Professional Documents

Culture Documents

Bar Review May 2000

Bar Review May 2000

Uploaded by

ValerieTanWorkCopyright:

Available Formats

You might also like

- Equity Cases Semester 2Document13 pagesEquity Cases Semester 2Máirtín Ó hUallacháin100% (9)

- Jean Keating Prison TreatiseDocument34 pagesJean Keating Prison TreatiseSharif 912100% (7)

- Referat Engleza DreptDocument4 pagesReferat Engleza DreptNicolae Mihai67% (3)

- Jean Keating S Prison Treatise PDFDocument36 pagesJean Keating S Prison Treatise PDFJOHN75% (4)

- Equitable LienDocument29 pagesEquitable LienWave WalkerNo ratings yet

- Tracing 1Document4 pagesTracing 1Stupid 5No ratings yet

- SP 44Document68 pagesSP 44omonster8No ratings yet

- The Rule in Clayton's Case Revisited.Document20 pagesThe Rule in Clayton's Case Revisited.Adam Channing100% (2)

- Recent Anomalies and ContradictionsDocument31 pagesRecent Anomalies and ContradictionsCj CrowellNo ratings yet

- (Revised) Intangible Personal Property Part 1Document9 pages(Revised) Intangible Personal Property Part 1roselleyap20No ratings yet

- Automatic Crystallisation of A Floating Charge - Dean - 1984Document5 pagesAutomatic Crystallisation of A Floating Charge - Dean - 1984Claudia OwusuNo ratings yet

- In Re Third Ave. Transit Corp. Melniker v. Lehman, 198 F.2d 703, 2d Cir. (1952)Document6 pagesIn Re Third Ave. Transit Corp. Melniker v. Lehman, 198 F.2d 703, 2d Cir. (1952)Scribd Government DocsNo ratings yet

- Damage Assessment Problems in Foreign Currency 1Document8 pagesDamage Assessment Problems in Foreign Currency 1Nandita SurolliaNo ratings yet

- Bank One, OK v. Commercial Fin SVC, 10th Cir. (2002)Document11 pagesBank One, OK v. Commercial Fin SVC, 10th Cir. (2002)Scribd Government DocsNo ratings yet

- Urykr 2015 9 9Document10 pagesUrykr 2015 9 9Sanu ChatholilNo ratings yet

- Case and Comment: Correspondence: St. Catharine's College, Cambridge, CB2 I RL, UK. EmailDocument4 pagesCase and Comment: Correspondence: St. Catharine's College, Cambridge, CB2 I RL, UK. EmailhNo ratings yet

- Jean Keating Prison TreatiseDocument27 pagesJean Keating Prison TreatiseSherman Sevidal83% (6)

- Maggio v. Zeitz, 333 U.S. 56 (1948)Document32 pagesMaggio v. Zeitz, 333 U.S. 56 (1948)Scribd Government DocsNo ratings yet

- Jean Keating's Prison TreatiseDocument41 pagesJean Keating's Prison Treatise:Lawiy-Zodok:Shamu:-ElNo ratings yet

- BANK OF AMERICA VS. CA G.R. NO. 120135 MAR 31, 2003 FactsDocument53 pagesBANK OF AMERICA VS. CA G.R. NO. 120135 MAR 31, 2003 FactsMacNo ratings yet

- Waltons Stores (Interstate) LTD V Maher: Implications For T H E LawDocument19 pagesWaltons Stores (Interstate) LTD V Maher: Implications For T H E LawBernie BenastoNo ratings yet

- Peoples Westchester Savings Bank v. Federal Deposit Insurance Corporation, As Receiver of Guardian Bank, N.A., 961 F.2d 327, 2d Cir. (1992)Document8 pagesPeoples Westchester Savings Bank v. Federal Deposit Insurance Corporation, As Receiver of Guardian Bank, N.A., 961 F.2d 327, 2d Cir. (1992)Scribd Government DocsNo ratings yet

- 264-Article Text-854-1-10-20121116Document20 pages264-Article Text-854-1-10-20121116Ritesh RajNo ratings yet

- Floating Charge - WikipediaDocument48 pagesFloating Charge - WikipediaGhulam AliNo ratings yet

- Tracing GeneralDocument4 pagesTracing Generalshahmiran99No ratings yet

- Estate of Philip Landau, Deceased, Herbert Landau and Sidney Landau, Executors v. Commissioner of Internal Revenue, 219 F.2d 278, 3rd Cir. (1955)Document6 pagesEstate of Philip Landau, Deceased, Herbert Landau and Sidney Landau, Executors v. Commissioner of Internal Revenue, 219 F.2d 278, 3rd Cir. (1955)Scribd Government DocsNo ratings yet

- Tracing General ShahDocument4 pagesTracing General Shahshahmiran99No ratings yet

- CT RemedialDocument3 pagesCT Remedialshahmiran99No ratings yet

- Brownell v. Singer, 347 U.S. 403 (1954)Document5 pagesBrownell v. Singer, 347 U.S. 403 (1954)Scribd Government DocsNo ratings yet

- JEAN-KEATINGS-PRISON-TREATISE-SPC-University(1)Document34 pagesJEAN-KEATINGS-PRISON-TREATISE-SPC-University(1)BillionaireBabe Regina BNo ratings yet

- United States Court of Appeals, Fifth CircuitDocument8 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- Pari Passu' Means What NowDocument4 pagesPari Passu' Means What Nowvidovdan9852No ratings yet

- Law of Banking Garnishing - 1Document9 pagesLaw of Banking Garnishing - 1Ibidun TobiNo ratings yet

- Demorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Document11 pagesDemorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Scribd Government DocsNo ratings yet

- A Trap For Remittance - Basis Taxpayers The Situs of Choses in Action Michael Firth PDFDocument19 pagesA Trap For Remittance - Basis Taxpayers The Situs of Choses in Action Michael Firth PDFvinod_tanwani5181No ratings yet

- Constantino V. Cuisia and Del Rosario PDFDocument43 pagesConstantino V. Cuisia and Del Rosario PDFNatsu DragneelNo ratings yet

- Guidhall Chambers UK Freezing OrderDocument15 pagesGuidhall Chambers UK Freezing Orderelbury91No ratings yet

- Bail Pending Appeal in The Second Circuit2Document2 pagesBail Pending Appeal in The Second Circuit2Seble KinfeNo ratings yet

- Legal Focus Nov 2023Document3 pagesLegal Focus Nov 2023jianNo ratings yet

- Title and Foreclosure LitigationDocument4 pagesTitle and Foreclosure LitigationJohn Reed100% (2)

- T. M. Evans and Josephine S. Evans v. Alexander J. Dudley, Individually, and As Former District Director of Internal Revenue. United States of America, Intervenor, 295 F.2d 713, 3rd Cir. (1961)Document6 pagesT. M. Evans and Josephine S. Evans v. Alexander J. Dudley, Individually, and As Former District Director of Internal Revenue. United States of America, Intervenor, 295 F.2d 713, 3rd Cir. (1961)Scribd Government DocsNo ratings yet

- Commercial Credit Corporation, A Maryland Corporation v. University National Bank of Fort Collins, 590 F.2d 849, 10th Cir. (1979)Document5 pagesCommercial Credit Corporation, A Maryland Corporation v. University National Bank of Fort Collins, 590 F.2d 849, 10th Cir. (1979)Scribd Government DocsNo ratings yet

- ApelaciónDocument21 pagesApelaciónflimonbringasNo ratings yet

- Global and Systemic Implications of United States Supreme Court Rulings in Favour of Hedge Funds Over Argentina On 2001 Defaulted BondsDocument4 pagesGlobal and Systemic Implications of United States Supreme Court Rulings in Favour of Hedge Funds Over Argentina On 2001 Defaulted BondsMinutoUno.comNo ratings yet

- 5 Tracing (Part 2)Document8 pages5 Tracing (Part 2)Hishvar RameshNo ratings yet

- Harold J. HAWKINS and Eugenia B. Hawkins, Appellants, v. Landmark Finance Company, Appellee. in Re Harold J. HAWKINS and Eugenia B. Hawkins, DebtorsDocument5 pagesHarold J. HAWKINS and Eugenia B. Hawkins, Appellants, v. Landmark Finance Company, Appellee. in Re Harold J. HAWKINS and Eugenia B. Hawkins, DebtorsScribd Government DocsNo ratings yet

- Backward Tracing ShahDocument3 pagesBackward Tracing Shahshahmiran99No ratings yet

- Alliotts Bankruptcy Article Importance of TillDocument2 pagesAlliotts Bankruptcy Article Importance of Tilltheoaklandjournal@gmail.com100% (1)

- Conflict of Laws Digest: Bank of America V. CA (2003) : G.R. No. 120135Document2 pagesConflict of Laws Digest: Bank of America V. CA (2003) : G.R. No. 120135Obin Tambasacan BaggayanNo ratings yet

- In Re McGann Mfg. Co., Inc, 188 F.2d 110, 3rd Cir. (1951)Document4 pagesIn Re McGann Mfg. Co., Inc, 188 F.2d 110, 3rd Cir. (1951)Scribd Government DocsNo ratings yet

- 3A Contractual Estoppel TFDocument17 pages3A Contractual Estoppel TFMutahar SahtoNo ratings yet

- Digest BankingDocument8 pagesDigest BankingJas MineNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument19 pagesUnited States Bankruptcy Court Southern District of New YorkTBP_Think_TankNo ratings yet

- HSBC Bank USA v. Bank of New England, 364 F.3d 355, 1st Cir. (2004)Document14 pagesHSBC Bank USA v. Bank of New England, 364 F.3d 355, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- LAWS3113 Lecture 2 - Maxims of EquityDocument7 pagesLAWS3113 Lecture 2 - Maxims of EquityThoughts of a Law StudentNo ratings yet

- Fixed and Floating ChargesDocument6 pagesFixed and Floating ChargesChikwason Sarcozy MwanzaNo ratings yet

- Bankruptcy - 2013 AnswersDocument5 pagesBankruptcy - 2013 AnswersmaddolaxNo ratings yet

- 17 Ala LRev 297Document12 pages17 Ala LRev 297rajputkhushi00108No ratings yet

- New Zealand Deportation Cases & The International Conventions: 2023, #1From EverandNew Zealand Deportation Cases & The International Conventions: 2023, #1No ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Style, Grace and EloquenceDocument4 pagesStyle, Grace and EloquenceArmen MagbitangNo ratings yet

- Digest Civil CasesDocument10 pagesDigest Civil CasesPammyNo ratings yet

- 38 - Sherman Shaper vs. Hon. Judge RTC of OlongapoDocument1 page38 - Sherman Shaper vs. Hon. Judge RTC of OlongapoN.Santos100% (1)

- Orjuela-Medina v. United States of America - Document No. 3Document2 pagesOrjuela-Medina v. United States of America - Document No. 3Justia.comNo ratings yet

- Evidence AccompliceDocument20 pagesEvidence AccompliceSubhroBhattacharya100% (2)

- S3 - Lesson 17 (Fact and Opinion)Document8 pagesS3 - Lesson 17 (Fact and Opinion)Muhammad Harist MurdaniNo ratings yet

- CV Angelica Ricaurte PDFDocument18 pagesCV Angelica Ricaurte PDFAngelica Ricaurte VillalobosNo ratings yet

- BPI Family Savings Bank Vs Sps. YujuicoDocument2 pagesBPI Family Savings Bank Vs Sps. YujuicoWyeth de VillaNo ratings yet

- Dmitry Pronin v. Troy Johnson, 4th Cir. (2015)Document13 pagesDmitry Pronin v. Troy Johnson, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Averment of Jurisdiction Delaware Ucc OfficeDocument8 pagesAverment of Jurisdiction Delaware Ucc Officekingtbrown50No ratings yet

- Ledesma V ClimacoDocument1 pageLedesma V ClimacoCherish Kim FerrerNo ratings yet

- Mara Hoffman v. Forever 21 - ComplaintDocument8 pagesMara Hoffman v. Forever 21 - ComplaintSarah BursteinNo ratings yet

- The State of Bihar Vs The Bihar Secondary Teachers ... On 10 May, 2019Document87 pagesThe State of Bihar Vs The Bihar Secondary Teachers ... On 10 May, 2019Adv Ratnesh DubeNo ratings yet

- (MOOT 2019) International Law Relevant ConceptsDocument6 pages(MOOT 2019) International Law Relevant ConceptsDILG STA MARIANo ratings yet

- 1 ComplaintDocument6 pages1 ComplaintIvy PazNo ratings yet

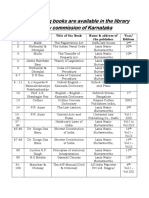

- Books in LCKDocument31 pagesBooks in LCKTrupti GowdaNo ratings yet

- Ex. J - Griffin, Angela PDFDocument44 pagesEx. J - Griffin, Angela PDFWilliam MostNo ratings yet

- Condolence LetterDocument2 pagesCondolence LetterYew Yee SiangNo ratings yet

- Jones v. Pollard - Document No. 4Document2 pagesJones v. Pollard - Document No. 4Justia.comNo ratings yet

- Pascual V CADocument5 pagesPascual V CAJan Mark WongNo ratings yet

- The Enlightenment and Democratic RevolutionsDocument7 pagesThe Enlightenment and Democratic RevolutionsFuturehistorian2468No ratings yet

- 1992 Lockerbie Case SummaryDocument5 pages1992 Lockerbie Case SummaryrajgonzNo ratings yet

- Public Corp Finals Reviewer (Pup)Document42 pagesPublic Corp Finals Reviewer (Pup)Don So HiongNo ratings yet

- Peter Dipiro v. James L. Taft, Mayor, City of Cranston, Earl Croft, Director of Personnel, City of Cranston, and Thomas Powers, 584 F.2d 1, 1st Cir. (1978)Document4 pagesPeter Dipiro v. James L. Taft, Mayor, City of Cranston, Earl Croft, Director of Personnel, City of Cranston, and Thomas Powers, 584 F.2d 1, 1st Cir. (1978)Scribd Government DocsNo ratings yet

- Mojca Mps Fy 2016-17Document737 pagesMojca Mps Fy 2016-17Namamm fnfmfdnNo ratings yet

- Respondent Memorial For The Case of Nauna Gupta &and Vs Union of HemanapattiDocument32 pagesRespondent Memorial For The Case of Nauna Gupta &and Vs Union of HemanapattiXavier thomas50% (2)

- People V LigonDocument3 pagesPeople V LigonSean GalvezNo ratings yet

- Sharon Dye v. US Bank National Association, 4th Cir. (2016)Document2 pagesSharon Dye v. US Bank National Association, 4th Cir. (2016)Scribd Government DocsNo ratings yet

Bar Review May 2000

Bar Review May 2000

Uploaded by

ValerieTanWorkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bar Review May 2000

Bar Review May 2000

Uploaded by

ValerieTanWorkCopyright:

Available Formats

BarReview

A PPROPRIATING THE ASSETS

OF FAILED COMPANIES:

TRACING IN EQUITY INTO

A DIMINISHED FUND

Micheal McGrath BL analyses the recent High Court decision

In The Matter of Money Markets International Stockbrokers Ltd. (In Liquidation).

which considered the equitable concept of tracing.

Introduction would be borne by persons who had lodged money in the client

account before he had done. This result of the rule in Clayton's

he law on how the loss should be borne as between the Case has been described by Goff and Jones in as 'capricious

T beneficiaries of a fund from which a person in a

fiduciary capacity wrongfully takes money has been

helpfully clarified by Laffoy J.'s judgment in In The Matter of

1

3

and arbitrary'. In a passage quoted in Laffoy J.'s judgment the

Chief Justice Keane writing extrajudicially described it as

'rough justice' and doubted whether:

Money Markets International Stockbrokers Ltd. (In Liquidation).

The question is in essence one of tracing the money invested in "the Court would now continue to apply Clayton's case

the fund into the diminished value of the fund, although in (which has always been regarded as based on rather

practice it arises as one of how the amount left in the fund crude if convenient assumptions) to the case of

should be appropriated amongst the investors. competing claims of beneficiaries to money in a bank

account."4

Money Markets International Stockbrokers (MMI) was

suspended by the Stock Exchange on 19th February 1999.The The dislike of the rule in Clayton's Case is not confined to

liquidator found that over £2.7 million was owed to clients but academic commentaries on the law. In Re Registered Securities

5

the amount available to satisfy this debt was under £1.5 Ltd. the New Zealand Court of Appeal stated 'The automatic

million. On 18th February the applicant had lodged a sum of application of the rule in Clayton's Case as between

money to the client account of MMI in order to pay for shares beneficiaries will not withstand scrutiny.'6 It held that because

purchased on his behalf by MMI. The applicant sought an the rule is a fiction based on presumed intent it cannot be

order directing the liquidator to complete the transaction to allowed to work an injustice. Secondly, because it is based on

buy shares with the amount that he had lodged, or, in the presumed intent it must give way 'to an express contrary

alternative, to return to him the money that he had lodged. conclusion or to circumstances which point to a contrary

conclusion'7

Background

Woolf L.J.'s (as he then was) judgment in Barlow Clowes

Accounts of the law to be applied to this issue generally start International (in liquidation) v. Vaughan8 was a significant

2

with Clayton's Case, 1816. This established the principle of influence on Laffoy J.'s judgment. Woolf L.J. stated that the

'first in, first out', which is best explained by an example. X following obiter dictum of Judge Learned Hand accurately

contributes £10,000 to a fund containing no other money and described the application of the rule to the case before him:

the next day Y contributes £10,000 to that fund. If the

following day the trustee of the fund wrongfully takes £10,000 "To adopt the fiction [of first in, first out] . . . is to

from the fund the loss would be borne entirely by X. Such a apportion a common misfortune through a test which

result would benefit the applicant in Money Markets as the loss has no relation whatever to the justice of the case."9

May 2000 - Page 393

BarReview

However, as Woolf L.J. noted, Hand J. applied the rule as he

considered himself bound by precedent. The interaction "It may be that the rule in Clayton's Case does not apply

between a judicial dislike of the rule on the one hand and a beyond tracing in a bank account and the principle may

reluctance to explicitly overrule it on the other hand is have no application to property acquired by means of a

characteristic of much of the case law in this area. mixed fund. But I prefer to deal with the situation, for

safety's sake, as if the principle can properly be applied to

In Barlow Clowes the funds in two investment plans had been the case of property acquired with such a mixed fund."14

misapplied and when the company went into litigation there

was a shortfall in the plans to which around 11,000 investors Budd J. found that whereas it would be possible to apply the rule

had contributed. The Court of Appeal discussed three ways of to deposits in the bank account it was not possible to know whose

apportioning the loss between the investors: money had been withdrawn to purchase particular lots of stamps.

As it was practically impossible to apply the rule he ordered a pro

1. The rule in Clayton's Case. This was considered rata distribution.

impractical given the complexity of the accounts, and

unfair by both Woolf and Leggatt L.JJ. The Judgment

2. The 'rolling charge' or 'North American'10 solution. A

From her discussion of Shanahan, Barlow Clowes and the passage

withdrawal from the account is considered to be a

from Keane C.J.'s book set out above Laffoy J. stated that:

withdrawal in the proportion of the interests in the acount

at the moment prior to the withdrawal. Although Woolf "The conclusion I draw from the authorities are that . . . in the

11

L.J. stated that this 'would produce the most just result' case of a current account such as the account in issue here

given the complexity of the accounts in the present case all where trust funds sourced from various beneficiaries are

the parties accepted that the costs involved would be mixed or pooled in the account it is settled law that as a

disproportionate even to the significant amount of money general proposition the rule in Clayton's Case is applicable in

involved. determining to whom the balance of the account belongs.

3. The pari passu ex post facto solution (as

Woolf L.J. called it). All the available

assets of the fund are divided between

the beneficiaries proportionate to the “It would be a mistake to consider Money

amount that they have invested,

disregarding the date of the each

Markets, or indeed Barlow Clowes, as

investment and the date of each heralding a new approach to the law of

unauthorised withdrawal. Woolf L.J. tracing in equity. Although discussion of the

stated that this solution has 'the virtue

of relative simplicity and therefore

rule in Clayton's Case has become a regular

relative economy and also the virtue in feature of the case law and academic

this case of being more just than [the commentary on this question there has been a

Rule in Clayton's Case].'12

strong tradition of the courts actually

Having decided that the latter solution was deciding cases, as courts of equity should, in

the better in principle of the two in issue the light of the justice of the case as between

Woolf L.J. discussed the authorities to

ascertain whether there was binding

the parties. This is what Laffoy J. did on the

precedent preventing him from applying that facts of Money Markets.”

solution. Along with the other two judges

(Dillon and Leggatt L.JJ.) he held that

whereas there is a presumption in favour of

applying the rule in Clayton's Case that presumption is rebuttable However, the application of the rule may be displaced in the

where its application would be impractical or unjust - in the case particular circumstances of a case, for instance, if it is to be

in hand it would not be applied because it would be contrary to shown or to be inferred that it does not accord with the

the express or implied or presumed intention of the investors. intention or presumed intention of the beneficiaries of the

15

trust fund."

The other case that Laffoy J. relied upon in formulating the

applicable legal principle was the Irish case of Shanahan Stamp Laffoy J. stressed that she was not required to reach a conclusion

13 as to how the balance was to be divided out between all the parties

Auctions Ltd. v. Farrelly. In that case about £1.5 million pounds

investors' money first of all had been placed in an investment fund who had a claim to the funds in the account; she confined herself

for the purchase of stamps and secondly had been converted into to considering the position between the applicant on the one hand

goods (stamps). The value of the company's assets when it went and all other parties on the other hand. She held that even if

into liquidation was under £500,000. One of issues was whether Clayton's Case does not apply, on the facts the applicant had a

the rule in Clayton's Case should apply to a particular class of better claim than the other investors. After holding that the

investors. Budd J. stated: liquidator did not have the power to complete the purchase of the

May 2000 - Page 394

BarReview

shares she therefore ordered that he repay the applicant the full

1 High Court, unreported 28th July 1999.

amount transferred to the company.

2 Clayton's Case: Devaynes v. Noble (1816) 1 Mer. 572,

[1814-23] All ER 1, 35 ER 781

Analysis

3 Lord Goff of Chieveley and Gareth Jones The Law of

Restitution (5th ed.) (London: Sweet and Maxwell,

It would be a mistake to consider Money Markets, or indeed

1998) 108

Barlow Clowes, as heralding a new approach to the law of tracing

4 Keane Equity and the Law of Trusts in Ireland (Dublin:

in equity. Although discussion of the rule in Clayton's Case has

Butterworths, 1998) 286

become a regular feature of the case law and academic

5 [1991] 1 N.Z.L.R. 545

commentary on this question there has been a strong tradition of

6 ibid. 553

the courts actually deciding cases, as courts of equity should, in

7 ibid. 553

the light of the justice of the case as between the parties. This is

8 [1992] 4 All ER 22

what Laffoy J. did on the facts of Money Markets.

9 Re Walter J. Schmidt & Co. ex p. Feuerbach 298 F. 314

(1923). This passage was also approved in Registered

Laffoy J. stated that the courts should apply a presumption that

Securities.

the rule in Clayton's Case applies, but that this can be displaced

10 So called because it is favoured by the courts in the

by the intention or presumed intention of the parties. If a

United States and Canada, e.g., Re Ontario Securities

presumption of some other intention displaces a presumption of

Commission and Greymac Credit Corp. (1986) 55 OR

the application of a particular rule this in effect says no more than

(2d) 673.

that the courts should apply the intention or the presumed

11 [1992] 4 All ER 22, 35

intention of the parties. That this has been done by courts of

12 ibid. 36

equity for years is evident from the following (non-exhaustive)

13 [1962] I.R. 386

list of what can be termed with respect to Laffoy J.'s formula of

16 14 [1962] I.R. 386, 442. In Re Diplock [1948] Ch. 465 the

words as 'exceptions to the rule in Clayton's Case':

Court of Appeal stated that there is no justification

for extending [the rule in Clayton's Case] beyond the

a) The account is not a current account.17

case of a banking account. (at page 555)

b) The account was broken, i.e. one account was 15 Page 13 of the judgment

closed and a new account opened.18 16 Some of these cases concerned the situation where

c) Two accounts were kept.19 there was a running account between only two parties

d) Negotiations between the parties showed that they and the issue was how payments should be

intended that a particular transaction was to be appropriated, rather than the situation discussed in

treated separately from any other course of this article where funds are to be appropriated

20 between different beneficiaries of a blended fund.

dealings between the parties.

These two situations have been treated similarly by the

e) The account contains entries made in anticipation

courts and there is no reason why principles set down

of payment.21

in the one situation would not apply to the other.

f) The account contains a blend of the trustee's 17 The Mecca [1897] A.C. 286

money and trust money.22 18 Re Sherry (1885) 25 Ch. D. 692

g) Fraudulent withdrawals are made from the 19 Bradford old Bank v. Sutcliffe [1918] 2 K.B. 838

account.23 20 City Discount Co. Ltd. v. McLean (1874) L.R. 9 C.P.

h) ultra vires transactions are made on the account.24 692. See also Henniker v.Wigg (1843) 4 Q.B. 792

i) A balance remains in a charitable fund the 21 Galula v. Pintus (1911) 104 L.T. 574. The Plaintiff

purpose of which has been fulfilled.25 entered the amount of bills discounted in the account

without waiting until they were paid.

j) It is impossible to attribute the benefit of a

22 Re Hallett's Estate (1880) 13 Ch. D. 696. There is a

particular contract to a particular client.26

presumption that the trustee is honest and withdraws

k) Short term transfers were made from one account his own money first.

to another in order to earn a higher rate of interest 23 Lacey v. Hill, Leney v. Hill (1876) 4 Ch. D. 537

rather than as an investment of a particular (affirmed on other grounds sub. nom. Read v. Bailey

27

investor's money. (1877) 3 App. Cas. 94)

24 Blackburn Building Society v. Cunliffe, Brooks and Co.

Conclusion (1884) 9 App. Cas. 857

25 Re British Red Cross Balkan Fund [1914] 2 Ch. 419. In

The decision in Money Markets can be fully reconciled with the Ireland that situation is now governed by Section 47 of

historical nature and purpose of equity: of doing what is right the Charities Act, 1961, which allows such a fund to

to bring about the fairest possible result between the parties. It be applied cy-prËs.

is to be hoped that the Irish courts will continue to uphold the 26 Re Eastern Capital Future Ltd. (in liq.) [1989] B.C.L.C.

equitable tradition of adjudication and never be in the position 371

in which Hand J. found himself in Schmidt of feeling obliged to 27 Norton Warburg Investment Management Ltd. v. Gibbons

apply a rule that he considered unjust.l unrep. English H.C. 31st July 1981

May 2000 - Page 395

You might also like

- Equity Cases Semester 2Document13 pagesEquity Cases Semester 2Máirtín Ó hUallacháin100% (9)

- Jean Keating Prison TreatiseDocument34 pagesJean Keating Prison TreatiseSharif 912100% (7)

- Referat Engleza DreptDocument4 pagesReferat Engleza DreptNicolae Mihai67% (3)

- Jean Keating S Prison Treatise PDFDocument36 pagesJean Keating S Prison Treatise PDFJOHN75% (4)

- Equitable LienDocument29 pagesEquitable LienWave WalkerNo ratings yet

- Tracing 1Document4 pagesTracing 1Stupid 5No ratings yet

- SP 44Document68 pagesSP 44omonster8No ratings yet

- The Rule in Clayton's Case Revisited.Document20 pagesThe Rule in Clayton's Case Revisited.Adam Channing100% (2)

- Recent Anomalies and ContradictionsDocument31 pagesRecent Anomalies and ContradictionsCj CrowellNo ratings yet

- (Revised) Intangible Personal Property Part 1Document9 pages(Revised) Intangible Personal Property Part 1roselleyap20No ratings yet

- Automatic Crystallisation of A Floating Charge - Dean - 1984Document5 pagesAutomatic Crystallisation of A Floating Charge - Dean - 1984Claudia OwusuNo ratings yet

- In Re Third Ave. Transit Corp. Melniker v. Lehman, 198 F.2d 703, 2d Cir. (1952)Document6 pagesIn Re Third Ave. Transit Corp. Melniker v. Lehman, 198 F.2d 703, 2d Cir. (1952)Scribd Government DocsNo ratings yet

- Damage Assessment Problems in Foreign Currency 1Document8 pagesDamage Assessment Problems in Foreign Currency 1Nandita SurolliaNo ratings yet

- Bank One, OK v. Commercial Fin SVC, 10th Cir. (2002)Document11 pagesBank One, OK v. Commercial Fin SVC, 10th Cir. (2002)Scribd Government DocsNo ratings yet

- Urykr 2015 9 9Document10 pagesUrykr 2015 9 9Sanu ChatholilNo ratings yet

- Case and Comment: Correspondence: St. Catharine's College, Cambridge, CB2 I RL, UK. EmailDocument4 pagesCase and Comment: Correspondence: St. Catharine's College, Cambridge, CB2 I RL, UK. EmailhNo ratings yet

- Jean Keating Prison TreatiseDocument27 pagesJean Keating Prison TreatiseSherman Sevidal83% (6)

- Maggio v. Zeitz, 333 U.S. 56 (1948)Document32 pagesMaggio v. Zeitz, 333 U.S. 56 (1948)Scribd Government DocsNo ratings yet

- Jean Keating's Prison TreatiseDocument41 pagesJean Keating's Prison Treatise:Lawiy-Zodok:Shamu:-ElNo ratings yet

- BANK OF AMERICA VS. CA G.R. NO. 120135 MAR 31, 2003 FactsDocument53 pagesBANK OF AMERICA VS. CA G.R. NO. 120135 MAR 31, 2003 FactsMacNo ratings yet

- Waltons Stores (Interstate) LTD V Maher: Implications For T H E LawDocument19 pagesWaltons Stores (Interstate) LTD V Maher: Implications For T H E LawBernie BenastoNo ratings yet

- Peoples Westchester Savings Bank v. Federal Deposit Insurance Corporation, As Receiver of Guardian Bank, N.A., 961 F.2d 327, 2d Cir. (1992)Document8 pagesPeoples Westchester Savings Bank v. Federal Deposit Insurance Corporation, As Receiver of Guardian Bank, N.A., 961 F.2d 327, 2d Cir. (1992)Scribd Government DocsNo ratings yet

- 264-Article Text-854-1-10-20121116Document20 pages264-Article Text-854-1-10-20121116Ritesh RajNo ratings yet

- Floating Charge - WikipediaDocument48 pagesFloating Charge - WikipediaGhulam AliNo ratings yet

- Tracing GeneralDocument4 pagesTracing Generalshahmiran99No ratings yet

- Estate of Philip Landau, Deceased, Herbert Landau and Sidney Landau, Executors v. Commissioner of Internal Revenue, 219 F.2d 278, 3rd Cir. (1955)Document6 pagesEstate of Philip Landau, Deceased, Herbert Landau and Sidney Landau, Executors v. Commissioner of Internal Revenue, 219 F.2d 278, 3rd Cir. (1955)Scribd Government DocsNo ratings yet

- Tracing General ShahDocument4 pagesTracing General Shahshahmiran99No ratings yet

- CT RemedialDocument3 pagesCT Remedialshahmiran99No ratings yet

- Brownell v. Singer, 347 U.S. 403 (1954)Document5 pagesBrownell v. Singer, 347 U.S. 403 (1954)Scribd Government DocsNo ratings yet

- JEAN-KEATINGS-PRISON-TREATISE-SPC-University(1)Document34 pagesJEAN-KEATINGS-PRISON-TREATISE-SPC-University(1)BillionaireBabe Regina BNo ratings yet

- United States Court of Appeals, Fifth CircuitDocument8 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- Pari Passu' Means What NowDocument4 pagesPari Passu' Means What Nowvidovdan9852No ratings yet

- Law of Banking Garnishing - 1Document9 pagesLaw of Banking Garnishing - 1Ibidun TobiNo ratings yet

- Demorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Document11 pagesDemorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Scribd Government DocsNo ratings yet

- A Trap For Remittance - Basis Taxpayers The Situs of Choses in Action Michael Firth PDFDocument19 pagesA Trap For Remittance - Basis Taxpayers The Situs of Choses in Action Michael Firth PDFvinod_tanwani5181No ratings yet

- Constantino V. Cuisia and Del Rosario PDFDocument43 pagesConstantino V. Cuisia and Del Rosario PDFNatsu DragneelNo ratings yet

- Guidhall Chambers UK Freezing OrderDocument15 pagesGuidhall Chambers UK Freezing Orderelbury91No ratings yet

- Bail Pending Appeal in The Second Circuit2Document2 pagesBail Pending Appeal in The Second Circuit2Seble KinfeNo ratings yet

- Legal Focus Nov 2023Document3 pagesLegal Focus Nov 2023jianNo ratings yet

- Title and Foreclosure LitigationDocument4 pagesTitle and Foreclosure LitigationJohn Reed100% (2)

- T. M. Evans and Josephine S. Evans v. Alexander J. Dudley, Individually, and As Former District Director of Internal Revenue. United States of America, Intervenor, 295 F.2d 713, 3rd Cir. (1961)Document6 pagesT. M. Evans and Josephine S. Evans v. Alexander J. Dudley, Individually, and As Former District Director of Internal Revenue. United States of America, Intervenor, 295 F.2d 713, 3rd Cir. (1961)Scribd Government DocsNo ratings yet

- Commercial Credit Corporation, A Maryland Corporation v. University National Bank of Fort Collins, 590 F.2d 849, 10th Cir. (1979)Document5 pagesCommercial Credit Corporation, A Maryland Corporation v. University National Bank of Fort Collins, 590 F.2d 849, 10th Cir. (1979)Scribd Government DocsNo ratings yet

- ApelaciónDocument21 pagesApelaciónflimonbringasNo ratings yet

- Global and Systemic Implications of United States Supreme Court Rulings in Favour of Hedge Funds Over Argentina On 2001 Defaulted BondsDocument4 pagesGlobal and Systemic Implications of United States Supreme Court Rulings in Favour of Hedge Funds Over Argentina On 2001 Defaulted BondsMinutoUno.comNo ratings yet

- 5 Tracing (Part 2)Document8 pages5 Tracing (Part 2)Hishvar RameshNo ratings yet

- Harold J. HAWKINS and Eugenia B. Hawkins, Appellants, v. Landmark Finance Company, Appellee. in Re Harold J. HAWKINS and Eugenia B. Hawkins, DebtorsDocument5 pagesHarold J. HAWKINS and Eugenia B. Hawkins, Appellants, v. Landmark Finance Company, Appellee. in Re Harold J. HAWKINS and Eugenia B. Hawkins, DebtorsScribd Government DocsNo ratings yet

- Backward Tracing ShahDocument3 pagesBackward Tracing Shahshahmiran99No ratings yet

- Alliotts Bankruptcy Article Importance of TillDocument2 pagesAlliotts Bankruptcy Article Importance of Tilltheoaklandjournal@gmail.com100% (1)

- Conflict of Laws Digest: Bank of America V. CA (2003) : G.R. No. 120135Document2 pagesConflict of Laws Digest: Bank of America V. CA (2003) : G.R. No. 120135Obin Tambasacan BaggayanNo ratings yet

- In Re McGann Mfg. Co., Inc, 188 F.2d 110, 3rd Cir. (1951)Document4 pagesIn Re McGann Mfg. Co., Inc, 188 F.2d 110, 3rd Cir. (1951)Scribd Government DocsNo ratings yet

- 3A Contractual Estoppel TFDocument17 pages3A Contractual Estoppel TFMutahar SahtoNo ratings yet

- Digest BankingDocument8 pagesDigest BankingJas MineNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument19 pagesUnited States Bankruptcy Court Southern District of New YorkTBP_Think_TankNo ratings yet

- HSBC Bank USA v. Bank of New England, 364 F.3d 355, 1st Cir. (2004)Document14 pagesHSBC Bank USA v. Bank of New England, 364 F.3d 355, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- LAWS3113 Lecture 2 - Maxims of EquityDocument7 pagesLAWS3113 Lecture 2 - Maxims of EquityThoughts of a Law StudentNo ratings yet

- Fixed and Floating ChargesDocument6 pagesFixed and Floating ChargesChikwason Sarcozy MwanzaNo ratings yet

- Bankruptcy - 2013 AnswersDocument5 pagesBankruptcy - 2013 AnswersmaddolaxNo ratings yet

- 17 Ala LRev 297Document12 pages17 Ala LRev 297rajputkhushi00108No ratings yet

- New Zealand Deportation Cases & The International Conventions: 2023, #1From EverandNew Zealand Deportation Cases & The International Conventions: 2023, #1No ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Style, Grace and EloquenceDocument4 pagesStyle, Grace and EloquenceArmen MagbitangNo ratings yet

- Digest Civil CasesDocument10 pagesDigest Civil CasesPammyNo ratings yet

- 38 - Sherman Shaper vs. Hon. Judge RTC of OlongapoDocument1 page38 - Sherman Shaper vs. Hon. Judge RTC of OlongapoN.Santos100% (1)

- Orjuela-Medina v. United States of America - Document No. 3Document2 pagesOrjuela-Medina v. United States of America - Document No. 3Justia.comNo ratings yet

- Evidence AccompliceDocument20 pagesEvidence AccompliceSubhroBhattacharya100% (2)

- S3 - Lesson 17 (Fact and Opinion)Document8 pagesS3 - Lesson 17 (Fact and Opinion)Muhammad Harist MurdaniNo ratings yet

- CV Angelica Ricaurte PDFDocument18 pagesCV Angelica Ricaurte PDFAngelica Ricaurte VillalobosNo ratings yet

- BPI Family Savings Bank Vs Sps. YujuicoDocument2 pagesBPI Family Savings Bank Vs Sps. YujuicoWyeth de VillaNo ratings yet

- Dmitry Pronin v. Troy Johnson, 4th Cir. (2015)Document13 pagesDmitry Pronin v. Troy Johnson, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Averment of Jurisdiction Delaware Ucc OfficeDocument8 pagesAverment of Jurisdiction Delaware Ucc Officekingtbrown50No ratings yet

- Ledesma V ClimacoDocument1 pageLedesma V ClimacoCherish Kim FerrerNo ratings yet

- Mara Hoffman v. Forever 21 - ComplaintDocument8 pagesMara Hoffman v. Forever 21 - ComplaintSarah BursteinNo ratings yet

- The State of Bihar Vs The Bihar Secondary Teachers ... On 10 May, 2019Document87 pagesThe State of Bihar Vs The Bihar Secondary Teachers ... On 10 May, 2019Adv Ratnesh DubeNo ratings yet

- (MOOT 2019) International Law Relevant ConceptsDocument6 pages(MOOT 2019) International Law Relevant ConceptsDILG STA MARIANo ratings yet

- 1 ComplaintDocument6 pages1 ComplaintIvy PazNo ratings yet

- Books in LCKDocument31 pagesBooks in LCKTrupti GowdaNo ratings yet

- Ex. J - Griffin, Angela PDFDocument44 pagesEx. J - Griffin, Angela PDFWilliam MostNo ratings yet

- Condolence LetterDocument2 pagesCondolence LetterYew Yee SiangNo ratings yet

- Jones v. Pollard - Document No. 4Document2 pagesJones v. Pollard - Document No. 4Justia.comNo ratings yet

- Pascual V CADocument5 pagesPascual V CAJan Mark WongNo ratings yet

- The Enlightenment and Democratic RevolutionsDocument7 pagesThe Enlightenment and Democratic RevolutionsFuturehistorian2468No ratings yet

- 1992 Lockerbie Case SummaryDocument5 pages1992 Lockerbie Case SummaryrajgonzNo ratings yet

- Public Corp Finals Reviewer (Pup)Document42 pagesPublic Corp Finals Reviewer (Pup)Don So HiongNo ratings yet

- Peter Dipiro v. James L. Taft, Mayor, City of Cranston, Earl Croft, Director of Personnel, City of Cranston, and Thomas Powers, 584 F.2d 1, 1st Cir. (1978)Document4 pagesPeter Dipiro v. James L. Taft, Mayor, City of Cranston, Earl Croft, Director of Personnel, City of Cranston, and Thomas Powers, 584 F.2d 1, 1st Cir. (1978)Scribd Government DocsNo ratings yet

- Mojca Mps Fy 2016-17Document737 pagesMojca Mps Fy 2016-17Namamm fnfmfdnNo ratings yet

- Respondent Memorial For The Case of Nauna Gupta &and Vs Union of HemanapattiDocument32 pagesRespondent Memorial For The Case of Nauna Gupta &and Vs Union of HemanapattiXavier thomas50% (2)

- People V LigonDocument3 pagesPeople V LigonSean GalvezNo ratings yet

- Sharon Dye v. US Bank National Association, 4th Cir. (2016)Document2 pagesSharon Dye v. US Bank National Association, 4th Cir. (2016)Scribd Government DocsNo ratings yet