Professional Documents

Culture Documents

This Study Resource Was Shared Via

This Study Resource Was Shared Via

Uploaded by

Christine BaguioCopyright:

Available Formats

You might also like

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Suggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?Document12 pagesSuggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?lixvanter0% (1)

- Quiz 2 HolyeDocument47 pagesQuiz 2 Holyegoamank100% (5)

- Problem 27 5Document20 pagesProblem 27 5Cjezerei Dangue VerdaderoNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Problem 2: To Record Stock-Related Issuance CostsDocument6 pagesProblem 2: To Record Stock-Related Issuance CostsRuel Lenard Calusin83% (6)

- Consolidated FSDocument5 pagesConsolidated FSNicah AcojonNo ratings yet

- MODULE 3-Short Problems (2.0)Document4 pagesMODULE 3-Short Problems (2.0)asdasdaNo ratings yet

- MODULE 3-Short ProblemsDocument5 pagesMODULE 3-Short ProblemsJaimell LimNo ratings yet

- Step 1: Analysis of The Subsidiary's Net AssetsDocument10 pagesStep 1: Analysis of The Subsidiary's Net AssetsJulie Mae Caling MalitNo ratings yet

- 06 Consolidation AnnotatedDocument18 pages06 Consolidation AnnotatedLloydNo ratings yet

- Peter5 QnADocument8 pagesPeter5 QnAAnsong KennedyNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Investment in Associate' 2Document9 pagesInvestment in Associate' 2Joefrey Pujadas BalumaNo ratings yet

- IV. Financial Study A. Project CostDocument13 pagesIV. Financial Study A. Project CostKeil Joshua VerdaderoNo ratings yet

- Assignment On Installment SalesDocument12 pagesAssignment On Installment SalesTricia Nicole Dimaano100% (1)

- Chapter18 BuenaventuraDocument6 pagesChapter18 BuenaventuraAnonnNo ratings yet

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- Twice Incorporated: Percentage of Recov For USC W/o 35%Document4 pagesTwice Incorporated: Percentage of Recov For USC W/o 35%Paolo LocquiaoNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- NeDocument3 pagesNeppmasojt2024No ratings yet

- Additional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitDocument8 pagesAdditional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitMastura Abd HamidNo ratings yet

- Installment Sales and Long Term Construction ContractDocument13 pagesInstallment Sales and Long Term Construction ContractPaupauNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Rubino Anna Bu20145 Budget Project s3-23Document10 pagesRubino Anna Bu20145 Budget Project s3-23api-701459983No ratings yet

- Intermediate Accounting II Chapter 18Document2 pagesIntermediate Accounting II Chapter 18izza zahratunnisaNo ratings yet

- Quiz 3 CFS Subsequent To Date of AcquisitionDocument3 pagesQuiz 3 CFS Subsequent To Date of AcquisitionJi Eun VinceNo ratings yet

- Accf3114 1Document12 pagesAccf3114 1Krishna 11No ratings yet

- Financial Study: Projected CostDocument5 pagesFinancial Study: Projected CostRamir SamonNo ratings yet

- Chapter 19Document41 pagesChapter 19Tati AnaNo ratings yet

- Assignment 4 Intercompany Sale of PPEDocument2 pagesAssignment 4 Intercompany Sale of PPEAivan De LeonNo ratings yet

- Classroom Exercises On Consolidation With Intercompany Sale of InventoryDocument7 pagesClassroom Exercises On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- Manlimos Lyka AssignmentDocument7 pagesManlimos Lyka AssignmentMitch Tokong MinglanaNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Intacc2-Quiz ExamDocument5 pagesIntacc2-Quiz ExamCmNo ratings yet

- Chapter 18 ProblemsDocument4 pagesChapter 18 ProblemsAhritch DalanginNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- AFAR 3 - Intercompany TransactionsDocument2 pagesAFAR 3 - Intercompany TransactionsPanda ErarNo ratings yet

- Question 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Document6 pagesQuestion 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Laud ListowellNo ratings yet

- AFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFDocument2 pagesAFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFSid TuazonNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- Solutions - Long-Term Construction ContractsDocument19 pagesSolutions - Long-Term Construction Contractskaren perrerasNo ratings yet

- GP 2 Far 620Document8 pagesGP 2 Far 620Syafahani SafieNo ratings yet

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Pm-Section D - BudgetingDocument43 pagesPm-Section D - BudgetingAlbee Koh Jia YeeNo ratings yet

- Group Assignment B - Amni - Merc - LioniDocument5 pagesGroup Assignment B - Amni - Merc - LioniAmniNo ratings yet

- Error Correction SolutionDocument3 pagesError Correction SolutionMary Grace Garcia VergaraNo ratings yet

- Corporate Reporting Paper 3.1Document27 pagesCorporate Reporting Paper 3.1Obeng CliffNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- GP 2 Far 620Document17 pagesGP 2 Far 620Syafahani SafieNo ratings yet

- Winter2021 Final ACCY112 QuestionDocument6 pagesWinter2021 Final ACCY112 QuestionaryanNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- Far1 Artt Ias 8 & 33 Test SolDocument2 pagesFar1 Artt Ias 8 & 33 Test SolHassan TanveerNo ratings yet

- Documents Downloader24Document10 pagesDocuments Downloader24Phú NguyễnNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- Lecture Practice QuestionsDocument5 pagesLecture Practice QuestionsMariøn Lemonnier BruelNo ratings yet

- Investment in AssociatesDocument5 pagesInvestment in Associatescherry blossomNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- 531-19-Prince Damanik-P5-1 & P5-6Document34 pages531-19-Prince Damanik-P5-1 & P5-6Julia Pratiwi ParhusipNo ratings yet

- 7 - Corp LiquidationDocument4 pages7 - Corp LiquidationALLYSON BURAGANo ratings yet

- Bank AlfalahDocument66 pagesBank AlfalahShahid MehmoodNo ratings yet

- Preparation of SCE in A Single Proprietorship: ExpectationsDocument8 pagesPreparation of SCE in A Single Proprietorship: ExpectationsMichael Mangahas100% (1)

- zMSQ-07 - Financial Statement AnalysisDocument13 pageszMSQ-07 - Financial Statement AnalysisHania M. CalandadaNo ratings yet

- Ghandhara NissanDocument7 pagesGhandhara NissanShamsuddin SoomroNo ratings yet

- How To Read A Financial Report by Merrill LynchDocument0 pagesHow To Read A Financial Report by Merrill Lynchjunaid_256No ratings yet

- KietPHMSS170832 ACC101 Individual AssignmentDocument17 pagesKietPHMSS170832 ACC101 Individual AssignmentMinh Kiet Pham HuuNo ratings yet

- F & A - Basic Accounting TermsDocument3 pagesF & A - Basic Accounting TermsAbdul Azeez 312No ratings yet

- Chilime Annual Report Final 2074075 PDFDocument90 pagesChilime Annual Report Final 2074075 PDFRojan ShresthaNo ratings yet

- Teresita Buenaflor Shoes PDFDocument23 pagesTeresita Buenaflor Shoes PDFJester Ten-ten BermejoNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Relic Spotter StatementsDocument6 pagesRelic Spotter StatementsArpit AgarwalNo ratings yet

- Maynard Solutions Ch15Document27 pagesMaynard Solutions Ch15Anton VitaliNo ratings yet

- Quiz No. 1 - Corporate LiquidationDocument15 pagesQuiz No. 1 - Corporate LiquidationJam SurdivillaNo ratings yet

- Proforma Invoice Santika TMIIDocument4 pagesProforma Invoice Santika TMIIAngga Ciro BamsNo ratings yet

- Lecture 1 - Accounting in ActionDocument71 pagesLecture 1 - Accounting in Actionarman islamNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial Statement of Corporate OrganisationsDocument37 pagesQuestion Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial Statement of Corporate Organisationsrocky singhNo ratings yet

- Isc Specimen Question Paper Accounts 2014Document9 pagesIsc Specimen Question Paper Accounts 2014BIKASH166No ratings yet

- HW2 - Preparing Statement of Cash FlowsDocument2 pagesHW2 - Preparing Statement of Cash FlowsDeepak KapoorNo ratings yet

- NotesDocument2 pagesNotesNoella Marie BaronNo ratings yet

- Adjusting Entries: Prepaid Expenses (Its An Assets)Document3 pagesAdjusting Entries: Prepaid Expenses (Its An Assets)Hira SialNo ratings yet

- Corporate Liquidation PDFDocument6 pagesCorporate Liquidation PDFJae DenNo ratings yet

- NIKE and AdidasDocument46 pagesNIKE and AdidasJov E. AlcanseNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument9 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- FK Kuliah 1 Laporan KeuanganDocument21 pagesFK Kuliah 1 Laporan KeuanganGrace HerlisNo ratings yet

- Baker CorporationDocument1 pageBaker CorporationNextdoor CosplayerNo ratings yet

- 2012 WPA by R.r.ocampo - Check FiguresDocument23 pages2012 WPA by R.r.ocampo - Check FiguresjaseyNo ratings yet

This Study Resource Was Shared Via

This Study Resource Was Shared Via

Uploaded by

Christine BaguioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Study Resource Was Shared Via

This Study Resource Was Shared Via

Uploaded by

Christine BaguioCopyright:

Available Formats

Problem 1

On January 1, 2020, Entity A acquired 70% of outstanding ordinary shares of Entity B at a price of

P210,000. On the same date, the net assets of Entity B were reported at P260,000. On January 1,

2020 Entity A reported retained earnings of P2,000,000 while Entity B reported retained earnings of

P200,000.

All the assets and liabilities of Entity B are fairly valued except machinery which is undervalued by

P80,000 and inventory which is overvalued by P10,000. The said machinery has remaining useful life

of four years while 40% of the said inventory remained unsold at the end of 2020.

For the year ended December 31, 2020, Entity A reported net income of P1,000,000 and declared

dividends of P150,000 in the separate financial statements while Entity B reported net income of

P150,000 and declared dividends of P20,000 in the separate financial statements.

Entity A accounted the investment in Entity B using cost method in the separate financial

statements.

1. What is the non-controlling interest in net assets on December 31, 2020?

2. What is the consolidated net income attributable to parent shareholders for the year ended

December 31, 2020?

3. What is the amount of consolidated retained earnings on December 31, 2020?

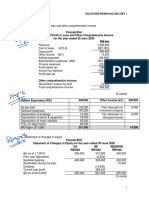

FVCGU 210,000

NCI (330,000 x 30%) 99,000

Total Consideration Transferred 309,000

FVNAA 330,000

Partial Bargain Purchase Gain 21,000

Net Income of Subsidiary 150,000 NCI 99,000

2020 U/S of Dep. Machinery (80,000/4 years) (20,000) 2021 NCI NI 40,800

Co are rce y

2020 O/S of Cost of Sale (10,000 x 60%) 6,000 Dividends (30%) (6,000)

se ia s

Adj. NI of Subsidiary 136,000 NCI Net Assets 133,800

sh u tud

ur d v wa

NCI % 30%

2021 NCI NI 40,800

s

2020 Net Income Parent (cost method) 1,000,000 RE Parent 2,000,000

2020 Bargain Purchase Gain 21,000 CNI to Parent 1,102,200

re is

Dividends Subsidiary (70%) (14,000) Dividends Subs. (150,000)

2021 Share in Adj. NI of Subsidiary (70%) 95,200 Consolidated RE 2,952,200

Th

CNI to Parent Shareholder 1,102,200

er

o

PAS 27 Cost Method Equity Method

12/31/2020 Historical Cost 210,000 1/1/2020 Initial Measurement 210,000

s

Investment 2020 Bargain Purchase Gain 21,000

in Subsidiary 2020 Share in NI Subsidiary (70%) 95,200

Dividends Subsidiary (70%) (14,000)

BV Investment of Subsidiary 312,200

Net Effect in Dividends from 2020 Bargain Purchase Gain 21,000

Profit Subsidiary (70%) 14,000 2020 Share in NI Subsidiary (70%) 95,200

116,200

This study source was downloaded by 100000782422448 from CourseHero.com on 09-12-2021

Problem 2

On January 2, 2020, Fever Company acquired 60% of the outstanding shares of Benz Inc. Resulting to

an income from acquisition in the amount P330,000. During 2020 and 2021, intercompany sales

amounted to P6,800,000 and P9,400,000 respectively. Fever Company consistently recognized a 30%

gross profit on sales while Benz Inc. Had a 40% gross profit on sales. The inventories of the buying

affiliate were as follows: % of the beginning inventory came from the intercompany transactions and

1/3 of the ending inventory came from outsiders. The December 31, 2020 inventory of Fever and

Benz amount to P840,000 and P350,000, respectively. The December 31, 2021 inventory of Fever

and Benz amount to P570,000 and P150,000 respectively.

On September 1, 2020, Benz Inc., purchased a piece of land costing P3,500,000 from Fever Company

for P5,250,000. On November 2, 2021, the buying affiliate sold this land to Jam Co. For P7,500,000.

On the other hand, on May 1, 2021, Benz Inc., sold a machinery with a carrying value of P430,000

and remaining life of 4 years to Fever Company for P190,000. Benz Inc. Declared dividends in 2021 in

the amount of P600,000. Separate Statement of Comprehensive Income for the two companies for

the year 2021 follow:

Fever Company Benz Inc.

Sales 21,500,000 10,000,000

Cost of Sales (13,500,000) (6,200,000)

Gross Profit 8,000,000 3,800,000

Operating Expenses (3,240,000) (1,100,000)

Operating Profit 4,760,000 2,700,000

Gain on Sale of Land 2,250,000

Loss on Sale of Machinery (240,000)

Dividend Revenue 450,000 110,000

Net Income 5,210,000 4,820,000

1. Consolidated Gross Profit as of December 31, 2021?

2. Consolidated Net Income attributable to Parent?

Co are rce y

3. Consolidated Operating Expense?

se ia s

sh u tud

ur d v wa

2021 Gross Profit Parent 8,000,000

2021 Gross Profit Subsidiary 3,800,000

RGP on Beg Inv. Of Parent (US) (840,000 x 3/4 x 40%) 252,000

RGP on Beg Inv. Of Subsidiary (DS) (350,000 x 3/4 x 30%) 78,750

s

UGP on End Inv. Of Parent (US) (570,000 x 2/3 x 40%) (152,000)

re is

UGP on End Inv. Of Subsidiary (DS) (150,000 x 2/3 x 30%) (30,000)

2021 Consolidated Gross Profit 11,948,750

Th

2020 NI Subsidiary 4,820,000

er

o

RGP on Beg Inv. Of Parent (US) 252,000

UGP on End Inv. Of Parent (US) (152,000)

s

UGP on Loss on Sale of Machinery (US) 240,000

RGP on Loss on Sale of Machinery (US) (U/S of Dep. Exp.) (40,000) (240,000/4 x 8/12)

2021 Adj. NI Subsidiary 5,120,000

NCI% 40%

NCI NI 2,048,000

2021 NI Parent (cost method) 5,210,000

2020 BPG 0

Dividends Subsidiary (60%) (360,000)

This study source was downloaded by 100000782422448 from CourseHero.com on 09-12-2021

Realized Gain on Sale of Land to third party (DS) 1,750,000

RGP on Beg Inv. Of Subsidiary (DS) 78,750

UGP on End Inv. Of Subsidiary (DS) (30,000)

2021 Share in NI Subsidiary (60%) 3,072,000

CNI Parent 9,720,750

2021 OPEX Parent 3,240,000 Selling price to third party 7,500,000

2021 OPEX Subsidiary 1,100,000 BV of Land (3,500,000)

Realized Loss on Dep. Exp. (U/S) 40,000 Consol. Gain on Sale of Land 4,000,000

Consolidated Operating Expenses 4,380,000

Consol. Dep. Exp. (430,000/4) 107,500

2021 Sales of Parent 21,500,000

2021 Sales of Subsidiary 10,000,000 Dividend Rev. Parent 450,000

Intercompany Sales (9,400,000) Dividend Rev. Subsidiary 110,000

Consolidated Sales 22,100,000 Dividends Subsidiary (360,000)

Consolidated Gross Profit (11,948,750) Consolidated Dividend Rev. 200,000

Consolidated Cost of Sales 10,151,250

BV Machinery 430,000

BV Inv. 12/31/2020 Parent 570,000 Dep. Exp. (107,500 x 8/12) 71,667

BV Inv. 12/31/2020 Subsidiary 150,000 Consolidated BV of Machinery 358,333

UGP on 2021 End Inv. Parent (152,000)

UGP on 2021 End Inv. Subsidiary (30,000)

Consolidated BV of Inv. 538,000

Problem 3

A summary of the separate income statement of Techno Corporation and its 75% owned subsidiary,

Duo Company, for 2021 were as follows:

Techno Duo

Sales 9,000,000 5,400,000

Co are rce y

Gain on sale of equipment 180,000 ----

se ia s

Cost of goods sold (3,600,000) (2,340,000)

sh u tud

ur d v wa

Depreciation expense (900,000) (540,000)

Other expenses (1,140,000) (720,000)

Income from operations 3,240,000 1,800,000

s

There was an upstream sale of equipment with a book value of P720,000 for P1,170,000 on January

re is

2, 2019. At the time of the intercompany sale, the equipment had a remaining useful life of five

years. Techno uses straight-line depreciation. The buying affiliate used the equipment until

December 31, 2021, at which time it was sold to Genex for P648,000.

Th

er

1. What is the amount of net profit attributable to Non-controlling interests for 2021?

o

Net Income of Subsidiary 1,540,000

s

2020 UGP on Gain on Sale of Equipment (US) (140,000)

2021 RGP (US) (160,000)

2021 Realized Gain on Sale of Equipment to third party (US) 1,240,000

NCI % 20%

2021 NCI NI 248,000

This study source was downloaded by 100000782422448 from CourseHero.com on 09-12-2021

Problem 4

On July 1, 2020, Density Company purchased 80% of the outstanding shares of Evolve Company at a

cost of P4,000,000. On that date, Evolve had P2,500,000 of ordinary shares and P3,500,000 of

retained earnings. For 2020, Evolve reported income of P325,000 and paid dividends of P150,000. All

the assets and liabilities of Evolve have book values equal to their respective fair market values. On

October 1, 2020, there was an upstream sale of machinery for P500,000. The book value of

machinery on that date was P600,000. The machinery is expected to have a useful life of 5 years

from the date of sale.

1. In the December 31, 2020 consolidated income statement, how much is the consolidated net

income attributable to the controlling interest?

FVCGU 4,000,000 a) PS of FVNAA

NCI 1,200,000 (6,000,00 x 20%) 1,200,000

Total Consideration Transferred 5,200,000 b) Implied FV

FVNAA 6,000,000 (4,000,000 x 20%) 1,000,000

Partial Bargain Purchase Gain 800,000 80%

2020 NI Subsidiary (cost method) 325,000

2020 Unrealized loss on Sale of Machinery (US) 100,000

Adj. NI Subsidiary before Realized Loss 425,000

6/12

Adj. NI Subs. from July-Dec 2020 before Loss Real. 212,500

2020 Loss Realization on Sale (US) Dep. Exp. 5,000 (100,000/5 x 3/12)

Adj. NI Subs. From July-Dec 2020 after Loss Real. 207,500

NCI% 20%

NCI NI 41,500

2020 NI Parent (cost method) 1,520,000

Dividends Subsidiary (80%) 120,000

Co are rce y

2020 Inc. From Separate Operations of Parent 1,400,000

se ia s

Bargain Purchase Gain 800,000

sh u tud

ur d v wa

2020 Share in NI Subsidiary (80%) 166,000 (207,500 x 80%)

CNI Parent 2,366,000

Problem 5

s

Superior Company owns 60 % of Uptown Corporation, which in turn owns 80% of Newton Company.

re is

Uptown exercises control over Newton and Superior exercises control over Uptown. The following

information is available.

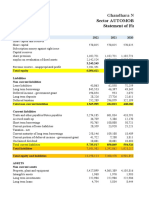

Superior Co. Uptown Co. Newton Co.

Th

Income from Continuing Operations 3,900,000 2,690,000 1,540,000

er

Cash dividends declared by: 250,000 180,000 110,000

s o

Cash dividends from:

Associates 75,000 50,000 ----

Other investments at fair value ---- 90,000 40,000

Net unrealized inter-company gains/(loss) 360,000 (220,000) 160,000

within current year income downstream downstream upstream

Amortization relating to excess of fair value (190,000) 140,000 ----

over book value/(book value over fair value of

investment)

This study source was downloaded by 100000782422448 from CourseHero.com on 09-12-2021

1. What is the consolidated net income attributable to Superior Company stockholders?

Consolidated IS of Parent Uptown (Uptown+Newton)

Net Income of Sub. Newton 1,540,000 NI of Parent Uptown (cost method) 2,690,000

U/S of Depreciation (140,000) Div. From Sub. Newton (80%) (88,000)

Net Unrealized Gain on Sale (US) (160,000) Net Unrealized Loss on Sale (DS) 220,000

Adj. NI of Sub. Newton 1,240,000 Share in Adj. NI of Sub. Newton (80%) 992,000

NCI % 20% NI Parent Uptown 3,814,000

NCI NI Sub. Newton 248,000

Consolidated IS of Parent Superior (Superior+Uptown)

Net Income of Sub. Uptown 3,814,000 NI of Parent Superior (cost method) 3,900,000

O/S of Depreciation 190,000 Div. From Sub. Uptown (60%) (108,000)

Adj. NI of Sub. Uptown 4,004,000 Net Unrealized Gain on Sale (DS) (360,000)

NCI % 40% Share in Adj. NI of Sub. Newton (60%) 2,402,400

NCI NI Sub. Uptown 1,601,600 CNI Parent Superior 5,834,400

Co are rce y

se ia s

sh u tud

ur d v wa

s

re is

Th

er

s o

This study source was downloaded by 100000782422448 from CourseHero.com on 09-12-2021

Powered by TCPDF (www.tcpdf.org)

You might also like

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Suggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?Document12 pagesSuggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?lixvanter0% (1)

- Quiz 2 HolyeDocument47 pagesQuiz 2 Holyegoamank100% (5)

- Problem 27 5Document20 pagesProblem 27 5Cjezerei Dangue VerdaderoNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Problem 2: To Record Stock-Related Issuance CostsDocument6 pagesProblem 2: To Record Stock-Related Issuance CostsRuel Lenard Calusin83% (6)

- Consolidated FSDocument5 pagesConsolidated FSNicah AcojonNo ratings yet

- MODULE 3-Short Problems (2.0)Document4 pagesMODULE 3-Short Problems (2.0)asdasdaNo ratings yet

- MODULE 3-Short ProblemsDocument5 pagesMODULE 3-Short ProblemsJaimell LimNo ratings yet

- Step 1: Analysis of The Subsidiary's Net AssetsDocument10 pagesStep 1: Analysis of The Subsidiary's Net AssetsJulie Mae Caling MalitNo ratings yet

- 06 Consolidation AnnotatedDocument18 pages06 Consolidation AnnotatedLloydNo ratings yet

- Peter5 QnADocument8 pagesPeter5 QnAAnsong KennedyNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Investment in Associate' 2Document9 pagesInvestment in Associate' 2Joefrey Pujadas BalumaNo ratings yet

- IV. Financial Study A. Project CostDocument13 pagesIV. Financial Study A. Project CostKeil Joshua VerdaderoNo ratings yet

- Assignment On Installment SalesDocument12 pagesAssignment On Installment SalesTricia Nicole Dimaano100% (1)

- Chapter18 BuenaventuraDocument6 pagesChapter18 BuenaventuraAnonnNo ratings yet

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- Twice Incorporated: Percentage of Recov For USC W/o 35%Document4 pagesTwice Incorporated: Percentage of Recov For USC W/o 35%Paolo LocquiaoNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- NeDocument3 pagesNeppmasojt2024No ratings yet

- Additional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitDocument8 pagesAdditional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitMastura Abd HamidNo ratings yet

- Installment Sales and Long Term Construction ContractDocument13 pagesInstallment Sales and Long Term Construction ContractPaupauNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Rubino Anna Bu20145 Budget Project s3-23Document10 pagesRubino Anna Bu20145 Budget Project s3-23api-701459983No ratings yet

- Intermediate Accounting II Chapter 18Document2 pagesIntermediate Accounting II Chapter 18izza zahratunnisaNo ratings yet

- Quiz 3 CFS Subsequent To Date of AcquisitionDocument3 pagesQuiz 3 CFS Subsequent To Date of AcquisitionJi Eun VinceNo ratings yet

- Accf3114 1Document12 pagesAccf3114 1Krishna 11No ratings yet

- Financial Study: Projected CostDocument5 pagesFinancial Study: Projected CostRamir SamonNo ratings yet

- Chapter 19Document41 pagesChapter 19Tati AnaNo ratings yet

- Assignment 4 Intercompany Sale of PPEDocument2 pagesAssignment 4 Intercompany Sale of PPEAivan De LeonNo ratings yet

- Classroom Exercises On Consolidation With Intercompany Sale of InventoryDocument7 pagesClassroom Exercises On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- Manlimos Lyka AssignmentDocument7 pagesManlimos Lyka AssignmentMitch Tokong MinglanaNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Intacc2-Quiz ExamDocument5 pagesIntacc2-Quiz ExamCmNo ratings yet

- Chapter 18 ProblemsDocument4 pagesChapter 18 ProblemsAhritch DalanginNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- AFAR 3 - Intercompany TransactionsDocument2 pagesAFAR 3 - Intercompany TransactionsPanda ErarNo ratings yet

- Question 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Document6 pagesQuestion 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Laud ListowellNo ratings yet

- AFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFDocument2 pagesAFAR8719 - Foreign-Currency-Transaction-and-Translation Solutions PDFSid TuazonNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- Solutions - Long-Term Construction ContractsDocument19 pagesSolutions - Long-Term Construction Contractskaren perrerasNo ratings yet

- GP 2 Far 620Document8 pagesGP 2 Far 620Syafahani SafieNo ratings yet

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Pm-Section D - BudgetingDocument43 pagesPm-Section D - BudgetingAlbee Koh Jia YeeNo ratings yet

- Group Assignment B - Amni - Merc - LioniDocument5 pagesGroup Assignment B - Amni - Merc - LioniAmniNo ratings yet

- Error Correction SolutionDocument3 pagesError Correction SolutionMary Grace Garcia VergaraNo ratings yet

- Corporate Reporting Paper 3.1Document27 pagesCorporate Reporting Paper 3.1Obeng CliffNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- GP 2 Far 620Document17 pagesGP 2 Far 620Syafahani SafieNo ratings yet

- Winter2021 Final ACCY112 QuestionDocument6 pagesWinter2021 Final ACCY112 QuestionaryanNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- Far1 Artt Ias 8 & 33 Test SolDocument2 pagesFar1 Artt Ias 8 & 33 Test SolHassan TanveerNo ratings yet

- Documents Downloader24Document10 pagesDocuments Downloader24Phú NguyễnNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- Lecture Practice QuestionsDocument5 pagesLecture Practice QuestionsMariøn Lemonnier BruelNo ratings yet

- Investment in AssociatesDocument5 pagesInvestment in Associatescherry blossomNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- 531-19-Prince Damanik-P5-1 & P5-6Document34 pages531-19-Prince Damanik-P5-1 & P5-6Julia Pratiwi ParhusipNo ratings yet

- 7 - Corp LiquidationDocument4 pages7 - Corp LiquidationALLYSON BURAGANo ratings yet

- Bank AlfalahDocument66 pagesBank AlfalahShahid MehmoodNo ratings yet

- Preparation of SCE in A Single Proprietorship: ExpectationsDocument8 pagesPreparation of SCE in A Single Proprietorship: ExpectationsMichael Mangahas100% (1)

- zMSQ-07 - Financial Statement AnalysisDocument13 pageszMSQ-07 - Financial Statement AnalysisHania M. CalandadaNo ratings yet

- Ghandhara NissanDocument7 pagesGhandhara NissanShamsuddin SoomroNo ratings yet

- How To Read A Financial Report by Merrill LynchDocument0 pagesHow To Read A Financial Report by Merrill Lynchjunaid_256No ratings yet

- KietPHMSS170832 ACC101 Individual AssignmentDocument17 pagesKietPHMSS170832 ACC101 Individual AssignmentMinh Kiet Pham HuuNo ratings yet

- F & A - Basic Accounting TermsDocument3 pagesF & A - Basic Accounting TermsAbdul Azeez 312No ratings yet

- Chilime Annual Report Final 2074075 PDFDocument90 pagesChilime Annual Report Final 2074075 PDFRojan ShresthaNo ratings yet

- Teresita Buenaflor Shoes PDFDocument23 pagesTeresita Buenaflor Shoes PDFJester Ten-ten BermejoNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Relic Spotter StatementsDocument6 pagesRelic Spotter StatementsArpit AgarwalNo ratings yet

- Maynard Solutions Ch15Document27 pagesMaynard Solutions Ch15Anton VitaliNo ratings yet

- Quiz No. 1 - Corporate LiquidationDocument15 pagesQuiz No. 1 - Corporate LiquidationJam SurdivillaNo ratings yet

- Proforma Invoice Santika TMIIDocument4 pagesProforma Invoice Santika TMIIAngga Ciro BamsNo ratings yet

- Lecture 1 - Accounting in ActionDocument71 pagesLecture 1 - Accounting in Actionarman islamNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial Statement of Corporate OrganisationsDocument37 pagesQuestion Bank - Multiple Choice Questions (MCQS) : Unit 1: Financial Statement of Corporate Organisationsrocky singhNo ratings yet

- Isc Specimen Question Paper Accounts 2014Document9 pagesIsc Specimen Question Paper Accounts 2014BIKASH166No ratings yet

- HW2 - Preparing Statement of Cash FlowsDocument2 pagesHW2 - Preparing Statement of Cash FlowsDeepak KapoorNo ratings yet

- NotesDocument2 pagesNotesNoella Marie BaronNo ratings yet

- Adjusting Entries: Prepaid Expenses (Its An Assets)Document3 pagesAdjusting Entries: Prepaid Expenses (Its An Assets)Hira SialNo ratings yet

- Corporate Liquidation PDFDocument6 pagesCorporate Liquidation PDFJae DenNo ratings yet

- NIKE and AdidasDocument46 pagesNIKE and AdidasJov E. AlcanseNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument9 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- FK Kuliah 1 Laporan KeuanganDocument21 pagesFK Kuliah 1 Laporan KeuanganGrace HerlisNo ratings yet

- Baker CorporationDocument1 pageBaker CorporationNextdoor CosplayerNo ratings yet

- 2012 WPA by R.r.ocampo - Check FiguresDocument23 pages2012 WPA by R.r.ocampo - Check FiguresjaseyNo ratings yet