Professional Documents

Culture Documents

Donabelle C. Marimon ACC111 (412) Forum4

Donabelle C. Marimon ACC111 (412) Forum4

Uploaded by

Donabelle MarimonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Donabelle C. Marimon ACC111 (412) Forum4

Donabelle C. Marimon ACC111 (412) Forum4

Uploaded by

Donabelle MarimonCopyright:

Available Formats

DONABELLE C.

MARIMON ACC111(412) FORUM4

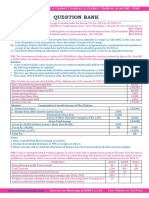

For the following transactions, identify the type of transaction, the effect, and prepare

the correct journal entry.

Aug. 5- Remitted to the BIR the withholding tax of July amounting to P300.

Aug. 10- ABC enterprise release a cash advance to employee A amounting to P20,000.

Aug. 15- Paid salary to employee amounting to P30,000 with the following deductions.

Cash advance . . . . . P5,000

w/holding tax . . . 400

DATE TRANSACTION TYPE OF EFFECT JOURNAL ENTRY

TRANSACTION

Aug 05 Remitted to the BIR the UA Dec. in OE W/holding Tax Pay P300

withholding tax of July (Withholdin

amounting to P300. g Tax Cash P300

Expense)

Payment of BIR w/holding

Dec. in Asset tax

(Cash)

10 ABC enterprise release EA Inc. in Asset Advances to Employees P20,000

a cash advance to (Advances to

employee A amounting Employees) Cash P20,000

to P20,000.

Dec. in Asset Cash advance of employees

(Cash)

15 Paid salary to employee UA Dec. in Asset Salaries Expense P30,000

amounting to P30,000 (Cash)

with the following Cash Advance P5,000

deductions. Dec. in Asset

(Advances of W/holding Tax P400

Cash Employees)

advance . . . . . P5,000 Cash P24,600

Dec. in OE

w/holding tax . . (Salaries Payment of salaries w/

. 400 Expense) deductions

Inc. in

Liability

(Withholdin

g Tax

Payable)

You might also like

- HDFC Ergo Policy Renewal 2023 SelfDocument5 pagesHDFC Ergo Policy Renewal 2023 SelfGopivishnu KanchiNo ratings yet

- Adjusting Entries Problems 2022 DahonogDocument2 pagesAdjusting Entries Problems 2022 DahonogBaltazar JustinianoNo ratings yet

- U3A5 - Transactions With HST - TemplateDocument2 pagesU3A5 - Transactions With HST - TemplateJay Patel0% (1)

- Docsity Fundamentals of Accounting 1 3Document5 pagesDocsity Fundamentals of Accounting 1 3Timothy Arbues ReyesNo ratings yet

- Activity 10: We All Know That The Purpose of Accounting Is To Provide Quantitative InformationDocument16 pagesActivity 10: We All Know That The Purpose of Accounting Is To Provide Quantitative InformationDonabelle MarimonNo ratings yet

- Acct Project Question 3Document14 pagesAcct Project Question 3grace100% (1)

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- The Woman Speaks To The Man Who Has Employed Her SonDocument3 pagesThe Woman Speaks To The Man Who Has Employed Her SonSerena SulawammotNo ratings yet

- Morales Vin Allen A. BSE-1A Activity#1Document4 pagesMorales Vin Allen A. BSE-1A Activity#1Renz MoralesNo ratings yet

- Jcps Accounting 04 Activity 1Document4 pagesJcps Accounting 04 Activity 1Daphne Robles100% (1)

- O & M of Sub StationDocument94 pagesO & M of Sub StationAlbert Sekar100% (2)

- Fotocopias Ingles Tema Climate 1º EsoDocument6 pagesFotocopias Ingles Tema Climate 1º EsoMayOrdóñezNo ratings yet

- Transaction Type of Transaction Effect Journal EntryDocument4 pagesTransaction Type of Transaction Effect Journal EntryDonabelle MarimonNo ratings yet

- Third HW - Nabilah Khansa Luthfiyah - 1911000089Document12 pagesThird HW - Nabilah Khansa Luthfiyah - 1911000089NABILAH KHANSA 1911000089No ratings yet

- GLS Partnership - 1st PageDocument1 pageGLS Partnership - 1st PagearrmfarmeggcellentNo ratings yet

- Extra PDFDocument12 pagesExtra PDFAjay DesaleNo ratings yet

- AX Computer ShopDocument1 pageAX Computer ShopCherry Jana RobianesNo ratings yet

- Accounting Equation Journal Ledger (T Accounts) Trial Balance Statement of Profit and Loss Balance SheetDocument17 pagesAccounting Equation Journal Ledger (T Accounts) Trial Balance Statement of Profit and Loss Balance SheetVharshinee SridharNo ratings yet

- Accounting Aug 31Document7 pagesAccounting Aug 31Mary Ingrid Arellano RabulanNo ratings yet

- Chapter 4 EXERCISES - Estates and TrustsDocument9 pagesChapter 4 EXERCISES - Estates and TrustscathyydumpNo ratings yet

- Chap 3 Adjusting Entries IFRS NoanwDocument43 pagesChap 3 Adjusting Entries IFRS NoanwVũ LongNo ratings yet

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoNo ratings yet

- PA Lecture 6Document12 pagesPA Lecture 6jackparker01321No ratings yet

- 2204 - Financial StatementsDocument4 pages2204 - Financial StatementsKasey Mae AsoyNo ratings yet

- Saplan - Danilyn - Final OutputDocument16 pagesSaplan - Danilyn - Final OutputMarilyn Cercado FernandezNo ratings yet

- Personal Services: Appropriations, Allotments, and ObligationsDocument4 pagesPersonal Services: Appropriations, Allotments, and ObligationsLaika Mae D. CariñoNo ratings yet

- Individual Chargeable Income (Section 4a To 4d) Tax Computation FormatDocument1 pageIndividual Chargeable Income (Section 4a To 4d) Tax Computation FormatHaananth SubramaniamNo ratings yet

- General Journal CholoDocument9 pagesGeneral Journal CholokrylNo ratings yet

- Accounting For Revenue and Other Receipts: Lester C. ArnadoDocument39 pagesAccounting For Revenue and Other Receipts: Lester C. ArnadoRica BlancaNo ratings yet

- CHAPTER 7 Installment LiquidationDocument20 pagesCHAPTER 7 Installment LiquidationRaymond PascualNo ratings yet

- PhamThi YenPhuongBABAIU20591homeworkDocument13 pagesPhamThi YenPhuongBABAIU20591homeworkphamthiyenphuong090820No ratings yet

- 1 MO3 Transaction AnalysisDocument11 pages1 MO3 Transaction AnalysisZoe FormosoNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Financial StatementsDocument13 pagesFinancial StatementsAlbert Jun Piquero AlegadoNo ratings yet

- FAR - 01 Task Performance 1Document5 pagesFAR - 01 Task Performance 1Sol LunaNo ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- FAR.2854 - Cash To Accrual.Document3 pagesFAR.2854 - Cash To Accrual.stephen ponciano100% (2)

- Finacial and Managerial Accounting Assignment 2Document21 pagesFinacial and Managerial Accounting Assignment 2tsigemulugetaNo ratings yet

- Basic AccountingDocument3 pagesBasic AccountingXAM NAVARRONo ratings yet

- Steady Answering Service Adjusting Entries Date Particulars Debit CreditDocument5 pagesSteady Answering Service Adjusting Entries Date Particulars Debit Creditnicka nocheNo ratings yet

- Preparation of Financial StatementsDocument5 pagesPreparation of Financial StatementsOji ArashibaNo ratings yet

- FS SaplanDocument16 pagesFS SaplanMarilyn Cercado FernandezNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion0% (1)

- Partnership - Jaboy - v2.1.1Document19 pagesPartnership - Jaboy - v2.1.1Van Dahuyag100% (1)

- Notes - Cash Flow Statement and ProblemsDocument4 pagesNotes - Cash Flow Statement and ProblemsDhruv MalhotraNo ratings yet

- TUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA NewDocument8 pagesTUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA Newrico anantaNo ratings yet

- Ayub Traders Nov-23 Return PSTDocument4 pagesAyub Traders Nov-23 Return PSTABBAS KHANNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20John Carlos Doringo100% (1)

- Sep 23 UD PVT LTDDocument5 pagesSep 23 UD PVT LTDtanvirNo ratings yet

- ACC10 - Journal Entry, T-AccountDocument1 pageACC10 - Journal Entry, T-AccountVimal KvNo ratings yet

- STReturnWithAnnexures74845607August2018 PDFDocument5 pagesSTReturnWithAnnexures74845607August2018 PDFMahmood AkhtarNo ratings yet

- VATReturn All Annexs 7566687Document4 pagesVATReturn All Annexs 7566687Quaid JamalNo ratings yet

- ReceiptDocument1 pageReceiptKipronoNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- Key Insurance Company Trail Balance For The Year 2020: InstructionsDocument8 pagesKey Insurance Company Trail Balance For The Year 2020: InstructionsArmaan BalochNo ratings yet

- MARS PartnershipDocument12 pagesMARS PartnershiparrmfarmeggcellentNo ratings yet

- PART B - SET A (Odd Groups - 1,3,5,7,9)Document4 pagesPART B - SET A (Odd Groups - 1,3,5,7,9)ngocanhhlee.11No ratings yet

- Conceptual Framework - PAS 1 Presentation of Financial StatementsDocument40 pagesConceptual Framework - PAS 1 Presentation of Financial StatementsDewdrop Mae RafananNo ratings yet

- MERELOS Accounting-Cycle FARDocument19 pagesMERELOS Accounting-Cycle FARRae Jeniña E.MerelosNo ratings yet

- Mr. Addams' EditingDocument15 pagesMr. Addams' EditingKim KoalaNo ratings yet

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- 3 - Chapter-3-Govt Accounting Process - Part 2Document6 pages3 - Chapter-3-Govt Accounting Process - Part 2Joebet DebuyanNo ratings yet

- Cash Flow Statement: Final ExamDocument4 pagesCash Flow Statement: Final ExamAiman Abdul QadirNo ratings yet

- Acc 222 Review MaterialDocument6 pagesAcc 222 Review MaterialDonabelle MarimonNo ratings yet

- Acc223-Standard Costing-ApplicationsDocument4 pagesAcc223-Standard Costing-ApplicationsDonabelle MarimonNo ratings yet

- Task 2.4Document2 pagesTask 2.4Donabelle MarimonNo ratings yet

- Application 2.7Document1 pageApplication 2.7Donabelle MarimonNo ratings yet

- Acc224-2nd Exam ReviewerDocument2 pagesAcc224-2nd Exam ReviewerDonabelle MarimonNo ratings yet

- Business Process Re-EngineeringDocument2 pagesBusiness Process Re-EngineeringDonabelle MarimonNo ratings yet

- Acc224 (8315) - Week 5 AssignmentDocument1 pageAcc224 (8315) - Week 5 AssignmentDonabelle MarimonNo ratings yet

- CBM 321 Final Exam ReviewerDocument12 pagesCBM 321 Final Exam ReviewerDonabelle MarimonNo ratings yet

- Acc111 (412) Activity28 MarimonDocument2 pagesAcc111 (412) Activity28 MarimonDonabelle MarimonNo ratings yet

- ACTIVITY 5. Now That You Are Acquainted With The Account Titles and Its Classification, Let UsDocument3 pagesACTIVITY 5. Now That You Are Acquainted With The Account Titles and Its Classification, Let UsDonabelle MarimonNo ratings yet

- Acc111 (412) Activity27 MarimonDocument2 pagesAcc111 (412) Activity27 MarimonDonabelle MarimonNo ratings yet

- Activity 6. The Study of The Elements of The Financial Statements and Its Accounts Is ADocument6 pagesActivity 6. The Study of The Elements of The Financial Statements and Its Accounts Is ADonabelle MarimonNo ratings yet

- Activity 7Document2 pagesActivity 7Donabelle MarimonNo ratings yet

- Transaction Type of Transaction Effect Journal EntryDocument4 pagesTransaction Type of Transaction Effect Journal EntryDonabelle MarimonNo ratings yet

- Activity 11: ExplanationDocument11 pagesActivity 11: ExplanationDonabelle Marimon0% (1)

- Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDocument4 pagesActivity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDonabelle MarimonNo ratings yet

- Let'S Check: Activity 12. in This Activity Let Us Check Your Understanding On TheDocument2 pagesLet'S Check: Activity 12. in This Activity Let Us Check Your Understanding On TheDonabelle MarimonNo ratings yet

- Let'S Check Activity 1. All This Information Presented in The Metalanguage andDocument5 pagesLet'S Check Activity 1. All This Information Presented in The Metalanguage andDonabelle MarimonNo ratings yet

- Pentingnya Memelihara Kebersihan Dan Keamanan Lingkungan Secarapartisipatif Demi Meningkatkan Gotong Royong Dan Kualitas Hidup WargaDocument6 pagesPentingnya Memelihara Kebersihan Dan Keamanan Lingkungan Secarapartisipatif Demi Meningkatkan Gotong Royong Dan Kualitas Hidup WargaMey MeyNo ratings yet

- Dietary Computation For Pregnant ClientDocument12 pagesDietary Computation For Pregnant ClientLuis WashingtonNo ratings yet

- Notes-Nutrition in PlantsDocument3 pagesNotes-Nutrition in PlantsADHIL MOHAMMEDNo ratings yet

- Grade 12 LM Physical Science 1 Module4Document21 pagesGrade 12 LM Physical Science 1 Module4ladyheart ۦۦNo ratings yet

- Bibliography Primary Sources: Books:: Marie-Curie-Speech - HTMLDocument11 pagesBibliography Primary Sources: Books:: Marie-Curie-Speech - HTMLapi-130099490No ratings yet

- Chapter 05 Dental Caries - SlidesDocument27 pagesChapter 05 Dental Caries - SlidesNabila ApriyanNo ratings yet

- Early Alt-RAMEC and Facial Mask Protocol in Class III MalocclusionDocument9 pagesEarly Alt-RAMEC and Facial Mask Protocol in Class III MalocclusionNievecillaNeiraNo ratings yet

- Proforma A1: Residential/Domicile CertificateDocument6 pagesProforma A1: Residential/Domicile CertificateSamim ParvezNo ratings yet

- Muay Thai Beginners GuideDocument44 pagesMuay Thai Beginners GuideAmar Cooper67% (3)

- Furnace SoftwareDocument7 pagesFurnace SoftwareolaNo ratings yet

- Final LIST OF IMPORTANT GRID ELEMENTS Updated On May 2020 PDFDocument74 pagesFinal LIST OF IMPORTANT GRID ELEMENTS Updated On May 2020 PDFbhargavNo ratings yet

- BRAC Annual Report 2017 PDFDocument116 pagesBRAC Annual Report 2017 PDFShoaib AhmedNo ratings yet

- Economics 9732/01: Pioneer Junior College, Singapore Preliminary Examinations 2014 Higher 2Document8 pagesEconomics 9732/01: Pioneer Junior College, Singapore Preliminary Examinations 2014 Higher 2Yvette LimNo ratings yet

- Phason FHC1D User ManualDocument16 pagesPhason FHC1D User Manuale-ComfortUSANo ratings yet

- Riko Technical Brochure PDFDocument29 pagesRiko Technical Brochure PDFGrigoreOzonNo ratings yet

- Gothic Arch Tracing PDFDocument9 pagesGothic Arch Tracing PDFSimran SahniNo ratings yet

- 555-Timer AStable and MonostableDocument13 pages555-Timer AStable and MonostableenzuekNo ratings yet

- Dan Sof TG 0122Document30 pagesDan Sof TG 0122Erick Trujillo100% (1)

- 7.44.session VI EHa and LTR Process Flow and Steam Gathering System v3 PDFDocument56 pages7.44.session VI EHa and LTR Process Flow and Steam Gathering System v3 PDFadityaNo ratings yet

- PhilRice - Fertilizer CalculationDocument21 pagesPhilRice - Fertilizer CalculationMichelle Ann SoledadNo ratings yet

- Blue Bead McqsDocument11 pagesBlue Bead Mcqsanu minochaNo ratings yet

- Biosolids EpaDocument13 pagesBiosolids EpaKhansa HapsariNo ratings yet

- Parental/Guardian Permission and Liability Waiver Name of Student BirthDocument2 pagesParental/Guardian Permission and Liability Waiver Name of Student BirthlifeteenministryNo ratings yet

- Developments in The Internal Dosimetry of Radiopharmaceuticals.Document6 pagesDevelopments in The Internal Dosimetry of Radiopharmaceuticals.Edis ĐedovićNo ratings yet

- Background of The StudyDocument13 pagesBackground of The Studyjeffrey rodriguezNo ratings yet

- Workload ManagementDocument25 pagesWorkload Managementdex adecNo ratings yet