Professional Documents

Culture Documents

BFD Primer 2021 (Updated As of March 2021)

BFD Primer 2021 (Updated As of March 2021)

Uploaded by

Meg GutierrezCopyright:

Available Formats

You might also like

- Major Development Programs and Personalities in Science And-1Document27 pagesMajor Development Programs and Personalities in Science And-1Prince Sanji66% (128)

- Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) LTDDocument2 pagesAl-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) LTDHassan Naveed54% (26)

- Birchbox Rep Marketing PlanDocument18 pagesBirchbox Rep Marketing Planapi-32128012750% (2)

- Timor Leste's Strategic Development Plan - 2011 - 2030Document24 pagesTimor Leste's Strategic Development Plan - 2011 - 2030fabricadosblogs4466No ratings yet

- Buy Government Bonds From Abroad Using Your Foreign Currency AccountDocument1 pageBuy Government Bonds From Abroad Using Your Foreign Currency AccountTasneef ChowdhuryNo ratings yet

- Mera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Document2 pagesMera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Hur Hussain SyedNo ratings yet

- CAF Kotak Mutual Fund Lumpsum SIP Common Application Forms SIP Registration NACH ECS Auto Direct Debit One Time Mandate Otm FATCA Application Form 1Document3 pagesCAF Kotak Mutual Fund Lumpsum SIP Common Application Forms SIP Registration NACH ECS Auto Direct Debit One Time Mandate Otm FATCA Application Form 1Darkness DarknessNo ratings yet

- VATRAININGPOWERPTDocument59 pagesVATRAININGPOWERPTboxxer01833100% (1)

- Indian Financial System: Financial Market Consists ofDocument67 pagesIndian Financial System: Financial Market Consists ofTHILAGALAKSHMI M DNo ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

- State Bank of Pakistan On Low Cost HousingDocument2 pagesState Bank of Pakistan On Low Cost HousingAmir SafdarNo ratings yet

- Tuition Fee FTR Receipt PDFDocument1 pageTuition Fee FTR Receipt PDFSALMAN KHANNo ratings yet

- Change of Life Assured Form 70000981Document8 pagesChange of Life Assured Form 70000981Shareen TeoNo ratings yet

- GE I ChallanFormDocument1 pageGE I ChallanFormMaroofNo ratings yet

- NSDL Ind. V. 20.4 (Revised Standing Instructions) 2.9.2022Document1 pageNSDL Ind. V. 20.4 (Revised Standing Instructions) 2.9.2022Patel Enterprise SeamsNo ratings yet

- The Game Changers of Indian Realty!Document14 pagesThe Game Changers of Indian Realty!Mohd ShifanNo ratings yet

- China Interbank Bond Market and FX MarketDocument60 pagesChina Interbank Bond Market and FX MarketbondbondNo ratings yet

- Onlineadmission - Iba.edu - PK Voucher 81252Document1 pageOnlineadmission - Iba.edu - PK Voucher 81252Usman BalochNo ratings yet

- One Pager-NR Initiative - Sep'23Document2 pagesOne Pager-NR Initiative - Sep'23JereenNo ratings yet

- Tenure General Public FD Rate Senior Citizens FD RateDocument9 pagesTenure General Public FD Rate Senior Citizens FD Rateisha jsNo ratings yet

- SBI Bond IssueDocument2 pagesSBI Bond Issueanon_722571No ratings yet

- Hand Out On All Types of Star Personal Loan - Updated Upto 25 May 2021Document35 pagesHand Out On All Types of Star Personal Loan - Updated Upto 25 May 2021Amit Manju AgrawalNo ratings yet

- Module 3 Getting Ahead With VULDocument10 pagesModule 3 Getting Ahead With VULJun Reyes RamirezNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- Scoring CriteriaDocument1 pageScoring CriteriaArsal AliNo ratings yet

- CUOnline Student PortalDocument1 pageCUOnline Student Portalch.hamzagorya.794No ratings yet

- LT Infrastructure FinanceLtd 2011B Series Tranche 1Document2 pagesLT Infrastructure FinanceLtd 2011B Series Tranche 1priya thackerNo ratings yet

- Personal Details: The Hong Kong Confederation of Insurance BrokersDocument5 pagesPersonal Details: The Hong Kong Confederation of Insurance Brokersrayallen1234No ratings yet

- 02 Insurance Claim (MIR SIR)Document1 page02 Insurance Claim (MIR SIR)Aguilar QuezonNo ratings yet

- Fee VoucherDocument1 pageFee VoucherShaikh Arham AyazNo ratings yet

- Capital Markets - 4/11/2008Document1 pageCapital Markets - 4/11/2008Russell KlusasNo ratings yet

- CUOnline Student PortalDocument1 pageCUOnline Student Portalmahamaamir60No ratings yet

- Deposit Interest Rates Bank of BarodaDocument1 pageDeposit Interest Rates Bank of Barodagrv0025No ratings yet

- Scribd 1Document2 pagesScribd 1sobiaNo ratings yet

- Agriculture Loan.1Document2 pagesAgriculture Loan.1babu41652107No ratings yet

- Product Feature SheetDocument3 pagesProduct Feature SheethasanveletanlicNo ratings yet

- CU 2nd Sem FeeDocument1 pageCU 2nd Sem Feenasas nasNo ratings yet

- Dividend - Cash Endowment - Cash Coupon - Withdrawal Request Form 提取紅利 現金儲蓄 可支取現金申請書 (With PIPL) 2Document14 pagesDividend - Cash Endowment - Cash Coupon - Withdrawal Request Form 提取紅利 現金儲蓄 可支取現金申請書 (With PIPL) 2stellakcsloveNo ratings yet

- Loans and AdvancveDocument15 pagesLoans and AdvancveLeo SaimNo ratings yet

- SwapDocument31 pagesSwapashmitgupta411No ratings yet

- BondsDocument19 pagesBondsSam SamNo ratings yet

- ElanDocument2 pagesElankalumaadari1970No ratings yet

- DownloadDocument1 pageDownloadalishbkhan18No ratings yet

- C 1 MaroonDocument15 pagesC 1 Maroonaneeqahsan20No ratings yet

- Product Eligibility USDDocument4 pagesProduct Eligibility USDnormanNo ratings yet

- Importance of Consumer Durable Loan For Keralites: SL - No ParametersDocument8 pagesImportance of Consumer Durable Loan For Keralites: SL - No ParametersSandeep MishraNo ratings yet

- SAPM Unit 3Document62 pagesSAPM Unit 3Hansa rathoreNo ratings yet

- Loi A U)Document6 pagesLoi A U)Marcos RosalesNo ratings yet

- Online Fees Account Indian Bank A/c No. 830641451 Indian Bank A/c No. 830641451 Online Fees Account Online Fees Account Indian Bank A/c No. 830641451Document1 pageOnline Fees Account Indian Bank A/c No. 830641451 Indian Bank A/c No. 830641451 Online Fees Account Online Fees Account Indian Bank A/c No. 830641451Shiva KumarNo ratings yet

- Future Health SurakshaDocument39 pagesFuture Health SurakshaColin GeneraliNo ratings yet

- Future Advantage Top Up Brochure 21 Dec 2018 1Document27 pagesFuture Advantage Top Up Brochure 21 Dec 2018 1Subham sikdarNo ratings yet

- Commercial Banking-Hdfc Housing FinanceDocument24 pagesCommercial Banking-Hdfc Housing FinancePankul KohliNo ratings yet

- Korea Visa ChecklistDocument1 pageKorea Visa ChecklistAlverastine AnNo ratings yet

- 2221013256Document1 page2221013256luckytraders0511No ratings yet

- 2221013256Document1 page2221013256luckytraders0511No ratings yet

- FI06 Corporate Bonds 6523d7e802edbDocument65 pagesFI06 Corporate Bonds 6523d7e802edbKinzimbu Asset ManagementNo ratings yet

- Mnsuam Mnsuam Mnsuam Mnsuam: Semest./Yr Semest./Yr Semest./Yr Semest./YrDocument1 pageMnsuam Mnsuam Mnsuam Mnsuam: Semest./Yr Semest./Yr Semest./Yr Semest./Yrڈاکٹر محمد امجدNo ratings yet

- CETUG 2019 308580 FeeDocument1 pageCETUG 2019 308580 FeechandniNo ratings yet

- Capital Markets - 2/29/2008Document1 pageCapital Markets - 2/29/2008Russell KlusasNo ratings yet

- Part Withdrawal or Surrender FormDocument1 pagePart Withdrawal or Surrender FormAkshay MalhotraNo ratings yet

- PD Sam I MT Q Home FinancingDocument10 pagesPD Sam I MT Q Home FinancingMichael TanNo ratings yet

- 1228325909262508032Document2 pages1228325909262508032narrasridharNo ratings yet

- Case Study Overhead Costs AnalysisDocument13 pagesCase Study Overhead Costs AnalysisTon SyNo ratings yet

- A Toy Super Shop-Kidzomania: Marketing Plan For ToysDocument22 pagesA Toy Super Shop-Kidzomania: Marketing Plan For ToysArnob ChowdhuryNo ratings yet

- Chapter 13 Exporting, Importing, and CountertradeDocument7 pagesChapter 13 Exporting, Importing, and CountertradeThế TùngNo ratings yet

- MARGINAL COSTING ExamplesDocument10 pagesMARGINAL COSTING ExamplesLaljo VargheseNo ratings yet

- Pillars Mission & VisionDocument12 pagesPillars Mission & VisionNouran El GendyNo ratings yet

- HVS - 2009 Hotel Development Cost SurveyDocument8 pagesHVS - 2009 Hotel Development Cost SurveyAmir Khalil SanjaniNo ratings yet

- Long Lived Assets (Peserta)Document23 pagesLong Lived Assets (Peserta)bush0275No ratings yet

- The 21st Century Maritime Silk Road PDFDocument63 pagesThe 21st Century Maritime Silk Road PDFoanabrandaNo ratings yet

- Chapter 18 - Budgeting The Education PlanDocument2 pagesChapter 18 - Budgeting The Education PlanSheila May DomingoNo ratings yet

- Pricing of Port ServicesDocument130 pagesPricing of Port ServicesvenkateswarantNo ratings yet

- Making Cement BricksDocument3 pagesMaking Cement BricksCampbell OGENRWOTNo ratings yet

- Sarba Shanti Ayog Is A Unique and Pioneering Enabling Platform For Building Fair Trade Business at The Grassroots LevelDocument6 pagesSarba Shanti Ayog Is A Unique and Pioneering Enabling Platform For Building Fair Trade Business at The Grassroots LevelAWANTIKA CHAUDHARYNo ratings yet

- NIMS University Jaipur - B.sc. Economics Course Fees, Eligibility, ScholarshipDocument8 pagesNIMS University Jaipur - B.sc. Economics Course Fees, Eligibility, ScholarshipstepincollegeNo ratings yet

- Inflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalDocument24 pagesInflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalpriyanshuNo ratings yet

- Tugas HUKUM KONTRAK BISNIS INSTERNASIONALDocument5 pagesTugas HUKUM KONTRAK BISNIS INSTERNASIONALnovaaprianto253No ratings yet

- SWOT Titan FinalDocument29 pagesSWOT Titan FinalMukesh Manwani100% (1)

- FM Quiz #3 SET 1Document2 pagesFM Quiz #3 SET 1Cjhay MarcosNo ratings yet

- Working of RBI: Supervised By: DR - Anjana AttriDocument25 pagesWorking of RBI: Supervised By: DR - Anjana AttriKajal ChaudharyNo ratings yet

- Workshop On VegetablesDocument12 pagesWorkshop On Vegetablesdiptikanta72100% (1)

- MBA EX. Mid Term Examination Schedule - Summer 2021Document1 pageMBA EX. Mid Term Examination Schedule - Summer 2021Shehreiz SiddiquiNo ratings yet

- Chapter 8 ProductDocument48 pagesChapter 8 Productqdrsnbk85mNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Taxation NotesDocument5 pagesTaxation NotesNaya AtinNo ratings yet

- Types of Opinions Provided by The AuditorDocument20 pagesTypes of Opinions Provided by The AuditorFarrukh TahirNo ratings yet

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Environmental Impact Assessment in Ethiopia: A General Review of History, Transformation and Challenges Hindering Full ImplementationDocument9 pagesEnvironmental Impact Assessment in Ethiopia: A General Review of History, Transformation and Challenges Hindering Full ImplementationAmanu WorkuNo ratings yet

- CMPL Summit Letter For Plenary Speaker MMSUDocument1 pageCMPL Summit Letter For Plenary Speaker MMSURyan PazonNo ratings yet

BFD Primer 2021 (Updated As of March 2021)

BFD Primer 2021 (Updated As of March 2021)

Uploaded by

Meg GutierrezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BFD Primer 2021 (Updated As of March 2021)

BFD Primer 2021 (Updated As of March 2021)

Uploaded by

Meg GutierrezCopyright:

Available Formats

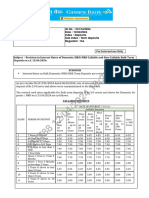

NEW SAN JOSE BUILDERS, INC.

Bank Financing Department

Office Landline 442.77.77 loc. 232/175/202/163 * Direct Line 442.83.41/415.00.25

ACCREDITED BANKS FOR 2021

BANCO DE ORO CHINABANK UCPB RBC CEBUANA LHUILLER MAYBANK

Loan Term Interest Rate Loan Term Interest Rate Loan Term Interest Rate Loan Term Interest Rate Loan Term Interest Rate Loan Term Interest Rate

Fixed 1-3 years 5.75% Fixed 1-3 years 5.00% Fixed 3 years 5.88% Fixed 5 years 6.50% Fixed 1 year 6.50% Fixed 5 years 6.38%

Fixed 4-5 years 6.75% Fixed 4-5 years 6.00% Fixed 5 years 6.88% Fixed 3 years 6.75%

* subject to repricing * subject to repricing * subject to repricing * subject to repricing * subject to repricing * subject to repricing

15 years Loan Term 10 years Loan Term 20 years Loan Term 15 years Loan Term 20 years Loan Term 15 years Loan Term

*Subject to change until further notice *Subject to change until further notice *Subject to change until further notice *Subject to change until further notice *Subject to change until further notice *Subject to change until further notice

Projects Enrolled Projects Enrolled Projects Enrolled Projects Enrolled Projects Enrolled Projects Enrolled

VT, VDM 1,VS1, FV, IDV-BCD, VM,

All RFO Condos, VDMR, VDM2, VS2, VT, VS1, VS2, VDM, VDM2, VDMR, FT,

VDMR, VDM2, VS2, Isabel Terraces, All RFO Condos Isabel Terraces & Theresa Heights VDM1, VS1, VT, FV, IDV, VM

MMH-TH, ITH FV, VM, MMH, RDM, IDV

MMH 2E

Maximum Age at Maturity 65 Maximum Age at Maturity 65 Maximum Age at Maturity 65 Maximum Age at Maturity 65 Maximum Age at Maturity 65 Maximum Age at Maturity 65

Loan Value 90% of TCP Loan Value 90% of TCP Loan Value 80% of TCP Loan Value 90% of TCP Loan Value 90% of TCP Loan Value 90% of TCP

STANDARD REQUIREMENTS BANK PROVIDED FORMS AIF REQUIREMENTS

1. Housing Loan Application Form (Duly accomplished and signed) 1. Loan Mortgage Agreement 1. Housing Loan Application Form or AIF Information Sheet

2. One (1) each 2x2 picture of borrower and spouse (if applicable) 2. Disclosure Statement 2. Photocopy of 2 valid ID's (back to back) with 3 specimen

3. Photocopy each of 2 valid ID's (back to back) of borrower and spouse 3. Mortgage Redemption Insurance 3. Proof of Billing or Barangay Clearance

4. Birth certificate and CENOMAR (if single) 4. Collateral Authorization

5. Marriage Contract or Certificate (if married) 5. Special Power of attorney (if applicable)

COLLATERAL REQUIREMENTS

If Employed If Engaged in Business If Contract Worker If Professional If Foreigner

1. Certificate of Employment, indicating 1. DTI/SEC Registration/Mayor's Permit 1. Certificate of Employment, indicating position, tenure and 1. PRC License 1. Alien Certificate of Registration (Permanent Residency,

position, tenure and monthly salary 2. Articles of Incorporation and By-Laws monthly basic salary and fixed allowance, if any 2. Latest 2 years Income Tax Returns Special Investor's, Resident Visa)

2. latest Income Tax Return 3. 3 Years Audited Financial Statements 2. Latest Income Tax Return, if applicable 3. Latest 2 years Audited and in-house 2. Certificate of Employment, indicating position, tenure,

3. Latest 3 months Payslips 4. Latest 2 years Income Tax 3. Latest 3 months Payslips and Remittance Financial Statement monthly basic salary and fixed allowance, (if applicable)

4. Latest 6 months Bank Statements 5. Latest 6 months Bank Statement 4. POEA Contract, (if applicable) 4. Latest 3 months Bank Statements 3. Latest 3 months Payslips

6. Company Profile/ Business Background 5. Latest 3 months Bank Statements 4. Latest 3 months Bank Statements

7. List of Customers and Suppliers with 6. Working Visa or Green Card or Immigrant Visa

Contact Numbers

*These rates are just indicative and may change depending on the prevailing rate at the time of loan release. ONE TIME BANK CHARGES UPON LOAN APPROVAL ESTIMATED AT AROUND 3-3.5% OF APPROVED LOAN

You might also like

- Major Development Programs and Personalities in Science And-1Document27 pagesMajor Development Programs and Personalities in Science And-1Prince Sanji66% (128)

- Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) LTDDocument2 pagesAl-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) Ltd. Al-Kabir Town (PVT.) LTDHassan Naveed54% (26)

- Birchbox Rep Marketing PlanDocument18 pagesBirchbox Rep Marketing Planapi-32128012750% (2)

- Timor Leste's Strategic Development Plan - 2011 - 2030Document24 pagesTimor Leste's Strategic Development Plan - 2011 - 2030fabricadosblogs4466No ratings yet

- Buy Government Bonds From Abroad Using Your Foreign Currency AccountDocument1 pageBuy Government Bonds From Abroad Using Your Foreign Currency AccountTasneef ChowdhuryNo ratings yet

- Mera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Document2 pagesMera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Hur Hussain SyedNo ratings yet

- CAF Kotak Mutual Fund Lumpsum SIP Common Application Forms SIP Registration NACH ECS Auto Direct Debit One Time Mandate Otm FATCA Application Form 1Document3 pagesCAF Kotak Mutual Fund Lumpsum SIP Common Application Forms SIP Registration NACH ECS Auto Direct Debit One Time Mandate Otm FATCA Application Form 1Darkness DarknessNo ratings yet

- VATRAININGPOWERPTDocument59 pagesVATRAININGPOWERPTboxxer01833100% (1)

- Indian Financial System: Financial Market Consists ofDocument67 pagesIndian Financial System: Financial Market Consists ofTHILAGALAKSHMI M DNo ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

- State Bank of Pakistan On Low Cost HousingDocument2 pagesState Bank of Pakistan On Low Cost HousingAmir SafdarNo ratings yet

- Tuition Fee FTR Receipt PDFDocument1 pageTuition Fee FTR Receipt PDFSALMAN KHANNo ratings yet

- Change of Life Assured Form 70000981Document8 pagesChange of Life Assured Form 70000981Shareen TeoNo ratings yet

- GE I ChallanFormDocument1 pageGE I ChallanFormMaroofNo ratings yet

- NSDL Ind. V. 20.4 (Revised Standing Instructions) 2.9.2022Document1 pageNSDL Ind. V. 20.4 (Revised Standing Instructions) 2.9.2022Patel Enterprise SeamsNo ratings yet

- The Game Changers of Indian Realty!Document14 pagesThe Game Changers of Indian Realty!Mohd ShifanNo ratings yet

- China Interbank Bond Market and FX MarketDocument60 pagesChina Interbank Bond Market and FX MarketbondbondNo ratings yet

- Onlineadmission - Iba.edu - PK Voucher 81252Document1 pageOnlineadmission - Iba.edu - PK Voucher 81252Usman BalochNo ratings yet

- One Pager-NR Initiative - Sep'23Document2 pagesOne Pager-NR Initiative - Sep'23JereenNo ratings yet

- Tenure General Public FD Rate Senior Citizens FD RateDocument9 pagesTenure General Public FD Rate Senior Citizens FD Rateisha jsNo ratings yet

- SBI Bond IssueDocument2 pagesSBI Bond Issueanon_722571No ratings yet

- Hand Out On All Types of Star Personal Loan - Updated Upto 25 May 2021Document35 pagesHand Out On All Types of Star Personal Loan - Updated Upto 25 May 2021Amit Manju AgrawalNo ratings yet

- Module 3 Getting Ahead With VULDocument10 pagesModule 3 Getting Ahead With VULJun Reyes RamirezNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- Scoring CriteriaDocument1 pageScoring CriteriaArsal AliNo ratings yet

- CUOnline Student PortalDocument1 pageCUOnline Student Portalch.hamzagorya.794No ratings yet

- LT Infrastructure FinanceLtd 2011B Series Tranche 1Document2 pagesLT Infrastructure FinanceLtd 2011B Series Tranche 1priya thackerNo ratings yet

- Personal Details: The Hong Kong Confederation of Insurance BrokersDocument5 pagesPersonal Details: The Hong Kong Confederation of Insurance Brokersrayallen1234No ratings yet

- 02 Insurance Claim (MIR SIR)Document1 page02 Insurance Claim (MIR SIR)Aguilar QuezonNo ratings yet

- Fee VoucherDocument1 pageFee VoucherShaikh Arham AyazNo ratings yet

- Capital Markets - 4/11/2008Document1 pageCapital Markets - 4/11/2008Russell KlusasNo ratings yet

- CUOnline Student PortalDocument1 pageCUOnline Student Portalmahamaamir60No ratings yet

- Deposit Interest Rates Bank of BarodaDocument1 pageDeposit Interest Rates Bank of Barodagrv0025No ratings yet

- Scribd 1Document2 pagesScribd 1sobiaNo ratings yet

- Agriculture Loan.1Document2 pagesAgriculture Loan.1babu41652107No ratings yet

- Product Feature SheetDocument3 pagesProduct Feature SheethasanveletanlicNo ratings yet

- CU 2nd Sem FeeDocument1 pageCU 2nd Sem Feenasas nasNo ratings yet

- Dividend - Cash Endowment - Cash Coupon - Withdrawal Request Form 提取紅利 現金儲蓄 可支取現金申請書 (With PIPL) 2Document14 pagesDividend - Cash Endowment - Cash Coupon - Withdrawal Request Form 提取紅利 現金儲蓄 可支取現金申請書 (With PIPL) 2stellakcsloveNo ratings yet

- Loans and AdvancveDocument15 pagesLoans and AdvancveLeo SaimNo ratings yet

- SwapDocument31 pagesSwapashmitgupta411No ratings yet

- BondsDocument19 pagesBondsSam SamNo ratings yet

- ElanDocument2 pagesElankalumaadari1970No ratings yet

- DownloadDocument1 pageDownloadalishbkhan18No ratings yet

- C 1 MaroonDocument15 pagesC 1 Maroonaneeqahsan20No ratings yet

- Product Eligibility USDDocument4 pagesProduct Eligibility USDnormanNo ratings yet

- Importance of Consumer Durable Loan For Keralites: SL - No ParametersDocument8 pagesImportance of Consumer Durable Loan For Keralites: SL - No ParametersSandeep MishraNo ratings yet

- SAPM Unit 3Document62 pagesSAPM Unit 3Hansa rathoreNo ratings yet

- Loi A U)Document6 pagesLoi A U)Marcos RosalesNo ratings yet

- Online Fees Account Indian Bank A/c No. 830641451 Indian Bank A/c No. 830641451 Online Fees Account Online Fees Account Indian Bank A/c No. 830641451Document1 pageOnline Fees Account Indian Bank A/c No. 830641451 Indian Bank A/c No. 830641451 Online Fees Account Online Fees Account Indian Bank A/c No. 830641451Shiva KumarNo ratings yet

- Future Health SurakshaDocument39 pagesFuture Health SurakshaColin GeneraliNo ratings yet

- Future Advantage Top Up Brochure 21 Dec 2018 1Document27 pagesFuture Advantage Top Up Brochure 21 Dec 2018 1Subham sikdarNo ratings yet

- Commercial Banking-Hdfc Housing FinanceDocument24 pagesCommercial Banking-Hdfc Housing FinancePankul KohliNo ratings yet

- Korea Visa ChecklistDocument1 pageKorea Visa ChecklistAlverastine AnNo ratings yet

- 2221013256Document1 page2221013256luckytraders0511No ratings yet

- 2221013256Document1 page2221013256luckytraders0511No ratings yet

- FI06 Corporate Bonds 6523d7e802edbDocument65 pagesFI06 Corporate Bonds 6523d7e802edbKinzimbu Asset ManagementNo ratings yet

- Mnsuam Mnsuam Mnsuam Mnsuam: Semest./Yr Semest./Yr Semest./Yr Semest./YrDocument1 pageMnsuam Mnsuam Mnsuam Mnsuam: Semest./Yr Semest./Yr Semest./Yr Semest./Yrڈاکٹر محمد امجدNo ratings yet

- CETUG 2019 308580 FeeDocument1 pageCETUG 2019 308580 FeechandniNo ratings yet

- Capital Markets - 2/29/2008Document1 pageCapital Markets - 2/29/2008Russell KlusasNo ratings yet

- Part Withdrawal or Surrender FormDocument1 pagePart Withdrawal or Surrender FormAkshay MalhotraNo ratings yet

- PD Sam I MT Q Home FinancingDocument10 pagesPD Sam I MT Q Home FinancingMichael TanNo ratings yet

- 1228325909262508032Document2 pages1228325909262508032narrasridharNo ratings yet

- Case Study Overhead Costs AnalysisDocument13 pagesCase Study Overhead Costs AnalysisTon SyNo ratings yet

- A Toy Super Shop-Kidzomania: Marketing Plan For ToysDocument22 pagesA Toy Super Shop-Kidzomania: Marketing Plan For ToysArnob ChowdhuryNo ratings yet

- Chapter 13 Exporting, Importing, and CountertradeDocument7 pagesChapter 13 Exporting, Importing, and CountertradeThế TùngNo ratings yet

- MARGINAL COSTING ExamplesDocument10 pagesMARGINAL COSTING ExamplesLaljo VargheseNo ratings yet

- Pillars Mission & VisionDocument12 pagesPillars Mission & VisionNouran El GendyNo ratings yet

- HVS - 2009 Hotel Development Cost SurveyDocument8 pagesHVS - 2009 Hotel Development Cost SurveyAmir Khalil SanjaniNo ratings yet

- Long Lived Assets (Peserta)Document23 pagesLong Lived Assets (Peserta)bush0275No ratings yet

- The 21st Century Maritime Silk Road PDFDocument63 pagesThe 21st Century Maritime Silk Road PDFoanabrandaNo ratings yet

- Chapter 18 - Budgeting The Education PlanDocument2 pagesChapter 18 - Budgeting The Education PlanSheila May DomingoNo ratings yet

- Pricing of Port ServicesDocument130 pagesPricing of Port ServicesvenkateswarantNo ratings yet

- Making Cement BricksDocument3 pagesMaking Cement BricksCampbell OGENRWOTNo ratings yet

- Sarba Shanti Ayog Is A Unique and Pioneering Enabling Platform For Building Fair Trade Business at The Grassroots LevelDocument6 pagesSarba Shanti Ayog Is A Unique and Pioneering Enabling Platform For Building Fair Trade Business at The Grassroots LevelAWANTIKA CHAUDHARYNo ratings yet

- NIMS University Jaipur - B.sc. Economics Course Fees, Eligibility, ScholarshipDocument8 pagesNIMS University Jaipur - B.sc. Economics Course Fees, Eligibility, ScholarshipstepincollegeNo ratings yet

- Inflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalDocument24 pagesInflation Rises To 3-Month High of 4.9% in November in Festive Season, Fraud App Installations Half of TotalpriyanshuNo ratings yet

- Tugas HUKUM KONTRAK BISNIS INSTERNASIONALDocument5 pagesTugas HUKUM KONTRAK BISNIS INSTERNASIONALnovaaprianto253No ratings yet

- SWOT Titan FinalDocument29 pagesSWOT Titan FinalMukesh Manwani100% (1)

- FM Quiz #3 SET 1Document2 pagesFM Quiz #3 SET 1Cjhay MarcosNo ratings yet

- Working of RBI: Supervised By: DR - Anjana AttriDocument25 pagesWorking of RBI: Supervised By: DR - Anjana AttriKajal ChaudharyNo ratings yet

- Workshop On VegetablesDocument12 pagesWorkshop On Vegetablesdiptikanta72100% (1)

- MBA EX. Mid Term Examination Schedule - Summer 2021Document1 pageMBA EX. Mid Term Examination Schedule - Summer 2021Shehreiz SiddiquiNo ratings yet

- Chapter 8 ProductDocument48 pagesChapter 8 Productqdrsnbk85mNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Taxation NotesDocument5 pagesTaxation NotesNaya AtinNo ratings yet

- Types of Opinions Provided by The AuditorDocument20 pagesTypes of Opinions Provided by The AuditorFarrukh TahirNo ratings yet

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Environmental Impact Assessment in Ethiopia: A General Review of History, Transformation and Challenges Hindering Full ImplementationDocument9 pagesEnvironmental Impact Assessment in Ethiopia: A General Review of History, Transformation and Challenges Hindering Full ImplementationAmanu WorkuNo ratings yet

- CMPL Summit Letter For Plenary Speaker MMSUDocument1 pageCMPL Summit Letter For Plenary Speaker MMSURyan PazonNo ratings yet