Professional Documents

Culture Documents

Current Yield Capital Gains Yield Total Return: Solution

Current Yield Capital Gains Yield Total Return: Solution

Uploaded by

Triechia LaudOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Current Yield Capital Gains Yield Total Return: Solution

Current Yield Capital Gains Yield Total Return: Solution

Uploaded by

Triechia LaudCopyright:

Available Formats

LAUD, TRIECHIA

BSACC 3A

MODULE 6: Assignment 6

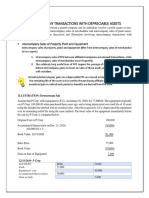

The Washington Corporation issued a new series of bonds on January 1, 2005.

The bonds were sold at par (Php 1000); had a 12% coupon, and mature in 30

years, on December 31, 2034. Coupon payments are made semi-annually (on June

30 and December 31).

A. What was the YTM on January 1, 2005?

B. What was the price of the bonds on January 1, 2010, 5 years later,

assuming the interest rates had fallen to 10%?

C. Find the current yield, capital gains yield, and total return on

January 1, 2010, given the price as determined in Part b?

A 12%

B Php 1,182.56

C

Current yield 10.15%

Capital gains yield -0.15%

Total return 10%

SOLUTION:

A. Washington Corporations bond is sold at par; therefore the original YTM

equalled the coupon rate which is 12%.

50

120/2 1000

V B =∑ t

+

B. t=1 .10 1.10 50

(1+ ) (1+ )

2 2

1 1 1000

= 60 [ − 50 ]+

0.05 .05 (1+ .05) (1+.05)

50

= Php 1,182.56

C. Current Yield= Annual Coupon Payment / Price

= 120/1,182.56

= 0.1015

= 10.15%

o Capital Gains Yield= Total Return – Current Yield

= 10% - 10.15%

= -0.15%

o Total Return= Current Yield + Capital Gains Yield

= 10.15% + (-.015%)

= 10%

You might also like

- Corporate Finance (Chapter 4) (7th Ed)Document27 pagesCorporate Finance (Chapter 4) (7th Ed)Israt Mustafa100% (1)

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- Intercompany Inventory TransfersDocument2 pagesIntercompany Inventory TransfersTriechia LaudNo ratings yet

- Advanced Corporate Finance Quiz 2 SolutionsDocument3 pagesAdvanced Corporate Finance Quiz 2 SolutionslaurenNo ratings yet

- Accountancy Review: Assignment Lpu Review For Submission After April 30, 2020Document5 pagesAccountancy Review: Assignment Lpu Review For Submission After April 30, 2020jackie delos santosNo ratings yet

- Exam 1 - Econ 380 - Fall 2016 - KEYDocument4 pagesExam 1 - Econ 380 - Fall 2016 - KEYAlexNo ratings yet

- Chapter-10: Valuation & Rates of ReturnDocument22 pagesChapter-10: Valuation & Rates of ReturnTajrian RahmanNo ratings yet

- Assignment 6Document3 pagesAssignment 6mary4aileen4bucayu4cNo ratings yet

- Bond Valuation Practice SolutionDocument5 pagesBond Valuation Practice SolutionXDkillua45No ratings yet

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavNo ratings yet

- MATH 1003 Calculus and Linear Algebra (Lecture 4) : Albert KuDocument19 pagesMATH 1003 Calculus and Linear Algebra (Lecture 4) : Albert Kuandy15No ratings yet

- Dividend Policy Question and AnswerDocument7 pagesDividend Policy Question and AnswerBella CynthiaNo ratings yet

- Ordinary AnnuityDocument6 pagesOrdinary AnnuityJonathan TolentinoNo ratings yet

- Corporate Finance: Chapter 3: Time Value of MoneyDocument26 pagesCorporate Finance: Chapter 3: Time Value of Moneynaila FaizahNo ratings yet

- Chapter (5A) 2021Document17 pagesChapter (5A) 2021Nour Al KaddahNo ratings yet

- Solution Manual For Cfin 6th by BesleyDocument12 pagesSolution Manual For Cfin 6th by BesleyAmandaHarrissftia100% (95)

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- Ejercicio Nro 8 SolucionnnnnnDocument9 pagesEjercicio Nro 8 SolucionnnnnnSugar Leonardo Herrera CoaquiraNo ratings yet

- Practice Questions Capital StucutreDocument26 pagesPractice Questions Capital StucutreMuhammad Abdul Wajid RaiNo ratings yet

- Econ FTRDocument13 pagesEcon FTRsolayao.jamesNo ratings yet

- Discounted Cah Flow Valuation Chapter 6Document31 pagesDiscounted Cah Flow Valuation Chapter 6Rahul KhadkaNo ratings yet

- Financial ManagementDocument19 pagesFinancial ManagementJenny LaiNo ratings yet

- Mock Test SolutionsDocument11 pagesMock Test SolutionsMyraNo ratings yet

- Answer Keys - Time Value of MoneyDocument22 pagesAnswer Keys - Time Value of MoneyrhlvajpayeeNo ratings yet

- FM Group 4Document21 pagesFM Group 4Jerus CruzNo ratings yet

- FM Lecture 2 Time Value of Money S2 2020.21Document75 pagesFM Lecture 2 Time Value of Money S2 2020.21Quỳnh NguyễnNo ratings yet

- Time Value of Money Practice Problems - SolutionsDocument12 pagesTime Value of Money Practice Problems - Solutionslex_jung100% (1)

- Fitzgeraldhyne Rappan - A031221038Document2 pagesFitzgeraldhyne Rappan - A031221038Fitzgeraldhyne RappanNo ratings yet

- CFIN 5th Edition Besley Solutions Manual DownloadDocument11 pagesCFIN 5th Edition Besley Solutions Manual DownloadElizabeth Mcmullen100% (26)

- FM - Lecture 2 - Time Value of Money PDFDocument82 pagesFM - Lecture 2 - Time Value of Money PDFMi ThưNo ratings yet

- Report Group C (M02)Document19 pagesReport Group C (M02)Huynh Anh Thu B1901863No ratings yet

- Discounted Cash Flow ValuationDocument33 pagesDiscounted Cash Flow ValuationShadow IpNo ratings yet

- Wacc SolutionsDocument8 pagesWacc SolutionssrassmasoodNo ratings yet

- Time Value of Money: SolutionsDocument12 pagesTime Value of Money: SolutionsParth Hemant PurandareNo ratings yet

- BAT Unit 5 AssignmentDocument14 pagesBAT Unit 5 AssignmentTalhah WaleedNo ratings yet

- Jawaban Chapter 1Document7 pagesJawaban Chapter 1yazidceliboytugasumm123No ratings yet

- Tugas FM CH 14 SD 17 - Fitriyanto - NewDocument12 pagesTugas FM CH 14 SD 17 - Fitriyanto - NewiyanNo ratings yet

- Week 4 Assignement-Aulia Ridho MDocument4 pagesWeek 4 Assignement-Aulia Ridho MdhosmanyosNo ratings yet

- Jawaban Latihan Cost of CapitalDocument13 pagesJawaban Latihan Cost of CapitalSagitariusstar2100% (1)

- Chapter 2 PQ FMDocument5 pagesChapter 2 PQ FMRohan SharmaNo ratings yet

- Practice Set Time Value of MoneyDocument5 pagesPractice Set Time Value of MoneyKena Montes Dela PeñaNo ratings yet

- Understanding Financial Management: A Practical Guide: Problems and AnswersDocument9 pagesUnderstanding Financial Management: A Practical Guide: Problems and AnswersManuel BoahenNo ratings yet

- Seminar 04 - Task SolutionDocument5 pagesSeminar 04 - Task SolutionJuliana CabreraNo ratings yet

- Answer To Q On IFRS 9Document4 pagesAnswer To Q On IFRS 9johny SahaNo ratings yet

- Assignment 3.Document5 pagesAssignment 3.Yusuf RaharjaNo ratings yet

- CFVG - IDBV - 1 - Time Value of Money ExerciseDocument6 pagesCFVG - IDBV - 1 - Time Value of Money ExerciseThu Thủy ĐỗNo ratings yet

- Time Value of MoneyDocument49 pagesTime Value of MoneySYEDWASIQABBAS RIZVINo ratings yet

- Chapter 02 - How To Calculate Present ValuesDocument15 pagesChapter 02 - How To Calculate Present ValuesShoaibTahirNo ratings yet

- 2 Time Value of MoneyDocument46 pages2 Time Value of MoneyABHINAV AGRAWALNo ratings yet

- Coporate FinanceDocument6 pagesCoporate Financeplayjake18No ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As IsDocument3 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Isvishal nigamNo ratings yet

- The Time Value of Money: (Chapter 9)Document22 pagesThe Time Value of Money: (Chapter 9)ellaNo ratings yet

- Problem Set 2 Solution 2021Document8 pagesProblem Set 2 Solution 2021Pratyush GoelNo ratings yet

- Chapter - ThreeDocument19 pagesChapter - Threemagarsa hirphaNo ratings yet

- Tvmreviewlecture 131226185711 Phpapp02Document19 pagesTvmreviewlecture 131226185711 Phpapp02Đào Quốc AnhNo ratings yet

- ACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankDocument100 pagesACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankGuinevereNo ratings yet

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- Capital StructureDocument11 pagesCapital StructureMira miguelitoNo ratings yet

- Chapter 2Document14 pagesChapter 2Kumar ShivamNo ratings yet

- Chapter 02 - How To Calculate Present ValuesDocument18 pagesChapter 02 - How To Calculate Present ValuesTrinh VũNo ratings yet

- MATH 109 Amortization: The Monthly PaymentDocument8 pagesMATH 109 Amortization: The Monthly PaymentEarl Jan TampusNo ratings yet

- Assignment 3Document6 pagesAssignment 3Triechia LaudNo ratings yet

- Contract of SaleDocument8 pagesContract of SaleTriechia LaudNo ratings yet

- Time Value of Money ApplicationDocument4 pagesTime Value of Money ApplicationTriechia LaudNo ratings yet

- Financial Ratio AnalysisDocument32 pagesFinancial Ratio AnalysisTriechia LaudNo ratings yet

- Assignment: Triechia Laud Bsacc 3ADocument3 pagesAssignment: Triechia Laud Bsacc 3ATriechia LaudNo ratings yet

- Consolidated Financial StatementDocument5 pagesConsolidated Financial StatementTriechia LaudNo ratings yet