of its paid equity share capital.The paid up equity share

capital is rupees 2500 million. The current market price of A limited is rupees 75. Company

decides to buy back 37.5 million shares at a price to be decided through book building

process. Company offers a price band of 80-100. The shareholders response were as follows:

Numbers of shares Price quoted

tendered (in million)

3.0 100

4.5 95

5 85

7.5 82

10 87

12.5 88

2.5 90

The balance sheet of A limited before buyback was as follows:

Sources of funds Rs. Million

Paid up share capital FV Rs. 2500

10

General reserves 27,500

Securities premium 12,500

Capital reserve 5000

Loan funds 30,000

Total 77,500

Application of funds

Net block 45,500

Investments 17,500

Net current assets 14,500

total 77,500

Investments with a book value of rupees 1200 million are sold for rupees 2000 million.9.5%

preference shares were issued for rupees 1000 million. Current liabilities and provisions

included in net current assets are rupees 8500 million. Cash and bank balance as on the date

if balance sheet is rupees 5000 million. Determine the buyback price and prepare the post

buyback balance sheet .

You might also like

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDocument6 pagesProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Castlepines 2021 V18-1Document8 pagesCastlepines 2021 V18-1Steven RosarioNo ratings yet

- Semester V (Finance) 2018-19Document51 pagesSemester V (Finance) 2018-19anurag chaurasiaNo ratings yet

- Buy Back of Shares HandoutDocument15 pagesBuy Back of Shares Handoutdhiren.c.shekar99No ratings yet

- CMA Volume 2 MergedDocument153 pagesCMA Volume 2 MergedShyaambhavi NsNo ratings yet

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Sample Quiz March 2022Document2 pagesSample Quiz March 20222024916967No ratings yet

- Acquisition of Shares Through Buyback: Presented To: Prof. RajanDocument44 pagesAcquisition of Shares Through Buyback: Presented To: Prof. RajanBook wormNo ratings yet

- Ratio Analysis QuestionDocument3 pagesRatio Analysis QuestionPraween BimsaraNo ratings yet

- COM203 AmalgamationDocument10 pagesCOM203 AmalgamationLogeshNo ratings yet

- June 2019 All Paper SuggestedDocument120 pagesJune 2019 All Paper SuggestedEdtech NepalNo ratings yet

- Answered The Following Information Was Provided BartlebyDocument5 pagesAnswered The Following Information Was Provided BartlebyMarkNo ratings yet

- Redemption of Preference Shares IllustrationsDocument6 pagesRedemption of Preference Shares IllustrationsManya GargNo ratings yet

- Balance Sheet: Capital Reconstruction Additional IllustrationsDocument4 pagesBalance Sheet: Capital Reconstruction Additional Illustrationsathirah jamaludinNo ratings yet

- Company Acc PracticeDocument9 pagesCompany Acc PracticeRaffayNo ratings yet

- Corporate Acc 6.2.22Document3 pagesCorporate Acc 6.2.22VANSHAJ SHAHNo ratings yet

- Quiz 1 - Statement of Financial PositionDocument9 pagesQuiz 1 - Statement of Financial PositionJonathan SolerNo ratings yet

- Activity CorporationDocument5 pagesActivity CorporationbucsitNo ratings yet

- Absorption Questions 1Document4 pagesAbsorption Questions 1naazhim nasarNo ratings yet

- Module-2 Equity Valuation Numerical For StudentsDocument11 pagesModule-2 Equity Valuation Numerical For Studentsgaurav supadeNo ratings yet

- Group 2 Ia3Document5 pagesGroup 2 Ia3Abe Mayores CañasNo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Company AccountsDocument10 pagesCompany AccountsLawrence101No ratings yet

- Inbound 4302319183908505426Document6 pagesInbound 4302319183908505426Gizelle DizonNo ratings yet

- 3internal Reconstruction 230725 165705Document6 pages3internal Reconstruction 230725 165705Ruchita JanakiramNo ratings yet

- Finance1 Problem1 121013094019 Phpapp01 PDFDocument13 pagesFinance1 Problem1 121013094019 Phpapp01 PDFMauro SacamayNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- Redeemable Preferred Stock Long-Term Loans Liabilities Against Asset Subject To Financial Lease Deferred Tax Liabilities Warranty ObligationsDocument2 pagesRedeemable Preferred Stock Long-Term Loans Liabilities Against Asset Subject To Financial Lease Deferred Tax Liabilities Warranty Obligationsnida vardakNo ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- Chapter 1 - Buyback Additional QuestionsDocument9 pagesChapter 1 - Buyback Additional QuestionsMohammad ArifNo ratings yet

- Excel Sheet LessonDocument12 pagesExcel Sheet LessonHassibNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- Rohit TestDocument9 pagesRohit TestRohitNo ratings yet

- 616806cf0cf2b988fbcdbd97 OriginalDocument20 pages616806cf0cf2b988fbcdbd97 OriginalTM GamingNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- Wa0035.Document5 pagesWa0035.Barack MikeNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- 3526 - 25114 - Textbooksolution - PDF 3Document108 pages3526 - 25114 - Textbooksolution - PDF 3dhanuka jiNo ratings yet

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Business Accounting-Ii BS-VDocument2 pagesBusiness Accounting-Ii BS-Vzahid khanNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- CBCS - BCOM - HONS - Sem-5 - COMMERCE - DSE 5.2 A - CORPORATE ACCOUNTING-10992Document7 pagesCBCS - BCOM - HONS - Sem-5 - COMMERCE - DSE 5.2 A - CORPORATE ACCOUNTING-10992R3shav JaiswalNo ratings yet

- FR (New) A MTP Final Mar 2021Document17 pagesFR (New) A MTP Final Mar 2021ritz meshNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- Problem Based On Ratio Analysis - Part - 2Document1 pageProblem Based On Ratio Analysis - Part - 2Mohd shariqNo ratings yet

- Sept 2014 - 230716 - 233727Document22 pagesSept 2014 - 230716 - 233727mohddanialhanaffimustaffiNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Problem 2 6Document6 pagesProblem 2 6Abe Mayores CañasNo ratings yet

- CA Bcom PH 3rd Sem 2016Document7 pagesCA Bcom PH 3rd Sem 2016Gursirat KaurNo ratings yet

- NCLT Cases Valuation Jan 2018Document8 pagesNCLT Cases Valuation Jan 2018NiveditaNo ratings yet

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocument6 pagesIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNo ratings yet

- Accounting Redemption of Debentures 1642416359Document19 pagesAccounting Redemption of Debentures 1642416359Shashank SikarwarNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- Amalgamation Dec 2020Document46 pagesAmalgamation Dec 2020binu100% (2)

- Q2: (8+8 16marks) Debit BalancesDocument2 pagesQ2: (8+8 16marks) Debit BalancesMaryam EhsanNo ratings yet

- Practice Question 09-05-2024Document2 pagesPractice Question 09-05-2024Waqas Younas BandukdaNo ratings yet

- Redemption of Debentures (Inter CA) PDFDocument4 pagesRedemption of Debentures (Inter CA) PDFvenkata srikanth topalliNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- LEVERAGEDocument19 pagesLEVERAGEraka1010100% (10)

- Financial Markets and InstitutionsDocument5 pagesFinancial Markets and InstitutionsEng Abdikarim WalhadNo ratings yet

- Ifm Grade 9-10 SyllabusDocument15 pagesIfm Grade 9-10 SyllabusNOTSI23JNo ratings yet

- Social Capital and Academic Achievement in An Electrical Engineering LabDocument6 pagesSocial Capital and Academic Achievement in An Electrical Engineering LabjohnNo ratings yet

- IPO ProcessDocument27 pagesIPO ProcessCA VK AsawaNo ratings yet

- Financial Markets and Institutions: (Chapter 2)Document16 pagesFinancial Markets and Institutions: (Chapter 2)georgeNo ratings yet

- Real Estate InvestmentDocument9 pagesReal Estate InvestmentRiddhi PirogiwalNo ratings yet

- Thu Cs CostDocument31 pagesThu Cs CostthulasikNo ratings yet

- CF McqsDocument44 pagesCF McqsManish GuptaNo ratings yet

- 1-Asset Based Valuation PDFDocument25 pages1-Asset Based Valuation PDFFlovgrNo ratings yet

- II Sem. - Financial AccountingDocument16 pagesII Sem. - Financial Accountingakhterparveen50896No ratings yet

- MDI GWPI Prep - Monetrix ChapterDocument22 pagesMDI GWPI Prep - Monetrix ChapterAnand1832No ratings yet

- Midterm For Business FinanceDocument6 pagesMidterm For Business FinanceCJ WATTPAD100% (2)

- Accenture QuarterDocument11 pagesAccenture QuarterHans SchmidtNo ratings yet

- Dabur India Limited: Type Industry Founded Founder Headquarters Area Served Key PeopleDocument17 pagesDabur India Limited: Type Industry Founded Founder Headquarters Area Served Key PeopleJaskeerat Singh OberoiNo ratings yet

- FM NotesDocument15 pagesFM NotesEbsa AdemeNo ratings yet

- Capital BudgetingggDocument73 pagesCapital Budgetingggjeremy nicoleNo ratings yet

- Ratios Solved ProblemsDocument8 pagesRatios Solved ProblemsYasser Maamoun50% (2)

- Strategy 4 TH UnitDocument21 pagesStrategy 4 TH UnitElango VSNo ratings yet

- Massey Ferguson LTD 1980 v2Document10 pagesMassey Ferguson LTD 1980 v2AnthonyTiuNo ratings yet

- PA 321 MidDocument14 pagesPA 321 Midalam ashemaNo ratings yet

- Asset-Liability Management in Banking SectorDocument7 pagesAsset-Liability Management in Banking SectorsukanyaNo ratings yet

- FM - Capital StructureDocument9 pagesFM - Capital StructureTea Cher CelineNo ratings yet

- Capital StructureDocument48 pagesCapital StructurePRECIOUSNo ratings yet

- Booooo OkDocument247 pagesBooooo OkMelva MacusiNo ratings yet

- Fin Market and InstitutionDocument3 pagesFin Market and Institutionzeus manNo ratings yet

- 3 Internal ReconstructionDocument11 pages3 Internal ReconstructionkautiNo ratings yet

- What Is The Difference Between P & L Ac and Income & Expenditure Statement?Document22 pagesWhat Is The Difference Between P & L Ac and Income & Expenditure Statement?pranjali shindeNo ratings yet

- Project of Financial Reporting AnalysisDocument29 pagesProject of Financial Reporting AnalysisAhmad Mujtaba PhambraNo ratings yet