Professional Documents

Culture Documents

Article 1808-1827

Article 1808-1827

Uploaded by

Janaisa Bugayong Espanto0 ratings0% found this document useful (0 votes)

2K views7 pagesThis document discusses partnership property rights and obligations under Philippine law. It outlines:

1) Restrictions on capitalist partners engaging in competitive business without permission. Violations require profits to be surrendered and losses to be personally borne.

2) Partners' rights to formal accounting and access partnership information and books. Accounting may be demanded after dissolution or with allegations of fraud/error.

3) Distinctions between partnership property, which can fluctuate in value, and partnership capital, which remains fixed without partner consent. Partners are co-owners of specific partnership property.

4) Obligations of partners regarding third parties include liability for contractual obligations, with individual liability after partnership assets are exhausted. Certain stipulations exemp

Original Description:

article 1808

Original Title

ARTICLE 1808-1827

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses partnership property rights and obligations under Philippine law. It outlines:

1) Restrictions on capitalist partners engaging in competitive business without permission. Violations require profits to be surrendered and losses to be personally borne.

2) Partners' rights to formal accounting and access partnership information and books. Accounting may be demanded after dissolution or with allegations of fraud/error.

3) Distinctions between partnership property, which can fluctuate in value, and partnership capital, which remains fixed without partner consent. Partners are co-owners of specific partnership property.

4) Obligations of partners regarding third parties include liability for contractual obligations, with individual liability after partnership assets are exhausted. Certain stipulations exemp

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2K views7 pagesArticle 1808-1827

Article 1808-1827

Uploaded by

Janaisa Bugayong EspantoThis document discusses partnership property rights and obligations under Philippine law. It outlines:

1) Restrictions on capitalist partners engaging in competitive business without permission. Violations require profits to be surrendered and losses to be personally borne.

2) Partners' rights to formal accounting and access partnership information and books. Accounting may be demanded after dissolution or with allegations of fraud/error.

3) Distinctions between partnership property, which can fluctuate in value, and partnership capital, which remains fixed without partner consent. Partners are co-owners of specific partnership property.

4) Obligations of partners regarding third parties include liability for contractual obligations, with individual liability after partnership assets are exhausted. Certain stipulations exemp

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

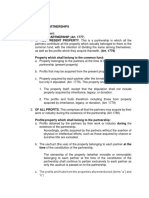

Art.

1808 – Prohibition against a Capitalist Partner

Business Prohibition on Capitalist Partner

- prohibited from engaging for his own account in any operation which is the kind of

business in which the partnership is engaged

Instances where there is no prohibition

a. when there is an express stipulation allowing the capitalist partner to engage himself;

b. when the other partners expressly allow him to do so;

c. when the other partners impliedly allowed him to do so;

d. when the company ceases to be engaged in business during the period of liquidation

and winding up; and

e. when the general-capitalist partner becomes merely a limited partner in a competitive

enterprise

· Effect of Violation

a. the violator shall bring the partner shall of the profits illegally obtained;

b. he shall personally bear all the losses

· Art. 1809 – Right of Partner to a Formal Account

Right to demand a formal account

a. generally, no formal accounting is demandable until after dissolution

b. however, under Art. 1809, formal accounting may be properly asked for

Estoppel

- cannot be questioned anymore if it was accepted without objection for this would

now be a case of estoppel, unless fraud and error are alleged and proved

· Stipulation and Continuing Share

- valid and proper accounting must be made

III. Property Rights of a Partner

Art. 1810 – Property Rights of a Partner

Principal Rights:

a. specific partnership

b. interest in the partnership

c. right to participate in the management

Related Rights:

a. the right to reimbursement for amounts advanced to the partnership and to

indemnification for risks in consequence of management;

b. the right to access the inspection of partnership books;

c. the right to true and full information of all things affecting the partnership;

d. the right to formal account of partnership affairs under certain circumstances;

and

e. the right to have the partnership dissolved also under certain conditions

Distinction between Partnership Property and Partnership Capital

a. as to changes in value

PP – variable; its value may vary from day to day with changes in the market value of

the partnership assets

PC – constant; remains unchanged as the amount fixed by agreement of partners, and

is not affected by fluctuations in the value of partnership property, although it may be

increased or diminished by unanimous consent of the partners

b. as to assets included

PP – includes not only the original capital contributions of the partners, but all property

subsequently acquired on account of the partnership or with partnership funds,

including partnership name and the good will of the partnership

PC – represents the aggregate of the individual contributions made by the partners in

establishing or continuing the partnership

Art. 1811 – Partnership in Specific Partnership Property

· Co-ownership in Specific Partnership Property

- partners are co-owners but rules on co-ownership does not necessarily apply

· Rights of a partner in specific partnership property

1. in general, he has an equal right with his partners to posses, but only for

partnership purposes;

2. he cannot assign his right;

3. his right is not subject to attachment or execution; and

4. his rights is not subject to legal support

Art. 1812 – Partner’s Interest in the Partnership is his share of the profits and surplus

In general., a partner’s interest in the partnership (his share in the profits and

surplus) may be assigned, attached or be subject to legal support

Art. 1813 – Conveyance of Interest

· Effects of conveyance by partner of his Interest in the Partnership

1. Partnership may still remain; partnership may be dissolved

2. Assignee does not necessarily become a partner

3. Assignee cannot even interfere in the management or administration of the

partnership business or affairs

4. Assignee cannot demand information, accounting or inspection of the partnership

books

· Rights of Assignee

1. to get whatever profits the assignor-partner would have obtained;

2. to avail himself of the usual remedies in case of fraud in the management;

3. to ask for annulment of the contract of assignment if there was fraud, error,

intimidation, force, undue influence;

4. to demand an accounting

Art. 1814 –

Charging Interest of a Partner

- while a partner’s interest in the partnership may be charged or levied upon, his

interest in a specific firm property cannot as a rule be attached.

· Preferential Rights of Partnership Creditors

- preference is given to partnership creditors in the partnership assets;

- separate or individual creditors have preference in separate or individual properties

· Remedies of separate Judgment Creditor of a Partner

1. Application for the “charging order” after securing judgment on his credit

2. Availability of other remedies

· Receivership

a. when the charging order is applied for and granted, the court may at the same time

or later appoint a receiver of the partner’s share in the profits or money due him

b. the receiver appointed is entitled to any relief necessary to conserve the partnership

assets for partnership purposes

· Redemption of the Interest Charged

a. redemption- means the extinguishment of the charge or attachment on the

partner’s interest in the profits;

b. when redemption is made

- any time before closure;

- after closure, it may still be bought with separate property or with partnership

property

IV. Obligation of the Partners with regard to Third Persons

Art. 1815 – Firm Name

· Firm Name

- name, title or style under which a company transacts business; a partnership of

two or more persons; a commercial house

· Purpose

- necessary to distinguish the partnership which has a distinct and separate juridical

personality from the individuals composing the partnership and from other

partnerships and entities.

· Liability of strangers who include their name

- liability as partners because of estoppel, but do not have the rights as partners

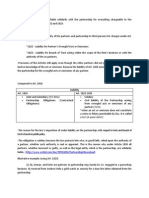

Art. 1816 – Liability for Contractual Obligations of Partners

· Partnership Liability

· Individual Liability

Liability Distinguished from Losses

- an industrial partner is exempted by law for losses’ but not from liability;

- third persons may sue the firm and the partners, including the industrial partners;

- partners will be personally liable only after the assets of the partnership have been

exhausted

Stipulations such as those exempting all the industrial partners and some of the

capitalist partners, insofar as third persons are concerned, would be null and void

Art 1817 – Stipulations Eliminating Liability

Art. 1799 and 1817 reconciled:

- it is permissible to stipulate among them that a capitalist partner will be exempted

from liability in excess of the original capital contributed; but will not be exempted

insofar as his capital is concerned

Liability vs. Losses

Liability – refers to responsibility towards third persons

Losses – refers to responsibility as among partners

Art. 1818 – Partner as an Agent of Partnership

When a partner can bind or cannot bind the firm

a. Art. 1818 speaks of an instance when the partner is an agent; and

b. when he can and cannot bind as agent

· Agency of a partner

- partnership is a contract of mutual agency

- each partner acting as a principal on his own behalf and as an agent for his co-

partners or the firm

When can a partner bind the partnership

Requisites:

a. when he is expressly authorized or impliedly authorized; and

b. when he acts in behalf and in the name of the partnership

When will act not bind the partnership

A. when, although for apparently carrying on in the usual way the business of the

partnership,” still the partner has in fact NO AUTHORITY, and the third party

knows that the partner has no authority;

B. when the act is not for apparently carrying on in the usual way of the

partnership and the partner has no authority

NOTE: The 7 kinds of acts enumerated in Art. 1818 are instances of acts which are

NOT for apparently carrying on in the usual way the business of the partnership.

In the 7 instances, the authority must be unanimous except if the business

has been abandoned.

· Reasons why 7 acts are “unusual”

a. assign the firm property – firm will virtually be dishonored

b. dispose of the goodwill – good will is valuable property

c. do any other act which would make it impossible to carry on – this is evidently

prejudicial

d. confers a judgment – if done before a case is filed, this is null and void; if done later,

the firm would be jeopardized

e. compromise – an act of ownership and may be said to be equivalent to alienation

f. arbitration – an act of ownership which may not be justified

g. renounce a claim – why should a partner renounce a claim that does not belong to

him but to the partnership?

Art. 1819 – Conveyance of Real Property

· the article speaks of “:to convey” or a conveyance

· real property may be registered or owned in the name of

- the partnership

- all the partners

- one, some or not all the partners in trust for the partnership

Art. 1920 – Admission or representation made by a partner

Conditions:

- admission must concern partnership affairs;

- within the scope of the authority

Restrictions on the rule:

a. admission made BEFORE dissolution are binding only when the partners has

authority to act on the particular matter

b. admissions made AFTER dissolution are binding only if the admissions were

necessary to wind up the business

note: a previous admission of a partner is admissible in evidence against the

partnership when it is made within the scope of the partnership, and during the

existence, provided of course that the existence of the partnership is first proved by

evidence other than such act or declaration

Art. 1821 – Notice to a Partner

· Cases of Knowledge of a Partner

1. knowledge of a partner acting in a particular matter acquired while a partner;

2. knowledge of a partner acting in a particular matter then present to his mind; and

3. knowledge of any partner who reasonably could and should have communicated it

to the acting partner

· Effect of Notice to a Partner

a. in general, notice to a partner is notice to the partnership, that is, a partnership

cannot claim ignorance if a partner knew (but this is with restriction)

b. notice to a partner, given while already a partner, is a notice to the partnership

provided it relates to partnership affairs

· Effect of knowledge although no notice was given

- notice of the partner is also knowledge of the firm provided:

a. the knowledge was acquired by a partner who is acting in the particular matter

involved;

b. the knowledge may have been acquired by a partner not acting in the particular

matter involved

Art. 1822 – Liability of Partnership

· Requisites for Liability

a. the partner must be guilty of a wrongful act or omission; and

b. he must be acting in the ordinary course of business, or with the authority of his

co-partners even if the act is unconnected with the business

note: partnership liability does not extend to criminal liability

· Instances when the firm and other partners are not liable:

a. if the wrongful act or omission was not done within the scope of the partnership

business and for its benefit;

b. if the act or omission was not wrongful;

c. if the act or omission, although wrongful, did not make the partner concerned liable

himself; and

d. if the wrongful act or omission was committed after the firm had been dissolved and

the same was not in connection with the process of winding up

Art. 1823 – Liability for Misappropriation

· Liability of partnership for misappropriation

- the difference between par. 1 and par. 2 is that in the former misappropriation is

made by the receiving partner, while in the latter, the culprit may be any partner. The

effect however is the same in both cases

Art. 1824 – Solidary Liability of partners

- not only the partners that are liable in solidum; it is also the partnership

Art. 1825 – Partner by Estoppel and Partnership by Estoppel

· Estoppel

- a bar which precludes a person from denying or asserting anything contrary to that

which has been established as the truth by his own deed or representation, either

express or implied

When Partnership Liability Results:

- if all the actual partners consented to the representation, then the liability of the

person who represented himself to be a partner or who consented to such

representation and the actual partners is considered a partnership liability.

Elements to establish liability as a partner on ground of estoppel:

1. proof by plaintiff that he was individually aware of the defendant’s

representations as to his being a partner or that such representations were made by

others and not denied or refuted by the defendant;

2. reliance on such representations by the plaintiff; and

3. lack of denial or refutation of the statements by the defendants; such denial

need not precede plaintiff’s acting thereon if the denial was forthcoming promptly

upon hearing of the representations, and if, by prudence and diligence the plaintiff

might have learned the truth or untruth of the representations.

· When the problem may arise:

A person may:

a. represent himself as a partner of an existing partnership with or without the

consent of the partnership;

b. represent himself as a partner of a non-consent partnership

When estoppel does not apply:

- when although there is misrepresentation, the third party is not deceived, the

doctrine of estoppel does not apply

Burden of Proof

- the creditor, or whoever alleges the existence of a partner or partnership by

estoppel has the burden of proving the existence of the misrepresentation and the innocent

reliance on it

Art. 1826 – Entry of a New Partner

· Entry of a new partner into an existing partnership

- the newly admitted partner would be liable as an ordinary original partner for all

partnership obligations incurred after his admission to the firm

· Creation of a new partnership in view of the entry

- the admission of a new partner dissolves the old firm and creates a new one;

- since the old firm is dissolved, the original creditors would not be the creditors of

the new firm, but only of the original partners; hence, they may lose their preference;

- under the civil code, they are considered creditors of the new firm

· Liability of incoming partner for partnership obligations

1. limited to his share in partnership property for existing obligations, unless there is

stipulation to the contrary;

2. extends to his separate property for subsequent obligations

· Liability of an Outgoing Partner

- where a partner gives notice of his retirement or withdrawal from the partnership,

he is freed from any liability on contracts entered into thereafter, but his liability on

existing incomplete contract continues.

· the rule of holding the new partner liable for previous obligations of the firm is not

harsh on the said new partner. After all the incoming partner partakes of the benefit of

the partnership, property and an established business

Art. 1827 – Creditors of Partnership

Reason for the Preference of Partnership Creditors

- after all, the partnership is a juridical person with whom the creditors have

contracted; moreover the assets of the partnership must first be executed

Reason why industrial creditors may still attach the partner’s share

- after all, remainder belongs to the partner

Sale by a partner of his share to a third party

- if a partner sells his share to a third party, but the firm itself still remains solvent,

creditors of the partnership cannot assail the validity of the sale by alleging that it is

made in fraud of them, since they have not really been prejudiced

You might also like

- Musical Acoustics PDFDocument26 pagesMusical Acoustics PDFGino Mendoza0% (1)

- Least Mastered Competencies (Grade 6)Document14 pagesLeast Mastered Competencies (Grade 6)Renge Taña91% (33)

- This Study Resource WasDocument5 pagesThis Study Resource WasStephanie LeeNo ratings yet

- Article 1767 - 1867 SummaryDocument34 pagesArticle 1767 - 1867 SummaryJanaisa Bugayong Espanto75% (4)

- Illustrative CaseDocument11 pagesIllustrative CaseCristine CaringalNo ratings yet

- Article 1800: Who Manages The Partnership?Document9 pagesArticle 1800: Who Manages The Partnership?Mhico MateoNo ratings yet

- Article 1825Document11 pagesArticle 1825Alex Buzarang SubradoNo ratings yet

- CIVIL LAW BAR EXAM ANSWERS - PartnershipDocument5 pagesCIVIL LAW BAR EXAM ANSWERS - Partnershipybun100% (2)

- Law On Partnerships (General Provisions)Document3 pagesLaw On Partnerships (General Provisions)Citoy LabadanNo ratings yet

- Obligations of The PartnersDocument3 pagesObligations of The PartnersBasri Jay100% (1)

- Article 1822-1824Document15 pagesArticle 1822-1824jalilah gunti50% (2)

- Art. 1804-1809Document17 pagesArt. 1804-1809Rizalyn C DuetizNo ratings yet

- Articles 1807-1827 REVIEWERDocument17 pagesArticles 1807-1827 REVIEWERJayel C.No ratings yet

- Art. 1776. Kinds of PartnershipsDocument4 pagesArt. 1776. Kinds of PartnershipsJoe P PokaranNo ratings yet

- Article 1788Document3 pagesArticle 1788enliven morenoNo ratings yet

- Property Rights of A PartnerDocument17 pagesProperty Rights of A Partnererikha_araneta100% (5)

- Article 1822, 1823, and 1824Document3 pagesArticle 1822, 1823, and 1824maria cruzNo ratings yet

- 1868 1883Document6 pages1868 1883janicsds420% (1)

- CHAPTER 3 Dissolution and Winding Up CODALDocument5 pagesCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosNo ratings yet

- PartnershipDocument8 pagesPartnershipFrancis Ray Arbon FilipinasNo ratings yet

- Article 1771Document1 pageArticle 1771karl doceoNo ratings yet

- Article 1774-1783Document35 pagesArticle 1774-1783kim che50% (2)

- Business Laws and Regulations - Prelim Exam (BAYNA, TRIXIA MAE)Document2 pagesBusiness Laws and Regulations - Prelim Exam (BAYNA, TRIXIA MAE)Trixia Mae BaynaNo ratings yet

- ARTICLE 1857 One of The Characteristics of Limited PartnershipsDocument6 pagesARTICLE 1857 One of The Characteristics of Limited PartnershipsJovelyn OrdoniaNo ratings yet

- Article 1504-1522Document3 pagesArticle 1504-1522Rachel Mae FajardoNo ratings yet

- RFBT 2 Partnership Midterm ReviewerDocument6 pagesRFBT 2 Partnership Midterm ReviewerJamaica DavidNo ratings yet

- LAW Chapter II (1791 - 1809)Document14 pagesLAW Chapter II (1791 - 1809)JaimeMorNo ratings yet

- Estates and TrustsDocument4 pagesEstates and TrustsXiaoyu KensameNo ratings yet

- Notes For Civil Code Article 1177 and Article 1178Document5 pagesNotes For Civil Code Article 1177 and Article 1178Chasz CarandangNo ratings yet

- Article 1793Document2 pagesArticle 1793JudyNo ratings yet

- Art 1838-1839 (Partnership)Document2 pagesArt 1838-1839 (Partnership)Mosarah AltNo ratings yet

- Article 1827. The Creditors of The Partnership Shall Be Preferred To Those of Each Partner AsDocument2 pagesArticle 1827. The Creditors of The Partnership Shall Be Preferred To Those of Each Partner AsJanice100% (1)

- Essential Elements: Chapter 1 Nature and Form of The ContractDocument11 pagesEssential Elements: Chapter 1 Nature and Form of The ContractMaricrisNo ratings yet

- Article 1258 Discusses How To Consign or The Process To ConsignDocument2 pagesArticle 1258 Discusses How To Consign or The Process To ConsignAlyssa Mae Ogao-ogao100% (1)

- Partnership Dissolution and Winding UpDocument3 pagesPartnership Dissolution and Winding UpPedro Jr SantosNo ratings yet

- Art 1767-1770Document4 pagesArt 1767-1770Mark Andrei TalastasNo ratings yet

- BLR 211 Final ExamDocument19 pagesBLR 211 Final ExammercyvienhoNo ratings yet

- Title Iii Board of Directors - Trustees and OfficersDocument7 pagesTitle Iii Board of Directors - Trustees and OfficersMeAnn TumbagaNo ratings yet

- Article 1801Document2 pagesArticle 1801XaxxyNo ratings yet

- 02 Handout 1Document9 pages02 Handout 1PopoyNo ratings yet

- The Law On Partnerships and Private CorporationsDocument32 pagesThe Law On Partnerships and Private CorporationsFluffy SnowbearNo ratings yet

- Buslaw2 Midterm ExamDocument5 pagesBuslaw2 Midterm ExamIan Pang100% (1)

- Law On Sales Chapter 8Document4 pagesLaw On Sales Chapter 8Edith DalidaNo ratings yet

- Essential Elements of The Contract ofDocument12 pagesEssential Elements of The Contract ofjanicetorredaNo ratings yet

- PRTC Corporations PDFDocument313 pagesPRTC Corporations PDFHazel Kaye EspelitaNo ratings yet

- Article 1830Document13 pagesArticle 1830Rustom IbanezNo ratings yet

- Topics Questions: Miranda, Romar VDocument2 pagesTopics Questions: Miranda, Romar VRomar MirandaNo ratings yet

- Obli ART 1232Document44 pagesObli ART 1232Pearl Angeli Quisido CanadaNo ratings yet

- Questions (Edited)Document8 pagesQuestions (Edited)Madelle PinedaNo ratings yet

- Generally, No Formal Accounting Is Demandable Till After Dissolution. ExceptionsDocument7 pagesGenerally, No Formal Accounting Is Demandable Till After Dissolution. ExceptionsDan LocsinNo ratings yet

- A Contract of Sale May Be Absolute or ConditionalDocument5 pagesA Contract of Sale May Be Absolute or ConditionalImthe OneNo ratings yet

- Chapter 2 Obligations of PartnersDocument35 pagesChapter 2 Obligations of PartnersPhil UriarteNo ratings yet

- LIMITED PARTNERSHIP Summary of Limited PartnershipDocument9 pagesLIMITED PARTNERSHIP Summary of Limited PartnershipAlia Arnz-DragonNo ratings yet

- Chapter 1 - General ProvisionsDocument8 pagesChapter 1 - General ProvisionsCharmaine AlipayoNo ratings yet

- Art 1795 - 1799Document5 pagesArt 1795 - 1799Mhico Mateo100% (1)

- Law On Corporations Test Bank With Revised Corporate Code References - CompressDocument62 pagesLaw On Corporations Test Bank With Revised Corporate Code References - CompressCharles MateoNo ratings yet

- Law On AgencyDocument11 pagesLaw On AgencyJoseph Dimalanta Dajay100% (1)

- Art. 1815 - 1827Document41 pagesArt. 1815 - 1827erikha_aranetaNo ratings yet

- Buslaw-Rights of The PartnersDocument4 pagesBuslaw-Rights of The PartnersCrazy Little ThriengsNo ratings yet

- A. Equal Rights To Possess 1807, 1788, 1811, 1803, 1800 &1818Document4 pagesA. Equal Rights To Possess 1807, 1788, 1811, 1803, 1800 &1818RonaldCuerdoNo ratings yet

- Article 1812-14Document3 pagesArticle 1812-14BS Accoutancy St. SimonNo ratings yet

- Obligations of PartnersDocument5 pagesObligations of PartnersLIGAWAD, MELODY P.No ratings yet

- Sculpt Unbelievable Abs: Eight Potent Exercises That Zero in On Your AbdominalsDocument8 pagesSculpt Unbelievable Abs: Eight Potent Exercises That Zero in On Your Abdominalsjesus alamillaNo ratings yet

- Environmental Protection: "We Never Know The Worth of Water Till The Wellis Dry."Document14 pagesEnvironmental Protection: "We Never Know The Worth of Water Till The Wellis Dry."Mary Jane BuaronNo ratings yet

- A GUIDE TO TRULY RICH CLUB by BO SANCHEZDocument4 pagesA GUIDE TO TRULY RICH CLUB by BO SANCHEZRaymunda Rauto-avilaNo ratings yet

- HCI634K - Technical Data SheetDocument8 pagesHCI634K - Technical Data SheetQuynhNo ratings yet

- The Quiescent Benefits and Drawbacks of Coffee IntakeDocument6 pagesThe Quiescent Benefits and Drawbacks of Coffee IntakeVikram Singh ChauhanNo ratings yet

- Engr Qazi Arsalan Hamid AliDocument4 pagesEngr Qazi Arsalan Hamid AliEnpak ArsalanNo ratings yet

- Whyte Human Rights and The Collateral Damage oDocument16 pagesWhyte Human Rights and The Collateral Damage ojswhy1No ratings yet

- Electrical Symbols and StandardsDocument12 pagesElectrical Symbols and StandardsSanjay KNo ratings yet

- Grade 5 CommentsDocument17 pagesGrade 5 Commentsreza anggaNo ratings yet

- The Secret Book of JamesDocument17 pagesThe Secret Book of JameslaniNo ratings yet

- Muscle Memo Workout - Guitar Coach MagDocument28 pagesMuscle Memo Workout - Guitar Coach Magpeterd87No ratings yet

- Piglia - Hotel AlmagroDocument2 pagesPiglia - Hotel AlmagroJustin LokeNo ratings yet

- GIS Based Analysis On Walkability of Commercial Streets at Continuing Growth Stages - EditedDocument11 pagesGIS Based Analysis On Walkability of Commercial Streets at Continuing Growth Stages - EditedemmanuelNo ratings yet

- Unusual Ways Usual DestinationDocument3 pagesUnusual Ways Usual DestinationLina Saad0% (1)

- RecipesDocument7 pagesRecipesIndira UmareddyNo ratings yet

- BProfile EnglishDocument3 pagesBProfile EnglishFaraz Ahmed WaseemNo ratings yet

- Russian General Speaks Out On UFOsDocument7 pagesRussian General Speaks Out On UFOsochaerryNo ratings yet

- AUDCISE Unit 3 Worksheets Agner, Jam Althea ODocument3 pagesAUDCISE Unit 3 Worksheets Agner, Jam Althea OdfsdNo ratings yet

- Absorption Costing PDFDocument10 pagesAbsorption Costing PDFAnonymous leF4GPYNo ratings yet

- Level B1 - Threshold: Speaking Mark Scheme - Assessor'sDocument2 pagesLevel B1 - Threshold: Speaking Mark Scheme - Assessor'sdeasaadiah100% (1)

- Trial in AbsentiaDocument12 pagesTrial in AbsentiaNahid hossainNo ratings yet

- Furosemide DSDocument2 pagesFurosemide DSjhanrey0810_18768No ratings yet

- SBC Code 301Document360 pagesSBC Code 301mennnamohsen81No ratings yet

- Practical Research 2: Sampling and Probability SamplingDocument11 pagesPractical Research 2: Sampling and Probability SamplingJohn Joseph JalandoniNo ratings yet

- Test Taker Score Report: Prabhakar Thapa MagarDocument1 pageTest Taker Score Report: Prabhakar Thapa MagarRosy BasnetNo ratings yet

- Term Paper (Dev - Econ-2)Document14 pagesTerm Paper (Dev - Econ-2)acharya.arpan08No ratings yet

- Direct BriberyDocument4 pagesDirect Briberyjuillien isiderioNo ratings yet

- Welspun Linen Customer Price List 2023Document4 pagesWelspun Linen Customer Price List 2023Vipin SharmaNo ratings yet