Professional Documents

Culture Documents

Topic 7 Individual Activity ACC

Topic 7 Individual Activity ACC

Uploaded by

heyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 7 Individual Activity ACC

Topic 7 Individual Activity ACC

Uploaded by

heyCopyright:

Available Formats

Topic 7: Introduction to Risk Management and Practical Guidelines in

Reducing and Managing Business Risks

CHAPTER 11

1. How can effective corporate governance be attained?

It can be attained when an organization masters the art of risk management.

2. What are the factors that increased the levels of risk faced by business

firms?

These include the fast-growing sophistication of organization, globalization,

modern technology and impact of corporate scandals.

3. Define risk management (RM).

It is the process of measuring or assessing risk and developing strategies to

manage it.

4. How is RM defined in the ISO 31000?

It is the identification, assessment, and prioritization of risks followed by

coordinated and economical application of resources to minimize, monitor and

control the probability and/or impact of unfortunate events and to maximize the

realization of opportunities.

5. What is the role of RM in business?

Through risk management, risks in business are assessed and systematically

managed to reduce risk to an acceptable level.

6. What are the basic principles of RM as identified by ISO?

Create value

Address uncertainty and assumptions

Be an integral part of organizational process and decision-making

Be dynamic, iterative, transparent, tailorable, and responsive to change

Create capability of continual improvement considering best

information and human factors

Be systematic, structured and continually reassessed

7. What are the steps involved in the process of RM according to ISO?

1 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

1. Establishing the Context

a. Identification of risk

b. Planning

c. Mapping

i. Social scope of risk management

ii. Identity and objectives of stakeholders

iii. Basis upon risks will be evaluated

d. Defining a framework

e. Developing analysis of risks

f. Mitigation or Solution

2. Identification of potential risks

3. Risk assessment

8. How do you identify potential risk?

It can start with the analysis of the source of the problem or the analysis of the

problem itself.

9. What are the common risk identification methods?

a. Objective-based risk

b. Scenario-based risk

c. Taxanomy-based risk

d. Common-risk checking

e. Risk charting

10. What is the ideal RM?

It should minimize spending of manpower or other resources while minimizing

the negative effect of risks.

11. Enumerate the elements in the performance of assessment method.

1. Identification, characterization, and assessment of threats

2 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

2. Assessment of vulnerability of critical assets to specific threats

3. Determination of the risk

4. Identification of ways to reduce those risks

5. Prioritization of risk reduction measures based on a strategy

12. What are the factors usually considered with respect to risks associated

with the following? Identify and summarize each

Risks associated with investments

Risks associated with manufacturing, trading and service concerns

Risks associated with financial institutions

13. Investment

Business risk refers to the uncertainty about the rate of return caused by

the nature of the business.

Financial risk is determined by the firm’s capital structure or sources of

financing.

Liquidity risk is associated with the uncertainty created by the inability to

sell the investment quickly for cash

Default risk is related to the probability that some or all of the initial

investment will not be returned.

Interest rate risk is the potential for investment losses that result from a

change in interest rates.

Management risk involves the possible risk associated by the decisions

made by the firm’s management and board of directors.

Purchasing power risk is the chance that the cash flows from an

investment won't be worth as much in the future because of changes

in purchasing power due to inflation.

14. Manufacturing, trading and service concerns

A. Market Risk

Product Risk

o Complexity

3 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

o Obsolescence

o Research and Development

o Packaging

o Delivery of Warranties

Competitor Risk

o Pricing Strategy

o Market Share

o Market Strategy

B. Operations Risk

Process Stoppage

Health and Safety

After Sales Service Failure

Environmental

Technological Obsolescence

Integrity

o Management Fraud

o Employee Fraud

o Illegal Acts

C. Financial Risk

Interest Rates Value

Foreign Currency

Liquidity

Derivative

Viability

4 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

D. Business Risk

Regulatory Change

Reputation

Political

Regulatory and Legal

Shareholder Relations

Credit Rating

Capital Availability

Business Interruptions

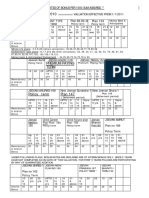

15. Financial institutions

Financial Non-Financial

Liquidity Risk Operational Risk

Market Risk o Systems

o Currency Information

Processing

o Equity Technology

o Commodity o Customer Satisfaction

Credit Risk o Human Resources

o Counterparty o Fraud and Illegal Acts

o Trading o Bankcruptcy

o Commercial Regulatory Risk

Loans o Capital Adequacy

Guarantees o Compliance

Market Liquidity Risk o Taxation

o Currency Rates o Changing laws and policies

5 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

o Interest Rates Environment Risk

o Bond and Equity Prices o Politics

Hedged Positions Risk o Natural disasters

Portfolio Exposure Risk o War

Derivative Risk o Terrorism

Accounting Information Risk Integrity Risk

o Completeness o Reputation

o Accuracy Leadership Risk

Financial Reporting Risk o Turnover

o Adequacy o Succession

o Completeness

16. What are the categories of the techniques in managing risk as suggested

by ISO 31000?

Risk Avoidance

Risk Reduction

Sharing

Retention

17. How do you apply the Basel II framework in managing risk?

It breaks risks into market risk, credit risk and operational risk and specifies

methods for calculating capital requirements for each of these components.

18. What are the most commonly encountered areas of RM?

1. Enterprise risk management

2. Risk management activities as applied to project management

3. Risk management for megaprojects

6 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

4. Risk management of information technology

5. Risk management techniques in petroleum and natural gas.

19. Study the simplified framework of enterprise-wide RM system vis-à-vis

top management’s involvement.

The diagram shows that the top management has to be involved in the

oversight activities and risk management process. The top management must set

management policy, ensure that process covers all risks, ensuring usage of tools

and methodologies, review plans, evaluate reports and recommendations. These are

then actualized through the five-step risk management process. The steps include

assessing of risk, developing action plan, implementing action plans, monitoring

performance, and improving risk management capabilities respectively.

20. What is the SEC requirement pertaining to ERM of publicly listed

corporation? (Principle, Recommendation and Explanation)

Principle 12 deals with strengthening the Internal Control System and

Enterprise Risk Management Framework.

Recommendation 2.11 stand corresponding explanation provide the

following

“The Board should oversee that a sound enterprise risk management

(ERM) framework is in place to effectively identify, monitor, assess and

manage key business risks. The risk management framework should guide

the Board in identifying units/business lines and enterprise-level risk

exposures, as well as the effectiveness of risk management strategies.

Risk management policy is part and parcel of a corporation’s corporate

strategy. The Board is responsible for defining the company’s level of risk

tolerance and providing oversight over it risk management policies and

procedures.”

21. What is the role of the board in relation to RM framework?

The Board should oversee that a sound enterprise risk management (ERM)

framework is in place to effectively identify, monitor, assess and manage key

business risk.

22. Summarize the steps in the RM process.

1. Set up a separate risk management committee chaired by a board

member.

2. Ensure that a formal comprehensive risk management system is in

place.

3. Assess whether the formal system process the necessary elements.

7 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

4. Evaluate the effectiveness of the various steps in the assessment of

the comprehensive risks faced by the business firm.

5. Assess if management has developed and implemented the suitable

risk management strategies and evaluate their effectiveness.

6. Evaluate if management has designed and implemented risk

management capabilities.

7. Assess management’s effort to monitor overall company risk

management performance and to improve continuously the firm’s

capabilities.

8. See to it that best practices as well as mistakes are shared by all. This

involves regular communication of results and feedback to all

concerned.

9. Assess regularly the level of sophistication of the firm’s risk

management system.

10. Hire experts when needed.

CHAPTER 12

1. What is the defining characteristic of an entrepreneurial decision maker?

It is the willingness and readiness to take personal and financial risks.

2. How do successful businessmen and decision-makers deal with risks?

They make sure that the risks resulting from their decisions are measured,

understood and as far as possible eliminated. In addition, they go beyond the direct

financial perspective and actively manage risk as it affects the whole organization.

3. What is the significance of identifying and prioritizing risks?

This makes it easier to avoid unnecessary surprises.

4. What are the typical areas of organizational risk?

Financial

Commercial

Strategic

Technical

Operational

8 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

5. How is an acceptable level of risk considered?

Determine the nature and extent of the risks the business will accept, assess

the likelihood of risks becoming reality and their effect, and consider opportunity cost

associated with risk.

6. After identifying the risk, what is the reason for raking them?

This helps to highlight not only where things might go wrong and what their

impact would be, but also how, why and where these catalysts might be triggered.

7. What are the risk catalysts? Summarize each.

Technology. New hardware, software or system configurations can

trigger risks, as can new demands on existing information systems and

technology.

Organizational change. Risks can be triggered by new management

structures, reporting lines, new strategies and commercial agreements.

Processes. New products, markets and acquisitions all cause change

and can trigger risks.

People. Hiring new employees, losing key people, poor succession

planning, or weak people management can all create dislocation, but

the main danger is behavior.

External factors. Changes to regulation and political, economic or

social developments can all affect strategic decisions by bringing to the

surface risks that may have lain hidden.

8. What are the stages involved in managing enterprise-wide risk that are

inherent in decision making? Summarize each

First, assess and analyze risks resulting from a decision by identifying

and quantifying them (Risk Assessment and Analysis).

Second, consider how best to avoid or mitigate them (Risk

Management and Control).

o Avoiding and Mitigating Risks

o Create a Positive Climate for Mitigating Risk

o Overcoming the Fear of Risk

Third, take action to manage control and monitor the risks (Controlling

and Monitoring Enterprise-Wide Risk).

9 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

9. Enumerate the practical considerations in managing and reducing

financial risk. Summarize the factors involved in each type of consideration.

Improving Profitability

A. Variance Analysis

B. Assessment of Market Entry and Exit Barriers

C. Break-even Analysis

D. Controlling Costs

o Focus on the big items of expenditure

o Be cost aware

o Maintain and balance between costs and quality

o Use budgets for dynamic financial management

o Develop a positive attitude to budgeting

o Eliminate waste

Practical Techniques to Improve Profitability

o Focus decision-making on the most profitable areas

o Decide how to treat the least profitable products

o Make sure new products enhance overall profitability

o Manage development and production decisions

o Set the buying policy

o Consider how to create greater value from existing customers

and products to enhance profitability

o Consider how to increase profitability by managing people

Avoiding Pitfalls

o Financial expertise must be widely available

o Consider the impact of financial decisions

10 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

o Avoid weak budgetary control

o Understand the impact of cash flow

o Know where the risk lies

Reduce Financial Risk (Positive replies to the following Questions

would assist top management to manage financial risk)

o Are the most effective performance measures in place?

o Have you analyzed key business ratios recently?

o Is there a positive attitude to budgets?

o Does decision-making focus on profitable products or is it

preoccupied with peripheral issues?

o What are the least profitable parts of the organization?

o Are market and customer decisions focused on improving

profitability?

o How efficiently is cash managed?

11 of 9 I Topic 7 Risk Management [Hora, Amanda Marie B.]; ACC

You might also like

- Book 1 - Foundations of Risk Management PDFDocument19 pagesBook 1 - Foundations of Risk Management PDFmohamed0% (1)

- Marine Insurance Law PDFDocument651 pagesMarine Insurance Law PDFDaman Waruwu100% (2)

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Moodys All SetsDocument106 pagesMoodys All Setsiva100% (1)

- Chapter 4 Extinguishment of ObligationsDocument8 pagesChapter 4 Extinguishment of Obligationshey100% (9)

- 2013 FRM Level 1 Practice ExamDocument93 pages2013 FRM Level 1 Practice ExamDũng Nguyễn TiếnNo ratings yet

- GBERMIC - Module 11Document8 pagesGBERMIC - Module 11Paolo Niel ArenasNo ratings yet

- Risk CrisilDocument21 pagesRisk Crisilapi-3833893No ratings yet

- Investments, Risks and Rates of ReturnsDocument60 pagesInvestments, Risks and Rates of ReturnsJade Berlyn AgcaoiliNo ratings yet

- Compiled Notes CH 11 15Document26 pagesCompiled Notes CH 11 15Miks EnriquezNo ratings yet

- MGT 209 - CH 11 NotesDocument7 pagesMGT 209 - CH 11 NotesAmiel Christian MendozaNo ratings yet

- P3 - Summary Notes - Ultimate AccessDocument128 pagesP3 - Summary Notes - Ultimate AccessRecruit guideNo ratings yet

- MODULE 8 - RMIC Rev01Document37 pagesMODULE 8 - RMIC Rev01Liza Mae MirandaNo ratings yet

- CCFA03 - S4 Financial Institution & Risk Management - Lecture OneDocument9 pagesCCFA03 - S4 Financial Institution & Risk Management - Lecture OnemonirNo ratings yet

- Risk Management Limuel Dela CruzDocument23 pagesRisk Management Limuel Dela CruzPRINCESS MENDOZANo ratings yet

- AFA 4e PPT Chap01Document55 pagesAFA 4e PPT Chap01فهد التويجريNo ratings yet

- CH 1 Foundations of Risk ManagementDocument162 pagesCH 1 Foundations of Risk ManagementMohd RizzuNo ratings yet

- Green and Orange Illustrated Brainstorm PresentationDocument23 pagesGreen and Orange Illustrated Brainstorm PresentationridenphoretNo ratings yet

- Operational Risk MGT TrainingDocument84 pagesOperational Risk MGT TrainingAB Zed100% (1)

- Gov. CH 11 To 17 FinalDocument11 pagesGov. CH 11 To 17 FinalGlen PeralesNo ratings yet

- Enterprise Risk ManagementDocument12 pagesEnterprise Risk ManagementDesna IkhsandraNo ratings yet

- Research Project AssignmentDocument27 pagesResearch Project AssignmentSam CleonNo ratings yet

- Introduction To Risk ManagementDocument91 pagesIntroduction To Risk Managementaiman afiqNo ratings yet

- Risk ManagementDocument2 pagesRisk ManagementZariah GtNo ratings yet

- 20 Types of Business Risk - SimplicableDocument1 page20 Types of Business Risk - SimplicableSulemanNo ratings yet

- RiskDocument8 pagesRiskRahul MalikNo ratings yet

- Full P3 Case Study BookletDocument302 pagesFull P3 Case Study BookletAli ShahnawazNo ratings yet

- Project Risk Management: A Develoment Institution'S PerspectiveDocument73 pagesProject Risk Management: A Develoment Institution'S Perspectivegauravgd16No ratings yet

- Risk Management: by DR Safdar A ButtDocument18 pagesRisk Management: by DR Safdar A ButtMunnah BhaiNo ratings yet

- Report Ka SakenDocument27 pagesReport Ka Sakenchristian.a.m.121800No ratings yet

- Risk ManagementDocument44 pagesRisk ManagementJane GavinoNo ratings yet

- Module - 5: Protection of Information AssetsDocument118 pagesModule - 5: Protection of Information AssetsRaghu VamsiNo ratings yet

- Aon - 2021 Global Risk Management Survey FindingsDocument142 pagesAon - 2021 Global Risk Management Survey FindingsIgnacio Alfredo A.F.No ratings yet

- Risk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarDocument9 pagesRisk Management in Banking Sector - An Empirical Study: Thirupathi Kanchu M. Manoj KumarKunTal MoNdalNo ratings yet

- 419 USBrok 071Document89 pages419 USBrok 071ANo ratings yet

- Finance AssignmentDocument14 pagesFinance AssignmentWadud LimonNo ratings yet

- Module 5Document118 pagesModule 5Naresh Batra AssociatesNo ratings yet

- Risk Management and InsuranceDocument38 pagesRisk Management and InsuranceNepali Bikrant Shrestha RaiNo ratings yet

- Additonal Question BankDocument372 pagesAdditonal Question Bankapurv 11 jainNo ratings yet

- B1__Additonal question bankDocument75 pagesB1__Additonal question bankapurv 11 jainNo ratings yet

- Enterprise Risk Management: by Erni EkawatiDocument23 pagesEnterprise Risk Management: by Erni EkawatiRidho AnjikoNo ratings yet

- Risk Management Limuel Dela CruzDocument24 pagesRisk Management Limuel Dela CruzEDUARDO JR. VILLANUEVANo ratings yet

- FRM一级强化段风险管理 Mikey 金程教育(打印版)Document50 pagesFRM一级强化段风险管理 Mikey 金程教育(打印版)Kexian WuNo ratings yet

- ERM-Application Week 7-8Document49 pagesERM-Application Week 7-8Ken TuazonNo ratings yet

- FRM一级百题 风险管理基础Document67 pagesFRM一级百题 风险管理基础bertie RNo ratings yet

- Paper: 08, International Business Operations: ManagementDocument15 pagesPaper: 08, International Business Operations: ManagementMonika SainiNo ratings yet

- Risk Management - ITCDocument65 pagesRisk Management - ITCVenugopal VutukuruNo ratings yet

- Arslan Gohar IRMDocument11 pagesArslan Gohar IRMUzma SheikhNo ratings yet

- Class IV-FinanceDocument19 pagesClass IV-FinanceVinayak RaoNo ratings yet

- ERM Application Case StudiesDocument62 pagesERM Application Case StudiesMarcos Araújo100% (3)

- Enterprise Risk ManagementDocument51 pagesEnterprise Risk ManagementKajal Tiwary100% (2)

- Operational Risk NewDocument22 pagesOperational Risk NewMahdi MaahirNo ratings yet

- Financial Risk Management - The Way ForwardDocument31 pagesFinancial Risk Management - The Way Forwardankit_85No ratings yet

- Business & Finance Chapter-5: Introduction To Risk ManagementDocument4 pagesBusiness & Finance Chapter-5: Introduction To Risk ManagementShahid MahmudNo ratings yet

- Paper On Risk ManagementDocument8 pagesPaper On Risk ManagementSANTOSHNo ratings yet

- Risk Management v0.3Document47 pagesRisk Management v0.3Ashwini BalaNo ratings yet

- RM For Cooperatives PICPA 2015Document70 pagesRM For Cooperatives PICPA 2015Rheneir MoraNo ratings yet

- Risk Mgt.Document20 pagesRisk Mgt.shiv sindhuNo ratings yet

- Module 7 Risk MnagementDocument10 pagesModule 7 Risk MnagementddddddaaaaeeeeNo ratings yet

- Mastering Financial Risk Management : Strategies for SuccessFrom EverandMastering Financial Risk Management : Strategies for SuccessNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part I - Finance TheoryFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part I - Finance TheoryNo ratings yet

- Risk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryFrom EverandRisk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryRating: 5 out of 5 stars5/5 (1)

- PRMIA: A Primer for Professional Operational Risk Managers in Financial ServicesFrom EverandPRMIA: A Primer for Professional Operational Risk Managers in Financial ServicesJonathan HowittNo ratings yet

- GLF Asia-Pac Oct'21 Student Info Flyer (Asia)Document2 pagesGLF Asia-Pac Oct'21 Student Info Flyer (Asia)heyNo ratings yet

- Final ScriptDocument3 pagesFinal ScriptheyNo ratings yet

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Mid PS3Document8 pagesMid PS3heyNo ratings yet

- Title 1 ObligationsDocument3 pagesTitle 1 ObligationsheyNo ratings yet

- This Study Resource Was Shared Via: ScoreDocument9 pagesThis Study Resource Was Shared Via: ScoreheyNo ratings yet

- Chapter 3Document9 pagesChapter 3heyNo ratings yet

- This Study Resource Was: Audit Test 3 Study Guide HW 5 Cash ArDocument5 pagesThis Study Resource Was: Audit Test 3 Study Guide HW 5 Cash ArheyNo ratings yet

- Activity No. 1 Mind MappingDocument1 pageActivity No. 1 Mind MappingheyNo ratings yet

- Tutorial 4 - Audit of Purchases System Tutorial 4 - Audit of Purchases SystemDocument11 pagesTutorial 4 - Audit of Purchases System Tutorial 4 - Audit of Purchases SystemheyNo ratings yet

- Volkswagen Is A German CompanyDocument4 pagesVolkswagen Is A German CompanyheyNo ratings yet

- Activity No. 1 Cultural PracticesDocument1 pageActivity No. 1 Cultural PracticesheyNo ratings yet

- Volkswagens Bad Decisions & Harmful Emissions - How Poor ProcessDocument45 pagesVolkswagens Bad Decisions & Harmful Emissions - How Poor ProcessheyNo ratings yet

- Graded Forum - 070921 Financial Statement ReportingDocument3 pagesGraded Forum - 070921 Financial Statement ReportingheyNo ratings yet

- Grading RubricDocument1 pageGrading RubricheyNo ratings yet

- A. Reasons For Corruption and Allegations at Major German CorporationsDocument4 pagesA. Reasons For Corruption and Allegations at Major German CorporationsheyNo ratings yet

- Accenture PLC Is An Irish-Domiciled Multinational Professional Services CompanyDocument4 pagesAccenture PLC Is An Irish-Domiciled Multinational Professional Services CompanyheyNo ratings yet

- Accenture CEO Julie SweetDocument6 pagesAccenture CEO Julie SweetheyNo ratings yet

- Topic 8 Internal ControlDocument16 pagesTopic 8 Internal ControlheyNo ratings yet

- Metlife To Pay $10M Over Internal Control FailuresDocument2 pagesMetlife To Pay $10M Over Internal Control FailuresheyNo ratings yet

- Metlife Case StudyDocument2 pagesMetlife Case StudyheyNo ratings yet

- Problems 13 14Document13 pagesProblems 13 14heyNo ratings yet

- Accounts ReceivableDocument21 pagesAccounts ReceivableheyNo ratings yet

- Chapter 13Document66 pagesChapter 13Nguyen Hai AnhNo ratings yet

- Dynamic-Asset Allocation FundDocument8 pagesDynamic-Asset Allocation FundArmstrong CapitalNo ratings yet

- Business Finance: Week 5 Compare and Contrast The Different Types of InvestmentsDocument22 pagesBusiness Finance: Week 5 Compare and Contrast The Different Types of InvestmentsI am MystineNo ratings yet

- Insurance SectorDocument33 pagesInsurance SectorRhishabh SuritNo ratings yet

- JPM 2015 Equity Derivati 2014-12-15 1578141 PDFDocument76 pagesJPM 2015 Equity Derivati 2014-12-15 1578141 PDFfu jiNo ratings yet

- Entrepreneurial AttributesDocument25 pagesEntrepreneurial AttributesPatrie Eunice BuezaNo ratings yet

- PDFDocument4 pagesPDFJwalant J AntaniNo ratings yet

- ACI Dealing Practice Exam 5 To DoDocument12 pagesACI Dealing Practice Exam 5 To DomorrienteskNo ratings yet

- Practice Question 1-Portfolio ManagementDocument8 pagesPractice Question 1-Portfolio Managementzoyaatique72No ratings yet

- Sec B B.6. International Finance: Cma Athul KrishnaDocument28 pagesSec B B.6. International Finance: Cma Athul KrishnaAjay BhaskarNo ratings yet

- SampoornaDocument1 pageSampoornaimam janiNo ratings yet

- Re InsuranceDocument49 pagesRe InsuranceVaibhavRanjankarNo ratings yet

- Review Questions - Corporate Finance 58.51Document17 pagesReview Questions - Corporate Finance 58.51Đỗ Tuấn An100% (2)

- Kenyan Licensed Insurance Industry Players As at 2020-02-07Document4 pagesKenyan Licensed Insurance Industry Players As at 2020-02-07Okanga AnjichiNo ratings yet

- Iamp 7Document30 pagesIamp 7Tshepang MatebesiNo ratings yet

- Models For PD LGD EadDocument38 pagesModels For PD LGD Eadshanks de rouxeNo ratings yet

- Icici Lombard - Swiss VillasDocument1 pageIcici Lombard - Swiss VillasAshish KumarNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- KK - JeevanUtsav - 30-1-2024 9.31.47Document6 pagesKK - JeevanUtsav - 30-1-2024 9.31.47mouli4454No ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Campoamor, Luis & Rosalina Fire Coc Nov 2022-2023Document1 pageCampoamor, Luis & Rosalina Fire Coc Nov 2022-2023Penguin 37No ratings yet

- ReinsuranceDocument56 pagesReinsuranceprasadpatilNo ratings yet

- Sid Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 Etf Fund of FundDocument100 pagesSid Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 Etf Fund of Fundanilkumarbaghar143No ratings yet

- Chapter 2Document8 pagesChapter 2sguldekar123No ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Mark Andrew FeltonDocument1 pageMark Andrew FeltonJim ShortNo ratings yet

- Bonus - Rates Lic Jeevan Surbhi 2009 - 2010 PDFDocument5 pagesBonus - Rates Lic Jeevan Surbhi 2009 - 2010 PDFVipul KaushikNo ratings yet

- SEGURO DEL CARRO (08-21-2023 A 02-21-2024) - Páginas-2,12Document2 pagesSEGURO DEL CARRO (08-21-2023 A 02-21-2024) - Páginas-2,12Marius SrrNo ratings yet