Professional Documents

Culture Documents

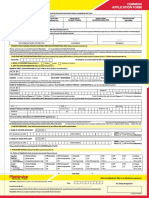

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

Uploaded by

Gargi ShuklaCopyright:

Available Formats

You might also like

- UBL Report HRMDocument50 pagesUBL Report HRMmeharahutsham33% (3)

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainNo ratings yet

- STP and SWP Form May17 FillPrintDocument2 pagesSTP and SWP Form May17 FillPrintRohan KapoorNo ratings yet

- Mirae Sip FormDocument2 pagesMirae Sip Formitkahs120No ratings yet

- Bandhan MF - STP FormDocument2 pagesBandhan MF - STP FormserviceNo ratings yet

- Family Solutions Transaction FormDocument2 pagesFamily Solutions Transaction FormSelva KumarNo ratings yet

- Sip Enrollment DetailsDocument2 pagesSip Enrollment DetailsDBCGNo ratings yet

- Mirae Asset MF Common & SIPDocument5 pagesMirae Asset MF Common & SIPMadhu SudhananNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- Mirae SIP FormDocument5 pagesMirae SIP FormdurgeshNo ratings yet

- A Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingDocument2 pagesA Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingProfessional positiveNo ratings yet

- Common Application FormDocument5 pagesCommon Application FormNeeraj KumarNo ratings yet

- Sole / First Applicant Second Applicant Third ApplicantDocument2 pagesSole / First Applicant Second Applicant Third ApplicantAnkur KaushikNo ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- SIP1018 Kotak - CDRDocument1 pageSIP1018 Kotak - CDRNikesh MewaraNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Common Application Form: For Lump Sum/Systematic InvestmentsDocument4 pagesCommon Application Form: For Lump Sum/Systematic Investmentspunitwishes7157No ratings yet

- BNP Common Application With SIPDocument3 pagesBNP Common Application With SIPRakesh LahoriNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- Common Application FormsDocument5 pagesCommon Application Formsvgudge8475No ratings yet

- HDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantDocument7 pagesHDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantAltamash FaridNo ratings yet

- STP and SWP FormDocument2 pagesSTP and SWP FormHitesh MiskinNo ratings yet

- Sip Registration Cum Mandate Form: For Investment Through NACH/Direct DebitDocument2 pagesSip Registration Cum Mandate Form: For Investment Through NACH/Direct DebitAbhijit patraNo ratings yet

- COM0004057712 REG Dist SIP ApplicationDocument1 pageCOM0004057712 REG Dist SIP Applicationraj tripathiNo ratings yet

- Slip PDFDocument1 pageSlip PDFPrachi BhosaleNo ratings yet

- Equity SIP Application Form April 2022Document8 pagesEquity SIP Application Form April 2022Selva KumarNo ratings yet

- SIP Auto Debit Form 2011Document4 pagesSIP Auto Debit Form 2011Anirudha MohapatraNo ratings yet

- Common Application Form MAHINDRADocument4 pagesCommon Application Form MAHINDRAsathisha123No ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- Baroda BNP Paribas SIP Form 127Document2 pagesBaroda BNP Paribas SIP Form 127custodian.archiveNo ratings yet

- Common Application FormDocument7 pagesCommon Application FormKrishna GoyalNo ratings yet

- Mahindra MF Application FromDocument4 pagesMahindra MF Application FromnanduvermaNo ratings yet

- Quantmf Common - Application - FormDocument4 pagesQuantmf Common - Application - FormMadhu SudhananNo ratings yet

- Common Transaction Form: First Unitholder Second Unitholder Third UnitholderDocument1 pageCommon Transaction Form: First Unitholder Second Unitholder Third UnitholderKailash VijayvargiaNo ratings yet

- IIFL MF Common Transaction Unit Holders 022819Document2 pagesIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeNo ratings yet

- Quant Mutual FundDocument4 pagesQuant Mutual FundSunil RawtaniNo ratings yet

- Application Form: Arn - ArnDocument4 pagesApplication Form: Arn - ArnRavindraNo ratings yet

- SIP Registation Form-With One Time MandateDocument4 pagesSIP Registation Form-With One Time MandatePrince ANo ratings yet

- Sip - 1Document1 pageSip - 1Lamar Wealth solutionsNo ratings yet

- Commen Trasaction FormDocument1 pageCommen Trasaction Formsandip vishwakarmaNo ratings yet

- Common Transaction Slip 12 06 2017 PDFDocument3 pagesCommon Transaction Slip 12 06 2017 PDFvenkatnimmsNo ratings yet

- SIP Registration Cum Mandate - EditableDocument2 pagesSIP Registration Cum Mandate - EditableKaushalNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- Boi Axa Common Application With SipDocument4 pagesBoi Axa Common Application With SipRakesh LahoriNo ratings yet

- Existing Investor'S Folio Number Unit Holding Options: Transaction Charges ORDocument4 pagesExisting Investor'S Folio Number Unit Holding Options: Transaction Charges ORraj tripathiNo ratings yet

- Sip Cum Nach FormDocument8 pagesSip Cum Nach FormAmit GuptaNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- SIP Facility Appl Form V 1Document4 pagesSIP Facility Appl Form V 1DBCGNo ratings yet

- Av Birla Sip FormDocument1 pageAv Birla Sip FormVikas RaiNo ratings yet

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitDocument2 pagesOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareNo ratings yet

- PGIM Common Application With SIPDocument6 pagesPGIM Common Application With SIPRakesh LahoriNo ratings yet

- BNP MF Common Application Form EquityDocument2 pagesBNP MF Common Application Form EquityQUSI E. ABDNo ratings yet

- Amc Copy: Enrolment FormDocument4 pagesAmc Copy: Enrolment FormAhmad ZaibNo ratings yet

- JM Equity Tax Saver FundDocument4 pagesJM Equity Tax Saver Funddrashti.investments1614No ratings yet

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationDocument2 pagesSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVNo ratings yet

- JM Finance MF - Sip NachDocument1 pageJM Finance MF - Sip NacharunimaapkNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- Transaction Slip: E-154428 ARN-110547Document1 pageTransaction Slip: E-154428 ARN-110547Money Manager OnlineNo ratings yet

- Please Fill All Fields With Black Ball Point, in Block Letters and All Fields Are MandatoryDocument4 pagesPlease Fill All Fields With Black Ball Point, in Block Letters and All Fields Are MandatoryApurv DixitNo ratings yet

- TheftDocument30 pagesTheftAnushi Amin100% (1)

- GCSR Nagaland - GTU ReportDocument10 pagesGCSR Nagaland - GTU ReportSatish J. MakwanaNo ratings yet

- Topic 9 Sharpe's Portfolio TheoryDocument21 pagesTopic 9 Sharpe's Portfolio TheoryMuhammad Muneeb ShafiqNo ratings yet

- August 2015Document64 pagesAugust 2015Eric Santiago100% (1)

- Cooperative A UsDocument6 pagesCooperative A UscjethmalaniNo ratings yet

- Best Forex TipsDocument11 pagesBest Forex TipsSena Rashi100% (1)

- Consumer Decision Making For Residential MortgagesDocument10 pagesConsumer Decision Making For Residential MortgagesKevin MNo ratings yet

- Syllabus International FinanceDocument1 pageSyllabus International FinanceRabin JoshiNo ratings yet

- INFORMS Style Instructions 2016-02-22Document21 pagesINFORMS Style Instructions 2016-02-22Philip ThomasNo ratings yet

- Tourism in The Zayandeh Rud CatchmentDocument18 pagesTourism in The Zayandeh Rud CatchmentISOE - Institute for Social-Ecological ResearchNo ratings yet

- Project Report On Lic IndiaDocument72 pagesProject Report On Lic IndiagauravNo ratings yet

- Singapore Cybersecurity Firm Sixscape Secures S$2 Million Funding From Tembusu ICT Fund IDocument3 pagesSingapore Cybersecurity Firm Sixscape Secures S$2 Million Funding From Tembusu ICT Fund IWeR1 Consultants Pte LtdNo ratings yet

- Thesis For Store123Document14 pagesThesis For Store123info techNo ratings yet

- The Encyclopedia Americana 1997Document78 pagesThe Encyclopedia Americana 1997Lichelle SeeNo ratings yet

- ABM ApEc AIRs LM Q1 W6Document15 pagesABM ApEc AIRs LM Q1 W6Christia Margarette BravoNo ratings yet

- JPSO050115Document8 pagesJPSO050115theadvocate.comNo ratings yet

- Tell Me Something About YourselfDocument10 pagesTell Me Something About Yourselframeshkarthik810100% (1)

- A222 BWBB3193 Topic 05 - Fin Ratio Part 2Document41 pagesA222 BWBB3193 Topic 05 - Fin Ratio Part 2NurFazalina AkbarNo ratings yet

- Final Project of Financial Statement AnalysisDocument19 pagesFinal Project of Financial Statement AnalysisFaizan ChNo ratings yet

- Insights 2018 Mains Exclusive International Relations PDFDocument40 pagesInsights 2018 Mains Exclusive International Relations PDFAbhishek TyagiNo ratings yet

- The Financial Collapse of The Enron Corporation and Its Impact in The United States Capital MarketDocument11 pagesThe Financial Collapse of The Enron Corporation and Its Impact in The United States Capital Marketwindow805No ratings yet

- % of Par Value of Rs. 50/-Funds Dividend (RS.)Document10 pages% of Par Value of Rs. 50/-Funds Dividend (RS.)Salman ArshadNo ratings yet

- Key Man InsuranceDocument40 pagesKey Man Insurancemldc2011No ratings yet

- Investers' Perception On Mutual Funds: Final Research Project ReportDocument28 pagesInvesters' Perception On Mutual Funds: Final Research Project ReportAryan Sharma54No ratings yet

- Accruals and DeferralsDocument2 pagesAccruals and DeferralsravisankarNo ratings yet

- 2010 Yr10 POA AnswerDocument66 pages2010 Yr10 POA AnswerMuhammad SamhanNo ratings yet

- ND 2 BFN Financial Institutions Lectures 2023Document20 pagesND 2 BFN Financial Institutions Lectures 2023sanusi bello bakura100% (1)

- Bas430 FPD 6 2021 2 PDFDocument44 pagesBas430 FPD 6 2021 2 PDFNkhandu S M WilliamsNo ratings yet

- NPV and IRRDocument19 pagesNPV and IRRGukan VenkatNo ratings yet

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

Uploaded by

Gargi ShuklaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

Uploaded by

Gargi ShuklaCopyright:

Available Formats

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

Investor must read the instructions section before completing this form. First time investors need to submit this form along with the main application form

Distributor Name & Broker Sub Broker / Agent Sub Agent Code EUIN* Internal Code ISC Date Time Stamp, Sign,

Code / ARN / RIA Code ARN Code RIA No. for AMC Reference No.

*EUIN Declaration: Declaration for “Execution Only” Transaction (where Employee Unique Identification Number-EUIN* box is left blank). Please refer instruction 12 of KIM for complete details on EUIN. I/We hereby confirm

that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or

Please Read All Instructions as given in KIM, to help you complete the Application Form Correctly.

notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker. RIA Declaration: “I/We hereby give you my/our consent to share/provide

the transactions data feed/portfolio holdings/ NAV etc. in respect of my/our investments under Direct Plan of all Schemes managed by you, to the above mentioned SEBI-Registered Investment Adviser/ RIA”.

Signature of 1st Applicant/Guardian/ Signature of 2nd Applicant/Guardian/ Signature of 3rd Applicant/Guardian/

Authorised Signatory/PoA/Karta Authorised Signatory/PoA Authorised Signatory/PoA

1. EXISTING UNIT HOLDER INFORMATION (The details in our records under the folio number mentioned will apply for this application.)

Folio No.: CKYC Identification No. (KIN)

Name of 1st Unit Holder:

2. SYSTEMATIC TRANSFER PLAN (STP) (For instructions please refer the next page)

From Scheme Regular Plan Div. Payout Div frequency*

Direct Plan Growth Div. Reinvestment

To Scheme Regular Plan Div. Payout Div frequency*

Direct Plan Growth (Default) Div. Reinvestment (Default)

Dividend frequency is applicable only for Mirae Asset Cash Management Fund & Mirae Asset Savings Fund. Default option will be daily frequency if not selected any dividend frequency..

Please ( ) STP Frequency from the below options (Please refer over leaf Instruction point no.:3) Please use multiple forms for multiple dates.

Daily (Monday to Friday) Weekly (Every Wednesday) Fortnightly (Alternate Wednesday) Monthly (Default) Quarterly

02-2021

For Daily, Weekly, Fortnightly, Monthly & Quarterly option minimum 5 transfers of ` 1000 each.

Please () STP date: 10 (Default)

th

1 15 21 28

st th st th

Amount per transfer (` In Figures): STP Start Date from: D D M M Y Y Y Y To: D D M M Y Y Y Y

3. SYSTEMATIC WITHDRAWAL PLAN (SWP) (For instructions please refer the next page)

Scheme Growth

Regular Plan Direct Plan

SWP is allowed only under Growth option

Please ( ) SWP Frequency from the option (Transactions will be triggered after 5 days from the date of submission) Minimum 5 transaction and ` 1000 each and above

Monthly (Default) Quarterly Semi Annually Annually

Start Date from: To: Fixed Withdrawal Amount Per installment `:

Withdrawal Date: Please ( ) 1st 10th (Default) 15th 21st 28th

4. DECLARATION AND SIGNATURES / THUMB IMPRESSION OF APPLICANT(s) [Refer Instructions 2(f) of KIM]

To The Trustees, Mirae Asset Mutual Fund (The Fund) – (A) Having read and understood the contents of the SID/SAI/KIM of the Scheme applied for (Including the scheme(s) available during the New Fund Offer period); I/We hereby apply for units of the said such scheme and agree to abide by the terms, conditions,

rules and regulations governing the scheme. (B) I/We hereby declare that the amount invested in the scheme is through legitimate sources only and does not involve and is not designed for the purpose of the contravention of any provisions of the Income Tax Act, Anti Money Laundering Laws or any other applicable

laws enacted by the Government of India from time to time. (C) Signature of the nominee acknowledging receipts of my/our credit will constitute full discharge of liabilities of Mirae Asset Mutual Fund. (D) The information given in / with this application form is true and correct and further agrees to furnish additional

information sought by Mirae Asset Investment Managers (India) Private Limited* (AMC)/ Fund and undertake to update the information/details with the AMC / Fund/Registrars and Transfer Agent (RTA) from time to time. I/We hereby confirm that the AMC/Fund shall have the right to share my information and other

details with the regulatory and government authorities as and when needed. I/We will indemnify the Fund, AMC, Trustee, RTA and other intermediaries in case of any dispute regarding the eligibility, validity and authorization of my/our transactions. (E) I/We further declare that "The ARN holder has disclosed to

me/us all the commissions (in the form of trail commission or any other mode), payable to him for the different competing Schemes of various Mutual Funds from amongst which the Scheme is being recommended to me/us. (F) I/We hereby confirm that I/We have not been offered/ communicated any indicative

portfolio and/ or any indicative yield by the Fund/AMC/its distributor for this investment. I/We have not received nor have been induced by any rebate or gifts, directly or indirectly in making this investment. (G) Applicable to Investors availing the online facility: I/We have read, understood and shall be bound by the

terms & conditions of the PIN agreement available on the AMC website for transacting online. (H) RIA: I/We hereby agree to consent the AMC to share my transaction details to the registered investment advisor (RIA) through the registrar or otherwise. (I) Applicable to Foreign Resident's Residing in India:- I/ We

confirm that I/We satisfy the Residency test as prescribed under FEMA provisions. I/We further declare that I/We am/are "Person Resident in India" and are allowed to invest into the Scheme as per the said FEMA regulations and other applicable laws and regulations. (J) I / We confirm that I am / We are not United

States person(s) under the laws of United States or resident(s) of Canada. In case of change to this status, I / We shall notify the AMC, in which event the AMC reserves the right to redeem my / our investments in the Scheme(s). (K) FATCA /CRS Certification: I / We have understood the information requirements

of this Form (read along with the FATCA & CRS Instructions) and hereby confirm that the information provided by me / us on this Form is true, correct, and complete. I / We also confirm that I / We have read and understood the FATCA& CRS Terms and Conditions and hereby accept the same. In case the above

information is not provided, it will be presumed that applicant is the ultimate beneficial owner, with no declaration to submit. In such case, the concerned SEBI registered intermediary reserves the right to reject the application or reverse the allotment of units, if subsequently it is found that applicant has concealed

the facts of beneficial ownership. I/We also undertake to keep you informed in writing about any changes/modification to the above information in future & also undertake to provide any other additional information as may be required at your end. (L) Aadhaar: I/We hereby voluntarily submit Aadhar card to the

Fund/AMC for updating the same in my folio. * Securities and Exchange Board of India (“SEBI”) vide its letter dated November 20, 2019 bearing reference no. SEBI/HO/IMD/DF5/OW/P/2019/30719/1 (“SEBI NOC”) had granted their non-objection to transfer the AMC Business from ‘Mirae Asset Global Investments

(India) Pvt Ltd’ to ‘Mirae Asset Investment Managers (India) Private Limited’, in this regard we request you to refer to our notice cum addendum no. AD/28/2019 dated November 25, 2019 to know in detail.

Signature of 1st Applicant/Guardian/ Signature of 2nd Applicant/Guardian/ Signature of 3rd Applicant/Guardian/

Authorised Signatory/PoA/Karta Authorised Signatory/PoA Authorised Signatory/PoA

ACKNOWLEDGEMENT SLIP

Received Application from ___________________________________________________________ Folio No.: ____________________________as per details below:

Scheme Name and Plan Details Date & Stamp of Collection Centre / ISC

SWP Amount (`) ______________________________

STP Amount (`) ______________________________

Cheque / DD is subject to realisation

Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)

A. INSTRUCTIONS - COMMON TO SWP / STP

1. New investors who wish to enrol for SWP / STP should fill the form in addition to the Common Application Form. Please complete all details in the Common Application Form. Details of SWP /

STP should be provided on this form. Existing investors need to fill up this form only.

2. For multiple transactions under more than 1 scheme, separate form should be used.

3. STP / SWP the form should be submitted at least 5 days (inclusive of the date of submission - before Cut-off however, excluding Saturday, Sunday and other non-business day) before the

commencement date.

a) The installment start date shall not be later than 100 calender days from the date of application submission date.

4. The investor has the right to discontinue SWP / STP at any time he/she so desires by sending cancellation form at least 7 business days in advance of the immediate next due date to any of the

offices of Mirae Asset Mutual Fund or its Authorised Collection Centres. On receipt of such request the SWP / STP will be terminated and in case of SIP balance post-dated cheques will be

returned to the investor.

5. Units will be Allotted / Redeemed / Transferred at the NAV related prices of the 1st, 10th, 15th, 21st, 28th of every month (or next business day, if 1st and/or 10th and/ or 15th and/or 21st and/or

28th is a non business day). In case of Post Dated Cheques submitted for any dates, other than the dates offered, immediate next offered date would be considered as the SIP date(s). An

updated account statement will be sent after each transaction under the Special Products, wherever, email address has been provided, the account statements will be sent through email only.

Other investors will be sent on a quarterly basis.

B. INSTRUCTIONS - SYSTEMATIC WITHDRAWAL PLAN (SWP)

Options available and Minimum Amount :

1. Investors can withdraw fixed amount of Rs. 1,000/- each and above, only under the Growth option of the scheme under which SWP is allowed

2. SWP is not available for investments under lock-in period and for investments which are pledged.

3. SWP can be made through Fixed withdrawals only.

4. The SWP will be registered at the requested frequency after 5 days (inclusive of the date of submission - before Cut-off however, excluding Saturday, Sunday and other non- business day).

5. SWP payment will be made in the bank account registered under the folio.

6. In case of Fixed Withdrawal, if the amount of installment is more than the amount available in that account for redemption, the entire available amount will be redeemed and the SWP will be

terminated.

7. Investors can withdraw fixed amount on 1st, 10th, 15th, 21st and 28th under the 4 frequencies which is Monthly, Quarterly, Semi Annually and Annually.

8. SWP shall be registered for a default of 5 installments across each frequency for a minimum of Rs.1000 or above.

9 Default frequency will be Monthly and 10th of each month in case of option selected or any ambiguity in selection of frequency or date.

10. Applicable Exit Load under SWP, which will be on First In First Out Basis (FIFO):

a) SWP for 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Exit Load Nil. Not eligible for Mirae Asset Focused

Fund.

b) Any redemption by virtue of SWP in excess of such above limits in the first 365 days from the date of allotment, Exit Load of 1% shall apply. There shall be NIL Exit Load, for the units that

are redeemed after 1 year (365 days) from the date of allotment.

11. If there are 3 Consecutive failures on account of SWP execution, by virtue of insufficient balance in the Scheme opted for the designated frequency/date, SWP shall be automatically ceased/

terminated for all future installments.

C. INSTRUCTIONS - SYSTEMATIC TRANSFER PLAN (STP)

1. Transfer fixed sums from their Unit accounts in the Scheme to the existing schemes or other schemes launched by the Mirea Asset Mutual Fund from time to time.

2. Minimum Amount: A] Daily - Monday to Friday: 5 transfers of ` 1,000/- each and above.

B] Weekly - Every Wednesday / Fortnightly - Every Alternate Wednesday Monthly Plan: Minimum 5 transfers of ` 1,000/- each and above.

C] Quarterly Plan: Minimum 5 transfers of ` 1,000/- each and above.

D] For STPs under Mirae Asset Tax Saver Fund (MATS) minimum amount of STP shall be of ` 500/- and in multiples of ` 500/- thereafter. Each STP Installment ‘OUT’ of Mirae Asset Tax Saver

Fund shall be subject to lock in period of 3 years from the date of allotment of Units proposed to be redeemed. In the interest of investors, it is hereby clarified that where the switch request has

been made from one scheme to another specifying the number of Units or Amount (during NFO as well as ongoing), the request will be processed for the corresponding value of such units or

amount and that the allotment in the resultant scheme may be done in fractional units, subject to fulfillment of the minimum purchase amount of the scheme where it is being switched.

3. STP is not available for investments under lock-in period.

4. In case of insufficient balance, the transfer will not be effected. In case of absence /ambiguity in selection of frequency, default will be monthly for 10 of each month,

5. Transfer Dates/ Days: Daily - Monday to Friday, Weekly - Every Wednesday, Fortnightly - Every Alternate Wednesday

Monthly Plan: Transfers can be on 1st, 10th, 15th, 21st, 28th of each month for minimum 5 transfers.

Quarterly Systematic Transfer Plan: Transfers can be on 1st, 10th, 15th, 21st, 28th of each quarter or minimum 5 quarters.

6. Transactions will be triggered after 5 days (inclusive of the date of submission - before Cut-off however, excluding Saturday, Sunday and other non-business day). In case of any ambiguity in

selection transfer frequency or start date, the STP date will be 10th of the month / quarter, and STP will start from the immediate available applicable day for the respective frequency option

after the expiry of Said Period. Further, if there is a discrepancy in terms of Transfer Period, STP will continue as long as there is suffcient balance under the OUT scheme.

7. At every installment, the system will check for the Balance amount in the Transferor Scheme with "STP Amount":

1. If "Balance Amount in the Transferor Scheme" is more than or equal to "2 x STP Amount", then only the STP amount will be transferred and the balance amount will continue to remain in

the Scheme.

2. If "Balance Amount in the Transferor Scheme" is less than "2 x STP Amount", the entire Balance Amount in the Transferor Scheme (OUT Scheme) will be switched out in to the Transferee

Scheme (IN Scheme).

Further, if there are 3 consecutive failures on account of STP execution from the Transferor Scheme (OUT Scheme), on the designated frequency, STP shall be ceased / terminated for all

future installments. The provision relating to "Minimum Redemption Amount" of the designated Transferor Scheme(s) and "Minimum Application Amount" of the designated Transferee

Scheme(s) shall not be applicable for such STP executions on a residual note.

Example: If an investor having investment of ` 15,000 in Mirae Asset Cash Management Fund (MACMF) starts monthly STP of ` 1,000 in Mirae Asset Emerging Bluechip Fund (MAIEF)

• If at the time of STP installment, the Balance amount in the MACMF is more than or equal to ` 2,000 – only STP Amount of ` 1,000 will be transferred to MAIEF.

• If at the time of STP installment, the Balance amount in the MACMF is less than ` 2,000 – the entire balance amount in MACMF will be transferred to MAIEF.

D. EUIN

Employee Unique Identification Number (EUIN): SEBI has made it compulsory for every employee / relationship manager / sales person of the distributor of mutual fund products to quote the EUIN

obtained by him / her from AMFI in the Application Form. EUIN, particularly in advisory transaction, would assist in addressing any instance of mis-selling even if the employee / relationship

manager/sales person later leaves the employment of the distributor. individual ARN holders including senior citizens distributing mutual fund products are also required to optain and quote EUIN in

the Application Form. Hence, if your investments are routed through a distributor please ensure that the EUIN is correctly filled up in the Application Form. However, if your distributor has not given

you any advice pertaining to the investment, the EUIN box may be left blank. In this case, you are required to tick mark the box provided above the signature box. However, in case of any exceptional

cases where there is no interaction by the employee/ sales person/ relationship manager of the distributor/ sub broker with respect to the transaction, AMCs shall take the requisite declaration

separately signed by the investor.

You might also like

- UBL Report HRMDocument50 pagesUBL Report HRMmeharahutsham33% (3)

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Document2 pagesApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainNo ratings yet

- STP and SWP Form May17 FillPrintDocument2 pagesSTP and SWP Form May17 FillPrintRohan KapoorNo ratings yet

- Mirae Sip FormDocument2 pagesMirae Sip Formitkahs120No ratings yet

- Bandhan MF - STP FormDocument2 pagesBandhan MF - STP FormserviceNo ratings yet

- Family Solutions Transaction FormDocument2 pagesFamily Solutions Transaction FormSelva KumarNo ratings yet

- Sip Enrollment DetailsDocument2 pagesSip Enrollment DetailsDBCGNo ratings yet

- Mirae Asset MF Common & SIPDocument5 pagesMirae Asset MF Common & SIPMadhu SudhananNo ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- Mirae SIP FormDocument5 pagesMirae SIP FormdurgeshNo ratings yet

- A Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingDocument2 pagesA Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingProfessional positiveNo ratings yet

- Common Application FormDocument5 pagesCommon Application FormNeeraj KumarNo ratings yet

- Sole / First Applicant Second Applicant Third ApplicantDocument2 pagesSole / First Applicant Second Applicant Third ApplicantAnkur KaushikNo ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- SIP1018 Kotak - CDRDocument1 pageSIP1018 Kotak - CDRNikesh MewaraNo ratings yet

- SIP Form DebtDocument6 pagesSIP Form DebtNilesh MahajanNo ratings yet

- Common Application Form: For Lump Sum/Systematic InvestmentsDocument4 pagesCommon Application Form: For Lump Sum/Systematic Investmentspunitwishes7157No ratings yet

- BNP Common Application With SIPDocument3 pagesBNP Common Application With SIPRakesh LahoriNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- Common Application FormsDocument5 pagesCommon Application Formsvgudge8475No ratings yet

- HDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantDocument7 pagesHDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantAltamash FaridNo ratings yet

- STP and SWP FormDocument2 pagesSTP and SWP FormHitesh MiskinNo ratings yet

- Sip Registration Cum Mandate Form: For Investment Through NACH/Direct DebitDocument2 pagesSip Registration Cum Mandate Form: For Investment Through NACH/Direct DebitAbhijit patraNo ratings yet

- COM0004057712 REG Dist SIP ApplicationDocument1 pageCOM0004057712 REG Dist SIP Applicationraj tripathiNo ratings yet

- Slip PDFDocument1 pageSlip PDFPrachi BhosaleNo ratings yet

- Equity SIP Application Form April 2022Document8 pagesEquity SIP Application Form April 2022Selva KumarNo ratings yet

- SIP Auto Debit Form 2011Document4 pagesSIP Auto Debit Form 2011Anirudha MohapatraNo ratings yet

- Common Application Form MAHINDRADocument4 pagesCommon Application Form MAHINDRAsathisha123No ratings yet

- Common Transaction Form Financial Transaction Kk3i5z51Document8 pagesCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNo ratings yet

- Baroda BNP Paribas SIP Form 127Document2 pagesBaroda BNP Paribas SIP Form 127custodian.archiveNo ratings yet

- Common Application FormDocument7 pagesCommon Application FormKrishna GoyalNo ratings yet

- Mahindra MF Application FromDocument4 pagesMahindra MF Application FromnanduvermaNo ratings yet

- Quantmf Common - Application - FormDocument4 pagesQuantmf Common - Application - FormMadhu SudhananNo ratings yet

- Common Transaction Form: First Unitholder Second Unitholder Third UnitholderDocument1 pageCommon Transaction Form: First Unitholder Second Unitholder Third UnitholderKailash VijayvargiaNo ratings yet

- IIFL MF Common Transaction Unit Holders 022819Document2 pagesIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeNo ratings yet

- Quant Mutual FundDocument4 pagesQuant Mutual FundSunil RawtaniNo ratings yet

- Application Form: Arn - ArnDocument4 pagesApplication Form: Arn - ArnRavindraNo ratings yet

- SIP Registation Form-With One Time MandateDocument4 pagesSIP Registation Form-With One Time MandatePrince ANo ratings yet

- Sip - 1Document1 pageSip - 1Lamar Wealth solutionsNo ratings yet

- Commen Trasaction FormDocument1 pageCommen Trasaction Formsandip vishwakarmaNo ratings yet

- Common Transaction Slip 12 06 2017 PDFDocument3 pagesCommon Transaction Slip 12 06 2017 PDFvenkatnimmsNo ratings yet

- SIP Registration Cum Mandate - EditableDocument2 pagesSIP Registration Cum Mandate - EditableKaushalNo ratings yet

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Document3 pagesSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikNo ratings yet

- Boi Axa Common Application With SipDocument4 pagesBoi Axa Common Application With SipRakesh LahoriNo ratings yet

- Existing Investor'S Folio Number Unit Holding Options: Transaction Charges ORDocument4 pagesExisting Investor'S Folio Number Unit Holding Options: Transaction Charges ORraj tripathiNo ratings yet

- Sip Cum Nach FormDocument8 pagesSip Cum Nach FormAmit GuptaNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- SIP Facility Appl Form V 1Document4 pagesSIP Facility Appl Form V 1DBCGNo ratings yet

- Av Birla Sip FormDocument1 pageAv Birla Sip FormVikas RaiNo ratings yet

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitDocument2 pagesOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareNo ratings yet

- PGIM Common Application With SIPDocument6 pagesPGIM Common Application With SIPRakesh LahoriNo ratings yet

- BNP MF Common Application Form EquityDocument2 pagesBNP MF Common Application Form EquityQUSI E. ABDNo ratings yet

- Amc Copy: Enrolment FormDocument4 pagesAmc Copy: Enrolment FormAhmad ZaibNo ratings yet

- JM Equity Tax Saver FundDocument4 pagesJM Equity Tax Saver Funddrashti.investments1614No ratings yet

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationDocument2 pagesSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVNo ratings yet

- JM Finance MF - Sip NachDocument1 pageJM Finance MF - Sip NacharunimaapkNo ratings yet

- Sip Enrolment FormDocument1 pageSip Enrolment FormYankit SoniNo ratings yet

- Transaction Slip: E-154428 ARN-110547Document1 pageTransaction Slip: E-154428 ARN-110547Money Manager OnlineNo ratings yet

- Please Fill All Fields With Black Ball Point, in Block Letters and All Fields Are MandatoryDocument4 pagesPlease Fill All Fields With Black Ball Point, in Block Letters and All Fields Are MandatoryApurv DixitNo ratings yet

- TheftDocument30 pagesTheftAnushi Amin100% (1)

- GCSR Nagaland - GTU ReportDocument10 pagesGCSR Nagaland - GTU ReportSatish J. MakwanaNo ratings yet

- Topic 9 Sharpe's Portfolio TheoryDocument21 pagesTopic 9 Sharpe's Portfolio TheoryMuhammad Muneeb ShafiqNo ratings yet

- August 2015Document64 pagesAugust 2015Eric Santiago100% (1)

- Cooperative A UsDocument6 pagesCooperative A UscjethmalaniNo ratings yet

- Best Forex TipsDocument11 pagesBest Forex TipsSena Rashi100% (1)

- Consumer Decision Making For Residential MortgagesDocument10 pagesConsumer Decision Making For Residential MortgagesKevin MNo ratings yet

- Syllabus International FinanceDocument1 pageSyllabus International FinanceRabin JoshiNo ratings yet

- INFORMS Style Instructions 2016-02-22Document21 pagesINFORMS Style Instructions 2016-02-22Philip ThomasNo ratings yet

- Tourism in The Zayandeh Rud CatchmentDocument18 pagesTourism in The Zayandeh Rud CatchmentISOE - Institute for Social-Ecological ResearchNo ratings yet

- Project Report On Lic IndiaDocument72 pagesProject Report On Lic IndiagauravNo ratings yet

- Singapore Cybersecurity Firm Sixscape Secures S$2 Million Funding From Tembusu ICT Fund IDocument3 pagesSingapore Cybersecurity Firm Sixscape Secures S$2 Million Funding From Tembusu ICT Fund IWeR1 Consultants Pte LtdNo ratings yet

- Thesis For Store123Document14 pagesThesis For Store123info techNo ratings yet

- The Encyclopedia Americana 1997Document78 pagesThe Encyclopedia Americana 1997Lichelle SeeNo ratings yet

- ABM ApEc AIRs LM Q1 W6Document15 pagesABM ApEc AIRs LM Q1 W6Christia Margarette BravoNo ratings yet

- JPSO050115Document8 pagesJPSO050115theadvocate.comNo ratings yet

- Tell Me Something About YourselfDocument10 pagesTell Me Something About Yourselframeshkarthik810100% (1)

- A222 BWBB3193 Topic 05 - Fin Ratio Part 2Document41 pagesA222 BWBB3193 Topic 05 - Fin Ratio Part 2NurFazalina AkbarNo ratings yet

- Final Project of Financial Statement AnalysisDocument19 pagesFinal Project of Financial Statement AnalysisFaizan ChNo ratings yet

- Insights 2018 Mains Exclusive International Relations PDFDocument40 pagesInsights 2018 Mains Exclusive International Relations PDFAbhishek TyagiNo ratings yet

- The Financial Collapse of The Enron Corporation and Its Impact in The United States Capital MarketDocument11 pagesThe Financial Collapse of The Enron Corporation and Its Impact in The United States Capital Marketwindow805No ratings yet

- % of Par Value of Rs. 50/-Funds Dividend (RS.)Document10 pages% of Par Value of Rs. 50/-Funds Dividend (RS.)Salman ArshadNo ratings yet

- Key Man InsuranceDocument40 pagesKey Man Insurancemldc2011No ratings yet

- Investers' Perception On Mutual Funds: Final Research Project ReportDocument28 pagesInvesters' Perception On Mutual Funds: Final Research Project ReportAryan Sharma54No ratings yet

- Accruals and DeferralsDocument2 pagesAccruals and DeferralsravisankarNo ratings yet

- 2010 Yr10 POA AnswerDocument66 pages2010 Yr10 POA AnswerMuhammad SamhanNo ratings yet

- ND 2 BFN Financial Institutions Lectures 2023Document20 pagesND 2 BFN Financial Institutions Lectures 2023sanusi bello bakura100% (1)

- Bas430 FPD 6 2021 2 PDFDocument44 pagesBas430 FPD 6 2021 2 PDFNkhandu S M WilliamsNo ratings yet

- NPV and IRRDocument19 pagesNPV and IRRGukan VenkatNo ratings yet