Professional Documents

Culture Documents

MGT101 Module 16 17 18

MGT101 Module 16 17 18

Uploaded by

Shahbaz AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MGT101 Module 16 17 18

MGT101 Module 16 17 18

Uploaded by

Shahbaz AliCopyright:

Available Formats

MGT101 module 16 17 18

Final preparation

Important topics:

Sole Proprietorship:

In proprietorship the owner is one and he alone get full profit and loss.

Partnership:

In partnership the profit and loss is distributed among the partners.\

Basis for distribution:

1. Interest on Capital

2. Partner’s Salary

3. Profit sharing ratio

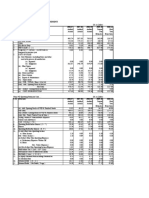

Reporting difference between sole proprietorship and partnership entities

Sole proprietorship and partnership both entities prepare Income Statement (Profit and loss account)

and Statement of Financial Position (Balance Sheet) in a same manner. The only difference that is

identified while preparing reports of both types of entities is distribution of profits among the owners.

Profit distribution statement:

For sole-proprietorship; the net profit/loss amount is directly transferred to the owner’s capital

account

For partnership firms; a statement is prepared in addition to the income statement and Statement of

Financial Position (balance sheet). It shows how profit is distributed among the partners, the outcome of

which is the distributed profit that is then posted to the partners’ current accounts.

Changes in constitution of partnership firm:

Admission of a new partner

• Retirement of an existing partner

• Death of a partner

Admission of a new partner:

A new partner may be admitted for different reasons such as personal influence, need of more capital,

or special skills.

Prepared by shoaib akram contact 03024847687

At the time of admission of a new partner, certain adjustments are necessary, like:

• Calculation of new profit sharing ratio.

• Calculation and accounting treatment of goodwill

• Revaluation of net assets.

Retirement of a Partner:

When a partner intends to retire; his/her capital account balance after adjustments for share in goodwill

and revaluation gains or losses is recognized as loan (liability) to the entity.

Death of a Partner:

At the time of death of a partner, his/her share in current years’ profits is estimated based on previous

year’s net profit or average profit of past few years’ profits (it would be mentioned in partnership

agreement).

Goodwill Calculation methods:

1. Average profit method

2. Super profit method

3. Market capitalization method

Average profit method:

Under this method, at first, average profit is calculated on the basis of the past few years’ profits. After

calculating average profit, it is multiplied by a number (times) 3, or 4, or 5, whatever, as agreed.

Super Profit Method:

Super profit is the excess of actual profit (average profit) over the normal profit of an entity. A common

method of valuation of goodwill is the super profit method.

Market Capitalization Method:

Under this method value of the firm is first determined based on market capitalization rate using the

following formula:

Market rate of return / Average profit of the firm x 100

The above formula will give an estimate of firm’s value in the market.

Fixed Tangible Assets:

These are the property, plant and equipment that are held by the entity a) for production or selling of

goods or services, r. Examples include: land & Building, Plant & Machinery, Furniture & Fixtures, Motor

Vehicles, office equipment etc.

Prepared by shoaib akram contact 03024847687

Fixed Intangible Assets:

These are the identifiable, non-monetary asset in control of the entity that have no physical existence

and are expected to be useful for the entity for more than one accounting year. Examples include:

Trademark.

Current Assets:

These are the assets recoverable and tradable within the normal operating cycle of an entity that is 12

months after the reporting date in normal circumstances. Cash and cash equivalents are also current

assets.

Current Liabilities:

These are the present obligations of the entity that are payable within the normal operating cycle of an

entity that is 12 months after the reporting date in normal circumstances. These also include bank

overdraft and short-term debts.

Non-Current Liabilities:

These are the present obligations of the entity that are payable after one or more than one accounting

year. These include; lease liabilities, bank loans, issuance of loan certificates and bonds.

Purpose of preparing Statement of Cash Flows:

Statement of Cash Flows is an analytical statement that is prepared to analyze all cash receipts and cash

payments during an accounting period.

Cash Receipts = Cash In-flows

Cash Payments = Cash Out-flows

Prepared by shoaib akram contact 03024847687

You might also like

- Bulacan State University: College of Business AdministrationDocument13 pagesBulacan State University: College of Business AdministrationLiana100% (1)

- Retained Earnings Sample QuizDocument9 pagesRetained Earnings Sample QuizGali jizNo ratings yet

- Profit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership FirmDocument10 pagesProfit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership Firmd-fbuser-65596417No ratings yet

- 33 - Financial Statements: 33.1 Statement of Profit or LossDocument14 pages33 - Financial Statements: 33.1 Statement of Profit or LossRokaia MortadaNo ratings yet

- Twenty For Non Financial Activity) : Final Accounts of Partnership Firms MeaningDocument14 pagesTwenty For Non Financial Activity) : Final Accounts of Partnership Firms MeaningJeetendra KhilnaniNo ratings yet

- Business Mangement (3.4 Final Accounts)Document35 pagesBusiness Mangement (3.4 Final Accounts)Yatharth SejpalNo ratings yet

- Business Mangement (3.4 Final Accounts) PDFDocument35 pagesBusiness Mangement (3.4 Final Accounts) PDFYatharth SejpalNo ratings yet

- Partnership Operations ReviewDocument37 pagesPartnership Operations ReviewShin Shan JeonNo ratings yet

- Fabm ReviewerDocument7 pagesFabm Reviewersab lightningNo ratings yet

- Concept of Retirement of A PartnerDocument3 pagesConcept of Retirement of A PartnerManjeet KaurNo ratings yet

- Retirement of A PartnerDocument6 pagesRetirement of A Partnershrey narulaNo ratings yet

- Financial Accounting Level Ii NotesDocument22 pagesFinancial Accounting Level Ii NotesYash WanthNo ratings yet

- Profit and Loss AccountDocument5 pagesProfit and Loss AccountLanston PintoNo ratings yet

- 3b - Chapter 3 Financial ManagementDocument51 pages3b - Chapter 3 Financial ManagementIni Ichiii100% (1)

- Full Download Principles of Corporate Finance Canadian 2nd Edition Gitman Solutions ManualDocument36 pagesFull Download Principles of Corporate Finance Canadian 2nd Edition Gitman Solutions Manualterleckisunday1514fx100% (32)

- Advocates and Partnership NotesDocument5 pagesAdvocates and Partnership Notespauline1988No ratings yet

- Revision Notes For Cbse Class 12 Accountancy Chapter 1Document6 pagesRevision Notes For Cbse Class 12 Accountancy Chapter 1elonreevemusk2kNo ratings yet

- Lecture 6 Bus. MNGMNTDocument69 pagesLecture 6 Bus. MNGMNTAizhan BaimukhamedovaNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingHaseebNo ratings yet

- Ugbs 002 - 1Document135 pagesUgbs 002 - 1CourageNo ratings yet

- GoodwillDocument14 pagesGoodwillsandeep44% (9)

- Items That Do Not Appear in Financial StatementDocument13 pagesItems That Do Not Appear in Financial StatementMahendra KureelNo ratings yet

- The ProDocument39 pagesThe Profisho abukeNo ratings yet

- Accounting For Partnership - Additional Notes On FormationDocument26 pagesAccounting For Partnership - Additional Notes On Formation海豚海豚No ratings yet

- Glossary of Accounting TermsDocument16 pagesGlossary of Accounting TermsSamarpan RoyNo ratings yet

- Accounting of Life Insurance CompaniesDocument4 pagesAccounting of Life Insurance CompaniesAnish ThomasNo ratings yet

- Assignment 1Document4 pagesAssignment 1Hiwot kassaNo ratings yet

- Financial Analysis of PNB Met LifeDocument92 pagesFinancial Analysis of PNB Met LifeKomal chawlaNo ratings yet

- What Are The Parties Interested in Accounting?Document7 pagesWhat Are The Parties Interested in Accounting?Mohammad Zahirul IslamNo ratings yet

- 1.1 Balance Sheet: Balance Sheet Income Statement Cash Flow Statement Statement of Stockholders' EquityDocument5 pages1.1 Balance Sheet: Balance Sheet Income Statement Cash Flow Statement Statement of Stockholders' EquityKamran ShahNo ratings yet

- Chap.2 Financial Statements: Accounting Identity: Assets Liabilities + Owners' EquityDocument4 pagesChap.2 Financial Statements: Accounting Identity: Assets Liabilities + Owners' EquityGhassan EidNo ratings yet

- Fabm Q2 AnswersDocument15 pagesFabm Q2 AnswersminiriftyNo ratings yet

- Chapter 2 Financing EnterpriseDocument9 pagesChapter 2 Financing EnterpriseMaheen AtharNo ratings yet

- Principles of Corporate Finance Canadian 2nd Edition Gitman Solutions ManualDocument26 pagesPrinciples of Corporate Finance Canadian 2nd Edition Gitman Solutions ManualEugeneMurraykspo100% (58)

- Financial Statements, Cash Flows, and Taxes: Learning ObjectivesDocument54 pagesFinancial Statements, Cash Flows, and Taxes: Learning ObjectivesShoniqua Johnson100% (1)

- Finman CHPT 1Document12 pagesFinman CHPT 1Rosda DhangNo ratings yet

- Financial StatementDocument16 pagesFinancial StatementCuracho100% (1)

- Accounting BasicsDocument13 pagesAccounting BasicskameshpatilNo ratings yet

- Partnership AccountsDocument4 pagesPartnership AccountsManoj Kumar GeldaNo ratings yet

- Why We Need of Accounting StandardDocument5 pagesWhy We Need of Accounting StandardrashidgNo ratings yet

- Social AccountingDocument28 pagesSocial Accountingfeiyuqing_276100% (1)

- Valuation of GoodwillDocument17 pagesValuation of GoodwillGeetika BhattiNo ratings yet

- Company Situation AnalysisDocument3 pagesCompany Situation AnalysisZukhruf 555No ratings yet

- Financial StatementsDocument10 pagesFinancial StatementsFraulien Legacy MaidapNo ratings yet

- Acctg 1Document39 pagesAcctg 1Clarize R. MabiogNo ratings yet

- CFA Level 1 (Book-B)Document170 pagesCFA Level 1 (Book-B)butabutt100% (1)

- 1st Assignment Badar FinancialDocument6 pages1st Assignment Badar FinancialMuhammad MateenNo ratings yet

- Accounting of Life Insurance Companies: Prakash VDocument4 pagesAccounting of Life Insurance Companies: Prakash VSaurav RaiNo ratings yet

- Fca PBLDocument21 pagesFca PBLttanishataNo ratings yet

- ACC202 PCOQ 2 RealDocument8 pagesACC202 PCOQ 2 RealGish KK.GNo ratings yet

- Ch03 - Financial Statements and Ratio AnalysisDocument26 pagesCh03 - Financial Statements and Ratio Analysisaccswc21No ratings yet

- 2مصطلحات تجارية محاسبة 1Document14 pages2مصطلحات تجارية محاسبة 1Mohamedmostafa MostafaNo ratings yet

- 2مصطلحات تجارية محاسبة 1Document14 pages2مصطلحات تجارية محاسبة 1Mohamedmostafa MostafaNo ratings yet

- Financial StatementsDocument10 pagesFinancial StatementsRachel OtazaNo ratings yet

- Understanding Financial Statement FM 1Document5 pagesUnderstanding Financial Statement FM 1ashleyNo ratings yet

- Hsslive-CHAPTER 3.2 Admission of A Partner - NotesDocument8 pagesHsslive-CHAPTER 3.2 Admission of A Partner - NotesPES FOOTBALLNo ratings yet

- Types of Financial StatementsDocument18 pagesTypes of Financial Statementsxyz mah100% (1)

- Accounting Basics Cheat SheetDocument5 pagesAccounting Basics Cheat SheetxzxhiujinhNo ratings yet

- Appropriated P & L DetailsDocument10 pagesAppropriated P & L DetailsM Usman AslamNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- MCM301 Quiz-1 FileDocument53 pagesMCM301 Quiz-1 FileShahbaz AliNo ratings yet

- CS504 Assignment 2 Solution Fall 2021Document5 pagesCS504 Assignment 2 Solution Fall 2021Shahbaz AliNo ratings yet

- Cs101 Mid-Term Solved QuizDocument46 pagesCs101 Mid-Term Solved QuizShahbaz Ali100% (1)

- Quiz of mgt501 Quiz 4 04-07-2012: Log Employee Handbook Personal Diary ChartsDocument10 pagesQuiz of mgt501 Quiz 4 04-07-2012: Log Employee Handbook Personal Diary ChartsShahbaz AliNo ratings yet

- Sohaib AslamDocument1 pageSohaib AslamShahbaz AliNo ratings yet

- After A Year of Transformation, Executives Are All-In On SocialDocument49 pagesAfter A Year of Transformation, Executives Are All-In On SocialShahbaz AliNo ratings yet

- Epistemology - An Islamic PerspectiveDocument10 pagesEpistemology - An Islamic PerspectiveShahbaz AliNo ratings yet

- MTH301 Assignment 2 Solution by VU AnswerDocument7 pagesMTH301 Assignment 2 Solution by VU AnswerShahbaz Ali0% (1)

- MGT101 Solved MCQsDocument11 pagesMGT101 Solved MCQsShahbaz AliNo ratings yet

- Lesson 4: Family Budget: Its Advantages ADocument4 pagesLesson 4: Family Budget: Its Advantages AAlex OlescoNo ratings yet

- Mortgages NotesDocument42 pagesMortgages NotesBaguma Patrick RobertNo ratings yet

- Problems For Profit Planning Pt. 3Document7 pagesProblems For Profit Planning Pt. 3krisha milloNo ratings yet

- Happy Tails Inc Has A June 1 Accounts Payable BalanceDocument1 pageHappy Tails Inc Has A June 1 Accounts Payable BalanceBube KachevskaNo ratings yet

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- PC 22 Point Wise - MSO (Audit) - 1Document19 pagesPC 22 Point Wise - MSO (Audit) - 1manoj sainiNo ratings yet

- Financial Markets and Institutions Test Bank (051 060)Document10 pagesFinancial Markets and Institutions Test Bank (051 060)Thị Ba PhạmNo ratings yet

- Deed of Undertaking: Customer/AfflantDocument3 pagesDeed of Undertaking: Customer/AfflantNatasha BAl-utNo ratings yet

- Assessment of Working Capital Requirements Form # II: OperatingDocument10 pagesAssessment of Working Capital Requirements Form # II: OperatingSuzanne Davis100% (2)

- Episode 2 ReflectionDocument1 pageEpisode 2 ReflectionLev Clarence Mag-isaNo ratings yet

- (Title Same As in Form 2) : Form 55 (Rules 73-78) Proof of Debt/General FormDocument2 pages(Title Same As in Form 2) : Form 55 (Rules 73-78) Proof of Debt/General FormNurizniQadisaHarisNo ratings yet

- Discounted Cash Flows and ValuationDocument31 pagesDiscounted Cash Flows and ValuationkamranNo ratings yet

- BAC 223 Topic TwoDocument39 pagesBAC 223 Topic TwoGABRIEL KAMAU KUNG'UNo ratings yet

- VILLALVA V RCBC BankDocument1 pageVILLALVA V RCBC BankNino Kim AyubanNo ratings yet

- Value Addition Notes - Indian EconomyDocument6 pagesValue Addition Notes - Indian Economynikitash1222No ratings yet

- Resolvability Living Will XYZ LimitedDocument28 pagesResolvability Living Will XYZ LimitedRishikesh MishraNo ratings yet

- Answer Key Robert CabatcanDocument14 pagesAnswer Key Robert CabatcanJowen PergisNo ratings yet

- 3 Subject Content: 1 The Fundamentals of Accounting 1.1 The Purpose of AccountingDocument7 pages3 Subject Content: 1 The Fundamentals of Accounting 1.1 The Purpose of AccountingLeow Zi LiangNo ratings yet

- Corporation Law ReviewerDocument3 pagesCorporation Law ReviewerJada WilliamsNo ratings yet

- 12 2006 Accountancy 4Document5 pages12 2006 Accountancy 4Akash TamuliNo ratings yet

- Loan FormDocument1 pageLoan FormEduardo CainaNo ratings yet

- Balance Sheet: Pt. Cahaya - AndhikaDocument1 pageBalance Sheet: Pt. Cahaya - AndhikaAndhika Dwi PutraNo ratings yet

- P1 2ND Preboard PDFDocument9 pagesP1 2ND Preboard PDFmaria evangelistaNo ratings yet

- Accounting Dr. Ashraf Lecture 03 PDFDocument20 pagesAccounting Dr. Ashraf Lecture 03 PDFMahmoud AbdullahNo ratings yet

- Re Zirceram LTD (In Liquidation), J Paterson Brodie & Son (A Firm) and Another V Zirceram LTD (In Liquidation) (2000) 1 BCLC 751Document10 pagesRe Zirceram LTD (In Liquidation), J Paterson Brodie & Son (A Firm) and Another V Zirceram LTD (In Liquidation) (2000) 1 BCLC 751Dharshiney visuvasevenNo ratings yet

- Biography of Daniel DefoeDocument2 pagesBiography of Daniel DefoeChrisNo ratings yet

- Brahma Chaithanya AgarbattisDocument6 pagesBrahma Chaithanya AgarbattisBinduNo ratings yet

- Topic 1: Financial Manager (3 Fundamental Questions)Document8 pagesTopic 1: Financial Manager (3 Fundamental Questions)KHAkadsbdhsg100% (1)

- Chapter - 1 Introduction To Commercial BankingDocument26 pagesChapter - 1 Introduction To Commercial BankingMd Mohsin AliNo ratings yet