Professional Documents

Culture Documents

MGT 480

MGT 480

Uploaded by

Nur Nahar LimaCopyright:

Available Formats

You might also like

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Case Marriott A and Flinder ValvesDocument6 pagesCase Marriott A and Flinder ValvesGerardo FumagalNo ratings yet

- Mergers and AcquisitionsDocument54 pagesMergers and AcquisitionsSudhir Kumar Varshney100% (5)

- 10 - Chapter 2 PDFDocument29 pages10 - Chapter 2 PDFSai PrabhasNo ratings yet

- 12 OperationsoninsuranceDocument14 pages12 Operationsoninsurancedimas rialdyNo ratings yet

- 12 OperationsoninsuranceDocument14 pages12 OperationsoninsuranceKlysh SalvezNo ratings yet

- June Green Modern Finance 4FIN7A2 PaperDocument17 pagesJune Green Modern Finance 4FIN7A2 PaperJune GreenNo ratings yet

- 12 OperationsoninsuranceDocument14 pages12 Operationsoninsuranceagasthiya parshithNo ratings yet

- Managing Risks in MergersDocument4 pagesManaging Risks in Mergersk gowtham kumarNo ratings yet

- Mergers and Acquisitions: A Complete and Updated OverviewDocument12 pagesMergers and Acquisitions: A Complete and Updated OverviewRizwana ArifNo ratings yet

- FMGD Term End Assignment: Submitted By: Yashodhan Joshi UM18068 Xavier Institute of ManagementDocument6 pagesFMGD Term End Assignment: Submitted By: Yashodhan Joshi UM18068 Xavier Institute of ManagementYashodhan JoshiNo ratings yet

- Course 7: Mergers & Acquisitions (Part 1) : Prepared By: Matt H. Evans, CPA, CMA, CFMDocument18 pagesCourse 7: Mergers & Acquisitions (Part 1) : Prepared By: Matt H. Evans, CPA, CMA, CFMAshish NavadayNo ratings yet

- Risks: Impact of Capital Structure On Profitability: Panel Data Evidence of The Telecom Industry in The United StatesDocument20 pagesRisks: Impact of Capital Structure On Profitability: Panel Data Evidence of The Telecom Industry in The United StatesN SNo ratings yet

- Primus Automation Division FinalDocument12 pagesPrimus Automation Division FinalreinharduyNo ratings yet

- F3 Chapter 11Document12 pagesF3 Chapter 11Ali ShahnawazNo ratings yet

- A Literature Review of The Trade Off Theory of Capital StructureDocument10 pagesA Literature Review of The Trade Off Theory of Capital Structurekebede desalegnNo ratings yet

- Managerial Economics: Applications, Strategy, and Tactics, 12 EditionDocument16 pagesManagerial Economics: Applications, Strategy, and Tactics, 12 Editionsamer abou saadNo ratings yet

- Project On Merger and AcquisitionDocument8 pagesProject On Merger and Acquisitionaashish0128No ratings yet

- Mergers Acquisitions Sam ChapDocument24 pagesMergers Acquisitions Sam ChapNaveen RaajNo ratings yet

- Addendum - Covid-19 CrisisDocument8 pagesAddendum - Covid-19 CrisishacerserttNo ratings yet

- Managerial EconomicsDocument16 pagesManagerial EconomicsIzwan YusofNo ratings yet

- Why M&As Fail Often?Document17 pagesWhy M&As Fail Often?Insideout100% (4)

- Chapter 8 - Operations of Insurance CompaniesDocument11 pagesChapter 8 - Operations of Insurance CompaniesFrancis Gumawa100% (1)

- Audit and AssuranceDocument8 pagesAudit and AssuranceJoe AndrewNo ratings yet

- GE Prior To Jack WelchDocument3 pagesGE Prior To Jack WelchFirdausNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- Failure MergersDocument23 pagesFailure MergersBrijesh Sarkar100% (1)

- Strategic Jet Blue UpdatedDocument28 pagesStrategic Jet Blue UpdatedSakshi SharmaNo ratings yet

- Pledge (And Hedge) Allegiance To The CompanyDocument6 pagesPledge (And Hedge) Allegiance To The CompanyBrian TayanNo ratings yet

- Merger and AcquisitionDocument11 pagesMerger and AcquisitionPriyanka AgarwalNo ratings yet

- Is A Share Buyback Right For YouDocument4 pagesIs A Share Buyback Right For YouJesus Anthony QuiambaoNo ratings yet

- Corporate Restructuring and InsolvencyDocument19 pagesCorporate Restructuring and InsolvencyJayachandra JcNo ratings yet

- Mergers & Acquisitions Unit I: Is M & A, A Simple Investment Decision?Document19 pagesMergers & Acquisitions Unit I: Is M & A, A Simple Investment Decision?reedbkNo ratings yet

- Mergers Acquisitions Sam ChapDocument24 pagesMergers Acquisitions Sam ChapMaria Mirabela StefanNo ratings yet

- Letter To Investors, Q1 2021 Performance: ACML Performance Is Net of Fees and Standard CostsDocument6 pagesLetter To Investors, Q1 2021 Performance: ACML Performance Is Net of Fees and Standard CostsYog MehtaNo ratings yet

- DerivativesDocument10 pagesDerivativesmuralikrishna3322No ratings yet

- Mergers & AcquisitionsDocument62 pagesMergers & AcquisitionsJermaine Weiss100% (1)

- Ib BM - Paper 1Document6 pagesIb BM - Paper 1DANIYA GENERALNo ratings yet

- Mangerial EconomicsDocument5 pagesMangerial EconomicsEhteshamNo ratings yet

- MGT - 304 Assignment - 2 - 1Document7 pagesMGT - 304 Assignment - 2 - 1Risad AhmedNo ratings yet

- 4.aug Ijmte - 830Document16 pages4.aug Ijmte - 830BasappaSarkarNo ratings yet

- ITM - Capstone Project ReportDocument53 pagesITM - Capstone Project ReportArchana Singh33% (3)

- Mergers & Acquisitions: Prepared byDocument31 pagesMergers & Acquisitions: Prepared byhasansupNo ratings yet

- Corporate Restructuring - Types and ImportanceDocument15 pagesCorporate Restructuring - Types and ImportanceAbhijeetNo ratings yet

- W3 Winning-Strategic-Race-To-SustainabilityDocument22 pagesW3 Winning-Strategic-Race-To-SustainabilitycarissaNo ratings yet

- A Ril 22 ProjectDocument13 pagesA Ril 22 ProjectAKANSHAm mGUPTANo ratings yet

- B2B Marketing: by Arunav Shandeelya IIIT BhubaneswarDocument21 pagesB2B Marketing: by Arunav Shandeelya IIIT BhubaneswarMulia PutriNo ratings yet

- Precourse AssignmentDocument10 pagesPrecourse AssignmentNguyen Thanh ToanNo ratings yet

- STRM043 Competitive Strategy & Innovation Anil Kumar Ganessen Chinnapen Adrian Pryce 16444036 2900 GE Case StudyDocument20 pagesSTRM043 Competitive Strategy & Innovation Anil Kumar Ganessen Chinnapen Adrian Pryce 16444036 2900 GE Case StudyXimena Lucero Gutierrez HurtadoNo ratings yet

- Sarwanti Purwandari Conceptual QuestionsDocument5 pagesSarwanti Purwandari Conceptual QuestionsSarwanti PurwandariNo ratings yet

- Capital Structure - Bharati CementDocument14 pagesCapital Structure - Bharati CementMohmmedKhayyumNo ratings yet

- ESG CEO & ProfDocument14 pagesESG CEO & Profneil5mNo ratings yet

- Daimler Benz Principles and Practises 04 - Managing Risks in Mergers and AcquisitionsDocument39 pagesDaimler Benz Principles and Practises 04 - Managing Risks in Mergers and Acquisitionsgnatesh7131No ratings yet

- Corning Bisb PDFDocument10 pagesCorning Bisb PDFArunNo ratings yet

- Equity Research-Measuring The MoatDocument117 pagesEquity Research-Measuring The MoatproxygangNo ratings yet

- Basic Concepts: M & A DefinedDocument23 pagesBasic Concepts: M & A DefinedChe DivineNo ratings yet

- Stream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementFrom EverandStream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementNo ratings yet

- The What, The Why, The How: Mergers and AcquisitionsFrom EverandThe What, The Why, The How: Mergers and AcquisitionsRating: 2 out of 5 stars2/5 (1)

- Amrutha Ragothaman: +1 732-707-2195 Ragothaa@Kean - EduDocument2 pagesAmrutha Ragothaman: +1 732-707-2195 Ragothaa@Kean - EduNur Nahar LimaNo ratings yet

- Prakul ResumeDocument1 pagePrakul ResumeNur Nahar LimaNo ratings yet

- MKT 401Document3 pagesMKT 401Nur Nahar LimaNo ratings yet

- Compensation System of Berger Paints BanDocument18 pagesCompensation System of Berger Paints BanNur Nahar LimaNo ratings yet

- Excel DoxDocument83 pagesExcel DoxNur Nahar LimaNo ratings yet

- Assignment 01: 'The Importance and Relevance of International Relations in A Globalized World'Document9 pagesAssignment 01: 'The Importance and Relevance of International Relations in A Globalized World'Nur Nahar LimaNo ratings yet

- MGT 337Document3 pagesMGT 337Nur Nahar LimaNo ratings yet

- Boeing Commercial Aircraft:comeback?: Nur Nahar Lima 2017-1-10-247Document7 pagesBoeing Commercial Aircraft:comeback?: Nur Nahar Lima 2017-1-10-247Nur Nahar LimaNo ratings yet

- MGT 480Document7 pagesMGT 480Nur Nahar LimaNo ratings yet

- Case SummaryDocument3 pagesCase SummaryNur Nahar LimaNo ratings yet

- "Job Analysis"-The Building Block of Human Resource ManagementDocument16 pages"Job Analysis"-The Building Block of Human Resource ManagementNur Nahar LimaNo ratings yet

- Assignment 01, HRM 412Document3 pagesAssignment 01, HRM 412Nur Nahar LimaNo ratings yet

- SSR250 - 450HP O&mDocument98 pagesSSR250 - 450HP O&mKamran IbadovNo ratings yet

- Tutorial 1 by HenryDocument21 pagesTutorial 1 by HenryChris WongNo ratings yet

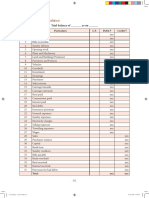

- Your Company Name: Income Statement For The Year Ending On: DD/MM/YYDocument4 pagesYour Company Name: Income Statement For The Year Ending On: DD/MM/YYBohdan KozarNo ratings yet

- Contex Corp. v. Commissioner of InternalDocument9 pagesContex Corp. v. Commissioner of InternalCamshtNo ratings yet

- Car Sale AgreementDocument2 pagesCar Sale AgreementIan KibetNo ratings yet

- Starbucks Supply Chain ManagementDocument11 pagesStarbucks Supply Chain ManagementVicky NguyenNo ratings yet

- Ciruclar On UV Lamp For CTS Cheques 370 - 2014 - 31052014Document2 pagesCiruclar On UV Lamp For CTS Cheques 370 - 2014 - 31052014Puli BaskarNo ratings yet

- The Handbook of Research On Entrepreneurship in Agriculture and Rural DevelopmentDocument336 pagesThe Handbook of Research On Entrepreneurship in Agriculture and Rural DevelopmentMoosa AmirNo ratings yet

- WP CVA RISK 2021 FinalDocument11 pagesWP CVA RISK 2021 FinalRenu MundhraNo ratings yet

- Ec2 Economics: Command Words Review Chapters 11 - 16 RevisionsDocument33 pagesEc2 Economics: Command Words Review Chapters 11 - 16 Revisionsbardak twoNo ratings yet

- Will India Become An Economic Superpower, Does It Matter & What Might Prevent It?Document38 pagesWill India Become An Economic Superpower, Does It Matter & What Might Prevent It?Yashvi TanejaNo ratings yet

- Value Chain Analysis of AmazonDocument4 pagesValue Chain Analysis of AmazonJie Yi LimNo ratings yet

- BusTax Chap 3Document16 pagesBusTax Chap 3Lisa ManobanNo ratings yet

- Accountancy 12 Set 1 DS2Document24 pagesAccountancy 12 Set 1 DS2Anshul JainNo ratings yet

- MTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerDocument12 pagesMTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerMelsew BelachewNo ratings yet

- ECO561 EconomicsDocument14 pagesECO561 EconomicsG JhaNo ratings yet

- Affect of Green Marketing On ConsumersDocument17 pagesAffect of Green Marketing On Consumersjuan felipe betancourt lopezNo ratings yet

- Ragan Micro Economics CH 1Document30 pagesRagan Micro Economics CH 1patrick dhattNo ratings yet

- Transfer PricingDocument15 pagesTransfer PricingJulie Marie Anne LUBINo ratings yet

- Consolidated FS at Date of AcquisitionDocument2 pagesConsolidated FS at Date of AcquisitionRafael BarbinNo ratings yet

- Specimen of A Trial Balance: S.No. Particulars L.F. Debit CreditDocument1 pageSpecimen of A Trial Balance: S.No. Particulars L.F. Debit CreditArun SankarNo ratings yet

- Commercials: Sr. No. TXN Mode Services Type Vle ShareDocument2 pagesCommercials: Sr. No. TXN Mode Services Type Vle ShareSHASHI KANTNo ratings yet

- 07 - Chapter 2Document39 pages07 - Chapter 2tapanamoriaNo ratings yet

- Starbucks Social ResponsibilityDocument22 pagesStarbucks Social ResponsibilityAmeenii Mukhlis100% (6)

- Cma Cia 3Document12 pagesCma Cia 3DIVYANG AGARWAL 2023291No ratings yet

- Statement of Cash Flows HandoutDocument17 pagesStatement of Cash Flows HandoutCharudatta MundeNo ratings yet

- Accounting For Partnership Firm-FundamentalsDocument28 pagesAccounting For Partnership Firm-FundamentalsTushNo ratings yet

- Analysis of Starbucks CorporationDocument17 pagesAnalysis of Starbucks CorporationSimran ChaudharyNo ratings yet

- Affidavit of Consolidation..Document2 pagesAffidavit of Consolidation..Sa LeeNo ratings yet

- Review Test - Chapter 1 - 4 - Attempt ReviewDocument15 pagesReview Test - Chapter 1 - 4 - Attempt ReviewOanh TrầnNo ratings yet

MGT 480

MGT 480

Uploaded by

Nur Nahar LimaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MGT 480

MGT 480

Uploaded by

Nur Nahar LimaCopyright:

Available Formats

FINAL Examination: SPRING 2021

MGT 480: Strategic Management

Section 5 Marks: 20 Time: 75 min.

Answer to the all questions

Part: 2 Subjective Part (Marks: 16)

1.“This increases the value of a company’s product line because customers often

obtain a price discount when purchasing a set of products at one time, and customers

become used to dealing with only one company and its representatives.” Discussing it

by using the most relevant two points (benefits) of relevant integration (Marks 4)

2. “when the board of Sotheby’s discovered that the company had been engaged in

price fixing with Christie’s, board members moved quickly to oust both the CEO and

the chairman of the company. But not all boards perform as well as they should. The

board of now-bankrupt energy company Enron approved the company’s audited

financial statements, which were later discovered to be grossly misleading” Find out

the most relevant one agency problem & one relevant solution (governance

mechanism) then explain them with pros & cons. (Marks 4)

3. “In 2010, a study by Graef Crystal evaluated the relationship between CEO pay

and performance and concluded that there virtually is none. For example, if CEOs

were paid according to shareholder return, the CEO of CBS Corporation, Leslie

Moonves, who earned an impressive $43.2 million in 2009, should have gotten a $28

million paycut, according to Crystal.” Is it a agency problem or solution

(governance mechanism) or both? Justify your answer with proper explanation.

(Marks 4)

4. The lack of trust arises from the risk of holdup—that is, being taken advantage of

by a trading partner after the investment in specialized assets has been made. How

can an organization overcome the situation of hold up? Explain the most

relevant two ways for overcoming this hold up situation?(Marks 4)

Part: 3 Case Study Analysis (Marks 4)

GE competes in many different industries ranging from appliances, aviation, and

consumer electronics to energy, financial services, health care, oil, and wind turbines.

Historically, GE has done an exceptionally good job of allocating capital across its

many businesses, although it has suffered a discount to other diversified competitors

of late. Even though GE is a related linked firm, it differentially allocates capital

across its major strategic business units. Even though GE Capital (GE’s financial

services business unit) produced high returns for GE over the last few decades, it

received a healthy amount of capital from internal allocations. However, GE has been

balancing its financial services portfolio over the last few years. In particular, GE

committed to shrinking its financial operation because Jeff Immelt, GE’s CEO, has

been under pressure by investors to make GE a more focused industrial company,

primarily because its stock price has stayed below $30 since the financial crisis.

Ultimately, the goal is to scale back GE Capital from 42 percent of the profit in 2014

to 25 percent of GE’s profit in 2016. Before the financial crisis, almost 50 percent of

profits were derived from GE Capital. Regulation has forced GE to keep more capital

in its financial arm, and thus it can no longer pull as much cash out “to help pay

dividends, buy back shares, and help finance GE’s industrial operations.” It also

prevents other restructuring efforts. For example, GE wanted to sell its appliance

business, but had to hold on to it for several years during the crisis because the price it

could get would be too low. Immelt added, “make no mistake, the ultimate size of GE

Capital will be based on competitiveness, returns, and the impact of regulation on the

entire company.” However, since the financial crisis, GE realized the risks of have so

much capital invested in GE Capital which almost toppled GE. GE is also under

pressure because it had built up its oil and gas service operations through acquisitions.

However, since the drop in oil prices, this unit has come under pressure. When these

assets were purchased, crude oil was selling for $100 per barrel, but crude oil has

been recently selling for near $50 per barrel. Also, United Technologies, an unrelated

firm, has allocated resources internally according to their best and most efficient use.

Similar to GE, it often bought, restructured, and operated the businesses until it made

sense to sell them. United Technologies owns Otis Elevator, building fires and

security system brands Chubb and Kidde, Pratt & Whitney jet engines, Carrier air

conditioners, and Sikorsky Aircraft. Sikorsky is best known for its Black Hawk

helicopters, and it is one of the largest helicopter makers in the world. United

Technologies’ new CEO, Gregory J. Hayes, told analysts that it was evaluating its

portfolio. The Sikorsky division has come under pressure amidst softer military

spending and weakness in demand for oil services companies which utilize

helicopters to fly employees to platforms offshore as well as onshore. Although Hayes

had considered a tax free spinoff, he ultimately contracted to sell the Sikorsky

business unit to Lockheed Martin, a big defense contractor. Interestingly, he is also

hunting for a large acquisition to purchase, restructure, and include in United

Technologies portfolio. Both GE and United Technology have used internal capital

allocate resources among their diversified business units efficiently. Also, both

businesses have used the restructuring strategy to make their operations more efficient

and, when appropriate, sold them on the open market, either through selloff to another

acquirer or through spinoffs where two stock prices are created, one for the legacy

business and one for the spinoff firm

Question Identify the most relevant reason for value creation (value creation/value

neutral/ value reducing ) then explain the reasons in the context of above mention

case.

You might also like

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Case Marriott A and Flinder ValvesDocument6 pagesCase Marriott A and Flinder ValvesGerardo FumagalNo ratings yet

- Mergers and AcquisitionsDocument54 pagesMergers and AcquisitionsSudhir Kumar Varshney100% (5)

- 10 - Chapter 2 PDFDocument29 pages10 - Chapter 2 PDFSai PrabhasNo ratings yet

- 12 OperationsoninsuranceDocument14 pages12 Operationsoninsurancedimas rialdyNo ratings yet

- 12 OperationsoninsuranceDocument14 pages12 OperationsoninsuranceKlysh SalvezNo ratings yet

- June Green Modern Finance 4FIN7A2 PaperDocument17 pagesJune Green Modern Finance 4FIN7A2 PaperJune GreenNo ratings yet

- 12 OperationsoninsuranceDocument14 pages12 Operationsoninsuranceagasthiya parshithNo ratings yet

- Managing Risks in MergersDocument4 pagesManaging Risks in Mergersk gowtham kumarNo ratings yet

- Mergers and Acquisitions: A Complete and Updated OverviewDocument12 pagesMergers and Acquisitions: A Complete and Updated OverviewRizwana ArifNo ratings yet

- FMGD Term End Assignment: Submitted By: Yashodhan Joshi UM18068 Xavier Institute of ManagementDocument6 pagesFMGD Term End Assignment: Submitted By: Yashodhan Joshi UM18068 Xavier Institute of ManagementYashodhan JoshiNo ratings yet

- Course 7: Mergers & Acquisitions (Part 1) : Prepared By: Matt H. Evans, CPA, CMA, CFMDocument18 pagesCourse 7: Mergers & Acquisitions (Part 1) : Prepared By: Matt H. Evans, CPA, CMA, CFMAshish NavadayNo ratings yet

- Risks: Impact of Capital Structure On Profitability: Panel Data Evidence of The Telecom Industry in The United StatesDocument20 pagesRisks: Impact of Capital Structure On Profitability: Panel Data Evidence of The Telecom Industry in The United StatesN SNo ratings yet

- Primus Automation Division FinalDocument12 pagesPrimus Automation Division FinalreinharduyNo ratings yet

- F3 Chapter 11Document12 pagesF3 Chapter 11Ali ShahnawazNo ratings yet

- A Literature Review of The Trade Off Theory of Capital StructureDocument10 pagesA Literature Review of The Trade Off Theory of Capital Structurekebede desalegnNo ratings yet

- Managerial Economics: Applications, Strategy, and Tactics, 12 EditionDocument16 pagesManagerial Economics: Applications, Strategy, and Tactics, 12 Editionsamer abou saadNo ratings yet

- Project On Merger and AcquisitionDocument8 pagesProject On Merger and Acquisitionaashish0128No ratings yet

- Mergers Acquisitions Sam ChapDocument24 pagesMergers Acquisitions Sam ChapNaveen RaajNo ratings yet

- Addendum - Covid-19 CrisisDocument8 pagesAddendum - Covid-19 CrisishacerserttNo ratings yet

- Managerial EconomicsDocument16 pagesManagerial EconomicsIzwan YusofNo ratings yet

- Why M&As Fail Often?Document17 pagesWhy M&As Fail Often?Insideout100% (4)

- Chapter 8 - Operations of Insurance CompaniesDocument11 pagesChapter 8 - Operations of Insurance CompaniesFrancis Gumawa100% (1)

- Audit and AssuranceDocument8 pagesAudit and AssuranceJoe AndrewNo ratings yet

- GE Prior To Jack WelchDocument3 pagesGE Prior To Jack WelchFirdausNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- Failure MergersDocument23 pagesFailure MergersBrijesh Sarkar100% (1)

- Strategic Jet Blue UpdatedDocument28 pagesStrategic Jet Blue UpdatedSakshi SharmaNo ratings yet

- Pledge (And Hedge) Allegiance To The CompanyDocument6 pagesPledge (And Hedge) Allegiance To The CompanyBrian TayanNo ratings yet

- Merger and AcquisitionDocument11 pagesMerger and AcquisitionPriyanka AgarwalNo ratings yet

- Is A Share Buyback Right For YouDocument4 pagesIs A Share Buyback Right For YouJesus Anthony QuiambaoNo ratings yet

- Corporate Restructuring and InsolvencyDocument19 pagesCorporate Restructuring and InsolvencyJayachandra JcNo ratings yet

- Mergers & Acquisitions Unit I: Is M & A, A Simple Investment Decision?Document19 pagesMergers & Acquisitions Unit I: Is M & A, A Simple Investment Decision?reedbkNo ratings yet

- Mergers Acquisitions Sam ChapDocument24 pagesMergers Acquisitions Sam ChapMaria Mirabela StefanNo ratings yet

- Letter To Investors, Q1 2021 Performance: ACML Performance Is Net of Fees and Standard CostsDocument6 pagesLetter To Investors, Q1 2021 Performance: ACML Performance Is Net of Fees and Standard CostsYog MehtaNo ratings yet

- DerivativesDocument10 pagesDerivativesmuralikrishna3322No ratings yet

- Mergers & AcquisitionsDocument62 pagesMergers & AcquisitionsJermaine Weiss100% (1)

- Ib BM - Paper 1Document6 pagesIb BM - Paper 1DANIYA GENERALNo ratings yet

- Mangerial EconomicsDocument5 pagesMangerial EconomicsEhteshamNo ratings yet

- MGT - 304 Assignment - 2 - 1Document7 pagesMGT - 304 Assignment - 2 - 1Risad AhmedNo ratings yet

- 4.aug Ijmte - 830Document16 pages4.aug Ijmte - 830BasappaSarkarNo ratings yet

- ITM - Capstone Project ReportDocument53 pagesITM - Capstone Project ReportArchana Singh33% (3)

- Mergers & Acquisitions: Prepared byDocument31 pagesMergers & Acquisitions: Prepared byhasansupNo ratings yet

- Corporate Restructuring - Types and ImportanceDocument15 pagesCorporate Restructuring - Types and ImportanceAbhijeetNo ratings yet

- W3 Winning-Strategic-Race-To-SustainabilityDocument22 pagesW3 Winning-Strategic-Race-To-SustainabilitycarissaNo ratings yet

- A Ril 22 ProjectDocument13 pagesA Ril 22 ProjectAKANSHAm mGUPTANo ratings yet

- B2B Marketing: by Arunav Shandeelya IIIT BhubaneswarDocument21 pagesB2B Marketing: by Arunav Shandeelya IIIT BhubaneswarMulia PutriNo ratings yet

- Precourse AssignmentDocument10 pagesPrecourse AssignmentNguyen Thanh ToanNo ratings yet

- STRM043 Competitive Strategy & Innovation Anil Kumar Ganessen Chinnapen Adrian Pryce 16444036 2900 GE Case StudyDocument20 pagesSTRM043 Competitive Strategy & Innovation Anil Kumar Ganessen Chinnapen Adrian Pryce 16444036 2900 GE Case StudyXimena Lucero Gutierrez HurtadoNo ratings yet

- Sarwanti Purwandari Conceptual QuestionsDocument5 pagesSarwanti Purwandari Conceptual QuestionsSarwanti PurwandariNo ratings yet

- Capital Structure - Bharati CementDocument14 pagesCapital Structure - Bharati CementMohmmedKhayyumNo ratings yet

- ESG CEO & ProfDocument14 pagesESG CEO & Profneil5mNo ratings yet

- Daimler Benz Principles and Practises 04 - Managing Risks in Mergers and AcquisitionsDocument39 pagesDaimler Benz Principles and Practises 04 - Managing Risks in Mergers and Acquisitionsgnatesh7131No ratings yet

- Corning Bisb PDFDocument10 pagesCorning Bisb PDFArunNo ratings yet

- Equity Research-Measuring The MoatDocument117 pagesEquity Research-Measuring The MoatproxygangNo ratings yet

- Basic Concepts: M & A DefinedDocument23 pagesBasic Concepts: M & A DefinedChe DivineNo ratings yet

- Stream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementFrom EverandStream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementNo ratings yet

- The What, The Why, The How: Mergers and AcquisitionsFrom EverandThe What, The Why, The How: Mergers and AcquisitionsRating: 2 out of 5 stars2/5 (1)

- Amrutha Ragothaman: +1 732-707-2195 Ragothaa@Kean - EduDocument2 pagesAmrutha Ragothaman: +1 732-707-2195 Ragothaa@Kean - EduNur Nahar LimaNo ratings yet

- Prakul ResumeDocument1 pagePrakul ResumeNur Nahar LimaNo ratings yet

- MKT 401Document3 pagesMKT 401Nur Nahar LimaNo ratings yet

- Compensation System of Berger Paints BanDocument18 pagesCompensation System of Berger Paints BanNur Nahar LimaNo ratings yet

- Excel DoxDocument83 pagesExcel DoxNur Nahar LimaNo ratings yet

- Assignment 01: 'The Importance and Relevance of International Relations in A Globalized World'Document9 pagesAssignment 01: 'The Importance and Relevance of International Relations in A Globalized World'Nur Nahar LimaNo ratings yet

- MGT 337Document3 pagesMGT 337Nur Nahar LimaNo ratings yet

- Boeing Commercial Aircraft:comeback?: Nur Nahar Lima 2017-1-10-247Document7 pagesBoeing Commercial Aircraft:comeback?: Nur Nahar Lima 2017-1-10-247Nur Nahar LimaNo ratings yet

- MGT 480Document7 pagesMGT 480Nur Nahar LimaNo ratings yet

- Case SummaryDocument3 pagesCase SummaryNur Nahar LimaNo ratings yet

- "Job Analysis"-The Building Block of Human Resource ManagementDocument16 pages"Job Analysis"-The Building Block of Human Resource ManagementNur Nahar LimaNo ratings yet

- Assignment 01, HRM 412Document3 pagesAssignment 01, HRM 412Nur Nahar LimaNo ratings yet

- SSR250 - 450HP O&mDocument98 pagesSSR250 - 450HP O&mKamran IbadovNo ratings yet

- Tutorial 1 by HenryDocument21 pagesTutorial 1 by HenryChris WongNo ratings yet

- Your Company Name: Income Statement For The Year Ending On: DD/MM/YYDocument4 pagesYour Company Name: Income Statement For The Year Ending On: DD/MM/YYBohdan KozarNo ratings yet

- Contex Corp. v. Commissioner of InternalDocument9 pagesContex Corp. v. Commissioner of InternalCamshtNo ratings yet

- Car Sale AgreementDocument2 pagesCar Sale AgreementIan KibetNo ratings yet

- Starbucks Supply Chain ManagementDocument11 pagesStarbucks Supply Chain ManagementVicky NguyenNo ratings yet

- Ciruclar On UV Lamp For CTS Cheques 370 - 2014 - 31052014Document2 pagesCiruclar On UV Lamp For CTS Cheques 370 - 2014 - 31052014Puli BaskarNo ratings yet

- The Handbook of Research On Entrepreneurship in Agriculture and Rural DevelopmentDocument336 pagesThe Handbook of Research On Entrepreneurship in Agriculture and Rural DevelopmentMoosa AmirNo ratings yet

- WP CVA RISK 2021 FinalDocument11 pagesWP CVA RISK 2021 FinalRenu MundhraNo ratings yet

- Ec2 Economics: Command Words Review Chapters 11 - 16 RevisionsDocument33 pagesEc2 Economics: Command Words Review Chapters 11 - 16 Revisionsbardak twoNo ratings yet

- Will India Become An Economic Superpower, Does It Matter & What Might Prevent It?Document38 pagesWill India Become An Economic Superpower, Does It Matter & What Might Prevent It?Yashvi TanejaNo ratings yet

- Value Chain Analysis of AmazonDocument4 pagesValue Chain Analysis of AmazonJie Yi LimNo ratings yet

- BusTax Chap 3Document16 pagesBusTax Chap 3Lisa ManobanNo ratings yet

- Accountancy 12 Set 1 DS2Document24 pagesAccountancy 12 Set 1 DS2Anshul JainNo ratings yet

- MTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerDocument12 pagesMTP Case Analysis 1. Bharat Engineering Works Limited: 2. The Assistant Business ManagerMelsew BelachewNo ratings yet

- ECO561 EconomicsDocument14 pagesECO561 EconomicsG JhaNo ratings yet

- Affect of Green Marketing On ConsumersDocument17 pagesAffect of Green Marketing On Consumersjuan felipe betancourt lopezNo ratings yet

- Ragan Micro Economics CH 1Document30 pagesRagan Micro Economics CH 1patrick dhattNo ratings yet

- Transfer PricingDocument15 pagesTransfer PricingJulie Marie Anne LUBINo ratings yet

- Consolidated FS at Date of AcquisitionDocument2 pagesConsolidated FS at Date of AcquisitionRafael BarbinNo ratings yet

- Specimen of A Trial Balance: S.No. Particulars L.F. Debit CreditDocument1 pageSpecimen of A Trial Balance: S.No. Particulars L.F. Debit CreditArun SankarNo ratings yet

- Commercials: Sr. No. TXN Mode Services Type Vle ShareDocument2 pagesCommercials: Sr. No. TXN Mode Services Type Vle ShareSHASHI KANTNo ratings yet

- 07 - Chapter 2Document39 pages07 - Chapter 2tapanamoriaNo ratings yet

- Starbucks Social ResponsibilityDocument22 pagesStarbucks Social ResponsibilityAmeenii Mukhlis100% (6)

- Cma Cia 3Document12 pagesCma Cia 3DIVYANG AGARWAL 2023291No ratings yet

- Statement of Cash Flows HandoutDocument17 pagesStatement of Cash Flows HandoutCharudatta MundeNo ratings yet

- Accounting For Partnership Firm-FundamentalsDocument28 pagesAccounting For Partnership Firm-FundamentalsTushNo ratings yet

- Analysis of Starbucks CorporationDocument17 pagesAnalysis of Starbucks CorporationSimran ChaudharyNo ratings yet

- Affidavit of Consolidation..Document2 pagesAffidavit of Consolidation..Sa LeeNo ratings yet

- Review Test - Chapter 1 - 4 - Attempt ReviewDocument15 pagesReview Test - Chapter 1 - 4 - Attempt ReviewOanh TrầnNo ratings yet