Professional Documents

Culture Documents

IA3 - Classification of Accounts

IA3 - Classification of Accounts

Uploaded by

sofiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IA3 - Classification of Accounts

IA3 - Classification of Accounts

Uploaded by

sofiaCopyright:

Available Formats

CHAPTER 9

Accounting for Long Term Construction Contract Change in Accounting Policy

Accruals are counter balancing error Take Note

Addition to noncurrent assets Disclosed if regularly provided to the chief

operating decision maker

Advertising Independent View/Not Allocated

Advertising No anticipation/ recognized when they

occur/Expensed outright

Amount of correction at the beginning of the earliest Prior Disclosure of Prior Period Errors

Period Presented

Amount of Correction for each prior period presented, for Disclosure of Prior Period Errors

basic and diluted EPS

Amount of Correction for each prior period presented, for Disclosure of Prior Period Errors

each FS line item presented

Application of a new Accounting Policy which did not occur Not Changes in Accounting Policy

previously

Application of an Accounting Policy for events which differ in Not Changes in Accounting Policy

substance

Asset acquisition planned for later No anticipation/ recognized when they

occur/Expensed outright

Asset disposition planned for later No anticipation/ recognized when they

occur/Expensed outright

Bad Debts Change in Accounting Estimate

Bonus has a reliable estimate of the obligation Anticipate/ allocated

Bonus is a legal obligation Anticipate/ allocated

Capitalization to expense method of developmental cost Prior Period Error

Car parts segment Disclosure about type of product segment

Cash basis to accrual basis of accounting Prior Period Error

Change from cost model to fair value model in measuring Change in Accounting Policy

Investment Property

Change in inventory method pricing Change in Accounting Policy

Change in the method of accoutning LT construction contract Change in Accounting Policy

Change to a new policy - requirement of a new PRFS Change in Accounting Policy

Changin Specific Subsidiaries Change in Accounting Policy

Changing from what is not acceptable to what is acceptable Prior Period Error

Changing specific subsidiaries Change on Reporting Entity/ Change in

Accounting Policy

Corporate Headquarters Not an Operating Segment

Correcting from what is not acceptable to what is acceptable Prior Period Error

Cost recovery is not counter balancing Take Note

Depreciation Integral View/Allocated

Depreciation and amortization Anticipate

Depreciation and amortization/included in segment P and L Disclosed if regularly provided to the chief

operating decision maker

Depreciation Method/ Change in Depreciation Change in Accounting Estimate

Description of how and from where the error has been Disclosure of Prior Period Errors

corrected

Dividend Revenue No anticipation/ recognized when they

occur/Expensed outright

Donations Independent View/Not Allocated

Doubtful Accounts Change in Accounting Estimate

Enforceable as legal commitments Anticipate/ allocated

Failure to record expense Prior Period Error

Failure to record income Prior Period Error

Fair Value of the asset Change in Accounting Estimate

Fair value of the Liability Change in Accounting Estimate

Fraud Prior Period Error

Gain and loss No anticipation/ recognized when they

occur/Expensed outright

Government Grant No anticipation/ recognized when they

occur/Expensed outright

If retrospective is impracticable for a particular prior period Disclosure of Prior Period Errors

Imapairment Loss Disclosed if regularly provided to the chief

operating decision maker

Income tax expense/included in segment P and L Disclosed if regularly provided to the chief

operating decision maker

Initial Adoption of Policy to carry assets at revalued amount Change in Accounting Policy

Interest Expense Disclosed if regularly provided to the chief

operating decision maker

Interest Expense/included in segment P and L Disclosed if regularly provided to the chief

operating decision maker

Interest Revenue Disclosed if regularly provided to the chief

operating decision maker

Interest Revenue/included in segment P and L Disclosed if regularly provided to the chief

operating decision maker

Intersegment Sales/included in segment P and L Disclosed if regularly provided to the chief

operating decision maker

Inventory is counter balancing error Take Note

Inventory Obsolescence Change in Accounting Estimate

Irregular cost No anticipation/ recognized when they

occur/Expensed outright

Material items if income and expense as required by PAR 97 Disclosed if regularly provided to the chief

of PAS1/included in segment P and L operating decision maker

Material Noncash items other than depreciation and Disclosed if regularly provided to the chief

amortization/included in segment P and L operating decision maker

Mathematical Mistakes Prior Period Error

Misinterpretation of facts Prior Period Error

Misstatement of depreciation cost Prior Period Error

Mistakes in applying accounting policies Prior Period Error

Motor vessels segment Disclosure about type of product segment

Nature of Prior Period Error Disclosure of Prior Period Errors

Ordinary Repairs to equipment No anticipation/ recognized when they

occur/Expensed outright

Overhaul No anticipation/ recognized when they

occur/Expensed outright

Oversight Prior Period Error

Overstated Ending Deduct Retained earnings/debit

Overstated Ending Expense Add Retained earnings/credit

Overstated Ending Income Deduct Retained earnings/debit

Overstated Ending Inventory Deduct Retained earnings/debit

Overstatement Prior Period Error

Paid vacation and holiday leave Anticipate/ allocated

Percentage of completion is not counter balancing Take Note

Prepaid Integral View/Allocated

Prepaid Insurance Integral View/Allocated

Prepaid is counter balancing error Take Note

Profit or loss Disclosed under all circumstances

Property taxes Anticipate/ allocated

Provision of Warranty Anticipate/ allocated

Repair and Maintenance Independent View/Not Allocated

Repair and Maintenance No anticipation/ recognized when they occur

Residual value Change in Accounting Estimate

Revaluation in accordance of PAS 16 Change in Accounting Policy

Revenue form External Customers/included in segment P and Disclosed if regularly provided to the chief

L operating decision maker

Revenue from transactions with operating segments of the Disclosed if regularly provided to the chief

same entity/included in segment P and L operating decision maker

Royalties No anticipation/ recognized when they

occur/Expensed outright

sales -external and internal Disclosed if regularly provided to the chief

operating decision maker

Seasonal, cyclical or occasional revenue No anticipation/ recognized when they

occur/Expensed outright

Software segment Disclosure about type of product segment

The entity's interest in the profit or loss of associate and joint Disclosed if regularly provided to the chief

venture accounted for by the equity method/included in operating decision maker

segment P and L

Total assets Disclosed if regularly provided to the chief

operating decision maker

Total Liabilities Disclosed if regularly provided to the chief

operating decision maker

Understated Ending Add Retained earnings/credit

Understated Ending Expense Deduct Retained earnings/debit

Understated Ending Income Add Retained earnings/credit

Understated Ending Inventory Add Retained earnings/credit

Understatement Prior Period Error

Unearned Integral View/Allocated

Uneven Cost Anticipate/ allocated

Useful life Change in Accounting Estimate

Utilities Integral View/Allocated

Warranty Cost Change in Accounting Estimate

Chapter 14

Cash Basis Accrual Basis

Accrued Salaries Payable Yes

Acrued Interest Receivable Yes

Bad Debts/Doubtful Accounts Yes

Cash Purchases Yes Yes

Cash Sales Yes Yes

Collections from customer Yes

Depreciation Yes Yes

Ending Inventory Yes (deduct) Yes (deduct)

Equipment Depreciated Depreciated

Interest Received Yes Yes

Items Earned/Receivable Yes

Items Incurred/Payable Yes

Items Paid Yes

Items Received Yes

Office Supplies Paid Yes Yes

Office Supplies unusesd Yes

Other Expenses Paid Yes Yes

Payment to trade Creditors Yes

Purchases on Account Yes

Salaries Paid Yes Yes

Sales on Account Yes

Cash Basis to Accrual Basis (reverse if accrual to cash)

Accounts Payable - beginning Purchases (minus) - Sales (add)

Accounts Payable - end Purchases (add) - Sales (minus)

Accounts Receivable - beg Sales (minus)

Accounts Receivable - end Sales (add)

Accounts Receivable Written off Sales (add)

Accrued Expenses - beg Expenses (minus)

Accrued Expenses - end Expenses (add)

Accrued Income - beg Income OTS (minus)

Accrued Income - end Income OTS (add)

Accrued interest payable - beg Expenses (minus)

Accrued interest payable - end Expenses (add)

Accrued Interest Receivable - beg Income OTS (minus)

Accrued Interest Receivable - end Income OTS (add)

Accrued rental payable - beg Expenses (minus)

Accrued rental payable - end Expenses (add)

Accrued Rental Receivable - beg Income OTS (minus)

Accrued Rental Receivable - end Income OTS (add)

Accrued royalties payable - beg Expenses (minus)

Accrued royalties payable - end Expenses (add)

Accrued Royalties Receivable - beg Income OTS (minus)

Accrued Royalties Receivable - end Income OTS (add)

Accrued Salaries payable - beg Expenses (minus)

Accrued Salaries payable - end Expenses (add)

Accrues Expenses - end Expenses (add)

Advances from customers (deferred rev) - beg Sales (add)

Advances from customers (deferred rev) - end Sales (minus)

Carrying amount of equipment sold Depreciation (minus)

Cash disbursement - equipment Depreciation (add)

Cash Purchases Purchases (add)

Cash Sales Sales (add)

Collection of Accounts Receivable Sales (add)

Collections from customers Sales (add)

Collections of Notes Receivable Sales (add)

Collections of Trade Receivables Sales (add)

Deferred Income - beginning Income OTS (add)

Deferred Income - end Income OTS (minus)

Deposited by customer Sales (minus)

Equipment - beg Depreciation (add)

Equipment - end Depreciation (minus)

Income Received - cash basis Income OTS (add)

Investment - beg Gain or loss on sale (minus)

Investment - end Gain or loss on sale (add)

Notes Payable - beginning Purchases (minus)

Notes Payable - end Purchases (add)

Notes Receivable - beginning Sales (minus)

Notes Receivable - end Sales (add)

Notes receivable discounted Sales (add)

Notes Receivable written off Sales (add)

Payment of Accounts Payable Purchases (add)

Payment of Notes Payable Purchases (add)

Payment of Trade Notes Payable Purchases (add)

Payment of Trade Payables Purchases (add)

Prepaid Expenses - beg Expenses (add)

Prepaid Expenses - end Expenses (minus)

Prepaid Insurance - beg Expenses (add)

Prepaid Insurance - end Expenses (minus)

Prepaid interest - beg Expenses (add)

Prepaid interest - end Expenses (minus)

Prepaid interest on notes - beg Expenses (add) - separate

Prepaid interest on notes - end Expenses (minus) - separate

Prepaid Rent - beg Expenses (add)

Prepaid Rent - end Expenses (minus)

Prepaid royalties - beg Expenses (add)

Prepaid royalties - end Expenses (minus)

Prepaid salaries - beg Expenses (add)

Prepaid salaries - end Expenses (minus)

Prepaid taxes - beg Expenses (add)

Prepaid taxes - end Expenses (minus)

Purchase Allowances Purchases (add)

Purchase Discounts Purchases (add)

Purchase Returns Purchases (add)

Sale Price Gain or loss on sale (add)

Sales allowances Sales (add)

Sales Discount Sales (add) and NET Sales (minus)

Sales Return Sales (add) and NET Sales (minus)

Trade Payable - beginning Purchases (minus)

Trade Payable - end Purchases (add)

Trade Receivable - beginning Sales (minus)

Trade Receivables - end Sales (add)

Uncollectible Rent Written off Income OTS (add)

Unearned Interest Income - beg Income OTS (add)

Unearned Interest Income - end Income OTS (minus)

Unearned Rental Income - beg Income OTS (add)

Unearned Rental Income - end Income OTS (minus)

Year-end credit adjustment to expense Expenses (add)

Chapter 15

Additional Investments Net Income (minus)

Capital - beg Net Income (minus)

Capital - end Net Income (add)

Cash Dividends declared Net Income (add)

Decrease in Asset Net Income (minus)

Decrease in bank loan Net Income (add)

Decrease in Interest Payable Net Income (add)

Decrease in Liability Net Income (add)

Increase in Asset Net Income (add)

Increase in bank loan Net Income (minus)

Increase in Interest Payable Net Income (minus)

Increase in Liability Net Income (minus)

Increase in Retained Earnings Net Income (minus)

Overdepreciation Net Income (add)

Overstatement of Ending Inventory Net Income (minus)

Retained Earnings - beg Net Income (minus)

Retained Earnings - end Net Income (add)

SC issued exceeded dividends Net Income (minus)

Share Capital increase Net Income (minus)

Share Dividends declared Net Income (add)

Share Premium increase Net Income (minus)

Underdeprecation Net Income (minus)

Understatement of Ending Inventory Net Income (add)

Withdrawals Net Income (add)

Chapter 16

R/E in subsequent Expense/COGS Income Net Icome Retained Earnings

Accrued Expense - over Plus Over Under Under

Accrued Expense - under Minus Under Over Over

Accrued Income - over Minus Over Over Over

Accrued Income - under Plus Under Under Under

Beginning Inventory - over Plus Over Under Under

Beginning Inventory - under Minus Under Over Over

Deferred Income - over Plus Under Under Under

Deferred Income - under Minus Over Over Over

Depreciation - over Plus Over Under Under

Depreciation - under Minus Under Over Over

Ending inventory - over Minus Under Over Over

Ending inventory - under Plus Over Under Under

Prepaid expense - over Minus Under Over Over

Prepaid expense - under Plus Over Under Under

Purchases - over Plus Over Under Under

Purchases - under Minus Under Over Over

Sales - over Minus Over Over Over

Sales - under Plus Under Under Under

Chapter 20

Convertible Bonds Payable

As if Converted

Net Income Net Income

Basic EPS Basic EPS

Ordinary Shares Outstanding Ordinary S O + Converted Shares (averaged)

NI + Interest Exp (averaged) (net of tax) Net Income + Interest Exp(averaged) (net of tax)

Diluted EPS Diluted EPS

Ordinary S O + As if converted (averaged) Ordinary S O + Converted Shares

Covertible Preference Share

As if Converted

Net Income - Pref Share Div Net Income - Preference Share Div (if paid in full bef conv)

Basic EPS Basic EPS

Ordinary Shares Outstanding Ordinary SO + Converted Shares (averaged)

Net Income Net Income

Diluted EPS Diluted EPS

Ordinary SO + As if Converted (averaged) Ordinary SO + Converted

Share Options and Warrants

As if Converted

Net Income Net Income

Basic EPS Basic EPS

Ordinary Shares Outstanding Ordinary SO + Converted Shares (averaged)

Net Income Net Income page

Diluted EPS Diluted EPS

Ordinary SO + Incremental Shares (averaged) Ordinary SO + (incremental shares + converted) 625

Option Shares - (option shares x option price/ Market Price)

Incremental Shares

You might also like

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- 2 Cement Block Plant Study 4 LbanonDocument14 pages2 Cement Block Plant Study 4 Lbanonyakarim0% (1)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Reading 18 - Evaluating Quality of Financial ReportsDocument10 pagesReading 18 - Evaluating Quality of Financial ReportsJuan MatiasNo ratings yet

- Accounting and DisclosureDocument3 pagesAccounting and DisclosureJennicaBailon100% (1)

- Business PlanDocument16 pagesBusiness PlanRenalyn De Pedro0% (2)

- Accounting Standards (Group-Ii) : AS - 4: Contingencies and Events Occurring After The Balance Sheet DateDocument14 pagesAccounting Standards (Group-Ii) : AS - 4: Contingencies and Events Occurring After The Balance Sheet DateNitin pandeyNo ratings yet

- AS 5 Net Profit or Loss, Prior Period Items Changes in AccountingDocument9 pagesAS 5 Net Profit or Loss, Prior Period Items Changes in AccountingakulamNo ratings yet

- Shareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSDocument15 pagesShareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSvdforeNo ratings yet

- Sybaf Sem Iii: Paper Code: 1.financial Accounting (Special Accounting Areas) - IIIDocument4 pagesSybaf Sem Iii: Paper Code: 1.financial Accounting (Special Accounting Areas) - IIISonam PandeyNo ratings yet

- As 5Document17 pagesAs 5d.rameswarraodoraNo ratings yet

- IFRS Study Notes-Day 2Document46 pagesIFRS Study Notes-Day 2Obisike EmeziNo ratings yet

- Lecture 05 Completed SlidesDocument27 pagesLecture 05 Completed SlidesJING NIENo ratings yet

- AP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - EncryptedDocument5 pagesAP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - Encryptedkisheal kimNo ratings yet

- Notes Chapter 1 FARDocument5 pagesNotes Chapter 1 FARcpacfa90% (50)

- Other Comprehensive Income Reclassified Subseq. To P/L Reclassified To Retained EarningsDocument2 pagesOther Comprehensive Income Reclassified Subseq. To P/L Reclassified To Retained EarningsKonrad Lorenz Madriaga UychocoNo ratings yet

- IAChap 004 PPTDocument41 pagesIAChap 004 PPTلين صبحNo ratings yet

- 28 Diff Bet Usgaap Igaap IfrsDocument7 pages28 Diff Bet Usgaap Igaap IfrsRohit BeniwalNo ratings yet

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- Sources of GAAP: FAR - Notes Chapter 1Document5 pagesSources of GAAP: FAR - Notes Chapter 1kmkim9No ratings yet

- ACC2001 Lecture 5Document50 pagesACC2001 Lecture 5michael krueseiNo ratings yet

- Conceptual FrameworkDocument24 pagesConceptual FrameworkShin Wei ChaiNo ratings yet

- Full PFRS Pfrs For Smes Pfrs For Se: Statement of Comprehensive Income - Non PresentationDocument2 pagesFull PFRS Pfrs For Smes Pfrs For Se: Statement of Comprehensive Income - Non PresentationRELLYSA MARIE ONGNo ratings yet

- Category A & B & C (ADV-Accounting)Document343 pagesCategory A & B & C (ADV-Accounting)Khushal SoniNo ratings yet

- CFAS Millan CHAPTERS 9-10Document8 pagesCFAS Millan CHAPTERS 9-10Maria Mikaela ReyesNo ratings yet

- Financial Statement Analysis An Introduction: Fabricio Chala, CFA, FRMDocument45 pagesFinancial Statement Analysis An Introduction: Fabricio Chala, CFA, FRMJhonatan Perez VillanuevaNo ratings yet

- Inancial CCTG: Adjusting The AccountsDocument28 pagesInancial CCTG: Adjusting The AccountsLj BesaNo ratings yet

- Financial StatementsDocument3 pagesFinancial StatementsNana LeeNo ratings yet

- FTU - Financial Reporting QualityDocument22 pagesFTU - Financial Reporting Qualityk60.2113343020No ratings yet

- A 1 Financial StatementsDocument7 pagesA 1 Financial Statementsmohit0503No ratings yet

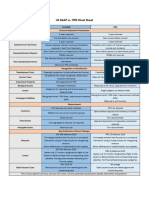

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting Standardsjoy26iNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAPDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAPishakc20070% (1)

- Sources of GAAP: Statements of Financial Accounting Concepts (SFAC) - Establish The Objectives andDocument37 pagesSources of GAAP: Statements of Financial Accounting Concepts (SFAC) - Establish The Objectives andElwatnNo ratings yet

- Balance SheetDocument28 pagesBalance SheetrimaNo ratings yet

- Full PFRS Pfrs For Smes Pfrs For Se: Statement of Comprehensive Income - Non PresentationDocument3 pagesFull PFRS Pfrs For Smes Pfrs For Se: Statement of Comprehensive Income - Non PresentationRELLYSA MARIE ONGNo ratings yet

- Reconciliation of Cost and Financial AccountingDocument5 pagesReconciliation of Cost and Financial AccountingMighty RajuNo ratings yet

- Ifrs VS Us GaapDocument1 pageIfrs VS Us GaapPratidina Aji WidodoNo ratings yet

- US GAAP Vs IFRSDocument1 pageUS GAAP Vs IFRSreg.comp2000No ratings yet

- 74705bos60485 Inter p1 cp7 U2Document14 pages74705bos60485 Inter p1 cp7 U2jdeconomic06No ratings yet

- Suryani Ikasari: Accounting Changes and Error AnalysisDocument4 pagesSuryani Ikasari: Accounting Changes and Error AnalysisSuryani Ikasari SE100% (1)

- My CollectionDocument2 pagesMy CollectionSuspensifyNo ratings yet

- Financial Accounting MasterDocument80 pagesFinancial Accounting Mastertimbuc202No ratings yet

- Chapter 4 17th Edition Part 5 TO BE POSTEDDocument22 pagesChapter 4 17th Edition Part 5 TO BE POSTEDAccounting geekNo ratings yet

- AP03-04-Audit-of-PPE-annotations On Problems 1 To 3Document9 pagesAP03-04-Audit-of-PPE-annotations On Problems 1 To 3kisheal kimNo ratings yet

- Lesson 1 PPT AccountingDocument12 pagesLesson 1 PPT AccountingArchieliz Espinosa AsesorNo ratings yet

- Acctg For NGASDocument5 pagesAcctg For NGASMicha SubaNo ratings yet

- Mahusay - Bsa211 - Module 1 Major OutputDocument3 pagesMahusay - Bsa211 - Module 1 Major OutputJeth MahusayNo ratings yet

- AS 1 Disclosure of Accounting PoliciesDocument27 pagesAS 1 Disclosure of Accounting Policiesprince vadgamaNo ratings yet

- AS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesDocument22 pagesAS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesbosskeyNo ratings yet

- REVIEWER AACA (Midterm)Document15 pagesREVIEWER AACA (Midterm)cynthia karylle natividadNo ratings yet

- Issuing An Audit Report: University of Santo Tomas Alfredo M. Velayo College of Accountancy Espana, ManilaDocument31 pagesIssuing An Audit Report: University of Santo Tomas Alfredo M. Velayo College of Accountancy Espana, ManilaRhea Mae AmitNo ratings yet

- IFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASADocument32 pagesIFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASAkamrangulNo ratings yet

- Pas 8 SuperfinalDocument16 pagesPas 8 SuperfinalmattNo ratings yet

- Intermediate Accounting 3 Chapter 1Document3 pagesIntermediate Accounting 3 Chapter 1Lea EndayaNo ratings yet

- Lecture 05 Slides-1Document54 pagesLecture 05 Slides-1Zhu ZiRuiNo ratings yet

- Accounting Changes//: Accounting Estimate Accounting PolicyDocument2 pagesAccounting Changes//: Accounting Estimate Accounting PolicyFaye RagosNo ratings yet

- Buad 803 Assignment 2Document3 pagesBuad 803 Assignment 2jeff4real2007No ratings yet

- Chapter Fourteen: Mcgraw-Hill/IrwinDocument26 pagesChapter Fourteen: Mcgraw-Hill/IrwinAdityaPutriWibowoNo ratings yet

- Comparison of IFRS With Ind AS - P3Document7 pagesComparison of IFRS With Ind AS - P3Zarana PatelNo ratings yet

- AS 1 Disclosure of Accounting PoliciesDocument6 pagesAS 1 Disclosure of Accounting PoliciesAnanya SharmaNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Final Exam - Set A - Accounting For Business Combinations - Teresita E. CRUCERODocument37 pagesFinal Exam - Set A - Accounting For Business Combinations - Teresita E. CRUCEROsofiaNo ratings yet

- Assignment For The YearDocument18 pagesAssignment For The YearsofiaNo ratings yet

- Quiz 1 - Chapter 1-4Document18 pagesQuiz 1 - Chapter 1-4sofiaNo ratings yet

- Chapter 3 - Audit Planning and Analytical ProceduresDocument47 pagesChapter 3 - Audit Planning and Analytical ProceduressofiaNo ratings yet

- Quiz in IADocument1 pageQuiz in IAsofiaNo ratings yet

- Quiz in IA-2Document1 pageQuiz in IA-2sofiaNo ratings yet

- Quiz in IA-8Document1 pageQuiz in IA-8sofiaNo ratings yet

- Module 3 - Pre Spanish PeriodDocument3 pagesModule 3 - Pre Spanish PeriodsofiaNo ratings yet

- Lesson 5 Part 1 of His Life: Page 18-23 Dr. Jose Rizal's Life StoryDocument6 pagesLesson 5 Part 1 of His Life: Page 18-23 Dr. Jose Rizal's Life StorysofiaNo ratings yet

- Module 4 - Spanish Period OverviewDocument8 pagesModule 4 - Spanish Period OverviewsofiaNo ratings yet

- Lesson 5 Part 2 of His LifeDocument5 pagesLesson 5 Part 2 of His LifesofiaNo ratings yet

- Module 2 - Views and Approaches in The Study of HistoryDocument3 pagesModule 2 - Views and Approaches in The Study of HistorysofiaNo ratings yet

- Combined QUIZ PDF Fma PDFDocument90 pagesCombined QUIZ PDF Fma PDFsanjeev misraNo ratings yet

- Hieu Nguyen Valuation Description: Domino Pizza (DPZ)Document3 pagesHieu Nguyen Valuation Description: Domino Pizza (DPZ)Hiếu Nguyễn Minh HoàngNo ratings yet

- Appraisal - TCS - FinalDocument61 pagesAppraisal - TCS - FinalgetkhosaNo ratings yet

- Accounting - Exam - Day 1Document40 pagesAccounting - Exam - Day 1Fat AjummaNo ratings yet

- IFRS Financial Statements Aviva PLC 2017 Annual Report and Accounts PDFDocument154 pagesIFRS Financial Statements Aviva PLC 2017 Annual Report and Accounts PDFĐặng Xuân HiểuNo ratings yet

- Common Stock Financing Worked-Out ProblemsDocument6 pagesCommon Stock Financing Worked-Out ProblemsSoo CealNo ratings yet

- Problems in Relevant CostingDocument20 pagesProblems in Relevant CostingJem ValmonteNo ratings yet

- Valuation of Goodwill and SharesDocument40 pagesValuation of Goodwill and Sharesakshata100% (2)

- Acco 30013 Accounting For Special Transactions 2019Document8 pagesAcco 30013 Accounting For Special Transactions 2019Azel Ann AlibinNo ratings yet

- Rajagopal Deloitte Business ValuationDocument85 pagesRajagopal Deloitte Business Valuationanalyst_anil14No ratings yet

- Chapter 2 ProblemsDocument6 pagesChapter 2 ProblemsYour MaterialsNo ratings yet

- CatatanDocument2 pagesCatatanDanarNo ratings yet

- Security Valuation: Soumendra RoyDocument38 pagesSecurity Valuation: Soumendra RoySoumendra Roy0% (1)

- Financial Report On Pioneer CementDocument62 pagesFinancial Report On Pioneer Cementl080082No ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Modul Xiv Audit Lanjutan Ing, 2020Document20 pagesModul Xiv Audit Lanjutan Ing, 2020Ismail MarzukiNo ratings yet

- CENTR10Document201 pagesCENTR10Sagar KudekarNo ratings yet

- Mod 5Document18 pagesMod 5Madella ZamoraNo ratings yet

- Safal Niveshak Stock Analysis Excel Version 4.0Document37 pagesSafal Niveshak Stock Analysis Excel Version 4.0Naresh KumarNo ratings yet

- Accounting For Managers PPT 3Document206 pagesAccounting For Managers PPT 3AbdiNo ratings yet

- Advanced FA I - Individual Assignment 1Document4 pagesAdvanced FA I - Individual Assignment 1Hawultu AsresieNo ratings yet

- Fundamentals of Accounting, Business and Management 2Document86 pagesFundamentals of Accounting, Business and Management 2Derek Jason DomanilloNo ratings yet

- UntitledDocument5 pagesUntitledbetty KemNo ratings yet

- Transco IMDocument7 pagesTransco IMEdmondNo ratings yet

- Lec 1Document44 pagesLec 1Ahmad FauzanNo ratings yet

- Central Texas Turnpike System: Annual Financial ReportDocument47 pagesCentral Texas Turnpike System: Annual Financial ReportJorge GarzaNo ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysisganeshNo ratings yet

- MAS Module 1Document24 pagesMAS Module 1bang yedamiNo ratings yet