Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

178 viewsPrinciples of Corporate Governance

Principles of Corporate Governance

Uploaded by

Trần Ánh NgọcCorporate governance is based on principles of integrity, accountability, independence and good management. It involves balancing stakeholder interests through a system of rules, practices and processes. There are several theories of corporate governance, including agency theory which focuses on the relationship between principals and agents, and stewardship theory which views managers as stewards acting in the best interests of the company. Stakeholder theory considers the impact on all stakeholders both internal and external. Principles-based approaches to governance focus on best practices rather than legal requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Hbspcat 9 OrganizationalDocument231 pagesHbspcat 9 OrganizationalDeepak Kumar Patnala100% (1)

- Three Theories of JusticeDocument27 pagesThree Theories of JusticeReza KhajeNo ratings yet

- A Comparative Study of Performance Appraisal in Manufacturing and Service SectorDocument5 pagesA Comparative Study of Performance Appraisal in Manufacturing and Service Sectorajayajay83100% (3)

- Ethics AssignmentDocument13 pagesEthics AssignmentMawere WilsonNo ratings yet

- Leadership Importance in Construction Productivity Improvement PDFDocument12 pagesLeadership Importance in Construction Productivity Improvement PDFJorge Jimenez XoloNo ratings yet

- Corporate Governance For PumaDocument10 pagesCorporate Governance For PumaPranay Singh Raghuvanshi100% (1)

- 3 - CH - Landmarks in The Emergence of Corporate GovernanceDocument39 pages3 - CH - Landmarks in The Emergence of Corporate GovernanceAnonymous wbMjF3L5100% (2)

- Module 1Document62 pagesModule 1Linly KeomahavongNo ratings yet

- Assignment 2 (Set 2)Document7 pagesAssignment 2 (Set 2)sashaNo ratings yet

- CSR IV Presentation FinlDocument25 pagesCSR IV Presentation FinlAPS1974SNo ratings yet

- Dr. W. Edwards Deming: Dr. Deming's Ideas Dr. Deming's Famous 14 Points, Originally Presented in Out of The Crisis, ServeDocument4 pagesDr. W. Edwards Deming: Dr. Deming's Ideas Dr. Deming's Famous 14 Points, Originally Presented in Out of The Crisis, ServeshanawerNo ratings yet

- ABE (SM0381) Assignment Part B - SampleDocument15 pagesABE (SM0381) Assignment Part B - Samplesummer100% (2)

- Understanding The Self Module 3 (20231025233509)Document15 pagesUnderstanding The Self Module 3 (20231025233509)Anna Carmella PascualNo ratings yet

- CG Assignment 1Document13 pagesCG Assignment 1arslan0989No ratings yet

- Unit 1 - Business EthicsDocument23 pagesUnit 1 - Business Ethics088jay IsamaliyaNo ratings yet

- MNB1501 Tutorials (Summary of Each Unit)Document11 pagesMNB1501 Tutorials (Summary of Each Unit)Ghairunisa HarrisNo ratings yet

- Curriculum Development ProcessDocument45 pagesCurriculum Development ProcessMuhammad JavedNo ratings yet

- FileChapter 2 - Accounting, Ethics and The Business World - Power PointsDocument36 pagesFileChapter 2 - Accounting, Ethics and The Business World - Power PointsNot Going to Argue Jesus is KingNo ratings yet

- Industrial Relations Has Three FacesDocument2 pagesIndustrial Relations Has Three FacesRaju Das0% (1)

- Situation Factors That Affect ConformityDocument4 pagesSituation Factors That Affect ConformityKayleigh EdwardsNo ratings yet

- Distributive Justice: Ayhee Marie David Jhollie Felipe Mark Gabriel DangaDocument10 pagesDistributive Justice: Ayhee Marie David Jhollie Felipe Mark Gabriel DangaMark Gabriel DangaNo ratings yet

- Participation and Empowerment 1Document7 pagesParticipation and Empowerment 1Shankar MahantiNo ratings yet

- Teaching Behavioral Ethics by Robert A. Prentice 2Document50 pagesTeaching Behavioral Ethics by Robert A. Prentice 2kiwitenNo ratings yet

- Unit 11 Conflict Management and Conflict Resolution: StructureDocument8 pagesUnit 11 Conflict Management and Conflict Resolution: StructuremireilleNo ratings yet

- Theory of X and yDocument6 pagesTheory of X and ybitsat hailuNo ratings yet

- Environment EthicsDocument25 pagesEnvironment EthicsSivamani SelvarajuNo ratings yet

- Organizational ChangeDocument36 pagesOrganizational ChangeSuresh Malapuram0% (1)

- Running Head: TEAMWORK 1: Teamwork Name of Student Name of Institution DateDocument8 pagesRunning Head: TEAMWORK 1: Teamwork Name of Student Name of Institution DateBest EssaysNo ratings yet

- Ethics Integrity MoralityDocument1 pageEthics Integrity MoralityNatasyaNo ratings yet

- What Is Useful Is Good, and The Moral Value of Actions Are Determined by The Utility of Its Consequences.Document8 pagesWhat Is Useful Is Good, and The Moral Value of Actions Are Determined by The Utility of Its Consequences.jonelNo ratings yet

- Ethics, Also Called Moral Philosophy, The Discipline Concerned With What Is Morally GoodDocument3 pagesEthics, Also Called Moral Philosophy, The Discipline Concerned With What Is Morally GoodNiyati SoodNo ratings yet

- Classical Approach of ManagementDocument57 pagesClassical Approach of ManagementPiyam RazaNo ratings yet

- Literature Review MotivationDocument4 pagesLiterature Review MotivationSwarnajeet GaekwadNo ratings yet

- Prison NurseriesDocument8 pagesPrison Nurseriesapi-553524498No ratings yet

- Ethical Management LeadershipDocument25 pagesEthical Management Leadershipmihai simionescuNo ratings yet

- GS-F311 Intro To Conflict Management - Handout PDFDocument2 pagesGS-F311 Intro To Conflict Management - Handout PDFUtkarsh GuptaNo ratings yet

- Utilitarianism by John Stuart MillDocument11 pagesUtilitarianism by John Stuart MillJason BorresNo ratings yet

- CSR LawrenceDocument12 pagesCSR LawrenceHangga DarismanNo ratings yet

- Health Psychology ModuleDocument76 pagesHealth Psychology ModuleMahad AliNo ratings yet

- Minnow Brook IIIDocument1 pageMinnow Brook IIIsunishsugunan100% (5)

- Chapter 1.2Document51 pagesChapter 1.2AntondeepakNo ratings yet

- Conflict New PDFDocument107 pagesConflict New PDFfaisalNo ratings yet

- Ethical IssuesDocument2 pagesEthical IssuesSilviaDeeaNo ratings yet

- Introduction To OhsDocument41 pagesIntroduction To OhsJorge Cronwell Montaño Vásquez100% (1)

- History of Contingency Theory: Reporter: Emiliana J. LozanoDocument23 pagesHistory of Contingency Theory: Reporter: Emiliana J. Lozanoaireenclores100% (3)

- Organizational Development: Books To Be ReadDocument49 pagesOrganizational Development: Books To Be ReadPeperZeaMaysNo ratings yet

- Ethics of Organizational Gift GivingDocument7 pagesEthics of Organizational Gift GivingKyle SnyderNo ratings yet

- Behaviorism: Zhou, Molly and Brown, David, "Educational Learning Theories: 2nd Edition" (2015) - Education OpenDocument9 pagesBehaviorism: Zhou, Molly and Brown, David, "Educational Learning Theories: 2nd Edition" (2015) - Education OpenNesbher Vulgira100% (1)

- History of Social WorkDocument44 pagesHistory of Social WorkLenethLestino100% (1)

- To Resolve A Conflict, First DecideDocument13 pagesTo Resolve A Conflict, First DecideEko SakapurnamaNo ratings yet

- Ethical CultureDocument15 pagesEthical CultureAbdul SamiNo ratings yet

- Topic - Theories of Corporate Ethical - Social ResponsibilityDocument10 pagesTopic - Theories of Corporate Ethical - Social ResponsibilityMarilou Olaguir SañoNo ratings yet

- Learning OrganisationDocument9 pagesLearning OrganisationZulfekar Dulmeer100% (1)

- Decision Heuristics and Biases CARMENDocument58 pagesDecision Heuristics and Biases CARMENnagl.1No ratings yet

- Neo Classical Theory of ManagementDocument3 pagesNeo Classical Theory of ManagementwaleedjuttNo ratings yet

- PE GTU Study Material Presentations Unit-1 13082021074152PMDocument13 pagesPE GTU Study Material Presentations Unit-1 13082021074152PMsinofe3634100% (1)

- Advantages of Collective BargainingDocument2 pagesAdvantages of Collective BargainingMamta ThanwaniNo ratings yet

- Barnard's Goals in Writing The Functions of The ExecutiveDocument4 pagesBarnard's Goals in Writing The Functions of The Executivegrogers006No ratings yet

- Conflict Management Techniques: ForcingDocument10 pagesConflict Management Techniques: ForcingIvan ClarkNo ratings yet

- Theories of Scientific Management: Presented byDocument61 pagesTheories of Scientific Management: Presented bytacticiankerala100% (1)

- Compelling Returns: A Practical Guide to Socially Responsible InvestingFrom EverandCompelling Returns: A Practical Guide to Socially Responsible InvestingNo ratings yet

- Building an entrepreneurial culture from the strategic modelingFrom EverandBuilding an entrepreneurial culture from the strategic modelingNo ratings yet

- Perception Snapshot - ESG FactorsDocument3 pagesPerception Snapshot - ESG Factorsadampasick4788No ratings yet

- Effect of Corporate Governance On Financial Performance of SACCOs in KenyaDocument13 pagesEffect of Corporate Governance On Financial Performance of SACCOs in KenyaZainudin MohamedNo ratings yet

- Chambers Corporate Governance 2021 Corporate Governance 2021Document600 pagesChambers Corporate Governance 2021 Corporate Governance 2021Bella TjendriawanNo ratings yet

- 2015 British Airways Annual Report PDFDocument78 pages2015 British Airways Annual Report PDFAndreea AvramescuNo ratings yet

- Corporate Governance and CSRDocument31 pagesCorporate Governance and CSRYash SoniNo ratings yet

- Ihg 2019ar PDFDocument257 pagesIhg 2019ar PDFJardan TatianaNo ratings yet

- Accountability and Responsibility in Corporate GovernanceDocument65 pagesAccountability and Responsibility in Corporate Governanceapril rose dinampoNo ratings yet

- Cannon Trading Education: Options 101Document5 pagesCannon Trading Education: Options 101krolldoggNo ratings yet

- Aguilhera Et Al. The Corporate Governance of Environmental SustainabilityDocument30 pagesAguilhera Et Al. The Corporate Governance of Environmental SustainabilityPriscila VieiraNo ratings yet

- 2013 UCPB Annual ReportDocument116 pages2013 UCPB Annual ReportPat Dela CruzNo ratings yet

- Danaharta Annual Report 2003Document147 pagesDanaharta Annual Report 2003az1972100% (6)

- Diffferent Pathways That Suggest Whether Auditors' Going Concern Opinion Are Ethical BasedDocument17 pagesDiffferent Pathways That Suggest Whether Auditors' Going Concern Opinion Are Ethical BasedKurniawan FebryNo ratings yet

- The Relationship of Compliance with the Philippine Stock Exchange Corporate Governance Guidebook and Return Of Equity of Selected Publicly Listed Companies in The Philippines For The Reporting Years 2012 and 2013Document86 pagesThe Relationship of Compliance with the Philippine Stock Exchange Corporate Governance Guidebook and Return Of Equity of Selected Publicly Listed Companies in The Philippines For The Reporting Years 2012 and 2013dyanmerz.tolentinoNo ratings yet

- Shri Ram Policy FormDocument3 pagesShri Ram Policy FormMOHD AFZANo ratings yet

- URC Annual Corporate Governance Report 2016 - FinalDocument74 pagesURC Annual Corporate Governance Report 2016 - FinalDennis DimaanoNo ratings yet

- Data Tables Foxia - Responsive Bootstrap 5 Admin DashboardDocument2 pagesData Tables Foxia - Responsive Bootstrap 5 Admin DashboardnaimahadouNo ratings yet

- Struktur Org Mula IndonesiaDocument3 pagesStruktur Org Mula IndonesiaErlangga DarmawanNo ratings yet

- 5 Company Law IIDocument4 pages5 Company Law IIVani ChoudharyNo ratings yet

- C OptionsPlaybook 2nded 1 3 PDFDocument33 pagesC OptionsPlaybook 2nded 1 3 PDFNisha SinglaNo ratings yet

- Strategic Management: Concepts and Cases: Arab World EditionDocument71 pagesStrategic Management: Concepts and Cases: Arab World Editionwaheeba84No ratings yet

- Directors 2022Document73 pagesDirectors 2022Sherry LaiNo ratings yet

- The Legal History of Corporate Governance in EuropeDocument43 pagesThe Legal History of Corporate Governance in Europebabayao10No ratings yet

- Ac 1204 GovernanceDocument55 pagesAc 1204 GovernanceAnthony Carl UnabiaNo ratings yet

- DIGI - Annual Report 2019Document179 pagesDIGI - Annual Report 2019jesson kimNo ratings yet

- DerivativesDocument2 pagesDerivativesKiran Janu BNo ratings yet

- Listed Companies (Code of Corporate Governance) Regulations 2017Document5 pagesListed Companies (Code of Corporate Governance) Regulations 2017Latest BeddingNo ratings yet

Principles of Corporate Governance

Principles of Corporate Governance

Uploaded by

Trần Ánh Ngọc0 ratings0% found this document useful (0 votes)

178 views6 pagesCorporate governance is based on principles of integrity, accountability, independence and good management. It involves balancing stakeholder interests through a system of rules, practices and processes. There are several theories of corporate governance, including agency theory which focuses on the relationship between principals and agents, and stewardship theory which views managers as stewards acting in the best interests of the company. Stakeholder theory considers the impact on all stakeholders both internal and external. Principles-based approaches to governance focus on best practices rather than legal requirements.

Original Description:

Original Title

Principles of Corporate Governance (4)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporate governance is based on principles of integrity, accountability, independence and good management. It involves balancing stakeholder interests through a system of rules, practices and processes. There are several theories of corporate governance, including agency theory which focuses on the relationship between principals and agents, and stewardship theory which views managers as stewards acting in the best interests of the company. Stakeholder theory considers the impact on all stakeholders both internal and external. Principles-based approaches to governance focus on best practices rather than legal requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

178 views6 pagesPrinciples of Corporate Governance

Principles of Corporate Governance

Uploaded by

Trần Ánh NgọcCorporate governance is based on principles of integrity, accountability, independence and good management. It involves balancing stakeholder interests through a system of rules, practices and processes. There are several theories of corporate governance, including agency theory which focuses on the relationship between principals and agents, and stewardship theory which views managers as stewards acting in the best interests of the company. Stakeholder theory considers the impact on all stakeholders both internal and external. Principles-based approaches to governance focus on best practices rather than legal requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

I.

Principles of corporate governance

Most corporate governance reports are based around the principles of integrity,

accountability, independence and good management

1. Definition of corporate governance

Corporate governance is the system of rules, practices and processes by which

a company is directed and controlled. (Cadbury Committee, 1992)

Corporate governance is the system of principles, policies, procedures, and

clearly defined the responsibilities and accountabilities used by stakeholders to

overcome the conflicts of interest inherent in the corporate form.

More specifically it is the framework by which the various stakeholder

interests are balanced, or, as the IFC states, “the relationships among the

management, Board of Directors, controlling shareholders, minority shareholders

and other stakeholders”. (James Chen, 2021)

2. Principles of corporate governance

2.1 Principles of corporate governance

Corporate governance is based on eight following principles.

● Minimize risk and compliance

● Adherence to strategic objectives

● Fulfil stakeholder responsibilities

● Establish clear accountability

● Maintain independence

● Accurate/ Timely reporting

● Encourage owner involvement

● Promote integrity

Successful organizations do not view enterprise performance and

conformance in isolation. They fully understand how these two dimensions

together represent the entire value creation, resource utilization and

accountability framework of an enterprise.

The difference between the performance dimension and the conformance

dimension is that the former is more forward-looking and the later backward-

looking.

Performance responsibilities focus on strategy, value creation and resource

utilization whereas conformance responsibilities focus on providing assurance to

stakeholders that the organization is working effectively and efficiently to achieve

its strategic and operational goals.

However, both performance and conformance responsibilities enhance each

other and the organization as a whole. (Karol M.Kopp, 2021)

3. Perspectives on governance

There are many theories of corporate governance which addressed the

challenges of governance of firms and companies from time to time namely

Agency Theory, Stewardship Theory, Resource Dependency Theory, Stakeholder

Theory, Transaction Cost Theory, Political Theory (Papertiary, 2018)

3.1 Agency Theory

Agency theory defines the relationship between the principals (such as

shareholders of company) and agents (such as directors of company). According

to this theory, the principals of the company hire the agents to perform work. The

principals delegate the work of running the business to the directors or managers,

who are agents of shareholders. The shareholders expect the agents to represent

the best interests of the principal without regard for self-interest. Diverging

interests of principals and agents may lead to conflict as the agent may be

succumbed to self-interest, opportunistic behavior and fall short of expectations

of the principal. Such conflict of interest may lead to inefficiences and financial

losses. Corporate governance can be used to change the rules under which an

agents operates in order to restore the principal’s interest. The key feature of

agency theory is separation of ownership and control. The principal must

overcome lack of information about the agent’s performance of tasks and agents

must be incentivised to act in favor of the principal’s interests. => The Agency

theory may be used to design these incentives appropriately by considering the

interests that motivate the agent to act.

A common example of agency theory is between the employees and

employers of an organization. The employees are hired to work in accordance

with the objectives of the organization. However, the growing number of

corporate scams shows that this relationship is not always taken in a way it is

meant to be. The employees work against the ethics of the organization causing it

huge financial and reputational damage. Sometimes, the loss caused by such

corrupt employees is beyond repair and an organization has to wind up its

business altogether. (Keay, 2017)

3.2 Stewardship Theory

Stewardship theory of corporate governance is a normative alternative to

agency theory. According to Stewardship theory, managers are stewards whose

behaviors are in line with the aim of their principals. Managers are viewed as

being loyal to the company and as being interested in achieving high

performance. The dominant motive that drives the managers to achieve their

goals is their inherent desire to deliver excellence. Managers are thought to be

motivated by the needs to achieve, gain intrinsic satisfaction by performing

inherently challenging work exercise responsibility and authority, and being

recognized.

An example of a stewardship model of corporate governance might include a

business focused on environmental concerns, where the company believes it

should operate with as little impact as possible on the earth.The Coca-Cola

Company which uses huge amounts of water for its products, for example, has

committed to being good stewards of water resources. (Chron Contributor, 2021)

3.3 The Stakeholder theory

The stakeholder theory of corporate governance focuses on the effect of

corporate activity on all identifiable stakeholders of the corporation. This theory

posits that corporate managers (officers and directors) should take into

consideration the interests of each stakeholder in its governance process. This

theory includes taking efforts to reduce or mitigate the conflicts between

stakeholder interests. It looks further than the traditional members of the

corporation (officers, directors, and shareholders) and also focuses on the interests

of any third party that has some level of dependence upon the corporation.

Stakeholders are generally divided into internal and external stakeholders.

● Internal Stakeholders - Are the corporate directors and employees, who

are actually involved in corporate governance process.

● External Stakeholders - May include creditors, auditors, customers,

suppliers, government agencies, and the community at large.

These stakeholders exert influence but are not directly involved in the

process. Key to the stakeholder theory is the realization that all stakeholders

engage in some manner with the corporation with the hope or expectation that

the corporation will deliver the type of value desired or expected. The benefits

may include dividends, salary, bonuses, additional orders, new jobs, tax revenue,

etc. (Jason Gordon, 2021)

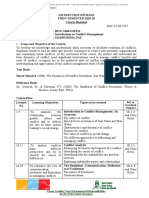

4. Principles vs rules

Rules-Based Approach Principle-Based Approach

Code of Corporate Governance is a set of

Code of Corporate Governance is a set of

best practices that companies should

legal requirements mentioned in the Act.

follow.

Legal Requirement Not a Legal Requirement

Practically it is difficult to set up rules that This is the usual approach which most

are suitable for every set of circumstances. organizations in the world are practicing.

Compliance or non-compliance

Compliance or non-compliance Judgements

Judgements are being made by the

are being made by the court.

owners of the business (shareholders)

Non-compliance will result in an

Non-compliance will result in heavy penalties

explanation to the shareholders by the

in the form of fines.

board.

Ex: In the US, organizations to follow legislations such as USA Sarbanes-

Oxley Act, which is a U.S. federal law that aims to protect investors by making

corporate disclosures more reliable and accurate. The Act was spurred by major

accounting scandals, such as Enron and WorldCom (today called MCI Inc.), that

tricked investors and inflated stock prices. Spearheaded by Senator Paul Sarbanes

and Representative Michael Oxley, the Act was signed into law by President

George W. Bush on July 30, 2002. (Peter Chisambara, n.d)

In the United Kingdom (UK) company should agree to apply UK Code on

Corporate Governance after the company is listed. Listed companies in the UK are

required to state in their financial statements whether they fully comply with the

code. If not, the company needs to mention the way in which they don’t and why.

Investors will ultimately have the information they need to decide whether they

are ok with the level of compliance of their company. (Rusth, n.d)

1. Applied Corporate Governance, “Definition of corporate governance”,

[Online] Available at: https://www.applied-corporate-governance.com/definition-

of-corporate-governance/ [Accessed 20 Apr.2021]

2. James Chen (2021), “Corpote Governance”, Investopia, [Online] Available

at: https://www.investopedia.com/terms/c/corporategovernance.asp#examples-of-

corporate-governance [Accessed 20 Apr.2021]

3. Carol M.Kopp (2021), “Agency Theory”, Investopia, [Online] Available at:

https://www.investopedia.com/terms/a/agencytheory.asp [Accessed 20 Apr.2021]

4. Papertyari (2018), “Theories of Corporate Governance: Agency,

Stewardship etc”, Papertyari.com, [Online] Available at:

https://www.papertyari.com/general-awareness/management/theories-corporate-

governance-agency-stewardship-etc/ [Accessed 20 Apr.2021]

5. Keay, A (2017), Stewardship Theory : Is Board Accountability Necessary?

International Journal of Law and Management, 59 (6). pp. 1292-1314. [Online]

Available at: https://eprints.whiterose.ac.uk/109675/3/BOARD

%20ACCOUNTABILITY%20AND%20THE%20STEWARDSHIP%20THEORY

%20J%20Law%20and%20manrevised.pdf [Accessed 20 Apr.2021]

6. Chron Contributor (2021), “Stewardship Theory of Corporate Governance”,

Small Business, [Online] Available at:

https://smallbusiness.chron.com/stewardship-theory-corporate-governance-

74073.html [Accessed 20 Apr.2021]

7. Rushth, “Understanding Corporate Governance”, Learn Business Concepts,

[Online] Available at: https://learnbusinessconcepts.com/understanding-corporate-

governance/#What-is-Corporate-Governance [Accessed 20 Apr.2021]

8. Peter Chisambara, “Creating Balance Between Performance and

Conformance”, Erpminsight, [Online] Available at:

https://erpminsights.com/improving-governance-in-organizations-how-to-create-a-

balance-between-performance-and-conformance/ [Accessed 20 Apr.2021]

9. Jason Gordon (2021), “Stakeholder Theory of Corporate Governance: What

does it mean for Officer and Director Decision Making”, The Business Professor,

[Online] Available at: https://thebusinessprofessor.com/en_US/business-

governance/stakeholder-theory-of-corporate-governance [Accessed 20 Apr.2021]

You might also like

- Hbspcat 9 OrganizationalDocument231 pagesHbspcat 9 OrganizationalDeepak Kumar Patnala100% (1)

- Three Theories of JusticeDocument27 pagesThree Theories of JusticeReza KhajeNo ratings yet

- A Comparative Study of Performance Appraisal in Manufacturing and Service SectorDocument5 pagesA Comparative Study of Performance Appraisal in Manufacturing and Service Sectorajayajay83100% (3)

- Ethics AssignmentDocument13 pagesEthics AssignmentMawere WilsonNo ratings yet

- Leadership Importance in Construction Productivity Improvement PDFDocument12 pagesLeadership Importance in Construction Productivity Improvement PDFJorge Jimenez XoloNo ratings yet

- Corporate Governance For PumaDocument10 pagesCorporate Governance For PumaPranay Singh Raghuvanshi100% (1)

- 3 - CH - Landmarks in The Emergence of Corporate GovernanceDocument39 pages3 - CH - Landmarks in The Emergence of Corporate GovernanceAnonymous wbMjF3L5100% (2)

- Module 1Document62 pagesModule 1Linly KeomahavongNo ratings yet

- Assignment 2 (Set 2)Document7 pagesAssignment 2 (Set 2)sashaNo ratings yet

- CSR IV Presentation FinlDocument25 pagesCSR IV Presentation FinlAPS1974SNo ratings yet

- Dr. W. Edwards Deming: Dr. Deming's Ideas Dr. Deming's Famous 14 Points, Originally Presented in Out of The Crisis, ServeDocument4 pagesDr. W. Edwards Deming: Dr. Deming's Ideas Dr. Deming's Famous 14 Points, Originally Presented in Out of The Crisis, ServeshanawerNo ratings yet

- ABE (SM0381) Assignment Part B - SampleDocument15 pagesABE (SM0381) Assignment Part B - Samplesummer100% (2)

- Understanding The Self Module 3 (20231025233509)Document15 pagesUnderstanding The Self Module 3 (20231025233509)Anna Carmella PascualNo ratings yet

- CG Assignment 1Document13 pagesCG Assignment 1arslan0989No ratings yet

- Unit 1 - Business EthicsDocument23 pagesUnit 1 - Business Ethics088jay IsamaliyaNo ratings yet

- MNB1501 Tutorials (Summary of Each Unit)Document11 pagesMNB1501 Tutorials (Summary of Each Unit)Ghairunisa HarrisNo ratings yet

- Curriculum Development ProcessDocument45 pagesCurriculum Development ProcessMuhammad JavedNo ratings yet

- FileChapter 2 - Accounting, Ethics and The Business World - Power PointsDocument36 pagesFileChapter 2 - Accounting, Ethics and The Business World - Power PointsNot Going to Argue Jesus is KingNo ratings yet

- Industrial Relations Has Three FacesDocument2 pagesIndustrial Relations Has Three FacesRaju Das0% (1)

- Situation Factors That Affect ConformityDocument4 pagesSituation Factors That Affect ConformityKayleigh EdwardsNo ratings yet

- Distributive Justice: Ayhee Marie David Jhollie Felipe Mark Gabriel DangaDocument10 pagesDistributive Justice: Ayhee Marie David Jhollie Felipe Mark Gabriel DangaMark Gabriel DangaNo ratings yet

- Participation and Empowerment 1Document7 pagesParticipation and Empowerment 1Shankar MahantiNo ratings yet

- Teaching Behavioral Ethics by Robert A. Prentice 2Document50 pagesTeaching Behavioral Ethics by Robert A. Prentice 2kiwitenNo ratings yet

- Unit 11 Conflict Management and Conflict Resolution: StructureDocument8 pagesUnit 11 Conflict Management and Conflict Resolution: StructuremireilleNo ratings yet

- Theory of X and yDocument6 pagesTheory of X and ybitsat hailuNo ratings yet

- Environment EthicsDocument25 pagesEnvironment EthicsSivamani SelvarajuNo ratings yet

- Organizational ChangeDocument36 pagesOrganizational ChangeSuresh Malapuram0% (1)

- Running Head: TEAMWORK 1: Teamwork Name of Student Name of Institution DateDocument8 pagesRunning Head: TEAMWORK 1: Teamwork Name of Student Name of Institution DateBest EssaysNo ratings yet

- Ethics Integrity MoralityDocument1 pageEthics Integrity MoralityNatasyaNo ratings yet

- What Is Useful Is Good, and The Moral Value of Actions Are Determined by The Utility of Its Consequences.Document8 pagesWhat Is Useful Is Good, and The Moral Value of Actions Are Determined by The Utility of Its Consequences.jonelNo ratings yet

- Ethics, Also Called Moral Philosophy, The Discipline Concerned With What Is Morally GoodDocument3 pagesEthics, Also Called Moral Philosophy, The Discipline Concerned With What Is Morally GoodNiyati SoodNo ratings yet

- Classical Approach of ManagementDocument57 pagesClassical Approach of ManagementPiyam RazaNo ratings yet

- Literature Review MotivationDocument4 pagesLiterature Review MotivationSwarnajeet GaekwadNo ratings yet

- Prison NurseriesDocument8 pagesPrison Nurseriesapi-553524498No ratings yet

- Ethical Management LeadershipDocument25 pagesEthical Management Leadershipmihai simionescuNo ratings yet

- GS-F311 Intro To Conflict Management - Handout PDFDocument2 pagesGS-F311 Intro To Conflict Management - Handout PDFUtkarsh GuptaNo ratings yet

- Utilitarianism by John Stuart MillDocument11 pagesUtilitarianism by John Stuart MillJason BorresNo ratings yet

- CSR LawrenceDocument12 pagesCSR LawrenceHangga DarismanNo ratings yet

- Health Psychology ModuleDocument76 pagesHealth Psychology ModuleMahad AliNo ratings yet

- Minnow Brook IIIDocument1 pageMinnow Brook IIIsunishsugunan100% (5)

- Chapter 1.2Document51 pagesChapter 1.2AntondeepakNo ratings yet

- Conflict New PDFDocument107 pagesConflict New PDFfaisalNo ratings yet

- Ethical IssuesDocument2 pagesEthical IssuesSilviaDeeaNo ratings yet

- Introduction To OhsDocument41 pagesIntroduction To OhsJorge Cronwell Montaño Vásquez100% (1)

- History of Contingency Theory: Reporter: Emiliana J. LozanoDocument23 pagesHistory of Contingency Theory: Reporter: Emiliana J. Lozanoaireenclores100% (3)

- Organizational Development: Books To Be ReadDocument49 pagesOrganizational Development: Books To Be ReadPeperZeaMaysNo ratings yet

- Ethics of Organizational Gift GivingDocument7 pagesEthics of Organizational Gift GivingKyle SnyderNo ratings yet

- Behaviorism: Zhou, Molly and Brown, David, "Educational Learning Theories: 2nd Edition" (2015) - Education OpenDocument9 pagesBehaviorism: Zhou, Molly and Brown, David, "Educational Learning Theories: 2nd Edition" (2015) - Education OpenNesbher Vulgira100% (1)

- History of Social WorkDocument44 pagesHistory of Social WorkLenethLestino100% (1)

- To Resolve A Conflict, First DecideDocument13 pagesTo Resolve A Conflict, First DecideEko SakapurnamaNo ratings yet

- Ethical CultureDocument15 pagesEthical CultureAbdul SamiNo ratings yet

- Topic - Theories of Corporate Ethical - Social ResponsibilityDocument10 pagesTopic - Theories of Corporate Ethical - Social ResponsibilityMarilou Olaguir SañoNo ratings yet

- Learning OrganisationDocument9 pagesLearning OrganisationZulfekar Dulmeer100% (1)

- Decision Heuristics and Biases CARMENDocument58 pagesDecision Heuristics and Biases CARMENnagl.1No ratings yet

- Neo Classical Theory of ManagementDocument3 pagesNeo Classical Theory of ManagementwaleedjuttNo ratings yet

- PE GTU Study Material Presentations Unit-1 13082021074152PMDocument13 pagesPE GTU Study Material Presentations Unit-1 13082021074152PMsinofe3634100% (1)

- Advantages of Collective BargainingDocument2 pagesAdvantages of Collective BargainingMamta ThanwaniNo ratings yet

- Barnard's Goals in Writing The Functions of The ExecutiveDocument4 pagesBarnard's Goals in Writing The Functions of The Executivegrogers006No ratings yet

- Conflict Management Techniques: ForcingDocument10 pagesConflict Management Techniques: ForcingIvan ClarkNo ratings yet

- Theories of Scientific Management: Presented byDocument61 pagesTheories of Scientific Management: Presented bytacticiankerala100% (1)

- Compelling Returns: A Practical Guide to Socially Responsible InvestingFrom EverandCompelling Returns: A Practical Guide to Socially Responsible InvestingNo ratings yet

- Building an entrepreneurial culture from the strategic modelingFrom EverandBuilding an entrepreneurial culture from the strategic modelingNo ratings yet

- Perception Snapshot - ESG FactorsDocument3 pagesPerception Snapshot - ESG Factorsadampasick4788No ratings yet

- Effect of Corporate Governance On Financial Performance of SACCOs in KenyaDocument13 pagesEffect of Corporate Governance On Financial Performance of SACCOs in KenyaZainudin MohamedNo ratings yet

- Chambers Corporate Governance 2021 Corporate Governance 2021Document600 pagesChambers Corporate Governance 2021 Corporate Governance 2021Bella TjendriawanNo ratings yet

- 2015 British Airways Annual Report PDFDocument78 pages2015 British Airways Annual Report PDFAndreea AvramescuNo ratings yet

- Corporate Governance and CSRDocument31 pagesCorporate Governance and CSRYash SoniNo ratings yet

- Ihg 2019ar PDFDocument257 pagesIhg 2019ar PDFJardan TatianaNo ratings yet

- Accountability and Responsibility in Corporate GovernanceDocument65 pagesAccountability and Responsibility in Corporate Governanceapril rose dinampoNo ratings yet

- Cannon Trading Education: Options 101Document5 pagesCannon Trading Education: Options 101krolldoggNo ratings yet

- Aguilhera Et Al. The Corporate Governance of Environmental SustainabilityDocument30 pagesAguilhera Et Al. The Corporate Governance of Environmental SustainabilityPriscila VieiraNo ratings yet

- 2013 UCPB Annual ReportDocument116 pages2013 UCPB Annual ReportPat Dela CruzNo ratings yet

- Danaharta Annual Report 2003Document147 pagesDanaharta Annual Report 2003az1972100% (6)

- Diffferent Pathways That Suggest Whether Auditors' Going Concern Opinion Are Ethical BasedDocument17 pagesDiffferent Pathways That Suggest Whether Auditors' Going Concern Opinion Are Ethical BasedKurniawan FebryNo ratings yet

- The Relationship of Compliance with the Philippine Stock Exchange Corporate Governance Guidebook and Return Of Equity of Selected Publicly Listed Companies in The Philippines For The Reporting Years 2012 and 2013Document86 pagesThe Relationship of Compliance with the Philippine Stock Exchange Corporate Governance Guidebook and Return Of Equity of Selected Publicly Listed Companies in The Philippines For The Reporting Years 2012 and 2013dyanmerz.tolentinoNo ratings yet

- Shri Ram Policy FormDocument3 pagesShri Ram Policy FormMOHD AFZANo ratings yet

- URC Annual Corporate Governance Report 2016 - FinalDocument74 pagesURC Annual Corporate Governance Report 2016 - FinalDennis DimaanoNo ratings yet

- Data Tables Foxia - Responsive Bootstrap 5 Admin DashboardDocument2 pagesData Tables Foxia - Responsive Bootstrap 5 Admin DashboardnaimahadouNo ratings yet

- Struktur Org Mula IndonesiaDocument3 pagesStruktur Org Mula IndonesiaErlangga DarmawanNo ratings yet

- 5 Company Law IIDocument4 pages5 Company Law IIVani ChoudharyNo ratings yet

- C OptionsPlaybook 2nded 1 3 PDFDocument33 pagesC OptionsPlaybook 2nded 1 3 PDFNisha SinglaNo ratings yet

- Strategic Management: Concepts and Cases: Arab World EditionDocument71 pagesStrategic Management: Concepts and Cases: Arab World Editionwaheeba84No ratings yet

- Directors 2022Document73 pagesDirectors 2022Sherry LaiNo ratings yet

- The Legal History of Corporate Governance in EuropeDocument43 pagesThe Legal History of Corporate Governance in Europebabayao10No ratings yet

- Ac 1204 GovernanceDocument55 pagesAc 1204 GovernanceAnthony Carl UnabiaNo ratings yet

- DIGI - Annual Report 2019Document179 pagesDIGI - Annual Report 2019jesson kimNo ratings yet

- DerivativesDocument2 pagesDerivativesKiran Janu BNo ratings yet

- Listed Companies (Code of Corporate Governance) Regulations 2017Document5 pagesListed Companies (Code of Corporate Governance) Regulations 2017Latest BeddingNo ratings yet