Professional Documents

Culture Documents

A Louder Voice For China's Private Petroleum Companies

A Louder Voice For China's Private Petroleum Companies

Uploaded by

Decxon LukeCopyright:

Available Formats

You might also like

- Free Petroleum Engineering Books PDFDocument2 pagesFree Petroleum Engineering Books PDFPaulaNo ratings yet

- Analysis of The Triton Oil ScandalDocument12 pagesAnalysis of The Triton Oil ScandalBen MudoziNo ratings yet

- Fuel Oils To China: Page 1 of 4Document4 pagesFuel Oils To China: Page 1 of 4Michael HeongNo ratings yet

- China's Teapot Refineries Face Regulatory Challenges: 26 October 2012Document3 pagesChina's Teapot Refineries Face Regulatory Challenges: 26 October 2012Bhagoo HatheyNo ratings yet

- China Corruption IndonesiaDocument5 pagesChina Corruption IndonesiaLawrence SunNo ratings yet

- The Top 10 Oil & Gas Companies in The World - 2019 - Oil & Gas IQDocument5 pagesThe Top 10 Oil & Gas Companies in The World - 2019 - Oil & Gas IQOxaLic AcidNo ratings yet

- Preamble: Consult Club Industry Profiling-PetroleumDocument5 pagesPreamble: Consult Club Industry Profiling-PetroleumvikaspisalNo ratings yet

- The Strategy of Sinochem Group Oil and Gas ResourceDocument20 pagesThe Strategy of Sinochem Group Oil and Gas ResourceQingming MaNo ratings yet

- OBUDocument30 pagesOBUYanhong Zhao0% (1)

- Oil and Gas Company ProfileDocument3 pagesOil and Gas Company ProfileLeo DoeNo ratings yet

- The Future of Asian RefiningDocument4 pagesThe Future of Asian Refiningponmanikandan1No ratings yet

- Chinesesoftpower Chap7Document6 pagesChinesesoftpower Chap7Conference CoordinatorNo ratings yet

- Petron Terminal PaperDocument19 pagesPetron Terminal PaperKamper DanNo ratings yet

- Oligopoly in Oil Refinery IndustryDocument5 pagesOligopoly in Oil Refinery IndustryDokania Anish100% (2)

- Surprising Resilience in Singapore Oil Storage Petroleum EconomistDocument4 pagesSurprising Resilience in Singapore Oil Storage Petroleum EconomistT. LimNo ratings yet

- Petrolimex FTUDocument28 pagesPetrolimex FTUk62.2312950081No ratings yet

- New Seven Sisters: Group 3: Abhishek Kumar Anuj Malviya Mohit Kapoor Ravi Dudeja Stuti SethiDocument33 pagesNew Seven Sisters: Group 3: Abhishek Kumar Anuj Malviya Mohit Kapoor Ravi Dudeja Stuti SethiMohit KapoorNo ratings yet

- Bunker Firms Face Credit Woes in South KoreaDocument1 pageBunker Firms Face Credit Woes in South Koreachiang107No ratings yet

- Industry Analysis of ONGCDocument8 pagesIndustry Analysis of ONGCHarshil ShahNo ratings yet

- Iocl Project AnjuDocument93 pagesIocl Project AnjuKain Anjali100% (4)

- Strengths: Brand EquitiesDocument6 pagesStrengths: Brand EquitiesSHETTY VIRAJNo ratings yet

- PTT Philippines CorporationDocument48 pagesPTT Philippines Corporationdragme2hell14100% (1)

- Summary - English - Petral and PertaminaDocument4 pagesSummary - English - Petral and PertaminaAlex PardinNo ratings yet

- Credit Analysis ProjectDocument7 pagesCredit Analysis ProjectSyed Muhammad Rafay AhmedNo ratings yet

- Nigerian Refineries - Histories, Problems and Possible SolutionDocument17 pagesNigerian Refineries - Histories, Problems and Possible Solutionmexx4u2nvNo ratings yet

- Oil Distribution & Retail 2009Document8 pagesOil Distribution & Retail 2009Jhh BakaNo ratings yet

- Industrial Analysis of PSODocument8 pagesIndustrial Analysis of PSOAkash AliNo ratings yet

- A Grand Report On Working Capital ManagementDocument91 pagesA Grand Report On Working Capital ManagementQuiana CampbellNo ratings yet

- Oil and Gas OverviewDocument5 pagesOil and Gas OverviewKrishna KumarNo ratings yet

- SM Report Group01Document13 pagesSM Report Group01Aninda DuttaNo ratings yet

- Aizaz Home Work 1Document4 pagesAizaz Home Work 1Aizaz MuhammadNo ratings yet

- Globalisation and Indian Petroleum SectorDocument6 pagesGlobalisation and Indian Petroleum SectorishtiaqrasoolNo ratings yet

- ChinaGasReport (Sep2008)Document8 pagesChinaGasReport (Sep2008)An ArNo ratings yet

- MBA OG - III Group No 7 - Global Oil and Gas Industry 2010Document6 pagesMBA OG - III Group No 7 - Global Oil and Gas Industry 2010Rajagopalan IyerNo ratings yet

- Rigged: Who Is Undermining India's National Oil Company?Document16 pagesRigged: Who Is Undermining India's National Oil Company?narayanan_rNo ratings yet

- IntroDocument2 pagesIntroarunsdev10No ratings yet

- 07-09-11 Keystone XL Tar Sands PipelineDocument3 pages07-09-11 Keystone XL Tar Sands PipelineWilliam J GreenbergNo ratings yet

- 2019-01 Future Outlook For Myanma Petrochemical Enterprise (MPE)Document16 pages2019-01 Future Outlook For Myanma Petrochemical Enterprise (MPE)Thitikorn Wassanarpheernphong0% (1)

- Business News Reading For Business English: Unit 2Document2 pagesBusiness News Reading For Business English: Unit 2Cristian J CalderónNo ratings yet

- S+P Venezualan Crude ArticleDocument4 pagesS+P Venezualan Crude ArticleNeil RNo ratings yet

- Aramco Strategic Management PaperDocument9 pagesAramco Strategic Management PaperRaphael Seke OkokoNo ratings yet

- Petroleum IndustryDocument9 pagesPetroleum IndustryKhushbu ShahNo ratings yet

- DTT Oil Gas Reality Check 2012 12511Document24 pagesDTT Oil Gas Reality Check 2012 12511Mariano OrtulanNo ratings yet

- Impact of COVID-19 in Oil Industry: Dr. CA. Nabeel AhmedDocument21 pagesImpact of COVID-19 in Oil Industry: Dr. CA. Nabeel AhmedDr VerdasNo ratings yet

- GAIL India CompanyAnalysis923492384Document11 pagesGAIL India CompanyAnalysis923492384yaiyajieNo ratings yet

- Rigged - The Caravan - A Journal of Politics and Culture PDFDocument12 pagesRigged - The Caravan - A Journal of Politics and Culture PDFduttbishwajeetNo ratings yet

- The Challenge of Crude BlendingDocument8 pagesThe Challenge of Crude Blendingvicktorinox230388100% (1)

- China Shale Block AuctionsDocument2 pagesChina Shale Block AuctionsKuicKReseachNo ratings yet

- Khartoum Refinery Report-1Document8 pagesKhartoum Refinery Report-1محمد ياسر غانمNo ratings yet

- TATAD vs. Sec of DOEDocument17 pagesTATAD vs. Sec of DOEPJANo ratings yet

- Table of Contents:: Page NoDocument42 pagesTable of Contents:: Page NoCh Arslan Bashir67% (3)

- Saudi Arabia: Oil Reserves Production CostsDocument8 pagesSaudi Arabia: Oil Reserves Production CostsYASHNo ratings yet

- CIMA GBC 2015 Case StudyDocument25 pagesCIMA GBC 2015 Case StudyPasanPethiyagodeNo ratings yet

- Oil Gas in MalaysiaDocument24 pagesOil Gas in MalaysialordofindieNo ratings yet

- A Project Report On Cil-Ipo Analysis: Central Coalfields LimitedDocument71 pagesA Project Report On Cil-Ipo Analysis: Central Coalfields LimitedAnkita SharmaNo ratings yet

- Egypt's Refineries - A COMPLETE PICTURE - Egypt Oil & GasDocument8 pagesEgypt's Refineries - A COMPLETE PICTURE - Egypt Oil & GasreemNo ratings yet

- TetreaultDocument14 pagesTetreaultBrian KebatenneNo ratings yet

- Indian Petroleum Industry: Group 8Document20 pagesIndian Petroleum Industry: Group 8Arun Singh SikarwarNo ratings yet

- Future Energy: How the New Oil Industry Will Change People, Politics and PortfoliosFrom EverandFuture Energy: How the New Oil Industry Will Change People, Politics and PortfoliosNo ratings yet

- Pharma Gets The Inscrutable Message: Focus On ChinaDocument2 pagesPharma Gets The Inscrutable Message: Focus On ChinaDecxon LukeNo ratings yet

- 806 FengDocument4 pages806 FengDecxon LukeNo ratings yet

- 795 Sep 07Document2 pages795 Sep 07Decxon LukeNo ratings yet

- 760 ChinaDocument1 page760 ChinaDecxon LukeNo ratings yet

- 767 China FocusDocument3 pages767 China FocusDecxon LukeNo ratings yet

- Daily Schedule: Start Time Time BlocksDocument3 pagesDaily Schedule: Start Time Time BlocksMartinMoooNo ratings yet

- Ecopetrol-CCI Asphalt Market Update - Feb162022Document26 pagesEcopetrol-CCI Asphalt Market Update - Feb162022Fabián Quesada UribeNo ratings yet

- Analogue GAZPROMNEFT Products 2Document44 pagesAnalogue GAZPROMNEFT Products 2batte ondon-ndouhNo ratings yet

- Sampling SystemDocument4 pagesSampling Systemaamer6789No ratings yet

- Indian Oil Corporation: Rural Marketing Fair, JalgaonDocument20 pagesIndian Oil Corporation: Rural Marketing Fair, Jalgaonchandramohan.patelNo ratings yet

- Enhanced Oil Recovery MethodsDocument14 pagesEnhanced Oil Recovery MethodsSuleiman Baruni100% (1)

- PETRONAS 2016pdfDocument129 pagesPETRONAS 2016pdfDisha BatraNo ratings yet

- Nomenclature of BenzeneDocument11 pagesNomenclature of BenzeneNajwa ZhafiraNo ratings yet

- SOGT DevReportDocument43 pagesSOGT DevReportAWFAShop NajwahNo ratings yet

- Aceites Frenadora - TiradoraDocument2 pagesAceites Frenadora - TiradorafranciscotorosazoNo ratings yet

- US Geological Survey The Sirte Basin Province of Libya-Sirte-ZeltenDocument33 pagesUS Geological Survey The Sirte Basin Province of Libya-Sirte-ZeltenSalah ElbakkoushNo ratings yet

- HP Top Project AwardsDocument9 pagesHP Top Project AwardsSterlingNo ratings yet

- Project Outlook 2023 30.12.2022Document10 pagesProject Outlook 2023 30.12.2022Ashish GuptaNo ratings yet

- Oil & Gas BasicsDocument46 pagesOil & Gas Basicsnguyendan81985No ratings yet

- Coefficient of Isothermal Compressibility of Liquid - Organic CompoundsDocument6 pagesCoefficient of Isothermal Compressibility of Liquid - Organic CompoundsJose Antonio CastilloNo ratings yet

- Chapter Three Methods of Advanced Enhanced Oil Recovery (EOR)Document5 pagesChapter Three Methods of Advanced Enhanced Oil Recovery (EOR)Ashraf MohamedNo ratings yet

- Petrobowl Qns - JPT May 2015Document2 pagesPetrobowl Qns - JPT May 2015ZharasShNo ratings yet

- In The Name of God The Merciful The CompassionateDocument47 pagesIn The Name of God The Merciful The CompassionateschifanoNo ratings yet

- Scotraco Oil PipelineDocument1 pageScotraco Oil PipelineSandesh Tukaram GhandatNo ratings yet

- GPN of Oil Assignment - British Petroleum BPDocument2 pagesGPN of Oil Assignment - British Petroleum BPapi-405567065No ratings yet

- Bayla (Las 10)Document7 pagesBayla (Las 10)Zeian Jacob BaylaNo ratings yet

- Crude-to-Chemicals (CTC) : A Straight-Forward Route For A Strategic TurnDocument29 pagesCrude-to-Chemicals (CTC) : A Straight-Forward Route For A Strategic TurnrahulNo ratings yet

- Unit Conversion Factors - RakeshRRDocument4 pagesUnit Conversion Factors - RakeshRRRakesh Roshan RanaNo ratings yet

- Refining Crude Oil History, Process and ProductsDocument4 pagesRefining Crude Oil History, Process and ProductsdevifakeNo ratings yet

- Drilling Deeper: A Reality Check On U.S. Government Forecasts For A Lasting Tight Oil & Shale Gas BoomDocument315 pagesDrilling Deeper: A Reality Check On U.S. Government Forecasts For A Lasting Tight Oil & Shale Gas BoomPost Carbon Institute100% (1)

- Bevo - Mercedes-Benz - Com Bevolisten 229.5 en PDFDocument3 pagesBevo - Mercedes-Benz - Com Bevolisten 229.5 en PDFv_tsoulosNo ratings yet

- Especificaciones Mtu PDFDocument11 pagesEspecificaciones Mtu PDFCeciliagorraNo ratings yet

- Journal FSRU 2Document68 pagesJournal FSRU 2Shah Reza DwiputraNo ratings yet

A Louder Voice For China's Private Petroleum Companies

A Louder Voice For China's Private Petroleum Companies

Uploaded by

Decxon LukeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Louder Voice For China's Private Petroleum Companies

A Louder Voice For China's Private Petroleum Companies

Uploaded by

Decxon LukeCopyright:

Available Formats

focus on china

A louder voice for China’s private

petroleum companies

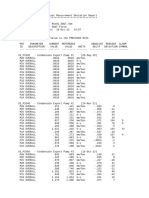

IT IS -18 °C outside at Shangzhi City, which, with strong support from the the central government granted the

Heilongjiang Province. 55-year-old government, are monopolising the three state giants exclusive rights to

Zhu Jun is struggling to walk through industry. oil exploitation, import, export and

the knee-deep snow. He is to check But there is hope that this is wholesale, oil supply has become the

the 130,000 t oil tank, which has about to change, following the bottleneck for nearly every Chinese

been idle for a long time. Ten years establishment of the first petroleum private oil company. This has left

ago, Zhu Jun was still the president of association for China’s private oil private companies to beg for supplies

a petrol station affiliated to Zhujiang firms, the China Chamber of Commerce from the three giants. “Natural

Lu Feng Petroleum, but now his job is simply for the Petroleum Industry (CCCPI), on resources like oil and gas are passed

investigates checking and guarding the company’s 11 December 2004. Nearly 100 private down from our ancestors, and should

oil tank. “It has been two months since companies in up-, mid- and down- be jointly owned by all nationals

how the

we got paid,” said Zhu Jun. Less than streams joined the chamber. and companies. So why should those

first 1 km from the oil tank, Kong Linggui Gong Jialong, president and ceo of resources be restricted only to the three

association is very anxious for the oil supply. In Hubei Tianfa Group and also founder giants?” says an angry Huang Zuping,

1992, Kong Linggui started up Zhujiang and president of the association, says: general manager at Yantai Bajiao Oil

for China’s

Petroleum Company with 300 workers. “We are trying to build a bridge which Company.

private And to date, he has invested more than will not only connect companies and In August, the China Chamber of

oil firms ¥35m ($4.2m), and owns 1 oil tank government, but also tighten the Commerce granted licences for import

and 14 petrol stations. But since 1998, relationship between state giants and export of refined oil products to 15

is going

his company has been in a downward and private firms.” Analysts believe private companies. Two companies even

to change trend. “The main problem is that our that the real purpose of the chamber got the licence for crude oil import and

business oil supplies are low. PetroChina will not is to “boost the fair competition in export. Hubei Tianfa was one of those.

give us oil, since we are competitors.” China’s petroleum industry”, which But even with the licence, private

PetroChina is designated by the is also stipulated in the chamber’s companies find it hard to compete

central government as the sole and constitution. against the giants.

exclusive oil supplier for wholesale and For a long time, China’s private “With current stipulation, chamber

retail businesses in Heilongjiang. But companies in the petroleum industry members cannot exploit crude oil in

as PetroChina itself also has an interest claim they have all been treated with China territory. And although a very

in retail, that makes state-owned oil prejudice and disrespect from the few companies won licences for import

companies and private oil companies three state conglomerates, Sinopec, of crude oil, they are still annoyed

direct competitors in many areas. PetroChina and CNOOC. by the quota limitation, and other

China’s private oil and oil products The problems between China’s questions like storage and logistics,”

companies say this is only one example private oil companies and state says Xia Lei, a senior analyst at China

of the prejudice and discrimination that conglomerates fall into four Chemical Online (CCO). He adds:

China’s private oil companies face from categories. “Although some other members in

the three State-owned conglomerates, The first is oil supply. Since the chamber won licences for import

50 tce march 2005 wcce7 is coming to Glasgow... see www.chemengcongress2005.com

focus on china

and export of refined oil products, State Council state that no private so big. “If they chose to cooperate with

they are straining under the quota petrol station can be set up without us, we could all benefit,” he said.

limitation imposed on them.” In most Sinopec or PetroChina holding In sharp contrast to the two giants’

cases, private companies will not be or buying shares in it. Although, coldness was the extreme warmth from

allocated a quota, making the license according to the Provisional Decision some oil exporters. Ambassadors from

a useless piece of paper. Even for on Market Management of Refined Oil countries including Malaysia, Saudi

those lucky enough to get the quota, Products issued by the Chamber of Arabia, Iraq, Yemen, Bahrain and

it is stipulated that the real import Commerce in December 2004, from the Egypt attended the ceremony, pledging

and export job should be handled by beginning of 2005 it is not necessary to cooperate with CCCPI. The Iraqi

Sinopec or PetroChina (CNOOC is still that the two giants hold or buy shares ambassador Mohammad Ismail said

weak compared with the other two). in newly-built private petrol stations, that China’s private companies were

Also, because the petrol retail some places, however, have passed welcome to cooperate with the Iraqi oil

market is still dominated by the rules or amendments which deter most and gas industry, and would enjoy the

two giants, and more importantly, private companies. same treatment as companies from other

prices for oil products are completely In addition, since China’s wholesale countries. Malaysian ambassador Datuk

regulated and controlled by Sinopec, market for refined oil products will only Abdul Majid Ahmad Khan, representing

PetroChina and the National be opened up to foreign companies at all present ambassadors, said they would

Development and Reform Commission the end of 2006, private petrol stations help institutions and related companies

(NDRC), “it’s really hard for Chinese will need to source their supplies from in their own country cooperate with

private petroleum companies to the Chinese national giants until then. Chinese private oil companies.

compete with the state giants,” says The fourth bone of contention is oil CCCPI is even more ambitious. It

Xia Lei. reserves. China plans to build a 90-day aims to not only fight for its rights in

The second aspect is price. Since strategic oil reserve, which is meant the domestic sector, but has also set

private companies do not have the oil to insulate the country’s economy up a fund with ¥10b for overseas oil

supply and the NDRC only advises on from interruptions in imports. (In exploitation. However, analysts have

price, they have to accept the final the first ten months of 2004, China doubts. Xia Lei said: “¥10b is too small

prices set and controlled by the two imported almost 100m t of crude oil, an amount in oil exploitation. It would

state giants, Sinopec and PetroChina. and is expected to exceed 120m t for be better for this money to be used

For example, the no. 90 fuel, which the whole year.) As private firms are in the capital market and invested in

is most widely used among Chinese excluded from building or operating oil-related financial products.” In fact,

car drivers, is priced at ¥3427/t the four reserve bases, they fear that this is a view shared by many possible

($415) when it comes out of the Sinopec, PetroChina and CNOOC could investors, such as the Zhejiang Haiyue

refinery, but the price goes up to abuse their control should there be a Company, which hesitates to invest in

¥4348 when private companies buy it major crisis such as a war or a natural the fund in light of its small scale.

from PetroChina in Heilongjiang. This disaster. Some others also doubt how far the

27% price increase makes it nearly Compared to the enthusiasm from chamber can go, believing it to be a

impossible for private companies the CCCPI, Sinopec and PetroChina misplaced initiative. An anonymous

and petrol stations to make a profit. appear to be giving the new chamber official from the NDRC says, “Currently,

“For every ton of oil we buy, we lose the short shrift. Neither of them the most important task for the chamber

¥100”, said Kong Linggui. sent representative to attend the is to struggle for a better market

Another bizarre thing is that establishment ceremony, nor did they environment, vigorously protect their

sometimes the wholesale price from comment on it. Officials explain that own rights and try to break up the non-

the two giants is even higher than the establishment of the new chamber market-oriented manipulation of the

the retail price at the petrol stations. is more a symbolic gesture. Zhou Chun, system, instead of talking about this oil

In Jiangxi province, where Sinopec deputy director of the Petroleum and fund thing, which is unrealistic for them

owns over 65% of petrol stations, the Petrochemical Department at the to do now.”

prescribed wholesale price of China Chamber of Commerce of Metals, In any case, CCCPI seems to

no. 90 fuel has been at ¥4400/t since Minerals & Chemicals Importers & understand its current status and

November 2004, while the retail price Exporters (CCCMC), says: “It’s a sign of commission clearly, and has repeated

is fixed at ¥3.6/l. This means that an progress, but the role it’s going to play many times that its relationship to

independent petrol station would lose I think is very minor.” Xia Lei added: the state giants is not competitive

¥0.25–0.3 for every litre it sells. For “In the short term, I don’t see a great but cooperative. Now many of them

no. 93 petrol, the wholesale price is future for the new chamber, since in are anxiously awaiting the coming

¥4900/t, and petrol stations would respect to both government support of December 2006, when China has

lose ¥0.1 per litre sold. As a result, and its own strength, the chamber promised to open up its wholesale

most private petrol stations have is in a disadvantageous position. It’s market for refined oil products. “Then

stopped selling those types of fuel. more of a symbolic gesture than of real foreign oil giants will invade China

Sinopec explains: “International oil importance.” more ferociously, which scares them

prices are rocketing and supply is very But Wang Degang, spokesman of [the state giants] a lot, but we view the

tight. We are doing this out of fear of CCCPI, says that if the two giants look foreign companies as life-savers. Let’s

agents stocking up on oil and making down on them, “they [Sinopec and persist into 2006, I really can see a

the market unstable.” PetroChina] are totally wrong.” He says, bright future,” says Guo Yuzhu, general

The third problem is petrol compared to international oil giants, manager of a private oil company in

stations. Regulations issued by the Sinopec and PetroChina are really not Heilongjiang. ■

wcce7 is coming to Glasgow... see www.chemengcongress2005.com march 2005 tce 51

You might also like

- Free Petroleum Engineering Books PDFDocument2 pagesFree Petroleum Engineering Books PDFPaulaNo ratings yet

- Analysis of The Triton Oil ScandalDocument12 pagesAnalysis of The Triton Oil ScandalBen MudoziNo ratings yet

- Fuel Oils To China: Page 1 of 4Document4 pagesFuel Oils To China: Page 1 of 4Michael HeongNo ratings yet

- China's Teapot Refineries Face Regulatory Challenges: 26 October 2012Document3 pagesChina's Teapot Refineries Face Regulatory Challenges: 26 October 2012Bhagoo HatheyNo ratings yet

- China Corruption IndonesiaDocument5 pagesChina Corruption IndonesiaLawrence SunNo ratings yet

- The Top 10 Oil & Gas Companies in The World - 2019 - Oil & Gas IQDocument5 pagesThe Top 10 Oil & Gas Companies in The World - 2019 - Oil & Gas IQOxaLic AcidNo ratings yet

- Preamble: Consult Club Industry Profiling-PetroleumDocument5 pagesPreamble: Consult Club Industry Profiling-PetroleumvikaspisalNo ratings yet

- The Strategy of Sinochem Group Oil and Gas ResourceDocument20 pagesThe Strategy of Sinochem Group Oil and Gas ResourceQingming MaNo ratings yet

- OBUDocument30 pagesOBUYanhong Zhao0% (1)

- Oil and Gas Company ProfileDocument3 pagesOil and Gas Company ProfileLeo DoeNo ratings yet

- The Future of Asian RefiningDocument4 pagesThe Future of Asian Refiningponmanikandan1No ratings yet

- Chinesesoftpower Chap7Document6 pagesChinesesoftpower Chap7Conference CoordinatorNo ratings yet

- Petron Terminal PaperDocument19 pagesPetron Terminal PaperKamper DanNo ratings yet

- Oligopoly in Oil Refinery IndustryDocument5 pagesOligopoly in Oil Refinery IndustryDokania Anish100% (2)

- Surprising Resilience in Singapore Oil Storage Petroleum EconomistDocument4 pagesSurprising Resilience in Singapore Oil Storage Petroleum EconomistT. LimNo ratings yet

- Petrolimex FTUDocument28 pagesPetrolimex FTUk62.2312950081No ratings yet

- New Seven Sisters: Group 3: Abhishek Kumar Anuj Malviya Mohit Kapoor Ravi Dudeja Stuti SethiDocument33 pagesNew Seven Sisters: Group 3: Abhishek Kumar Anuj Malviya Mohit Kapoor Ravi Dudeja Stuti SethiMohit KapoorNo ratings yet

- Bunker Firms Face Credit Woes in South KoreaDocument1 pageBunker Firms Face Credit Woes in South Koreachiang107No ratings yet

- Industry Analysis of ONGCDocument8 pagesIndustry Analysis of ONGCHarshil ShahNo ratings yet

- Iocl Project AnjuDocument93 pagesIocl Project AnjuKain Anjali100% (4)

- Strengths: Brand EquitiesDocument6 pagesStrengths: Brand EquitiesSHETTY VIRAJNo ratings yet

- PTT Philippines CorporationDocument48 pagesPTT Philippines Corporationdragme2hell14100% (1)

- Summary - English - Petral and PertaminaDocument4 pagesSummary - English - Petral and PertaminaAlex PardinNo ratings yet

- Credit Analysis ProjectDocument7 pagesCredit Analysis ProjectSyed Muhammad Rafay AhmedNo ratings yet

- Nigerian Refineries - Histories, Problems and Possible SolutionDocument17 pagesNigerian Refineries - Histories, Problems and Possible Solutionmexx4u2nvNo ratings yet

- Oil Distribution & Retail 2009Document8 pagesOil Distribution & Retail 2009Jhh BakaNo ratings yet

- Industrial Analysis of PSODocument8 pagesIndustrial Analysis of PSOAkash AliNo ratings yet

- A Grand Report On Working Capital ManagementDocument91 pagesA Grand Report On Working Capital ManagementQuiana CampbellNo ratings yet

- Oil and Gas OverviewDocument5 pagesOil and Gas OverviewKrishna KumarNo ratings yet

- SM Report Group01Document13 pagesSM Report Group01Aninda DuttaNo ratings yet

- Aizaz Home Work 1Document4 pagesAizaz Home Work 1Aizaz MuhammadNo ratings yet

- Globalisation and Indian Petroleum SectorDocument6 pagesGlobalisation and Indian Petroleum SectorishtiaqrasoolNo ratings yet

- ChinaGasReport (Sep2008)Document8 pagesChinaGasReport (Sep2008)An ArNo ratings yet

- MBA OG - III Group No 7 - Global Oil and Gas Industry 2010Document6 pagesMBA OG - III Group No 7 - Global Oil and Gas Industry 2010Rajagopalan IyerNo ratings yet

- Rigged: Who Is Undermining India's National Oil Company?Document16 pagesRigged: Who Is Undermining India's National Oil Company?narayanan_rNo ratings yet

- IntroDocument2 pagesIntroarunsdev10No ratings yet

- 07-09-11 Keystone XL Tar Sands PipelineDocument3 pages07-09-11 Keystone XL Tar Sands PipelineWilliam J GreenbergNo ratings yet

- 2019-01 Future Outlook For Myanma Petrochemical Enterprise (MPE)Document16 pages2019-01 Future Outlook For Myanma Petrochemical Enterprise (MPE)Thitikorn Wassanarpheernphong0% (1)

- Business News Reading For Business English: Unit 2Document2 pagesBusiness News Reading For Business English: Unit 2Cristian J CalderónNo ratings yet

- S+P Venezualan Crude ArticleDocument4 pagesS+P Venezualan Crude ArticleNeil RNo ratings yet

- Aramco Strategic Management PaperDocument9 pagesAramco Strategic Management PaperRaphael Seke OkokoNo ratings yet

- Petroleum IndustryDocument9 pagesPetroleum IndustryKhushbu ShahNo ratings yet

- DTT Oil Gas Reality Check 2012 12511Document24 pagesDTT Oil Gas Reality Check 2012 12511Mariano OrtulanNo ratings yet

- Impact of COVID-19 in Oil Industry: Dr. CA. Nabeel AhmedDocument21 pagesImpact of COVID-19 in Oil Industry: Dr. CA. Nabeel AhmedDr VerdasNo ratings yet

- GAIL India CompanyAnalysis923492384Document11 pagesGAIL India CompanyAnalysis923492384yaiyajieNo ratings yet

- Rigged - The Caravan - A Journal of Politics and Culture PDFDocument12 pagesRigged - The Caravan - A Journal of Politics and Culture PDFduttbishwajeetNo ratings yet

- The Challenge of Crude BlendingDocument8 pagesThe Challenge of Crude Blendingvicktorinox230388100% (1)

- China Shale Block AuctionsDocument2 pagesChina Shale Block AuctionsKuicKReseachNo ratings yet

- Khartoum Refinery Report-1Document8 pagesKhartoum Refinery Report-1محمد ياسر غانمNo ratings yet

- TATAD vs. Sec of DOEDocument17 pagesTATAD vs. Sec of DOEPJANo ratings yet

- Table of Contents:: Page NoDocument42 pagesTable of Contents:: Page NoCh Arslan Bashir67% (3)

- Saudi Arabia: Oil Reserves Production CostsDocument8 pagesSaudi Arabia: Oil Reserves Production CostsYASHNo ratings yet

- CIMA GBC 2015 Case StudyDocument25 pagesCIMA GBC 2015 Case StudyPasanPethiyagodeNo ratings yet

- Oil Gas in MalaysiaDocument24 pagesOil Gas in MalaysialordofindieNo ratings yet

- A Project Report On Cil-Ipo Analysis: Central Coalfields LimitedDocument71 pagesA Project Report On Cil-Ipo Analysis: Central Coalfields LimitedAnkita SharmaNo ratings yet

- Egypt's Refineries - A COMPLETE PICTURE - Egypt Oil & GasDocument8 pagesEgypt's Refineries - A COMPLETE PICTURE - Egypt Oil & GasreemNo ratings yet

- TetreaultDocument14 pagesTetreaultBrian KebatenneNo ratings yet

- Indian Petroleum Industry: Group 8Document20 pagesIndian Petroleum Industry: Group 8Arun Singh SikarwarNo ratings yet

- Future Energy: How the New Oil Industry Will Change People, Politics and PortfoliosFrom EverandFuture Energy: How the New Oil Industry Will Change People, Politics and PortfoliosNo ratings yet

- Pharma Gets The Inscrutable Message: Focus On ChinaDocument2 pagesPharma Gets The Inscrutable Message: Focus On ChinaDecxon LukeNo ratings yet

- 806 FengDocument4 pages806 FengDecxon LukeNo ratings yet

- 795 Sep 07Document2 pages795 Sep 07Decxon LukeNo ratings yet

- 760 ChinaDocument1 page760 ChinaDecxon LukeNo ratings yet

- 767 China FocusDocument3 pages767 China FocusDecxon LukeNo ratings yet

- Daily Schedule: Start Time Time BlocksDocument3 pagesDaily Schedule: Start Time Time BlocksMartinMoooNo ratings yet

- Ecopetrol-CCI Asphalt Market Update - Feb162022Document26 pagesEcopetrol-CCI Asphalt Market Update - Feb162022Fabián Quesada UribeNo ratings yet

- Analogue GAZPROMNEFT Products 2Document44 pagesAnalogue GAZPROMNEFT Products 2batte ondon-ndouhNo ratings yet

- Sampling SystemDocument4 pagesSampling Systemaamer6789No ratings yet

- Indian Oil Corporation: Rural Marketing Fair, JalgaonDocument20 pagesIndian Oil Corporation: Rural Marketing Fair, Jalgaonchandramohan.patelNo ratings yet

- Enhanced Oil Recovery MethodsDocument14 pagesEnhanced Oil Recovery MethodsSuleiman Baruni100% (1)

- PETRONAS 2016pdfDocument129 pagesPETRONAS 2016pdfDisha BatraNo ratings yet

- Nomenclature of BenzeneDocument11 pagesNomenclature of BenzeneNajwa ZhafiraNo ratings yet

- SOGT DevReportDocument43 pagesSOGT DevReportAWFAShop NajwahNo ratings yet

- Aceites Frenadora - TiradoraDocument2 pagesAceites Frenadora - TiradorafranciscotorosazoNo ratings yet

- US Geological Survey The Sirte Basin Province of Libya-Sirte-ZeltenDocument33 pagesUS Geological Survey The Sirte Basin Province of Libya-Sirte-ZeltenSalah ElbakkoushNo ratings yet

- HP Top Project AwardsDocument9 pagesHP Top Project AwardsSterlingNo ratings yet

- Project Outlook 2023 30.12.2022Document10 pagesProject Outlook 2023 30.12.2022Ashish GuptaNo ratings yet

- Oil & Gas BasicsDocument46 pagesOil & Gas Basicsnguyendan81985No ratings yet

- Coefficient of Isothermal Compressibility of Liquid - Organic CompoundsDocument6 pagesCoefficient of Isothermal Compressibility of Liquid - Organic CompoundsJose Antonio CastilloNo ratings yet

- Chapter Three Methods of Advanced Enhanced Oil Recovery (EOR)Document5 pagesChapter Three Methods of Advanced Enhanced Oil Recovery (EOR)Ashraf MohamedNo ratings yet

- Petrobowl Qns - JPT May 2015Document2 pagesPetrobowl Qns - JPT May 2015ZharasShNo ratings yet

- In The Name of God The Merciful The CompassionateDocument47 pagesIn The Name of God The Merciful The CompassionateschifanoNo ratings yet

- Scotraco Oil PipelineDocument1 pageScotraco Oil PipelineSandesh Tukaram GhandatNo ratings yet

- GPN of Oil Assignment - British Petroleum BPDocument2 pagesGPN of Oil Assignment - British Petroleum BPapi-405567065No ratings yet

- Bayla (Las 10)Document7 pagesBayla (Las 10)Zeian Jacob BaylaNo ratings yet

- Crude-to-Chemicals (CTC) : A Straight-Forward Route For A Strategic TurnDocument29 pagesCrude-to-Chemicals (CTC) : A Straight-Forward Route For A Strategic TurnrahulNo ratings yet

- Unit Conversion Factors - RakeshRRDocument4 pagesUnit Conversion Factors - RakeshRRRakesh Roshan RanaNo ratings yet

- Refining Crude Oil History, Process and ProductsDocument4 pagesRefining Crude Oil History, Process and ProductsdevifakeNo ratings yet

- Drilling Deeper: A Reality Check On U.S. Government Forecasts For A Lasting Tight Oil & Shale Gas BoomDocument315 pagesDrilling Deeper: A Reality Check On U.S. Government Forecasts For A Lasting Tight Oil & Shale Gas BoomPost Carbon Institute100% (1)

- Bevo - Mercedes-Benz - Com Bevolisten 229.5 en PDFDocument3 pagesBevo - Mercedes-Benz - Com Bevolisten 229.5 en PDFv_tsoulosNo ratings yet

- Especificaciones Mtu PDFDocument11 pagesEspecificaciones Mtu PDFCeciliagorraNo ratings yet

- Journal FSRU 2Document68 pagesJournal FSRU 2Shah Reza DwiputraNo ratings yet