Professional Documents

Culture Documents

Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +

Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +

Uploaded by

Lalit NarayanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +

Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +

Uploaded by

Lalit NarayanCopyright:

Available Formats

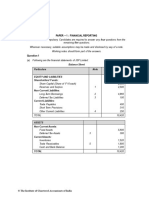

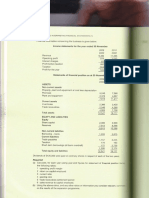

FORMAT FOR PREPARING CASH FLOW STATEMENT - start with PBT

Assets Liabilities and Stockholders’ Equity

(A) CASH FLOW FROM OPERATING ACTIVITIES (Data: Income statement, CA andSign

CL)

2010 2011 2010 2011

Cash ₹ 2,00,000.00 ₹ 1,40,000.00 Current Liabilities ₹ 1,50,000.00 ₹ 1,37,000.00 Profit before tax/Losses +/- 49000

Other current assets ₹ 1,50,000.00 ₹ 1,85,000.00 Bonds payable (face value) ₹ 60,000.00 ₹ 32,000.00

Land ₹ 3,00,000.00 ₹ 3,00,000.00 Dividends payable ₹ 5,000.00 ₹ 8,000.00 Adjustments before working capital changes

Stock ₹ 25,000.00 (1) Add back all non-cash expenses, Depreciation and Amortisation + 7000

Buildings and Equipment ₹ 6,30,000.00 ₹ 7,10,000.00 Common Stock ₹ 9,00,000.00 ₹ 10,00,000.00 (2) Subtract/add profit/loss on sale of equipment +/- -2000

Accumulated Depreciation- Retained Earnings ₹ 45,000.00 ₹ 64,000.00 (2) Subtract/add profit/loss on sale of Bonds +/- 5000

Buildings and Equipment ₹ -1,60,000.00 ₹ -1,56,000.00 (3) Reclassify interest/dividend income under investing activities -

Patents ₹ 40,000.00 ₹ 37,000.00 ________ ________ (4) Reclassify interest paid under financing activities +

Total ₹ 11,60,000.00 ₹ 12,41,000.00 Total ₹ 11,60,000.00 ₹ 12,41,000.00 Note: US GAAP treats interest paid as operating activities and hence, step 4 is not relevant under US GAAP.

Working Capital Changes

(1) Increase in current assets, Receivable - -35000

(2) Decrease in current assets +

(3) Increase in current liabilities, Payable +

(4) Decrease in current liabilities - -13000

Taxes Paid, deferred income tax -

Net cash generated from/used in operating activities (A) +/- 11000

(B) CASH FLOW FROM INVESTING ACTIVITIES (Data: Interest/Divi income, non-current assets)

(1) Reclassification of interest/dividend income +

(2) Purchase of fixed assets -

(3) Proceeds from sale of fixed assets + 14000

(4) Purchase of investments - -25000

(5) Proceeds from sale of investments +

Net cash generated from/used in investing activities (B) +/- -11000

(C) CASH FLOW FROM FINANCING ACTIVITIES (Data: Interest Paid, Dividend paid, non-current liabilities)

(1) Interest Paid -See note above

(2) Dividend paid - -27000

(3) Issuance of share capital with or without premium +

(4) Buy back of shares with or without premium (shown as treasury stock

- in the balance sheet)

(5) Proceeds from borrowings (including short term borrowings) +

(6) Repayment of borrowings (including short term borrowings) - -33000

Notes

(a) Issue of bonus shares does not affect the cash flow as it involves transfer

from Reserves & Surplus account to Capital account.

(b) Changes in Retained earnings (part of Reserves & Surplus) due to net income

or net losses during the accounting period are not considered for cash flow statement as computation

of operating cash flows starts from Profit before tax/Losses which include such changes.

Net cash generated from/used in financing activities (C) +/- -60000

Net changes in cash and cash equivalents during the year (A+B+C) -60000

Opening Balance of cash and cash equivalents ₹ 2,00,000.00

Closing balance of cash and cash equivalents ₹ 1,40,000.00

You might also like

- International Financial Reporting and Analysis 7Th Edition Alexander Solutions Manual Full Chapter PDFDocument29 pagesInternational Financial Reporting and Analysis 7Th Edition Alexander Solutions Manual Full Chapter PDFPatriciaSimonrdio100% (14)

- Penn Foster 06101501 Financial Accounting Exam Parts 1 and 2 Manville and Coleman-FooseDocument3 pagesPenn Foster 06101501 Financial Accounting Exam Parts 1 and 2 Manville and Coleman-FooseMike RussellNo ratings yet

- Chapter 1 - A Framework For Financial Accounting: Click On LinksDocument14 pagesChapter 1 - A Framework For Financial Accounting: Click On LinksABDULLAH ALSHEHRINo ratings yet

- GL Translation ExplainedDocument30 pagesGL Translation ExplainedAnushree ChitranshuNo ratings yet

- Exercise 1 - Transaction AnalysisDocument2 pagesExercise 1 - Transaction AnalysistmhoangvnaNo ratings yet

- DocxDocument5 pagesDocxChy BNo ratings yet

- Chemalite, Inc. (B) Case BackgroundDocument2 pagesChemalite, Inc. (B) Case BackgroundAnuragNo ratings yet

- BCVR 5 Years (Company Accounting)Document13 pagesBCVR 5 Years (Company Accounting)celineNo ratings yet

- YogurtDocument25 pagesYogurtblueextc3221No ratings yet

- Financial Forecasting and BudgetingDocument11 pagesFinancial Forecasting and BudgetingAra AlangcaoNo ratings yet

- Advanced Accounting Case Study PDFDocument7 pagesAdvanced Accounting Case Study PDFAnonymous IpBC61Z100% (1)

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Document2 pagesFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNo ratings yet

- HW5Document6 pagesHW5SHIVANI SHARMANo ratings yet

- Cash Flow Statements Interim Check 1 Yolo LTD Question and AnswerDocument5 pagesCash Flow Statements Interim Check 1 Yolo LTD Question and AnswerjunaidahNo ratings yet

- PIOCORE 2022 - ThousandDocument7 pagesPIOCORE 2022 - ThousandAbhishek RaiNo ratings yet

- Unit 12-Question 12-D Sol (2023)Document2 pagesUnit 12-Question 12-D Sol (2023)shirleygebenga020829No ratings yet

- Chemalite Group - Cash Flow Statement - PBTDocument8 pagesChemalite Group - Cash Flow Statement - PBTAmit Shukla100% (1)

- Malik Group of Companies (Disposal + Acquisition)Document1 pageMalik Group of Companies (Disposal + Acquisition).No ratings yet

- Compass CompanyDocument3 pagesCompass CompanyKanishka KartikeyaNo ratings yet

- Accounting Chapter 11Document69 pagesAccounting Chapter 11Brisa MasiniNo ratings yet

- Financial Accounting 2nd AssignmentDocument4 pagesFinancial Accounting 2nd AssignmentedwardfangthuNo ratings yet

- Valuation of GoodwillDocument3 pagesValuation of GoodwillAhiaanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiacdNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiaShobhit JalanNo ratings yet

- Hapsburg SDocument3 pagesHapsburg SMunir Muhammad Shafi, ACA, ACCANo ratings yet

- FGHRDocument1 pageFGHRJPNo ratings yet

- Cash Flow Statement With Solution 5Document12 pagesCash Flow Statement With Solution 5Kaytise profNo ratings yet

- Unit 12-Question 12-A Sol (2023)Document3 pagesUnit 12-Question 12-A Sol (2023)shirleygebenga020829No ratings yet

- Act 3602. Chapter 3. Prob.3-39 HomeworkDocument3 pagesAct 3602. Chapter 3. Prob.3-39 HomeworkphanupongnineNo ratings yet

- CFS - 18 Oct 2022Document11 pagesCFS - 18 Oct 2022Kartik SujanNo ratings yet

- CA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Document32 pagesCA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Upasana NimjeNo ratings yet

- 2019-20 Man 310 Financial Management Midterm Prepatory QuestionsDocument9 pages2019-20 Man 310 Financial Management Midterm Prepatory QuestionsKinNo ratings yet

- Managerial RemunerationDocument7 pagesManagerial RemunerationM SameerNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersJhagantini PalaniveluNo ratings yet

- Particulars: © The Institute of Chartered Accountants of IndiaDocument17 pagesParticulars: © The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleNo ratings yet

- Long Question Kaplan 2 AnswerDocument2 pagesLong Question Kaplan 2 Answerphithuhang2909No ratings yet

- Financial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Document3 pagesFinancial Reporting, Statement and Analysis Assignment For 2 Semester Name: Dishant Tibrewal SUBMISSION DATE - 16/07/21Dishant TibrewalNo ratings yet

- ACCA SBR PapersDocument9 pagesACCA SBR PapersKaran KumarNo ratings yet

- Marking Scheme: F7 ACCA December 2013 Exam: BPP AnswersDocument12 pagesMarking Scheme: F7 ACCA December 2013 Exam: BPP AnswersRowbby GwynNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- HW C23 U Can Read But NoDocument2 pagesHW C23 U Can Read But NoLăng Quân VươngNo ratings yet

- International Financial Reporting and Analysis 7th Edition Alexander Solutions ManualDocument13 pagesInternational Financial Reporting and Analysis 7th Edition Alexander Solutions Manualcrastzfeiej100% (17)

- FR - QuestionsDocument8 pagesFR - Questionsrocks007123No ratings yet

- Chapter 13 - Cfs - Lecture NotesDocument36 pagesChapter 13 - Cfs - Lecture NotesTrung Võ ThànhNo ratings yet

- Tutorial 7 - Problem 7Document3 pagesTutorial 7 - Problem 7Joe DicksonNo ratings yet

- Statement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Document13 pagesStatement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Fiza Xiena100% (1)

- RIL Excel Sheet FRADocument56 pagesRIL Excel Sheet FRAAditi AgrawalNo ratings yet

- Lec 6Document37 pagesLec 627-06223No ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- Exercise 2.1B: PA12 - GROUP 3 - PE - CH2Document5 pagesExercise 2.1B: PA12 - GROUP 3 - PE - CH2AN HỒ QUÝNo ratings yet

- Xii AccDocument4 pagesXii AccSanjayNo ratings yet

- SCorp 26062022Document27 pagesSCorp 26062022Jagmohan TeamentigrityNo ratings yet

- M2Document2 pagesM2sejal aroraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiasolomonNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 3Document6 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 3Renee WongNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Fund Flow Statement: by Dr. Aleem AnsariDocument18 pagesFund Flow Statement: by Dr. Aleem AnsariPRIYAL GUPTANo ratings yet

- Accounts Project (Solution 1)Document3 pagesAccounts Project (Solution 1)sejanahmad48No ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- Today'S Lesson: Preparing Cash Flow StatementDocument3 pagesToday'S Lesson: Preparing Cash Flow StatementTAFARA MUKARAKATENo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- 2009-10-31 023930 William CountyDocument2 pages2009-10-31 023930 William CountyWilliamNo ratings yet

- Far210 - July2020 SS Q5Document2 pagesFar210 - July2020 SS Q5imn njwaaaNo ratings yet

- Bhaivav Laxmi Ma Galla Bhandar7677Document14 pagesBhaivav Laxmi Ma Galla Bhandar7677Ravi KarnaNo ratings yet

- Particulars Debit Credit: © The Institute of Chartered Accountants of IndiaDocument46 pagesParticulars Debit Credit: © The Institute of Chartered Accountants of IndiaOveyaaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- 3.3 Statement of Financial Position (Balance Sheet)Document12 pages3.3 Statement of Financial Position (Balance Sheet)Brier Jaspin AguirreNo ratings yet

- Quicknet Sure Success Series Ugc Net Solved Paper 2006 2017 For Paper IDocument9 pagesQuicknet Sure Success Series Ugc Net Solved Paper 2006 2017 For Paper IYousaf JamalNo ratings yet

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNo ratings yet

- 2021 December QPDocument11 pages2021 December QPMarchella LukitoNo ratings yet

- Financial ModellingDocument136 pagesFinancial ModellingSahil Shaha100% (1)

- 2023 Financial StatementsDocument27 pages2023 Financial Statementsdemo040804No ratings yet

- Pre Test Dan Quiz 1 2Document9 pagesPre Test Dan Quiz 1 2Devenda Kartika RoffandiNo ratings yet

- Review Questions and ProblemsDocument13 pagesReview Questions and ProblemsLalaina EnriquezNo ratings yet

- NN 5 Chap 4 Review of AccountingDocument10 pagesNN 5 Chap 4 Review of AccountingNguyet NguyenNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- Lembar Jawaban Kosong-AkuntansiDocument30 pagesLembar Jawaban Kosong-AkuntansiernyNo ratings yet

- CH 22Document75 pagesCH 22Chika WijayaNo ratings yet

- Principles of AccountingDocument40 pagesPrinciples of Accountingzameerahmad100% (1)

- Heineken 2004Document50 pagesHeineken 2004k0yujinNo ratings yet

- Technical Finance Interview Prep - Course ManualDocument273 pagesTechnical Finance Interview Prep - Course ManualChandan Khanna100% (1)

- FinRep SummaryDocument36 pagesFinRep SummaryNikolaNo ratings yet

- FAR Revision Questions - ICAEWDocument16 pagesFAR Revision Questions - ICAEWEduskill Learning CentreNo ratings yet

- Financial Statement Sivaswathi TEXTILESDocument103 pagesFinancial Statement Sivaswathi TEXTILESSakhamuri Ram'sNo ratings yet

- Smarts - Fs AnalysisDocument11 pagesSmarts - Fs AnalysisKarlo D. ReclaNo ratings yet

- ACTG1A - Fundamentas of AccountingDocument17 pagesACTG1A - Fundamentas of AccountingdeltanlawNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Pro Forma Financial Statements4Document50 pagesPro Forma Financial Statements4SakibMDShafiuddinNo ratings yet

- A Refresher in Financial AccountingDocument115 pagesA Refresher in Financial AccountingWang Hon Yuen100% (1)

- Cyanamid Philippines, Inc. vs. Court of AppealsDocument14 pagesCyanamid Philippines, Inc. vs. Court of AppealsNor-Alissa M DisoNo ratings yet