Professional Documents

Culture Documents

Browning - Ch02 P15 Build A Model

Browning - Ch02 P15 Build A Model

Uploaded by

AdamCopyright:

Available Formats

You might also like

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Financial Management - Brigham Chapter 3Document4 pagesFinancial Management - Brigham Chapter 3Fazli AleemNo ratings yet

- Sunset Boards Case StudyDocument3 pagesSunset Boards Case StudyMeredith Wilkinson Ramirez100% (2)

- For December 31 20x1 The Balance Sheet of Baxter Corporation Was As FollowsDocument4 pagesFor December 31 20x1 The Balance Sheet of Baxter Corporation Was As Followslaale dijaanNo ratings yet

- Glenn S Glue Stick IncDocument5 pagesGlenn S Glue Stick IncHenry KimNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- FM16 Ch21 Tool KitDocument41 pagesFM16 Ch21 Tool KitAdamNo ratings yet

- Tool Kit Distributions To Shareholders: Dividends and RepurchasesDocument6 pagesTool Kit Distributions To Shareholders: Dividends and RepurchasesAdamNo ratings yet

- Ch04 Tool KitDocument80 pagesCh04 Tool KitAdamNo ratings yet

- 3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedDocument8 pages3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedCASTOR, Vincent Paul0% (1)

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Document13 pagesANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNo ratings yet

- FCF 12th Edition Case SolutionsDocument66 pagesFCF 12th Edition Case SolutionsDavid ChungNo ratings yet

- Nebraska FRSDocument87 pagesNebraska FRSMatt BrownNo ratings yet

- E. Ch02 P15 Flujo Caja, EVA, MVA SolutionDocument3 pagesE. Ch02 P15 Flujo Caja, EVA, MVA SolutionDarling Desirée Togna SalasNo ratings yet

- Chapter 7. Student CH 07-15 Build A Model: AssetsDocument3 pagesChapter 7. Student CH 07-15 Build A Model: Assetsseth litchfieldNo ratings yet

- Ch02 P21 Build A ModelDocument3 pagesCh02 P21 Build A ModelFelipe WeulerNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Assignment Part OneDocument3 pagesAssignment Part Onetovi0821No ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- University of Business& Technology: Worksheet # 4Document3 pagesUniversity of Business& Technology: Worksheet # 4nikowawaNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- PepsiCo Financial StatementsDocument9 pagesPepsiCo Financial StatementsBorn TaylorNo ratings yet

- Bail Am Tren LopDocument10 pagesBail Am Tren LopquyruaxxNo ratings yet

- Verizon Communications Inc.: Horizontal AnalysisDocument42 pagesVerizon Communications Inc.: Horizontal Analysisjm gonzalezNo ratings yet

- Group 4 OL-groupproject Mar 26Document19 pagesGroup 4 OL-groupproject Mar 26Jessica HummelNo ratings yet

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Business AccountingDocument14 pagesBusiness AccountingLoguNo ratings yet

- Week 4 AssignmentDocument4 pagesWeek 4 AssignmentLovepreet malhiNo ratings yet

- Sales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitDocument5 pagesSales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitMichaela KowalskiNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- CH4 MinicaseDocument4 pagesCH4 Minicasemervin coquillaNo ratings yet

- Ch02-20 ModDocument4 pagesCh02-20 ModDaniel BalchaNo ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Solution Exercise 2 Required Home Work (With Inventories - FIFO)Document3 pagesSolution Exercise 2 Required Home Work (With Inventories - FIFO)Hanzo vargasNo ratings yet

- WA12Document2 pagesWA12IzzahIkramIllahiNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Pepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Document2 pagesPepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Graciel Dela CruzNo ratings yet

- Latihan Arus KasDocument8 pagesLatihan Arus KasEka Junita HartonoNo ratings yet

- Financial Analysis and InterpretationDocument22 pagesFinancial Analysis and Interpretationirfan_rana4uNo ratings yet

- Colgate Ratio Analysis SolvedDocument7 pagesColgate Ratio Analysis SolvedKavitha RagupathyNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Balance Sheet: (In Millions of Dollars) AssetsDocument8 pagesBalance Sheet: (In Millions of Dollars) AssetsThiện Nhân100% (1)

- Afs ExcelDocument8 pagesAfs ExcelAyesha SheheryarNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Solution To Ch02 P15 Build A ModelDocument3 pagesSolution To Ch02 P15 Build A ModelHaseeb Malik100% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- FM16 Ch20 Tool KitDocument22 pagesFM16 Ch20 Tool KitAdamNo ratings yet

- Ch17 Tool KitDocument25 pagesCh17 Tool KitAdamNo ratings yet

- FM16 Ch25 Tool KitDocument35 pagesFM16 Ch25 Tool KitAdamNo ratings yet

- FM16 Ch22 Tool KitDocument20 pagesFM16 Ch22 Tool KitAdamNo ratings yet

- Ch15 Tool KitDocument55 pagesCh15 Tool KitAdamNo ratings yet

- FM16 Ch18 Tool KitDocument7 pagesFM16 Ch18 Tool KitAdamNo ratings yet

- Ch16 Tool KitDocument13 pagesCh16 Tool KitAdamNo ratings yet

- Ch05 Tool KitDocument31 pagesCh05 Tool KitAdamNo ratings yet

- FM16 Ch28 Tool KitDocument7 pagesFM16 Ch28 Tool KitAdamNo ratings yet

- FM16 Ch27 Tool KitDocument5 pagesFM16 Ch27 Tool KitAdamNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- FM16 Ch26 Tool KitDocument21 pagesFM16 Ch26 Tool KitAdamNo ratings yet

- Ch02 Tool KitDocument16 pagesCh02 Tool KitAdamNo ratings yet

- Service Level Agreement (Sla) - Access BankDocument6 pagesService Level Agreement (Sla) - Access BankEfe AgbozeroNo ratings yet

- Module - 2 Auditor'S Report: Objectives of The AuditorDocument20 pagesModule - 2 Auditor'S Report: Objectives of The AuditorVijay KumarNo ratings yet

- PIZZA - SEC 17-A - Annual Report 2022-1Document28 pagesPIZZA - SEC 17-A - Annual Report 2022-1Cm BeNo ratings yet

- BA7021-Security Analysis and Portfolio PDFDocument6 pagesBA7021-Security Analysis and Portfolio PDFLavanya GunalanNo ratings yet

- Methodology of The Moscow Exchange Equity Indices CalculationDocument30 pagesMethodology of The Moscow Exchange Equity Indices CalculationJimmyNo ratings yet

- Fintech in IndiaDocument39 pagesFintech in IndiaKunwarbir Singh lohat100% (2)

- BurgerKing Versus McDonaldsDocument4 pagesBurgerKing Versus McDonaldsmarkus johannessenNo ratings yet

- Castro Maryliam T 3Document4 pagesCastro Maryliam T 3Kyle KuroNo ratings yet

- Offer Letter - New RutujaDocument2 pagesOffer Letter - New RutujaAvinash JadhavNo ratings yet

- 1.1.6 Practice - Solving Business Problems With Spreadsheets (Practice)Document12 pages1.1.6 Practice - Solving Business Problems With Spreadsheets (Practice)Godfrey Byaombe0% (3)

- Revised Development Project Proforma/Proposal (RDPP) : ST NDDocument11 pagesRevised Development Project Proforma/Proposal (RDPP) : ST NDEngr. Mohammad Moinul HossainNo ratings yet

- Biblio Kelompok 5Document56 pagesBiblio Kelompok 5scarlett phantomNo ratings yet

- Amro Faisal ResumeDocument3 pagesAmro Faisal ResumeAmroNo ratings yet

- Seagull OptionDocument3 pagesSeagull OptionabrNo ratings yet

- Account Title PR Trial Balance Dr. CRDocument15 pagesAccount Title PR Trial Balance Dr. CRJEERAPA KHANPHETNo ratings yet

- Model 10 InflationDocument10 pagesModel 10 InflationnaufalNo ratings yet

- Tax Preparation ChecklistDocument3 pagesTax Preparation ChecklistElias TijerinaNo ratings yet

- Financial Wellness SurveyDocument1 pageFinancial Wellness SurveyRosanne Tan RoxasNo ratings yet

- Harish Mba ProjectDocument72 pagesHarish Mba ProjectchaluvadiinNo ratings yet

- ABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Document45 pagesABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Willie Montes Poblacion Jr.No ratings yet

- Compounding and Annuity Tables Use in Equity ValuationDocument8 pagesCompounding and Annuity Tables Use in Equity ValuationKarya BangunanNo ratings yet

- Discounted Cash FlowDocument29 pagesDiscounted Cash FlowAlkhair SangcopanNo ratings yet

- Compliance Calendar For Category I-Ii Alternative Investment Funds-V2Document11 pagesCompliance Calendar For Category I-Ii Alternative Investment Funds-V2Oxford PML2020No ratings yet

- American Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDocument26 pagesAmerican Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDaniel KwanNo ratings yet

- Quiz Investment Appraisal - GeorgeDocument16 pagesQuiz Investment Appraisal - GeorgeGABRIELLA GUNAWANNo ratings yet

- Accounting Concepts and Applications 11th Edition Albrecht Test BankDocument25 pagesAccounting Concepts and Applications 11th Edition Albrecht Test BankMichelleHarrisjspr100% (47)

- Chapter 4 - More On Sales and PurchasesDocument7 pagesChapter 4 - More On Sales and PurchaseskundiarshdeepNo ratings yet

- Detailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietyDocument20 pagesDetailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietysauravNo ratings yet

- Monthly ReportDocument13 pagesMonthly ReportWillian Delgado MendozaNo ratings yet

Browning - Ch02 P15 Build A Model

Browning - Ch02 P15 Build A Model

Uploaded by

AdamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Browning - Ch02 P15 Build A Model

Browning - Ch02 P15 Build A Model

Uploaded by

AdamCopyright:

Available Formats

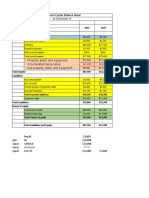

Solution Adam Browni 9/1/2021

Chapter: 2

Problem: 15

a. Using the financial statements shown below, calculate net operating working capital, total net

operating capital, net operating profit after taxes, free cash flow, and return on invested capital for

the most recent year.

Lan & Chen Technologies: Income Statements for Year Ending December 31

(Thousands of Dollars) 2016 2015

Sales $945,000 $900,000

Expenses excluding depreciation and amortization 812,700 774,000

EBITDA $132,300 $126,000

Depreciation and amortization 33,100 31,500

EBIT $99,200 $94,500

Interest Expense 10,470 8,600

EBT $88,730 $85,900

Taxes (40%) 35,492 34,360

Net income $53,238 $51,540

Common dividends $43,300 $41,230

Addition to retained earnings $9,938 $10,310

Lan & Chen Technologies: December 31 Balance Sheets

(Thousands of Dollars)

Assets 2016 2015

Cash and cash equivalents $47,250 $45,000

Short-term investments 3,800 3,600

Accounts Receivable 283,500 270,000

Inventories 141,750 135,000

Total current assets $476,300 $453,600

Net fixed assets 330,750 315,000

Total assets $807,050 $768,600

Liabilities and equity

Accounts payable $94,500 $90,000

Accruals 47,250 45,000

Notes payable 26,262 9,000

Total current liabilities $168,012 $144,000

Long-term debt 94,500 90,000

Total liabilities $262,512 $234,000

Common stock 444,600 444,600

Retained Earnings 99,938 90,000

Total common equity $544,538 $534,600

Total liabilities and equity $807,050 $768,600

Key Input Data

Tax rate 40%

Net operating working capital

Operating Operating

2016 NOWC = current assets - current liabilities

2016 NOWC = $472,500 - $141,750

2016 NOWC = $330,750

Operating Operating

2015 NOWC = current assets - current liabilities

2015 NOWC = $450,000 - $135,000

2015 NOWC = $315,000

Total net operating capital

2016 TOC = NOWC + Fixed assets

2016 TOC = $330,750 + $330,750

2016 TOC = $661,500

2015 TOC = NOWC + Fixed assets

2015 TOC = $315,000 + $315,000

2015 TOC = $630,000

Investment in total net operating capital

2016 2015

2016 Inv. In TOC = TOC - TOC

2016 Inv. In TOC = $661,500 - $630,000

2016 Inv. In TOC = $31,500

Net operating profit after taxes

2016 NOPAT = EBIT x (1-T)

2016 NOPAT = $99,200 x 60%

2016 NOPAT = $59,520

Free cash flow

2016 FCF = NOPAT - Net investment in operating capital

2016 FCF = $59,520 - $31,500

2016 FCF = $28,020

Return on invested capital

2016 ROIC = NOPAT / Total net operating capital

2016 ROIC = $59,520 / $661,500

2016 ROIC = 9.0%

b. Assume that there were 15 million shares outstanding at the end of the year, the year-end closing

stock price was $65 per share, and the after-tax cost of capital was 8%. Calculate EVA and MVA for

the most recent year.

Additional Input Data

Stock price per share $65.00

# of shares (in thousands) 15,000

After-tax cost of capital 8.0%

Market Value Added

MVA = Stock price x # of shares - Total common equity

MVA = $65.00 x 15,000 - $544,538

MVA = $975,000 - $544,538

MVA = $430,462

Economic Value Added

EVA = NOPAT - (Operating Capital x After-tax cost of capital)

EVA = $59,520 - $661,500 x 8%

EVA = $59,520 - $52,920

EVA = $6,600

You might also like

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Financial Management - Brigham Chapter 3Document4 pagesFinancial Management - Brigham Chapter 3Fazli AleemNo ratings yet

- Sunset Boards Case StudyDocument3 pagesSunset Boards Case StudyMeredith Wilkinson Ramirez100% (2)

- For December 31 20x1 The Balance Sheet of Baxter Corporation Was As FollowsDocument4 pagesFor December 31 20x1 The Balance Sheet of Baxter Corporation Was As Followslaale dijaanNo ratings yet

- Glenn S Glue Stick IncDocument5 pagesGlenn S Glue Stick IncHenry KimNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- FM16 Ch21 Tool KitDocument41 pagesFM16 Ch21 Tool KitAdamNo ratings yet

- Tool Kit Distributions To Shareholders: Dividends and RepurchasesDocument6 pagesTool Kit Distributions To Shareholders: Dividends and RepurchasesAdamNo ratings yet

- Ch04 Tool KitDocument80 pagesCh04 Tool KitAdamNo ratings yet

- 3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedDocument8 pages3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedCASTOR, Vincent Paul0% (1)

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Document13 pagesANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNo ratings yet

- FCF 12th Edition Case SolutionsDocument66 pagesFCF 12th Edition Case SolutionsDavid ChungNo ratings yet

- Nebraska FRSDocument87 pagesNebraska FRSMatt BrownNo ratings yet

- E. Ch02 P15 Flujo Caja, EVA, MVA SolutionDocument3 pagesE. Ch02 P15 Flujo Caja, EVA, MVA SolutionDarling Desirée Togna SalasNo ratings yet

- Chapter 7. Student CH 07-15 Build A Model: AssetsDocument3 pagesChapter 7. Student CH 07-15 Build A Model: Assetsseth litchfieldNo ratings yet

- Ch02 P21 Build A ModelDocument3 pagesCh02 P21 Build A ModelFelipe WeulerNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Assignment Part OneDocument3 pagesAssignment Part Onetovi0821No ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- University of Business& Technology: Worksheet # 4Document3 pagesUniversity of Business& Technology: Worksheet # 4nikowawaNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- PepsiCo Financial StatementsDocument9 pagesPepsiCo Financial StatementsBorn TaylorNo ratings yet

- Bail Am Tren LopDocument10 pagesBail Am Tren LopquyruaxxNo ratings yet

- Verizon Communications Inc.: Horizontal AnalysisDocument42 pagesVerizon Communications Inc.: Horizontal Analysisjm gonzalezNo ratings yet

- Group 4 OL-groupproject Mar 26Document19 pagesGroup 4 OL-groupproject Mar 26Jessica HummelNo ratings yet

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Business AccountingDocument14 pagesBusiness AccountingLoguNo ratings yet

- Week 4 AssignmentDocument4 pagesWeek 4 AssignmentLovepreet malhiNo ratings yet

- Sales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitDocument5 pagesSales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitMichaela KowalskiNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- CH4 MinicaseDocument4 pagesCH4 Minicasemervin coquillaNo ratings yet

- Ch02-20 ModDocument4 pagesCh02-20 ModDaniel BalchaNo ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Solution Exercise 2 Required Home Work (With Inventories - FIFO)Document3 pagesSolution Exercise 2 Required Home Work (With Inventories - FIFO)Hanzo vargasNo ratings yet

- WA12Document2 pagesWA12IzzahIkramIllahiNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Pepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Document2 pagesPepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Graciel Dela CruzNo ratings yet

- Latihan Arus KasDocument8 pagesLatihan Arus KasEka Junita HartonoNo ratings yet

- Financial Analysis and InterpretationDocument22 pagesFinancial Analysis and Interpretationirfan_rana4uNo ratings yet

- Colgate Ratio Analysis SolvedDocument7 pagesColgate Ratio Analysis SolvedKavitha RagupathyNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Balance Sheet: (In Millions of Dollars) AssetsDocument8 pagesBalance Sheet: (In Millions of Dollars) AssetsThiện Nhân100% (1)

- Afs ExcelDocument8 pagesAfs ExcelAyesha SheheryarNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Solution To Ch02 P15 Build A ModelDocument3 pagesSolution To Ch02 P15 Build A ModelHaseeb Malik100% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- FM16 Ch20 Tool KitDocument22 pagesFM16 Ch20 Tool KitAdamNo ratings yet

- Ch17 Tool KitDocument25 pagesCh17 Tool KitAdamNo ratings yet

- FM16 Ch25 Tool KitDocument35 pagesFM16 Ch25 Tool KitAdamNo ratings yet

- FM16 Ch22 Tool KitDocument20 pagesFM16 Ch22 Tool KitAdamNo ratings yet

- Ch15 Tool KitDocument55 pagesCh15 Tool KitAdamNo ratings yet

- FM16 Ch18 Tool KitDocument7 pagesFM16 Ch18 Tool KitAdamNo ratings yet

- Ch16 Tool KitDocument13 pagesCh16 Tool KitAdamNo ratings yet

- Ch05 Tool KitDocument31 pagesCh05 Tool KitAdamNo ratings yet

- FM16 Ch28 Tool KitDocument7 pagesFM16 Ch28 Tool KitAdamNo ratings yet

- FM16 Ch27 Tool KitDocument5 pagesFM16 Ch27 Tool KitAdamNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- FM16 Ch26 Tool KitDocument21 pagesFM16 Ch26 Tool KitAdamNo ratings yet

- Ch02 Tool KitDocument16 pagesCh02 Tool KitAdamNo ratings yet

- Service Level Agreement (Sla) - Access BankDocument6 pagesService Level Agreement (Sla) - Access BankEfe AgbozeroNo ratings yet

- Module - 2 Auditor'S Report: Objectives of The AuditorDocument20 pagesModule - 2 Auditor'S Report: Objectives of The AuditorVijay KumarNo ratings yet

- PIZZA - SEC 17-A - Annual Report 2022-1Document28 pagesPIZZA - SEC 17-A - Annual Report 2022-1Cm BeNo ratings yet

- BA7021-Security Analysis and Portfolio PDFDocument6 pagesBA7021-Security Analysis and Portfolio PDFLavanya GunalanNo ratings yet

- Methodology of The Moscow Exchange Equity Indices CalculationDocument30 pagesMethodology of The Moscow Exchange Equity Indices CalculationJimmyNo ratings yet

- Fintech in IndiaDocument39 pagesFintech in IndiaKunwarbir Singh lohat100% (2)

- BurgerKing Versus McDonaldsDocument4 pagesBurgerKing Versus McDonaldsmarkus johannessenNo ratings yet

- Castro Maryliam T 3Document4 pagesCastro Maryliam T 3Kyle KuroNo ratings yet

- Offer Letter - New RutujaDocument2 pagesOffer Letter - New RutujaAvinash JadhavNo ratings yet

- 1.1.6 Practice - Solving Business Problems With Spreadsheets (Practice)Document12 pages1.1.6 Practice - Solving Business Problems With Spreadsheets (Practice)Godfrey Byaombe0% (3)

- Revised Development Project Proforma/Proposal (RDPP) : ST NDDocument11 pagesRevised Development Project Proforma/Proposal (RDPP) : ST NDEngr. Mohammad Moinul HossainNo ratings yet

- Biblio Kelompok 5Document56 pagesBiblio Kelompok 5scarlett phantomNo ratings yet

- Amro Faisal ResumeDocument3 pagesAmro Faisal ResumeAmroNo ratings yet

- Seagull OptionDocument3 pagesSeagull OptionabrNo ratings yet

- Account Title PR Trial Balance Dr. CRDocument15 pagesAccount Title PR Trial Balance Dr. CRJEERAPA KHANPHETNo ratings yet

- Model 10 InflationDocument10 pagesModel 10 InflationnaufalNo ratings yet

- Tax Preparation ChecklistDocument3 pagesTax Preparation ChecklistElias TijerinaNo ratings yet

- Financial Wellness SurveyDocument1 pageFinancial Wellness SurveyRosanne Tan RoxasNo ratings yet

- Harish Mba ProjectDocument72 pagesHarish Mba ProjectchaluvadiinNo ratings yet

- ABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Document45 pagesABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Willie Montes Poblacion Jr.No ratings yet

- Compounding and Annuity Tables Use in Equity ValuationDocument8 pagesCompounding and Annuity Tables Use in Equity ValuationKarya BangunanNo ratings yet

- Discounted Cash FlowDocument29 pagesDiscounted Cash FlowAlkhair SangcopanNo ratings yet

- Compliance Calendar For Category I-Ii Alternative Investment Funds-V2Document11 pagesCompliance Calendar For Category I-Ii Alternative Investment Funds-V2Oxford PML2020No ratings yet

- American Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDocument26 pagesAmerican Eagle Outfitters, Inc.: United States Securities and Exchange Commission Form 8-KDaniel KwanNo ratings yet

- Quiz Investment Appraisal - GeorgeDocument16 pagesQuiz Investment Appraisal - GeorgeGABRIELLA GUNAWANNo ratings yet

- Accounting Concepts and Applications 11th Edition Albrecht Test BankDocument25 pagesAccounting Concepts and Applications 11th Edition Albrecht Test BankMichelleHarrisjspr100% (47)

- Chapter 4 - More On Sales and PurchasesDocument7 pagesChapter 4 - More On Sales and PurchaseskundiarshdeepNo ratings yet

- Detailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietyDocument20 pagesDetailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietysauravNo ratings yet

- Monthly ReportDocument13 pagesMonthly ReportWillian Delgado MendozaNo ratings yet