Professional Documents

Culture Documents

Consumption Tax Is A Tax Level Upon Businesses

Consumption Tax Is A Tax Level Upon Businesses

Uploaded by

Sophia Keratin0 ratings0% found this document useful (0 votes)

15 views1 pageConsumption tax is a tax levied on businesses based on purchases, which are a form of consumption. As a tax on consumption, it effectively causes all residents of a state or country to pay tax based on their consumption of goods and services. Consumption tax is considered more consistent with the ability to pay theory of taxation than the benefit received theory.

Original Description:

INCOME TAX

Original Title

Consumption Tax is a Tax Level Upon Businesses

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentConsumption tax is a tax levied on businesses based on purchases, which are a form of consumption. As a tax on consumption, it effectively causes all residents of a state or country to pay tax based on their consumption of goods and services. Consumption tax is considered more consistent with the ability to pay theory of taxation than the benefit received theory.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views1 pageConsumption Tax Is A Tax Level Upon Businesses

Consumption Tax Is A Tax Level Upon Businesses

Uploaded by

Sophia KeratinConsumption tax is a tax levied on businesses based on purchases, which are a form of consumption. As a tax on consumption, it effectively causes all residents of a state or country to pay tax based on their consumption of goods and services. Consumption tax is considered more consistent with the ability to pay theory of taxation than the benefit received theory.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

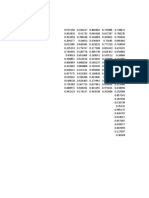

1. Consumption tax is a tax level upon businesses.

2. A purchase is a form of consumption.

3. A tax on consumption is the acquisition will effectively causes all residents of the state to pay

tax.

4. Consumption is the acquisition or utilization of goods and services.

5. Income tax is based on the taxpayer's capacity to sacrifice for the support of the government.

6. Consumption tax is more consistent with the " ability to pay " theory rather that the ' Benefit

received' theory.

7. A tax on consumption would support savings initiative.

8. Consumption taxes should not apply to basic necessities.

9. Both domestic consumption and foreign consumption are subject to tax

10. Resident seller shall pay consumption tax on foreign consumption.

11. Non-resident seller are exempt from consumption taxes on their domestic sales.

12. The sale by non-resident persons abroad is subject to Philippine consumption tax.

13. The utilization or consumption of goods or services shall be taxable in their country

14. The sale by non0resident persons in the Philippines is exempt from consumption tax.

15. The sale by resident in the Philippines is subject to consumption tax.

16. The consumption tax for purchases of goods or services from foreign sources shall be payable by

the buyer.

17. Business tax is a form of consumption tax.

18. Consumption tax is a form of business tax.

19. Business tax is imposed on the sales of sellers which is the purchase made by buyers.

20. The VAT on importation is payable only by those regularly engaged in trade or business

You might also like

- TAX 2 ExercisesDocument22 pagesTAX 2 ExercisesWinter Summer50% (4)

- Income TaxationDocument211 pagesIncome Taxationfritz100% (2)

- Principles and Practice of Taxation Lecture NotesDocument20 pagesPrinciples and Practice of Taxation Lecture NotesSony Axle100% (11)

- General Principles of Income Taxation in The PhilippinesDocument2 pagesGeneral Principles of Income Taxation in The PhilippinesCrystal Bennett100% (1)

- Tax Banggawan2019 Ch.15-ADocument12 pagesTax Banggawan2019 Ch.15-ANoreen LeddaNo ratings yet

- Income TaxationDocument211 pagesIncome Taxationfritz100% (5)

- Final Exam - VAT With QuestionsDocument6 pagesFinal Exam - VAT With Questionsjanus lopez100% (1)

- Business and Transfer Taxation - T or FDocument3 pagesBusiness and Transfer Taxation - T or FEuli Mae SomeraNo ratings yet

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- Principles of TaxDocument46 pagesPrinciples of TaxPASCUA, ROWENA V.No ratings yet

- Fundamental Concepts of Individual Income TaxationDocument43 pagesFundamental Concepts of Individual Income TaxationLawrence Ting100% (1)

- Business and Transfer TaxationDocument16 pagesBusiness and Transfer TaxationEuli Mae SomeraNo ratings yet

- Income TaxationDocument27 pagesIncome TaxationAries Gonzales CaraganNo ratings yet

- Income Taxation Second QuizDocument1 pageIncome Taxation Second Quizkim mindoroNo ratings yet

- Bmtax CompilationDocument50 pagesBmtax CompilationMarco Alexander O. AgtagNo ratings yet

- Bustax TheoriesDocument90 pagesBustax TheoriesMary Angel EscañoNo ratings yet

- National TaxDocument6 pagesNational TaxRoi RimasNo ratings yet

- Tax ComplianceDocument1 pageTax ComplianceAnj CuregNo ratings yet

- Week 3: Principles of Income TaxDocument13 pagesWeek 3: Principles of Income TaxMariah ConcepcionNo ratings yet

- Income and Business Taxation: GradeDocument9 pagesIncome and Business Taxation: GradeTinny Casana100% (1)

- Income TaxationDocument220 pagesIncome TaxationJoanna RojoNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationAntonioGloriaComiqueNo ratings yet

- Review of Income Tax Reporting For Individuals & Corporate TaxpayersDocument159 pagesReview of Income Tax Reporting For Individuals & Corporate TaxpayersRyan Christian BalanquitNo ratings yet

- Điền từDocument4 pagesĐiền từMai ĐàoNo ratings yet

- Drill 1-3 With AnswerDocument76 pagesDrill 1-3 With AnswerELISHA OCAMPONo ratings yet

- Consumption TaxesDocument9 pagesConsumption TaxesmarielNo ratings yet

- Quiz 2 Tax Answer KeyDocument1 pageQuiz 2 Tax Answer KeyRozuel BibalNo ratings yet

- Facilities and Protection: Lifeblood DoctrineDocument4 pagesFacilities and Protection: Lifeblood DoctrineKayelaine RollonNo ratings yet

- TAX ReviewerDocument77 pagesTAX ReviewerMark AloysiusNo ratings yet

- Lesson 11 Income and Business TaxationDocument51 pagesLesson 11 Income and Business TaxationGelai BatadNo ratings yet

- English For Finance, AOFDocument14 pagesEnglish For Finance, AOFLinh NguyenNo ratings yet

- Lesson 4.2 - TAXATION INCOMEDocument4 pagesLesson 4.2 - TAXATION INCOMEIshi MaxineNo ratings yet

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesRieva Jean Pacina100% (1)

- Lesson 6Document6 pagesLesson 6Iris Lavigne RojoNo ratings yet

- VAT ReviewerDocument3 pagesVAT ReviewerCJ LopezNo ratings yet

- TAX-Chap 2-3 Question and AnswerDocument9 pagesTAX-Chap 2-3 Question and AnswerPoison Ivy0% (1)

- Scope and Limitation of TaxationDocument2 pagesScope and Limitation of TaxationBianca Viel Tombo CaligaganNo ratings yet

- Module 6 Income TaxationDocument11 pagesModule 6 Income Taxationtabarnerorene17No ratings yet

- Taxation 1Document11 pagesTaxation 1graciaNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- ObliCon ReviewerDocument8 pagesObliCon ReviewerRaymark MejiaNo ratings yet

- Income Taxation 1Document54 pagesIncome Taxation 1dffaurilloNo ratings yet

- Written ReportDocument4 pagesWritten ReportCassius NicholeNo ratings yet

- Public Finance and Fiscal PolicyDocument51 pagesPublic Finance and Fiscal PolicyWASSWA ALEXNo ratings yet

- What Is Taxation AutosavedDocument7 pagesWhat Is Taxation AutosavedMila Casandra CastañedaNo ratings yet

- MamalateoDocument12 pagesMamalateoKim Orven M. SolonNo ratings yet

- EconomicDocument3 pagesEconomicpamelNo ratings yet

- Income Taxation Chapter 1Document3 pagesIncome Taxation Chapter 1Armalyn CangqueNo ratings yet

- 2.2 - Aggregate Demand, Aggregate Supply and Macroeconomic EquilibriumDocument10 pages2.2 - Aggregate Demand, Aggregate Supply and Macroeconomic Equilibriumom sawantNo ratings yet

- General Principles of Taxation - Sample CasesDocument2 pagesGeneral Principles of Taxation - Sample CasesJace Tanaya100% (1)

- Module 4 Lesson 10 Taxation Read... in Phil. His.Document5 pagesModule 4 Lesson 10 Taxation Read... in Phil. His.John Mark Candeluna EreniaNo ratings yet

- Notes On The Consumer Protection Act 2007Document2 pagesNotes On The Consumer Protection Act 2007api-207606282No ratings yet

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- The Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsFrom EverandThe Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsRating: 5 out of 5 stars5/5 (1)

- 7Document2 pages7Sophia KeratinNo ratings yet

- ThreeDocument2 pagesThreeSophia KeratinNo ratings yet

- 13Document2 pages13Sophia KeratinNo ratings yet

- Upload 5Document1 pageUpload 5Sophia KeratinNo ratings yet

- 4Document2 pages4Sophia KeratinNo ratings yet

- 2Document6 pages2Sophia KeratinNo ratings yet

- Upload 1Document2 pagesUpload 1Sophia KeratinNo ratings yet

- 3Document2 pages3Sophia KeratinNo ratings yet

- Upload 4Document4 pagesUpload 4Sophia KeratinNo ratings yet

- Upload 2Document6 pagesUpload 2Sophia KeratinNo ratings yet

- Business Tax Quiz 3Document1 pageBusiness Tax Quiz 3Sophia KeratinNo ratings yet

- Upload 3Document6 pagesUpload 3Sophia KeratinNo ratings yet

- Chapter 1: Introduction To TaxationDocument2 pagesChapter 1: Introduction To TaxationSophia KeratinNo ratings yet

- Thor Semiconductor Is An Exporter of Transistors To The United StatesDocument6 pagesThor Semiconductor Is An Exporter of Transistors To The United StatesSophia KeratinNo ratings yet