Professional Documents

Culture Documents

Example 4.3: Solution

Example 4.3: Solution

Uploaded by

Omar KhalilCopyright:

Available Formats

You might also like

- Interpol Buyers-Black-List 5-6-2020Document47 pagesInterpol Buyers-Black-List 5-6-2020chris perry0% (1)

- Accounting Errors 8-9 (Answers)Document2 pagesAccounting Errors 8-9 (Answers)angela pajelNo ratings yet

- PPE2-sample - Debi Comia PPE2-sample - Debi ComiaDocument16 pagesPPE2-sample - Debi Comia PPE2-sample - Debi ComiaAngelica Pagaduan50% (2)

- Solutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenDocument33 pagesSolutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenErika LanezNo ratings yet

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Worksheet No. 5Document2 pagesWorksheet No. 5Xie Zhen WuNo ratings yet

- Sogradiel - Final ExamDocument17 pagesSogradiel - Final ExamRIZLE SOGRADIELNo ratings yet

- Assigment 4 SolutionDocument2 pagesAssigment 4 SolutionRamy ShabanaNo ratings yet

- UntitledDocument15 pagesUntitledemielyn lafortezaNo ratings yet

- ARR Practice QuestionsDocument6 pagesARR Practice QuestionsAnanya VasishthaNo ratings yet

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (33)

- Intermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDocument43 pagesIntermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDebraWhitecxgn100% (14)

- Latihan Soal Akuntansi BiayaDocument5 pagesLatihan Soal Akuntansi Biayaaufa alfayedhaNo ratings yet

- Solutions Winter 2022Document5 pagesSolutions Winter 2022sissy.he.7No ratings yet

- Cap Buget ProblemsDocument8 pagesCap Buget ProblemsramakrishnanNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Chapter 11 In-Class Problems SolutionDocument4 pagesChapter 11 In-Class Problems Solutionliuxuhan3No ratings yet

- E9-3 Determining Financial Statement Effects of An Asset Acquisition and Straight-Line DepreciationDocument12 pagesE9-3 Determining Financial Statement Effects of An Asset Acquisition and Straight-Line DepreciationRamiro Gallo Diaz GonzalezNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- Actual Results Flexible-Budget Variances Flexible Budget Sales - Variances Static Budget Unit Rev V.C C.M FC O.IDocument2 pagesActual Results Flexible-Budget Variances Flexible Budget Sales - Variances Static Budget Unit Rev V.C C.M FC O.IReem Hani JabariNo ratings yet

- EvaluationDocument3 pagesEvaluationLatoya SmithNo ratings yet

- GATLABAYAN - Activity #1 M3Document4 pagesGATLABAYAN - Activity #1 M3Al Dominic GatlabayanNo ratings yet

- Earned Value ChartDocument4 pagesEarned Value ChartRanda S JowaNo ratings yet

- Accounting Module 2 Learning ActivityDocument5 pagesAccounting Module 2 Learning ActivityHannah Jean MabunayNo ratings yet

- Solution Manual For Accounting For Decision Making and Control 9th Edition Jerold ZimmermanDocument7 pagesSolution Manual For Accounting For Decision Making and Control 9th Edition Jerold Zimmermanfuze.riddle.ghik9100% (51)

- Problem 1: Change Variable Factory Overhead Change Machine Hours $ 1,875,000 $ 1,250,000) $ 625,000Document6 pagesProblem 1: Change Variable Factory Overhead Change Machine Hours $ 1,875,000 $ 1,250,000) $ 625,000AJ OrtegaNo ratings yet

- Note Chapter 14 + 15 + CH A Mid-Term TestDocument4 pagesNote Chapter 14 + 15 + CH A Mid-Term TestGenoso OtakuNo ratings yet

- In-Class 1 SolutionsDocument2 pagesIn-Class 1 SolutionssassNo ratings yet

- Financial Management - Capital Budgeting Answer KeyDocument5 pagesFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Consolidated FinancialDocument21 pagesConsolidated FinancialMaria Raven Joy Espartinez ValmadridNo ratings yet

- CapbdgtDocument25 pagesCapbdgtmajidNo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- (IFA 13) - Rendy Filiang - 1402210324Document10 pages(IFA 13) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Profitability AnalysisDocument12 pagesProfitability AnalysisTHE TERMINATORNo ratings yet

- FA Practice 2 - QuestionsDocument10 pagesFA Practice 2 - QuestionsZhen WuNo ratings yet

- El Modelo de Baumol: Tasa de Interés AnualDocument6 pagesEl Modelo de Baumol: Tasa de Interés AnualvaleriaNo ratings yet

- DepreciationDocument4 pagesDepreciationMùhammad TàhaNo ratings yet

- Afar SolutionDocument8 pagesAfar SolutionAsnifah AlinorNo ratings yet

- Rupasha ProjectDocument27 pagesRupasha ProjectJabedur RahmanNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Rate of Return Analysis: Multiple Alternatives: Solutions To End-Of-Chapter ProblemsDocument14 pagesRate of Return Analysis: Multiple Alternatives: Solutions To End-Of-Chapter ProblemsenmanuelkasparianNo ratings yet

- Set 2 MS, 2ND PBDocument10 pagesSet 2 MS, 2ND PBHarini NarayananNo ratings yet

- Reviewer 47 PDF Free HelpfulDocument153 pagesReviewer 47 PDF Free HelpfulVon Rother Celoso DiazNo ratings yet

- CH 12 Excel (Students)Document9 pagesCH 12 Excel (Students)Daniela VelezNo ratings yet

- Replacement Breakeven AnalysisDocument8 pagesReplacement Breakeven AnalysisZoloft Zithromax ProzacNo ratings yet

- Least Square Regression Method: Cost AccountingDocument11 pagesLeast Square Regression Method: Cost Accountingretchiel love calinogNo ratings yet

- Economic Engineering - Solution Chapter 9Document19 pagesEconomic Engineering - Solution Chapter 9ScribdTranslationsNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- Fabiz en Page 1 of 5 Test Preparation MaterialDocument5 pagesFabiz en Page 1 of 5 Test Preparation MaterialOanaPetruNo ratings yet

- Date Particulars: in The Books of XYZ JournalDocument38 pagesDate Particulars: in The Books of XYZ JournalAnanya ChoudharyNo ratings yet

- Nominex Presentation Bop 25 Jun 2022 - PublicDocument46 pagesNominex Presentation Bop 25 Jun 2022 - PublicAsni Nor Rizwan Abdul RaniNo ratings yet

- Full Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full Chapterhomelingcomposedvqve100% (21)

- DrGoodwill AccDocument17 pagesDrGoodwill AccpancrasNo ratings yet

- Color ScopeDocument12 pagesColor Scopeprincemech2004100% (2)

- Worksheet Assigned Problem 7-17, 7-35 (Chapter 7)Document4 pagesWorksheet Assigned Problem 7-17, 7-35 (Chapter 7)Vu NguyenNo ratings yet

- Topic 03 (Set A) - ADocument5 pagesTopic 03 (Set A) - Acixiang0620No ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- F2 - Mock A - Answers-2-11 143Document10 pagesF2 - Mock A - Answers-2-11 143MD KaifNo ratings yet

- Group 6 Drill WS & FSDocument12 pagesGroup 6 Drill WS & FSSheilla Dela Torre PaderangaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Lecture 7Document14 pagesLecture 7Omar KhalilNo ratings yet

- 3.2 Types of Engineering Problems & Economic Analysis ObjectiveDocument14 pages3.2 Types of Engineering Problems & Economic Analysis ObjectiveOmar KhalilNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Engineering Economy GEN351: Dr. Abdelmagid A. Abdalla Manufacturing Engineering and Production Technology DeptDocument10 pagesEngineering Economy GEN351: Dr. Abdelmagid A. Abdalla Manufacturing Engineering and Production Technology DeptOmar KhalilNo ratings yet

- Quiz 20 Past QuizzesDocument23 pagesQuiz 20 Past QuizzesSarah Joy Corpuz-Cabasag100% (1)

- 1-2 Math at Home Game TimeDocument1 page1-2 Math at Home Game TimeKarla Panganiban TanNo ratings yet

- Save Money. Live BetterDocument1 pageSave Money. Live BetterdopoviNo ratings yet

- QCSH MCQ QCSH MCQDocument15 pagesQCSH MCQ QCSH MCQchutiyahu787No ratings yet

- Market Driven StrategyDocument43 pagesMarket Driven StrategyAhsan ShahidNo ratings yet

- OctaneRenderUserManualBeta2 46Document137 pagesOctaneRenderUserManualBeta2 46Romeo CostanNo ratings yet

- Thyrotronic Rectifier ManualDocument3 pagesThyrotronic Rectifier ManualUsama SheikhNo ratings yet

- An Investigation Into The Shear Strength of Rock DiscontinuityDocument6 pagesAn Investigation Into The Shear Strength of Rock DiscontinuityAzeNo ratings yet

- Solar Water Heating Project Analysis: Glazed Flat Plate Collectors, Ontario, CanadaDocument18 pagesSolar Water Heating Project Analysis: Glazed Flat Plate Collectors, Ontario, CanadaAnadin Ane DžinićNo ratings yet

- Maintenance of Building ComponentsDocument4 pagesMaintenance of Building ComponentsIZIMBANo ratings yet

- Passenger Locator Form: STATUS: Airside TransitDocument3 pagesPassenger Locator Form: STATUS: Airside TransitMERLITO HERRERANo ratings yet

- Case Study For 1st AssignmentDocument17 pagesCase Study For 1st AssignmentMaher Ahmed100% (1)

- EFL IS User ManualDocument26 pagesEFL IS User Manualarupamguria05No ratings yet

- A Qualitative Study of Health Information Seeking Behavior On The Internet Among Information Technology ProfessionalsDocument8 pagesA Qualitative Study of Health Information Seeking Behavior On The Internet Among Information Technology ProfessionalsYogesh BkNo ratings yet

- Endless HaulageDocument6 pagesEndless Haulagedudealok100% (3)

- Media and Information Literacy Prelims Reviewer PDFDocument7 pagesMedia and Information Literacy Prelims Reviewer PDFElishaNo ratings yet

- Abdul Rauf Alias CV 2023Document4 pagesAbdul Rauf Alias CV 2023Rauf AliasNo ratings yet

- Bangladesh Bank HistoryDocument5 pagesBangladesh Bank HistoryzonayetgaziNo ratings yet

- History of Educ - TechDocument5 pagesHistory of Educ - Techjiggly popNo ratings yet

- Circus LionDocument5 pagesCircus LionTiduj Rácsib100% (1)

- UK Armed Forces Equipment and Formations 2022 TablesDocument17 pagesUK Armed Forces Equipment and Formations 2022 TablesПриходько РомаNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument17 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- English Ki Tooti Hui TangDocument2 pagesEnglish Ki Tooti Hui TangGaurav PandeyNo ratings yet

- 3kV Cabinet Housed Traction RectifierDocument4 pages3kV Cabinet Housed Traction Rectifierandy_mickNo ratings yet

- Soneye Adebayo CVDocument4 pagesSoneye Adebayo CVBayo SoneyeNo ratings yet

- Company Name State LocationDocument18 pagesCompany Name State LocationompatelNo ratings yet

- Bhum103l - Micro-Economics - TH - 1.0 - 71 - Bhum103l - 66 AcpDocument2 pagesBhum103l - Micro-Economics - TH - 1.0 - 71 - Bhum103l - 66 AcpDarshilNo ratings yet

- The Optimal Petroleum Fiscal Regime For Ghana: An Analysis of Available AlternativesDocument12 pagesThe Optimal Petroleum Fiscal Regime For Ghana: An Analysis of Available AlternativesIbrahim SalahudinNo ratings yet

Example 4.3: Solution

Example 4.3: Solution

Uploaded by

Omar KhalilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example 4.3: Solution

Example 4.3: Solution

Uploaded by

Omar KhalilCopyright:

Available Formats

EXAMPLE 4.

3

A laser surgical tool has a cost basis of $200,000 and a five-year depreciable life. The estimated S.V.

of the laser is $20,000 at the end of five years. Tabulate the annual depreciation amounts and the

book value of the laser at the end of each year using:

(a) Straight line depreciation;

(b) Sum-of-years-digits depreciation;

(c) Double declining balance depreciation

Solution Year DC($) Total Dep.(n) ($) B.V.(n) ($)

𝑷 = $𝟐𝟎𝟎, 𝟎𝟎𝟎 , 𝑺 = $𝟐𝟎, 𝟎𝟎𝟎 , 𝐍 = 𝟓 𝐲𝐞𝐚𝐫𝐬 0 0 0 200,000

(a) Straight line depreciation 1 36,000 36,000 164,000

𝟏

𝑫𝑪 = 𝑷 − 𝑺 = $36,000 2 36,000 72,000 128,000

𝑵

3 36,000 108,000 92,000

4 36,000 144,000 56,000

5 36,000 180,000 20,000

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 1

Year DC(n)($) Total Dep.(n) ($) B.V.(n) ($)

(b) Sum-of-years-digits depreciation

0 0 0 200,000

𝟐 𝑵−𝒏+𝟏

𝑫𝑪 𝒏 = 𝑷−𝑺 1 60,000 60,000 140,000

𝑵 𝑵+𝟏

2 48,000 108,000 92,000

𝟐 𝟓−𝒏+𝟏

𝑫𝑪 𝒏 = 𝟐𝟎𝟎, 𝟎𝟎𝟎 − 𝟐𝟎, 𝟎𝟎 3 36,000 144,000 56,000

𝟓×𝟔

4 24,000 168,000 32,000

𝑫𝑪 𝒏 = 𝟏𝟐, 𝟎𝟎𝟎(𝟔 − 𝒏)

5 12,000 180,000 20,000

Year DDB(n)($) Total Dep.(n) ($) B.V.(n) ($)

(c) Double declining balance depreciation 0 0 0 200,000

𝟐

𝑫𝑫𝑩 𝒏 = 𝑩. 𝑽. 𝒏 − 𝟏 1 80,000 80,000 120,000

𝑵 2 48,000 128,000 72,000

3 28,800 156,800 43,200

4 17,280 174,080 25,920

5 10,368 184,448 15,512

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 2

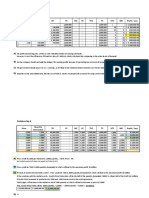

EXAMPLE 4.4

A new electric saw for cutting small pieces of lumber in a furniture manufacturing plant has a cost

basis of $4,000 and a 10-year depreciable life. The estimated S.V. of the saw is zero at the end of 10

years. Tabulate the annual depreciation Year DC($) Total Dep.(n) ($) B.V.(n) ($)

amounts and the book value at the end of 0 0 0 4,000

each year using: 1 400 400 3600

(a) Straight line depreciation; 2 400 800 3200

(b) Sum-of-years-digits depreciation; 3 400 1200 2800

(c) Double declining balance depreciation 4 400 1600 2400

.Solution 5 400 2000 2000

𝑷 = $𝟒, 𝟎𝟎𝟎 , 𝑺 = 𝐙𝐞𝐫𝐨 , 𝐍 = 𝟏𝟎 𝐲𝐞𝐚𝐫𝐬 6 400 2400 1600

(a) Straight line depreciation 7 400 2800 1200

𝟏 8 400 3200 800

𝑫𝑪 = 𝑷 − 𝑺 = $400

𝑵 9 400 3600 400

10 400 4000 Zero

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 3

(b) Sum-of-years-digits depreciation

𝟐 𝑵−𝒏+𝟏

𝑫𝑪 𝒏 = 𝑷−𝑺 Yea DC(n)($) Total Dep.(n) ($) B.V.(n) ($)

𝑵 𝑵+𝟏

r

𝟐 𝟏𝟎 − 𝒏 + 𝟏

𝑫𝑪 𝒏 = 𝟒, 𝟎𝟎𝟎 − 𝟎 0 0 0 4,000

𝟏𝟎 × 𝟏𝟏

1 8,000/11 8,000/11 36,000/11

𝟖𝟎𝟎

𝑫𝑪 𝒏 = (𝟏𝟏 − 𝒏) 2 7,200/11 15,200/11 28,800/11

𝟏𝟏 3 6,400/11 21,600/11 22,400/11

4 5,600/11 27,200/11 16,800/11

5 4,800/11 32,000/11 12,000/11

6 4,000/11 36,000/11 8000/11

7 3,200/11 39,200/11 4,800/11

8 2,400/11 41,600/11 2,400/11

9 1,600/11 43,200/11 800/11

10 800/11 4000 zero

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 4

(c) Double declining balance depreciation Year DDB(n)($) Total Dep.(n) B.V.(n) ($)

𝟐 ($)

𝑫𝑫𝑩 𝒏 = 𝑩. 𝑽. 𝒏 − 𝟏 0 0 0 4,000

𝑵

1 800 800 3,200

2 640 1440 2,560

3 512 1,952 2,048

4 409.6 2,361.6 1638.4

5 327.68 2689.28 1310.72

6 262.144 2951.424 1048.576

7 209.7152 3161.1392 838.8608

8 167.77216 3328.91136 671.08864

9 134.217728 3463.129088 536.870912

10 107.3741824 3570.50327 429.4967296

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 5

EXAMPLE 4.5

The La Salle Bus Company has decided to purchase a new bus for $85,000 with a trade-in of their old

bus. The old bus has a BV of $10,000 at the time of the trade-in. The new bus will be kept for 9 years

before being sold. Its estimated S.V. at that time is Year DC($) Total Dep.(n) ($) B.V.(n) ($)

expected to be $5,000. Calculate the depreciation 0 0 0 95,000

amounts and the book value at the end of each year 1 10,000 10,000 85,000

using: 2 10,000 20,000 75,000

(a) Straight line depreciation; 3 10,000 30,000 65,000

(b) Sum-of-years-digits depreciation; 4 10,000 40,000 55,000

(c) Double declining balance depreciation 5 10,000 50,000 45,000

.Solution 6 10,000 60,000 35,000

𝑷 = 𝟖𝟓, 𝟎𝟎𝟎 + 𝟏𝟎, 𝟎𝟎𝟎 = $𝟗𝟓, 𝟎𝟎𝟎 7 10,000 70,000 25,000

𝑷 = $𝟗𝟓, 𝟎𝟎𝟎 , 𝑺 = $𝟓, 𝟎𝟎𝟎 , 𝐍 = 𝟗 𝐲𝐞𝐚𝐫𝐬 8 10,000 80,000 15,000

(a) Straight line depreciation 9 10,000 90,000 5,000

𝟏

𝑫𝑪 = 𝑷 − 𝑺 = $𝟏𝟎, 𝟎𝟎𝟎

𝑵

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 6

(b) Sum-of-years-digits depreciation

𝟐 𝑵−𝒏+𝟏

𝑫𝑪 𝒏 = 𝑷−𝑺

𝑵 𝑵+𝟏

Year DC(n)($) Total Dep.(n) ($) B.V.(n) ($)

𝟐 𝟗−𝒏+𝟏

𝑫𝑪 𝒏 = 𝟗𝟓, 𝟎𝟎𝟎 − 𝟓, 𝟎𝟎𝟎 0 0 0 95,000

𝟗 × 𝟏𝟎 1 18,000 18,000 77,000

𝑫𝑪 𝒏 = 𝟐, 𝟎𝟎𝟎(𝟏𝟎 − 𝒏)

2 16,000 34,000 61,000

3 14,000 48,000 47,000

4 12,000 60,000 35,000

5 10,000 70,000 25,000

6 8,000 78,000 17,000

7 6,000 84,000 11,000

8 4,000 88,000 7,000

9 2,000 90,000 5,000

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 7

(c) Double declining balance depreciation Year DDB(n)($) Total Dep.(n) ($) B.V.(n) ($)

𝟐

𝑫𝑫𝑩 𝒏 = 𝑩. 𝑽. 𝒏 − 𝟏 0 0 0 95,000

𝑵 1 21,111 21,111 73,888

2 16,419.753 37530.864 57469.136

3 12,770.919 50,301.783 44,698.216

4 9,932.937 60,234.720 34,765.2799

5 7,725.617 67,969.150 27,030.849

6 6,006.855 73,969.005 21,023.994

7 4,671.998 78,641.003 16,358.997

8 3,635.332 82,276.335 12,723.664

9 2,827.480 85,103.815 9,896.184

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 8

EXAMPLE 4.6

Trucks purchased by a delivery company cost $7000 each. Past records indicate the trucks would

have a useful life of five years. They can be sold for an average of $1000 each after 5 years of use.

Calculate the depreciation amounts and the book value at the end of each year using:

(a)Straight line depreciation;

(b) Sum-of-years-digits depreciation;

(c) Double declining balance depreciation

Year DC($) Total Dep.(n) ($) B.V.(n) ($)

Solution

𝑷 = $𝟕, 𝟎𝟎𝟎 , 𝑺 = $𝟏, 𝟎𝟎𝟎 , 𝐍 = 𝟓 𝐲𝐞𝐚𝐫𝐬 0 0 0 7000

(a) Straight line depreciation 1 1,200 1,200 5,800

𝟏 2 1,200 2,400 4,600

𝑫𝑪 = 𝑷 − 𝑺 = $𝟏, 𝟐𝟎𝟎 3 1,200 3,600 3,400

𝑵

4 1,200 4,800 2,200

5 1,200 6,000 1,000

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 9

(b) Sum-of-years-digits depreciation Year DC(n)($) Total Dep.(n) ($) B.V.(n) ($)

𝟐 𝑵−𝒏+𝟏 0 0 0 7000

𝑫𝑪 𝒏 = 𝑷−𝑺

𝑵 𝑵+𝟏

1 2,000 2,000 5,000

𝟐 𝟓−𝒏+𝟏 2 1,600 3,600 3,400

𝑫𝑪 𝒏 = 𝟕, 𝟎𝟎𝟎 − 𝟏, 𝟎𝟎𝟎

𝟓×𝟔 3 1,200 4,800 2,200

𝑫𝑪 𝒏 = 𝟒𝟎𝟎(𝟔 − 𝒏) 4 800 5,600 1,400

5 400 6,000 1,000

Year DDB($) Total Dep.(n) ($) B.V.(n) ($)

0 0 0 7000

(c) Double declining balance depreciation

𝟐 1 2,800 2,800 4,200

𝑫𝑫𝑩 𝒏 = 𝑩. 𝑽. 𝒏 − 𝟏 2 1,680 4,480 2,520

𝑵

3 1008 5488 1512

4 604.8 6092.8 907.2

5 362.88 6,455.68 544.32

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 10

EXAMPLE 4.7

The cost of a new asset is $900 and its useful life is five years. If the salvage value is estimated to

be $30, compute the depreciation charts using:

(a)Straight line depreciation;

(b) Sum-of-years-digits depreciation;

(c) Double declining balance depreciation

Solution

𝑷 = $𝟗𝟎𝟎, 𝑺 = $𝟑𝟎, 𝐍 = 𝟓 𝐲𝐞𝐚𝐫𝐬 Year DC($) Total Dep.(n) ($) B.V.(n) ($)

(a) Straight line depreciation 0 0 0 900

𝟏 1 174 174 726

𝑫𝑪 = 𝑷 − 𝑺 = $𝟏𝟕𝟒

𝑵 2 174 348 552

3 174 522 378

4 174 696 204

5 174 870 30

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 11

(b) Sum-of-years-digits depreciation Year DC(n)($) Total Dep.(n) ($) B.V.(n) ($)

𝟐 𝑵−𝒏+𝟏 0 0 0 900

𝑫𝑪 𝒏 = 𝑷−𝑺

𝑵 𝑵+𝟏 1 290 290 610

𝟐 𝟓−𝒏+𝟏 2 232 512 388

𝑫𝑪 𝒏 = 𝟗𝟎𝟎 − 𝟑𝟎

𝟓×𝟔 3 174 686 114

𝑫𝑪 𝒏 = 𝟓𝟖(𝟔 − 𝒏) 4 116 812 88

5 58 870 30

Year DDB($) Total Dep.(n) ($) B.V.(n) ($)

(c) Double declining balance depreciation 0 0 0 900

𝟐 1 360 360 540

𝑫𝑫𝑩 𝒏 = 𝑩. 𝑽. 𝒏 − 𝟏

𝑵 2 216 576 324

3 129.6 705.6 194.4

4 77.76 783.36 116.64

5 46.656 830.016 69.984

Dr. Abdelmagid A. Abdalla Lecture 8 12/17/2020 12

You might also like

- Interpol Buyers-Black-List 5-6-2020Document47 pagesInterpol Buyers-Black-List 5-6-2020chris perry0% (1)

- Accounting Errors 8-9 (Answers)Document2 pagesAccounting Errors 8-9 (Answers)angela pajelNo ratings yet

- PPE2-sample - Debi Comia PPE2-sample - Debi ComiaDocument16 pagesPPE2-sample - Debi Comia PPE2-sample - Debi ComiaAngelica Pagaduan50% (2)

- Solutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenDocument33 pagesSolutions Manual Management Accounting Sixth Canadian Edition 6th Edition HorngrenErika LanezNo ratings yet

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Worksheet No. 5Document2 pagesWorksheet No. 5Xie Zhen WuNo ratings yet

- Sogradiel - Final ExamDocument17 pagesSogradiel - Final ExamRIZLE SOGRADIELNo ratings yet

- Assigment 4 SolutionDocument2 pagesAssigment 4 SolutionRamy ShabanaNo ratings yet

- UntitledDocument15 pagesUntitledemielyn lafortezaNo ratings yet

- ARR Practice QuestionsDocument6 pagesARR Practice QuestionsAnanya VasishthaNo ratings yet

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (33)

- Intermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDocument43 pagesIntermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDebraWhitecxgn100% (14)

- Latihan Soal Akuntansi BiayaDocument5 pagesLatihan Soal Akuntansi Biayaaufa alfayedhaNo ratings yet

- Solutions Winter 2022Document5 pagesSolutions Winter 2022sissy.he.7No ratings yet

- Cap Buget ProblemsDocument8 pagesCap Buget ProblemsramakrishnanNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Chapter 11 In-Class Problems SolutionDocument4 pagesChapter 11 In-Class Problems Solutionliuxuhan3No ratings yet

- E9-3 Determining Financial Statement Effects of An Asset Acquisition and Straight-Line DepreciationDocument12 pagesE9-3 Determining Financial Statement Effects of An Asset Acquisition and Straight-Line DepreciationRamiro Gallo Diaz GonzalezNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- Actual Results Flexible-Budget Variances Flexible Budget Sales - Variances Static Budget Unit Rev V.C C.M FC O.IDocument2 pagesActual Results Flexible-Budget Variances Flexible Budget Sales - Variances Static Budget Unit Rev V.C C.M FC O.IReem Hani JabariNo ratings yet

- EvaluationDocument3 pagesEvaluationLatoya SmithNo ratings yet

- GATLABAYAN - Activity #1 M3Document4 pagesGATLABAYAN - Activity #1 M3Al Dominic GatlabayanNo ratings yet

- Earned Value ChartDocument4 pagesEarned Value ChartRanda S JowaNo ratings yet

- Accounting Module 2 Learning ActivityDocument5 pagesAccounting Module 2 Learning ActivityHannah Jean MabunayNo ratings yet

- Solution Manual For Accounting For Decision Making and Control 9th Edition Jerold ZimmermanDocument7 pagesSolution Manual For Accounting For Decision Making and Control 9th Edition Jerold Zimmermanfuze.riddle.ghik9100% (51)

- Problem 1: Change Variable Factory Overhead Change Machine Hours $ 1,875,000 $ 1,250,000) $ 625,000Document6 pagesProblem 1: Change Variable Factory Overhead Change Machine Hours $ 1,875,000 $ 1,250,000) $ 625,000AJ OrtegaNo ratings yet

- Note Chapter 14 + 15 + CH A Mid-Term TestDocument4 pagesNote Chapter 14 + 15 + CH A Mid-Term TestGenoso OtakuNo ratings yet

- In-Class 1 SolutionsDocument2 pagesIn-Class 1 SolutionssassNo ratings yet

- Financial Management - Capital Budgeting Answer KeyDocument5 pagesFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Consolidated FinancialDocument21 pagesConsolidated FinancialMaria Raven Joy Espartinez ValmadridNo ratings yet

- CapbdgtDocument25 pagesCapbdgtmajidNo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- (IFA 13) - Rendy Filiang - 1402210324Document10 pages(IFA 13) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Profitability AnalysisDocument12 pagesProfitability AnalysisTHE TERMINATORNo ratings yet

- FA Practice 2 - QuestionsDocument10 pagesFA Practice 2 - QuestionsZhen WuNo ratings yet

- El Modelo de Baumol: Tasa de Interés AnualDocument6 pagesEl Modelo de Baumol: Tasa de Interés AnualvaleriaNo ratings yet

- DepreciationDocument4 pagesDepreciationMùhammad TàhaNo ratings yet

- Afar SolutionDocument8 pagesAfar SolutionAsnifah AlinorNo ratings yet

- Rupasha ProjectDocument27 pagesRupasha ProjectJabedur RahmanNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Rate of Return Analysis: Multiple Alternatives: Solutions To End-Of-Chapter ProblemsDocument14 pagesRate of Return Analysis: Multiple Alternatives: Solutions To End-Of-Chapter ProblemsenmanuelkasparianNo ratings yet

- Set 2 MS, 2ND PBDocument10 pagesSet 2 MS, 2ND PBHarini NarayananNo ratings yet

- Reviewer 47 PDF Free HelpfulDocument153 pagesReviewer 47 PDF Free HelpfulVon Rother Celoso DiazNo ratings yet

- CH 12 Excel (Students)Document9 pagesCH 12 Excel (Students)Daniela VelezNo ratings yet

- Replacement Breakeven AnalysisDocument8 pagesReplacement Breakeven AnalysisZoloft Zithromax ProzacNo ratings yet

- Least Square Regression Method: Cost AccountingDocument11 pagesLeast Square Regression Method: Cost Accountingretchiel love calinogNo ratings yet

- Economic Engineering - Solution Chapter 9Document19 pagesEconomic Engineering - Solution Chapter 9ScribdTranslationsNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- Fabiz en Page 1 of 5 Test Preparation MaterialDocument5 pagesFabiz en Page 1 of 5 Test Preparation MaterialOanaPetruNo ratings yet

- Date Particulars: in The Books of XYZ JournalDocument38 pagesDate Particulars: in The Books of XYZ JournalAnanya ChoudharyNo ratings yet

- Nominex Presentation Bop 25 Jun 2022 - PublicDocument46 pagesNominex Presentation Bop 25 Jun 2022 - PublicAsni Nor Rizwan Abdul RaniNo ratings yet

- Full Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Introduction To Management Accounting Horngren 16th Edition Solutions Manual PDF Full Chapterhomelingcomposedvqve100% (21)

- DrGoodwill AccDocument17 pagesDrGoodwill AccpancrasNo ratings yet

- Color ScopeDocument12 pagesColor Scopeprincemech2004100% (2)

- Worksheet Assigned Problem 7-17, 7-35 (Chapter 7)Document4 pagesWorksheet Assigned Problem 7-17, 7-35 (Chapter 7)Vu NguyenNo ratings yet

- Topic 03 (Set A) - ADocument5 pagesTopic 03 (Set A) - Acixiang0620No ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- F2 - Mock A - Answers-2-11 143Document10 pagesF2 - Mock A - Answers-2-11 143MD KaifNo ratings yet

- Group 6 Drill WS & FSDocument12 pagesGroup 6 Drill WS & FSSheilla Dela Torre PaderangaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Lecture 7Document14 pagesLecture 7Omar KhalilNo ratings yet

- 3.2 Types of Engineering Problems & Economic Analysis ObjectiveDocument14 pages3.2 Types of Engineering Problems & Economic Analysis ObjectiveOmar KhalilNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Engineering Economy GEN351: Dr. Abdelmagid A. Abdalla Manufacturing Engineering and Production Technology DeptDocument10 pagesEngineering Economy GEN351: Dr. Abdelmagid A. Abdalla Manufacturing Engineering and Production Technology DeptOmar KhalilNo ratings yet

- Quiz 20 Past QuizzesDocument23 pagesQuiz 20 Past QuizzesSarah Joy Corpuz-Cabasag100% (1)

- 1-2 Math at Home Game TimeDocument1 page1-2 Math at Home Game TimeKarla Panganiban TanNo ratings yet

- Save Money. Live BetterDocument1 pageSave Money. Live BetterdopoviNo ratings yet

- QCSH MCQ QCSH MCQDocument15 pagesQCSH MCQ QCSH MCQchutiyahu787No ratings yet

- Market Driven StrategyDocument43 pagesMarket Driven StrategyAhsan ShahidNo ratings yet

- OctaneRenderUserManualBeta2 46Document137 pagesOctaneRenderUserManualBeta2 46Romeo CostanNo ratings yet

- Thyrotronic Rectifier ManualDocument3 pagesThyrotronic Rectifier ManualUsama SheikhNo ratings yet

- An Investigation Into The Shear Strength of Rock DiscontinuityDocument6 pagesAn Investigation Into The Shear Strength of Rock DiscontinuityAzeNo ratings yet

- Solar Water Heating Project Analysis: Glazed Flat Plate Collectors, Ontario, CanadaDocument18 pagesSolar Water Heating Project Analysis: Glazed Flat Plate Collectors, Ontario, CanadaAnadin Ane DžinićNo ratings yet

- Maintenance of Building ComponentsDocument4 pagesMaintenance of Building ComponentsIZIMBANo ratings yet

- Passenger Locator Form: STATUS: Airside TransitDocument3 pagesPassenger Locator Form: STATUS: Airside TransitMERLITO HERRERANo ratings yet

- Case Study For 1st AssignmentDocument17 pagesCase Study For 1st AssignmentMaher Ahmed100% (1)

- EFL IS User ManualDocument26 pagesEFL IS User Manualarupamguria05No ratings yet

- A Qualitative Study of Health Information Seeking Behavior On The Internet Among Information Technology ProfessionalsDocument8 pagesA Qualitative Study of Health Information Seeking Behavior On The Internet Among Information Technology ProfessionalsYogesh BkNo ratings yet

- Endless HaulageDocument6 pagesEndless Haulagedudealok100% (3)

- Media and Information Literacy Prelims Reviewer PDFDocument7 pagesMedia and Information Literacy Prelims Reviewer PDFElishaNo ratings yet

- Abdul Rauf Alias CV 2023Document4 pagesAbdul Rauf Alias CV 2023Rauf AliasNo ratings yet

- Bangladesh Bank HistoryDocument5 pagesBangladesh Bank HistoryzonayetgaziNo ratings yet

- History of Educ - TechDocument5 pagesHistory of Educ - Techjiggly popNo ratings yet

- Circus LionDocument5 pagesCircus LionTiduj Rácsib100% (1)

- UK Armed Forces Equipment and Formations 2022 TablesDocument17 pagesUK Armed Forces Equipment and Formations 2022 TablesПриходько РомаNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument17 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- English Ki Tooti Hui TangDocument2 pagesEnglish Ki Tooti Hui TangGaurav PandeyNo ratings yet

- 3kV Cabinet Housed Traction RectifierDocument4 pages3kV Cabinet Housed Traction Rectifierandy_mickNo ratings yet

- Soneye Adebayo CVDocument4 pagesSoneye Adebayo CVBayo SoneyeNo ratings yet

- Company Name State LocationDocument18 pagesCompany Name State LocationompatelNo ratings yet

- Bhum103l - Micro-Economics - TH - 1.0 - 71 - Bhum103l - 66 AcpDocument2 pagesBhum103l - Micro-Economics - TH - 1.0 - 71 - Bhum103l - 66 AcpDarshilNo ratings yet

- The Optimal Petroleum Fiscal Regime For Ghana: An Analysis of Available AlternativesDocument12 pagesThe Optimal Petroleum Fiscal Regime For Ghana: An Analysis of Available AlternativesIbrahim SalahudinNo ratings yet