Professional Documents

Culture Documents

Less: Cost of Goods Sold: Net Income After Tax: 474,222.00

Less: Cost of Goods Sold: Net Income After Tax: 474,222.00

Uploaded by

Daniella Mae ElipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Less: Cost of Goods Sold: Net Income After Tax: 474,222.00

Less: Cost of Goods Sold: Net Income After Tax: 474,222.00

Uploaded by

Daniella Mae ElipCopyright:

Available Formats

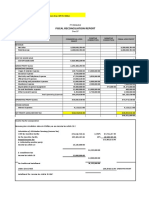

Sweets Creation

Income Statement

For the year ended December 31, 2021

Sales 2,345,400.00

Less: Cost of Goods Sold 418,800.00

Gross Profit 1,926,600.00

Less: Operating Expense

Supplies Expense 502,305.00

Freight-out 60,000.00

Taxes and License Expense 156,862.00

Utilities Expense 58,788.00

Advertising Expense 5,000.00

Salaries Expense 239,236.00

Payroll Expense 19,964.00

Rent Expense 120,000.00

Depreciation Expense - Equipment 37,495.00

Depreciation Expense – Furniture & Fixtures 4,490.00

Depreciation Expense – Vehicle 45,000.00 1,249,140.00

Net Income before tax 677,460.00

Less: Income Tax Expense (30%) 203,238.00

Net Income after Tax: 474,222.00

Sweets Creation

Income Statement

For the year ended December 31, 2022

Sales 2,626,848.00

Less: Cost of Goods Sold 469,056.00

Gross Profit 2,157,792.00

Less: Operating Expense

Supplies Expense 527,420.25

Freight-out 66,000.00

Taxes and License Expense 93,805.44

Utilities Expense 58,788.00

Advertising Expense 5,000.00

Salaries Expense 239,236.00

Payroll Expense 19,964.00

Rent Expense 120,000.00

Depreciation Expense - Equipment 37,495.00

Depreciation Expense – Furniture & Fixtures 4,490.00

Depreciation Expense – Vehicle 45,000.00 1,217,198.69

Net Income before tax 940,593.31

Less: Income Tax Expense (30%) 282,177.99

Net Income after Tax: 658,415.32

Assumptions:

1. Sales increase 12% in 2022

2. Cost of goods sold increase 12% in 2022

3. Freight-out increase 10% in 2022

4. Supplies expense increases 5% in 2022

5. Additional 15,000.00 fee annually for FDA. (taxes and licenses)

Sweets Creation

Income Statement

For the year ended December 31, 2022

Sales 3.020,875.20

Less: Cost of Goods Sold 539,414.40

Gross Profit 2,481,460.80

Less: Operating Expense

Supplies Expense 564,339.67

Freight-out 75,900.00

Taxes and License Expense 105,626.26

Utilities Expense 58,788.00

Advertising Expense 5,000.00

Salaries Expense 239,236.00

Payroll Expense 19,964.00

Rent Expense 120,000.00

Depreciation Expense - Equipment 37,495.00

Depreciation Expense – Furniture & Fixtures 4,490.00

Depreciation Expense – Vehicle 45,000.00 1,275,838.93

Net Income before tax 1,205,621.87

Less: Income Tax Expense (30%) 361,686.56

Net Income after Tax: 843,933.31

Assumptions:

1. Sales increase 15% in 2023

2. Cost of goods sold increase 15% in 2023

3. Freight-out increase 15% in 2023

4. Supplies expense increases 7% in 2023

5. Additional 15,000.00 fee annually for FDA. (taxes and licenses)

You might also like

- Strategic Healthcare Management Planning and Execution Second Edition Full ChapterDocument38 pagesStrategic Healthcare Management Planning and Execution Second Edition Full Chapterbobby.theiss375100% (26)

- ABC CompanyDocument7 pagesABC CompanyLouise Kyla CabreraNo ratings yet

- BuenaventuraEJ BSA1B Problem1,2,4.Document8 pagesBuenaventuraEJ BSA1B Problem1,2,4.Anonn75% (4)

- Case-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - FranciscoDocument10 pagesCase-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - Franciscoabigail franciscoNo ratings yet

- اسئلة انترفيو محاسبة عربي وانجليزىDocument22 pagesاسئلة انترفيو محاسبة عربي وانجليزىmustafa1001No ratings yet

- Management and Leadership Theories Coca ColaDocument19 pagesManagement and Leadership Theories Coca ColaMUHAMMAD RAZINNo ratings yet

- Contracts 616, Assignment#6, Feugueng 8460Document6 pagesContracts 616, Assignment#6, Feugueng 8460Michel Aaron FeuguengNo ratings yet

- Questions and Answers PPEDocument3 pagesQuestions and Answers PPEhoneyjoy salapantan100% (1)

- Sophie Financial StatementsDocument6 pagesSophie Financial Statementscarl fuerzasNo ratings yet

- Pre Operating Cash FlowDocument43 pagesPre Operating Cash FlowCamille ManalastasNo ratings yet

- SCI - Unit TestDocument5 pagesSCI - Unit TestRaymond RocoNo ratings yet

- ROCO - SCI Unit TestDocument9 pagesROCO - SCI Unit TestRaymond Roco100% (1)

- Musanity Financial StatementsDocument20 pagesMusanity Financial StatementsRenelyn DavidNo ratings yet

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- Sample Income Statement ManufacturingDocument1 pageSample Income Statement ManufacturingIrish Kit SarmientoNo ratings yet

- Jawaban E4.11Document2 pagesJawaban E4.11Muhammad RafiNo ratings yet

- Financial TTDocument4 pagesFinancial TTJamilexNo ratings yet

- FS Group 2Document5 pagesFS Group 2Ge-Ann BonuanNo ratings yet

- Financial Statements FinalssssssDocument5 pagesFinancial Statements FinalssssssHelping Five (H5)No ratings yet

- Kid'S Bloom Projected Income Statement For The Year Ended December 31Document3 pagesKid'S Bloom Projected Income Statement For The Year Ended December 31Myrose De La PeñaNo ratings yet

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- 03 Activity 1 ARGDocument2 pages03 Activity 1 ARGIvan CutiamNo ratings yet

- Data For ExamDocument6 pagesData For Examlerrin.mathew33No ratings yet

- NRG AUTO LIMITED-5-Year-Financial-PlanDocument21 pagesNRG AUTO LIMITED-5-Year-Financial-Plandariaivanov25No ratings yet

- Financial Study: Projected CostDocument5 pagesFinancial Study: Projected CostRamir SamonNo ratings yet

- Financial Analysis of Bestway Cement: Management AccountingDocument9 pagesFinancial Analysis of Bestway Cement: Management AccountingsohaibmaqboolNo ratings yet

- Answer W8 - As5 CashflowDocument2 pagesAnswer W8 - As5 CashflowJere Mae MarananNo ratings yet

- FinmanDocument4 pagesFinmanAngel ToribioNo ratings yet

- BFAR Chap 8 Prob 8 Accounting Cycle of A Merchandising BusinessDocument2 pagesBFAR Chap 8 Prob 8 Accounting Cycle of A Merchandising Businessscryx bloodNo ratings yet

- SCI Comprehensive Problem ABC CorpDocument1 pageSCI Comprehensive Problem ABC CorpAj BarbaNo ratings yet

- Preparation of Individual Income Tax Return For Mixed Income EarnerDocument3 pagesPreparation of Individual Income Tax Return For Mixed Income Earnercarl patNo ratings yet

- Income Statement Iremart2021v2Document4 pagesIncome Statement Iremart2021v2Dv AccountingNo ratings yet

- Acctg SCIoutput FundamentalsDocument2 pagesAcctg SCIoutput FundamentalsSaeym SegoviaNo ratings yet

- FS Financial StudyDocument6 pagesFS Financial StudyMarina AbanNo ratings yet

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Document5 pagesJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezNo ratings yet

- FS (1) - CFDocument12 pagesFS (1) - CFJessybel BanaganNo ratings yet

- Latihan Soal 1Document1 pageLatihan Soal 1Anggraeni AyuningtyasNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- Income-Statement - RAFDocument5 pagesIncome-Statement - RAFTushar M. TareqNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- V. Financial Feasibility StudyDocument14 pagesV. Financial Feasibility StudyEumar FabruadaNo ratings yet

- INCOTAXDocument4 pagesINCOTAXnicole bancoroNo ratings yet

- Key Metrics Sales ForecastingDocument1 pageKey Metrics Sales ForecastingAlcedo Karen R.No ratings yet

- Excel 1 ConsolidationDocument8 pagesExcel 1 Consolidationanushree sarpotdarNo ratings yet

- FabmDocument1 pageFabmRegene SoledadNo ratings yet

- Solution Problem 1Document6 pagesSolution Problem 1Michelle Joy Nuyad-PantinopleNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Problem Solving 1: RequirementsDocument4 pagesProblem Solving 1: RequirementsMariz TimarioNo ratings yet

- Activity 3 (New)Document3 pagesActivity 3 (New)Sharina Mhyca SamonteNo ratings yet

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNo ratings yet

- Balik Tanaw Café Projected Statement of Comprehensive Income For The Years Ended December 31, 2019-2023Document3 pagesBalik Tanaw Café Projected Statement of Comprehensive Income For The Years Ended December 31, 2019-2023Karl Stephen MarbellaNo ratings yet

- Maxiclean FinaleDocument36 pagesMaxiclean FinaleAngeline MicuaNo ratings yet

- Capital AllowanceDocument2 pagesCapital AllowanceBhanumati BhunjunNo ratings yet

- University of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceDocument16 pagesUniversity of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceKarla OñasNo ratings yet

- Financial Statements of FSDocument76 pagesFinancial Statements of FScarl fuerzasNo ratings yet

- Telchi Litel Ltda Eeff 2021Document3 pagesTelchi Litel Ltda Eeff 2021Info Riskma SolutionsNo ratings yet

- Full Download Solutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210 PDF Full ChapterDocument36 pagesFull Download Solutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210 PDF Full Chapterpolelessfeck8avz100% (20)

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintAbhay Kumar SinghNo ratings yet

- CH 4 Brief Exercises 16th PDFDocument18 pagesCH 4 Brief Exercises 16th PDFNiken PurwantyNo ratings yet

- Financial Plann Blisspad. DocsDocument6 pagesFinancial Plann Blisspad. Docsshanemarcopadigos93No ratings yet

- Pajak Rizki Rahmat Putra - 20AP2Document9 pagesPajak Rizki Rahmat Putra - 20AP2Alviana RenoNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Quize 14Document15 pagesQuize 14Daniella Mae ElipNo ratings yet

- Week1 IntAcc2 ANSWER KEY PDFDocument5 pagesWeek1 IntAcc2 ANSWER KEY PDFDaniella Mae ElipNo ratings yet

- This Study Resource Was: 1. Damon Is The Lessee in Connection With A Type A Lease. Under The New ASU, Damon WouldDocument4 pagesThis Study Resource Was: 1. Damon Is The Lessee in Connection With A Type A Lease. Under The New ASU, Damon WouldDaniella Mae ElipNo ratings yet

- D) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDocument5 pagesD) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDaniella Mae ElipNo ratings yet

- Chapter 2: Statement of Financial Position Statement of Financial PositionDocument16 pagesChapter 2: Statement of Financial Position Statement of Financial PositionDaniella Mae ElipNo ratings yet

- Balance Sheet and Statement of Cash Flows: True-FalseDocument45 pagesBalance Sheet and Statement of Cash Flows: True-FalseDaniella Mae ElipNo ratings yet

- Jocelle: Howard: JocelleDocument3 pagesJocelle: Howard: JocelleDaniella Mae ElipNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- Deciding Timely Replenishment of StocksDocument2 pagesDeciding Timely Replenishment of StocksDaniella Mae ElipNo ratings yet

- INFODocument6 pagesINFODaniella Mae ElipNo ratings yet

- Reviewer in Theory of Accounts Multiple ChoiceDocument17 pagesReviewer in Theory of Accounts Multiple ChoiceDaniella Mae ElipNo ratings yet

- Executive Summary (Operational Plan)Document1 pageExecutive Summary (Operational Plan)Daniella Mae ElipNo ratings yet

- IA 1 and 2 - Midterm Quiz - Student FileDocument21 pagesIA 1 and 2 - Midterm Quiz - Student FileDaniella Mae ElipNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument171 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNo ratings yet

- IA1 - Midterm ExamDocument25 pagesIA1 - Midterm ExamDaniella Mae ElipNo ratings yet

- Responsibility AccountingDocument15 pagesResponsibility Accountingnishashetty2022No ratings yet

- 10 Pitfalls of SRMDocument1 page10 Pitfalls of SRMCosmos AfagachieNo ratings yet

- 7.0 RujukanDocument3 pages7.0 RujukanLim JiazhengNo ratings yet

- Question Bank Digital MarketingDocument9 pagesQuestion Bank Digital Marketingismaileyyad00No ratings yet

- Test Bank MaDocument392 pagesTest Bank MaPhước NguyễnNo ratings yet

- Service Quality and Customer Satisfaction in The Pay TV Industry: A Case Study of Multichoice Zambia LimitedDocument6 pagesService Quality and Customer Satisfaction in The Pay TV Industry: A Case Study of Multichoice Zambia LimitedNowshin FarhinNo ratings yet

- Hotel Details Check in Check Out Rooms: Guest Name: DateDocument1 pageHotel Details Check in Check Out Rooms: Guest Name: DatePrasanth JNo ratings yet

- GeM Bidding 2336932Document4 pagesGeM Bidding 2336932Vijay RauljiNo ratings yet

- Objectives - : BCG Matrix For FlipkartDocument11 pagesObjectives - : BCG Matrix For FlipkartrameshNo ratings yet

- Audit ReportDocument33 pagesAudit ReportShinosuke ExtendezNo ratings yet

- Roland Berger Building Industry WinnersDocument32 pagesRoland Berger Building Industry WinnersbranerNo ratings yet

- A) Business ObjectivesDocument4 pagesA) Business ObjectivesAnoushaNo ratings yet

- Seatwork No. 1 - Error Correction, Changes in Accounting Policies and Changes in Accounting EstimatesDocument1 pageSeatwork No. 1 - Error Correction, Changes in Accounting Policies and Changes in Accounting EstimatesAaron MañacapNo ratings yet

- Ifrs 12 Disclosure of Interests in Other Entities SummaryDocument7 pagesIfrs 12 Disclosure of Interests in Other Entities SummaryajejeNo ratings yet

- Cash Flows From Operating Activities (Indirect Method) : Net Profit/Loss Before Tax and Extraordinary ItemsDocument13 pagesCash Flows From Operating Activities (Indirect Method) : Net Profit/Loss Before Tax and Extraordinary ItemsALEKHYA BANERJEENo ratings yet

- Yojana: KurukshetraDocument63 pagesYojana: KurukshetraSatria KegelapanNo ratings yet

- Reference MaterialDocument16 pagesReference MaterialJaiPawanChandhNo ratings yet

- Bus Ethics - Module 7 - Major Ethical Issues in The Corporate WorldDocument6 pagesBus Ethics - Module 7 - Major Ethical Issues in The Corporate WorldKJ Jones100% (1)

- Sep 22Document1 pageSep 22krishna tiwari (OHRWA TM)No ratings yet

- Challenges and Solutions For Marketing in A Digital EraDocument13 pagesChallenges and Solutions For Marketing in A Digital EraPaul BernardNo ratings yet

- What If Marvel Enter DCDocument15 pagesWhat If Marvel Enter DCJust EVILNo ratings yet

- Mid Term FCGDocument10 pagesMid Term FCGSharjeelNo ratings yet

- Mohammed Shaban, M.SC., PMP®: About MeDocument3 pagesMohammed Shaban, M.SC., PMP®: About MeMohammed ShabanNo ratings yet

- Nig BankDocument4 pagesNig BankFakz OlaNo ratings yet

- Cloud Computing Final 3Document14 pagesCloud Computing Final 3VaishnaviNo ratings yet