Professional Documents

Culture Documents

Notes On Internal Reconstruction

Notes On Internal Reconstruction

Uploaded by

Ali NadafOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes On Internal Reconstruction

Notes On Internal Reconstruction

Uploaded by

Ali NadafCopyright:

Available Formats

Internal Reconstruction

1. Meaning of Reconstruction :

”Reconstruction of a company means re-organization of financial activities or

affairs of the company when its financial condition or position in not good or

satisfactory. This is accumulated loss and over valuation of assets etc.

Types of Reconstruction

1. External Re-construction

2. Internal Re-construction

1. Internal Re-construction :

It means re-arrangement or re-organization of the financial

activities or financial affairs of the company by re-valuation of its

assets, ascertaining the correct amount of liabilities or writing off the

accumulated losses by reducing the share capital of the company, with

or without changing the rights of share holders but without liquidation

of the company.

2. External Reconstruction:

It means winding up of existing company and transferring the

assets and liabilities at their natural value to new company.

Need of Internal Reconstruction :

1. True and Fair View of Financial Position: A company may

be incurring losses for several years. In cases the financial

position cannot reflect a true and fair view. Hence it

necessitates reorganization in order to disclose the actual

financial position of an enterprise

2. Value of Assets: On a careful analysis it may reveal that

such continues loss-making companies consist either

overvalued tangible assets or insignificant intangible assets.

To get rid of these unreal values of assets they should be

updated to their real values by way of reconstruction

3. External Liabilities : External liabilities include loan, payment

of preference dividends, debenture, etc These cannot be

reduced to a great extent to maximize profitability through

reorganization

4. Share capital : The capital figures (i.e the value of the net

assets) is not reliable as it tends to show a higher figure

than the real figure due to various factors such as

overvalued tangible assets, idle and valueless intangible

assets and fictitious assets and outstanding liabilities not

discharged on maturity date. Because of this the share

capital of such loss-incurring companies will not reflect the

real and fair value of the net assets of the company . To set

right this sort of over capitalization reconstruction is of

vital importance.

5. Remedial Measures: If proper reorganization does not take

place it will lead to total disaster. To escape from such a

scenario, reconstruction is necessary. To a certain extent.

Reconstruction is remedy to avoid unforeseen disaster to

companies. Proper diagnosis and reorganization may alleviate

such evils

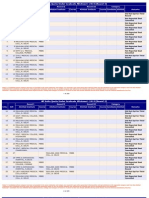

Difference between Internal Reconstruction and External Reconstruction

Basis of Difference Internal Reconstruction External Reconstruction

1. Liquidation of It does not require liquidation of It involve liquidation of the

company the company company

2. Formation of It does not involve formation of It requires formation of a

company a new company new company which takes

over the business of

liquidating company.

3. Accounting It involves revaluation of assets It is recorded as per AS-14

Treatment and liquidation of an existing

company

4. Legal It requires fewer legal It requires more legal

Formalities formalities. There is no need to formalities

settle the claims of creditors

and debenture holders

5. Tax Benefit It ensure tax advantage to the A company is not allowed to

company carry forward its losses for

income tax purpose

6. Regulation It is done as per provisions of It is regulated by section 494

sections 100 of the companies of the companies act 1956

act

7. Reduction These is certain of capital and There is no reduction of

sometimes the outside liabilities capital in fact there is fresh

like debenture holders may share capital of the company

have to reduce their claim

Capital reduction (section 100 to 105)

Capital Reduction refers to the cancellation of that part of paid up capital which is lost

in operation which is not represented by existing assets. It is generally resorted to write

up the past accumulated loss of the company. It is unlawful except when sanctioned

by the court because conservation of capital is one of the main principles of the

company law. The issued share capital of a company represents the security on which

the creditors rely. Companies usually do not call the full value of shares at one time.

The uncalled capital act as a future security of creditor.

ACCORDING TO SECTION 100 OF THE Indian COMPANIES ACT 1956

If any company (limited by shares of limited by Guarantee) suffering from heavy

losses or having a debit balance of profit and loss account or the valuation of such

assets is doubtful or goodwill or assets have been overvalued or the capital is more

than its requirements than the company can reduce its share capital as per the

procedures laid down in the Indian Companies Act 1956.

Procedures of Reduction of Share Capital:

The procedures of reduction of share capital is done as per provision of the section 100

of the companies Act which are as follow

1. It is permitted by its articles of association

2. A special resolution is passed and this is done as per rule 46 of the Table A,

3. Permission of the court has been taken/obtained. The court permits only when it is

felt that the financial position of the company would improve in the future.

Otherwise, permission is not granted.

4. After receiving/ getting permission from the court the company is required to use

the term and reduced along with its name.

Calculation of Capital Reduction and its Utilization :

1. By reducing or extinguishing the liability of members for uncalled capital

2. By writing off any paid up capital which is lost or unrepresentative by

uncalled capital.

3. By paying off capital which is in excess of the wants of the company

4. Through any other method approved by the court,

Passing Journal entries

1. For reducing the Liability in Respect of Uncalled amount:

2. For Paying –Off the surplus Paid-Up Capital

Date Particular LF Debit Credit

Equity Share Capital a/c Dr xxx

To Equity share capital a/c xxx

To sundry Members a/c xxx

3. Writing-Off Lost Capital

Date Particular LF Debit Credit

Equity Share Capital a/c Dr xxx

Preference share capital a/c Dr xxx

To capital Reduction / Reconstruction a/c Xxx

4. Reduction in claim of creditors, Debenture Holders etc.,

- In case the debenture-holders or creditors also agree to forgo or reduce their

claims against the company

Date Particular LF Debit Credit

Debenture a/c Dr xxx

Creditors a/c Dr xxx

To Capital Reduction / Reconstruction Xxx

Date Particular LF Debit Credit

(Old) Debenture a/c xxx

To (New) Debenture a/c xxx

To capital Reduction / Reconstruction Xxx

ii) If the debentures-holders agree to accepts new debenture of lower amount:

5. Disposal of Reconstruction Account : When accumulated losses and fictitious

assets, intangible are written-off and over-valued assets and unrecorded liability are

adjusted.

Date Particular LF Debit Credit

Reconstruction a/c

To Profit and loss a/c

To preliminary Expenses a/c

To Discount on Issue of Share/Debenture a/c

To Goodwill

To Patent, Copyrights and Trademarks a/c

To Plant and Machinery a/c

To Furniture a/c

To other Fixed assets a/c

To Unrecorded Liability a/c

6. Expenses on Reconstruction : when expenses are incurred

Dat Particular LF Debit Credit

e

Reconstruction a/c Dr Xxx

To Bank a/c xxx

7. If shortfall in Reconstruction account : If there is a short fall i.e the amount required

to be adjusted against Reconstruction a/c is more than the amount standing to the

credit of Reconstruction account, accumulated profit in any form such as General

Reserve, Profit and Loss a/c (Cr) or profit and Loss Appropriation a/c or any unutilized

provision may be used

Dat Particular LF Debit Credit

e

General Reserve a/c Xxx

Profit and loss/Profit and Loss appropriation a/c Xxx

Provision a/c (Name) xxx

To Reconstruction a/c xxx

8. Balance Transfer to Capital Reserve :

Balance of Reconstruction a/c remaining after above adjustment is transferred to

capital Reserve:

Date Particular LF Debit Credit

Reconstruction a/c Xxx

To Capital Reserve a/c xxx

Particular Amount Particular Amount

Profit & Loss a/c (Loss Written off) Xxx Share capital Account (Reduction in Xxx

Paid-up value)

Intangible Assets Account (Useless XXX Debenture account (amount of Xxx

Intangible Assets Written off Reduction)

Individually)

Miscellaneous Expenditure (Written Xxx Creditors Account (amount of scarifies) Xxx

off- Each Expenses Individually)

Discount on Issue of share (written off) Xxx Fixed assets account (Increases in xxx

value)

Fixed asset a/c (Decrease in Value of Xxx Current assets account (Increases in xxx

Individually ) value )

Current Asset a/c (Decrease in value Xxxx Bank account (sale amount of xxx

Individually) Unrecorded assets)

Provision for Doubtful Debts Xxx Reserve account xxx

Bank account (Unrecorded liability Xxx Provision account ( to the Extent not xxx

paid) required )

Bank account (arrears of Preference Xxx

Dividend –paid)

New liability account Xxx

Bank account (Directors Fees Xxx

Refunded)

Capital Reserve a/c (If any Balance Xxx

Xxxx xxxx

Preparation of Balance sheet after Reconstruction :

The factors that should be taken into account while preparing the balance sheet after the

completion on internal reconstruction are as follows :

1.. The words “ And Reduced must be added to the name of the company . This should be continued

for certain accounting period as ordered by the court

2. i) the revised appreciated values of the assets on the date of internal reconstruction

must be shown in the balance sheet. The book values should be ignored.

ii. The amount of increases in the value of assets on account of revaluation should be shown in the

balance sheet.

iii) The revised lower figure i.e original cost-deprecation should be shown instead of book values.

3) i. For fixed assets, and investments, the amount written off should be shown separately for a

period of 5 years.

ii. For current assets and individual the amount written off need not be shown. They should be

shown only at their revised lower values.

iii) For provision such amount of provision should be shown as a deduction from the gross amount

in the inner column and only the net amount in the outer column.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Raaf Mirage Story Opt PDFDocument104 pagesThe Raaf Mirage Story Opt PDFSebastian ArdilesNo ratings yet

- Shocking Psychological Studies and The Lessons They TeachDocument99 pagesShocking Psychological Studies and The Lessons They TeachArun Sharma100% (1)

- New Education Policy 2020: A Comparative Analysis With Existing National Policy of Education 1986Document11 pagesNew Education Policy 2020: A Comparative Analysis With Existing National Policy of Education 1986Ali NadafNo ratings yet

- International Marketing TotalDocument88 pagesInternational Marketing TotalAli NadafNo ratings yet

- A Study On The Awareness of New Education Policy (2020) Among The Primary School Teachers in Dindigul DistrictDocument6 pagesA Study On The Awareness of New Education Policy (2020) Among The Primary School Teachers in Dindigul DistrictAli NadafNo ratings yet

- NEP 2020: A Road Map To Vocational Development: ArticleDocument5 pagesNEP 2020: A Road Map To Vocational Development: ArticleAli NadafNo ratings yet

- National Education Policy 2020 and Higher Education: A Brief ReviewDocument5 pagesNational Education Policy 2020 and Higher Education: A Brief ReviewAli NadafNo ratings yet

- 5th REGISTRATION DoneDocument19 pages5th REGISTRATION DoneAli NadafNo ratings yet

- National Education Policy 2020 and Its Comparative Analysis With RTEDocument7 pagesNational Education Policy 2020 and Its Comparative Analysis With RTEAli NadafNo ratings yet

- Impact of New Education Policy 2020 On Higher Education: November 2020Document11 pagesImpact of New Education Policy 2020 On Higher Education: November 2020Ali NadafNo ratings yet

- Public Opinion On The New Education Policy 2020: January 2022Document11 pagesPublic Opinion On The New Education Policy 2020: January 2022Ali NadafNo ratings yet

- 4th ChapterDocument19 pages4th ChapterAli NadafNo ratings yet

- Chapter-3 Conceptual Framwork: 3.1 EntreprenurDocument33 pagesChapter-3 Conceptual Framwork: 3.1 EntreprenurAli NadafNo ratings yet

- Valuation of Goodwill and Share CapitalDocument4 pagesValuation of Goodwill and Share CapitalAli NadafNo ratings yet

- Chapter - 3 Conceptual Framework 3.1Document19 pagesChapter - 3 Conceptual Framework 3.1Ali NadafNo ratings yet

- Notes On Internal ReconstructionDocument2 pagesNotes On Internal ReconstructionAli NadafNo ratings yet

- 2nd CHAPTERDocument71 pages2nd CHAPTERAli NadafNo ratings yet

- Chapter - 1 Introduction and Research DesighDocument9 pagesChapter - 1 Introduction and Research DesighAli NadafNo ratings yet

- Month Wise Revenue Collection During Financial Year 2021-2022Document4 pagesMonth Wise Revenue Collection During Financial Year 2021-2022Ali NadafNo ratings yet

- Target CostingDocument21 pagesTarget CostingAli NadafNo ratings yet

- Introduction To FDDocument12 pagesIntroduction To FDAli NadafNo ratings yet

- Presented by By: Ali NadafDocument24 pagesPresented by By: Ali NadafAli NadafNo ratings yet

- Learning Curve Model: By: Alisab NadafDocument10 pagesLearning Curve Model: By: Alisab NadafAli NadafNo ratings yet

- Annual Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsDocument31 pagesAnnual Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsAli NadafNo ratings yet

- 2 Marks Question On INcome Tax 1st ChapterDocument3 pages2 Marks Question On INcome Tax 1st ChapterAli NadafNo ratings yet

- Stock Market Vertality of Two IndustryDocument41 pagesStock Market Vertality of Two IndustryAli NadafNo ratings yet

- Basic of Income Tax (1st Chapter)Document43 pagesBasic of Income Tax (1st Chapter)Ali NadafNo ratings yet

- Ashok Laylend: Date Open High Low Close ReturnDocument4 pagesAshok Laylend: Date Open High Low Close ReturnAli NadafNo ratings yet

- Mayank Mehta EYDocument10 pagesMayank Mehta EYyasmeenfatimak52No ratings yet

- Entrepreneurship Module 8Document7 pagesEntrepreneurship Module 8Jay Mark Dulce HalogNo ratings yet

- Aipmt Round 3Document335 pagesAipmt Round 3AnweshaBoseNo ratings yet

- Tugas AK Hal 337Document45 pagesTugas AK Hal 337Selvy ApriliantyNo ratings yet

- The Special Activities DivisionDocument4 pagesThe Special Activities DivisionSpencer PearsonNo ratings yet

- Razon V IAC (De Leon)Document2 pagesRazon V IAC (De Leon)ASGarcia24No ratings yet

- Unit-5 Pollution Notes by AmishaDocument18 pagesUnit-5 Pollution Notes by AmishaRoonah KayNo ratings yet

- Indifference Curve AnalysisDocument91 pagesIndifference Curve AnalysisShweta SinghNo ratings yet

- Lesson 3 Module 3 Lec - Data Security AwarenessDocument16 pagesLesson 3 Module 3 Lec - Data Security AwarenessJenica Mae SaludesNo ratings yet

- Financial and Managerial Accounting: Wild, Shaw, and Chiappetta Fifth EditionDocument41 pagesFinancial and Managerial Accounting: Wild, Shaw, and Chiappetta Fifth EditionryoguNo ratings yet

- 中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-LibraryDocument490 pages中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-Libraryxxx caoNo ratings yet

- M607 L01 SolutionDocument7 pagesM607 L01 SolutionRonak PatelNo ratings yet

- LABELDocument2 pagesLABELerinNo ratings yet

- Florida Et Al v. Dept. of Health & Human Services Et AlDocument304 pagesFlorida Et Al v. Dept. of Health & Human Services Et AlDoug MataconisNo ratings yet

- Economic Survey 2017-18Document350 pagesEconomic Survey 2017-18Subhransu Sekhar SwainNo ratings yet

- The Black Map-A New Criticism AnalysisDocument6 pagesThe Black Map-A New Criticism AnalysisxiruomaoNo ratings yet

- PhilHealth Circ2017-0003Document6 pagesPhilHealth Circ2017-0003Toche DoceNo ratings yet

- Ho, Medieval Proof, J L Religion, 2004 PDFDocument44 pagesHo, Medieval Proof, J L Religion, 2004 PDFJanaNo ratings yet

- Bounty Hunter CreationDocument3 pagesBounty Hunter CreationdocidleNo ratings yet

- Quiambao v. Bamba (2005)Document2 pagesQuiambao v. Bamba (2005)JD DX100% (1)

- Unit 7 Exercises To StsDocument7 pagesUnit 7 Exercises To StsHưng TrầnNo ratings yet

- "Apocalypsis" - Future Revealed-Study 1Document14 pages"Apocalypsis" - Future Revealed-Study 1Aleksandar Miriam PopovskiNo ratings yet

- Corpse Grinder Cult Lijst - 1.2Document4 pagesCorpse Grinder Cult Lijst - 1.2Jimmy CarterNo ratings yet

- MLCFDocument27 pagesMLCFMuhammad HafeezNo ratings yet

- John Lee - China's Rise and The Road To War - WSJDocument4 pagesJohn Lee - China's Rise and The Road To War - WSJ33ds100No ratings yet

- Karl Knausgaard: My Struggle: Book One byDocument4 pagesKarl Knausgaard: My Struggle: Book One byGraciela Fregoso PlascenciaNo ratings yet

- WogManual 022408 AVAGDUDocument315 pagesWogManual 022408 AVAGDUhellishteethNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet