Professional Documents

Culture Documents

CASE STUDY-The Curious Corporal Dilemma of Harshad Mehta

CASE STUDY-The Curious Corporal Dilemma of Harshad Mehta

Uploaded by

Aditya Gupta0 ratings0% found this document useful (0 votes)

25 views4 pagesThe vice chairman of Global Synox, a multi-million dollar pharmaceutical company, wanted to remove Dr. Harshad Mehta from his position as chairman. He sued Mehta based on discrepancies in reports and Mehta was forced to resign. Without Mehta's leadership, the company started to struggle financially and lost many employees. It was later revealed that the vice chairman had conspired with Mehta's cousin to undermine the company for their own gain. Mehta was considering leaving to focus on another company he had funded, but employees wanted him to return to Global Synox to help turn things around.

Original Description:

Original Title

FEC (1) (3) (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe vice chairman of Global Synox, a multi-million dollar pharmaceutical company, wanted to remove Dr. Harshad Mehta from his position as chairman. He sued Mehta based on discrepancies in reports and Mehta was forced to resign. Without Mehta's leadership, the company started to struggle financially and lost many employees. It was later revealed that the vice chairman had conspired with Mehta's cousin to undermine the company for their own gain. Mehta was considering leaving to focus on another company he had funded, but employees wanted him to return to Global Synox to help turn things around.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views4 pagesCASE STUDY-The Curious Corporal Dilemma of Harshad Mehta

CASE STUDY-The Curious Corporal Dilemma of Harshad Mehta

Uploaded by

Aditya GuptaThe vice chairman of Global Synox, a multi-million dollar pharmaceutical company, wanted to remove Dr. Harshad Mehta from his position as chairman. He sued Mehta based on discrepancies in reports and Mehta was forced to resign. Without Mehta's leadership, the company started to struggle financially and lost many employees. It was later revealed that the vice chairman had conspired with Mehta's cousin to undermine the company for their own gain. Mehta was considering leaving to focus on another company he had funded, but employees wanted him to return to Global Synox to help turn things around.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

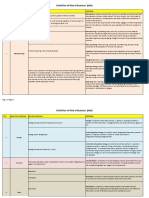

CASE STUDY- The Curious

Corporal Dilemma of Harshad

Mehta

Dr. Harshad Mehta is the Co-founder of Global Synox Neo-

Pharmaceutical solutions and Systems, a multi-million dollar company

whose net worth is an astonishing 500 million USD.

He was the owner as well as the board chairman of the Corporation. The

vice chairman was however in an unexplainable vendetta , a raw rude

and jealous attitude towards Harshad and wanted to remove from the

position of head chairman and wanted to take over both positions and

unify them as the Lead Chairman.

One fine day after observance of the market reports and discrepancies in

some reports by the junior ranking officials , the vice chairman sued Dr.

Harshad in a case of signatured transactions and since all the accounts

of the company linked to Harshad , the board had to unanimously

removed him from his position by an act of resignation compliance by

law . In short window of 22 hours he was put under house arrest and his

financial assets were frozen.

Some of the members/employees knew about this and remained to stay

silent. Collectively the Board of Directors and Vice Chairman were

involved in this power struggle frame.

However after few months , the corporation started to take a turn and

soon their profits started to dip and within 8 months of Harshad being

removed from his position, the company started going into massive

financial blunders , losses calculated upto 1.3 billion Euros and revenue

had fell by 30%.

Around an year had passed away and out of 10 board of directors and 7

financial and 20 technical panelists , only 5 of the board members

remained , most financial panelists and 10 technical panelists had been

fired or had resigned to join the competitor companies . This was a huge

loss to the company’s vision and mission and hurt the morale of the

workers and market customers and corporal dealers.

The individuals who knew about the vice chairman and his dirty tricks,

they approached him and asking him to tell confess everything and

bring back stability in the structure of the company or he and his

company which is in ruins now would go bankrupt .

The naturally adamant and arrogant vice chairman refuses to do it .Then

the other board members threaten him that they would expose his wrong

doing in court of law and he would be terminated as soon as the truth

comes out . The vice chairman still didn’t agree to it as there wasn’t

concrete evidence stating that he was lying.

Backlogs of the company still had blueprints of the ex-Chairman Dr.

Harshad Mehta . Raj Mehta , cousin and competitor in the market and

leader of chain of corporations handling the pharmaceutical monopoly

had been exposed a few months after the house arrest of Harshad to be

involved in backdoor conversation with the Vice Chairman in a slow

boiling scam to scrap away the funds and sell Harshad’s foundation and

corporation , this case is still at halt in the Delhi High Court.

Another dimension to this case is that Vision Med Tech , A corporation

which is a sister organization of Global Synox and is funded by Harshad

Mehta Foundation to serve in the MENA region , is currently still active

and having 90% of fund activation from Harshad’s foundation , if

negotiated and included back would shape some profits in from the

Pacific-Asian region of operation of Global Synox , this would mean

sapping in major profits and decreasing operations in MENA region in a

1 year period .

Plans for the future

So Harshad Mehta decides on the possibility of leading Vision Med

Tech onto greater heights

Meanwhile the employees don’t want Harshad Mehta to leave Global

Synox ,so the manager of human resources and development reaches

out to Harshad Mehta .

The manager fixes a meeting with Harshad Mehta inorder to negotiate

with him for his sudden decision of leaving Global Synox.

A case study by Aditya Karthik Gupta2k19/EC/008

Tushar Pal2k19/CE/130

You might also like

- Answer PDFDocument17 pagesAnswer PDFميلاد نوروزي رهبرNo ratings yet

- Transactional to Transformational Marketing in Pharma: The Science of Why and The Art of HowFrom EverandTransactional to Transformational Marketing in Pharma: The Science of Why and The Art of HowNo ratings yet

- DR Amita Joshi at Samuel Drugs Ltd.Document10 pagesDR Amita Joshi at Samuel Drugs Ltd.Sumit Sinha100% (3)

- Finlatics Research Presentation - Sun Pharma ReportDocument4 pagesFinlatics Research Presentation - Sun Pharma ReportAhana SarkarNo ratings yet

- TEV ReportDocument24 pagesTEV ReportSteven Greene80% (5)

- Hero Honda Demerger SynopsisDocument4 pagesHero Honda Demerger SynopsisYuktesh PawarNo ratings yet

- Assignment For Corporate GovernanceDocument4 pagesAssignment For Corporate GovernanceAmbrose Lim100% (1)

- Republic Act No. 10533Document6 pagesRepublic Act No. 10533Jecky Josette AsentistaNo ratings yet

- CV Europass - EnglezaDocument2 pagesCV Europass - EnglezaAnca PuiaNo ratings yet

- Industrial Disputes Act 1947Document2 pagesIndustrial Disputes Act 1947Jithin Krishnan100% (1)

- Sugar Methodology PDFDocument12 pagesSugar Methodology PDFDeepak DharmarajNo ratings yet

- The Satyam Acquisition by Tech MahindraDocument6 pagesThe Satyam Acquisition by Tech Mahindraabhijit_mandal86No ratings yet

- Employee Retention Management Policy in The IT SectorDocument5 pagesEmployee Retention Management Policy in The IT SectorAshish RamtekeNo ratings yet

- Cin: L24100GJ1984PLC111413Document3 pagesCin: L24100GJ1984PLC111413dipyaman patgiriNo ratings yet

- Sun Pharmaceuticals Case StudyDocument2 pagesSun Pharmaceuticals Case StudyAbhimita Gaine100% (2)

- Corporate Corruption in IndiaDocument16 pagesCorporate Corruption in IndiaNAGARAJA M RNo ratings yet

- Dr. Amita Joshi at Samuel Drugs Limited: Name-Pankaj TiwariDocument8 pagesDr. Amita Joshi at Samuel Drugs Limited: Name-Pankaj Tiwaripankaj tiwariNo ratings yet

- Company LawDocument20 pagesCompany LawHimanshu mishraNo ratings yet

- Hero Honda Demerger SynopsisDocument4 pagesHero Honda Demerger SynopsisSumit KalelkarNo ratings yet

- Equity Research Report For Faugi FoodsDocument17 pagesEquity Research Report For Faugi FoodsIrshad Ali (Father Name:Muhammad Rahim)No ratings yet

- DR Amita Joshi at Samuel Drugs LTDDocument10 pagesDR Amita Joshi at Samuel Drugs LTDGaurav KeswaniNo ratings yet

- Becg Case Study 2Document4 pagesBecg Case Study 2nidhibhopalNo ratings yet

- EntrepreneuerDocument13 pagesEntrepreneuerhasitNo ratings yet

- Business Strategy Case AnalysisDocument5 pagesBusiness Strategy Case AnalysisAnupam SinghNo ratings yet

- Final Ob Ppt-Amita JoshiDocument34 pagesFinal Ob Ppt-Amita JoshiVibhu Sharma100% (1)

- Governance Failure at SatyamDocument19 pagesGovernance Failure at SatyamAnil KardamNo ratings yet

- Current Affairs Capsule - 01Document9 pagesCurrent Affairs Capsule - 01darbha91No ratings yet

- Corporate Governance and Leadership-A Case of Infosys and TATADocument6 pagesCorporate Governance and Leadership-A Case of Infosys and TATASaketNo ratings yet

- StocksDocument3 pagesStocksgopal mundhraNo ratings yet

- Ortrax CaseDocument19 pagesOrtrax CaseanjaliNo ratings yet

- The Naked Truth About Independent DirectorsDocument18 pagesThe Naked Truth About Independent DirectorsmohitshripatNo ratings yet

- Case Study PatchesDocument10 pagesCase Study PatchesParesh Bhimani0% (1)

- Flight of Fund Final ReportDocument16 pagesFlight of Fund Final Reportsafra100% (1)

- ManpasandDocument5 pagesManpasandGautam TandonNo ratings yet

- Corporate Governance and Audit - Project WorkDocument6 pagesCorporate Governance and Audit - Project WorkAshmeet KAur 191398No ratings yet

- Corporate Governance in SatyamDocument6 pagesCorporate Governance in Satyamnishan_patel_3No ratings yet

- Final Paper On Corporate GovernanceDocument6 pagesFinal Paper On Corporate Governancepk61delhiNo ratings yet

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- Failure of Corporate Governance of DHFLDocument4 pagesFailure of Corporate Governance of DHFLs meena arumugamNo ratings yet

- The Composition of The Board of Directors of The Bank Is Governed by The Companies ActDocument2 pagesThe Composition of The Board of Directors of The Bank Is Governed by The Companies ActMahima BehalNo ratings yet

- Organisational Structure StudyDocument46 pagesOrganisational Structure StudyChing SantiagoNo ratings yet

- Organisational Structure StudyDocument49 pagesOrganisational Structure Studymiliya_abrahamNo ratings yet

- Torrent PharmaDocument212 pagesTorrent PharmaBharath NaniNo ratings yet

- Group 8 - TMODocument5 pagesGroup 8 - TMOSULOCHNA KUJURNo ratings yet

- Atlas Honda: June 30, 2013 Quarterly ReportDocument18 pagesAtlas Honda: June 30, 2013 Quarterly ReportAhmed AwanNo ratings yet

- Challenges To Corporate Governance: Issues and Concerns: Rujitha T RDocument6 pagesChallenges To Corporate Governance: Issues and Concerns: Rujitha T Raaditya01No ratings yet

- Athena-Op Ed 3 - W6-Social ResponsibilityDocument2 pagesAthena-Op Ed 3 - W6-Social ResponsibilityInoue JpNo ratings yet

- Moot Case - Aurangabad ActivityDocument2 pagesMoot Case - Aurangabad ActivityBodhisatya DeyNo ratings yet

- Square Pharmacueticals LimitedDocument19 pagesSquare Pharmacueticals Limitedmunazutd100% (2)

- MGT 368 Point No 8Document5 pagesMGT 368 Point No 8TauhidHasanRifatNo ratings yet

- Company Overview: Pfizer Inc. Is An American Multinational Pharmaceutical Corporation Headquartered in New YorkDocument8 pagesCompany Overview: Pfizer Inc. Is An American Multinational Pharmaceutical Corporation Headquartered in New YorkSrinivas NandikantiNo ratings yet

- Term Project: Renata Pharmaceutical's LTDDocument19 pagesTerm Project: Renata Pharmaceutical's LTDHamjaNo ratings yet

- Be - Unit - Types of BusinessDocument40 pagesBe - Unit - Types of BusinessdrashteeNo ratings yet

- Strategyand - Pharma Emerging Markets 2.0 PDFDocument68 pagesStrategyand - Pharma Emerging Markets 2.0 PDFZackyNo ratings yet

- Mehfooz General InsuranceDocument4 pagesMehfooz General InsuranceAre EbaNo ratings yet

- FINLATICS Pfizer Company ProfileDocument9 pagesFINLATICS Pfizer Company ProfileVISHAL GUPTANo ratings yet

- Management - Business OrganisationDocument9 pagesManagement - Business OrganisationSettipalli AamuktaNo ratings yet

- Company LawDocument8 pagesCompany LawMudasir AlamsNo ratings yet

- MBA 501 Assignment 3 Case StudyDocument3 pagesMBA 501 Assignment 3 Case StudyAbhishekSharma0% (1)

- Rameshan 2018Document5 pagesRameshan 2018Fredrick SafariNo ratings yet

- Jayshree SBL PDFDocument5 pagesJayshree SBL PDFs meena arumugamNo ratings yet

- Business Ethics FinalDocument9 pagesBusiness Ethics FinalAnurag SharmaNo ratings yet

- Franchise ProjectDocument3 pagesFranchise ProjectNicollete Limguangco SablaonNo ratings yet

- Sources of Income Summary - ReportDocument12 pagesSources of Income Summary - ReportRoxanne AvilaNo ratings yet

- Tender No. SH/013/2017-2019 For Supply of Cleaning Materials, Detergents and DisinfectantDocument37 pagesTender No. SH/013/2017-2019 For Supply of Cleaning Materials, Detergents and DisinfectantState House Kenya100% (4)

- Definition of Kind of Business (Kob)Document5 pagesDefinition of Kind of Business (Kob)yandexNo ratings yet

- Dailyfx Research: How To Use The FXCM Speculative Sentiment IndexDocument2 pagesDailyfx Research: How To Use The FXCM Speculative Sentiment IndexQuan PhamNo ratings yet

- Asia Pacific Shopping Center Definition Standard Proposal PDFDocument18 pagesAsia Pacific Shopping Center Definition Standard Proposal PDFwitanti nur utamiNo ratings yet

- I2 Adexa SAPcomparisonDocument21 pagesI2 Adexa SAPcomparisonBalpreet SinghNo ratings yet

- Marketing - Section ADocument15 pagesMarketing - Section AArchana NeppolianNo ratings yet

- Conjoint AnalysisDocument17 pagesConjoint Analysismark david sabellaNo ratings yet

- CH 1 To 8Document4 pagesCH 1 To 8John WickNo ratings yet

- (Form PE) Akhmad Fatah KhudinDocument3 pages(Form PE) Akhmad Fatah KhudinManto Fernando SiagianNo ratings yet

- How To Start Your Business?Document11 pagesHow To Start Your Business?Resti Gamiarsi100% (1)

- Risk Management GameDocument3 pagesRisk Management GameDhanalakshmi ThiyagarajanNo ratings yet

- SachinDocument43 pagesSachinsachin patraNo ratings yet

- Kongunadu College of Engineering and Technology: Quantitative Aptitude PartnershipDocument16 pagesKongunadu College of Engineering and Technology: Quantitative Aptitude PartnershipGnana Prakasam RNo ratings yet

- Khyber City Fee ScheduleDocument2 pagesKhyber City Fee ScheduleMohsin KhanNo ratings yet

- Bank Reconciliation SampleDocument11 pagesBank Reconciliation SampleShaira BaltazarNo ratings yet

- George Robinson CVDocument4 pagesGeorge Robinson CVGeorge RobinsonNo ratings yet

- 11.1valuation of Intellectual Property Assets PDFDocument31 pages11.1valuation of Intellectual Property Assets PDFShivam Anand100% (1)

- 02-05-MILESTONE1TASK2 Back To Envelope CalculationDocument2 pages02-05-MILESTONE1TASK2 Back To Envelope CalculationMuhamad AnnurNo ratings yet

- Christina M. Trujillo Proposal - RedactedDocument12 pagesChristina M. Trujillo Proposal - RedactedL. A. PatersonNo ratings yet

- Professor P Rameshan: Trade: Challenges & Strategies. New Delhi: Excel BooksDocument5 pagesProfessor P Rameshan: Trade: Challenges & Strategies. New Delhi: Excel BooksRuchi PundhirNo ratings yet

- Carbon PricingDocument13 pagesCarbon PricingJoeNo ratings yet

- RA CPA DAVAO Oct2017 PDFDocument38 pagesRA CPA DAVAO Oct2017 PDFPhilBoardResultsNo ratings yet

- Unit 3 Job Application Letters: ContentDocument17 pagesUnit 3 Job Application Letters: ContentanaNo ratings yet