Professional Documents

Culture Documents

Answer: Q4 / P22 / N20 - Analysis and Interpretation

Answer: Q4 / P22 / N20 - Analysis and Interpretation

Uploaded by

Haziqah JainiCopyright:

Available Formats

You might also like

- Exam Practice Question Glori Fried Chicken Rima Puri v2 WZ AnswersDocument4 pagesExam Practice Question Glori Fried Chicken Rima Puri v2 WZ AnswersJœ œNo ratings yet

- (TEST BANK and SOL) Current LiabilitiesDocument5 pages(TEST BANK and SOL) Current LiabilitiesJhazz DoNo ratings yet

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- ACCT 6011 Assignment #1 TemplateDocument8 pagesACCT 6011 Assignment #1 Templatepatel avaniNo ratings yet

- Answer: Q4 / P22 / N20 - Analysis and InterpretationDocument1 pageAnswer: Q4 / P22 / N20 - Analysis and InterpretationHaziqah JainiNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesIryne Kim PalatanNo ratings yet

- Chapter 3-4 Lab Problems 9.14.2021Document1 pageChapter 3-4 Lab Problems 9.14.2021Abdullah alhamaadNo ratings yet

- Chapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Document6 pagesChapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Jue WernNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- 2023spring Intro Assign4solDocument5 pages2023spring Intro Assign4solHamayun KhanNo ratings yet

- ACCT - Projected Income Statement Bank Reconciliation Inventory Costing DepreciationDocument17 pagesACCT - Projected Income Statement Bank Reconciliation Inventory Costing DepreciationTavakoli MehranNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- Nov 2022 P13Document12 pagesNov 2022 P13Toshna RawoteeaNo ratings yet

- British American Tobacco Bangladesh2019 2020Document7 pagesBritish American Tobacco Bangladesh2019 2020Zaref IslamNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- Exam - Midterm - Answers - 17 March 2022Document10 pagesExam - Midterm - Answers - 17 March 2022elodie Helme GuizonNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/13Document12 pagesCambridge International AS & A Level: Accounting 9706/13OSHADA AKALANKA 11-BNo ratings yet

- DEBT SECURITIES With Answer For Uploading 1Document7 pagesDEBT SECURITIES With Answer For Uploading 1Ryan Malanum AbrioNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- Chap Quiz To PrintDocument6 pagesChap Quiz To PrintKyla Alap-apNo ratings yet

- AC 310 Lab Problems - 9.7.2021Document2 pagesAC 310 Lab Problems - 9.7.2021Abdullah alhamaadNo ratings yet

- Sesssion 9 14-Nov-2020 For PresentationDocument35 pagesSesssion 9 14-Nov-2020 For PresentationUzma UzmaNo ratings yet

- Sesssion 9 14-Nov-2020 For PresentationDocument35 pagesSesssion 9 14-Nov-2020 For PresentationUzma UzmaNo ratings yet

- Sesssion 9 14-Nov-2020 For PresentationDocument35 pagesSesssion 9 14-Nov-2020 For PresentationNasreen FawadNo ratings yet

- Midterm Test - Code 37 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 37 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Instalment DISDocument4 pagesInstalment DISRenelyn David100% (1)

- S20Practice Sets 1-7 Rev ADocument68 pagesS20Practice Sets 1-7 Rev AarnavNo ratings yet

- Assign QP 2024 May - DP11.2 Intro Fin MGTDocument5 pagesAssign QP 2024 May - DP11.2 Intro Fin MGTshalomechinodyaNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Ch.6-9 Review Problems + SolutionsDocument29 pagesCh.6-9 Review Problems + Solutionsandrew.yerokhin1No ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelTatenda NdlovuNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Corpuz, Aily F-Fm2-2-Midterm Practice ProblemDocument5 pagesCorpuz, Aily F-Fm2-2-Midterm Practice ProblemAily CorpuzNo ratings yet

- Spring2022 (July) Exam-Fin Part1Document8 pagesSpring2022 (July) Exam-Fin Part1Ahmed TharwatNo ratings yet

- Introduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Document7 pagesIntroduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Chulbul PandeyNo ratings yet

- 02 Audit of Expenditure and Disbursements Cycle (Cont.)Document4 pages02 Audit of Expenditure and Disbursements Cycle (Cont.)Becky GonzagaNo ratings yet

- Group Assignment 2 - Fall 2021 - BlankDocument13 pagesGroup Assignment 2 - Fall 2021 - Blankhalelz69No ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- UntitledDocument176 pagesUntitledPriya NairNo ratings yet

- Assignment Financial Management: Student Id Unit CodeDocument7 pagesAssignment Financial Management: Student Id Unit CodeAdrian ContilloNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12Nadine JanganoNo ratings yet

- ADBM - Financial AccountingDocument10 pagesADBM - Financial AccountingMahima SheromiNo ratings yet

- PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionDocument4 pagesPRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionEnrique Hills RiveraNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document4 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )dinda ardiyaniNo ratings yet

- P20 Syl2012Document17 pagesP20 Syl2012jahanzaib.62490No ratings yet

- Ereta Education Cons P2Document2 pagesEreta Education Cons P2Ayen Geoffrey AlexanderNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument9 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelMichael RajaNo ratings yet

- Ross FCF 10ce Ch10Document12 pagesRoss FCF 10ce Ch10JudithNo ratings yet

- Financial Accounting 3.2Document7 pagesFinancial Accounting 3.2Tawanda HerbertNo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- FM RTP Merge FileDocument311 pagesFM RTP Merge FileAritra BanerjeeNo ratings yet

- Managerial Finance - Midterm ExamDocument4 pagesManagerial Finance - Midterm ExamNerissaNo ratings yet

- Guideline Answers: Executive ProgrammeDocument70 pagesGuideline Answers: Executive ProgrammeRiya GoyalNo ratings yet

- Mid Sem Sample Exam ABDADocument11 pagesMid Sem Sample Exam ABDALeah StonesNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Nag Gu FeminismDocument6 pagesNag Gu FeminismnageshNo ratings yet

- Communication: by Nyonika ChandakDocument5 pagesCommunication: by Nyonika ChandakNyonikaNo ratings yet

- SIMP Model Catch Certificates PDFDocument9 pagesSIMP Model Catch Certificates PDFElvita RizkyNo ratings yet

- (Richard Rawles) CallimachusDocument146 pages(Richard Rawles) Callimachusamany taha100% (1)

- Darden PDFDocument37 pagesDarden PDFRizal ApriyanNo ratings yet

- Supreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)Document17 pagesSupreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)muhammed iqbalNo ratings yet

- Cover Letter For Fresher - Sample, Format, Templates - Leverage EduDocument11 pagesCover Letter For Fresher - Sample, Format, Templates - Leverage EduJP ComputersNo ratings yet

- Samarqandi Chahar Maqala Revised EditionDocument198 pagesSamarqandi Chahar Maqala Revised EditionbanarisaliNo ratings yet

- SHRM 475Document70 pagesSHRM 475Anil KumarNo ratings yet

- Desecularisation As An Instituted ProcessDocument9 pagesDesecularisation As An Instituted ProcessRAGHUBALAN DURAIRAJUNo ratings yet

- CTA Case No. 10063Document16 pagesCTA Case No. 10063Karen Joy JavierNo ratings yet

- Gregorio Araneta Vs RodasDocument2 pagesGregorio Araneta Vs RodasLeomar Despi LadongaNo ratings yet

- Case 5Document2 pagesCase 5Thely GeollegueNo ratings yet

- Letter To LGU-Manila Re DC On Sep and Dec 2020Document1 pageLetter To LGU-Manila Re DC On Sep and Dec 2020Randell ManjarresNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- List of Law FirmsDocument18 pagesList of Law FirmsReena ShauNo ratings yet

- Project Horus by Anuraag RathDocument12 pagesProject Horus by Anuraag RatharNo ratings yet

- Volunteer Assignment Description VAD Peace CorpsDocument10 pagesVolunteer Assignment Description VAD Peace CorpsAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Rational Choice TheoryDocument10 pagesRational Choice TheoryGian Lizette Vilar LandichoNo ratings yet

- Pag-Ibig Loan Format - New Pagibig STLRF FormatDocument1 pagePag-Ibig Loan Format - New Pagibig STLRF FormatTrixie ClamohoyNo ratings yet

- Setup GuideDocument5 pagesSetup GuideBiwott MNo ratings yet

- 0419236201Document222 pages0419236201Andrei TodeNo ratings yet

- How Mintoff Killed The NBMDocument4 pagesHow Mintoff Killed The NBMsevee2081No ratings yet

- CDI Q and A1 ExpandedDocument171 pagesCDI Q and A1 ExpandedMugiwara No RufiNo ratings yet

- Employment Application: State of Utah Department of Workforce ServicesDocument3 pagesEmployment Application: State of Utah Department of Workforce Servicesapi-283418026No ratings yet

- Youth 21: Building An Architecture For Youth Engagement in The UN SystemDocument122 pagesYouth 21: Building An Architecture For Youth Engagement in The UN Systemapi-132480607No ratings yet

- Week 1: BBDM3404 Case StudyDocument15 pagesWeek 1: BBDM3404 Case StudyWEN RONG TEOHNo ratings yet

- Letter: Sid and Sandy ChesterDocument3 pagesLetter: Sid and Sandy ChesterTeddy LocNo ratings yet

- Welcome To Cambridge ClubDocument4 pagesWelcome To Cambridge ClubZhanna ZhannaNo ratings yet

- Ra 7353Document15 pagesRa 7353John Byron Jakes LasamNo ratings yet

Answer: Q4 / P22 / N20 - Analysis and Interpretation

Answer: Q4 / P22 / N20 - Analysis and Interpretation

Uploaded by

Haziqah JainiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer: Q4 / P22 / N20 - Analysis and Interpretation

Answer: Q4 / P22 / N20 - Analysis and Interpretation

Uploaded by

Haziqah JainiCopyright:

Available Formats

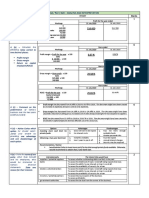

Q4 / P22 / N20 – ANALYSIS AND INTERPRETATION

Question Answer Marks

1

4 (a) – Calculate the profit Profit for the year ended

for the year ended 31 July Workings 31 July 2020 31 July 2019

2020. $

Sales 240 000 $16 000 $11 550

less: Cost of sales 169 000

Gross profit 71 000

less: operating expenses 55 000

Profit for the year 16 000

6

4 (b) – Calculate the Year ended

following ratios correct to Workings 31 July 2020 31 July 2019

two decimal places:

Profit margin = Profit for the year x 100 6.67 % 8.56 %

Sales

Profit margin

$ 16 000 x 100

Gross margin 240 000

Return on capital

employed (ROCE) Year ended

Workings 31 July 2020 31 July 2019

Gross margin = Gross profit x 100 29.58 % 34.26 %

Sales

$71 000 x 100

240 000

Year ended

Workings 31 July 2020 31 July 2019

ROCE = Profit for the year x 100 25.81 % 32.08 %

Capital employed

$16 000 x 100

62 000

Profit margin has decreased from 8.56% in 2019 to 6.67% in 2020. The decrease might have been caused 6

4 (c) – Comment on the by increase in expenses and poor control over expenses.

performance of Carlos’s

business over the two years Gross margin has decreased from 34.26% in 2019 to 29.45% in 2020. The decrease might have been

caused by reduction in selling price, increased cost of sales and purchasing from more expensive suppliers.

(2019 and 2020)

ROCE has decreased from 32.08 % in 2019 to 25.81 % in 2020. The decrease might have been caused by

increased in capital employed and less efficient use of its resources.

5

4 (d) – Advise Carlos which Options Advantages Disadvantages

option he should select. Investing more cash from his 1. Does not have to be repaid. 1. May not have enough

Justify your answer by private funds 2. No interest costs. available funds.

providing one advantage 2. Greater personal risks.

Obtaining a two-year bank loan 1. Instantly available. 1. Must be repaid.

and one disadvantage of

2. Has 2 years to pay it off. 2. Annual interest charges.

each option. 3. Security may be required.

Recommendation / Advise:

I would advise Carlos to invest more cash if he has that enough private funds available. Otherwise,

I would recommend to obtain that 2-year bank loan.

4 (e) – State the name of one 2

party, other than himself Interested party The interest they would have

and his employees, who suppliers / potential suppliers To assess whether outstanding debts are likely to be paid.

would be interested in banks To assess the likelihood of loan / overdraft being repaid when due.

Carlos’s financial To assess the ability to pay interest on loan / overdraft.

To assess the availability of security for a loan.

statements. State one

lenders / potential lenders To assess the likelihood of loan / overdraft being repaid when due.

reason for their interest.

To assess the ability to pay interest on loan / overdraft.

To assess the availability of security for a loan.

investors / potential partners To assess future prospects of the business.

To assess profitability.

government authorities To assess the tax due from the owner of the business.

You might also like

- Exam Practice Question Glori Fried Chicken Rima Puri v2 WZ AnswersDocument4 pagesExam Practice Question Glori Fried Chicken Rima Puri v2 WZ AnswersJœ œNo ratings yet

- (TEST BANK and SOL) Current LiabilitiesDocument5 pages(TEST BANK and SOL) Current LiabilitiesJhazz DoNo ratings yet

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- ACCT 6011 Assignment #1 TemplateDocument8 pagesACCT 6011 Assignment #1 Templatepatel avaniNo ratings yet

- Answer: Q4 / P22 / N20 - Analysis and InterpretationDocument1 pageAnswer: Q4 / P22 / N20 - Analysis and InterpretationHaziqah JainiNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesIryne Kim PalatanNo ratings yet

- Chapter 3-4 Lab Problems 9.14.2021Document1 pageChapter 3-4 Lab Problems 9.14.2021Abdullah alhamaadNo ratings yet

- Chapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Document6 pagesChapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Jue WernNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- 2023spring Intro Assign4solDocument5 pages2023spring Intro Assign4solHamayun KhanNo ratings yet

- ACCT - Projected Income Statement Bank Reconciliation Inventory Costing DepreciationDocument17 pagesACCT - Projected Income Statement Bank Reconciliation Inventory Costing DepreciationTavakoli MehranNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- Nov 2022 P13Document12 pagesNov 2022 P13Toshna RawoteeaNo ratings yet

- British American Tobacco Bangladesh2019 2020Document7 pagesBritish American Tobacco Bangladesh2019 2020Zaref IslamNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- Exam - Midterm - Answers - 17 March 2022Document10 pagesExam - Midterm - Answers - 17 March 2022elodie Helme GuizonNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/13Document12 pagesCambridge International AS & A Level: Accounting 9706/13OSHADA AKALANKA 11-BNo ratings yet

- DEBT SECURITIES With Answer For Uploading 1Document7 pagesDEBT SECURITIES With Answer For Uploading 1Ryan Malanum AbrioNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- Chap Quiz To PrintDocument6 pagesChap Quiz To PrintKyla Alap-apNo ratings yet

- AC 310 Lab Problems - 9.7.2021Document2 pagesAC 310 Lab Problems - 9.7.2021Abdullah alhamaadNo ratings yet

- Sesssion 9 14-Nov-2020 For PresentationDocument35 pagesSesssion 9 14-Nov-2020 For PresentationUzma UzmaNo ratings yet

- Sesssion 9 14-Nov-2020 For PresentationDocument35 pagesSesssion 9 14-Nov-2020 For PresentationUzma UzmaNo ratings yet

- Sesssion 9 14-Nov-2020 For PresentationDocument35 pagesSesssion 9 14-Nov-2020 For PresentationNasreen FawadNo ratings yet

- Midterm Test - Code 37 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 37 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Instalment DISDocument4 pagesInstalment DISRenelyn David100% (1)

- S20Practice Sets 1-7 Rev ADocument68 pagesS20Practice Sets 1-7 Rev AarnavNo ratings yet

- Assign QP 2024 May - DP11.2 Intro Fin MGTDocument5 pagesAssign QP 2024 May - DP11.2 Intro Fin MGTshalomechinodyaNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Ch.6-9 Review Problems + SolutionsDocument29 pagesCh.6-9 Review Problems + Solutionsandrew.yerokhin1No ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelTatenda NdlovuNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Corpuz, Aily F-Fm2-2-Midterm Practice ProblemDocument5 pagesCorpuz, Aily F-Fm2-2-Midterm Practice ProblemAily CorpuzNo ratings yet

- Spring2022 (July) Exam-Fin Part1Document8 pagesSpring2022 (July) Exam-Fin Part1Ahmed TharwatNo ratings yet

- Introduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Document7 pagesIntroduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Chulbul PandeyNo ratings yet

- 02 Audit of Expenditure and Disbursements Cycle (Cont.)Document4 pages02 Audit of Expenditure and Disbursements Cycle (Cont.)Becky GonzagaNo ratings yet

- Group Assignment 2 - Fall 2021 - BlankDocument13 pagesGroup Assignment 2 - Fall 2021 - Blankhalelz69No ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- UntitledDocument176 pagesUntitledPriya NairNo ratings yet

- Assignment Financial Management: Student Id Unit CodeDocument7 pagesAssignment Financial Management: Student Id Unit CodeAdrian ContilloNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12Nadine JanganoNo ratings yet

- ADBM - Financial AccountingDocument10 pagesADBM - Financial AccountingMahima SheromiNo ratings yet

- PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionDocument4 pagesPRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionEnrique Hills RiveraNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document4 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )dinda ardiyaniNo ratings yet

- P20 Syl2012Document17 pagesP20 Syl2012jahanzaib.62490No ratings yet

- Ereta Education Cons P2Document2 pagesEreta Education Cons P2Ayen Geoffrey AlexanderNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument9 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelMichael RajaNo ratings yet

- Ross FCF 10ce Ch10Document12 pagesRoss FCF 10ce Ch10JudithNo ratings yet

- Financial Accounting 3.2Document7 pagesFinancial Accounting 3.2Tawanda HerbertNo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- FM RTP Merge FileDocument311 pagesFM RTP Merge FileAritra BanerjeeNo ratings yet

- Managerial Finance - Midterm ExamDocument4 pagesManagerial Finance - Midterm ExamNerissaNo ratings yet

- Guideline Answers: Executive ProgrammeDocument70 pagesGuideline Answers: Executive ProgrammeRiya GoyalNo ratings yet

- Mid Sem Sample Exam ABDADocument11 pagesMid Sem Sample Exam ABDALeah StonesNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Nag Gu FeminismDocument6 pagesNag Gu FeminismnageshNo ratings yet

- Communication: by Nyonika ChandakDocument5 pagesCommunication: by Nyonika ChandakNyonikaNo ratings yet

- SIMP Model Catch Certificates PDFDocument9 pagesSIMP Model Catch Certificates PDFElvita RizkyNo ratings yet

- (Richard Rawles) CallimachusDocument146 pages(Richard Rawles) Callimachusamany taha100% (1)

- Darden PDFDocument37 pagesDarden PDFRizal ApriyanNo ratings yet

- Supreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)Document17 pagesSupreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)muhammed iqbalNo ratings yet

- Cover Letter For Fresher - Sample, Format, Templates - Leverage EduDocument11 pagesCover Letter For Fresher - Sample, Format, Templates - Leverage EduJP ComputersNo ratings yet

- Samarqandi Chahar Maqala Revised EditionDocument198 pagesSamarqandi Chahar Maqala Revised EditionbanarisaliNo ratings yet

- SHRM 475Document70 pagesSHRM 475Anil KumarNo ratings yet

- Desecularisation As An Instituted ProcessDocument9 pagesDesecularisation As An Instituted ProcessRAGHUBALAN DURAIRAJUNo ratings yet

- CTA Case No. 10063Document16 pagesCTA Case No. 10063Karen Joy JavierNo ratings yet

- Gregorio Araneta Vs RodasDocument2 pagesGregorio Araneta Vs RodasLeomar Despi LadongaNo ratings yet

- Case 5Document2 pagesCase 5Thely GeollegueNo ratings yet

- Letter To LGU-Manila Re DC On Sep and Dec 2020Document1 pageLetter To LGU-Manila Re DC On Sep and Dec 2020Randell ManjarresNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- List of Law FirmsDocument18 pagesList of Law FirmsReena ShauNo ratings yet

- Project Horus by Anuraag RathDocument12 pagesProject Horus by Anuraag RatharNo ratings yet

- Volunteer Assignment Description VAD Peace CorpsDocument10 pagesVolunteer Assignment Description VAD Peace CorpsAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Rational Choice TheoryDocument10 pagesRational Choice TheoryGian Lizette Vilar LandichoNo ratings yet

- Pag-Ibig Loan Format - New Pagibig STLRF FormatDocument1 pagePag-Ibig Loan Format - New Pagibig STLRF FormatTrixie ClamohoyNo ratings yet

- Setup GuideDocument5 pagesSetup GuideBiwott MNo ratings yet

- 0419236201Document222 pages0419236201Andrei TodeNo ratings yet

- How Mintoff Killed The NBMDocument4 pagesHow Mintoff Killed The NBMsevee2081No ratings yet

- CDI Q and A1 ExpandedDocument171 pagesCDI Q and A1 ExpandedMugiwara No RufiNo ratings yet

- Employment Application: State of Utah Department of Workforce ServicesDocument3 pagesEmployment Application: State of Utah Department of Workforce Servicesapi-283418026No ratings yet

- Youth 21: Building An Architecture For Youth Engagement in The UN SystemDocument122 pagesYouth 21: Building An Architecture For Youth Engagement in The UN Systemapi-132480607No ratings yet

- Week 1: BBDM3404 Case StudyDocument15 pagesWeek 1: BBDM3404 Case StudyWEN RONG TEOHNo ratings yet

- Letter: Sid and Sandy ChesterDocument3 pagesLetter: Sid and Sandy ChesterTeddy LocNo ratings yet

- Welcome To Cambridge ClubDocument4 pagesWelcome To Cambridge ClubZhanna ZhannaNo ratings yet

- Ra 7353Document15 pagesRa 7353John Byron Jakes LasamNo ratings yet