Professional Documents

Culture Documents

Truckincanada

Truckincanada

Uploaded by

Scarlett LiuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Truckincanada

Truckincanada

Uploaded by

Scarlett LiuCopyright:

Available Formats

INDUSTRY PROFILE

Light Trucks in

Canada

Reference Code: 0070-0348

Publication Date: November 2010

www.datamonitor.com

Datamonitor USA Datamonitor Europe Datamonitor Middle East Datamonitor Asia Pacific

245 Fifth Avenue 119 Farringdon Road and North Africa Level 46, 2 Park Street

4th Floor London EC1R 3DA Datamonitor Sydney, NSW 2000

New York, NY 10016 United Kingdom PO Box 24893 Australia

USA Dubai, UAE

t: +44 20 7551 9000

t: +1 212 686 7400 f: +44 20 7675 7500 t: +49 69 9754 4517 t: +61 2 8705 6900

f: +1 212 686 2626 e: eurinfo@datamonitor.com f: +49 69 9754 4900 f: +61 2 8705 6901

e: usinfo@datamonitor.com e: datamonitormena@ e: apinfo@datamonitor.com

datamonitor.com

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 1

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

Market value

The Canadian light trucks market shrank by 3.1% in 2009 to reach a value of $8.4 billion.

Market value forecast

In 2014, the Canadian light trucks market is forecast to have a value of $10.1 billion, an increase of 20.2%

since 2009.

Market volume

The Canadian light trucks market shrank by 2% in 2009 to reach a volume of 448.7 thousand units.

Market volume forecast

In 2014, the Canadian light trucks market is forecast to have a volume of 545.9 thousand units, an

increase of 21.7% since 2009.

Market segmentation I

LCV is the largest segment of the light trucks market in Canada, accounting for 99.9% of the market's

total volume.

Market segmentation II

Canada accounts for 5% of the Americas light trucks market value.

Market share

General Motors is the leading player in the Canadian light trucks market, generating a 35.1% share of the

market's volume.

Market rivalry

The current economic difficulties being experienced in Canada are having a profound effect on this

market.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 2

CONTENTS

TABLE OF CONTENTS

EXECUTIVE SUMMARY 2

MARKET OVERVIEW 7

Market definition 7

Research highlights 8

Market analysis 9

MARKET VALUE 10

MARKET VOLUME 11

MARKET SEGMENTATION I 12

MARKET SEGMENTATION II 13

MARKET SHARE 14

FIVE FORCES ANALYSIS 15

Summary 15

Buyer power 16

Supplier power 17

New entrants 18

Substitutes 19

Rivalry 20

LEADING COMPANIES 21

General Motors Company 21

Ford Motor Company 25

Chrysler Group LLC 29

MARKET FORECASTS 31

Market value forecast 31

Market volume forecast 32

MACROECONOMIC INDICATORS 33

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 3

CONTENTS

APPENDIX 35

Methodology 35

Industry associations 36

Related Datamonitor research 36

Disclaimer 37

ABOUT DATAMONITOR 38

Premium Reports 38

Summary Reports 38

Datamonitor consulting 38

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 4

CONTENTS

LIST OF TABLES

Table 1: Canada light trucks market value: $ billion, 2005–09 10

Table 2: Canada light trucks market volume: thousand units, 2005–09 11

Table 3: Canada light trucks market segmentation I:% share, by volume, 2009 12

Table 4: Canada light trucks market segmentation II: % share, by value, 2009 13

Table 5: Canada light trucks market share: % share, by volume, 2009 14

Table 6: General Motors Company: key facts 21

Table 7: General Motors Company: key financials ($) 23

Table 8: General Motors Company: key financial ratios 23

Table 9: Ford Motor Company: key facts 25

Table 10: Ford Motor Company: key financials ($) 27

Table 11: Ford Motor Company: key financial ratios 27

Table 12: Chrysler Group LLC: key facts 29

Table 13: Canada light trucks market value forecast: $ billion, 2009–14 31

Table 14: Canada light trucks market volume forecast: thousand units, 2009–14 32

Table 15: Canada size of population (million), 2005–09 33

Table 16: Canada gdp (constant 2000 prices, $ billion), 2005–09 33

Table 17: Canada gdp (current prices, $ billion), 2005–09 33

Table 18: Canada inflation, 2005–09 34

Table 19: Canada consumer price index (absolute), 2005–09 34

Table 20: Canada exchange rate, 2005–09 34

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 5

CONTENTS

LIST OF FIGURES

Figure 1: Canada light trucks market value: $ billion, 2005–09 10

Figure 2: Canada light trucks market volume: thousand units, 2005–09 11

Figure 3: Canada light trucks market segmentation I:% share, by volume, 2009 12

Figure 4: Canada light trucks market segmentation II: % share, by value, 2009 13

Figure 5: Canada light trucks market share: % share, by volume, 2009 14

Figure 6: Forces driving competition in the light trucks market in Canada, 2009 15

Figure 7: Drivers of buyer power in the light trucks market in Canada, 2009 16

Figure 8: Drivers of supplier power in the light trucks market in Canada, 2009 17

Figure 9: Factors influencing the likelihood of new entrants in the light trucks market in Canada,

2009 18

Figure 10: Factors influencing the threat of substitutes in the light trucks market in Canada, 2009 19

Figure 11: Drivers of degree of rivalry in the light trucks market in Canada, 2009 20

Figure 12: General Motors Company: revenues & profitability 24

Figure 13: General Motors Company: assets & liabilities 24

Figure 14: Ford Motor Company: revenues & profitability 28

Figure 15: Ford Motor Company: assets & liabilities 28

Figure 16: Canada light trucks market value forecast: $ billion, 2009–14 31

Figure 17: Canada light trucks market volume forecast: thousand units, 2009–14 32

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 6

MARKET OVERVIEW

MARKET OVERVIEW

Market definition

The light trucks market includes all light commercial vehicles (LCVs) and light buses and coaches (LBCs)

weighing up to 3.5 tons. This includes pick-ups and vans, but excludes sports utility and similar vehicles.

The market value is calculated in terms of manufacturer selling price (MSP), and excludes all taxes and

levies. Any currency conversions used in the creation of this report have been calculated using constant

2009 annual average exchange rates.

For the purposes of this report, the Americas consists of North America and South America.

North America consists of Canada, Mexico, and the United States.

South America comprises Argentina, Brazil, Chile, Colombia, and Venezuela.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 7

MARKET OVERVIEW

Research highlights

The Canadian light trucks market had total revenue of $8.4 billion in 2009, representing a compound

annual rate of change (CARC) of -1.6% for the period spanning 2005-2009.

Market consumption volumes decreased with a CARC of -0.7% between 2005 and 2009, to reach a total

of 448.7 thousand units in 2009.

The performance of the market is forecast to accelerate, with an anticipated CAGR of 4% for the five-year

period 2009-2014, which is expected to drive the market to a value of $10.1 billion by the end of 2014.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 8

MARKET OVERVIEW

Market analysis

After a period of consistent market decline, the Canadian light trucks market is expected to rebound and

post accelerating rates of growth towards 2014.

The Canadian light trucks market had total revenue of $8.4 billion in 2009, representing a compound

annual rate of change (CARC) of -1.6% for the period spanning 2005-2009. In comparison, the US and

Mexican markets declined with compound annual rates of change (CARCs) of -14.7% and -7.7%

respectively, over the same period, to reach respective values of $139.3 billion and $4 billion in 2009.

Market consumption volumes decreased with a CARC of -0.7% between 2005 and 2009, to reach a total

of 448.7 thousand units in 2009. The market's volume is expected to rise to 545.9 thousand units by the

end of 2014, representing a CAGR of 4% for the 2009-2014 period.

LCV sales had the highest volume in the Canadian light trucks market in 2009, with total sales of 448.1

thousand units, equivalent to 99.9% of the market's overall volume. In comparison, sales of LBC had a

volume of 599 units in 2009, equating to 0.1% of the market total.

The performance of the market is forecast to accelerate, with an anticipated CAGR of 4% for the five-year

period 2009-2014, which is expected to drive the market to a value of $10.1 billion by the end of 2014.

Comparatively, the US market will decline with a CARC of -6.1%, and the Mexican market will increase

with a CAGR of 9.3%, over the same period, to reach respective values of $101.6 billion and $6.2 billion

in 2014.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 9

MARKET VALUE

MARKET VALUE

The Canadian light trucks market shrank by 3.1% in 2009 to reach a value of $8.4 billion.

The compound annual rate of change of the market in the period 2005–09 was -1.6%.

Table 1: Canada light trucks market value: $ billion, 2005–09

Year $ billion C$ billion € billion % Growth

2005 8.9 10.2 6.4

2006 9.2 10.5 6.6 2.9%

2007 9.1 10.4 6.5 (1.1%)

2008 8.6 9.8 6.2 (5.0%)

2009 8.4 9.5 6.0 (3.1%)

CAGR: 2005–09 (1.6%)

Source: Datamonitor DATAMONITOR

Figure 1: Canada light trucks market value: $ billion, 2005–09

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 10

MARKET VOLUME

MARKET VOLUME

The Canadian light trucks market shrank by 2% in 2009 to reach a volume of 448.7 thousand units.

The compound annual rate of change of the market in the period 2005–09 was -0.7%.

Table 2: Canada light trucks market volume: thousand units, 2005–09

Year thousand units % Growth

2005 462.4

2006 481.8 4.2%

2007 480.2 (0.3%)

2008 457.7 (4.7%)

2009 448.7 (2.0%)

CAGR: 2005–09 (0.7%)

Source: Datamonitor DATAMONITOR

Figure 2: Canada light trucks market volume: thousand units, 2005–09

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 11

MARKET SEGMENTATION I

MARKET SEGMENTATION I

LCV is the largest segment of the light trucks market in Canada, accounting for 99.9% of the market's

total volume.

The LBC segment accounts for the remaining 0.1% of the market.

Table 3: Canada light trucks market segmentation I:% share, by volume, 2009

Category % Share

LCV 99.9%

LBC 0.1%

Total 100%

Source: Datamonitor DATAMONITOR

Figure 3: Canada light trucks market segmentation I:% share, by volume, 2009

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 12

MARKET SEGMENTATION II

MARKET SEGMENTATION II

Canada accounts for 5% of the Americas light trucks market value.

The United States accounts for a further 83.7% of the Americas market.

Table 4: Canada light trucks market segmentation II: % share, by value, 2009

Category % Share

United States 83.7%

Canada 5.0%

Mexico 2.4%

Rest of the Americas 8.8%

Total 100%

Source: Datamonitor DATAMONITOR

Figure 4: Canada light trucks market segmentation II: % share, by value, 2009

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 13

MARKET SHARE

MARKET SHARE

General Motors is the leading player in the Canadian light trucks market, generating a 35.1% share of the

market's volume.

Ford accounts for a further 24.3% of the market.

Table 5: Canada light trucks market share: % share, by volume, 2009

Company % Share

General Motors 35.1%

Ford 24.3%

Chrysler 10.9%

Other 29.7%

Total 100%

Source: Datamonitor DATAMONITOR

Figure 5: Canada light trucks market share: % share, by volume, 2009

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 14

FIVE FORCES ANALYSIS

FIVE FORCES ANALYSIS

The light trucks market will be analyzed taking manufacturers of light trucks as players. The key buyers

will be taken as end-users (including truck leasing firms), and raw material and equipment providers as

the key suppliers.

Summary

Figure 6: Forces driving competition in the light trucks market in Canada, 2009

Source: Datamonitor DATAMONITOR

The current economic difficulties being experienced in Canada are having a profound effect on this

market.

Many companies have struggled to cope with financial pressures, which have led to bankruptcy filings in

2009 for companies such as Chrysler and GM. Such a situation is intensifying competition in the market

as companies struggle to maintain revenues and keep their business afloat. The likelihood of new

entrants is further negatively impacted as the current situation proves off-putting to companies hoping to

enter the market. The threat from substitutes is increasing as the economic situation becomes

increasingly dire and buyers look for ways to cut costs. Buyers in this market benefit from low switching

costs and strong financial muscle, however this power remains moderate overall.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 15

FIVE FORCES ANALYSIS

Buyer power

Figure 7: Drivers of buyer power in the light trucks market in Canada, 2009

Source: Datamonitor DATAMONITOR

Many dealerships operating in this market are franchised to a particular manufacturer, and as such have

little influence upon the dynamics of the light trucks market. Buyers for light trucks generally tend to have

stronger financial muscle than in the car market as end users are mainly business customers. These can

include construction companies, transportation companies, as well as farmers and numerous small and

medium businesses. Losing these end users has a much larger impact on truck manufacturers than

individual consumers, thus increasing buyer power. Furthermore, buyers are relatively price sensitive, and

this is particularly evident in the current economic climate when businesses and consumers are looking

for ways to cut costs and save money. However, brand strength and reputation can diminish buyer power

to an extent as customers often display loyalty to a particular brand. Switching costs vary in this market

but are generally rather low. Buyers tend to be fairly reliant on the light trucks market, with little in the way

of viable alternatives for their transportation, which decreases buyer power to an extent. Overall, buyer

power is assessed as moderate in this market.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 16

FIVE FORCES ANALYSIS

Supplier power

Figure 8: Drivers of supplier power in the light trucks market in Canada, 2009

Source: Datamonitor DATAMONITOR

Suppliers in this market are mainly providers of raw materials and equipment for manufacture. They also

include manufacturers of parts and tires that are not produced in-house. With fairly low differentiation of

raw materials there is often little to distinguish between suppliers and manufacturers have low switching

costs. However primary raw materials used are aluminum and steel, the fluctuating prices of which are

increasingly putting pressure vehicle manufacturers. These rising prices can also threaten to damage the

relationship between manufacturers and their suppliers. One light truck manufacturer will only constitute a

small part of suppliers overall revenues, strengthening suppliers' position in this market. Furthermore the

high importance of the materials to the success of truck manufacturers' business enhances their position

further. Suppliers are able to implement forward integration, although this vertical integration also applies

to market players in terms of component manufacture. Overall supplier power in this market is moderate.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 17

FIVE FORCES ANALYSIS

New entrants

Figure 9: Factors influencing the likelihood of new entrants in the light trucks market in Canada,

2009

Source: Datamonitor DATAMONITOR

The Canadian light trucks market is facing difficulties within the current economic climate, creating a

situation that is off-putting to potential new entrants. Barriers to entry are also on the increase as Canada

face stricter regulations relating to the manufacture of vehicles. Authority to regulate emissions from

internal combustion engines in Canada currently rests with Environment Canada and Transport Canada.

Increasingly, the general approach to setting vehicle emissions standards in Canada is to harmonize

them with US Environmental Protection Agency federal standards as much as possible. This market has

fairly high barriers to entry with high fixed costs due to the manufacturing intensive nature of the

automotive industry. In this market start up costs are also significant, as players need to invest in

production facilities and a strong supply chain. Furthermore, the brand strength and reputation of the

established companies, such as Renault, also makes this market difficult to enter. Many of these

companies are able to tailor trucks to local markets, allowing existing competitors to benefit from scale

economies when entering new markets. A new company may need to ensure some level of integration to

compete with these incumbents. The likelihood of new entrants to this market is assessed as weak at

present.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 18

FIVE FORCES ANALYSIS

Substitutes

Figure 10: Factors influencing the threat of substitutes in the light trucks market in Canada, 2009

Source: Datamonitor DATAMONITOR

Substitutes to this market include second-hand vehicles. It is common for smaller businesses and

companies in developing countries to buy used vehicles as they are less likely to be able to afford new

light trucks. Prior to the global economic downturn, the purchasing power of companies in developed

economies meant that the threat from this substitute was relatively weak. However, the threat is

increasing in Canada as businesses attempt to cope with difficult financial times by cutting costs. On the

other hand, new emission standards, together with technological solutions, may lead to a situation in

which the companies owning new fleet may be able to complete work cheaper and faster than the

competition. Overall the threat of substitutes is assessed as moderate.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 19

FIVE FORCES ANALYSIS

Rivalry

Figure 11: Drivers of degree of rivalry in the light trucks market in Canada, 2009

Source: Datamonitor DATAMONITOR

In the light trucks market there exist a small number of large companies between whom competition is

fierce. Following the economic downturn that has been experienced on a global scale, this situation has

further intensified as companies have struggled to cope as revenues decline. For example, in April 2009

Chrysler LLC filed for Chapter 11 bankruptcy protection and announced a plan for a partnership with

Italian automaker Fiat. Similarly, in June 2009 General Motors filed for Chapter 11 bankruptcy

proceedings from which it emerged in July 2009 in a reorganization in which a new entity acquired the

most valuable assets. GM is now majority owned by the United States Treasury and Canadian

governments. Companies operating in this market tend to have operations in other markets such as

passenger car manufacture, which reduces their reliance on the light trucks market to an extent.

However, at present the whole vehicle manufacture industry is under pressure as demand weakens and

revenues drop. This creates an intensely competitive environment. Differentiation exists in terms of model

types and companies invest heavily in marketing to promote these models, reducing rivalry somewhat.

The current economic climate in Canada is reducing the uptake of vehicles in this market thus intensifying

rivalry as companies compete for a share of a smaller market. Overall, rivalry is currently assessed as

strong in this market.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 20

LEADING COMPANIES

LEADING COMPANIES

General Motors Company

Table 6: General Motors Company: key facts

Head office: 300 Renaissance Center, Detroit, Michigan 48265 3000 USA

Telephone: 1 313 556 5000

Fax: 1 313 556 5108

Website: www.gm.com

Financial year-end: December

Ticker: GM

Stock exchange: New York

Source: company website DATAMONITOR

General Motors (GM) is primarily engaged in the design, development, manufacturing, and marketing of

automotive products worldwide. The company manufactures vehicles in 31 countries. In FY2009, GM sold

7.5 million vehicles under its brands, including Buick, Cadillac, Chevrolet, FAW, GMC, GM Daewoo,

Holden, Jiefang, Opel, Vauxhall and Wuling. GM's largest national market is China, followed by the US,

Brazil, Germany, the UK, Canada, and Italy.

As a result of tough economic conditions and a rapid decline in sales in the three months ended

December 31 2008, GM determined that, despite the actions it had then taken to restructure its U.S.

business, it would be unable to pay its obligations in the normal course of business in 2009 or service its

debt in a timely fashion, which required the development of a new plan that depended on financial

assistance from the U.S. government. In December 2008 GM therefore requested and received financial

assistance from the U.S. government and entered into the UST Loan Agreement. In early 2009 GM's

business results and liquidity continued to deteriorate, and, as a result, GM obtained additional funding

from the UST under the UST Loan Agreement. GM also received funding from EDC, a corporation wholly-

owed by the government of Canada, under a loan and security agreement entered into in April 2009 (EDC

Loan Facility).

Substantially all of GM's cars, trucks and parts are marketed through retail dealers in North America, and

through distributors and dealers outside of North America, the substantial majority of which are

independently owned. As of December, 2009 there were 5,619 vehicle dealers in the US, 568 in Canada

and 263 in Mexico. Additionally, there were a total of 14,317 distribution outlets throughout the rest of the

world. These outlets include distributors, dealers and authorized sales, service and parts outlets.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 21

LEADING COMPANIES

As of December 2009, GM had equity ownership stakes directly or indirectly through various regional

subsidiaries, including GM Daewoo Auto & Technology (GM Daewoo), Shanghai General Motors (SGM),

SAIC-GM-Wuling Automobile (SGMW), and FAW-GM Light Duty Commercial Vehicle (FAW-GM). The

company operates through three business divisions, General Motors North America (GMNA), General

Motors Europe (GME), and General Motors M International Operations (GMIO).

GMNA primarily meets the demands of customers in North America with vehicles developed,

manufactured and/or marketed under the brands including, Buick, Cadillac, Chevrolet and GMC. The

demands of customers outside North America are primarily met with vehicles developed, manufactured

and/or marketed with brand names, Opel, GMC, Vauxhall, Buick, Cadillac, Isuzu, Holden, Chevrolet, and

Daewoo. GMNA sold 2.5 million vehicles in FY2009.

GME primarily meets the demands of customers in Europe. Vehicle sales and market share data from

sales of GM Daewoo produced Chevrolet brand products in Europe are reported as part of GME. GME

sold 1.7 million vehicles in FY2009.

GMIO primarily meets the demands of customers in China, Brazil, Venezuela, Australia, Middle East,

South Korea, Argentina, India, Colombia, Egypt and other regions. GMIO sold 3.3 million vehicles in

FY2009.

The company produced about 6.5 million vehicles in FY2009 of which 3.5 million vehicles were produced

by GMIO, 1.9 million by GMNA and 1.1 million by GME.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 22

LEADING COMPANIES

Key Metrics

The company recorded revenues of $104,589 million in the fiscal year ending December 2009, a

decrease of 29.8% compared to fiscal 2008. Its net income was $104,690 million in fiscal 2009, compared

to a net loss of $30,860 million in the preceding year.

Table 7: General Motors Company: key financials ($)

$ million 2005 2006 2007 2008 2009

Revenues 193,050.0 205,601.0 181,122.0 148,979.0 104,589.0

Net income (loss) (10,417.0) (1,978.0) (38,732.0) (30,860.0) 104,690.0

Total assets 474,156.0 186,304.0 148,883.0 91,047.0 136,295.0

Total liabilities 458,456.0 190,766.0 184,363.0 177,201.0 107,340.0

Employees 335,000 280,000 266,000 243,000 217,000

Source: company filings DATAMONITOR

Table 8: General Motors Company: key financial ratios

Ratio 2005 2006 2007 2008 2009

Profit margin (5.4%) (1.0%) (21.4%) (20.7%) 100.1%

Revenue growth (1.2%) 6.5% (11.9%) (17.7%) (29.8%)

Asset growth (1.2%) (60.7%) (20.1%) (38.8%) 49.7%

Liabilities growth 1.4% (58.4%) (3.4%) (3.9%) (39.4%)

Debt/asset ratio 96.7% 102.4% 123.8% 194.6% 78.8%

Return on assets (2.2%) (0.6%) (23.1%) (25.7%) 92.1%

Revenue per employee $576,269 $734,289 $680,910 $613,082 $481,977

Profit per employee ($31,096) ($7,064) ($145,609) ($126,996) $482,442

Source: company filings DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 23

LEADING COMPANIES

Figure 12: General Motors Company: revenues & profitability

Source: company filings DATAMONITOR

Figure 13: General Motors Company: assets & liabilities

Source: company filings DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 24

LEADING COMPANIES

Ford Motor Company

Table 9: Ford Motor Company: key facts

Head office: One American Road, Suite 1026, Dearborn, Michigan 48126 USA

Telephone: 1 313 845 8540

Fax: 1 313 845 6073

Website: www.ford.com

Financial year-end: December

Ticker: F

Stock exchange: New York

Source: company website DATAMONITOR

Ford Motor Company (Ford) is one of the largest automotive manufacturers in the world. The company

manufactures and distributes automobiles across six continents. With 80 manufacturing facilities

worldwide, the company's core and affiliated automotive brands include Ford, Lincoln, Mercury and Volvo.

The company conducts its business through two divisions: automotive and financial services. Within these

divisions, Ford's automotive business is further classified into reportable segments based upon its

geographical and organizational structure.

The automotive business division consists of the design, development, manufacture, sale and service of

cars, trucks and service parts. Through this division, Ford produces a wide range of vehicles including

cars for the small, medium, large and premium segments; trucks; buses/vans (including minivans); full-

size pickups; sport utility vehicles (SUV) and vehicles for the medium/heavy segments. In FY2009, the

company sold approximately 4,817,000 vehicles at wholesale throughout the world. The company's

automotive business is organized into the following segments: Ford North America, Ford South America,

Ford Europe, Ford Asia Pacific and Africa, and Volvo.

The Ford North America segment primarily includes the sale of Ford, Lincoln and Mercury brand vehicles

and related service parts in North America (the US, Canada and Mexico), together with the associated

costs to design, develop, manufacture and service these vehicles and parts. This segment also included

the sale of Mazda6 vehicles through its consolidated subsidiary, AutoAlliance International (AAI). This

business was sold in January 2010.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 25

LEADING COMPANIES

The Ford South America and Ford Europe segment includes primarily the sale of Ford brand vehicles and

related service parts in South America and in Europe (including all parts of Turkey and Russia),

respectively. Ford Asia Pacific and Africa segment primarily includes the sale of Ford-brand vehicles and

related service parts in the Asia Pacific region and South Africa. The Volvo segment includes primarily the

sale of Volvo brand vehicles and related service parts throughout the world (including in North America,

South America, Europe, Asia Pacific, and Africa).

In addition to producing and selling cars and trucks, Ford also provides a range of after sales services

and products through its dealer network. In addition to the products that are sold to dealers for retail sale,

Ford also sells cars and trucks to its dealers for sale to fleet customers, including daily rental car

companies, commercial fleet customers, leasing companies and governments. The company provides

services such as maintenance and light repair, heavy repair, collision, vehicle accessories and extended

service warranty. In North America, the company markets these products and services under several

brands, including Genuine Ford and Lincoln-Mercury Parts and Service, Ford Custom Accessories, Ford

Extended Service Plan, and Motorcraft. At the end of December 2009, the number of dealerships

distributing Ford's vehicle brands worldwide was approximately 17,107 (including 11,682 for Ford, 2,269

for Volvo, 1,780 for Mercury, and 1,376 for Lincoln).

The financial services division operates through the company subsidiary, Ford Motor Credit (Ford Credit).

Ford Credit offers a wide variety of automotive financing products to, and through automotive dealers

throughout the world. The predominant share of Ford Credit's business consists of financing Ford

vehicles and supporting the company's dealers. Ford Credit's primary financial products fall into three

categories: retail financing, wholesale financing, and other financing.

Ford Credit also services the finance receivables and leases that it originates and purchases, makes

loans to affiliates, purchases receivables from company subsidiaries, and provides selected insurance

services. Ford Credit's revenues are earned primarily from payments made under retail installment sale

contracts and retail leases, and from payments made under wholesale and other dealer loan financing

programs. Ford Credit does business in all states in the US and in all provinces in Canada through

automotive dealer financing branches and regional business centers. Outside US, FCE Bank (FCE) is

Ford Credit's largest operation. FCE's primary business is to support the sale of Ford's vehicles in Europe

through its dealer network. FCE offers a variety of retail, leasing and wholesale finance plans in most

countries in which it operates; FCE does business in the UK, Germany and most other European

countries. Ford Credit, through its subsidiaries, also operates in the Asia Pacific and Latin American

regions. In addition, FCE, through its worldwide trade financing division, provides financing to dealers in

countries where typically Ford has no established local presence.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 26

LEADING COMPANIES

Key Metrics

The company recorded revenues of $118,308 million in the fiscal year ending December 2009, a

decrease of 19.1% compared to fiscal 2008. Its net income was $2,717 million in fiscal 2009, compared to

a net loss of $14,672 million in the preceding year.

Table 10: Ford Motor Company: key financials ($)

$ million 2005 2006 2007 2008 2009

Revenues 176,835.0 160,065.0 172,455.0 146,277.0 118,308.0

Net income (loss) 1,440.0 (12,613.0) (2,723.0) (14,672.0) 2,717.0

Total assets 275,936.0 279,196.0 279,264.0 218,328.0 194,850.0

Total liabilities 262,494.0 281,502.0 272,215.0 235,639.0 201,365.0

Employees 300,000 283,000 224,000 213,000 176,000

Source: company filings DATAMONITOR

Table 11: Ford Motor Company: key financial ratios

Ratio 2005 2006 2007 2008 2009

Profit margin 0.8% (7.9%) (1.6%) (10.0%) 2.3%

Revenue growth 2.6% (9.5%) 7.7% (15.2%) (19.1%)

Asset growth (7.9%) 1.2% 0.0% (21.8%) (10.8%)

Liabilities growth (7.0%) 7.2% (3.3%) (13.4%) (14.5%)

Debt/asset ratio 95.1% 100.8% 97.5% 107.9% 103.3%

Return on assets 0.5% (4.5%) (1.0%) (5.9%) 1.3%

Revenue per employee $589,450 $565,601 $769,888 $686,746 $672,205

Profit per employee $4,800 ($44,569) ($12,156) ($68,883) $15,438

Source: company filings DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 27

LEADING COMPANIES

Figure 14: Ford Motor Company: revenues & profitability

Source: company filings DATAMONITOR

Figure 15: Ford Motor Company: assets & liabilities

Source: company filings DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 28

LEADING COMPANIES

Chrysler Group LLC

Table 12: Chrysler Group LLC: key facts

Head office: Auburn Hills, Michigan 48321 8004 USA

Telephone: 1 800 992 1997

Website: www.chryslergroupllc.com

Source: company website DATAMONITOR

Chrysler Group manufactures cars and trucks under the brand names Chrysler, Jeep, Dodge, Ram Truck

and Global Electric Motorcars (GEM). It operates 14 assembly plants, 11 powertrain plants, three

stamping operations, and six technical centers in North America.

The group operates through six brand lines: Chrysler, Dodge, Jeep, Global Electric Motorcars (GEM),

Mopar and Dodge Ram.

Chrysler Group designs, engineers, manufactures, assembles and sells passenger cars, minivans and

sport utility vehicles (SUVs) under the brand name Chrysler. The group's Chrysler brand lines include:

Chrysler 300, Chrysler Aspen, Crossfire, Pacifica, PT Cruiser Convertible, PT Cruiser, Sebring Sedan,

Sebring Convertible, and Town & Country.

The group's Dodge brand lines include: Avenger, Caliber, Challenger, Charger, Grand Caravan, Journey,

Magnum, Viper, Dakota, Durango, Nitro, Ram Trucks and Sprinter.

Chrysler manufactures sport utility vehicles (SUVs) under the brand name Jeep. The group's Jeep brand

lines include: Wrangler, Wrangler Unlimited, Patriot, Commander, Liberty, Grand Cherokee and

Compass.

Global Electric Motorcars (GEM), a Chrysler Group company, manufactures battery electric low-speed

vehicles. The GEM vehicles are used in fleet services, hospitals, military bases, airports, college and

industrial campuses, and parks and planned communities.

The group provides original equipment parts, accessories and services for Chrysler, Dodge and Jeep

vehicles under the brand name Mopar. It also includes Mopar Performance, a subdivision which provides

performance aftermarket parts for Chrysler-built vehicles.

The group manufactures trucks under the Dodge Ram brand. Its brand products include 2010 Ram 1500,

2010 Ram 2500 & 3500, 2010 Ram Chassis Cab 3500/4500/5500 and 2010 Dakota.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 29

LEADING COMPANIES

From 1998 to 2007, Chrysler and its subsidiaries were part of the German based DaimlerChrysler (now

Daimler AG).

In 2007, DaimlerChrysler sold 80.1% interest of Chrysler Holding to Cerberus Capital Management, a

private equity firm, to form a new company named Chrysler LLC.

Global Electric Motorcars, a Chrysler company, introduced the next generation of gas-free and emission-

free, battery electric vehicles in 2008. In the same year, Chrysler partnered with ZF Friedrichshafen to

form a new axle manufacturing alliance, to access the advanced axle technologies.

Chrysler and Fiat Group finalized the global strategic alliance and formed a new company under the

name Chrysler Group LLC in June 2009.

Key Metrics

Full financial information is unavailable. The company recorded revenues of $17,710 million for the six

month period to December 2009. Net loss for the same period was $3785 million. The company also

announced revenue for the six months to the end of June 2010 of $20,165 million and a net loss of $369

million.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 30

MARKET FORECASTS

MARKET FORECASTS

Market value forecast

In 2014, the Canadian light trucks market is forecast to have a value of $10.1 billion, an increase of 20.2%

since 2009.

The compound annual growth rate of the market in the period 2009–14 is predicted to be 4%.

Table 13: Canada light trucks market value forecast: $ billion, 2009–14

Year $ billion C$ billion € billion % Growth

2009 8.4 9.5 6.0 (3.1%)

2010 8.6 9.8 6.2 3.0%

2011 8.9 10.1 6.4 3.3%

2012 9.2 10.5 6.6 3.8%

2013 9.6 11.0 6.9 4.2%

2014 10.1 11.6 7.3 5.5%

CAGR: 2009–14 4.0%

Source: Datamonitor DATAMONITOR

Figure 16: Canada light trucks market value forecast: $ billion, 2009–14

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 31

MARKET FORECASTS

Market volume forecast

In 2014, the Canadian light trucks market is forecast to have a volume of 545.9 thousand units, an

increase of 21.7% since 2009.

The compound annual growth rate of the market in the period 2009–14 is predicted to be 4%.

Table 14: Canada light trucks market volume forecast: thousand units, 2009–14

Year thousand units % Growth

2009 448.7 (2.0%)

2010 461.2 2.8%

2011 476.0 3.2%

2012 494.4 3.9%

2013 516.3 4.4%

2014 545.9 5.7%

CAGR: 2009–14 4.0%

Source: Datamonitor DATAMONITOR

Figure 17: Canada light trucks market volume forecast: thousand units, 2009–14

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 32

MACROECONOMIC INDICATORS

MACROECONOMIC INDICATORS

Table 15: Canada size of population (million), 2005–09

Year Population (million) % Growth

2005 32.4 0.8%

2006 32.7 0.8%

2007 32.9 0.9%

2008 33.2 0.8%

2009 33.5 0.8%

Source: Datamonitor DATAMONITOR

Table 16: Canada gdp (constant 2000 prices, $ billion), 2005–09

Year Constant 2000 Prices, $ billion % Growth

2005 821.7 2.9%

2006 845.3 2.9%

2007 867.8 2.7%

2008 871.3 0.4%

2009 848.7 (2.6%)

Source: Datamonitor DATAMONITOR

Table 17: Canada gdp (current prices, $ billion), 2005–09

Year Current Prices, $ billion % Growth

2005 1,129.4 12.9%

2006 1,266.5 12.1%

2007 1,402.6 10.7%

2008 1,451.3 3.5%

2009 1,310.1 (9.7%)

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 33

MACROECONOMIC INDICATORS

Table 18: Canada inflation, 2005–09

Year Inflation Rate (%)

2005 2.2%

2006 2.0%

2007 2.1%

2008 2.4%

2009 0.3%

Source: Datamonitor DATAMONITOR

Table 19: Canada consumer price index (absolute), 2005–09

Year Consumer Price Index (2000 = % Growth

100)

2005 112.2 2.2%

2006 114.4 2.0%

2007 116.9 2.1%

2008 119.7 2.4%

2009 120.1 0.3%

Source: Datamonitor DATAMONITOR

Table 20: Canada exchange rate, 2005–09

Year Exchange rate ($/C$) Exchange rate (€/C$)

2005 1.2117 1.5061

2006 1.1346 1.4236

2007 1.0744 1.4701

2008 1.0667 1.5608

2009 1.1417 1.5876

Source: Datamonitor DATAMONITOR

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 34

APPENDIX

APPENDIX

Methodology

Datamonitor Industry Profiles draw on extensive primary and secondary research, all aggregated,

analyzed, cross-checked and presented in a consistent and accessible style.

Review of in-house databases – Created using 250,000+ industry interviews and consumer surveys

and supported by analysis from industry experts using highly complex modeling & forecasting tools,

Datamonitor’s in-house databases provide the foundation for all related industry profiles

Preparatory research – We also maintain extensive in-house databases of news, analyst

commentary, company profiles and macroeconomic & demographic information, which enable our

researchers to build an accurate market overview

Definitions – Market definitions are standardized to allow comparison from country to country. The

parameters of each definition are carefully reviewed at the start of the research process to ensure they

match the requirements of both the market and our clients

Extensive secondary research activities ensure we are always fully up-to-date with the latest

industry events and trends

Datamonitor aggregates and analyzes a number of secondary information sources, including:

- National/Governmental statistics

- International data (official international sources)

- National and International trade associations

- Broker and analyst reports

- Company Annual Reports

- Business information libraries and databases

Modeling & forecasting tools – Datamonitor has developed powerful tools that allow quantitative

and qualitative data to be combined with related macroeconomic and demographic drivers to create

market models and forecasts, which can then be refined according to specific competitive, regulatory

and demand-related factors

Continuous quality control ensures that our processes and profiles remain focused, accurate and

up-to-date

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 35

APPENDIX

Industry associations

International Organization of Motor Vehicle Manufacturers (OICA)

4 rue de Berri, 8éme arrondissement, Paris, France

Tel.: 33 1 4359 13

Fax: 33 1 4563 8441

www.oica.net

Canadian Vehicle Manufacturers' Association

170 Attwell Drive, Suite 4, Toronto, Ontario, M9W 5Z5, Canada

Tel.: 1 416 364 9333

Fax: 1 416 367 3221

www.cvma.ca/

Alliance of Automobile Manufacturers (Auto Alliance)

1401 Eye Street NW, Suite 9, Washington, DC 205, USA

Tel.: 1 202 326 55

Fax: 1 202 326 5598

www.autoalliance.org

Related Datamonitor research

Industry Profile

Light Trucks in Mexico

Light Trucks in Brazil

Light Trucks in France

Light Trucks in Germany

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 36

APPENDIX

Disclaimer

All Rights Reserved.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form

by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior

permission of the publisher, Datamonitor plc.

The facts of this report are believed to be correct at the time of publication but cannot be guaranteed.

Please note that the findings, conclusions and recommendations that Datamonitor delivers will be

based on information gathered in good faith from both primary and secondary sources, whose

accuracy we are not always in a position to guarantee. As such Datamonitor can accept no liability

whatever for actions taken based on any information that may subsequently prove to be incorrect.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 37

ABOUT DATAMONITOR

ABOUT DATAMONITOR

The Datamonitor Group is a world-leading provider of premium global business information, delivering

independent data, analysis and opinion across the Automotive, Consumer Markets, Energy & Utilities,

Financial Services, Logistics & Express, Pharmaceutical & Healthcare, Retail, Technology and

Telecoms industries.

Combining our industry knowledge and experience, we assist over 6,000 of the world’s leading

companies in making better strategic and operational decisions.

Delivered online via our user-friendly web platforms, our market intelligence products and services

ensure that you will achieve your desired commercial goals by giving you the insight you need to best

respond to your competitive environment.

Premium Reports

Datamonitor's premium reports are based on primary research with industry panels and consumers.

We gather information on market segmentation, market growth and pricing, competitors and products.

Our experts then interpret this data to produce detailed forecasts and actionable recommendations,

helping you create new business opportunities and ideas.

Summary Reports

Our series of company, industry and country profiles complements our premium products, providing

top-level information on 30,000 companies, 3,000 industries and 100 countries. While they do not

contain the highly detailed breakdowns found in premium reports, profiles give you the most important

qualitative and quantitative summary information you need - including predictions and forecasts.

Datamonitor consulting

We hope that the data and analysis in this profile will help you make informed and imaginative business

decisions. If you have further requirements, Datamonitor’s consulting team may be able to help you. For

more information about Datamonitor’s consulting capabilities, please contact us directly at

consulting@datamonitor.com.

Canada - Light Trucks 0070 - 0348 - 2009

© Datamonitor. This profile is a licensed product and is not to be photocopied Page 38

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- Adams Herb Chassis EngineeringDocument142 pagesAdams Herb Chassis EngineeringTapare Ankush90% (39)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Motor Grader XCMG GR215Document1 pageMotor Grader XCMG GR215HarisArmadi90% (10)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- T33000 Transmission DANADocument12 pagesT33000 Transmission DANAcristiannnnnnnnnn88% (8)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AISIN Catalog 2018Document60 pagesAISIN Catalog 2018Diego López0% (1)

- 234 Mazda BT 50 Factory Service Repair Manual J97M PDFDocument2,103 pages234 Mazda BT 50 Factory Service Repair Manual J97M PDFМихаил100% (2)

- Citroen Berlingo1996 2005Document12 pagesCitroen Berlingo1996 2005Marcelo Mura67% (3)

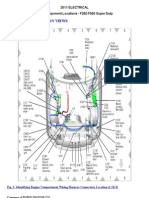

- 2011 ELECTRICAL OEM Component Locations - F250-F550 Super Duty PDFDocument41 pages2011 ELECTRICAL OEM Component Locations - F250-F550 Super Duty PDFAbdiel Vivanco100% (1)

- 125C PDFDocument96 pages125C PDFIbrain Moran100% (2)

- 2020 Cadillac ct5 Owners Manual PDFDocument359 pages2020 Cadillac ct5 Owners Manual PDFRAIN QINo ratings yet

- Mi F4a41Document4 pagesMi F4a41Miguel MorosNo ratings yet

- SBB Key Programer Models TableDocument23 pagesSBB Key Programer Models TableLucas Lopes FerreiraNo ratings yet

- Brilliance V5 2016 LBDocument6 pagesBrilliance V5 2016 LBmahmoudfaridgdNo ratings yet

- Usados Disponibles: Marca Modelo Color Dominio Año KM Precio VtaDocument3 pagesUsados Disponibles: Marca Modelo Color Dominio Año KM Precio Vtamarcos falcónNo ratings yet

- Gf00.19-P-2000-01baa Location and Assignment of Ground Points, Engine Compartment, LeftDocument2 pagesGf00.19-P-2000-01baa Location and Assignment of Ground Points, Engine Compartment, LeftDimitris KostarelosNo ratings yet

- Aw80 40le CatalogDocument3 pagesAw80 40le CatalogIvan Jose Torres LunaNo ratings yet

- WCAR TWC Summary Report - 28112022171805Document1 pageWCAR TWC Summary Report - 28112022171805FaizalNo ratings yet

- Mahindra Diag Manual Scorpio p10 of 53Document1 pageMahindra Diag Manual Scorpio p10 of 53William DeerNo ratings yet

- 7-2 Acho Que e de EmpilhadeiraDocument12 pages7-2 Acho Que e de EmpilhadeiraMarcioMartinhoFerreiraNo ratings yet

- Volvo l150h Service ListDocument2 pagesVolvo l150h Service ListSanjay DuttaNo ratings yet

- Ford Focus mk2 2007-2011 Fuse DiagDocument5 pagesFord Focus mk2 2007-2011 Fuse DiagAZERGUINo ratings yet

- Internal Analysis of Nissan Motors Co - PPDocument1 pageInternal Analysis of Nissan Motors Co - PPvignesh GtrNo ratings yet

- Lancia Thesis SWDocument5 pagesLancia Thesis SWBuyPapersOnlineUK100% (2)

- 408research Doc For BUS 5004Document11 pages408research Doc For BUS 5004olanrewaju victorNo ratings yet

- Volkswagen AGDocument7 pagesVolkswagen AGjogaviarNo ratings yet

- D20 25 30GP - Sb1249e PDFDocument580 pagesD20 25 30GP - Sb1249e PDFGORDNo ratings yet

- 01 - Etacs & BCMDocument8 pages01 - Etacs & BCMQuang HuyNo ratings yet

- TSB FUE038 Air Drain Case Replacement Rev 1Document5 pagesTSB FUE038 Air Drain Case Replacement Rev 1Cristhian HuilcapazNo ratings yet

- TGL Ta Ref - Doc P/N Deskription QTYDocument12 pagesTGL Ta Ref - Doc P/N Deskription QTYtomyaresNo ratings yet

- MeganeCoupeAndRenaultsport PDFDocument20 pagesMeganeCoupeAndRenaultsport PDFCaroline PuckettNo ratings yet