Professional Documents

Culture Documents

Daily Equity Market Report - 01.09.2021

Daily Equity Market Report - 01.09.2021

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 01.09.2021

Daily Equity Market Report - 01.09.2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

1ST SEPTEMBER, 2021

DAILY EQUITY MARKET REPORT

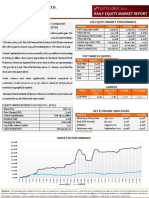

Indicator Current Previous Change

EQUITY MARKET HIGHLIGHTS: GSE Composite Index

GSE-Composite Index 2,750.92 2,750.37 0.55 pts

(GSE-CI) inched up by 0.55 points; returns 41.68% (YTD) YTD (GSE-CI) 41.68% 41.66% 0.05%

GSE-Finance Stock Index 1,929.19 1,929.19 0.00 pts

The Benchmark GSE Composite Index (GSE-CI) increased marginally by 0.55

YTD (GSE-FSI) 8.21% 8.21% 0.00%

points as a result of a GH¢0.05 price gain recorded by Fan milk PLC. (FML) Market Cap. (GH¢ MN) 62,912.55 62,904.96 7.59

to close at 2,750.92 translating into a Year-to-Date return of 41.68%. Volume Traded 90,697 752,717 -87.95%

Value Traded (GH¢) 260,750.53 929,687.50 -71.95%

The GSE Finance Stock Index (GSE-FSI) however continues to remain

TOP TRADED EQUITIES

unchanged as it closed today’s trading session at 1,929.19 (8.21% YTD) with

Ticker Volume Value (GH¢)

Market Capitalization growing to GH¢62.91 billion. UNIL 30,139 169,983.96

MTNGH 18,765 23,268.60

90,697 shares valued at GH¢260,750.53 were traded compared to

CAL 14,697 10,581.84

Tuesday’s turnover of 752,717 shares valued at GH¢929,687.50 as FML 10,658 17,581.90

fourteen (14) equities changed hands. ETI 4,780 334.60 65.2% of value traded

Unilever Ghana PLC. (UNIL) recorded the largest share of trades in both

GAINER

volume and value as it accounted for 33.2% and 65.2% of the total volume Ticker Close Price Open Price Change YTD Change

(GH¢) (GH¢)

and total value traded respectively.

FML 1.65 1.60 3.12% 52.78%

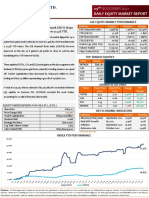

EQUITY UNDER REVIEW: SCANCOM PLC (MTNGH)

Share Price GH¢1.24

Price Change (YtD) 93.75% KEY ECONOMIC INDICATORS

Market Cap. (GH¢) 15,240.19 Indicator Current Previous

Dividend Yield 2.42% Monetary Policy Rate July 2021 13.50% 13.50%

Earnings Per Share GH¢0.1413 Real GDP Growth Q1 2021 3.10% 3.30%

Avg. Daily Trade Volumes 1,823,883 Inflation July 2021 9.00% 7.80%

Value Traded (YtD) GH¢265,367,865.00 Reference rate August 2021 13.51% 13.55%

Source: GSS, BOG, GBA

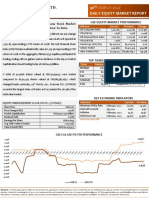

INDEX YTD PERFORMANCE

45.00%

40.00%

35.00%

30.00%

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

25-Jan

21-Jun

12-Jul

12-Apr

2-Aug

26-Apr

14-Jun

8-Feb

22-Feb

5-Jul

23-Aug

4-Jan

8-Mar

22-Mar

29-Mar

5-Apr

24-May

19-Jul

19-Apr

15-Feb

26-Jul

9-Aug

16-Aug

11-Jan

15-Mar

28-Jun

30-Aug

18-Jan

7-Jun

1-Feb

1-Mar

3-May

10-May

17-May

31-May

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Daily Equity Market Report - 09.09.2021Document1 pageDaily Equity Market Report - 09.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2021Document1 pageDaily Equity Market Report - 24.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.03.2022Document1 pageDaily Equity Market Report - 15.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.03.2022Document1 pageDaily Equity Market Report - 10.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.02.2022Document1 pageDaily Equity Market Report - 16.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.11.2021Document1 pageDaily Equity Market Report - 11.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.01.2022Document1 pageDaily Equity Market Report - 24.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2021Document1 pageDaily Equity Market Report - 06.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.11.2021Document1 pageDaily Equity Market Report - 24.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.11.2021Document1 pageDaily Equity Market Report - 09.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.08.2022Document1 pageDaily Equity Market Report - 03.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2021Document1 pageDaily Equity Market Report - 07.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.08.2022Document1 pageDaily Equity Market Report - 25.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.08.2021Document1 pageDaily Equity Market Report - 26.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.04.2022 2022-04-04Document1 pageDaily Equity Market Report 04.04.2022 2022-04-04Fuaad DodooNo ratings yet

- Daily Equity Market Report 29.11.2021 2021-11-29Document1 pageDaily Equity Market Report 29.11.2021 2021-11-29Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.07.2022Document1 pageDaily Equity Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.04.2022Document1 pageDaily Equity Market Report - 05.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 25.07.2022 2022-07-25Document1 pageDaily Equity Market Report 25.07.2022 2022-07-25Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.10.2021Document1 pageDaily Equity Market Report - 07.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.11.2021Document1 pageDaily Equity Market Report - 15.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report 16.12.2021 2021-12-16Document1 pageDaily Equity Market Report 16.12.2021 2021-12-16Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.07.2022Document1 pageDaily Equity Market Report - 26.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2022Document1 pageDaily Equity Market Report - 07.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.11.2021Document1 pageDaily Equity Market Report - 17.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 04-06-2021Document2 pagesWeekly Financial Market Review - Week Ending 04-06-2021Fuaad DodooNo ratings yet

- Stock Market Capitalization and Economic Growth in GhanaDocument13 pagesStock Market Capitalization and Economic Growth in GhanaAlexander DeckerNo ratings yet

- Weekly Capital Market Report - Week Ending 29.10.2021Document2 pagesWeekly Capital Market Report - Week Ending 29.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 15.10.2021Document2 pagesWeekly Capital Market Recap Week Ending 15.10.2021Fuaad DodooNo ratings yet