Professional Documents

Culture Documents

Capital Budgeting Sheet 2

Capital Budgeting Sheet 2

Uploaded by

Gursheen KaurCopyright:

Available Formats

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- 7 - BSBSUS401 - Student VersionDocument56 pages7 - BSBSUS401 - Student VersionGursheen Kaur0% (2)

- Worksheet For Clarifying Project ScopeDocument3 pagesWorksheet For Clarifying Project ScopeDianaNo ratings yet

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- EEC 124 Electronics 1theory PDFDocument56 pagesEEC 124 Electronics 1theory PDFDaniel Ayodeji Olawusi95% (20)

- Part 4 - Planning and Training U.S. Soccer Coaching Curriculum PDFDocument50 pagesPart 4 - Planning and Training U.S. Soccer Coaching Curriculum PDFScoala De Fotbal PlopeanuNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- Gaurav Solanki Section E 447 Assingment 3Document10 pagesGaurav Solanki Section E 447 Assingment 3Praveen Singh ChauhanNo ratings yet

- UNIT-II-Problems On Capital BudgetingDocument2 pagesUNIT-II-Problems On Capital BudgetingGlyding FlyerNo ratings yet

- Capital Budgeting: Jordan Enterprises Is Considering A Capital Expenditure That Requires An Initial InvestmentDocument2 pagesCapital Budgeting: Jordan Enterprises Is Considering A Capital Expenditure That Requires An Initial Investmenthafiz nwazNo ratings yet

- Capital Budgeting: Even Cash Flow Uneven Cash FlowDocument2 pagesCapital Budgeting: Even Cash Flow Uneven Cash FlowKeno OcampoNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Assignment 3 Capital Budgeting TechniqueDocument5 pagesAssignment 3 Capital Budgeting TechniqueProma MandalNo ratings yet

- Unit 2 Part 1 CHP 02-SPM-Project EvaluationDocument32 pagesUnit 2 Part 1 CHP 02-SPM-Project Evaluationabc xyzNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingkipovoNo ratings yet

- NPV PDFDocument2 pagesNPV PDFMOHD AnasNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- Corporate Finance 3Document6 pagesCorporate Finance 3Zahid HasanNo ratings yet

- Chapter 2. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 2. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- NPV Total Present Value - Cash Out Flow /investmentDocument3 pagesNPV Total Present Value - Cash Out Flow /investmentMafuzur RahmanNo ratings yet

- Further Practice On Interim Test (Soln)Document4 pagesFurther Practice On Interim Test (Soln)Lê ĐạtNo ratings yet

- Invesrment Decision Problems Only QuestionsDocument7 pagesInvesrment Decision Problems Only QuestionsDivyasree DsNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- Chapter 5. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 5. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Cap Evaluation Methods QuestionsDocument4 pagesCap Evaluation Methods QuestionsSrijan AcharyaNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingAkshat NagpalNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMahedi HasanNo ratings yet

- Group and Individual Exercises COTEM 6022Document12 pagesGroup and Individual Exercises COTEM 6022China AlemayehouNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Chapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsDocument20 pagesChapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsAkshat SinghNo ratings yet

- Management Information CLASS (L-03 & 04) : Prepared By: A.K.M Mesbahul Karim FCADocument28 pagesManagement Information CLASS (L-03 & 04) : Prepared By: A.K.M Mesbahul Karim FCASohag KhanNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- M 4 Cap BudgetingDocument21 pagesM 4 Cap BudgetingNitin DNo ratings yet

- A-3 Capital BudgetingDocument4 pagesA-3 Capital BudgetingUTkarsh DOgraNo ratings yet

- Capital Budgeting (Divya Jadi Booti)Document96 pagesCapital Budgeting (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Capital Budgeting Questions - UE - FMDocument3 pagesCapital Budgeting Questions - UE - FMVimoli MehtaNo ratings yet

- Appendix - Inv Appraisal ExamplesDocument13 pagesAppendix - Inv Appraisal ExamplesYougal MalikNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- Multiple Choice Questions - Week 1+2 - NPVDocument10 pagesMultiple Choice Questions - Week 1+2 - NPVtran thanhNo ratings yet

- Assignment: Long ProjectDocument8 pagesAssignment: Long ProjectTaetae ElyenNo ratings yet

- Capital Budgeting - NotesDocument171 pagesCapital Budgeting - NotesSiddharth mehtaNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- Treasury Management Assignment 1Document4 pagesTreasury Management Assignment 1jojie dadorNo ratings yet

- 11th Lecture Modified-PCFM-Project Cost and Financial ManagementDocument18 pages11th Lecture Modified-PCFM-Project Cost and Financial ManagementMuhammad ArshiyaanNo ratings yet

- Problems 7Document4 pagesProblems 7jojNo ratings yet

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- Session - 039Document5 pagesSession - 039Abcdef GhNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- Sample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SDocument7 pagesSample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SYasir ShaikhNo ratings yet

- Indian Cost Accountants Service Notes - Cap BudgetingDocument19 pagesIndian Cost Accountants Service Notes - Cap Budgetingbefox87318No ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- 3903 Question PaperDocument4 pages3903 Question PaperPacific TigerNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Benefits of Applying Different Depreciation Methods of Long-Term Tangible Assets in A CompanyDocument10 pagesBenefits of Applying Different Depreciation Methods of Long-Term Tangible Assets in A CompanyGursheen KaurNo ratings yet

- WSC - BSBFIA401 SD Depreciation Worksheet V 1.0Document4 pagesWSC - BSBFIA401 SD Depreciation Worksheet V 1.0Gursheen KaurNo ratings yet

- Bird Et Al. 2014. Fit For PurposeDocument17 pagesBird Et Al. 2014. Fit For PurposeGursheen KaurNo ratings yet

- WSC - BSBFIA401 SD Asset Register Worksheet V 1.0Document6 pagesWSC - BSBFIA401 SD Asset Register Worksheet V 1.0Gursheen KaurNo ratings yet

- Ratios Practice SetDocument6 pagesRatios Practice SetGursheen KaurNo ratings yet

- Appendix 4E and Annual Report FY20Document79 pagesAppendix 4E and Annual Report FY20Gursheen KaurNo ratings yet

- Case StudyDocument8 pagesCase StudyGursheen KaurNo ratings yet

- BB2020 Mpio Eca FinalDocument4 pagesBB2020 Mpio Eca FinalGursheen KaurNo ratings yet

- BSBMGT615 Student Assessment Booklet v3.1Document88 pagesBSBMGT615 Student Assessment Booklet v3.1Gursheen KaurNo ratings yet

- 2015 SAEA PaperDocument22 pages2015 SAEA PaperGursheen KaurNo ratings yet

- 05 CREBSS Vol 6 No 2 2020 Paper 03Document16 pages05 CREBSS Vol 6 No 2 2020 Paper 03Gursheen KaurNo ratings yet

- Holmes Institute Faculty of Higher Education: Page - 1 HC3141 - Group - Assignment - Guidelines - T1 - 2021Document7 pagesHolmes Institute Faculty of Higher Education: Page - 1 HC3141 - Group - Assignment - Guidelines - T1 - 2021Gursheen KaurNo ratings yet

- A General Theory of The Inner Structure of Strict Liability Common Law, Civil Law, and Comparative Law (Vernon Palmer)Document55 pagesA General Theory of The Inner Structure of Strict Liability Common Law, Civil Law, and Comparative Law (Vernon Palmer)Wahyu ArthaluhurNo ratings yet

- Alcohol Use Disorders Identification Test (Audit) : CAGE QuestionsDocument3 pagesAlcohol Use Disorders Identification Test (Audit) : CAGE QuestionsAndrei GilaNo ratings yet

- MFG Integration WhitepaperDocument26 pagesMFG Integration Whitepaperjack_rzm100% (1)

- Mcguire eDocument1 pageMcguire efranjuranNo ratings yet

- GyrascopeDocument88 pagesGyrascopeசெல்வ குமார்100% (2)

- Discrete-Time Processing of Speech Signals (IEEE Press Classic Reissue) PDFDocument919 pagesDiscrete-Time Processing of Speech Signals (IEEE Press Classic Reissue) PDFAnonymous bZtJlFvPtpNo ratings yet

- UCSP Module 4 Quarter 2 Social InequalityDocument18 pagesUCSP Module 4 Quarter 2 Social InequalityAllen Nusarte100% (1)

- CRM Project SynopsisDocument6 pagesCRM Project Synopsishairavi10_Scribd0% (1)

- Math Internal Assessment:: Investigating Parametric Equations in Motion ProblemsDocument16 pagesMath Internal Assessment:: Investigating Parametric Equations in Motion ProblemsByron JimenezNo ratings yet

- Merchant of Venice Workbook Answers: Act I Scene 1Document11 pagesMerchant of Venice Workbook Answers: Act I Scene 1Arshad MohammedNo ratings yet

- Lesson PlanDocument3 pagesLesson PlanCgit BocahNo ratings yet

- 30 Day JournalDocument51 pages30 Day JournalMatsu RylieNo ratings yet

- "Is There A Doctor On Board - " The Plight of The In-Flight Orthopaedic SurgeonDocument8 pages"Is There A Doctor On Board - " The Plight of The In-Flight Orthopaedic SurgeonRajiv TanwarNo ratings yet

- DR ZXDocument192 pagesDR ZXDuy Kha88% (34)

- E104 - Superposition Theorem and LinearityDocument19 pagesE104 - Superposition Theorem and LinearityRick AlvientoNo ratings yet

- Kaizen - 3ADocument7 pagesKaizen - 3AAkpomejero EsseogheneNo ratings yet

- The Points (-1, - 2), (1, 0), ( - 1, 2), ( - 3, 0) Form A Quadrilateral of TypeDocument11 pagesThe Points (-1, - 2), (1, 0), ( - 1, 2), ( - 3, 0) Form A Quadrilateral of Typemili groupNo ratings yet

- Communication Skills 2Document62 pagesCommunication Skills 2Maria Romelyn Montajes0% (1)

- Essay Helping OthersDocument2 pagesEssay Helping OthersafabkgdduNo ratings yet

- A Detailed Lesson Plan in Mathematics-1Document10 pagesA Detailed Lesson Plan in Mathematics-1Abdulhaq Ambod Mundi100% (1)

- NLC: Impact Evaluation 2011-2014Document130 pagesNLC: Impact Evaluation 2011-2014NorthLondonCares100% (1)

- Research in International Business and Finance: Badar Nadeem Ashraf TDocument7 pagesResearch in International Business and Finance: Badar Nadeem Ashraf TbouziNo ratings yet

- 3 Introduction To A Critique of Urban Geography: Guy DebordDocument5 pages3 Introduction To A Critique of Urban Geography: Guy DebordItz MarkiNo ratings yet

- DIY Wood Robot ToyDocument7 pagesDIY Wood Robot ToyMichael PaigeNo ratings yet

- A Method For Preparing Extensible Paper On The Laboratory ScaleDocument6 pagesA Method For Preparing Extensible Paper On The Laboratory ScaleDaniel GoffNo ratings yet

- 11 - Static Liquefaction Demonstration PDFDocument47 pages11 - Static Liquefaction Demonstration PDFJenny LimNo ratings yet

- Pontifical Council For Interreligious DialogueDocument2 pagesPontifical Council For Interreligious DialoguephotopemNo ratings yet

Capital Budgeting Sheet 2

Capital Budgeting Sheet 2

Uploaded by

Gursheen KaurOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting Sheet 2

Capital Budgeting Sheet 2

Uploaded by

Gursheen KaurCopyright:

Available Formats

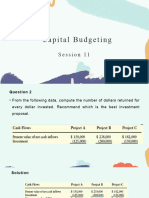

Capital budgeting Sheet 2

Q1. Calculate NPV and payback period for project Gold and Project Silver.

Year Gold Silver

Initial investment 50000 50000

1 5000 40000

2 5000 2000

3 40000 8000

4 10000 10000

5 10000 10000

Q2. Calculate NPV and payback period for Project X and Project Y

Year X Y

Initial investment 10000 10000

1 5000 3000

2 5000 4000

3 1000 3000

4 100 4000

5 100 3000

Q3. ABC Ltd. is a medium sized metal fabricator that is currently contemplating two

projects: Project A requires an initial investment of Rs. 42,000, project B an initial

investment of Rs. 45,000. Calculate NPV and payback.

Year A B

Initial investment 42000 45000

1 14000 28000

2 14000 12000

3 14000 10000

4 14000 10000

5 14000 10000

Q4. SK Manufacturing Company uses discounted payback period to evaluate

investments in capital assets. The company expects the following annual cash flows

from an investment of $3,500,000:

Year Cash flow

Initial investment 3500,000

1 900000

2 900000

3 900000

4 900000

5 900000

6 900000

7 900000

8 900000

No salvage/residual value is expected. The company’s cost of capital is 12%.

1. Compute discounted payback period of the investment.

2. Is the investment desirable if the required payback period is 4 years or less.

Q4. Mr. A is considering to invest in a business.

The business will cost $100,000 to set up and is expected to generate the following

yearly net cash flows:

Year Cash flow

Initial investment 100,000

1 (20000)

2 30000

3 35000

4 40000

5 150000

The cost of capital is 10%.

Calculate the discounted payback period and comment on your answer.

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- 7 - BSBSUS401 - Student VersionDocument56 pages7 - BSBSUS401 - Student VersionGursheen Kaur0% (2)

- Worksheet For Clarifying Project ScopeDocument3 pagesWorksheet For Clarifying Project ScopeDianaNo ratings yet

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- EEC 124 Electronics 1theory PDFDocument56 pagesEEC 124 Electronics 1theory PDFDaniel Ayodeji Olawusi95% (20)

- Part 4 - Planning and Training U.S. Soccer Coaching Curriculum PDFDocument50 pagesPart 4 - Planning and Training U.S. Soccer Coaching Curriculum PDFScoala De Fotbal PlopeanuNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- Gaurav Solanki Section E 447 Assingment 3Document10 pagesGaurav Solanki Section E 447 Assingment 3Praveen Singh ChauhanNo ratings yet

- UNIT-II-Problems On Capital BudgetingDocument2 pagesUNIT-II-Problems On Capital BudgetingGlyding FlyerNo ratings yet

- Capital Budgeting: Jordan Enterprises Is Considering A Capital Expenditure That Requires An Initial InvestmentDocument2 pagesCapital Budgeting: Jordan Enterprises Is Considering A Capital Expenditure That Requires An Initial Investmenthafiz nwazNo ratings yet

- Capital Budgeting: Even Cash Flow Uneven Cash FlowDocument2 pagesCapital Budgeting: Even Cash Flow Uneven Cash FlowKeno OcampoNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Assignment 3 Capital Budgeting TechniqueDocument5 pagesAssignment 3 Capital Budgeting TechniqueProma MandalNo ratings yet

- Unit 2 Part 1 CHP 02-SPM-Project EvaluationDocument32 pagesUnit 2 Part 1 CHP 02-SPM-Project Evaluationabc xyzNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingkipovoNo ratings yet

- NPV PDFDocument2 pagesNPV PDFMOHD AnasNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- Corporate Finance 3Document6 pagesCorporate Finance 3Zahid HasanNo ratings yet

- Chapter 2. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 2. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- NPV Total Present Value - Cash Out Flow /investmentDocument3 pagesNPV Total Present Value - Cash Out Flow /investmentMafuzur RahmanNo ratings yet

- Further Practice On Interim Test (Soln)Document4 pagesFurther Practice On Interim Test (Soln)Lê ĐạtNo ratings yet

- Invesrment Decision Problems Only QuestionsDocument7 pagesInvesrment Decision Problems Only QuestionsDivyasree DsNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- Chapter 5. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 5. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Cap Evaluation Methods QuestionsDocument4 pagesCap Evaluation Methods QuestionsSrijan AcharyaNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingAkshat NagpalNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMahedi HasanNo ratings yet

- Group and Individual Exercises COTEM 6022Document12 pagesGroup and Individual Exercises COTEM 6022China AlemayehouNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Chapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsDocument20 pagesChapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsAkshat SinghNo ratings yet

- Management Information CLASS (L-03 & 04) : Prepared By: A.K.M Mesbahul Karim FCADocument28 pagesManagement Information CLASS (L-03 & 04) : Prepared By: A.K.M Mesbahul Karim FCASohag KhanNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- M 4 Cap BudgetingDocument21 pagesM 4 Cap BudgetingNitin DNo ratings yet

- A-3 Capital BudgetingDocument4 pagesA-3 Capital BudgetingUTkarsh DOgraNo ratings yet

- Capital Budgeting (Divya Jadi Booti)Document96 pagesCapital Budgeting (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Capital Budgeting Questions - UE - FMDocument3 pagesCapital Budgeting Questions - UE - FMVimoli MehtaNo ratings yet

- Appendix - Inv Appraisal ExamplesDocument13 pagesAppendix - Inv Appraisal ExamplesYougal MalikNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- Multiple Choice Questions - Week 1+2 - NPVDocument10 pagesMultiple Choice Questions - Week 1+2 - NPVtran thanhNo ratings yet

- Assignment: Long ProjectDocument8 pagesAssignment: Long ProjectTaetae ElyenNo ratings yet

- Capital Budgeting - NotesDocument171 pagesCapital Budgeting - NotesSiddharth mehtaNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- Treasury Management Assignment 1Document4 pagesTreasury Management Assignment 1jojie dadorNo ratings yet

- 11th Lecture Modified-PCFM-Project Cost and Financial ManagementDocument18 pages11th Lecture Modified-PCFM-Project Cost and Financial ManagementMuhammad ArshiyaanNo ratings yet

- Problems 7Document4 pagesProblems 7jojNo ratings yet

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- Session - 039Document5 pagesSession - 039Abcdef GhNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- Sample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SDocument7 pagesSample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SYasir ShaikhNo ratings yet

- Indian Cost Accountants Service Notes - Cap BudgetingDocument19 pagesIndian Cost Accountants Service Notes - Cap Budgetingbefox87318No ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- 3903 Question PaperDocument4 pages3903 Question PaperPacific TigerNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Benefits of Applying Different Depreciation Methods of Long-Term Tangible Assets in A CompanyDocument10 pagesBenefits of Applying Different Depreciation Methods of Long-Term Tangible Assets in A CompanyGursheen KaurNo ratings yet

- WSC - BSBFIA401 SD Depreciation Worksheet V 1.0Document4 pagesWSC - BSBFIA401 SD Depreciation Worksheet V 1.0Gursheen KaurNo ratings yet

- Bird Et Al. 2014. Fit For PurposeDocument17 pagesBird Et Al. 2014. Fit For PurposeGursheen KaurNo ratings yet

- WSC - BSBFIA401 SD Asset Register Worksheet V 1.0Document6 pagesWSC - BSBFIA401 SD Asset Register Worksheet V 1.0Gursheen KaurNo ratings yet

- Ratios Practice SetDocument6 pagesRatios Practice SetGursheen KaurNo ratings yet

- Appendix 4E and Annual Report FY20Document79 pagesAppendix 4E and Annual Report FY20Gursheen KaurNo ratings yet

- Case StudyDocument8 pagesCase StudyGursheen KaurNo ratings yet

- BB2020 Mpio Eca FinalDocument4 pagesBB2020 Mpio Eca FinalGursheen KaurNo ratings yet

- BSBMGT615 Student Assessment Booklet v3.1Document88 pagesBSBMGT615 Student Assessment Booklet v3.1Gursheen KaurNo ratings yet

- 2015 SAEA PaperDocument22 pages2015 SAEA PaperGursheen KaurNo ratings yet

- 05 CREBSS Vol 6 No 2 2020 Paper 03Document16 pages05 CREBSS Vol 6 No 2 2020 Paper 03Gursheen KaurNo ratings yet

- Holmes Institute Faculty of Higher Education: Page - 1 HC3141 - Group - Assignment - Guidelines - T1 - 2021Document7 pagesHolmes Institute Faculty of Higher Education: Page - 1 HC3141 - Group - Assignment - Guidelines - T1 - 2021Gursheen KaurNo ratings yet

- A General Theory of The Inner Structure of Strict Liability Common Law, Civil Law, and Comparative Law (Vernon Palmer)Document55 pagesA General Theory of The Inner Structure of Strict Liability Common Law, Civil Law, and Comparative Law (Vernon Palmer)Wahyu ArthaluhurNo ratings yet

- Alcohol Use Disorders Identification Test (Audit) : CAGE QuestionsDocument3 pagesAlcohol Use Disorders Identification Test (Audit) : CAGE QuestionsAndrei GilaNo ratings yet

- MFG Integration WhitepaperDocument26 pagesMFG Integration Whitepaperjack_rzm100% (1)

- Mcguire eDocument1 pageMcguire efranjuranNo ratings yet

- GyrascopeDocument88 pagesGyrascopeசெல்வ குமார்100% (2)

- Discrete-Time Processing of Speech Signals (IEEE Press Classic Reissue) PDFDocument919 pagesDiscrete-Time Processing of Speech Signals (IEEE Press Classic Reissue) PDFAnonymous bZtJlFvPtpNo ratings yet

- UCSP Module 4 Quarter 2 Social InequalityDocument18 pagesUCSP Module 4 Quarter 2 Social InequalityAllen Nusarte100% (1)

- CRM Project SynopsisDocument6 pagesCRM Project Synopsishairavi10_Scribd0% (1)

- Math Internal Assessment:: Investigating Parametric Equations in Motion ProblemsDocument16 pagesMath Internal Assessment:: Investigating Parametric Equations in Motion ProblemsByron JimenezNo ratings yet

- Merchant of Venice Workbook Answers: Act I Scene 1Document11 pagesMerchant of Venice Workbook Answers: Act I Scene 1Arshad MohammedNo ratings yet

- Lesson PlanDocument3 pagesLesson PlanCgit BocahNo ratings yet

- 30 Day JournalDocument51 pages30 Day JournalMatsu RylieNo ratings yet

- "Is There A Doctor On Board - " The Plight of The In-Flight Orthopaedic SurgeonDocument8 pages"Is There A Doctor On Board - " The Plight of The In-Flight Orthopaedic SurgeonRajiv TanwarNo ratings yet

- DR ZXDocument192 pagesDR ZXDuy Kha88% (34)

- E104 - Superposition Theorem and LinearityDocument19 pagesE104 - Superposition Theorem and LinearityRick AlvientoNo ratings yet

- Kaizen - 3ADocument7 pagesKaizen - 3AAkpomejero EsseogheneNo ratings yet

- The Points (-1, - 2), (1, 0), ( - 1, 2), ( - 3, 0) Form A Quadrilateral of TypeDocument11 pagesThe Points (-1, - 2), (1, 0), ( - 1, 2), ( - 3, 0) Form A Quadrilateral of Typemili groupNo ratings yet

- Communication Skills 2Document62 pagesCommunication Skills 2Maria Romelyn Montajes0% (1)

- Essay Helping OthersDocument2 pagesEssay Helping OthersafabkgdduNo ratings yet

- A Detailed Lesson Plan in Mathematics-1Document10 pagesA Detailed Lesson Plan in Mathematics-1Abdulhaq Ambod Mundi100% (1)

- NLC: Impact Evaluation 2011-2014Document130 pagesNLC: Impact Evaluation 2011-2014NorthLondonCares100% (1)

- Research in International Business and Finance: Badar Nadeem Ashraf TDocument7 pagesResearch in International Business and Finance: Badar Nadeem Ashraf TbouziNo ratings yet

- 3 Introduction To A Critique of Urban Geography: Guy DebordDocument5 pages3 Introduction To A Critique of Urban Geography: Guy DebordItz MarkiNo ratings yet

- DIY Wood Robot ToyDocument7 pagesDIY Wood Robot ToyMichael PaigeNo ratings yet

- A Method For Preparing Extensible Paper On The Laboratory ScaleDocument6 pagesA Method For Preparing Extensible Paper On The Laboratory ScaleDaniel GoffNo ratings yet

- 11 - Static Liquefaction Demonstration PDFDocument47 pages11 - Static Liquefaction Demonstration PDFJenny LimNo ratings yet

- Pontifical Council For Interreligious DialogueDocument2 pagesPontifical Council For Interreligious DialoguephotopemNo ratings yet