Professional Documents

Culture Documents

India Cryptocurrency Article

India Cryptocurrency Article

Uploaded by

KANKATALA SRUJAN KUMARCopyright:

Available Formats

You might also like

- Learn How to Earn with Cryptocurrency TradingFrom EverandLearn How to Earn with Cryptocurrency TradingRating: 3.5 out of 5 stars3.5/5 (3)

- I Am Sharing 'Ceylon Cold Store' With YouDocument12 pagesI Am Sharing 'Ceylon Cold Store' With YouDeshanranga Pathiraja67% (3)

- J 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011Document14 pagesJ 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011kumar kartikeyaNo ratings yet

- PWC Cryptographic Assets and Related Transactions Accounting Considerations Under IfrsDocument23 pagesPWC Cryptographic Assets and Related Transactions Accounting Considerations Under IfrsJeanPNo ratings yet

- Case 19-6 Classification of Cryptocurrency Holdings: All Rights ReservedDocument2 pagesCase 19-6 Classification of Cryptocurrency Holdings: All Rights ReservedbalonyNo ratings yet

- IFRS (#) : Accounting For Crypto-AssetsDocument24 pagesIFRS (#) : Accounting For Crypto-AssetsNinjee BoNo ratings yet

- IFRS (#) : Accounting For Crypto-AssetsDocument35 pagesIFRS (#) : Accounting For Crypto-AssetsDwi Pamungkas UnggulNo ratings yet

- Cryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatDocument4 pagesCryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatChristos FloridisNo ratings yet

- A Study On Cryptocurrency-BitcoinDocument10 pagesA Study On Cryptocurrency-Bitcoinaditya jangdeNo ratings yet

- 3 Cryptocurrency RegulationDocument6 pages3 Cryptocurrency RegulationAmmar KattoulaNo ratings yet

- Cryptographic Assets Related Transactions Accounting Considerations Ifrs PWC in DepthDocument26 pagesCryptographic Assets Related Transactions Accounting Considerations Ifrs PWC in DepthSonja PrstecNo ratings yet

- The Dark Side of Cryptocurrency - Tushar ShahaniDocument25 pagesThe Dark Side of Cryptocurrency - Tushar ShahaniTushar ShahaniNo ratings yet

- Accounting - 1800136Document18 pagesAccounting - 1800136Anonymous pPcOy7J8No ratings yet

- Digital Asset Industry Response Group Aotearoa NZDocument13 pagesDigital Asset Industry Response Group Aotearoa NZDhruv GomberNo ratings yet

- New OpenDocument TextDocument6 pagesNew OpenDocument Textalaa hawatmehNo ratings yet

- Blockchain Technology PDFDocument6 pagesBlockchain Technology PDFAnirvan VinodNo ratings yet

- Blockchain & Crypto Guide 101Document17 pagesBlockchain & Crypto Guide 101viktoriyaNo ratings yet

- Accounting & Reporting of Cryptocurrencies: Anirudh Kar 4bcom If 1912705Document4 pagesAccounting & Reporting of Cryptocurrencies: Anirudh Kar 4bcom If 1912705Anirudh Kar 1912705No ratings yet

- Taxing Cryptocurrency: A Review and A Call For Consensus: Commentary & AnalysisDocument11 pagesTaxing Cryptocurrency: A Review and A Call For Consensus: Commentary & Analysisyash mehtaNo ratings yet

- Sri Mulyani (25-39)Document17 pagesSri Mulyani (25-39)Yuniarso Adi NugrohoNo ratings yet

- CryptocurrenciesDocument3 pagesCryptocurrenciesDivya ChowdhryNo ratings yet

- Cryptaxforency, When Cryptocurency, Taxation and Digital Forensic ColideDocument16 pagesCryptaxforency, When Cryptocurency, Taxation and Digital Forensic ColideMuhammad Albert YulyanNo ratings yet

- BNCoin White Paper (English) 200124Document20 pagesBNCoin White Paper (English) 200124dra arbyNo ratings yet

- Cryptocurrency Presentation - Vandana KeluskarDocument15 pagesCryptocurrency Presentation - Vandana KeluskarParag KabraNo ratings yet

- Anti-Money Laundering Regulation of Cryptocurrency: U.S. and Global ApproachesDocument14 pagesAnti-Money Laundering Regulation of Cryptocurrency: U.S. and Global ApproachesFiorella VásquezNo ratings yet

- Assignment 2Document4 pagesAssignment 2Anchal BhatiaNo ratings yet

- Vajra - CLT Blog - FootnotedDocument3 pagesVajra - CLT Blog - FootnotedRitwik PrakashNo ratings yet

- Proofreading Sri Mulyani (25-39) - RevDocument17 pagesProofreading Sri Mulyani (25-39) - RevYuniarso Adi NugrohoNo ratings yet

- Bit Coin Regulations in IndiaDocument15 pagesBit Coin Regulations in IndiaVaishnavi CNo ratings yet

- Cryptocurrency DefinitionDocument12 pagesCryptocurrency Definitionhabeeb_matrixNo ratings yet

- Aditya Sharma English PrationDocument14 pagesAditya Sharma English PrationKashyap KrishnaNo ratings yet

- Unit-4 CryptocurrencyDocument16 pagesUnit-4 Cryptocurrencyharisaikumar265No ratings yet

- CryptocurrenciesDocument13 pagesCryptocurrenciesTawfiqul WahidNo ratings yet

- Tokenization 1697136521Document5 pagesTokenization 1697136521Grisha KarunasNo ratings yet

- Sakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionDocument10 pagesSakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionSakshee SahayNo ratings yet

- Debate Mitra - CryptoDocument2 pagesDebate Mitra - Cryptosaman0711994No ratings yet

- Cryptoasssets ExplainedDocument11 pagesCryptoasssets ExplainedjeNo ratings yet

- Paper TsFKfa85Document17 pagesPaper TsFKfa85Hakim ThumNo ratings yet

- Own Summary On Crypto-Currency and BlockchainDocument4 pagesOwn Summary On Crypto-Currency and BlockchainZacharias Kuoh HaotengNo ratings yet

- Article On India at The Verge of Chocking It's Cryptocurrency Ecosystem Due To Dread in Taxation LawDocument10 pagesArticle On India at The Verge of Chocking It's Cryptocurrency Ecosystem Due To Dread in Taxation LawAnonymous TsEvYcc1No ratings yet

- J RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403Document18 pagesJ RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403kumar kartikeyaNo ratings yet

- Research CryptocurrencyDocument19 pagesResearch Cryptocurrencymayhem happening100% (1)

- Accounting in The World of CryptocurrencyDocument31 pagesAccounting in The World of Cryptocurrencynidhi thakurNo ratings yet

- T C R C - A: A C P: Jaideep ReddyDocument45 pagesT C R C - A: A C P: Jaideep ReddySweety RoyNo ratings yet

- USB CryptocurrencyDocument18 pagesUSB CryptocurrencytabNo ratings yet

- A Survey On Factors Leading To Rapid Fluctuations in The Price of CryptocurrencyDocument4 pagesA Survey On Factors Leading To Rapid Fluctuations in The Price of CryptocurrencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Pakistan Industries - Assignment No 05Document8 pagesAnalysis of Pakistan Industries - Assignment No 05Jannat AslamNo ratings yet

- Giudici2020 Article CryptocurrenciesMarketAnalysisDocument18 pagesGiudici2020 Article CryptocurrenciesMarketAnalysisGeysa Pratama EriatNo ratings yet

- Cryptocurrency Case Analysis M-5Document7 pagesCryptocurrency Case Analysis M-5sandrini salinasNo ratings yet

- How to Get Filthy Rich Investing in Bitcoin and Other Cryptocurrencies: Why It's Not Too Late to Become a Millionaire Investor With Digital MoneyFrom EverandHow to Get Filthy Rich Investing in Bitcoin and Other Cryptocurrencies: Why It's Not Too Late to Become a Millionaire Investor With Digital MoneyNo ratings yet

- Basic Aspectsof CryptoDocument9 pagesBasic Aspectsof CryptoSana BraiekNo ratings yet

- Blockchain Technology: An Approaching Game Changer in Financial Service IndustryDocument5 pagesBlockchain Technology: An Approaching Game Changer in Financial Service IndustryEditor IJTSRDNo ratings yet

- B Com2 W5P2T2 RPFinalDocument4 pagesB Com2 W5P2T2 RPFinalVinit VinitNo ratings yet

- HomeWork N2 NikaShaveshianiDocument3 pagesHomeWork N2 NikaShaveshianishaveshianinikaNo ratings yet

- Cryptocurrency The Present and The Future ScenarioDocument16 pagesCryptocurrency The Present and The Future ScenarioIJRASETPublicationsNo ratings yet

- TRAINING Client Support CoinMetro - PART 1,2,3,4Document53 pagesTRAINING Client Support CoinMetro - PART 1,2,3,4Armando Gabriel CMNo ratings yet

- The Crypto Effect On Cross Border Transfers and Future Trends of CryptocurrenciesDocument12 pagesThe Crypto Effect On Cross Border Transfers and Future Trends of CryptocurrenciesKasia AdamskaNo ratings yet

- CryptocurrencyDocument9 pagesCryptocurrencyRaghavNo ratings yet

- DocScanner 11-Aug-2022 1-49 AmDocument2 pagesDocScanner 11-Aug-2022 1-49 AmKANKATALA SRUJAN KUMARNo ratings yet

- DocScanner 17-Aug-2022 9-52 PMDocument4 pagesDocScanner 17-Aug-2022 9-52 PMKANKATALA SRUJAN KUMARNo ratings yet

- Bus Schedule W.E.F 11 April 2022Document2 pagesBus Schedule W.E.F 11 April 2022KANKATALA SRUJAN KUMARNo ratings yet

- MEL2040 Fluid Mechanics I and E Grade Exam Total Marks: 40 Duration: 2 HrsDocument2 pagesMEL2040 Fluid Mechanics I and E Grade Exam Total Marks: 40 Duration: 2 HrsKANKATALA SRUJAN KUMARNo ratings yet

- Yob 1986Document351 pagesYob 1986KANKATALA SRUJAN KUMARNo ratings yet

- Ac 2012-3019: Solar Water Heating System Experimental ApparatusDocument13 pagesAc 2012-3019: Solar Water Heating System Experimental ApparatusKANKATALA SRUJAN KUMARNo ratings yet

- Land Grabs and Agrarian ReformDocument3 pagesLand Grabs and Agrarian ReformKANKATALA SRUJAN KUMARNo ratings yet

- Experiment #5: ObjectivesDocument6 pagesExperiment #5: ObjectivesKANKATALA SRUJAN KUMARNo ratings yet

- Experiment # 3 &4 Solar Water Heating System: Page 1 of 6Document6 pagesExperiment # 3 &4 Solar Water Heating System: Page 1 of 6KANKATALA SRUJAN KUMARNo ratings yet

- Experiment #1 and 2: ObjectivesDocument5 pagesExperiment #1 and 2: ObjectivesKANKATALA SRUJAN KUMARNo ratings yet

- Analytics Quiz and Case StudyDocument12 pagesAnalytics Quiz and Case StudyKANKATALA SRUJAN KUMARNo ratings yet

- TCS Digital All Slots Questions PrepInstaDocument80 pagesTCS Digital All Slots Questions PrepInstaKANKATALA SRUJAN KUMAR100% (1)

- RNN & LSTM: Vamsi Krishna B 1 9 M E 0 2 3Document14 pagesRNN & LSTM: Vamsi Krishna B 1 9 M E 0 2 3KANKATALA SRUJAN KUMARNo ratings yet

- Ec101 NotesDocument60 pagesEc101 NotesSylvesterNo ratings yet

- What Is The Mandrake MechanismDocument16 pagesWhat Is The Mandrake Mechanismcanauzzie100% (1)

- Chapter 15 Tutorial Solutions Week 11Document11 pagesChapter 15 Tutorial Solutions Week 11Silo Ketenilagi0% (1)

- Short Term Liquidity Ratios Activity IIDocument7 pagesShort Term Liquidity Ratios Activity IIZarish AzharNo ratings yet

- How To Find Waterside AttachmentDocument3 pagesHow To Find Waterside AttachmentSplash1No ratings yet

- GST Working May 2022Document20 pagesGST Working May 2022Chandrashekar BNo ratings yet

- World of Three ZerosDocument4 pagesWorld of Three ZerosEdwinNo ratings yet

- 15MF02 Financial Derivatives Question BankDocument12 pages15MF02 Financial Derivatives Question BankDaksin PranauNo ratings yet

- Cash Is The Most Important Aspect of Operating A BusinessDocument5 pagesCash Is The Most Important Aspect of Operating A Businessmuudey sheikhNo ratings yet

- Marxist Criticism (Hunger Games) 10-Page Full PaperDocument11 pagesMarxist Criticism (Hunger Games) 10-Page Full PaperErin Iris Delos SantosNo ratings yet

- Resoluton 50 PesosDocument2 pagesResoluton 50 PesosKarole Marcelene MagnayeNo ratings yet

- Asian Security Practice - Material and Ideational Influences (PDFDrive)Document1,799 pagesAsian Security Practice - Material and Ideational Influences (PDFDrive)Muhammad Jahanzeb AkmalNo ratings yet

- P&G - RFQ - Ex. ZirakpurDocument5 pagesP&G - RFQ - Ex. Zirakpurgurpreet.singh1No ratings yet

- Question Paper Subject-Economics For Class-12th Examination - 2024-25Document41 pagesQuestion Paper Subject-Economics For Class-12th Examination - 2024-25AFRAH JALEELANo ratings yet

- Budgeting and Budgetary Control System - Zuari CementDocument20 pagesBudgeting and Budgetary Control System - Zuari CementShiva sagar ChallaNo ratings yet

- Mcqs On Logistics For Mba and TybbaDocument6 pagesMcqs On Logistics For Mba and TybbaVarathajayasudha JeganathanNo ratings yet

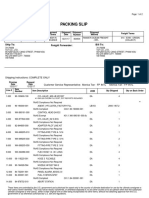

- Packing Slip: Ship To: Bill To: Freight ForwarderDocument2 pagesPacking Slip: Ship To: Bill To: Freight Forwardercan 3 cuopNo ratings yet

- Invoice (DSPA040424)Document2 pagesInvoice (DSPA040424)Michael GalosiNo ratings yet

- FreedomSIP Brochure Final Jan2021 FreedomWeekDocument4 pagesFreedomSIP Brochure Final Jan2021 FreedomWeekAyushi AgarwalNo ratings yet

- Seminar On SFM - Ca Final: Archana Khetan B.A, CFA (ICFAI), MS Finance, 9930812721Document53 pagesSeminar On SFM - Ca Final: Archana Khetan B.A, CFA (ICFAI), MS Finance, 9930812721shankar k.c.No ratings yet

- Acc 206 Manufacturing Account 2021Document21 pagesAcc 206 Manufacturing Account 2021Boi NonoNo ratings yet

- Foreign Direct Investment (Fdi), Foreign Institutional Investment (Fiis) and International Financial ManagementDocument54 pagesForeign Direct Investment (Fdi), Foreign Institutional Investment (Fiis) and International Financial Managementshankar k.c.No ratings yet

- Civil Law Review OBLICONDocument8 pagesCivil Law Review OBLICONachiNo ratings yet

- Mekane Eyesus FCFDocument41 pagesMekane Eyesus FCFKidanu Tilahun100% (1)

- MANECO AssignmentDocument4 pagesMANECO AssignmentNyah RoldanNo ratings yet

- Notes From Anna Coulling Ebook PDF FreeDocument9 pagesNotes From Anna Coulling Ebook PDF FreeJose CANo ratings yet

- Financial MarketDocument14 pagesFinancial MarketFel Salazar JapsNo ratings yet

- Assignment 2 (Part 2)Document5 pagesAssignment 2 (Part 2)Tricia DimaanoNo ratings yet

- Nwssu - Mod in Contemporary World - Module2Document34 pagesNwssu - Mod in Contemporary World - Module2raymundo canizaresNo ratings yet

India Cryptocurrency Article

India Cryptocurrency Article

Uploaded by

KANKATALA SRUJAN KUMAROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Cryptocurrency Article

India Cryptocurrency Article

Uploaded by

KANKATALA SRUJAN KUMARCopyright:

Available Formats

bloombergindustry.

com

Reproduced with permission. Published September 03, 2021. Copyright R 2021 The Bureau of National Affairs, Inc. 800-

372-1033. For further use, please visit https://www.bloombergindustry.com/copyright-and-usage-guidelines-copyright/

Cryptocurrencies—Legal and Tax Considerations in India

BY BIJAL AJINKYA, RAGHAV KUMAR BAJAJ AND evolving legal landscape as well as the income tax re-

lated implications related to cryptocurrencies in India.

MILIND HASRAJANI

With a global market capitalization of around $2 tril-

lion, cryptocurrencies (or virtual currencies—the ex- Technological Aspects of

pression in use recently for such assets) can no longer Cryptocurrencies

be ignored. The hunger for alternative investment op-

portunities fueled by pandemic-hit business sentiment Cryptocurrencies are usually defined as a digital rep-

has been a prominent reason for the astounding jump resentation of value which is secured using crypto-

in crypto valuations in the past 12 months. graphic methods and is recorded, transferred, or stored

From a global tax perspective, this provides a mas- electronically using distributed ledger technology. Sim-

sive tax opportunity for countries, and governments as ply put, these are electronic peer-to-peer currencies.

well as international economic bodies have become This concept gained traction after the 2007–08 global

more active and pragmatic in their approach towards financial crisis, with the introduction of a cryptocur-

cryptocurrencies. Though there are several macro-level rency named Bitcoin.

policy issues and aspects—legal, regulatory, and The core ideology behind cryptocurrencies was to

taxation—that require clarity in this area, the underly- create and move money without a central authority (i.e.

ing technology (i.e. the blockchain technology) needs to a central bank of a country). Hence it was necessary to

be leveraged and explored proactively to usher in the ensure that the underlying technology and infrastruc-

transition towards a digital economy. ture on which a cryptocurrency is based has an in-built

India’s approach towards cryptocurrencies has been trust mechanism and that the data/information entered

cautious and conservative, but it has certainly evolved on such networks remains immutable and tamper-

over time. From a tax perspective, there is no official proof.

guidance from the Indian government yet on how In this regard, we outline below some of the key tech-

crypto-related gains should be taxed and what should nological aspects:

be the most appropriate characterization for cryptocur- s Distributed Ledger Technology (DLT): a distrib-

rencies. The taxation of crypto-related gains will there- uted network of participants, using independent com-

fore need to be examined in light of the existing taxa- puters (also called nodes) which record, share, and syn-

tion principles. chronize information (essentially transactions or data)

In this article we discuss some of the key technologi- independently in their respective electronic ledgers. For

cal concepts that surround cryptocurrencies and the ease of understanding, as an analogy, DLT can be un-

derstood as a WhatsApp group chat where the chat his-

tory (which contains the information) is the ledger

Bijal Ajinkya is a Partner, Raghav Kumar

which is distributed on every member’s phone (node/

Bajaj is a Principal Associate and Milind Has-

participant).

rajani is an Associate at Khaitan & Co.

COPYRIGHT R 2021 BY THE BUREAU OF NATIONAL AFFAIRS, INC.

2

s Cryptography: the method of sending secured in- Key Taxable Events

formation between two or more participants. It essen-

tially involves converting information that is available The foundational step for imposing any tax on cryp-

in plain ordinary text into unintelligible text (encryp- tocurrencies is their characterization. It remains open

tion) and vice versa (decryption). Cryptography in the whether cryptocurrency should fall under the definition

realm of cryptocurrencies is used to secure and authen- of a ‘‘currency’’ or whether it should simply be classi-

ticate the information being recorded on a DLT. As the fied as an ‘‘intangible asset.’’ This question has become

idea behind cryptocurrencies is to eliminate the need even more interesting recently as El Salvador has rec-

for a central authority, cryptographic methods are used ognized Bitcoin as its legal tender and therefore it may

to secure and authenticate the information relating to be argued that Bitcoin falls under the definition of a

such cryptocurrency, to instil trust between the partici- ‘‘foreign currency.’’

pants transacting in a cryptocurrency. The taxable events in relation to cryptocurrencies can

be broadly divided into two categories—events which

lead to the creation or generation of a cryptocurrency,

s Blockchain: A blockchain is a subset of DLT and and events which relate to the secondary disposal of a

one of the most commonly used forms of DLT. As the cryptocurrency. The possible Indian income tax impli-

name suggests, it is essentially a chain of blocks with cations of such events are discussed below.

each block linked to the previous one. Each block con-

sists of information on the transactions (timestamp, Creation of Cryptocurrencies

value, etc.) that have taken place on the blockchain s Mining: If the activity of mining is carried out with

DLT and which has been cryptographically authenti- the intention of earning profits (i.e. as a business), then

cated by the participants on the DLT. According to the the rewarded cryptocurrency should be taxable as busi-

World Economic Forum, blockchain technology is be- ness income. However, if mining is carried out as a ca-

ing hailed as one of the seven revolutionary technolo- sual activity or a hobby, it needs to be evaluated

gies that will revolutionize various aspects of human whether the rewarded cryptocurrency will be character-

lives. ized as ordinary income or as a non-taxable capital re-

ceipt. For it to be characterized as ordinary income, the

relevant test will be whether cryptocurrency falls within

s Mining: As explained above, information related the ambit of a ‘‘security.’’ This is because under Indian

to transactions in a cryptocurrency is required to be au- income tax law, receipt of a ‘‘security’’ for nil or inad-

thenticated using cryptographic methods before it is equate consideration triggers a taxable event for the re-

stored on a DLT. Thus, mining is deploying computers cipient.

to cryptographically authenticate such information be-

ing recorded on a DLT. However, not every participant

s Initial Coin Offering (ICO): Similar to an initial

on the DLT may be interested in authenticating infor-

public offering by a company, an ICO refers to an event

mation and may merely be interested in transacting

where a new cryptocurrency is issued in exchange for

with the cryptocurrency. Therefore, to incentivize par-

one of the existing major cryptocurrencies (for ex-

ticipants to authenticate such information, a reward in

ample, Bitcoin, Ether) or in some cases even in ex-

the form of the cryptocurrency itself is given to such

change for fiat currencies. An ICO is a commonly used

participants. Participants who successfully authenticate

method for raising funds for a new project in the cryp-

such information using cryptographic methods are

tocurrency space. In the absence of any specific taxing

called ‘‘miners.’’

provision for such events in relation to cryptocurren-

cies, it seems that the existing provisions of Indian in-

come tax law relating to primary issuance of shares will

not be attracted in the case of an ICO.

Evolving Legal Landscape in India

s Airdrop: This refers to an event where cryptocur-

Since Bitcoin and the concept of cryptocurrencies rency is given or distributed, without any consideration,

started gaining traction, the Indian government has to a select few people (such as influencers, celebrities,

consistently taken a cautionary approach, with the Re- or other public figures) to increase awareness of the

serve Bank of India (RBI) warning the Indian public cryptocurrency. This method is generally adopted by

about the uncertainties surrounding cryptocurrencies. new cryptocurrencies upon their launch in the market.

In 2018, the RBI issued a prohibition on Indian banks A recent example of airdropping occurred when more

facilitating any transactions in cryptocurrencies. Fur- than 50% of the Shiba Inu (a relatively new cryptocur-

ther, in 2019 an Inter-Ministerial Committee set up by rency launched in 2020) in circulation was donated to

the Indian government also recommended that all pri- Vitalik Buterin, the co-founder of Ethereum. In the case

vate cryptocurrencies, except any official digital cur- of influencers and celebrities, the receipt of cryptocur-

rency issued by the state, be banned in India. rencies via an airdrop is likely to be taxable in the same

However, the legal landscape and the perception in manner as fees received for promoting brand aware-

India of cryptocurrencies has evolved, and the RBI pro- ness, i.e. as business income. However, in the case of

hibition described above was set aside by the Supreme public figures (such as Buterin), who are not in the busi-

Court of India in 2020. Arguably, this was a watershed ness of carrying out brand awareness or marketing ac-

moment in India’s cryptocurrency ecosystem. However, tivities, and to whom cryptocurrencies are airdropped

the statements made by the government and regulators without any expectation of service in return, the receipt

from time to time still indicate that the future of crypto- may be taxable as an ordinary income, provided that

currencies from an Indian regulatory perspective may the cryptocurrency falls within the ambit of a ‘‘secu-

be uncertain. rity.’’

COPYRIGHT R 2021 BY THE BUREAU OF NATIONAL AFFAIRS, INC.

3

currency being facilitated by the exchange) whether

cryptocurrencies will fall under the definition of

Secondary Disposal of Cryptocurrencies ‘‘goods.’’

s Mined coins: Where the secondary sale relates to It is relevant to note that the definition of ‘‘goods’’ un-

mined cryptocurrencies, the gains arising upon disposal der the Indian Sale of Goods Act has wide import and

of such mined coins should be taxable as business in- includes movable property of every kind which is sold

come, if mining activities were carried out with the in- for monetary consideration.

tention of earning profits. In any other case of a mined

coin, the gains arising upon disposal of mined coins

should be taxable as capital gains. However, it may be Global Tax Considerations and

argued that no capital gains tax should be levied in the

case of mined coins, as the cost of acquisition of such Implications

assets is not determinable, thereby resulting in failure

The Organization for Economic Cooperation and De-

of the machinery provisions for computing capital

velopment (OECD) in its report titled ‘‘Taxing Virtual

gains. However, the tax authorities may want to argue

Currencies: An Overview of Tax Treatments And

that the computing costs, electricity costs, etc., incurred

Emerging Tax Policy Issues’’ has noted that countries

in relation to cryptocurrency mining should form the

have different approaches in their characterization of

cost base for computing such capital gains.

cryptocurrencies for tax purposes.

While many countries have characterized cryptocur-

s Other than mined coins: In other cases, it needs to rencies as merely an intangible asset, some have gone

be evaluated whether the gains arising from such sec- further and classified them as a financial instrument or

ondary disposal would be taxable as business income or a virtual commodity. Certain countries such as Italy,

capital gains, as may be applicable according to the Belgium, and Poland have also classified them as ‘‘cur-

facts of the case. rency.’’

While a majority of countries is yet to formulate spe-

s Exchange for goods/services: Where cryptocur- cific laws and regulations to govern the cryptocurrency

rency was held for a period of time, during which its space, some, like the U.S., U.K., and Singapore, have

value increased/decreased, and thereafter it was ex- released detailed guidance in relation to the income tax

changed in return for any goods or services, the gains treatment of cryptocurrencies. The approach taken by

earned or the losses incurred during the holding period the U.S. and the U.K. is to treat mining as the first event

(i.e. the increase or decrease in the value of the crypto- of taxation; whereas in Singapore, mere mining of cryp-

currency since its acquisition) before the cryptocur- tocurrencies will not lead to any tax implications, and it

rency was exchanged for goods or service will result in is only upon secondary disposal that tax implications

a taxable event. The tax implications in relation to such arise.

gains should be the same as in case of a secondary dis- Another notable difference is that while Singapore

posal, as discussed above. has provided clear implications in the case of different

types of ICOs, the U.S. and the U.K. have not provided

any guidance in relation to the tax implications in case

Other Tax Considerations of an ICO. The U.K. has provided further guidance with

respect to determination of the situs of the cryptocur-

Equalization Levy The Indian income tax law im- rencies as well for tax purposes.

poses an additional tax of 2%, the equalization levy

(EL), on the consideration received by an offshore en-

tity which manages, operates, or owns an electronic fa- Going Forward

cility or platform, for online sale of goods or online pro-

vision of services or both. The Indian government has on various occasions

clarified that cryptocurrency-related gains will be tax-

Thus, for offshore cryptocurrency exchanges provid-

able depending upon the nature of the holding of such

ing cryptocurrency-related services to Indian residents

cryptocurrency. A clear road map and official guidance

or to any person using services from an Indian IP ad-

are keenly awaited on critical aspects such as what

dress, the possible application of the EL should be

should be the first taxable event and the valuation

evaluated.

mechanism, and who should have the obligation to re-

Similarly, the application of the EL in the case of an port cryptocurrency trades.

offshore entity providing online wallet services for cryp-

In recent years, the Indian income tax authorities

tocurrencies should also be evaluated.

have also issued notices to cryptocurrency holders and

Tax Deducted at Source (TDS) Under the Indian in- exchanges seeking details about their cryptocurrency

come tax law, if sale of goods by an Indian resident is dealings.

facilitated through an electronic facility or a platform It thus remains to be seen how the Indian govern-

owned, operated, or managed by an entity (whether off- ment develops regulations in the crypto space. If regu-

shore or onshore), TDS at the rate of 1% needs to be de- lated properly, this asset class could reap huge tax rev-

ducted by such entity. Thus, cryptocurrency exchanges enues for the government which could be used to meet

will need to evaluate the applicability of this provision its planned objectives in relation to the development of

to their business models for facilitating the sale of cryp- the country.

tocurrencies held by an Indian resident. Further, with talk gaining momentum that the Indian

However, as the term ‘‘goods’’ is not defined under government is considering a phased introduction of a

Indian income tax law, it is necessary to evaluate on a Central Bank Digital Currency, it will be imperative to

case-by-case basis (depending upon the sale of crypto- embrace the underlying blockchain technology.

COPYRIGHT R 2021 BY THE BUREAU OF NATIONAL AFFAIRS, INC.

4

The environmental impact of cryptocurrency mining tan & Co. For any further queries, please contact us at

will also need to be weighed by governments when de- ergo@khaitanco.com.

ciding their next course of action in this field—for in-

stance, it has been reported that the electricity con- This column does not necessarily reflect the opinion

sumed in mining Bitcoins represented about 0.59% of of The Bureau of National Affairs, Inc. or its owners.

global electricity consumption, and in May 2021, the

Iranian government imposed a four-month long ban on

cryptocurrency mining operations amid major power Bijal Ajinkya is a Partner, Raghav Kumar Bajaj is a

blackouts in many cities. Principal Associate and Milind Hasrajani is an Associ-

ate at Khaitan & Co.

The authors may be contacted at: bijal.ajinkya@

The views of the author(s) in this article are personal khaitanco.com; raghav.bajaj@khaitanco.com;

and do not constitute legal/professional advice of Khai- milind.hasrajani@khaitanco.com

COPYRIGHT R 2021 BY THE BUREAU OF NATIONAL AFFAIRS, INC.

You might also like

- Learn How to Earn with Cryptocurrency TradingFrom EverandLearn How to Earn with Cryptocurrency TradingRating: 3.5 out of 5 stars3.5/5 (3)

- I Am Sharing 'Ceylon Cold Store' With YouDocument12 pagesI Am Sharing 'Ceylon Cold Store' With YouDeshanranga Pathiraja67% (3)

- J 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011Document14 pagesJ 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011kumar kartikeyaNo ratings yet

- PWC Cryptographic Assets and Related Transactions Accounting Considerations Under IfrsDocument23 pagesPWC Cryptographic Assets and Related Transactions Accounting Considerations Under IfrsJeanPNo ratings yet

- Case 19-6 Classification of Cryptocurrency Holdings: All Rights ReservedDocument2 pagesCase 19-6 Classification of Cryptocurrency Holdings: All Rights ReservedbalonyNo ratings yet

- IFRS (#) : Accounting For Crypto-AssetsDocument24 pagesIFRS (#) : Accounting For Crypto-AssetsNinjee BoNo ratings yet

- IFRS (#) : Accounting For Crypto-AssetsDocument35 pagesIFRS (#) : Accounting For Crypto-AssetsDwi Pamungkas UnggulNo ratings yet

- Cryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatDocument4 pagesCryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatChristos FloridisNo ratings yet

- A Study On Cryptocurrency-BitcoinDocument10 pagesA Study On Cryptocurrency-Bitcoinaditya jangdeNo ratings yet

- 3 Cryptocurrency RegulationDocument6 pages3 Cryptocurrency RegulationAmmar KattoulaNo ratings yet

- Cryptographic Assets Related Transactions Accounting Considerations Ifrs PWC in DepthDocument26 pagesCryptographic Assets Related Transactions Accounting Considerations Ifrs PWC in DepthSonja PrstecNo ratings yet

- The Dark Side of Cryptocurrency - Tushar ShahaniDocument25 pagesThe Dark Side of Cryptocurrency - Tushar ShahaniTushar ShahaniNo ratings yet

- Accounting - 1800136Document18 pagesAccounting - 1800136Anonymous pPcOy7J8No ratings yet

- Digital Asset Industry Response Group Aotearoa NZDocument13 pagesDigital Asset Industry Response Group Aotearoa NZDhruv GomberNo ratings yet

- New OpenDocument TextDocument6 pagesNew OpenDocument Textalaa hawatmehNo ratings yet

- Blockchain Technology PDFDocument6 pagesBlockchain Technology PDFAnirvan VinodNo ratings yet

- Blockchain & Crypto Guide 101Document17 pagesBlockchain & Crypto Guide 101viktoriyaNo ratings yet

- Accounting & Reporting of Cryptocurrencies: Anirudh Kar 4bcom If 1912705Document4 pagesAccounting & Reporting of Cryptocurrencies: Anirudh Kar 4bcom If 1912705Anirudh Kar 1912705No ratings yet

- Taxing Cryptocurrency: A Review and A Call For Consensus: Commentary & AnalysisDocument11 pagesTaxing Cryptocurrency: A Review and A Call For Consensus: Commentary & Analysisyash mehtaNo ratings yet

- Sri Mulyani (25-39)Document17 pagesSri Mulyani (25-39)Yuniarso Adi NugrohoNo ratings yet

- CryptocurrenciesDocument3 pagesCryptocurrenciesDivya ChowdhryNo ratings yet

- Cryptaxforency, When Cryptocurency, Taxation and Digital Forensic ColideDocument16 pagesCryptaxforency, When Cryptocurency, Taxation and Digital Forensic ColideMuhammad Albert YulyanNo ratings yet

- BNCoin White Paper (English) 200124Document20 pagesBNCoin White Paper (English) 200124dra arbyNo ratings yet

- Cryptocurrency Presentation - Vandana KeluskarDocument15 pagesCryptocurrency Presentation - Vandana KeluskarParag KabraNo ratings yet

- Anti-Money Laundering Regulation of Cryptocurrency: U.S. and Global ApproachesDocument14 pagesAnti-Money Laundering Regulation of Cryptocurrency: U.S. and Global ApproachesFiorella VásquezNo ratings yet

- Assignment 2Document4 pagesAssignment 2Anchal BhatiaNo ratings yet

- Vajra - CLT Blog - FootnotedDocument3 pagesVajra - CLT Blog - FootnotedRitwik PrakashNo ratings yet

- Proofreading Sri Mulyani (25-39) - RevDocument17 pagesProofreading Sri Mulyani (25-39) - RevYuniarso Adi NugrohoNo ratings yet

- Bit Coin Regulations in IndiaDocument15 pagesBit Coin Regulations in IndiaVaishnavi CNo ratings yet

- Cryptocurrency DefinitionDocument12 pagesCryptocurrency Definitionhabeeb_matrixNo ratings yet

- Aditya Sharma English PrationDocument14 pagesAditya Sharma English PrationKashyap KrishnaNo ratings yet

- Unit-4 CryptocurrencyDocument16 pagesUnit-4 Cryptocurrencyharisaikumar265No ratings yet

- CryptocurrenciesDocument13 pagesCryptocurrenciesTawfiqul WahidNo ratings yet

- Tokenization 1697136521Document5 pagesTokenization 1697136521Grisha KarunasNo ratings yet

- Sakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionDocument10 pagesSakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionSakshee SahayNo ratings yet

- Debate Mitra - CryptoDocument2 pagesDebate Mitra - Cryptosaman0711994No ratings yet

- Cryptoasssets ExplainedDocument11 pagesCryptoasssets ExplainedjeNo ratings yet

- Paper TsFKfa85Document17 pagesPaper TsFKfa85Hakim ThumNo ratings yet

- Own Summary On Crypto-Currency and BlockchainDocument4 pagesOwn Summary On Crypto-Currency and BlockchainZacharias Kuoh HaotengNo ratings yet

- Article On India at The Verge of Chocking It's Cryptocurrency Ecosystem Due To Dread in Taxation LawDocument10 pagesArticle On India at The Verge of Chocking It's Cryptocurrency Ecosystem Due To Dread in Taxation LawAnonymous TsEvYcc1No ratings yet

- J RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403Document18 pagesJ RGNUL Student Research Review Kkartikeya14 Gmailcom 20200508 235403kumar kartikeyaNo ratings yet

- Research CryptocurrencyDocument19 pagesResearch Cryptocurrencymayhem happening100% (1)

- Accounting in The World of CryptocurrencyDocument31 pagesAccounting in The World of Cryptocurrencynidhi thakurNo ratings yet

- T C R C - A: A C P: Jaideep ReddyDocument45 pagesT C R C - A: A C P: Jaideep ReddySweety RoyNo ratings yet

- USB CryptocurrencyDocument18 pagesUSB CryptocurrencytabNo ratings yet

- A Survey On Factors Leading To Rapid Fluctuations in The Price of CryptocurrencyDocument4 pagesA Survey On Factors Leading To Rapid Fluctuations in The Price of CryptocurrencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Pakistan Industries - Assignment No 05Document8 pagesAnalysis of Pakistan Industries - Assignment No 05Jannat AslamNo ratings yet

- Giudici2020 Article CryptocurrenciesMarketAnalysisDocument18 pagesGiudici2020 Article CryptocurrenciesMarketAnalysisGeysa Pratama EriatNo ratings yet

- Cryptocurrency Case Analysis M-5Document7 pagesCryptocurrency Case Analysis M-5sandrini salinasNo ratings yet

- How to Get Filthy Rich Investing in Bitcoin and Other Cryptocurrencies: Why It's Not Too Late to Become a Millionaire Investor With Digital MoneyFrom EverandHow to Get Filthy Rich Investing in Bitcoin and Other Cryptocurrencies: Why It's Not Too Late to Become a Millionaire Investor With Digital MoneyNo ratings yet

- Basic Aspectsof CryptoDocument9 pagesBasic Aspectsof CryptoSana BraiekNo ratings yet

- Blockchain Technology: An Approaching Game Changer in Financial Service IndustryDocument5 pagesBlockchain Technology: An Approaching Game Changer in Financial Service IndustryEditor IJTSRDNo ratings yet

- B Com2 W5P2T2 RPFinalDocument4 pagesB Com2 W5P2T2 RPFinalVinit VinitNo ratings yet

- HomeWork N2 NikaShaveshianiDocument3 pagesHomeWork N2 NikaShaveshianishaveshianinikaNo ratings yet

- Cryptocurrency The Present and The Future ScenarioDocument16 pagesCryptocurrency The Present and The Future ScenarioIJRASETPublicationsNo ratings yet

- TRAINING Client Support CoinMetro - PART 1,2,3,4Document53 pagesTRAINING Client Support CoinMetro - PART 1,2,3,4Armando Gabriel CMNo ratings yet

- The Crypto Effect On Cross Border Transfers and Future Trends of CryptocurrenciesDocument12 pagesThe Crypto Effect On Cross Border Transfers and Future Trends of CryptocurrenciesKasia AdamskaNo ratings yet

- CryptocurrencyDocument9 pagesCryptocurrencyRaghavNo ratings yet

- DocScanner 11-Aug-2022 1-49 AmDocument2 pagesDocScanner 11-Aug-2022 1-49 AmKANKATALA SRUJAN KUMARNo ratings yet

- DocScanner 17-Aug-2022 9-52 PMDocument4 pagesDocScanner 17-Aug-2022 9-52 PMKANKATALA SRUJAN KUMARNo ratings yet

- Bus Schedule W.E.F 11 April 2022Document2 pagesBus Schedule W.E.F 11 April 2022KANKATALA SRUJAN KUMARNo ratings yet

- MEL2040 Fluid Mechanics I and E Grade Exam Total Marks: 40 Duration: 2 HrsDocument2 pagesMEL2040 Fluid Mechanics I and E Grade Exam Total Marks: 40 Duration: 2 HrsKANKATALA SRUJAN KUMARNo ratings yet

- Yob 1986Document351 pagesYob 1986KANKATALA SRUJAN KUMARNo ratings yet

- Ac 2012-3019: Solar Water Heating System Experimental ApparatusDocument13 pagesAc 2012-3019: Solar Water Heating System Experimental ApparatusKANKATALA SRUJAN KUMARNo ratings yet

- Land Grabs and Agrarian ReformDocument3 pagesLand Grabs and Agrarian ReformKANKATALA SRUJAN KUMARNo ratings yet

- Experiment #5: ObjectivesDocument6 pagesExperiment #5: ObjectivesKANKATALA SRUJAN KUMARNo ratings yet

- Experiment # 3 &4 Solar Water Heating System: Page 1 of 6Document6 pagesExperiment # 3 &4 Solar Water Heating System: Page 1 of 6KANKATALA SRUJAN KUMARNo ratings yet

- Experiment #1 and 2: ObjectivesDocument5 pagesExperiment #1 and 2: ObjectivesKANKATALA SRUJAN KUMARNo ratings yet

- Analytics Quiz and Case StudyDocument12 pagesAnalytics Quiz and Case StudyKANKATALA SRUJAN KUMARNo ratings yet

- TCS Digital All Slots Questions PrepInstaDocument80 pagesTCS Digital All Slots Questions PrepInstaKANKATALA SRUJAN KUMAR100% (1)

- RNN & LSTM: Vamsi Krishna B 1 9 M E 0 2 3Document14 pagesRNN & LSTM: Vamsi Krishna B 1 9 M E 0 2 3KANKATALA SRUJAN KUMARNo ratings yet

- Ec101 NotesDocument60 pagesEc101 NotesSylvesterNo ratings yet

- What Is The Mandrake MechanismDocument16 pagesWhat Is The Mandrake Mechanismcanauzzie100% (1)

- Chapter 15 Tutorial Solutions Week 11Document11 pagesChapter 15 Tutorial Solutions Week 11Silo Ketenilagi0% (1)

- Short Term Liquidity Ratios Activity IIDocument7 pagesShort Term Liquidity Ratios Activity IIZarish AzharNo ratings yet

- How To Find Waterside AttachmentDocument3 pagesHow To Find Waterside AttachmentSplash1No ratings yet

- GST Working May 2022Document20 pagesGST Working May 2022Chandrashekar BNo ratings yet

- World of Three ZerosDocument4 pagesWorld of Three ZerosEdwinNo ratings yet

- 15MF02 Financial Derivatives Question BankDocument12 pages15MF02 Financial Derivatives Question BankDaksin PranauNo ratings yet

- Cash Is The Most Important Aspect of Operating A BusinessDocument5 pagesCash Is The Most Important Aspect of Operating A Businessmuudey sheikhNo ratings yet

- Marxist Criticism (Hunger Games) 10-Page Full PaperDocument11 pagesMarxist Criticism (Hunger Games) 10-Page Full PaperErin Iris Delos SantosNo ratings yet

- Resoluton 50 PesosDocument2 pagesResoluton 50 PesosKarole Marcelene MagnayeNo ratings yet

- Asian Security Practice - Material and Ideational Influences (PDFDrive)Document1,799 pagesAsian Security Practice - Material and Ideational Influences (PDFDrive)Muhammad Jahanzeb AkmalNo ratings yet

- P&G - RFQ - Ex. ZirakpurDocument5 pagesP&G - RFQ - Ex. Zirakpurgurpreet.singh1No ratings yet

- Question Paper Subject-Economics For Class-12th Examination - 2024-25Document41 pagesQuestion Paper Subject-Economics For Class-12th Examination - 2024-25AFRAH JALEELANo ratings yet

- Budgeting and Budgetary Control System - Zuari CementDocument20 pagesBudgeting and Budgetary Control System - Zuari CementShiva sagar ChallaNo ratings yet

- Mcqs On Logistics For Mba and TybbaDocument6 pagesMcqs On Logistics For Mba and TybbaVarathajayasudha JeganathanNo ratings yet

- Packing Slip: Ship To: Bill To: Freight ForwarderDocument2 pagesPacking Slip: Ship To: Bill To: Freight Forwardercan 3 cuopNo ratings yet

- Invoice (DSPA040424)Document2 pagesInvoice (DSPA040424)Michael GalosiNo ratings yet

- FreedomSIP Brochure Final Jan2021 FreedomWeekDocument4 pagesFreedomSIP Brochure Final Jan2021 FreedomWeekAyushi AgarwalNo ratings yet

- Seminar On SFM - Ca Final: Archana Khetan B.A, CFA (ICFAI), MS Finance, 9930812721Document53 pagesSeminar On SFM - Ca Final: Archana Khetan B.A, CFA (ICFAI), MS Finance, 9930812721shankar k.c.No ratings yet

- Acc 206 Manufacturing Account 2021Document21 pagesAcc 206 Manufacturing Account 2021Boi NonoNo ratings yet

- Foreign Direct Investment (Fdi), Foreign Institutional Investment (Fiis) and International Financial ManagementDocument54 pagesForeign Direct Investment (Fdi), Foreign Institutional Investment (Fiis) and International Financial Managementshankar k.c.No ratings yet

- Civil Law Review OBLICONDocument8 pagesCivil Law Review OBLICONachiNo ratings yet

- Mekane Eyesus FCFDocument41 pagesMekane Eyesus FCFKidanu Tilahun100% (1)

- MANECO AssignmentDocument4 pagesMANECO AssignmentNyah RoldanNo ratings yet

- Notes From Anna Coulling Ebook PDF FreeDocument9 pagesNotes From Anna Coulling Ebook PDF FreeJose CANo ratings yet

- Financial MarketDocument14 pagesFinancial MarketFel Salazar JapsNo ratings yet

- Assignment 2 (Part 2)Document5 pagesAssignment 2 (Part 2)Tricia DimaanoNo ratings yet

- Nwssu - Mod in Contemporary World - Module2Document34 pagesNwssu - Mod in Contemporary World - Module2raymundo canizaresNo ratings yet