Professional Documents

Culture Documents

Week 6 Discussion Question Response

Week 6 Discussion Question Response

Uploaded by

Opeyemi OyewoleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 6 Discussion Question Response

Week 6 Discussion Question Response

Uploaded by

Opeyemi OyewoleCopyright:

Available Formats

Week 6 Discussion Question Response

Introduction

Capital budgeting involves the commitment of current funds in long term project or

activities. It is synonymous to investment appraisal and guides in decision making.

Effective investment decision making is vital to business continued existence and

long-term success (Kersyte, 2011). These decisions help to shape an organization’s

future opportunities and build competitive advantage in the business world

Capital Budgeting Evaluations

Payback period

This method of capital budgeting evaluation take into consideration the duration it

will take a project to payback the initial investment made into the project business

(Atrill & McLaney, 2011). This method of capital budget evaluation is beneficial as it

takes into consideration liquidity and ensures that selection of project that has the

ability to provide back immediate cash. It can also consider very importantly the cash

flow in place or as against profit within the period of the project. However, one of the

limitations of this method is that it does not take into consideration the time value for

money. Payback period is not a measure of profitability and does not seek to

maximize the wealth of shareholders.

Accounting rate of return (ARR)

This method of capital budgeting evaluation takes into consideration profitability of a

project. It is calculated by dividing the average accounting profit of the project by the

average capital invested during the life span of the project business (Atrill &

McLaney, 2011). It is of the view that the main factor in determining the worth of an

investment is the level of profitability that a project is meant to yield. It does not focus

upon liquidity and cash flows.

Net present value (NPV)

NPV endeavor to determine the present worth of a series of cash flows from a project

that extends into the future. It can be used to compare two projects that are mutually

exclusive. It takes into consideration the time value of money, relevant cash flow and

objective of the business (Atrill & McLaney, 2011). NPV is considered to be most

reliable method because it takes into consideration all the time value for money and

all cash flows for the present and future (Atrill & McLaney, 2011).

Internal rate of return (IRR)

IRR is the discount rate or factor for, which the NPV equals zero i.e. the compound

rate of return that is obtained from a series of cash flows. This rate equates the present

worth of the cash inflows of a project’s to the present worth of its outflows (Atrill &

McLaney, 2011). It is beneficial as it takes into consideration time value of money

and over the entire life of a project. However, it does not take into consideration the

relative size of investment and it involves complicated calculations

Case Study of Investment in Bahamas Island

Assumption of the Case study

i) There are two projects that are mutually exclusive

ii) They both have the same level of riskiness

iii) The rate of return is 20%

iv) Project A investment cost is 1000 and expected to yield an annual cash flow of

1000

v) Project B investment cost is 10000 and expected to yield an annual cash flow

of 4000

IRR

Using IRR to evaluate the investment, it shows that project A will yield a return of

100% and project B will yield a return of 40%. This thus indicates that project A is

more worthwhile than B because it has a higher IRR.

Payback period

Using payback period to evaluate the investment, Project A will payback the

investment in the first year while Project be will payback the investment in 2.5 years.

Payback period= Initial Capital out lay/ Cash inflow (Atrill & McLaney, 2011).

Project A = 1000/1000 = 1 years

Project B = 10000/ 4000= 2.5 years

This thus indicate that Project A takes a shorter time to payback the investment and it

therefore preferable to Project B.

ARR

Using ARR to evaluate the investment, it can be calculated thus:

ARR= Average annual operating profit x 100 (Atrill & McLaney, 2011)

Average investment to earn that profit

Project A = 1000/1000 x 100= 100%

Project B = 4000/10000 x 100= 40%

Since both of the investment exceeds 20% which is the target rate, the higher will be

selected. Thus Project A is more preferable.

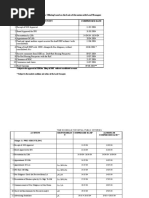

NPV

Using NPV to evaluate the investment with the discount rate of 20%, after fives the

NPV of the two projects are shown below.

Year Discount rate Project A Project B NPV A NPV B

20% £ £ £ £

0 1 -1000 -10000 -1000 -10000

1 0.83 1000 4000 830 3320

2 0.695 1000 4000 695 2780

3 0.5718 1000 4000 571.8 2287.2

4 0.4746 1000 4000 474.6 1898.4

5 0.3939 1000 4000 393.9 1575.6

NPV 1965.3 1861

After five years the PV of project A will be £2965 and for project B will be

£11861.They are both greater than the initial investment. Both Projects A and B are

worthwhile, since each of them has a positive NPV. But project A is preferred to B

because it has the higher NPV of £1965.3.

Factors to consider in choosing an investment

i. The objective for investing

ii. The time when the money invested in needed back

iii. Level and type of risk involve in the investment

iv. How quickly can one turn the investment into liquidity or profitability

Conclusion

I agree with assessment after using alternative evaluations for the capital budgeting

like the NPV, Payback period and ARR. All of them thus indicate that Project A is

more beneficial.

Reference List

Atrill, P. & McLaney, E. (2011) Finance and accounting for managers. Laureate

Online Education custom ed. Harlow, UK: Pearson Custom Publishing.

Kersyte (2011) ‘Capital budgeting process: theoretical aspects’ Economics and

Management 16 pp.1130-1134 [Online]. Available from:

http://www.ktu.lt/lt/mokslas/zurnalai/ekovad/16/1822-6515-2011-1130.pdf

(Accessed: 03 April 2014).

You might also like

- Steps To Writing Well 12th Edition Jean Wyrick Solutions ManualDocument22 pagesSteps To Writing Well 12th Edition Jean Wyrick Solutions Manualpursuitreexpel6735100% (30)

- Management Project Reflective PortfolioDocument15 pagesManagement Project Reflective PortfolioOpeyemi Oyewole100% (2)

- Review of The Department of Economic Opportunity's Florida CONNECT SystemDocument95 pagesReview of The Department of Economic Opportunity's Florida CONNECT SystemWTSP 10No ratings yet

- Capital BudgetingDocument7 pagesCapital BudgetingManisha DashNo ratings yet

- Management of Cost and RiskDocument39 pagesManagement of Cost and RisktechnicalvijayNo ratings yet

- Investment DecDocument29 pagesInvestment DecSajal BasuNo ratings yet

- Unit-2 Investment AppraisalDocument47 pagesUnit-2 Investment AppraisalPrà ShâñtNo ratings yet

- Capital Budgeting TechniquesDocument6 pagesCapital Budgeting TechniquesAnonymous f8tAzEb3oNo ratings yet

- Industrial Management and Process Economics Assignment: University of The PunjabDocument14 pagesIndustrial Management and Process Economics Assignment: University of The PunjabAbubakr KhanNo ratings yet

- BCC B Capital InvestmentDocument12 pagesBCC B Capital InvestmentNguyen Thi Tam NguyenNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingRuchika AgarwalNo ratings yet

- Payback Period Cash Outlay (Investment) / Annual Cash InflowDocument4 pagesPayback Period Cash Outlay (Investment) / Annual Cash InflowKyla BarbosaNo ratings yet

- Lecture 4-Capital BudgetingDocument38 pagesLecture 4-Capital BudgetingadmiremukureNo ratings yet

- Investment Appraisal Techniques 2Document24 pagesInvestment Appraisal Techniques 2Jul 480wesh100% (1)

- Capital Budgeting MethodsDocument13 pagesCapital Budgeting MethodsAmit SinghNo ratings yet

- PM Chapter 5Document31 pagesPM Chapter 5tedrostesfay74No ratings yet

- SFM FinDocument159 pagesSFM FinAakashNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- Project Appraisal TechniquesDocument11 pagesProject Appraisal TechniquesChristineNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- Week 5 Lecture 2Document25 pagesWeek 5 Lecture 2john DoeNo ratings yet

- Lecture 5 - Capital BudgetingDocument26 pagesLecture 5 - Capital BudgetingJason LuximonNo ratings yet

- Capital Budgeting Techniques PDFDocument57 pagesCapital Budgeting Techniques PDFMecheal ThomasNo ratings yet

- Capital Budgeting Techniques PDFDocument57 pagesCapital Budgeting Techniques PDFraj100% (1)

- Discounted Cash Flow - 082755Document3 pagesDiscounted Cash Flow - 082755EuniceNo ratings yet

- Quantitative AnalysisDocument23 pagesQuantitative AnalysisZinzy MNo ratings yet

- Cap 5Document21 pagesCap 5IvanaNo ratings yet

- Capital Budgeting TechniquesDocument57 pagesCapital Budgeting TechniquesAlethea DsNo ratings yet

- Chapter 7Document25 pagesChapter 7ElizabethNo ratings yet

- Semifinal Part2Document5 pagesSemifinal Part2emilobaromanivNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Unit 5Document46 pagesUnit 519-R-0503 ManogjnaNo ratings yet

- Capital Investment and Appraisal MethodsDocument34 pagesCapital Investment and Appraisal MethodsAnesu ChimhowaNo ratings yet

- Unit 2 Capital Budgeting Technique ProblemsDocument39 pagesUnit 2 Capital Budgeting Technique ProblemsAshok Kumar100% (1)

- CHAPTER 9 - Investment AppraisalDocument37 pagesCHAPTER 9 - Investment AppraisalnaurahimanNo ratings yet

- Summary Sheet - Helpful For Retention For Capital BudgetingDocument7 pagesSummary Sheet - Helpful For Retention For Capital BudgetingJJ KNo ratings yet

- Financial Management Note 9Document28 pagesFinancial Management Note 9Jonathan LimNo ratings yet

- Financial Management IrrDocument6 pagesFinancial Management IrrSanjay PotterNo ratings yet

- Lesson 4: Investment AppraisalDocument56 pagesLesson 4: Investment AppraisalYi WeiNo ratings yet

- EEF - Capital Budgeting - 2020-21Document31 pagesEEF - Capital Budgeting - 2020-21salkr30720No ratings yet

- Capital Budgeting TechniquesDocument35 pagesCapital Budgeting TechniquesGaurav gusaiNo ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDNo ratings yet

- An Introduction To Investment Appraisal - Payback and ARRDocument18 pagesAn Introduction To Investment Appraisal - Payback and ARRKate DrajneanuNo ratings yet

- Capital Budgeting - I: Gourav Vallabh Xlri JamshedpurDocument64 pagesCapital Budgeting - I: Gourav Vallabh Xlri JamshedpurSimran JainNo ratings yet

- ch6 IM 1EDocument20 pagesch6 IM 1EJoan MaryNo ratings yet

- Capital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Document8 pagesCapital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Imtiaz AhmedNo ratings yet

- Project Appraisal Techniques PDFDocument13 pagesProject Appraisal Techniques PDFUnni AmpadiNo ratings yet

- Lecture - Applications Financial Feasibility of The ProjectsDocument28 pagesLecture - Applications Financial Feasibility of The ProjectsAna MariaNo ratings yet

- Capital BudgetingDocument18 pagesCapital BudgetingRamesh KalwaniyaNo ratings yet

- Capital Investment Appraisal TechniquesDocument6 pagesCapital Investment Appraisal TechniquesAnuk PereraNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingRizwan Ali100% (1)

- Capital BudgetingDocument18 pagesCapital BudgetingAmrik Singh PothiwalNo ratings yet

- Lecture 1 Manufacturing Project Appraisal, Selection & FeasibilityDocument41 pagesLecture 1 Manufacturing Project Appraisal, Selection & FeasibilityMuhammadNo ratings yet

- Ce316 03Document27 pagesCe316 03Kelvin Kindice MapurisaNo ratings yet

- Financial Management: A Project On Capital BudgetingDocument20 pagesFinancial Management: A Project On Capital BudgetingHimanshi SethNo ratings yet

- Net Present Value: Time Value of MoneyDocument4 pagesNet Present Value: Time Value of MoneyChris tine Mae MendozaNo ratings yet

- Ebtm3103 Slides Topic 3Document26 pagesEbtm3103 Slides Topic 3SUHAILI BINTI BOHORI STUDENTNo ratings yet

- 4-Capital Budgeting TechniquesDocument20 pages4-Capital Budgeting TechniquesnoortiaNo ratings yet

- Project Appraisal TechniquesDocument6 pagesProject Appraisal TechniquesChristinaNo ratings yet

- Unit 12Document13 pagesUnit 12Mîñåk ŞhïïNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Warehouse Management SystemDocument12 pagesWarehouse Management SystemOpeyemi Oyewole0% (1)

- Process For Creating 5 Year Strategic PlanDocument4 pagesProcess For Creating 5 Year Strategic PlanOpeyemi Oyewole100% (2)

- Mars Climate Orbiter Failure Case Study AssignmentDocument6 pagesMars Climate Orbiter Failure Case Study AssignmentOpeyemi OyewoleNo ratings yet

- Design Thinking AssignmentDocument3 pagesDesign Thinking AssignmentOpeyemi OyewoleNo ratings yet

- Supply Selection Process AssignmentDocument4 pagesSupply Selection Process AssignmentOpeyemi OyewoleNo ratings yet

- Chapter 2 (Bus App)Document7 pagesChapter 2 (Bus App)Opeyemi OyewoleNo ratings yet

- Chapter 1 (Bus App)Document3 pagesChapter 1 (Bus App)Opeyemi OyewoleNo ratings yet

- Masters Dissertation Handbook2020Document32 pagesMasters Dissertation Handbook2020Opeyemi OyewoleNo ratings yet

- TFGM Business Plan 2017 20Document80 pagesTFGM Business Plan 2017 20Opeyemi OyewoleNo ratings yet

- Solution 1Document5 pagesSolution 1Opeyemi OyewoleNo ratings yet

- (Proposal Title Page) Your Contact Details and Project TitleDocument14 pages(Proposal Title Page) Your Contact Details and Project TitleOpeyemi OyewoleNo ratings yet

- Inventory Management AssignmentDocument3 pagesInventory Management AssignmentOpeyemi OyewoleNo ratings yet

- Religare-Trading in Deriavtive MarketDocument83 pagesReligare-Trading in Deriavtive MarketshashankNo ratings yet

- Bank Performance Analysis of Premier One BankDocument53 pagesBank Performance Analysis of Premier One BankTamim ChowdhuryNo ratings yet

- Assignment On Financial Analysis of Marico PVT LTDDocument65 pagesAssignment On Financial Analysis of Marico PVT LTDRãjâ Rj100% (1)

- Ewealth Insurance - BrochureDocument16 pagesEwealth Insurance - BrochurerajendranrajendranNo ratings yet

- Capital MarketDocument16 pagesCapital MarketPriya MalhotraNo ratings yet

- Vardhman Textiles Limited AR 2016-17 PDFDocument258 pagesVardhman Textiles Limited AR 2016-17 PDFPrakash Ranjan PothalNo ratings yet

- Crisis and Emergency Management - Theory and Practice, Second Edition (PDFDrive)Document830 pagesCrisis and Emergency Management - Theory and Practice, Second Edition (PDFDrive)fompo100% (1)

- Mba580 Act2Document3 pagesMba580 Act2ashsimeon2020No ratings yet

- ISO 2768 1 & 2 StandardDocument5 pagesISO 2768 1 & 2 StandardRafael CastroNo ratings yet

- Practices - Session 2Document4 pagesPractices - Session 2anxiaaNo ratings yet

- Backlonk Sites ListsDocument7 pagesBacklonk Sites Listsmohit kumarNo ratings yet

- 11 Ias 8Document5 pages11 Ias 8Irtiza AbbasNo ratings yet

- University Course Fee For Students & AgentsDocument4 pagesUniversity Course Fee For Students & AgentsChandan Kumar BanerjeeNo ratings yet

- Kiona Co Set Up A Petty Cash Fund For PaymentsDocument1 pageKiona Co Set Up A Petty Cash Fund For PaymentsAmit PandeyNo ratings yet

- Digital Marketing Solved MCQsDocument10 pagesDigital Marketing Solved MCQsJuhi GidwaniNo ratings yet

- Annual Report of IOCL 174Document1 pageAnnual Report of IOCL 174Nikunj ParmarNo ratings yet

- 2019 Trafigura Annual ReportDocument100 pages2019 Trafigura Annual ReportBachir CamaraNo ratings yet

- Civil 5Document19 pagesCivil 5attywithnocaseyetNo ratings yet

- IPO ChecklistDocument8 pagesIPO Checklistpbush998873No ratings yet

- FABM1 Module 3 Users of Accounting InformationDocument2 pagesFABM1 Module 3 Users of Accounting InformationDonna BautistaNo ratings yet

- Accountant Interview Questions 2Document1 pageAccountant Interview Questions 2JANINE TRISHA MAE O. PAGUIONo ratings yet

- CA Foundation Accounts Recodring of Transactions StudentsDocument57 pagesCA Foundation Accounts Recodring of Transactions StudentsRockyNo ratings yet

- Nagasri Nelluri: Core Competencies Profile SummaryDocument4 pagesNagasri Nelluri: Core Competencies Profile SummaryNidhi VashisthNo ratings yet

- Fsi-2023-038 Ipc Audit PlanDocument3 pagesFsi-2023-038 Ipc Audit PlanCherry AgabaoNo ratings yet

- Future of Trade 2021 - DMCC - 100621Document104 pagesFuture of Trade 2021 - DMCC - 100621kishore N100% (1)

- The Large Marketplace Comparison GuideDocument43 pagesThe Large Marketplace Comparison GuidegencmetohuNo ratings yet

- Swift Ratw HawkDocument1 pageSwift Ratw HawkMajid ImranNo ratings yet

- Taxation Law Case Doctrines (4DF1920)Document45 pagesTaxation Law Case Doctrines (4DF1920)roigtcNo ratings yet