Professional Documents

Culture Documents

Continued On Next Page..

Continued On Next Page..

Uploaded by

lindaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Continued On Next Page..

Continued On Next Page..

Uploaded by

lindaCopyright:

Available Formats

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

A

Absentee Owner – refers to a homeowner who does not live in the property.

After Repair Value (ARV) - describes an estimate of a property’s value, after repairs and renovations

have been made. As a part of deal analysis, real estate investors utilize this calculation to determine the

profit potential of a renovation property.

Analyze the Deal - conducting more in-depth research on the subject property before moving forward

with the purchase.

As-Is – the current condition of the property.

Assessed Value – the value established for property tax purposes and takes comparable property sales

and inspections of the property into consideration.

Assignee – the person to whom an agreement or contract is sold or transferred.

Assignment – a sales transaction with the original buyer of the property ("the assignor") allows another

buyer ("the assignee") to take over the buying rights to purchase the property. Assignment is often used

by wholesalers to get discounted properties under contract, with the intent to re-assign the buying rights

to another buyer for a small profit. They then sell the property contract to an end buyer, such as a

rehabber, by using a legal document called an assignment contract.

Asking Price - the initial selling price of a property, that the seller is asking for the property.

Assignor – the person who assigns or transfers an agreement or contract to another.

Auction - financial institutions will routinely sell properties, such as those they repossessed through

foreclosure, at auctions available to the public.

Acquisitions – the process of purchasing a real estate investment.

B

Bandit Signs - small corrugated signs that display marketing messages, often sighted on yards and busy

intersections. In real estate, these signs are often used to advertise to investors and motivated sellers.

Bird Dog – someone who spends their time locating potential real estate investment opportunities and

pass those deals on to another investor for a fee.

Broker – an individual who acts as an intermediary between two or more parties for the purpose of

negotiating a transaction agreeable to all of the parties. In lending, the broker arranges and negotiates

loan amounts, interest rates and loan terms between borrowers and lenders.

Buyers List – a list, or rolodex of investors who are actively looking for investment opportunities to buy.

These lists are built via marketing, networking and repeated business.

1 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

C

Cancellation Clause – a contract provision that gives the right to terminate the obligations upon the

occurrence of specified conditions or events.

Capital – money used to create income, either as an investment in a business or an income property.

Cash Flow – amount of money you pocket at the end of each month, after all expenses have been paid.

Chain of Title – a history of conveyances and encumbrances affecting a title. A valuable tool to identify

the past owners of any given property. This chain will follow the title from the original owners to the

current owners.

Clear Title – a marketable title, clear of any type of lien or anything else that might pose a question about

legal ownership. An owner with a clear title has legal ownership of the title and property and is able to

transfer this title legally to a purchaser.

Closing Costs – fees paid by buyer or seller at the end of a real estate transaction. These are expenses

incurred to complete the loan transaction. These costs may include title searches, title insurance, closing

fees, recording fees, processing fees and other charges.

Closing Date – the date on which the seller delivers the deed and the buyer pays for the property.

Closing Statement – an accounting of funds from a real estate transaction, also known as a HUD-1.

Cloud on Title – an outstanding claim or encumbrance that, if valid, would affect or impair the owner's

title. Cloud on title is usually discovered during the title search once a property is under contract.

Co-wholesaling - a partnership or collaboration of two real estate investors that work on a wholesale

deal together. One investor finds the seller while the other investor locates the buyer, or vice versa.

Cold Calling – calling someone with whom you have no current relationship in an attempt to gauge their

interest about purchasing their property.

Commission - a fee paid to a broker or an agent for facilitating the purchase or sale of real estate.

Generally, commissions are roughly 3% each (6% total) for the Buyer's Agent & Seller's Agent w/ the

commissions being paid entirely by the Seller.

Comparables (“Comps”) – recently sold properties that are similar or comparable to the one a real

estate investor is analyzing. The facts and details of the property comparables will be compared to those

of the subject property for the purpose of forming an opinion of value for the subject property.

Compliance - encompasses the sets of regulations that govern properties and their components.

Consideration – anything of value given to induce entering into a contract.

Contingency – a condition that must be met before a contract is legally binding. For example, home

purchasers often include a contingency that specifies that the contract is not binding until the purchaser

obtains a satisfactory home inspection report from a qualified home inspector.

Contract (or “purchase or sales agreement”) - an agreement between competent parties to do or not

do certain things for consideration.

Contingency Clause - a portion of a contract that will require certain things to take place before the

contract can be considered valid. This often is a part of a conditional offer made on a property during a

real estate transaction.

2 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

C

Contractor – one who constructs a building or other improvement for the owner or developer.

Conventional Loan – loans not insured or guaranteed by the Federal Government (such as FHA or VA

loans). These loans generally require a 20% down payment.

Counteroffer – a seller can accept, reject or counter an offer. When the seller counters an offer, the seller

can change the price, dates, contingencies, or many other terms of the purchase agreement.

Creative Financing – any financing arrangement other than a traditional mortgage from a third-party

lending institution.

D

Deal Analysis - conducting more in-depth research on the subject property before moving forward with

the purchase.

Deed – written document, properly signed and delivered, that conveys title to real property.

Deed in Lieu of Foreclosure – the act of giving property back to the lender without foreclosure.

Deed of Trust – similar to mortgages in that they serve as security for a loan by encumbering real estate.

However, a mortgage is between two parties (borrower and lender) and a deed of trust involves three

parties (borrower, lender and trustee). The trustee holds the property in trust as security for the payment

of the debt and can sell the property if the borrower defaults.

Default – failure to meet all of the commitments and obligations specified in the mortgage or deed of

trust. Defaults usually give the lender the right to accelerate payments and start foreclosure.

Deposit - provided by the buyer to a seller to show good faith that they are serious about purchasing the

property.

Disclosures - any material facts or defects that a Seller must disclose on a document called the Sellers

Disclosure.

Distressed Property - a property becomes distressed when a homeowner defaults on their mortgage

payments, is delinquent on paying property taxes, or is condemned due to disrepair.

Disposition – the process of selling a real estate investment.

Double Closing - a strategy used by wholesalers to purchase and sell property for a quick profit. The

wholesaler purchases a property from a seller at a discounted price and then immediately resells it to an

end buyer. This is different from an assignment because the wholesaler takes legal possession of the

property for a short amount of time. It’s called a double closing because the wholesaler participates in

two closings (the purchase & the sale).

Down Payment – the portion of the purchase price paid by a buyer to a seller from sources of funds

outside of those provided by a lender.

Due Diligence – the act of carefully reviewing, checking and verifying all of the facts and issues with the

property before proceeding. In other words, do your homework on the deal to ensure it’s a good deal.

3 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

E

Earnest Money – a deposit provided by the buyer to a seller to show good faith that they are serious

about purchasing the property. Earnest Money is generally between $500 to $1,000, but a buyer can

offer a larger earnest money deposit to entice the seller to accept their offer.

Equitable Rights - an interest in or right over property, which gives the holder the right to acquire

formal legal title.

Equitable Title – the interest held by one who has agreed to purchase, but has not yet closed the

transaction.

Equity – the difference between the market value of a property and the amount of money that is still

owed on the loan. Equity can accrue naturally through the market or can be forced into the home based

on improvements made by the owner.

Escrow – funds for a real estate transaction are 'held in escrow' in which a third-party, generally a Title

Company receives and distributes the funds of the transaction.

Escrow Payment – the portion of a borrower's monthly payment that is held by the loan servicer to pay

for taxes, hazard homeowners insurance, mortgage insurance, lease payments, and other items as they

become due. Known as “impounds” or “reserves” in some states.

Estate – the degree, nature, and extent of interest that a person has in real property.

F

Fair Credit Reporting Act – a federal law that allows individuals to examine and correct information

used by credit reporting services.

Financing Costs - costs incurred for utilizing outside funding to fund your flip project. A typical lender

will charge financing a loan origination fee/points upfront to originate the loan and process the

paperwork of 2 to 3%. The lender will also charge monthly or the length of the loan period.

Fix & Flip - term is coined for properties that need a lot of rehab to make them appealing to buyers.

Real estate investors will buy the property, renovate it, and resell the property for a profit.

Fiduciary Responsibility – an obligation to act in the best interest of another party. This type of

obligation typically exists when one person places special trust and confidence in another person and

that responsibility is accepted.

Foreclosure – The process by which the mortgagor's (borrower's) rights to a property are terminated.

While the general process is similar from state to state, the actual procedures tend to vary greatly.

For Sale By Owner (FSBO) – when a homeowner sells their home directly instead of going through a

Realtor or Agent to sell the property. The benefit to the seller is that there is no commission to pay out at

the end of the selling process.

4 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

G

General Warranty Deed – a deed in which the grantor agrees to protect the grantee against any other

claim to title of the property.

Grantee – the party to whom title to real property is conveyed.

Grantor – the party who gives the deed.

H

Hard Money Lender - generally a lender that provides short term (6 to 12 month), interest-only financing

for fix-and-flip projects, with relatively high interest rates (10 to 15%).

Hard Money Loan – a way to borrow funds without using traditional mortgage lenders. Funds typically

used to fix up a property. Loans come from individuals or investors who lend money based (for the most

part) on the property you’re using as collateral and not based off credit scores. When loans need to

happen quickly, or when traditional lenders will not approve a loan, hard money may be the only option.

Home Equity Line Of Credit (HELOC) - when a property owner borrows money against the equity that

has been built up in said property.

Holding Costs – costs associated with holding real estate, such as loan payments, taxes, utilities and

maintenance expenses.

HUD-1 Statement – also known as a “closing sheet” or “settlement form”. It itemizes all charges imposed

on a borrower and seller in a real estate transaction. This form gives a picture of the closing transaction,

and provides each party with a complete list of incoming and outgoing funds. “Buyers” are referred to as

“borrowers” on this form even if no loan is involved.

I

Improvements – additions to raw land such as buildings, streets, sewers, etc. that increase the value of

the property.

Inspection - a property inspection is the process of inspecting the condition of a property which can be

performed by the buyer or by a professional inspection company. Generally, real estate contracts allow

a 10 to 14 day window to allow the buyer of a property to inspect the property.

Interest Rate – the percentage of the loan amount charged for borrowing money; i.e., the cost of the

money expressed as a percentage.

J

Joint Venture (JV) – an agreement between two or more people who invest in a single business or

property.

Judgment – a decree of a court stating that one individual is indebted to another and fixing the amount

of the indebtedness.

5 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

L

Lien – a claim on a property of another as security for money owed. Examples of types of liens would

include judgments, mechanic's liens, mortgages and unpaid taxes.

Listing - what a property for sale is often referred to as by a real estate broker or agent.

List Price - the price at which a property is listed by the seller.

Lead – in Wholesaling, this person has expressed interest in selling their property.

Lease – a contract in which, for a rent payment, the one entitled to the possession of the real property

(lessor) transfers those rights to another (lessee) for a specified period of time.

Legal Description – legally acceptable identification of real estate by government survey, metes and

bounds, or recorded plat.

Lender - a person or entity that provides funding for your real estate project.

Letter of Intent – written expression of desire to enter into a contract without actually doing so.

Line Of Credit – an agreement by a lender to extend credit up to a certain amount for a certain time

without the need for the borrower to file another application.

Listing - a real estate listing is a home that is 'listed' on the MLS (Multiple Listing Service).

Loan-to-Value (LTV) – the ratio of the size of the loan to the value of the property. If the loan is $80,000

and the value of the property is $100,000 the LTV is 80% ($80,000 / $100,000).

M

Marketing – connecting with your audience by implementing strategic and innovative ideas to gain an

advantage over the competition, generate leads, and make it much easier to convert those leads into

prospects

Market Value - the price an asset would fetch in the marketplace.

Marketable Title – a title free from defect.

Maximum Allowable Offer (MAO) - the maximum price point at which investors in a real estate deal

can realistically expect to pull in a profit while minimizing the risk of losing money.

Mortgage – a lien against real property given by a borrower to a lender as security for money borrowed.

Motivated Sellers - homeowners who are motivated to sell their property because of different situations

in their life. They could be pressed for time, nearing foreclosure, want quick cash, can’t afford payments,

inherited a property, own a property out of state, and many other reasons.

Multi-Family - a property that has more than one living-unit on the same property. Examples of a multi-

family property are duplexes, triplexes, quadplexes, or apartment buildings/apartment complexes.

Multiple Listing Service (MLS) – a database where Real Estate Agents and Brokers list properties for

sale. The participating Real Estate Brokers share this information in a common local/regional MLS

system, which is then provided to consumers on the broker's websites.

6 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

N

Negative Equity - occurs when the value of real estate property falls below the outstanding balance on

the mortgage used to purchase that property.

Negotiation – the process of bargaining that precedes an agreement.

O

Offer - when a buyer offers a price on a property that the seller can accept or counter.

Open House - held by the selling agent in order for prospective buyers to come and look at a property.

It enables interested parties to view property without scheduling a showing with their agent.

Open Listing - a non-exclusive real estate contract in which more than one broker may be employed to

sell a property, including the owners themselves.

OPM (Other People's Money) - OPM is a term commonly used to describe the strategy to utilized other

people's money to fund your rehab projects, which will decrease your risk and increase your ROI.

Option – the right to purchase or lease a property upon specified terms within a specified period of time

Owner Financing (Seller Financing) – a method in which a buyer borrows from and makes payments to

the seller instead of a bank. Sometimes you take over the seller's payments. Can be done when a buyer

cannot qualify for a bank loan for the full amount. Also referred to as Seller's Financing.

Owner Occupied - is a form of housing tenure where a person, called the owner-occupier, owner-

occupant, or homeowner, owns the home in which they live.

P

Pocket Listing - a real estate listing that is not entered into the multiple listing service, or MLS.

Points – loan fees paid by the borrower. One point equals one percent of the loan amount.

Private Money Lender - a non-institutional individual or company that lends money for purchasing real

estate. Can be a family-member, friend, colleague or local passive investor that has money to invest in

your rehab projects.

Probate – the legal process through which a deceased person's estate is properly distributed to heirs

and designated beneficiaries and any debt owed to creditors is paid off.

Proof Of Funds - a document that stipulates that a buyer is financially capable of securing a mortgage or

has the funds necessary to make an all-cash purchase in a real estate transaction.

Property Scout - someone who spends their time locating potential real estate investment opportunities

and pass those deals on to another investor for a fee.

Property Value - the worth of a property based on the price that a buyer and seller agree upon.

The value of a property at any given time is determined by what the market will bear.

Purchase Agreement - a legal contract that obligates a buyer to buy a property from a seller. A way of

finalizing the interests of both parties before closing the deal.

7 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

Q

Quitclaim Deed – a deed that conveys only the grantor's rights or interest in a property, without stating

the nature of the rights or interest and with no warranties of ownership.

R

Real Estate Agent - licensed professionals who arrange real estate transactions for either a buyer or a

seller. Agents, generally charge a commission for selling the property of 3% each for the buyer's &

seller's agent (6% total).

Real Estate Broker - real estate agents but with a broker’s license. They work for a real estate brokerage

and assist buyers or sellers in the transfer of ownership of a property, much like a real estate agent.

Realtor - a real estate agent who is a member of the NAR (National Association of Realtors). Realtors

include real estate agents for residential and commercial properties, as well as salespeople, property

managers & appraisers.

Real Estate Owned (REO) – property owned by the bank or lender that has already been foreclosed on

but hasn’t been sold at auction. This happens when a borrower fails to make monthly mortgage

payments and therefore defaults on the loan. In this case, the property goes back to the bank or lender

for sale. It is typically sold at a discounted price.

Real Property – the rights to use real estate.

Realtor – a person who acts as an agent for the sale and purchase of buildings and land; a real estate

agent. They are members of the National Association of Realtors.

Rehabbing - when an investor renovates a property with the intention of improving it to either resell or

rent out for cash flow.

REI - REI is a commonly used acronym that stands for Real Estate Investing.

Refinance – process of a borrower paying off one loan with the proceeds from another. Allows a

borrower to obtain a better interest term and rate.

Repair Costs - typically applied to fix and flips or properties where there is repairs and renovations to be

done. Repair costs should be calculated before buying any investment property in order to accurately

assess a deal.

Return on Investment (ROI) - measures how much money or net profit is made on an investment,

displayed as a percentage of the cost of that investment.

S

Sales Agreement - a legal contract that obligates a seller to sell a property to a buyer. A way of finalizing

the interests of both parties before closing the deal.

Section 8 – privately owned rental dwelling units participating in the low-income rental assistance

program created by 1974 amendments to Section 8 of the 1937 Housing Act.

Seller Financing – also known as Owner Financing.

8 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

S

Settlement Statement – also known as Closing Statement or HUD-1.

Short Sale – a sale of a house in which the proceeds fall short of what the owner still owes on the

mortgage. Many lenders will agree to accept the proceeds of a short sale and forgive the rest of what is

owed on the mortgage when the owner cannot make the mortgage payments. By accepting a short sale,

the lender can avoid a lengthy and costly foreclosure, and the owner is able to pay off the loan for less

than what he owes.

Single-family Home (SFH) - A free-standing house that is different from a townhome or apartment

because it does not share walls or utilities with a neighboring property, and is located on its own parcel

of land.

Skip Trace – the process of finding the most up-to-date contact info and data about a person that may

not be listed publicly (phone number, mailing address, etc). Using public and private databases, court

records, driver’s license, and vehicle registration records, etc.

Subject To – buyer takes title to mortgaged real property but is not personally liable for the payment of

the amount due, buyer must make payments in order to keep the property.

Survey - the process of measuring/laying-out property boundaries, easements and encroachments for a

parcel of land as described in a deed.

T

Terms – conditions and arrangements specified within a contract.

Title – evidence of ownership, evidence of lawful possession.

Title Company - a company that performs a title search and provides title insurance for a property. Title

Companies also provide closing and escrow services for real estate transactions.

Title Defect – an unresolved claim against the ownership of property, prevents seller from providing

buyer clear title to the property

Title Insurance - insurance provided by a Title Company that insures the property has no debts, liens or

judgements and the title is free-and-clear.

Title Search –an examination of public records performed by a Title Company to determine and confirm

a property's legal ownership, and check for any outstanding debts, liens, or judgments against the

property.

Transactional Funding - a form of short-term funding in which a wholesaler uses the funding to

purchase of a wholesale deal, and wholesale the property to an end buyer, usually within 3 to 7 days.

Generally less expensive than traditional hard money loans and costs of borrowing are assessed by

paying points and processing fees.

Trust – an arrangement whereby property is transferred to a trusted third party trustee by a

grantor/trustor, trustee holds the property for the benefit of the beneficiary.

Turnkey Property - a fully renovated home or apartment building that an investor can purchase and

immediately rent out.

9 Continued on next page...

REAL PARTNERSHIP

Common Real Estate Investing

& Wholesaling Terms

U

Under Contract - a property is under contract when a buyer and a seller accept a contract for the

property.

Underwriting - when an individual or business entity seeks funding for a real estate purchase and the

loan request is scrutinized to determine how much risk the lender is willing to accept. This procedure is

performed by an underwriter.

W

Warranty Deed - a property owner, when transferring the title, warrants that he or she owns the property

free and clear of all liens. A warranty deed is used in most property sales. The warranty deed says that:

The grantor is the rightful owner and has the right to transfer the title.

Wholesaler - a wholesaler is a real estate investor that 'wholesales' properties - see wholesaling below...

Wholetailing - a mix between a wholesale deal and rehab deal. It involves you still buying at a deep

discount, but instead of selling to another investor, you rehab the property “just enough” so that it can be

sold on the MLS for retail profits.

Wholesaling - the process of finding deals at a discount, getting the property under contract and re-

assigning the contract to an end buyer for a small profit of $5,000 to $10,000.

Z

Zoning - legal mechanism for local governments to regulate the use of privately owned real estate to

prevent conflicting land uses and promote orderly development.

10

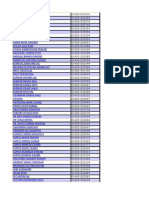

You might also like

- Vendor Lease 2023Document4 pagesVendor Lease 2023api-3412043480% (1)

- Health Unit: Social and Consumer Health Section: Government Agencies Activity: Federal AgenciesDocument2 pagesHealth Unit: Social and Consumer Health Section: Government Agencies Activity: Federal AgenciesShannon White40% (5)

- NCDOJ Servpro Settlement Agreement Fully ExecutedDocument3 pagesNCDOJ Servpro Settlement Agreement Fully ExecutedMark DarroughNo ratings yet

- Explosion Survivor Suing Texas Gas ServiceDocument15 pagesExplosion Survivor Suing Texas Gas ServiceAnonymous Pb39klJNo ratings yet

- Real Estate GlossaryDocument37 pagesReal Estate GlossaryMohamed AbulineinNo ratings yet

- TermsDocument30 pagesTermsweiwei8575No ratings yet

- Loans and MortgagesDocument3 pagesLoans and MortgagesLimario ManobanNo ratings yet

- Real Estate Salesperson SyllabusDocument51 pagesReal Estate Salesperson SyllabusRaja0% (1)

- REDDIT Marketing Plan FY13Document36 pagesREDDIT Marketing Plan FY13breeze450No ratings yet

- Apple 424B2 For International BondDocument70 pagesApple 424B2 For International BondMike WuertheleNo ratings yet

- Lra Fee Schedule 1Document4 pagesLra Fee Schedule 1Alvin SantosNo ratings yet

- Feasibility FormDocument25 pagesFeasibility FormJankey NdagileNo ratings yet

- Tax Audit ProcessesDocument3 pagesTax Audit ProcessesOkwuchi AlaukwuNo ratings yet

- Submission TemplateDocument3 pagesSubmission TemplateShahvaiz AliNo ratings yet

- Negotiable Instruments Act Sections BreakupDocument5 pagesNegotiable Instruments Act Sections BreakupPooja ShahNo ratings yet

- Course Catalog Search: Tuition and Fee Schedule 2012-2013Document5 pagesCourse Catalog Search: Tuition and Fee Schedule 2012-2013nice personNo ratings yet

- Housekeeping Manual 1Document101 pagesHousekeeping Manual 1Said ShetaNo ratings yet

- Discount RateDocument2 pagesDiscount RateAngeline RamirezNo ratings yet

- Payroll GlossaryDocument23 pagesPayroll GlossaryMarkandeya ChitturiNo ratings yet

- Personal Financial Statement Blank Form ExcelDocument8 pagesPersonal Financial Statement Blank Form ExcelMantasha Financial servicesNo ratings yet

- Motor Carrier and Driver Contract Template Version 2Document22 pagesMotor Carrier and Driver Contract Template Version 2Chad Artiaga100% (1)

- Syndicate MusharakaDocument10 pagesSyndicate MusharakaImranullah KhanNo ratings yet

- EPC 1 Ed.171210 S2 001 CC Rev00 180506Document134 pagesEPC 1 Ed.171210 S2 001 CC Rev00 180506Ibrahim Hussein100% (1)

- Lone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Document142 pagesLone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Texas WatchdogNo ratings yet

- Georgia Supreme Court Declares Black People Have No Right Which The White Man Have The Respect Is Shown by The Facts in This CaseDocument11 pagesGeorgia Supreme Court Declares Black People Have No Right Which The White Man Have The Respect Is Shown by The Facts in This CaseJames ThomasNo ratings yet

- Financial Statment AnalysisDocument42 pagesFinancial Statment AnalysisfehNo ratings yet

- Website 13thtextbookDocument92 pagesWebsite 13thtextbookFarahNasihaNo ratings yet

- Fo SopDocument211 pagesFo SopkatariamanojNo ratings yet

- Accountants Legal Responsabilities GleimDocument14 pagesAccountants Legal Responsabilities GleimpfreteNo ratings yet

- Tax 2 Outline (Consolidated)Document24 pagesTax 2 Outline (Consolidated)MRNo ratings yet

- National 20tax 20deed 20directory 20 - 20onlineDocument65 pagesNational 20tax 20deed 20directory 20 - 20onlineJime Guevara100% (1)

- Great American Forms FILL OUT 2020Document2 pagesGreat American Forms FILL OUT 2020Max Power100% (1)

- ADL Claim FormDocument1 pageADL Claim FormRaymond DavisNo ratings yet

- List of HotelsDocument2 pagesList of HotelsmengistuNo ratings yet

- Real Estate Management 2017solvedDocument24 pagesReal Estate Management 2017solvedsusmita sethiNo ratings yet

- Louisiana STATE UNCLAIMED FUNDS FormDocument3 pagesLouisiana STATE UNCLAIMED FUNDS FormdirtinlaNo ratings yet

- Real Estate InvestingDocument32 pagesReal Estate InvestingRudra SinghNo ratings yet

- Response To The Demand For Arbitration and CounterclaimDocument44 pagesResponse To The Demand For Arbitration and Counterclaimleonel ocanaNo ratings yet

- Rac Bidco Limited: Interim Report and Financial StatementsDocument27 pagesRac Bidco Limited: Interim Report and Financial StatementsMus ChrifiNo ratings yet

- Equitable DistributionDocument1 pageEquitable DistributionikrenflyNo ratings yet

- OGS Priority Sample PDFDocument7 pagesOGS Priority Sample PDFParimal paulNo ratings yet

- Check ListDocument72 pagesCheck ListMahir100% (1)

- United States Court of Appeals Tenth CircuitDocument15 pagesUnited States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- SalespersonDocument8 pagesSalespersonozworld3No ratings yet

- Dorman Point Lodge by The Sea: Media Proposal Group AssignmentDocument15 pagesDorman Point Lodge by The Sea: Media Proposal Group AssignmentMitali BiswasNo ratings yet

- Income Tax DavisDocument22 pagesIncome Tax DavisKatelyn Wear HarrellNo ratings yet

- Mortgage Broker Fee AgreementDocument2 pagesMortgage Broker Fee AgreementRohit WankhedeNo ratings yet

- Missouri New Lease WilliamDocument25 pagesMissouri New Lease WilliamDavid FreiheitNo ratings yet

- 10000001858Document124 pages10000001858Chapter 11 DocketsNo ratings yet

- Rental CriteriaDocument3 pagesRental CriteriaTian ZhangNo ratings yet

- Finance For Everyone Assignment Roahan 1099Document10 pagesFinance For Everyone Assignment Roahan 1099Natho100% (1)

- Il ReDocument24 pagesIl Re353135100% (1)

- Declining Resources Have Contributed To Unfavorable Trends in Several Key Automated Collection System Business ResultsDocument20 pagesDeclining Resources Have Contributed To Unfavorable Trends in Several Key Automated Collection System Business ResultsHansley Templeton CookNo ratings yet

- Final Book PDF Online 75Document406 pagesFinal Book PDF Online 75Anonymous klphXsnvNo ratings yet

- Rental Income and Expenses 2021Document2 pagesRental Income and Expenses 2021Finn KevinNo ratings yet

- Facebook Unlocked Course ItineraryDocument1 pageFacebook Unlocked Course Itineraryhiteshi patelNo ratings yet

- Financial TermsDocument6 pagesFinancial Termsapi-348487792No ratings yet

- Sellers RRRR#2Document2 pagesSellers RRRR#2Enrique GuevaraNo ratings yet

- USPTO Fee Schedule: Patent FeesDocument12 pagesUSPTO Fee Schedule: Patent Fees2PlusNo ratings yet

- Real Estate VocabularyDocument69 pagesReal Estate VocabularyCarlos Alberto RojasNo ratings yet

- Balanced GrowthDocument3 pagesBalanced GrowthshyamkakkadNo ratings yet

- Quia Timet InjunctionDocument2 pagesQuia Timet Injunctionjust nickNo ratings yet

- Brigada Pagbasa OrientationDocument43 pagesBrigada Pagbasa OrientationGreg Beloro100% (1)

- Pearson Mathematics Year 10-10a Homework Program AnswersDocument7 pagesPearson Mathematics Year 10-10a Homework Program Answersafeuaqppi100% (1)

- Shagun Dissertation Report 2023Document76 pagesShagun Dissertation Report 2023tarun ranaNo ratings yet

- Fingersmith EssayDocument2 pagesFingersmith EssaydpagoffsNo ratings yet

- 2 Young KydallaDocument364 pages2 Young Kydalladalya0019No ratings yet

- Auden As A Modern PoetDocument15 pagesAuden As A Modern Poetपुष्प समब्याल100% (1)

- Act 330 Assignment Final EditedDocument14 pagesAct 330 Assignment Final EditedTaufiq RahmanNo ratings yet

- Sanlakas v. Executive SecretaryDocument2 pagesSanlakas v. Executive SecretaryMigs RaymundoNo ratings yet

- People v. GarciaDocument8 pagesPeople v. GarciaKharol EdeaNo ratings yet

- Pardon - Remission and Commutation of Sentence ClassDocument27 pagesPardon - Remission and Commutation of Sentence Classyadav.varsha267No ratings yet

- BFINDocument105 pagesBFINMuh AdnanNo ratings yet

- Expectations of Women in SocietyDocument11 pagesExpectations of Women in Societyliliana cambasNo ratings yet

- Censorship: AS Media StudiesDocument9 pagesCensorship: AS Media StudiesBrandonLeeLawrenceNo ratings yet

- AnyDocument35 pagesAnyAashutosh SinghalNo ratings yet

- Disaster Waste Management in Malaysia: Significant Issues, Policies & StrategiesDocument7 pagesDisaster Waste Management in Malaysia: Significant Issues, Policies & Strategiesmuhamadrafie1975No ratings yet

- CBSE Worksheets For Class 12 English Core Assignment 2Document3 pagesCBSE Worksheets For Class 12 English Core Assignment 2MunisamyNo ratings yet

- Foundations of Political ScienceDocument60 pagesFoundations of Political ScienceAvinashNo ratings yet

- Fundamental Concepts: Engineering Economy 1Document10 pagesFundamental Concepts: Engineering Economy 1Andre BocoNo ratings yet

- Abrham Birhan Research MethodDocument20 pagesAbrham Birhan Research Methodabebe belahNo ratings yet

- Money Heist TV SeriesDocument9 pagesMoney Heist TV SeriesJayr Maslog NatorNo ratings yet

- University Institute of Legal StudiesDocument62 pagesUniversity Institute of Legal StudiesnosheenNo ratings yet

- Tax 2Document288 pagesTax 2Edelson Marinas ValentinoNo ratings yet

- UPDocument178 pagesUPDeepika Darkhorse ProfessionalsNo ratings yet

- Afghanistan - Education Equity Profile For Adolescent GirlsDocument16 pagesAfghanistan - Education Equity Profile For Adolescent GirlssalamNo ratings yet

- DunavskastrategijaEUu21 VekuDocument347 pagesDunavskastrategijaEUu21 VekuRadovi1231123No ratings yet

- E - L 7 - Risk - Liability in EngineeringDocument45 pagesE - L 7 - Risk - Liability in EngineeringJivan JayNo ratings yet

- 6.2 Making My First DecisionsDocument7 pages6.2 Making My First Decisionschuhieungan0729No ratings yet

- Consideration in Anglo American ContractDocument24 pagesConsideration in Anglo American ContractMati RosenbaumNo ratings yet