Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

19 viewsAccountancy Reviewer - 1st Grading

Accountancy Reviewer - 1st Grading

Uploaded by

MaxineThis document discusses the four main branches of accounting: public accounting, private accounting, governmental accounting, and accounting education. It provides examples for each branch, such as external auditing, tax preparation, and financial accounting for public and private sectors. The document also outlines the nature, function, and history of accounting. It discusses the difference between bookkeeping and accounting and lists some specialized areas of accounting like forensic, IT, environmental, and international accounting. Finally, it notes that internal and external users utilize accounting information for economic decision making.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Reviewer For Final Exam Fabm1Document6 pagesReviewer For Final Exam Fabm1medinachrstianaNo ratings yet

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- Auditing and Assurance Services 16th Edition Arens Solutions ManualDocument28 pagesAuditing and Assurance Services 16th Edition Arens Solutions Manualgloriaelfleda9twuoe100% (25)

- Test Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Document44 pagesTest Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Wendelyn Tutor100% (1)

- UGE Practice Set 1Document14 pagesUGE Practice Set 1Jeany Jatico Salazar92% (13)

- Services Subscription: Your Personal InformationDocument7 pagesServices Subscription: Your Personal InformationZiyanda SingasheNo ratings yet

- ACC124 - First ExamDocument4 pagesACC124 - First ExamBaby Leonor RazonableNo ratings yet

- Conceptual Framework and Accounting Standards Guide QuestionsDocument3 pagesConceptual Framework and Accounting Standards Guide QuestionsAngel heheNo ratings yet

- Cfas Reviewer Chapter 1 20Document11 pagesCfas Reviewer Chapter 1 20jullsandal41No ratings yet

- Acctg 121N Chapters 1-4: Public AccountantsDocument4 pagesAcctg 121N Chapters 1-4: Public Accountantskessa thea salvatoreNo ratings yet

- Fabm1 Chapter 1-4Document4 pagesFabm1 Chapter 1-4Kyle Aaron SoNo ratings yet

- Cfas 1-3Document13 pagesCfas 1-3Joan GacitaNo ratings yet

- Confras First Sem LectureDocument52 pagesConfras First Sem LectureRosette SANTOSNo ratings yet

- Conceptual FrameworkDocument8 pagesConceptual FrameworkJames DarylNo ratings yet

- Fabm MidtermDocument7 pagesFabm MidtermFritzie Mae Ruzhel GuimbuayanNo ratings yet

- CFAS Module Week 1-2Document11 pagesCFAS Module Week 1-2Yamit, Angel Marie A.No ratings yet

- Lesson 1 Fabm 1Document5 pagesLesson 1 Fabm 1Janelle Grace PanizalesNo ratings yet

- Accounting ReviewerDocument4 pagesAccounting Reviewerbiananaa14No ratings yet

- Academics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerDocument5 pagesAcademics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerAlexa Abary100% (1)

- UntitledDocument6 pagesUntitledPsalm Ruvi TalaNo ratings yet

- Basics of Accounting For MBA HRDocument19 pagesBasics of Accounting For MBA HRKundan JhaNo ratings yet

- FAR ReviewerDocument9 pagesFAR Reviewerghieyan solomonNo ratings yet

- Accounting 1 LectureDocument8 pagesAccounting 1 LecturePia louise RamosNo ratings yet

- FABM 1 NotesDocument13 pagesFABM 1 NotesNestyn Hanna VillarazaNo ratings yet

- Introduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Document14 pagesIntroduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Simon Marquis LUMBERANo ratings yet

- Introduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Document14 pagesIntroduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Simon Marquis LUMBERANo ratings yet

- The Accountancy Profession: American Accounting AssociationDocument2 pagesThe Accountancy Profession: American Accounting AssociationJonathan NavalloNo ratings yet

- (C1) Introduction To AccountingDocument3 pages(C1) Introduction To AccountingVenus LacambraNo ratings yet

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- Ae 111Document5 pagesAe 111YummyNo ratings yet

- Lesson 1Document22 pagesLesson 1PoonamNo ratings yet

- ACCA - Chapter 1-4Document11 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Cfas ReviewerDocument10 pagesCfas ReviewerMarian grace DivinoNo ratings yet

- Accounting 1Document25 pagesAccounting 1Harsh RanjanNo ratings yet

- Basic Concepts in Accounting: AbstractDocument7 pagesBasic Concepts in Accounting: AbstractinChristVeluz AgeasNo ratings yet

- Accounting Midterms ReviewerDocument6 pagesAccounting Midterms Reviewerpatricia culanibanNo ratings yet

- FABM1 Week1Document5 pagesFABM1 Week1TrixieNo ratings yet

- Basic AccountingDocument15 pagesBasic AccountingShellalyn RigonNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 1 - NotesDocument7 pagesConceptual Framework and Accounting Standards - Chapter 1 - NotesKhey KheyNo ratings yet

- Financial Accounting Valix Summary 1 7Document12 pagesFinancial Accounting Valix Summary 1 7notsogoodNo ratings yet

- Lesson 2Document29 pagesLesson 2AryannaNo ratings yet

- Chapter 1 Introduction To Accounting: ELE02-Special Topics in AccountingDocument12 pagesChapter 1 Introduction To Accounting: ELE02-Special Topics in AccountingPrincess ChanbaekNo ratings yet

- Accounting 3 NotesDocument7 pagesAccounting 3 NotesJudyNo ratings yet

- Reviewer For FarDocument20 pagesReviewer For FarFheuna EncarnacionNo ratings yet

- Accounting Standards Council: Important Points in The Definition ofDocument15 pagesAccounting Standards Council: Important Points in The Definition ofmicolleNo ratings yet

- ACCTG 101 Chapter 1 11Document60 pagesACCTG 101 Chapter 1 11JTNo ratings yet

- Cfas Valix ReviewerDocument24 pagesCfas Valix ReviewerMĀKUKIRANNo ratings yet

- Reviewer For CHAPTER 1 - Introduction To AccountingDocument5 pagesReviewer For CHAPTER 1 - Introduction To AccountingPatrick John AvilaNo ratings yet

- Study Note 1 Fundamental of AccountingDocument54 pagesStudy Note 1 Fundamental of Accountingnaga naveenNo ratings yet

- CFAS ReviewerDocument15 pagesCFAS ReviewerEvangeline Shane ManaloNo ratings yet

- CFAS ReviewerDocument11 pagesCFAS Reviewerbertochristine10No ratings yet

- ACT103 - Module 1Document13 pagesACT103 - Module 1Le MinouNo ratings yet

- Conceptual Framework and Accounting Standard Chapter 1-13 Digest NotesDocument14 pagesConceptual Framework and Accounting Standard Chapter 1-13 Digest Notesangelo subaNo ratings yet

- Financial Accounting and Reporting ReviewerDocument14 pagesFinancial Accounting and Reporting ReviewerRen Kouen100% (4)

- FINACC1 Accounting FrameworksDocument6 pagesFINACC1 Accounting FrameworksJerico DungcaNo ratings yet

- Fundamentals of Accounting: Prof. Marikriz M. Paulino, MBA Certified BookkeeperDocument22 pagesFundamentals of Accounting: Prof. Marikriz M. Paulino, MBA Certified BookkeeperCharina Jaramilla PesinoNo ratings yet

- ACT103 - Topic 1Document3 pagesACT103 - Topic 1Juan FrivaldoNo ratings yet

- ACCT 1026 Lesson ONEDocument13 pagesACCT 1026 Lesson ONEAnnie RapanutNo ratings yet

- Conceptual Framework and Accounting StandarsDocument12 pagesConceptual Framework and Accounting StandarsMarifel AldacaNo ratings yet

- Accounting NotesDocument2 pagesAccounting Noteselle elleNo ratings yet

- Lesson 01Document4 pagesLesson 01toufik techniqueNo ratings yet

- ACCA - Chapter 1Document11 pagesACCA - Chapter 1Bianca Alexa SacabonNo ratings yet

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleDocument8 pagesDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Design Principles and Elements of Design Principles and Elements ofDocument23 pagesDesign Principles and Elements of Design Principles and Elements ofMaxineNo ratings yet

- Practical Research-HistoricalDocument19 pagesPractical Research-HistoricalMaxineNo ratings yet

- PE FItness TestDocument10 pagesPE FItness TestMaxineNo ratings yet

- Introduction To EntrepreneurshipDocument22 pagesIntroduction To EntrepreneurshipMaxineNo ratings yet

- Statistics - 3rd GradingDocument3 pagesStatistics - 3rd GradingMaxineNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- Unit 4Document19 pagesUnit 4Dawit NegashNo ratings yet

- Company Final Account FormatDocument3 pagesCompany Final Account FormatAli RangwalaNo ratings yet

- PhilEquity Fund ProspectusDocument42 pagesPhilEquity Fund ProspectuskimencinaNo ratings yet

- B.vinod KumarDocument42 pagesB.vinod Kumarmrcopy xeroxNo ratings yet

- Ud Buana Work Sheet: For Month Ended December 31, 2019Document12 pagesUd Buana Work Sheet: For Month Ended December 31, 2019fitryna99No ratings yet

- Multi-Class Text Classification With Scikit-LearnDocument20 pagesMulti-Class Text Classification With Scikit-LearnmohitNo ratings yet

- REVISION PaDocument54 pagesREVISION PaNgoc Nguyen ThanhNo ratings yet

- 1400+financial Prompts For ChatGPTDocument67 pages1400+financial Prompts For ChatGPTMd Ahsan AliNo ratings yet

- FRM一级百题 风险管理基础Document67 pagesFRM一级百题 风险管理基础bertie RNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Financial Accounting Module 2 SummaryDocument2 pagesFinancial Accounting Module 2 Summarymohita.gupta4No ratings yet

- Provisional Certificate H402HHL0713483Document1 pageProvisional Certificate H402HHL0713483sivavm4No ratings yet

- FR Prep Session (2) - 1-5Document38 pagesFR Prep Session (2) - 1-5mahachem_hariNo ratings yet

- Good Earth Emporium IMc. Versus CADocument1 pageGood Earth Emporium IMc. Versus CACJ MelNo ratings yet

- Igacc0907 Ab CDocument34 pagesIgacc0907 Ab CMarcel JonathanNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Question Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?Document25 pagesQuestion Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?J. KNo ratings yet

- Example of A Valid Auto-Contract: If The Agent Has Been Empowered To Borrow Money, He May Himself Be The Lender atDocument9 pagesExample of A Valid Auto-Contract: If The Agent Has Been Empowered To Borrow Money, He May Himself Be The Lender atDwight BlezaNo ratings yet

- No More Gold Clause: A Contemporary Study Monetary Obligations Under The Conflict of LawDocument25 pagesNo More Gold Clause: A Contemporary Study Monetary Obligations Under The Conflict of LawAkshay Lal100% (1)

- Lesson 4 Importance of Establishing Business Beyond ProfitDocument3 pagesLesson 4 Importance of Establishing Business Beyond ProfitARIANNA BAJAMONDENo ratings yet

- The Debtors Act Chapter 77 of The Laws of Zambia SectionDocument7 pagesThe Debtors Act Chapter 77 of The Laws of Zambia SectionEdward Donhood MushipeNo ratings yet

- Sub: Auditing Class: Tybbi Sem: FiveDocument33 pagesSub: Auditing Class: Tybbi Sem: FiveNandhiniNo ratings yet

- Court - Ruling DOF Case $25MMDocument8 pagesCourt - Ruling DOF Case $25MMKaitlynSchallhornNo ratings yet

- Final Reviewer For ACC221Document91 pagesFinal Reviewer For ACC221ZalaR0cksNo ratings yet

Accountancy Reviewer - 1st Grading

Accountancy Reviewer - 1st Grading

Uploaded by

Maxine0 ratings0% found this document useful (0 votes)

19 views5 pagesThis document discusses the four main branches of accounting: public accounting, private accounting, governmental accounting, and accounting education. It provides examples for each branch, such as external auditing, tax preparation, and financial accounting for public and private sectors. The document also outlines the nature, function, and history of accounting. It discusses the difference between bookkeeping and accounting and lists some specialized areas of accounting like forensic, IT, environmental, and international accounting. Finally, it notes that internal and external users utilize accounting information for economic decision making.

Original Description:

Original Title

Accountancy Reviewer_1st Grading

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the four main branches of accounting: public accounting, private accounting, governmental accounting, and accounting education. It provides examples for each branch, such as external auditing, tax preparation, and financial accounting for public and private sectors. The document also outlines the nature, function, and history of accounting. It discusses the difference between bookkeeping and accounting and lists some specialized areas of accounting like forensic, IT, environmental, and international accounting. Finally, it notes that internal and external users utilize accounting information for economic decision making.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

19 views5 pagesAccountancy Reviewer - 1st Grading

Accountancy Reviewer - 1st Grading

Uploaded by

MaxineThis document discusses the four main branches of accounting: public accounting, private accounting, governmental accounting, and accounting education. It provides examples for each branch, such as external auditing, tax preparation, and financial accounting for public and private sectors. The document also outlines the nature, function, and history of accounting. It discusses the difference between bookkeeping and accounting and lists some specialized areas of accounting like forensic, IT, environmental, and international accounting. Finally, it notes that internal and external users utilize accounting information for economic decision making.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

Accountancy Branches of Accounting

According to Philippine Institute of Certified

Accounting Public Accountants (PICPA), there are four main sectors

- Accounting is the process of identifying, of Accounting namely;

measuring, and communicating economic 1. Public Accounting

information to permit informed judgement and Accountant performs or offers to

decisions by users of the information. (American perform any activity that will result to

Accounting Association, AAA) the issuance of an attest report that is in

- The art of recording, classifying, and accordance with professional standards.

summarizing in a significant manner as in terms *Certified Public Accountant- refer to those

of money, transactions and events which are in who passed the licensure examination for

part at least financial character, and interpreting accountants.

the results thereof. (American Institute of Examples:

Certified Public Accountant, AICPA) External Auditing

- A service activity. It’s function is to provide o Public accountants examine the

quantitative information, primarily financial in financial statements in order to

nature, about economic entities, that is intended express an opinion on whether

to be useful in making economic decisions, statements have been fairly

(Accounting Standards Council, ASC) presented or not.

Nature of Accounting Tax Preparations and Planning Services

- Accounting is an art o Accountants offer tax services

- Accounting deals with financial information and wherein they advise and help

transactions their clients in tax planning and

- Accounting is a process preparing tax returns.

- Accounting is an information system o Accountant is a tax specialist

- Accounting is a means to an end

Management Advisory Services

Function of Accounting in Business

o Involves financial planning and

1. To fulfill the stewardship function of the

control, and the development of

management (for owners)

accounting and computer

2. To help interested users to come up with

systems.

informed decisions

o Advises managements on

3. To support daily operations

matters such as the installations

Difference between bookkeeping and accounting

of an accounting system,

Bookkeeping

finance, budgeting, business

- Confide with the recording of monetary

processes, introduction to new

transactions.

products and others.

- Records business transactions

2. Private Accounting

Accounting

- Includes bookkeeping function. Involves setting up systems of recording

History of Accountancy business transaction that are aggregated

13th Century- The cradle of civilizations into financial statements and includes

14th Century- Double Entry Bookkeeping by Luca the development and interpretation of

Pacioli (the father of Accounting) accounting information intended to

17th- French Revolution assist management in operating the

1760s-1830- The industrial revolution business.

19th Century- The beginning of Modern Accounting in A private accountant is salaried

Europe and America employee who deals with company’s

The Present-The development of Modern Accounting day-to-day accounting needs.

Standard and Commerce. Examples

Financial Accounting

o Branch of accounting that

provides economic and financial

information for investors, relating to the revenues and

creditors, and other external expenditures of government offices.

users. 4. Accounting Education

o Uses a system of reporting Responsible for training future

designed to meet the accountants.

information needs of external Engages in teaching accounting,

users. financial management, taxation and

Cost Accounting other related business course.

o Focuses on accumulating As per CHED Memorandum Order

manufacturing costs for No.3, Series 2007, a CPA in accounting

financial reporting and decision- education should possess the

making purposes. educational qualifications, professional

o Accountant’s primary role is to experience, classroom teaching ability,

determine the inventory cost for computer literacy, scholarly research

financial reporting purposes. productivity, and other attributes.

Budgeting CPAs in Specialized Areas

o Provides detailed collection and 1. Forensic Accounting

reporting of the expenditures - Provide the detective work needed to

and revenues involved in a investigate and examine evidences of

business or company operations. white-collar financial crimes such as

o Tracks the financial details of stealing and fraud.

the firm, including the money 2. Information Technology Services

taken in and the money spent by - Individual who can design and

the company and the staff. implement customized software

Accounting Information System systems.

o Collects and processes 3. Environmental Accounting

- Determine how companies can be both

transaction data.

profitable and environmentally-

o Disseminates information to

responsible.

interested parties.

4. International Accounting

o Involves the designing of both

- Accountants are knowledgeable in

manual and computerized data

international trade rules and regulations,

processing systems.

international mergers, government

Tax Accounting regulations, tax laws, and overseas

o Deals with the preparation of transactions.

various tax returns and doing USERS OF ACCOUNTING INFORMATION

tax planning for the business.

Similar to tax services in Public Internal Users

Accounting. 1. Managers/Management - They plan, organize

Internal Auditing and run a business.

o Reviews the business operations a) Top-level management- CEO, COO,

to check if they are complying and CFO.

to management policies. b) Middle-level management- Dept. Heads,

o Evaluates the efficiency of branch managers, and junior executives.

business operations. c) Lower-level management- supervisors

3. Government Accounting and team leaders.

A system used in government offices to 2. Employees/Labor unions – they assess the

record and report financial transactions. company’s profitability and stability and their

Systematic process of collecting, consequence on future salary and job security.

recording, classifying, summarizing, and 3. Owners - Provides capital to the business.

interpreting the financial transactions External Users

1. Potential and existing investors – They need According to Activities

information to help them decide whether they

should invest or not in the business. Service Business

2. Creditors and potential creditors – they assess - Provides services

the credit worthiness and the capability of the Merchandising Business

business to pay its obligation. - Buy and sell

3. Customers – they assess the financial position of Manufacturing Business

their suppliers which is necessary for them to - Materials are bought to create a new product.

maintain stable source of supply in the long

term. ACCOUNTING PRINCIPLES

4. Suppliers – Use financial statement to determine

whether the debts owed to them will be paid GAAP- Generally Accepted Accounting Procedure

when due.

5. Tax authorities – use fs to determine the Underlying Accounting Assumption

credibility of the tax returns filed on behalf of 1. Economic Entity Assumption

the company. - Assumes all of the business transaction

6. Regulatory bodies – they want to ensure that the are separate form the business owner’s

company’s disclosure of accounting information personal transactions.

is in accordance with the rules and regulations. 2. Accrual Basis Assumption

7. Public – They use fs to know how the business - It requires that all business transactions

affects the economy. and other events are recognized in the

accounting records when they occur.

TYPES OS BUSINESSES 3. Going Concern Assumption

- Assumes that a company will continue

According to Ownership to exist long enough to carry out its

objectives.

Sole Proprietorship 4. Monetary Unit Assumption

- Owned by only one individual for the practice of - Assumes that only transactions that can

trade or profession. be expressed in terms of money are

Partnership recorded.

- Business that is owned by two or more - Measured in PH peso and is assumed to

individuals pooling their resources together as a be stable over the years in terms of

common fund. purchasing power.

- The profit is divided by among the partners as 5. Time Period Assumption

per their agreements. - Assumptions requires a business to

o General Partnership – each partner is a complete the whole accounting process

general partner with unlimited liability. of a business over a specific operating

o Limited Partnership – with limited time period.

partners and at least one general partner. -

They have limited liability to the extent Basic Accounting Period

only of their capital contribution. 1. Cost Principle

Corporation - All assets acquired should be valued and

- Required to have five to fifteen incorporators. recorded based on the actual cash

Incorporators refer to those who originally equivalent or original cost of

formed the corporation. acquisition, not the prevailing value.

- It is separate from its owners. 2. Full Disclosure Principle

Cooperative - Important information should be

- Owned by a group of individuals who also disclosed to permit stakeholders to make

serve as benefactors to the business endeavor. informed judgement.

- Usually requires at least fifteen members to 3. Matching Principle

function. - Requires that expenses be matched with

revenue.

4. Revenue Recognition Principle o Furniture and Fixtures

- Revenues are recognized as soon as o Building

goods have been sold or services has o Land

been rendered. o Allowance for bad debt

5. Materiality Principle *Contra asset account: Accumulated Deprecation

- Business transactions that may affect the LIABILITIES

decision of a sure of financial Present obligations of an entity arising from past

information are considered important or transaction or events, the settlement of which are

material and should be reported expected to result in an outflow from the

properly. business of resources embodying economic

6. Conservatism or Prudence Principle benefits.

- If a situation arises where there are two Something the business OWES.

acceptable alternatives for reporting an Classifications

item, conservatism directs the

Current

accountant to choose alternative that

o Payables

will result in less effect on net income

Account Payable

and/or less asset amount.

Notes Payable

7. Objectivity Principle

Loan Payable

- Requires business transactions to have

o Unearned Revenue

some form of impartial supporting

evidences or documentation. Non-Current

*Relevant – helps a decision maker o Mortgage Payable

*Reliable – verifiable and objective o Bonds Payable

*Consistent – allows meaningful comparisons OWNERS EQUITY

Residual interest

BASIC ACCOUNTING PERIOD Contains the net difference between total assets

and total liabilities.

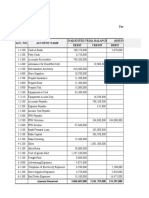

Asset = Liability + Owner’s Equity Examples

o Capital

ASSETS o Withdrawal/Drawing

Normal balance: Debit o Investment

Resources controlled by the business as a result o Additional Investment

of past transactions and events and from which o Net income/Net Loss

future economic benefits are expected to flow to REVENUES

the business. Earnings arising from the main line of

Something the business OWNS operations of the business.

`Classifications Result from rendering of services or selling

Current goods.

o Cash and Cash Equivalents o Service Revenue

Cash on hand o Interest Income

Cash in bank o Sales

o Receivables o Professional Fees

Account receivable EXPENSE

Interest receivable Cots being incurred by the business in

Notes receivable generating revenues.

Cash receivable o Salaries Expense

o Inventories

o Utilities Expense

o Unused Supplies

o Cost of Sales

o Prepaid Rent

o Wages Expense

*Contra asset account: Allowance for bad debts

Non-Current

o Equipment

You might also like

- Reviewer For Final Exam Fabm1Document6 pagesReviewer For Final Exam Fabm1medinachrstianaNo ratings yet

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- Auditing and Assurance Services 16th Edition Arens Solutions ManualDocument28 pagesAuditing and Assurance Services 16th Edition Arens Solutions Manualgloriaelfleda9twuoe100% (25)

- Test Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Document44 pagesTest Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Wendelyn Tutor100% (1)

- UGE Practice Set 1Document14 pagesUGE Practice Set 1Jeany Jatico Salazar92% (13)

- Services Subscription: Your Personal InformationDocument7 pagesServices Subscription: Your Personal InformationZiyanda SingasheNo ratings yet

- ACC124 - First ExamDocument4 pagesACC124 - First ExamBaby Leonor RazonableNo ratings yet

- Conceptual Framework and Accounting Standards Guide QuestionsDocument3 pagesConceptual Framework and Accounting Standards Guide QuestionsAngel heheNo ratings yet

- Cfas Reviewer Chapter 1 20Document11 pagesCfas Reviewer Chapter 1 20jullsandal41No ratings yet

- Acctg 121N Chapters 1-4: Public AccountantsDocument4 pagesAcctg 121N Chapters 1-4: Public Accountantskessa thea salvatoreNo ratings yet

- Fabm1 Chapter 1-4Document4 pagesFabm1 Chapter 1-4Kyle Aaron SoNo ratings yet

- Cfas 1-3Document13 pagesCfas 1-3Joan GacitaNo ratings yet

- Confras First Sem LectureDocument52 pagesConfras First Sem LectureRosette SANTOSNo ratings yet

- Conceptual FrameworkDocument8 pagesConceptual FrameworkJames DarylNo ratings yet

- Fabm MidtermDocument7 pagesFabm MidtermFritzie Mae Ruzhel GuimbuayanNo ratings yet

- CFAS Module Week 1-2Document11 pagesCFAS Module Week 1-2Yamit, Angel Marie A.No ratings yet

- Lesson 1 Fabm 1Document5 pagesLesson 1 Fabm 1Janelle Grace PanizalesNo ratings yet

- Accounting ReviewerDocument4 pagesAccounting Reviewerbiananaa14No ratings yet

- Academics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerDocument5 pagesAcademics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerAlexa Abary100% (1)

- UntitledDocument6 pagesUntitledPsalm Ruvi TalaNo ratings yet

- Basics of Accounting For MBA HRDocument19 pagesBasics of Accounting For MBA HRKundan JhaNo ratings yet

- FAR ReviewerDocument9 pagesFAR Reviewerghieyan solomonNo ratings yet

- Accounting 1 LectureDocument8 pagesAccounting 1 LecturePia louise RamosNo ratings yet

- FABM 1 NotesDocument13 pagesFABM 1 NotesNestyn Hanna VillarazaNo ratings yet

- Introduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Document14 pagesIntroduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Simon Marquis LUMBERANo ratings yet

- Introduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Document14 pagesIntroduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Simon Marquis LUMBERANo ratings yet

- The Accountancy Profession: American Accounting AssociationDocument2 pagesThe Accountancy Profession: American Accounting AssociationJonathan NavalloNo ratings yet

- (C1) Introduction To AccountingDocument3 pages(C1) Introduction To AccountingVenus LacambraNo ratings yet

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- Ae 111Document5 pagesAe 111YummyNo ratings yet

- Lesson 1Document22 pagesLesson 1PoonamNo ratings yet

- ACCA - Chapter 1-4Document11 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Cfas ReviewerDocument10 pagesCfas ReviewerMarian grace DivinoNo ratings yet

- Accounting 1Document25 pagesAccounting 1Harsh RanjanNo ratings yet

- Basic Concepts in Accounting: AbstractDocument7 pagesBasic Concepts in Accounting: AbstractinChristVeluz AgeasNo ratings yet

- Accounting Midterms ReviewerDocument6 pagesAccounting Midterms Reviewerpatricia culanibanNo ratings yet

- FABM1 Week1Document5 pagesFABM1 Week1TrixieNo ratings yet

- Basic AccountingDocument15 pagesBasic AccountingShellalyn RigonNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 1 - NotesDocument7 pagesConceptual Framework and Accounting Standards - Chapter 1 - NotesKhey KheyNo ratings yet

- Financial Accounting Valix Summary 1 7Document12 pagesFinancial Accounting Valix Summary 1 7notsogoodNo ratings yet

- Lesson 2Document29 pagesLesson 2AryannaNo ratings yet

- Chapter 1 Introduction To Accounting: ELE02-Special Topics in AccountingDocument12 pagesChapter 1 Introduction To Accounting: ELE02-Special Topics in AccountingPrincess ChanbaekNo ratings yet

- Accounting 3 NotesDocument7 pagesAccounting 3 NotesJudyNo ratings yet

- Reviewer For FarDocument20 pagesReviewer For FarFheuna EncarnacionNo ratings yet

- Accounting Standards Council: Important Points in The Definition ofDocument15 pagesAccounting Standards Council: Important Points in The Definition ofmicolleNo ratings yet

- ACCTG 101 Chapter 1 11Document60 pagesACCTG 101 Chapter 1 11JTNo ratings yet

- Cfas Valix ReviewerDocument24 pagesCfas Valix ReviewerMĀKUKIRANNo ratings yet

- Reviewer For CHAPTER 1 - Introduction To AccountingDocument5 pagesReviewer For CHAPTER 1 - Introduction To AccountingPatrick John AvilaNo ratings yet

- Study Note 1 Fundamental of AccountingDocument54 pagesStudy Note 1 Fundamental of Accountingnaga naveenNo ratings yet

- CFAS ReviewerDocument15 pagesCFAS ReviewerEvangeline Shane ManaloNo ratings yet

- CFAS ReviewerDocument11 pagesCFAS Reviewerbertochristine10No ratings yet

- ACT103 - Module 1Document13 pagesACT103 - Module 1Le MinouNo ratings yet

- Conceptual Framework and Accounting Standard Chapter 1-13 Digest NotesDocument14 pagesConceptual Framework and Accounting Standard Chapter 1-13 Digest Notesangelo subaNo ratings yet

- Financial Accounting and Reporting ReviewerDocument14 pagesFinancial Accounting and Reporting ReviewerRen Kouen100% (4)

- FINACC1 Accounting FrameworksDocument6 pagesFINACC1 Accounting FrameworksJerico DungcaNo ratings yet

- Fundamentals of Accounting: Prof. Marikriz M. Paulino, MBA Certified BookkeeperDocument22 pagesFundamentals of Accounting: Prof. Marikriz M. Paulino, MBA Certified BookkeeperCharina Jaramilla PesinoNo ratings yet

- ACT103 - Topic 1Document3 pagesACT103 - Topic 1Juan FrivaldoNo ratings yet

- ACCT 1026 Lesson ONEDocument13 pagesACCT 1026 Lesson ONEAnnie RapanutNo ratings yet

- Conceptual Framework and Accounting StandarsDocument12 pagesConceptual Framework and Accounting StandarsMarifel AldacaNo ratings yet

- Accounting NotesDocument2 pagesAccounting Noteselle elleNo ratings yet

- Lesson 01Document4 pagesLesson 01toufik techniqueNo ratings yet

- ACCA - Chapter 1Document11 pagesACCA - Chapter 1Bianca Alexa SacabonNo ratings yet

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleDocument8 pagesDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Design Principles and Elements of Design Principles and Elements ofDocument23 pagesDesign Principles and Elements of Design Principles and Elements ofMaxineNo ratings yet

- Practical Research-HistoricalDocument19 pagesPractical Research-HistoricalMaxineNo ratings yet

- PE FItness TestDocument10 pagesPE FItness TestMaxineNo ratings yet

- Introduction To EntrepreneurshipDocument22 pagesIntroduction To EntrepreneurshipMaxineNo ratings yet

- Statistics - 3rd GradingDocument3 pagesStatistics - 3rd GradingMaxineNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- Unit 4Document19 pagesUnit 4Dawit NegashNo ratings yet

- Company Final Account FormatDocument3 pagesCompany Final Account FormatAli RangwalaNo ratings yet

- PhilEquity Fund ProspectusDocument42 pagesPhilEquity Fund ProspectuskimencinaNo ratings yet

- B.vinod KumarDocument42 pagesB.vinod Kumarmrcopy xeroxNo ratings yet

- Ud Buana Work Sheet: For Month Ended December 31, 2019Document12 pagesUd Buana Work Sheet: For Month Ended December 31, 2019fitryna99No ratings yet

- Multi-Class Text Classification With Scikit-LearnDocument20 pagesMulti-Class Text Classification With Scikit-LearnmohitNo ratings yet

- REVISION PaDocument54 pagesREVISION PaNgoc Nguyen ThanhNo ratings yet

- 1400+financial Prompts For ChatGPTDocument67 pages1400+financial Prompts For ChatGPTMd Ahsan AliNo ratings yet

- FRM一级百题 风险管理基础Document67 pagesFRM一级百题 风险管理基础bertie RNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Financial Accounting Module 2 SummaryDocument2 pagesFinancial Accounting Module 2 Summarymohita.gupta4No ratings yet

- Provisional Certificate H402HHL0713483Document1 pageProvisional Certificate H402HHL0713483sivavm4No ratings yet

- FR Prep Session (2) - 1-5Document38 pagesFR Prep Session (2) - 1-5mahachem_hariNo ratings yet

- Good Earth Emporium IMc. Versus CADocument1 pageGood Earth Emporium IMc. Versus CACJ MelNo ratings yet

- Igacc0907 Ab CDocument34 pagesIgacc0907 Ab CMarcel JonathanNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Question Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?Document25 pagesQuestion Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?J. KNo ratings yet

- Example of A Valid Auto-Contract: If The Agent Has Been Empowered To Borrow Money, He May Himself Be The Lender atDocument9 pagesExample of A Valid Auto-Contract: If The Agent Has Been Empowered To Borrow Money, He May Himself Be The Lender atDwight BlezaNo ratings yet

- No More Gold Clause: A Contemporary Study Monetary Obligations Under The Conflict of LawDocument25 pagesNo More Gold Clause: A Contemporary Study Monetary Obligations Under The Conflict of LawAkshay Lal100% (1)

- Lesson 4 Importance of Establishing Business Beyond ProfitDocument3 pagesLesson 4 Importance of Establishing Business Beyond ProfitARIANNA BAJAMONDENo ratings yet

- The Debtors Act Chapter 77 of The Laws of Zambia SectionDocument7 pagesThe Debtors Act Chapter 77 of The Laws of Zambia SectionEdward Donhood MushipeNo ratings yet

- Sub: Auditing Class: Tybbi Sem: FiveDocument33 pagesSub: Auditing Class: Tybbi Sem: FiveNandhiniNo ratings yet

- Court - Ruling DOF Case $25MMDocument8 pagesCourt - Ruling DOF Case $25MMKaitlynSchallhornNo ratings yet

- Final Reviewer For ACC221Document91 pagesFinal Reviewer For ACC221ZalaR0cksNo ratings yet