Professional Documents

Culture Documents

Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896 February 17, 1988 Facts

Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896 February 17, 1988 Facts

Uploaded by

NoriCopyright:

Available Formats

You might also like

- Iloilo City Tax Ordinance 2007-016Document196 pagesIloilo City Tax Ordinance 2007-016Iloilo City Council88% (8)

- Business Express Loan Application FormDocument4 pagesBusiness Express Loan Application Formgosmiley67% (3)

- Case Study On IOSDocument3 pagesCase Study On IOSmsoneword0% (1)

- Next Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsDocument8 pagesNext Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsPaul FlorinNo ratings yet

- Nestor Ching V Subic Bay Golf and Country Club G.R. 174353Document8 pagesNestor Ching V Subic Bay Golf and Country Club G.R. 174353Dino Bernard LapitanNo ratings yet

- Funa Vs MecoDocument3 pagesFuna Vs Mecovermouth6wineNo ratings yet

- REMO v. SEC OF JUSTICE, G.R. No. 192925, Dec. 9, 2016Document14 pagesREMO v. SEC OF JUSTICE, G.R. No. 192925, Dec. 9, 2016LovelyNo ratings yet

- PNB Vs AndradaDocument2 pagesPNB Vs Andradajcfish07No ratings yet

- Donnina Halley v. Printwell IncorporationDocument2 pagesDonnina Halley v. Printwell IncorporationKayee KatNo ratings yet

- National Power Corporation vs. City of CabanatuanDocument21 pagesNational Power Corporation vs. City of CabanatuanMp CasNo ratings yet

- Classification of LandsDocument3 pagesClassification of LandsKaren Maechelle EdullantesNo ratings yet

- Miciano v. BrimoDocument2 pagesMiciano v. BrimoPraisah Marjorey PicotNo ratings yet

- Cargill V IntraDocument12 pagesCargill V IntraKim Dayag100% (1)

- Bataan Shipyard Engineering Co. Inc. vs. PCGGDocument4 pagesBataan Shipyard Engineering Co. Inc. vs. PCGGBernalyn Domingo AlcanarNo ratings yet

- People v. QuashaDocument3 pagesPeople v. QuashaJeunaj LardizabalNo ratings yet

- Bernas Vs CincoDocument4 pagesBernas Vs CincoInna LadislaoNo ratings yet

- 34 Eagleridge Devt Corp V CameronDocument8 pages34 Eagleridge Devt Corp V CameronIsagani CastilloNo ratings yet

- 095-Everett vs. Asia Banking Corp 49 Phil 512Document8 pages095-Everett vs. Asia Banking Corp 49 Phil 512wewNo ratings yet

- Lao Vs CA: 119178: June 20, 1997Document16 pagesLao Vs CA: 119178: June 20, 1997Re doNo ratings yet

- Zuiden V GVTLDocument2 pagesZuiden V GVTLClaude PeñaNo ratings yet

- Ang v. AngDocument9 pagesAng v. AngAhmedLucmanSangcopanNo ratings yet

- Ungab Vs CusiDocument11 pagesUngab Vs CusiPia Christine BungubungNo ratings yet

- 176 - Salafranca v. Philamlife (Pamplona)Document1 page176 - Salafranca v. Philamlife (Pamplona)Janice KimayongNo ratings yet

- Gesolgon v. CyberOne PH., Inc.Document9 pagesGesolgon v. CyberOne PH., Inc.Liz KawiNo ratings yet

- 259 Long Vs Basa (Consing)Document1 page259 Long Vs Basa (Consing)Christine Ang CaminadeNo ratings yet

- Llorente Vs CADocument6 pagesLlorente Vs CARichelle CartinNo ratings yet

- Ang V AngDocument33 pagesAng V Angkrys_elleNo ratings yet

- FPT - Case Digest Corpo (Riano)Document30 pagesFPT - Case Digest Corpo (Riano)Pamela DeniseNo ratings yet

- Succ 1Document18 pagesSucc 1Diane JulianNo ratings yet

- Forest Hills Golf and Country Club, Inc. Vs Gardpro, Inc. (GR No. 164686, 22 October 2014)Document10 pagesForest Hills Golf and Country Club, Inc. Vs Gardpro, Inc. (GR No. 164686, 22 October 2014)Braian HitaNo ratings yet

- G.R. No. 22595Document2 pagesG.R. No. 22595strgrl100% (1)

- Conflict of Laws Appilicable Laws Laws Governing Contracts (1992)Document11 pagesConflict of Laws Appilicable Laws Laws Governing Contracts (1992)Cecille Therese PedregosaNo ratings yet

- Board of Liquidators v. Kalaw, 20 SCRA 987Document3 pagesBoard of Liquidators v. Kalaw, 20 SCRA 987Alexander Genesis DungcaNo ratings yet

- HENARES V. LTFRB G.R. No. 158290Document2 pagesHENARES V. LTFRB G.R. No. 158290Rubz JeanNo ratings yet

- Sagales vs. RustanDocument1 pageSagales vs. RustanJohn Paul SantosNo ratings yet

- Lutz v. Araneta, 98 Phil. 148 - Public PurposeDocument1 pageLutz v. Araneta, 98 Phil. 148 - Public PurposeIVYJEAN LAGURANo ratings yet

- Tan vs. Sec - DigestDocument6 pagesTan vs. Sec - DigestNympa VillanuevaNo ratings yet

- Labrel Case Digests (Set 1)Document32 pagesLabrel Case Digests (Set 1)Shauna HerreraNo ratings yet

- Fuller v. KroghDocument1 pageFuller v. KroghkitakatttNo ratings yet

- 2014 Bar ExamDocument3 pages2014 Bar ExamRvic CivrNo ratings yet

- Rule 114, 115 & 116 CasesDocument41 pagesRule 114, 115 & 116 CasesfatimasenNo ratings yet

- Vda de Torres v. EncarnacionDocument3 pagesVda de Torres v. EncarnacionCLark Barcelon100% (1)

- T2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVADocument1 pageT2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVACJVNo ratings yet

- Bibiano Reynoso IV Vs Court of AppealsDocument1 pageBibiano Reynoso IV Vs Court of AppealsAnonymous oDPxEkdNo ratings yet

- Mangila v. PangilinanDocument2 pagesMangila v. PangilinanLuna BaciNo ratings yet

- GUY v. GACOTT G.R. No. 206147, January 13, 2016Document2 pagesGUY v. GACOTT G.R. No. 206147, January 13, 2016SS100% (1)

- Mendoza v. PeopleDocument6 pagesMendoza v. PeopleDanielle AngelaNo ratings yet

- Consti - Ablaza V CirDocument3 pagesConsti - Ablaza V CirGel BarrNo ratings yet

- Marubeni Nederland B.V. v. TensuanDocument5 pagesMarubeni Nederland B.V. v. TensuanIya AnonasNo ratings yet

- Mondano v. SilvosaDocument2 pagesMondano v. SilvosaOmar AlstonNo ratings yet

- Ryuichi Yamamoto v. Nishino Leather IndustriesDocument4 pagesRyuichi Yamamoto v. Nishino Leather IndustriesbearzhugNo ratings yet

- Vicmar v. ElarcosaDocument1 pageVicmar v. ElarcosaNN DDLNo ratings yet

- 187 CIR v. Visayan Electric Co.Document1 page187 CIR v. Visayan Electric Co.Eloise Coleen Sulla PerezNo ratings yet

- REPUBLIC v. CITY OF PARAÑAQUEDocument17 pagesREPUBLIC v. CITY OF PARAÑAQUEKhate AlonzoNo ratings yet

- Funa V VillarDocument1 pageFuna V VillarAubin Arn NievaNo ratings yet

- Iglesia Evangelica V Bishop LazaroDocument10 pagesIglesia Evangelica V Bishop Lazaroarianna0624No ratings yet

- V. Loyola Grand VillasDocument2 pagesV. Loyola Grand VillasDiane UyNo ratings yet

- 17 - Pasei v. TorresDocument1 page17 - Pasei v. TorresCheyz ErNo ratings yet

- Consti II - Case DigestsDocument59 pagesConsti II - Case DigestsJohn G. FloresNo ratings yet

- People v. Tulagan PDFDocument114 pagesPeople v. Tulagan PDFSamanthaNo ratings yet

- Goh vs. Bayron (G.R. No. 212584)Document40 pagesGoh vs. Bayron (G.R. No. 212584)Gretel MañalacNo ratings yet

- A.C. No. 5281 - Manuel L. Lee v. Atty. Regino B. TambagoDocument7 pagesA.C. No. 5281 - Manuel L. Lee v. Atty. Regino B. TambagoKaren Faye TorrecampoNo ratings yet

- CIR vs. Alegre Case DigestDocument2 pagesCIR vs. Alegre Case DigestKatrine Olga Ramones-CastilloNo ratings yet

- CIR v. AlgueDocument1 pageCIR v. Alguefay garneth buscatoNo ratings yet

- G.R. No. L-19550 Case DigestDocument2 pagesG.R. No. L-19550 Case DigestNoriNo ratings yet

- Chavez vs. Presidential Commission On Good GovernmentDocument2 pagesChavez vs. Presidential Commission On Good GovernmentNoriNo ratings yet

- Province of Cotabato vs. The Govt of The RP Peace On Ancestral DomainDocument2 pagesProvince of Cotabato vs. The Govt of The RP Peace On Ancestral DomainNoriNo ratings yet

- Iglesia Ni Cristo vs. Court of AppealsDocument2 pagesIglesia Ni Cristo vs. Court of AppealsNori100% (1)

- Makati Stock ExchangeDocument2 pagesMakati Stock ExchangeNoriNo ratings yet

- "Smart" Girl Fide Rated Chess Tournament - 2019 (Only For Female)Document4 pages"Smart" Girl Fide Rated Chess Tournament - 2019 (Only For Female)Gyan SinghNo ratings yet

- In The Supreme Court of IndiaDocument47 pagesIn The Supreme Court of IndiaKavyansh ltd100% (1)

- Critical Information Summary UNLIMITED 2GB - $12 Mobile PlanDocument2 pagesCritical Information Summary UNLIMITED 2GB - $12 Mobile PlanflowerboyNo ratings yet

- Module-3 1Document8 pagesModule-3 1Ronald AlmarezNo ratings yet

- An Ordinance Enacting The Revised Barangay Omnibus Tax Code of Del MonteDocument8 pagesAn Ordinance Enacting The Revised Barangay Omnibus Tax Code of Del MonteJaja Ordinario Quiachon-Abarca100% (4)

- Orchard Bank 288451024 - AgreementNPI2701ADocument15 pagesOrchard Bank 288451024 - AgreementNPI2701AKestrel1940No ratings yet

- Hamilton Township (Atlantic County) OPRA FormDocument4 pagesHamilton Township (Atlantic County) OPRA FormThe Citizens CampaignNo ratings yet

- CMS Report 1Document18 pagesCMS Report 1RecordTrac - City of OaklandNo ratings yet

- March 25, 2022 Hypmvl: ConfirmedDocument4 pagesMarch 25, 2022 Hypmvl: ConfirmedEdgie Ace PojadasNo ratings yet

- Uttar Pradesh Expressway Toll LevyDocument11 pagesUttar Pradesh Expressway Toll LevynikhilNo ratings yet

- SPR Bulletin NO. 3-03 November 21, 2003Document6 pagesSPR Bulletin NO. 3-03 November 21, 2003loomc100% (1)

- Business PlanDocument24 pagesBusiness PlanSAJEEL ARSHAD100% (1)

- Corrigendum InputformDocument2 pagesCorrigendum InputformsdotbalagNo ratings yet

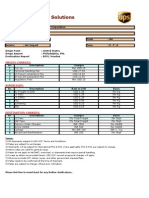

- UPS QuoteDocument1 pageUPS QuoteSwarup DoshiNo ratings yet

- Mobile Money Account Guide 1Document84 pagesMobile Money Account Guide 1Martins Othniel100% (1)

- Swiggy Order 43333379786Document2 pagesSwiggy Order 43333379786Bhargav VekariaNo ratings yet

- Applicant Details: Applicant Photo Applicationid:1920Vjv1000367159Document9 pagesApplicant Details: Applicant Photo Applicationid:1920Vjv1000367159gajananNo ratings yet

- CAA ACT 2017 EngDocument12 pagesCAA ACT 2017 Engkhorshed.eeeNo ratings yet

- ASA Admission FormDocument3 pagesASA Admission FormAaftab AhmadNo ratings yet

- 2023-11-08 Statement - USB Credit Card 2156Document6 pages2023-11-08 Statement - USB Credit Card 2156knazarenoNo ratings yet

- St. Francis de Sales Pilgrimage - Canterbury PilgrimagesDocument2 pagesSt. Francis de Sales Pilgrimage - Canterbury PilgrimagesCanterbury PilgrimagesNo ratings yet

- JPMCStatement (1) Chase Credit Caed STMNTDocument4 pagesJPMCStatement (1) Chase Credit Caed STMNTbhawanihpi100% (1)

- Jyske AftalerDocument15 pagesJyske AftalerFa JM0% (1)

- Credit Card Fees and ChargesDocument2 pagesCredit Card Fees and ChargesgwapongkabayoNo ratings yet

- RCPI vs. SecretaryDocument4 pagesRCPI vs. Secretaryasasasddd3836No ratings yet

Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896 February 17, 1988 Facts

Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896 February 17, 1988 Facts

Uploaded by

NoriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896 February 17, 1988 Facts

Commissioner of Internal Revenue Vs Algue Inc., and Court of Tax Appeals GR No. L-28896 February 17, 1988 Facts

Uploaded by

NoriCopyright:

Available Formats

Commissioner of Internal

Revenue vs Algue Inc., and Court of Tax Appeals

GR No. L-28896 February 17, 1988

Facts:

The Philippine Sugar Estate Development Company had earlier appointed Algue Inc., as

its agent, authorizing it to sell its land, factories and oil manufacturing process.As

such,the corporation worked for the formation of the Vegetable Oil Investment

Corporation, until they were able to purchased the PSEDC properties. For this sale,

Algue Inc., received as agent a commission of P126, 000.00, and it was from this

commission that the P75, 000.00 promotional fees were paid to Alberto Guevara, Jr.,

Eduardo Guevara, Isabel Guevara, Edith, O'Farell, and Pablo Sanchez.

Commissioner of Internal Revenue contends that the claimed deduction is not allowed

because it was not an ordinary reasonable or necessary business expense. The Court of

Tax Appeals had seen it differently. Agreeing with Algue Inc., it held that the said

amount had been legitimately paid by the private respondent for actual services

rendered. The payment was in the form of promotional fees.

Issue:

Whether or not the Collector of Internal Revenue correctly disallowed the P75, 000.00

deduction claimed by private respondent Algue Inc., as legitimate business expenses in

its income tax returns.

Ruling:

No, The Supreme Court agrees with the respondent court that the amount of the

promotional fees was not excessive. The P75,000.00 was 60% of the total commission.

This was a reasonable proportion, considering that it was the payees who did practically

everything, from the formation of the Vegetable Oil Investment Corporation to the

actual purchase by it of the Sugar Estate properties.

The claimed deduction by the private respondent was permitted under the Internal

Revenue Code and should therefore not have been disallowed by the petitioner.

the court agreed that the respondent promotional fee was a valid deductable. The total

commission paid by the Philippine Sugar Estate Development Co. according to the Tax

Code, Expenses In general are All the ordinary and necessary expenses paid or incurred

during the taxable year in carrying on any trade or business, including a reasonable

allowance for salaries or other compensation for personal services actually rendered.

The amount of P75,000.00 was 60% of the total commission. This was a reasonable

proportion, considering that it was the payees who did practically everything, from the

formation of the Vegetable Oil Investment Corporation to the actual purchase by it of

the Sugar Estate properties. That the private respondent has proved that the payment

of the fees was necessary and reasonable in the light of the efforts exerted by the

payees in inducing investors and prominent businessmen to venture in an experimental

enterprise and involve themselves in a new business requiring millions of pesos. This

was no mean feat and should be, as it was, sufficiently recompensed.

You might also like

- Iloilo City Tax Ordinance 2007-016Document196 pagesIloilo City Tax Ordinance 2007-016Iloilo City Council88% (8)

- Business Express Loan Application FormDocument4 pagesBusiness Express Loan Application Formgosmiley67% (3)

- Case Study On IOSDocument3 pagesCase Study On IOSmsoneword0% (1)

- Next Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsDocument8 pagesNext Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsPaul FlorinNo ratings yet

- Nestor Ching V Subic Bay Golf and Country Club G.R. 174353Document8 pagesNestor Ching V Subic Bay Golf and Country Club G.R. 174353Dino Bernard LapitanNo ratings yet

- Funa Vs MecoDocument3 pagesFuna Vs Mecovermouth6wineNo ratings yet

- REMO v. SEC OF JUSTICE, G.R. No. 192925, Dec. 9, 2016Document14 pagesREMO v. SEC OF JUSTICE, G.R. No. 192925, Dec. 9, 2016LovelyNo ratings yet

- PNB Vs AndradaDocument2 pagesPNB Vs Andradajcfish07No ratings yet

- Donnina Halley v. Printwell IncorporationDocument2 pagesDonnina Halley v. Printwell IncorporationKayee KatNo ratings yet

- National Power Corporation vs. City of CabanatuanDocument21 pagesNational Power Corporation vs. City of CabanatuanMp CasNo ratings yet

- Classification of LandsDocument3 pagesClassification of LandsKaren Maechelle EdullantesNo ratings yet

- Miciano v. BrimoDocument2 pagesMiciano v. BrimoPraisah Marjorey PicotNo ratings yet

- Cargill V IntraDocument12 pagesCargill V IntraKim Dayag100% (1)

- Bataan Shipyard Engineering Co. Inc. vs. PCGGDocument4 pagesBataan Shipyard Engineering Co. Inc. vs. PCGGBernalyn Domingo AlcanarNo ratings yet

- People v. QuashaDocument3 pagesPeople v. QuashaJeunaj LardizabalNo ratings yet

- Bernas Vs CincoDocument4 pagesBernas Vs CincoInna LadislaoNo ratings yet

- 34 Eagleridge Devt Corp V CameronDocument8 pages34 Eagleridge Devt Corp V CameronIsagani CastilloNo ratings yet

- 095-Everett vs. Asia Banking Corp 49 Phil 512Document8 pages095-Everett vs. Asia Banking Corp 49 Phil 512wewNo ratings yet

- Lao Vs CA: 119178: June 20, 1997Document16 pagesLao Vs CA: 119178: June 20, 1997Re doNo ratings yet

- Zuiden V GVTLDocument2 pagesZuiden V GVTLClaude PeñaNo ratings yet

- Ang v. AngDocument9 pagesAng v. AngAhmedLucmanSangcopanNo ratings yet

- Ungab Vs CusiDocument11 pagesUngab Vs CusiPia Christine BungubungNo ratings yet

- 176 - Salafranca v. Philamlife (Pamplona)Document1 page176 - Salafranca v. Philamlife (Pamplona)Janice KimayongNo ratings yet

- Gesolgon v. CyberOne PH., Inc.Document9 pagesGesolgon v. CyberOne PH., Inc.Liz KawiNo ratings yet

- 259 Long Vs Basa (Consing)Document1 page259 Long Vs Basa (Consing)Christine Ang CaminadeNo ratings yet

- Llorente Vs CADocument6 pagesLlorente Vs CARichelle CartinNo ratings yet

- Ang V AngDocument33 pagesAng V Angkrys_elleNo ratings yet

- FPT - Case Digest Corpo (Riano)Document30 pagesFPT - Case Digest Corpo (Riano)Pamela DeniseNo ratings yet

- Succ 1Document18 pagesSucc 1Diane JulianNo ratings yet

- Forest Hills Golf and Country Club, Inc. Vs Gardpro, Inc. (GR No. 164686, 22 October 2014)Document10 pagesForest Hills Golf and Country Club, Inc. Vs Gardpro, Inc. (GR No. 164686, 22 October 2014)Braian HitaNo ratings yet

- G.R. No. 22595Document2 pagesG.R. No. 22595strgrl100% (1)

- Conflict of Laws Appilicable Laws Laws Governing Contracts (1992)Document11 pagesConflict of Laws Appilicable Laws Laws Governing Contracts (1992)Cecille Therese PedregosaNo ratings yet

- Board of Liquidators v. Kalaw, 20 SCRA 987Document3 pagesBoard of Liquidators v. Kalaw, 20 SCRA 987Alexander Genesis DungcaNo ratings yet

- HENARES V. LTFRB G.R. No. 158290Document2 pagesHENARES V. LTFRB G.R. No. 158290Rubz JeanNo ratings yet

- Sagales vs. RustanDocument1 pageSagales vs. RustanJohn Paul SantosNo ratings yet

- Lutz v. Araneta, 98 Phil. 148 - Public PurposeDocument1 pageLutz v. Araneta, 98 Phil. 148 - Public PurposeIVYJEAN LAGURANo ratings yet

- Tan vs. Sec - DigestDocument6 pagesTan vs. Sec - DigestNympa VillanuevaNo ratings yet

- Labrel Case Digests (Set 1)Document32 pagesLabrel Case Digests (Set 1)Shauna HerreraNo ratings yet

- Fuller v. KroghDocument1 pageFuller v. KroghkitakatttNo ratings yet

- 2014 Bar ExamDocument3 pages2014 Bar ExamRvic CivrNo ratings yet

- Rule 114, 115 & 116 CasesDocument41 pagesRule 114, 115 & 116 CasesfatimasenNo ratings yet

- Vda de Torres v. EncarnacionDocument3 pagesVda de Torres v. EncarnacionCLark Barcelon100% (1)

- T2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVADocument1 pageT2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVACJVNo ratings yet

- Bibiano Reynoso IV Vs Court of AppealsDocument1 pageBibiano Reynoso IV Vs Court of AppealsAnonymous oDPxEkdNo ratings yet

- Mangila v. PangilinanDocument2 pagesMangila v. PangilinanLuna BaciNo ratings yet

- GUY v. GACOTT G.R. No. 206147, January 13, 2016Document2 pagesGUY v. GACOTT G.R. No. 206147, January 13, 2016SS100% (1)

- Mendoza v. PeopleDocument6 pagesMendoza v. PeopleDanielle AngelaNo ratings yet

- Consti - Ablaza V CirDocument3 pagesConsti - Ablaza V CirGel BarrNo ratings yet

- Marubeni Nederland B.V. v. TensuanDocument5 pagesMarubeni Nederland B.V. v. TensuanIya AnonasNo ratings yet

- Mondano v. SilvosaDocument2 pagesMondano v. SilvosaOmar AlstonNo ratings yet

- Ryuichi Yamamoto v. Nishino Leather IndustriesDocument4 pagesRyuichi Yamamoto v. Nishino Leather IndustriesbearzhugNo ratings yet

- Vicmar v. ElarcosaDocument1 pageVicmar v. ElarcosaNN DDLNo ratings yet

- 187 CIR v. Visayan Electric Co.Document1 page187 CIR v. Visayan Electric Co.Eloise Coleen Sulla PerezNo ratings yet

- REPUBLIC v. CITY OF PARAÑAQUEDocument17 pagesREPUBLIC v. CITY OF PARAÑAQUEKhate AlonzoNo ratings yet

- Funa V VillarDocument1 pageFuna V VillarAubin Arn NievaNo ratings yet

- Iglesia Evangelica V Bishop LazaroDocument10 pagesIglesia Evangelica V Bishop Lazaroarianna0624No ratings yet

- V. Loyola Grand VillasDocument2 pagesV. Loyola Grand VillasDiane UyNo ratings yet

- 17 - Pasei v. TorresDocument1 page17 - Pasei v. TorresCheyz ErNo ratings yet

- Consti II - Case DigestsDocument59 pagesConsti II - Case DigestsJohn G. FloresNo ratings yet

- People v. Tulagan PDFDocument114 pagesPeople v. Tulagan PDFSamanthaNo ratings yet

- Goh vs. Bayron (G.R. No. 212584)Document40 pagesGoh vs. Bayron (G.R. No. 212584)Gretel MañalacNo ratings yet

- A.C. No. 5281 - Manuel L. Lee v. Atty. Regino B. TambagoDocument7 pagesA.C. No. 5281 - Manuel L. Lee v. Atty. Regino B. TambagoKaren Faye TorrecampoNo ratings yet

- CIR vs. Alegre Case DigestDocument2 pagesCIR vs. Alegre Case DigestKatrine Olga Ramones-CastilloNo ratings yet

- CIR v. AlgueDocument1 pageCIR v. Alguefay garneth buscatoNo ratings yet

- G.R. No. L-19550 Case DigestDocument2 pagesG.R. No. L-19550 Case DigestNoriNo ratings yet

- Chavez vs. Presidential Commission On Good GovernmentDocument2 pagesChavez vs. Presidential Commission On Good GovernmentNoriNo ratings yet

- Province of Cotabato vs. The Govt of The RP Peace On Ancestral DomainDocument2 pagesProvince of Cotabato vs. The Govt of The RP Peace On Ancestral DomainNoriNo ratings yet

- Iglesia Ni Cristo vs. Court of AppealsDocument2 pagesIglesia Ni Cristo vs. Court of AppealsNori100% (1)

- Makati Stock ExchangeDocument2 pagesMakati Stock ExchangeNoriNo ratings yet

- "Smart" Girl Fide Rated Chess Tournament - 2019 (Only For Female)Document4 pages"Smart" Girl Fide Rated Chess Tournament - 2019 (Only For Female)Gyan SinghNo ratings yet

- In The Supreme Court of IndiaDocument47 pagesIn The Supreme Court of IndiaKavyansh ltd100% (1)

- Critical Information Summary UNLIMITED 2GB - $12 Mobile PlanDocument2 pagesCritical Information Summary UNLIMITED 2GB - $12 Mobile PlanflowerboyNo ratings yet

- Module-3 1Document8 pagesModule-3 1Ronald AlmarezNo ratings yet

- An Ordinance Enacting The Revised Barangay Omnibus Tax Code of Del MonteDocument8 pagesAn Ordinance Enacting The Revised Barangay Omnibus Tax Code of Del MonteJaja Ordinario Quiachon-Abarca100% (4)

- Orchard Bank 288451024 - AgreementNPI2701ADocument15 pagesOrchard Bank 288451024 - AgreementNPI2701AKestrel1940No ratings yet

- Hamilton Township (Atlantic County) OPRA FormDocument4 pagesHamilton Township (Atlantic County) OPRA FormThe Citizens CampaignNo ratings yet

- CMS Report 1Document18 pagesCMS Report 1RecordTrac - City of OaklandNo ratings yet

- March 25, 2022 Hypmvl: ConfirmedDocument4 pagesMarch 25, 2022 Hypmvl: ConfirmedEdgie Ace PojadasNo ratings yet

- Uttar Pradesh Expressway Toll LevyDocument11 pagesUttar Pradesh Expressway Toll LevynikhilNo ratings yet

- SPR Bulletin NO. 3-03 November 21, 2003Document6 pagesSPR Bulletin NO. 3-03 November 21, 2003loomc100% (1)

- Business PlanDocument24 pagesBusiness PlanSAJEEL ARSHAD100% (1)

- Corrigendum InputformDocument2 pagesCorrigendum InputformsdotbalagNo ratings yet

- UPS QuoteDocument1 pageUPS QuoteSwarup DoshiNo ratings yet

- Mobile Money Account Guide 1Document84 pagesMobile Money Account Guide 1Martins Othniel100% (1)

- Swiggy Order 43333379786Document2 pagesSwiggy Order 43333379786Bhargav VekariaNo ratings yet

- Applicant Details: Applicant Photo Applicationid:1920Vjv1000367159Document9 pagesApplicant Details: Applicant Photo Applicationid:1920Vjv1000367159gajananNo ratings yet

- CAA ACT 2017 EngDocument12 pagesCAA ACT 2017 Engkhorshed.eeeNo ratings yet

- ASA Admission FormDocument3 pagesASA Admission FormAaftab AhmadNo ratings yet

- 2023-11-08 Statement - USB Credit Card 2156Document6 pages2023-11-08 Statement - USB Credit Card 2156knazarenoNo ratings yet

- St. Francis de Sales Pilgrimage - Canterbury PilgrimagesDocument2 pagesSt. Francis de Sales Pilgrimage - Canterbury PilgrimagesCanterbury PilgrimagesNo ratings yet

- JPMCStatement (1) Chase Credit Caed STMNTDocument4 pagesJPMCStatement (1) Chase Credit Caed STMNTbhawanihpi100% (1)

- Jyske AftalerDocument15 pagesJyske AftalerFa JM0% (1)

- Credit Card Fees and ChargesDocument2 pagesCredit Card Fees and ChargesgwapongkabayoNo ratings yet

- RCPI vs. SecretaryDocument4 pagesRCPI vs. Secretaryasasasddd3836No ratings yet