Professional Documents

Culture Documents

Transaction Statement1627022355

Transaction Statement1627022355

Uploaded by

RamakantaSahooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transaction Statement1627022355

Transaction Statement1627022355

Uploaded by

RamakantaSahooCopyright:

Available Formats

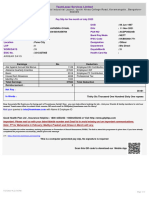

CENTRAL RECORDKEEPING AGENCY

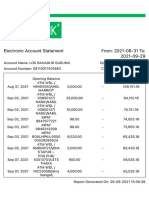

Transaction Statement-ATAL PENSION YOJANA (APY) for the period of:01-Apr-2021 to 23-Jul-2021

Subscriber Details

PRAN : 500015625245 Statement Date : Jul 23, 2021 12:09 PM

Name : SHRI RAMAKANTA SAHOO PRAN Generation

: 31-Jan-2017

Date

: K 327SEWA NAGARKOTLA MUB,NEW DELHI,

Date Of Birth : 02-Jun-1987

NEW DELHI

DELHI110003 Saving Bank A/C No. : 8462101002802

INDIA

APY-SP Bank Reg. APY-SP Bank Branch

IRA Status : IRA compliant : 7001750 : NPS025890E

no. Reg. No.

Mobile Number : 9716266450 APY-SP Bank Name : CANARA BANK APY-SP Bank Branch : DELHI SRI AUROBINDHO

Name COLLEGE BR -Canara Bank

Email ID :R.SAHOO335244@GMAIL.COM Pension Amount

: 5000

Selected

Periodicity of

: Monthly

Contribution

Spouse Name

: KABITA SAHOO

AADHAAR :

Nominee Name KABITA SAHOO Percentage 100%

The total contribution to your pension account till July 23,2021 was Rs.27483.00

The details of your Transaction are as under

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Govt. Co-

Date Particulars Uploaded By Subscriber

Contribution/Overdue Total

Contribution

Charges (Rs)

(Rs)

(Rs)

01-Apr-2021 Opening balance 25259.00

02-Jul-2021 By APY Contribution for DECEMBER 2020 CANARA BANK (7001750), 529.00 36.00 565.00

02-Jul-2021 By APY Contribution for JANUARY 2021 CANARA BANK (7001750), 529.00 30.00 559.00

02-Jul-2021 By APY Contribution for FEBRUARY 2021 CANARA BANK (7001750), 529.00 24.00 553.00

02-Jul-2021 By APY Contribution for MARCH 2021 CANARA BANK (7001750), 529.00 18.00 547.00

23-Jul-2021 Closing Balance 27,483.00

Billing Summary

Perticulars Amount

Summary of Billing during the statement period (12.14)

Government Co-contribution Details

No records found for the selected period

Notes for Transaction Statement::

1. The section 'Contribution Details' gives the details of the contributions processed in subscriber's account during the period.

The Central Government would co-contribute 50% of the total contribution or Rs.1000 per annum, whichever is lower, to each eligible subscriber for

a period of 5 years, i.e., from Financial Year 2015-16 to 2019-20, who joins APY before March 31, 2016 and who are not members of any statutory

2.

social security scheme & who are not income tax payers. This Government co-contribution is payable into subscriber's savings bank account half

yearly basis in a Financial Year once subscriber has made the entire contribution for six months.

3. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your APY bank

4. branch. In case there is no/less/excess contribution for any month or no clarity in the narration, please contact your APY Bank Branch. In case of any

discrepancy, you must contact your APY bank branch immediately.

Contribution amount is invested as per the guidelines of Government of India (upto 85% of the money will be invested in debt and government

5.

securities and upto 15% will be invested in equity).

Legends

Term Description

Under APY, the individual subscribers shall have an option to make the contribution on a monthly, quarterly, half yearly basis. Banks are required to collect additional amount for delayed

payments. The overdue interest for delayed contributions would be as shown below: Overdue interest for delayed contribution:Rs. 1 per month for contribution for every Rs. 100, or part

Overdue interest

thereof, for each delayed monthly payment. Overdue interest for delayed contribution for quarterly / half yearly mode of contribution shall be recovered accordingly. The overdue interest

amount collected will remain as part of the pension corpus of the subscriber.

You might also like

- April Fools IRS Audit Letter.Document3 pagesApril Fools IRS Audit Letter.moo the cowNo ratings yet

- Receipt From STC Pay: Transaction ID: 97247933 Amount 316647.02 INR MTCN 8460876949Document1 pageReceipt From STC Pay: Transaction ID: 97247933 Amount 316647.02 INR MTCN 8460876949M.FAIZAN ARSHADNo ratings yet

- Statement of AccountDocument2 pagesStatement of AccountSoumya Ranjan Mohanty Pupun100% (1)

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- Transaction Statement1656568636Document2 pagesTransaction Statement1656568636Gulzar Ali QadriNo ratings yet

- Transaction Statement1676126669Document1 pageTransaction Statement1676126669Vasanth EllendulaNo ratings yet

- Transaction Statement1676376886Document2 pagesTransaction Statement1676376886mukeshpradhan675No ratings yet

- Transaction Statement1563132579Document1 pageTransaction Statement1563132579Vincent VNo ratings yet

- Transaction Statement1673011931Document1 pageTransaction Statement1673011931SAMIR KUMARNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- Welcome To Central Record Keeping Agency PDFDocument2 pagesWelcome To Central Record Keeping Agency PDFparthi janaNo ratings yet

- Transaction Statement1698469666Document2 pagesTransaction Statement1698469666rk370666No ratings yet

- Wa0007Document2 pagesWa0007sandhya.iyyanar1992No ratings yet

- Welcome To Central Record Keeping Agency 22-23Document2 pagesWelcome To Central Record Keeping Agency 22-23tsvvpkumarNo ratings yet

- Welcome To Central Record Keeping Agency - PRDocument2 pagesWelcome To Central Record Keeping Agency - PRAbhishek SenguptaNo ratings yet

- Transaction Statement1703726923Document2 pagesTransaction Statement1703726923dipuhansda6300No ratings yet

- Transaction Statement1700677173Document2 pagesTransaction Statement1700677173Madhav LungareNo ratings yet

- Transaction Statement1705397004Document2 pagesTransaction Statement1705397004sureshpatil25No ratings yet

- Transaction Statement1705415418Document1 pageTransaction Statement1705415418bhavanakatakam0No ratings yet

- Account Statement 2019-2020Document2 pagesAccount Statement 2019-2020suhasNo ratings yet

- Welcome To Central Record Keeping AgencyDocument2 pagesWelcome To Central Record Keeping AgencyAbhishek SenguptaNo ratings yet

- Welcome To Central Record Keeping Agency 2023Document2 pagesWelcome To Central Record Keeping Agency 2023pratik patilNo ratings yet

- Welcome To Central Record Keeping Agency 2019Document2 pagesWelcome To Central Record Keeping Agency 2019pratik patilNo ratings yet

- Vijay Yogi SipDocument1 pageVijay Yogi SipAmit YadavNo ratings yet

- PayrollDocument185 pagesPayrollCarl VelascoNo ratings yet

- FORM47Document2 pagesFORM47Kotyada Srinu RaoNo ratings yet

- PaySlip July 2023Document1 pagePaySlip July 2023rushikeshovhal9697No ratings yet

- Member DetailsDocument2 pagesMember DetailsSmith LiriopeNo ratings yet

- Central Recordkeeping AgencyDocument11 pagesCentral Recordkeeping AgencyRudra GourNo ratings yet

- EngineeringDocument25 pagesEngineeringCarl VelascoNo ratings yet

- Su Raj Balasah Eb Ko Kare: Event BoardDocument3 pagesSu Raj Balasah Eb Ko Kare: Event Boardsuraj kokareNo ratings yet

- Jajulabanda FTODocument1 pageJajulabanda FTOb9042192No ratings yet

- Thabiso Bavuma Payslip Feb 2022Document1 pageThabiso Bavuma Payslip Feb 2022tbavuma36No ratings yet

- CDR For JHS SHSDocument3 pagesCDR For JHS SHSBulelat Orozco SagunNo ratings yet

- AxisDocument2 pagesAxisMukeshChoudharyNo ratings yet

- 555Document2 pages555HANGUKKWAN SEOULBULGOGINo ratings yet

- MTNL June 2021 BillDocument1 pageMTNL June 2021 BillMindplys FundaNo ratings yet

- Nagsantaan RCBDocument4 pagesNagsantaan RCBppskcabugaoisurNo ratings yet

- Funds Advance Details: (RSVPTPT) Logout Change PasswordDocument1 pageFunds Advance Details: (RSVPTPT) Logout Change PasswordusraoscribdNo ratings yet

- + Zero Fee: RewardsDocument2 pages+ Zero Fee: RewardsSuraj personalNo ratings yet

- Acctstmt LDocument3 pagesAcctstmt LIshwaryaNo ratings yet

- Sbi DocumentDocument1 pageSbi DocumentFaizan ShabirNo ratings yet

- Candidate'S Personal Details: Notification Details (Direct Recruitment)Document1 pageCandidate'S Personal Details: Notification Details (Direct Recruitment)Nirmala DhakalNo ratings yet

- Client Master List: National Securities Depository LimitedDocument2 pagesClient Master List: National Securities Depository Limitedmrcopy xeroxNo ratings yet

- Wa0008Document1 pageWa000801071993navibondNo ratings yet

- SalarySlipwithTaxDetails JulyDocument2 pagesSalarySlipwithTaxDetails JulyParveen SainiNo ratings yet

- JajulabandaDocument1 pageJajulabandab9042192No ratings yet

- 54GDL 2413177 Payslip 07 2022Document1 page54GDL 2413177 Payslip 07 2022samdaniNo ratings yet

- Salary Slip JulDocument1 pageSalary Slip Juldefinetrading2022.coNo ratings yet

- Bp-205-2024-Penro MPDocument2 pagesBp-205-2024-Penro MPzelleL21No ratings yet

- Statement of Account: L103G SBI Blue Chip Fund - Regular Plan - Growth NAV As On 21/08/2023: 70.2124Document3 pagesStatement of Account: L103G SBI Blue Chip Fund - Regular Plan - Growth NAV As On 21/08/2023: 70.2124pratik patilNo ratings yet

- SalarySlipwithTaxDetails JUNEDocument2 pagesSalarySlipwithTaxDetails JUNEParveen SainiNo ratings yet

- A PDFDocument58 pagesA PDFAkhilNo ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- Awayon Es DPDS Template Q4 Oct 2023Document21 pagesAwayon Es DPDS Template Q4 Oct 2023Wynoaj LucaNo ratings yet

- PaySlip - June 2023-1Document1 pagePaySlip - June 2023-1Ms khan KirdoliNo ratings yet

- Bill of Supply (March)Document2 pagesBill of Supply (March)Deepika PundirNo ratings yet

- Pradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Document2 pagesPradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Honey Ali33% (3)

- Form 47Document2 pagesForm 47Madhan MohanNo ratings yet

- Form Claim VoucherDocument1 pageForm Claim Voucherwong warasNo ratings yet

- Print Muster Roll S Badjena 02Document1 pagePrint Muster Roll S Badjena 02AYUSHNo ratings yet

- Working Together for Development Results: Lessons from ADB and Civil Society Organization Engagement in South AsiaFrom EverandWorking Together for Development Results: Lessons from ADB and Civil Society Organization Engagement in South AsiaNo ratings yet

- Cell and Molecular BiologyDocument1 pageCell and Molecular BiologyRamakantaSahooNo ratings yet

- Lesson 9Document6 pagesLesson 9RamakantaSahooNo ratings yet

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- Folk Tales - The Wise Minister.Document1 pageFolk Tales - The Wise Minister.RamakantaSahoo100% (1)

- Class-6 History - Lesson-3 in The Earliest Cities. .: Kalibanga (Present Rajasthan)Document5 pagesClass-6 History - Lesson-3 in The Earliest Cities. .: Kalibanga (Present Rajasthan)RamakantaSahooNo ratings yet

- Geography. Class-6 Lesson-3 Topic-Motions of The Earth. Homework-1Document3 pagesGeography. Class-6 Lesson-3 Topic-Motions of The Earth. Homework-1RamakantaSahooNo ratings yet

- "Reading Week": (Ranjana Dean) HeadmistressDocument2 pages"Reading Week": (Ranjana Dean) HeadmistressRamakantaSahooNo ratings yet

- Civics Class-6 L-1Document3 pagesCivics Class-6 L-1RamakantaSahooNo ratings yet

- Lesson 8 - Day 6Document1 pageLesson 8 - Day 6RamakantaSahooNo ratings yet

- DOA SBLC FreshCut 55% - PHendraDocument13 pagesDOA SBLC FreshCut 55% - PHendraSultan Cikupa100% (2)

- ACCA CAT Paper T9 Preparing Taxation Computations Solved Past PapersDocument190 pagesACCA CAT Paper T9 Preparing Taxation Computations Solved Past PapersSaad Salman100% (1)

- Municipal Corporation of Delhi: User Manual For Property Tax ApplicationDocument13 pagesMunicipal Corporation of Delhi: User Manual For Property Tax ApplicationanuragNo ratings yet

- Inbutax Fundamentals of Income TaxationDocument21 pagesInbutax Fundamentals of Income TaxationAsh AdoNo ratings yet

- PST 308 VehiclesDocument20 pagesPST 308 VehiclesKNo ratings yet

- Case Study - Accounts Receivable (FI - AR)Document56 pagesCase Study - Accounts Receivable (FI - AR)Virgo CruzNo ratings yet

- BIR RulingsDocument4 pagesBIR RulingsAndrea RioNo ratings yet

- Etutorial - TDS On PropertyDocument20 pagesEtutorial - TDS On PropertyarunkumarsundarNo ratings yet

- SSPUSADVDocument1 pageSSPUSADVgunashekarkalluriNo ratings yet

- Tax Invoice For: Your Telstra BillDocument5 pagesTax Invoice For: Your Telstra BillSarina HallamNo ratings yet

- 19XFC1F3XGE005782Document1 page19XFC1F3XGE005782Moisés BoquinNo ratings yet

- Tax Breaks To EliminateDocument4 pagesTax Breaks To Eliminatedacoda204No ratings yet

- View Duplicate Invoice - AppleDocument3 pagesView Duplicate Invoice - AppleEduardo Gamez0% (1)

- Income Statement: General Selling and Administration ExpensesDocument8 pagesIncome Statement: General Selling and Administration ExpensesShehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Flipkart Labels 19 Jun 2019-08-09Document10 pagesFlipkart Labels 19 Jun 2019-08-09Shakti MalikNo ratings yet

- Account StatementDocument2 pagesAccount StatementGaurav MishraNo ratings yet

- Individual Tax ReturnDocument6 pagesIndividual Tax Returnaklank_218105No ratings yet

- National Marine Dredging Company Employee Pay Slip For The Month ofDocument1 pageNational Marine Dredging Company Employee Pay Slip For The Month ofmurali.5482No ratings yet

- SAMPLE Form 941 2018 Q3 660873668Document2 pagesSAMPLE Form 941 2018 Q3 660873668Waseem TariqNo ratings yet

- Paleco - BaseportDocument20 pagesPaleco - BaseportAllan P. AborotNo ratings yet

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNo ratings yet

- Tax On PartnershipDocument3 pagesTax On PartnershipPrankyJellyNo ratings yet

- Invoice SIB 364152Document1 pageInvoice SIB 364152gauravmedicoNo ratings yet

- CH 10Document47 pagesCH 10Ismadth2918388100% (1)

- Andhra Pragathi Grameena Bank Andhra Pragathi Grameena BankDocument1 pageAndhra Pragathi Grameena Bank Andhra Pragathi Grameena BankdayaNo ratings yet

- Angelo Merchandise Journal Entry (Periodic)Document5 pagesAngelo Merchandise Journal Entry (Periodic)Jucel MarcoNo ratings yet

- Post-Closing Trial BalanceDocument4 pagesPost-Closing Trial Balanceapi-299265916100% (2)

- FLW00001 - AR Transaction Cycle 2Document1 pageFLW00001 - AR Transaction Cycle 2Rafael SampayanNo ratings yet