Professional Documents

Culture Documents

Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect of

Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect of

Uploaded by

Donabelle MarimonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect of

Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect of

Uploaded by

Donabelle MarimonCopyright:

Available Formats

LET’S ANALYZE

Activity 9. Understanding the normal balances is just a guide for you to correctly analyze the effect of

the transactions in the accounting equation. The most crucial part of the accounting process is the

journalizing function which is the recording of transaction in the journal. In this activity you are going to

identify the type of transactions (SA, UA, EA or EC), the value received and parted with,(using the

specific account title); the effect of the transactions and at the same time identify where to place the

increase or decrease of the accounts, is it on the debit? or on the credit side. Again a perfect score is

required so that that you can really prepare correctly the journal entries. The first 2 transactions are

answered for your reference.

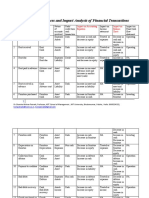

TRANSACTIONS TYPE OF Value Received and EFFECT WHAT TO

TRANSAC Value Parted With DEBIT AND

TIONS WHAT TO

CREDIT

Example: On Oct. 1, 2019 SA Increase in Debit Cash

Mr. Reyes invested cash Value Received: Cash Asset (Cash) Credit Capital

into his business to engage Increase in

in an “Internet Café” Value Parted With: Owner’s

Capital Equity

(Capital)

Example: Paid salaries of UA Decrease in Debit Salaries

employees Value Received: OE (Salaries Expense

Salaries Expense Expense) Credit Cash

Decrease in

Value Parted With: Asset (Cash)

Cash

1 Oct. 2, 2019 Paid rental of UA

internet space Value Received: Rent Decrease in Debit Rent

Expense OE (Rent Expense

Expense)

Value Parted With: Credit Cash

Cash Decrease in

Asset (Cash)

2 On Oct. 3, 2019 He bought EA

4 computer units for cash Value Received: Increase in Debit

Computer Asset Computer

Equipment (Computer Equipment

Equipment)

Value Parted With: Credit Cash

Cash Decrease in

Asset (Cash)

3 On Oct. 4, 2019 Paid UA

deposit to Davao Light for Value Received: Decrease in Debit Utilities

the light connection Utilities Expense OE (Utilities Expense

Expense)

Value Parted With: Credit Cash

Cash Decrease in

Asset (Cash)

4 On Oct. 5, 2019 Paid the UA

business permit and BIR Value Received: Decrease in Debit Taxes

registration Taxes and Licenses OE (Taxes and and Licenses

Licenses)

Value Parted With: Credit Cash

Cash Decrease in

Asset (Cash)

5 On Oct. 5, 2019 Bought SA

supplies for the internet Value Received: Increase in Debit

shop in cash (Asset Computer Supplies Asset Computer

Approach) (Computer Supplies

Value Parted With: Supplies)

Cash Credit Cash

Decrease in

Asset (Cash)

6 On Oct. 6, 2019 He paid UA

one month internet Value Received: Decrease in Debit Internet

connection Internet Expense OE (Internet Expense

Expense)

Value Parted With: Credit Cash

Cash Decrease in

Asset (Cash)

7 On Oct. 7, 2019 Received SA

cash from customers Value Received: Cash Increase in Debit Cash

Asset (Cash)

Value Parted With: Credit Service

Service Income Increase in OE Income

(Service

Income)

8 On Oct. 10, 2019 Bought SA

additional 1 unit computer Value Received: Increase in Debit

on credit Computer Asset Computer

Equipment (Computer Equipment

Equipment)

Value Parted With: Credit

Accounts Payable Increase in Accounts

Liability Payable

(Accounts

Payable)

9 On Oct. 11, 2019 Cash EA

receipts for 5 days Value Received: Cash Increase in Debit Cash

Asset (Cash)

Value Parted With: Credit

Accounts Decrease in Accounts

Receivables Asset Receivables

(Accounts

Receivables)

10 On Oct. 14, 2019 Billed a SA

loyal customer for 10 days Value Received: Increase in Debit

use of internet Accounts Receivable Asset Accounts

(Accounts Receivables

Value Parted With: Receivables)

Service Income Credit Service

Increase in OE Income

(Service

Income)

11 On Oct. 16, 2019 Paid in SA

full the account made in Value Received: Cash Increase in Debit Cash

Oct. 10 Asset (Cash)

Value Parted With: Credit Service

Service Income Increase in OE Income

(Service

Income)

12 Oct. 18, 2019 Received EA

partial payment from the Value Received: Cash Increase in Debit Cash

customer for his account Asset (Cash)

on Oct. 14 Value Parted With: Credit

Accounts Decrease in Accounts

Receivables Asset Receivables

(Accounts

Receivables)

13 Oct. 25, 2019 Received bill EC

from Davao Light for the Value Received: Decrease in Debit Utilities

month’s light consumption Utilities Expense OE (Utilities Expense

to be paid next month Expense)

Value Parted With: Credit

Accounts Payable Increase in Accounts

Liability Payable

(Accounts

Payable)

You might also like

- Activity 10: We All Know That The Purpose of Accounting Is To Provide Quantitative InformationDocument16 pagesActivity 10: We All Know That The Purpose of Accounting Is To Provide Quantitative InformationDonabelle MarimonNo ratings yet

- Sample Plaint-Suit For Recovery of DebtDocument6 pagesSample Plaint-Suit For Recovery of DebtAAnmol Narang100% (1)

- Visa Consulting and AnalyticsDocument20 pagesVisa Consulting and AnalyticsKristen NguyenNo ratings yet

- Real Estate Investing 101Document32 pagesReal Estate Investing 101jituNo ratings yet

- Public Finance Week 2Document30 pagesPublic Finance Week 2Letsah BrightNo ratings yet

- Capital Trainers Full PPT On TDSDocument78 pagesCapital Trainers Full PPT On TDSYamuna GNo ratings yet

- Sakhhhmple List of Commonly Used Ledger in TallyDocument9 pagesSakhhhmple List of Commonly Used Ledger in TallyAkash DhibarNo ratings yet

- Ca Foundation Lacture 1 ppt-1Document23 pagesCa Foundation Lacture 1 ppt-1idealNo ratings yet

- 1 Accounts-Debit or CreditDocument1 page1 Accounts-Debit or CreditPeter GeorgesNo ratings yet

- Tutorial Week 5Document7 pagesTutorial Week 5Mai HoàngNo ratings yet

- Canadian College Of: Business, Science & TechnologyDocument1 pageCanadian College Of: Business, Science & TechnologyAdel LatifNo ratings yet

- Acctg Terms and Debit CreditDocument3 pagesAcctg Terms and Debit CreditHel LoNo ratings yet

- Acctg Terms and Debit CreditDocument3 pagesAcctg Terms and Debit CreditHel LoNo ratings yet

- Asset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensDocument3 pagesAsset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensHel LoNo ratings yet

- Asset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensDocument3 pagesAsset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensediwowNo ratings yet

- Accounting Basic TermsDocument3 pagesAccounting Basic TermsHel LoNo ratings yet

- Chart of AccountDocument1 pageChart of AccountAndrei ManilaNo ratings yet

- Trading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & LedgerDocument2 pagesTrading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & Ledgersameer maddubaigariNo ratings yet

- Alfa Week 1Document13 pagesAlfa Week 1Cikgu kannaNo ratings yet

- Page 1 - 13 PDFDocument81 pagesPage 1 - 13 PDFCikgu kannaNo ratings yet

- Chap 3 Summary Notes EFFECTSDocument3 pagesChap 3 Summary Notes EFFECTSnabkillNo ratings yet

- Summary of Types of Accounts and Impact of Transactions Learning Unit 2.2Document1 pageSummary of Types of Accounts and Impact of Transactions Learning Unit 2.2Tiisetso MofokengNo ratings yet

- Actual BookkeepingDocument12 pagesActual BookkeepingRussel C. AdobasNo ratings yet

- Tally List of Ledger and GroupsDocument7 pagesTally List of Ledger and GroupsAnonymous 3yqNzCxtTz100% (1)

- 2024 Y10 chp 1 - 3Document33 pages2024 Y10 chp 1 - 3luluamurtazakarimiNo ratings yet

- Classification ActivityDocument1 pageClassification ActivitySmurtman69 IVNo ratings yet

- Classification ActivityDocument1 pageClassification ActivitySmurtman69 IVNo ratings yet

- List of Ledgers and It's Under Group in TallyDocument5 pagesList of Ledgers and It's Under Group in Tallyrachel Kujur100% (1)

- Accounting Analyzing Business Transaction ReviewerDocument7 pagesAccounting Analyzing Business Transaction Reviewerandreajade.cawaya10No ratings yet

- Accounting 1111Document3 pagesAccounting 1111Pak Shamaa School Doha QatarNo ratings yet

- Accounting Work Sheet No.01-1 PDFDocument3 pagesAccounting Work Sheet No.01-1 PDFTaskeen AliNo ratings yet

- Tally Ledger List in PDF Format TeachooDocument10 pagesTally Ledger List in PDF Format Teachoothakur731011No ratings yet

- 1) Debit The Receiver & Credit The Giver 2) Debit What Comes in & Credit What Goes Out 3) Debit All Expenses/losses & Credit All Profits/gainsDocument4 pages1) Debit The Receiver & Credit The Giver 2) Debit What Comes in & Credit What Goes Out 3) Debit All Expenses/losses & Credit All Profits/gainsDharmrajNo ratings yet

- 04 - COA SamplesDocument4 pages04 - COA SamplesJonalyn MalicdanNo ratings yet

- 3c ACC 15-2-1 Classifying ALEQDocument7 pages3c ACC 15-2-1 Classifying ALEQSmurtman69 IVNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- FABM2 (1st)Document3 pagesFABM2 (1st)7xnc4st2g8No ratings yet

- HeaderDocument1 pageHeadersupangkat.okNo ratings yet

- Problem 4 2aDocument12 pagesProblem 4 2aHCM Nguyen Do Huy HoangNo ratings yet

- Additional Illustration of Module 03Document2 pagesAdditional Illustration of Module 03ALTHEA JANE DURANNo ratings yet

- Columban College, Inc: The Following Are The Account Titles and Their Normal BalancesDocument3 pagesColumban College, Inc: The Following Are The Account Titles and Their Normal BalancesAriaiza SanpiaNo ratings yet

- Basic Principles of Accounting CH # 1Document7 pagesBasic Principles of Accounting CH # 1sameerdsportsmanNo ratings yet

- Ilovepdf MergedDocument10 pagesIlovepdf MergedDivyam RohillaNo ratings yet

- Flow Chart (L-8)Document2 pagesFlow Chart (L-8)Simer preet kaurNo ratings yet

- Rocksol COADocument2 pagesRocksol COAImran KaramatNo ratings yet

- Tally Ledger & GroupsDocument4 pagesTally Ledger & Groupsmanish guptaNo ratings yet

- Suggested Answers For Work Sheet-8-Process and Impact Analysis of Financial TransactionsDocument8 pagesSuggested Answers For Work Sheet-8-Process and Impact Analysis of Financial Transactionsaakash pandeyNo ratings yet

- Tally Ledger and Group ListDocument4 pagesTally Ledger and Group ListhatimNo ratings yet

- Chapter 4Document18 pagesChapter 42023661912No ratings yet

- ACCT1101 Wk3 Tutorial 2 SolutionsDocument7 pagesACCT1101 Wk3 Tutorial 2 SolutionskyleNo ratings yet

- Accounting Chapter 3Document14 pagesAccounting Chapter 3Huy Nguyễn NgọcNo ratings yet

- Revision Set 1Document7 pagesRevision Set 1Linh LinhNo ratings yet

- Chart of AccountDocument1 pageChart of AccountTusshar AhmedNo ratings yet

- Tally Group ListsDocument4 pagesTally Group Listssimrankaur69550No ratings yet

- Workshop 1Document7 pagesWorkshop 1yarimarNo ratings yet

- Comp-Youth-Hers: Chart of AccountsDocument2 pagesComp-Youth-Hers: Chart of AccountsAveryl Lei Sta.AnaNo ratings yet

- Acc - Section 2 Double Entry For AlcDocument3 pagesAcc - Section 2 Double Entry For AlcNathefa LayneNo ratings yet

- Tally Ass2Document2 pagesTally Ass2charu bishtNo ratings yet

- Corporation Practice Set Apelado i 13 1Document262 pagesCorporation Practice Set Apelado i 13 1tuazonkyla7No ratings yet

- Abm 1 Quiz No 1Document1 pageAbm 1 Quiz No 1Michael John DayondonNo ratings yet

- Tally Ledgers and GroupsDocument7 pagesTally Ledgers and Groupshrkumar440No ratings yet

- ABM3 Activity 6Document1 pageABM3 Activity 6april rose israelNo ratings yet

- Accounting Accounts and ItemsDocument2 pagesAccounting Accounts and ItemsmanoNo ratings yet

- Chart of AccountsDocument11 pagesChart of AccountsAmir Aijaz MemonNo ratings yet

- Acc 222 Review MaterialDocument6 pagesAcc 222 Review MaterialDonabelle MarimonNo ratings yet

- Acc223-Standard Costing-ApplicationsDocument4 pagesAcc223-Standard Costing-ApplicationsDonabelle MarimonNo ratings yet

- Task 2.4Document2 pagesTask 2.4Donabelle MarimonNo ratings yet

- Application 2.7Document1 pageApplication 2.7Donabelle MarimonNo ratings yet

- Acc224-2nd Exam ReviewerDocument2 pagesAcc224-2nd Exam ReviewerDonabelle MarimonNo ratings yet

- Business Process Re-EngineeringDocument2 pagesBusiness Process Re-EngineeringDonabelle MarimonNo ratings yet

- Acc224 (8315) - Week 5 AssignmentDocument1 pageAcc224 (8315) - Week 5 AssignmentDonabelle MarimonNo ratings yet

- CBM 321 Final Exam ReviewerDocument12 pagesCBM 321 Final Exam ReviewerDonabelle MarimonNo ratings yet

- Acc111 (412) Activity28 MarimonDocument2 pagesAcc111 (412) Activity28 MarimonDonabelle MarimonNo ratings yet

- ACTIVITY 5. Now That You Are Acquainted With The Account Titles and Its Classification, Let UsDocument3 pagesACTIVITY 5. Now That You Are Acquainted With The Account Titles and Its Classification, Let UsDonabelle MarimonNo ratings yet

- Acc111 (412) Activity27 MarimonDocument2 pagesAcc111 (412) Activity27 MarimonDonabelle MarimonNo ratings yet

- Activity 6. The Study of The Elements of The Financial Statements and Its Accounts Is ADocument6 pagesActivity 6. The Study of The Elements of The Financial Statements and Its Accounts Is ADonabelle MarimonNo ratings yet

- Activity 7Document2 pagesActivity 7Donabelle MarimonNo ratings yet

- Transaction Type of Transaction Effect Journal EntryDocument4 pagesTransaction Type of Transaction Effect Journal EntryDonabelle MarimonNo ratings yet

- Donabelle C. Marimon ACC111 (412) Forum4Document2 pagesDonabelle C. Marimon ACC111 (412) Forum4Donabelle MarimonNo ratings yet

- Activity 11: ExplanationDocument11 pagesActivity 11: ExplanationDonabelle Marimon0% (1)

- Let'S Check: Activity 12. in This Activity Let Us Check Your Understanding On TheDocument2 pagesLet'S Check: Activity 12. in This Activity Let Us Check Your Understanding On TheDonabelle MarimonNo ratings yet

- Let'S Check Activity 1. All This Information Presented in The Metalanguage andDocument5 pagesLet'S Check Activity 1. All This Information Presented in The Metalanguage andDonabelle MarimonNo ratings yet

- Questions With AnswersDocument8 pagesQuestions With AnswersAwadhesh SinghNo ratings yet

- FM Chap 1Document12 pagesFM Chap 1Mubarek AsefaNo ratings yet

- TCS Profit Up 50%, Declares 1:1 Bonus, 1,350% DividendDocument6 pagesTCS Profit Up 50%, Declares 1:1 Bonus, 1,350% DividendBhaskar NiraulaNo ratings yet

- Capital Market Theory-Topic FiveDocument62 pagesCapital Market Theory-Topic FiveRita NyairoNo ratings yet

- Irish CorporationDocument3 pagesIrish CorporationAngeline RamirezNo ratings yet

- Business Accounting Standard - LithuaniaDocument9 pagesBusiness Accounting Standard - Lithuaniafleur de VieNo ratings yet

- Financial Statements, Cash Flows, and Taxes: Learning ObjectivesDocument54 pagesFinancial Statements, Cash Flows, and Taxes: Learning ObjectivesShoniqua Johnson100% (1)

- Capital Raising Book by Richard C WilsonDocument101 pagesCapital Raising Book by Richard C WilsonNickMyersNo ratings yet

- PaymentDomain - Training Manual - 071811 - FinalDocument98 pagesPaymentDomain - Training Manual - 071811 - Finalbalwanbana100% (1)

- COOKIEDocument15 pagesCOOKIEBecca AlmencionNo ratings yet

- 12 New Trends in ManagementDocument18 pages12 New Trends in ManagementSaqib IqbalNo ratings yet

- Modelling Nigerian's FGN BondDocument69 pagesModelling Nigerian's FGN Bondmarthaaugustine2No ratings yet

- Is A PHL Tax Residency Certificate Relevant To My CorporationDocument4 pagesIs A PHL Tax Residency Certificate Relevant To My CorporationJemila Paula DialaNo ratings yet

- Revolutionary Perspectives 21Document55 pagesRevolutionary Perspectives 21HegelNo ratings yet

- Account Closure FormDocument1 pageAccount Closure FormvarunNo ratings yet

- List of Payment Purpose Code KRDocument10 pagesList of Payment Purpose Code KRあいうえおかきくけこNo ratings yet

- Annual Administration Report ProfarmaDocument4 pagesAnnual Administration Report ProfarmacherryprasaadNo ratings yet

- Ramcharan Tharu Laxmi BankDocument3 pagesRamcharan Tharu Laxmi BankNikhil Visa ServicesNo ratings yet

- Why Worlds Largest AMCs Not Present in India - August 2023Document12 pagesWhy Worlds Largest AMCs Not Present in India - August 2023manindrag00No ratings yet

- PFRS 9 - Financial InstrumentDocument3 pagesPFRS 9 - Financial InstrumentErika Panit ReyesNo ratings yet

- Personal Tariff GuideDocument1 pagePersonal Tariff GuideBUGIBONI SERVICE CENTRENo ratings yet

- 1 SMPG CA Global Market Practice Part 1 SR2017 v1 1Document104 pages1 SMPG CA Global Market Practice Part 1 SR2017 v1 1HoyoonJunNo ratings yet

- Mock Exam On InvestmentDocument5 pagesMock Exam On InvestmentDhaneshNo ratings yet

- Exercises For Before The Exam: November 11th November 18thDocument32 pagesExercises For Before The Exam: November 11th November 18thMušija AjlaNo ratings yet

- Service TaxDocument15 pagesService TaxMonu TulsyanNo ratings yet

- Chapter 4 9eDocument59 pagesChapter 4 9eRahil VermaNo ratings yet