Professional Documents

Culture Documents

Annexure P 1final

Annexure P 1final

Uploaded by

gkbantiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure P 1final

Annexure P 1final

Uploaded by

gkbantiCopyright:

Available Formats

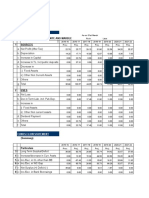

CENTRAL BANK OF INDIA

BRANCH - BHAINSDEHI REGION - CHHINDWARA ZONE BHOPAL

STATEMENT OF STRUCTURAL LIQUIDITY AS ON MARCH 31, 2011

ANNEXURE - P 1

RESIDUAL MATURITY

RUPEES IN CRORE

29 days to 3

OUTFLOWS Day one 2 to 7 days 8-14 days 15-28 days 3 to 6 mths 6 to 12 mths 1 to 3 yrs 3 to 5 yrs Over 5 yrs Total

mths

1 Capital

2 Reserves & Surplus

3 Deposits

i) Current Deposit 621335.10 3520898.90 4142234.00

ii) Savings Banks Deposits 10940381.60 98463434.50 109403816.19

iii) Term Deposits 0.00 201632.40 176205.00 219610.50 3257855.00 4511489.30 9295163.90 16612955.60 5434232.20 2800047.90 42509191.80

iv) Certificates of Deposits 0.00 0.00

4 Borrowings

i) Call and Short Notice 0.00 0.00

ii) Inter-Bank(Term) 0.00

iii) Refinances 0.00

iv) Others (specify) 0.00 0.00

5 Other liabilities & provs.

i) Bills Payable 20467.80 47758.20 68226.00

ii) Provisions 0.00 0.00

iii) Others 1211971.40 1211971.40

6 Lines of credit committed to 2290103.90 2290103.90

i) Institutions

ii) Customers

Unavailed portion of Cash credit/Overdraft/Demand

7

Loan component of working capital

114290.50 3549506.40 8470626.00 25641698.60 17037211.60 54813333.10

8 Letters of credit/guarantees

9 Repos

10 Bills rediscounted (DUPN)

11 Swaps (Buy/Sell)/maturing forwards.

12 Interest payable

13 Others (specify) 2173513.50 0.00 2173513.50

A. TOTAL OUTFLOW 16045801.90 201632.40 290495.50 3769116.90 11728481.00 30153187.90 26332375.50 118645047.20 5434232.20 4012019.30 216612389.80

B CUMULATIVE OUTFLOW 16045801.90 16247434.30 16537929.80 20307046.70 32035527.70 62188715.60 88521091.10 207166138.30 212600370.50 216612389.80

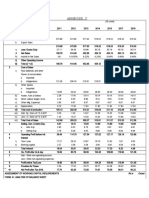

CENTRAL BANK OF INDIA

BRANCH - BHAINSDEHI REGION - CHHINDWARA ZONE BHOPAL

STATEMENT OF STRUCTURAL LIQUIDITY AS ON MARCH 31, 2011

ANNEXURE - P 1

RESIDUAL MATURITY

RUPEES IN CRORE

29 days to 3

INFLOWS Day one 2 to 7 days 8-14 days 15-28 days 3 to 6 mths 6 to 12 mths 1 to 3 yrs 3 to 5 yrs Over 5 yrs Total

mths

1 Cash 1432619 1432619

2 Balances with RBI 0 0

3 Balances with other Banks

i) Current Account 688420.83 688420.8

ii) Money at Call and Short Notice, 0 0

iii) Term Deposits and other placements

4 Investments (including

those under Repos but excluding Reverse Repos)

5 Advances (Performing)

Bills Purchased & Discounted.(including bills under

i)

DUPN)

ii) Cash Credits, Overdrafts and 250849 250849 250849 250849 250849 250849 250849 31250508.5 33006451.5

Loans repayable on demand

iii) Term Loans 750086.3 89779 63135.7 56388.3 3274211.9 1988266.5 3257784.5 8533814.6 4141406.8 2935812.4 25090686

6 NPAs (Advances & Investments)* 5398492 27422 5425914

7 Fixed Assets 1173649.2 1173649.2

8 Other Assets 0 0

i) Leased Assets

ii) Others 0 317512.2 7300 3915961 77933.4 37333.1 25333 0 0 0.5 4381373.2

9 Reverse Repos

10 Swaps (Sell/Buy)/maturing forwards

11 Bills rediscounted (DUPN) 0 0

12 Interest receivable

13 Committed lines of credit

14 Export refinance from RBI

15 Others (specify) 0 0 0

C TOTAL INFLOWS 2433554.3 658140.2 1009705.53 4223198.3 3602994.3 2276448.6 3533966.5 39784323.1 9539898.8 4136884.1 71199113.73

D MISMATCH (C-A) 13612247.6 -456507.8 719210.03 454081.4 8125486.7 -27876739.3 -22798409 -78860724.1 -4105666.6 124864.8 -145413276.07

E MISMATCH AS % To OUTFLOW (D as % to A.) 84.83 226.4 247.58 12.04 69.27 92.45 86.57 66.46 75.55 3.11

F CUMULATIVE MISMATCH 13612247.6 -13155739.8 -12436529.77 -11982448.37 -20107935.07 -47984674.37 -70783083.37 -149643807.47 -145538140.87 -145413276.07

G Cumulative mismatch as % to Cumulative Outflows 84.83 80.97 75.2 59 62.76 77.15 79.96 72.23 68.45 67.13

BRANCH /REGIONAL/ZONAL MANAGER

STATUTORY CENTRAL / BRANCH AUDITORS

DATE:

You might also like

- Tronica CityDocument10 pagesTronica CitysahildoraNo ratings yet

- 1 - Assignment - Case Study - Group4Document4 pages1 - Assignment - Case Study - Group4Jiya SehgalNo ratings yet

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- Notes For Government Procurement LawDocument12 pagesNotes For Government Procurement LawRodelLaborNo ratings yet

- Shail End RaDocument24 pagesShail End Rabharat khandelwalNo ratings yet

- Rail Wheel Factory, Bangalore - 560 064 Balance Sheet As On 31St March 2020 (Commercial Lines)Document4 pagesRail Wheel Factory, Bangalore - 560 064 Balance Sheet As On 31St March 2020 (Commercial Lines)Sneha S MNo ratings yet

- Balance Sheet: As at March 31, 2016Document31 pagesBalance Sheet: As at March 31, 2016samarth kumarNo ratings yet

- Management Accounting: Assignment 1Document8 pagesManagement Accounting: Assignment 1franky_pawanNo ratings yet

- RP Infra Cma ReportDocument12 pagesRP Infra Cma ReportJitendra NikhareNo ratings yet

- International Granimarmo CMA DTA 115 LACS CC - FinalDocument63 pagesInternational Granimarmo CMA DTA 115 LACS CC - FinalSURANA1973No ratings yet

- DB Renews Private Limited: Provisionalbalance Sheet As at 31stmarch, 2019Document8 pagesDB Renews Private Limited: Provisionalbalance Sheet As at 31stmarch, 2019Anonymous btsj64wRNo ratings yet

- SBNY Signature Bank Annual Balance Sheet - WSJDocument1 pageSBNY Signature Bank Annual Balance Sheet - WSJSanchit BudhirajaNo ratings yet

- Cma SCPL BG LoanDocument15 pagesCma SCPL BG LoanSteven BryantNo ratings yet

- Financial Statements - GOOD LEATHER SHOES PRIVATE LIMITEDDocument3 pagesFinancial Statements - GOOD LEATHER SHOES PRIVATE LIMITEDJas AyyapakkamNo ratings yet

- Annexure-Finacial Balance Sheet RCFDocument8 pagesAnnexure-Finacial Balance Sheet RCFkishorejayapalNo ratings yet

- Shree Shyam Granite Cma Data - Xls FINALDocument45 pagesShree Shyam Granite Cma Data - Xls FINALSURANA1973100% (1)

- Balance Sheet: As at 31st March, 2009Document6 pagesBalance Sheet: As at 31st March, 200922165228No ratings yet

- Adobe Scan 02 Nov 2023Document2 pagesAdobe Scan 02 Nov 2023umangchh2306No ratings yet

- Balance SheetDocument2 pagesBalance Sheetkrishnasinghal866No ratings yet

- Cash Flow Statement Xtra Qns Raja Ma'am RecDocument8 pagesCash Flow Statement Xtra Qns Raja Ma'am RecReedhima SrivastavaNo ratings yet

- Financials SaharaDocument19 pagesFinancials SaharaJitendra NikhareNo ratings yet

- SDP Stone Term Laon MarbleDocument72 pagesSDP Stone Term Laon MarbleSURANA1973No ratings yet

- Balance Sheet As at March 31, 2020Document1 pageBalance Sheet As at March 31, 2020sashahalaaNo ratings yet

- Annexure Iii: Current Liabilities and ProvisionsDocument2 pagesAnnexure Iii: Current Liabilities and Provisionssiva kumarNo ratings yet

- Accounts Project Term 2Document22 pagesAccounts Project Term 2Taaran ReddyNo ratings yet

- Data For Financial AnalysisDocument8 pagesData For Financial AnalysisPriyanshu SinghNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- Balance Sheet IOCLDocument1 pageBalance Sheet IOCLNishant YadavNo ratings yet

- Case Study: Security Analysis Abc Bank LTDDocument3 pagesCase Study: Security Analysis Abc Bank LTDSiddharajsinh GohilNo ratings yet

- Jamuna Bank: Dailv Statement of AffairsDocument14 pagesJamuna Bank: Dailv Statement of AffairsArman Hossain WarsiNo ratings yet

- BCL Ar 2020 21 Full 58 60Document3 pagesBCL Ar 2020 21 Full 58 60Joydeep GoraiNo ratings yet

- Itc Balance SheetDocument3 pagesItc Balance SheetDulce PericulumNo ratings yet

- Analysing Financial Performance: Centre For Financial Management, BangaloreDocument24 pagesAnalysing Financial Performance: Centre For Financial Management, Bangalorepankaj9mayNo ratings yet

- Bal SheetDocument4 pagesBal SheetVishal JainNo ratings yet

- Invincble Manufacturing Balance SheetDocument4 pagesInvincble Manufacturing Balance SheetArjun Pratap SinghNo ratings yet

- Pal BS 2019-20 31122019 PDFDocument1 pagePal BS 2019-20 31122019 PDFpushpdeepNo ratings yet

- State Bank of India: Balance Sheet As at 31 March, 2019Document111 pagesState Bank of India: Balance Sheet As at 31 March, 2019Ahmad DanielNo ratings yet

- Tata Consultancy Servies Common SizeDocument2 pagesTata Consultancy Servies Common Sizeshannia dcostaNo ratings yet

- Cma FormatDocument14 pagesCma FormatBISHNU PADA DASNo ratings yet

- Ratio Analysis SumsDocument8 pagesRatio Analysis Sumshabibi 101No ratings yet

- Problems On Balance Sheet of A Company As Per Revised Schedule VI of The Companies ActDocument7 pagesProblems On Balance Sheet of A Company As Per Revised Schedule VI of The Companies ActNithyananda PatelNo ratings yet

- RAJGHARANADocument20 pagesRAJGHARANAPriyanshu tripathiNo ratings yet

- Financial Statement of FY 2022-23Document60 pagesFinancial Statement of FY 2022-23utkarsh.srivastav1403No ratings yet

- Annual Report 2020 Balance SheetDocument1 pageAnnual Report 2020 Balance Sheetghayur khanNo ratings yet

- NDDB AR 2016-17 Eng 0 Part44Document2 pagesNDDB AR 2016-17 Eng 0 Part44siva kumarNo ratings yet

- Balance SheetDocument1 pageBalance Sheetdhuvad.2004No ratings yet

- Demand No. 16 Wms A/C 207214 Engineering Work Shops/Lallaguda Control Over Expenditure For The Month ofDocument1 pageDemand No. 16 Wms A/C 207214 Engineering Work Shops/Lallaguda Control Over Expenditure For The Month ofpasamvNo ratings yet

- Project Report - Paresh NathDocument13 pagesProject Report - Paresh NathITR FILENo ratings yet

- Auditing Problems Assignment AnswersDocument4 pagesAuditing Problems Assignment AnswersSophia Anne Margarette NicolasNo ratings yet

- Cestrum BS-Mar 23 ConsolDocument35 pagesCestrum BS-Mar 23 Consolprimestuff09No ratings yet

- Asian Paints ProjectDocument3 pagesAsian Paints ProjectRahul SinghNo ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- Bank Reconciliation Statement II - Accounting-Workbook - Zaheer-SwatiDocument4 pagesBank Reconciliation Statement II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- 5 Financial RatioDocument2 pages5 Financial Ratiosolitaire.vistaNo ratings yet

- BS NormallyDocument11 pagesBS Normallyvishwakarmaash75No ratings yet

- Provisional Profit and Loss Accounts For The Period Un-Audited AuditedDocument4 pagesProvisional Profit and Loss Accounts For The Period Un-Audited AuditedAnonymous btsj64wRNo ratings yet

- Liabilities 2.1.current Liabilities I. Borrowings From IOB From Other Banks Commercial Paper Sub-TotalDocument11 pagesLiabilities 2.1.current Liabilities I. Borrowings From IOB From Other Banks Commercial Paper Sub-TotalsethigaganNo ratings yet

- Holdings Limited: McdowellDocument14 pagesHoldings Limited: McdowellSarvesh SatavalekarNo ratings yet

- Birla Cable SplitDocument3 pagesBirla Cable SplitJoydeep GoraiNo ratings yet

- Solution 18preparation of Financial Statements Company Final AccDocument2 pagesSolution 18preparation of Financial Statements Company Final AccKajal BindalNo ratings yet

- Domestic DebtDocument1 pageDomestic DebtAbdulManan_uolccNo ratings yet

- Video - Ice CreamDocument2 pagesVideo - Ice CreamRosy HernandezNo ratings yet

- Brealey 9 e IPPTCh 07Document44 pagesBrealey 9 e IPPTCh 07haidarNo ratings yet

- Test Bank For Understanding Economics 7th Edition by LovewellDocument36 pagesTest Bank For Understanding Economics 7th Edition by Lovewelldianalaglyarw7u4100% (39)

- Project TitleDocument63 pagesProject TitleChetan AcharyaNo ratings yet

- Auditor's Report: To The Shareholders of R. S. Agro & Fertilizer Chemical Industries LTDDocument2 pagesAuditor's Report: To The Shareholders of R. S. Agro & Fertilizer Chemical Industries LTDArman Hossain WarsiNo ratings yet

- Lavén (2022) Introduction To Strategy and Organization - DocumentationDocument59 pagesLavén (2022) Introduction To Strategy and Organization - DocumentationfizasohaibNo ratings yet

- Onecard Statement (14 Aug 2022 - 13 Sep 2022) : Abhijeet PatilDocument3 pagesOnecard Statement (14 Aug 2022 - 13 Sep 2022) : Abhijeet PatilAbhijeet PatilNo ratings yet

- Summer Training Report of AkritiDocument62 pagesSummer Training Report of AkritiSuman GoyalNo ratings yet

- Instructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaDocument29 pagesInstructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaAISLINENo ratings yet

- Revision Questions. StatisticsDocument27 pagesRevision Questions. StatisticsKen Mugambi100% (5)

- To, Vimal Jagdish Singh: Chetananand - WARD 34 (3) (5), MUMBAIDocument1 pageTo, Vimal Jagdish Singh: Chetananand - WARD 34 (3) (5), MUMBAItomoreNo ratings yet

- Life Sciences OpX Consulting - OpX Begins Here Article ChemEng0307Document4 pagesLife Sciences OpX Consulting - OpX Begins Here Article ChemEng0307Sandu LicaNo ratings yet

- 6QQMN969 Module OutlineDocument4 pages6QQMN969 Module OutlineyuvrajwilsonNo ratings yet

- Omar - Confidentiality ActivityDocument6 pagesOmar - Confidentiality ActivityOMAR ID-AGRAMNo ratings yet

- Resume - Sanchit GoyalDocument1 pageResume - Sanchit GoyaltompaulmarottickalNo ratings yet

- Rayban MetaphorsDocument5 pagesRayban MetaphorsVishaal Kumaran J 2027825No ratings yet

- The Biologist's Imagination - Innovation in The Biosciences-Oxford University Press (2014)Document305 pagesThe Biologist's Imagination - Innovation in The Biosciences-Oxford University Press (2014)brancobraeNo ratings yet

- Market Positioning Assignment PDFDocument5 pagesMarket Positioning Assignment PDFazar emraanNo ratings yet

- Akshay ResumeDocument1 pageAkshay ResumeGaurav kushwahaNo ratings yet

- Guideline MS 100 IGNOU MBADocument7 pagesGuideline MS 100 IGNOU MBAsumit15509270No ratings yet

- Metro Pacific Hospitals: No Hospital # Bed Year Established Location (City/town)Document4 pagesMetro Pacific Hospitals: No Hospital # Bed Year Established Location (City/town)Sunshine PangatunganNo ratings yet

- Activity 4Document8 pagesActivity 4khelxoNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument19 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Return and Refund PolicyDocument4 pagesReturn and Refund PolicyChishty Shai NomaniNo ratings yet

- Rico 29319100 Corporate Strategy Case IndofoodDocument4 pagesRico 29319100 Corporate Strategy Case IndofoodMifta ZanariaNo ratings yet

- "Kuraloane Fab Tech Private Limited" at BangaloreDocument23 pages"Kuraloane Fab Tech Private Limited" at BangaloreCHANDAN CHANDUNo ratings yet

- Power BI Resume 02Document2 pagesPower BI Resume 02haribabu madaNo ratings yet