Professional Documents

Culture Documents

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

Suresh TamangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

Suresh TamangCopyright:

Available Formats

LEVEL-2

1. Input tax Credit is available on all supplies which are used or intended to be used in the course or furtherance

of business. Input tax credit will be available under which of the following situations?

a) GST paid on motor car used in the course and furtherance of business.

b) GST paid on club membership fees.

c) GST paid on goods or services or both used for personal consumption.

d) IGST @18% paid on inputs purchased from a vendor in Bangalore where the supplier is registered in

Rajasthan.

2. Table 6 in GSTR-1 captures information related to:

(i) Exports out of India

(ii) Supplies to SEZ unit/ and SEZ developer

(iii) Deemed Exports

a) (i) and (ii)

b) (ii) and (iii)

c) (i)

d) (i), (ii) and (iii)

3. Which of the following is FALSE w.r.t HSN disclosure in GSTR 1?

a) Disclosure is not required for taxpayers having annual turnover upto Rs. 1.5 Crore

b) It will be mandatory to report HSN code at 2 digit level for taxpayer having annual turnover in the preceding

year above Rs. 1.50 Crore but upto 5.00 Crore

c) Taxpayers having turnover above Rs. 5 Crore have to mandatorily report 8 digit level HSN code.

d) Taxpayers having turnover above Rs. 5 Crore have to mandatorily report 4 digit level HSN code.

4. Which of the statement is FALSE with regard to filing of GST return of Mr. Anup, a proprietor registered under

GST (under regular scheme) who is filing quarterly return as his annual turnover is less than Rs. 1.5 crore?

a) Mr. Anup has to file GSTR-1 quarterly

b) Mr. Anup has to pay tax quarterly.

c) Mr. Anup has to settle his tax liabilities before filing of return.

d) Mr. Anup has to pay tax monthly.

5. Mr. Alok had to transport his personal goods from Mumbai to Goa. He contacts Sigma Travel Services (STS).

STS is a Goods Transport Agency. Mr. Alok hands over the goods to STS and STS issues consignment note

for his goods. Alok is an unregistered person. What will be GST scenario in this case?

a) Goods transport agency service rendered to un-registered person is exempt from tax

b) Unregistered person is required to pay GST on said activity under reverse charge.

c) Unregistered person is required to pay GST to Goods transport agency which in turn will be deposited by

Goods transport agency to Government.

d) Goods Transport Agency is required to pay tax under forward charge.

© The Institute of Chartered Accountants of India

6. Which of the following statements are true w.r.t. accounts and records?

1) All accounts and records are to be retained for 6 years.

2) Stock record is to be maintained by all registered dealers except the dealers registered under composition

scheme.

3) Stock record is to be maintained by all registered dealers including composition dealers.

4) Account, containing the details of tax payable (including tax payable under reverse charge), tax collected and

paid are not required to be maintained by the composition dealer.

5) Account, containing the details of tax payable (including tax payable under reverse charge), tax collected and

paid are mandatorily required to be maintained by the composition dealer.

Which of the above are correct?

a) 1,2,4

b) 1,2,5

c) 3,5

d) 2,4

7. A special audit under GST is conducted by :

a) The CGST Officials

b) The SGST Officials

c) Chartered Accountant or Cost Accountant

d) Any of the above

8. Suppose, One Business Group has 35 businesses within a State and wishes to take separate GST

registrations under the same PAN. How many online registration applications with scanned documents have

to be filed by that Business Group?

a) 35 separate applications in GST REG-01

b) Only one registration application incorporating all the businesses in one go.

c) Either of the above at the option of the Business Group

d) Either of the above at the discretion of the Proper Officer

9. GSTN stands for Goods and Service Tax Network. Which of the following is not the role of GSTN in GST

regime?

a) Facilitating registration, forwarding return to Central and State authorities.

b) Maintenance of interfaces between the Common GST Portal and tax administration systems

c) Providing platform for litigation

d) Providing various MIS reports to Central and State Governments.

10. Mr. A purchases redeemable vouchers worth Rs. 8000/- on 1st January. The vouchers are redeemable

against purchase of any goods. The vouchers are valid till 30th June. What will be the time of supply in case

of such vouchers?

a) 1st January

b) 30th June

© The Institute of Chartered Accountants of India

c) The date of redemption of vouchers

d) Any date before 30th June

11. Mr. A, registered under regular scheme of payment of GST, had annual turnover of Rs. 3 crores last year.

He is required to file GSTR-1 on a monthly basis. While filing the GSTR-1 for July month, he found that he

has received advances worth INR 2,00,000/- for which goods have not been supplied till month end. The

goods will be supplied in coming months. What would be his reporting for the above transaction in GSTR-1?

a) Mr. A is not required to pay GST on receipt of advance payments.

b) He needs to report the details of advances received in Table 11A rate wise in the tax period and tax to be

paid thereon along with respective point of sale.

c) He needs to report the details of advances received in Table 8 rate wise in the tax period and tax to be paid

thereon along with respective point of sale.

d) Mr. A has to pay tax on advances and adjust the same on issue of invoice. Recipient will only be able to take

input tax credit only in the month of issue of Invoice.

12. Mr. R, a resident of Delhi, holds an account in ICICI Bank in Delhi. Hometown of Mr. R is, however, Lucknow.

Mr. R goes to Jaipur for work. During his visit to Jaipur he takes certain services relating to his account from

ICICI bank in Jaipur in relation to some transaction to be carried out at Mumbai. What will be place of supply

in this case?

a) Delhi

b) Jaipur

c) Mumbai

d) Lucknow

13. Mr. A has a head office in Mumbai and branches in various States. The head office and all the branches are

various registered under GST. Various input services are used by branches, payment for which is done by

head office. In this case, the input tax credit on input services used by more than one branch is:

a) Distributed pro rata among the branches who use such input service on the basis of turnover in a State of

such branch to the aggregate of turnover of all branches which use such input service

b) Distributed equally among all the branches

c) Distributed only to one branch which has the highest turnover

d) Cannot be distributed

14. Mr. Z, a registered dealer in Rajasthan, has supplied goods to Mr. A in Rajasthan. Due to some configuration

mistake in the software, on Tax invoice Mr. Z has wrongly charged IGST instead of CGST and SGST. What

is the available remedy to him to correct this mistake?

a) Pay CGST and SGST and claim IGST refund.

b) Take help of GST helpdesk to pass adjustment entry so that it is corrected in Electronic ledger

c) IGST wrongly paid can be used in subsequent month tax payment, no procedure for refund. CGST and

SGST liability to be paid now.

d) Pay CGST and SGST now. IGST paid can neither be adjusted in subsequent months nor be refunded.

15. Mr. X becomes liable to pay tax on 1st April and has obtained registration on 15th April. Such person is eligible

for input tax credit on inputs held in stock as on:

© The Institute of Chartered Accountants of India

a) 1st April

b) 31st March

c) 15th April

d) He cannot take credit for the past period

16. PQR is dealing in supply of services through XYZ, an e-commerce operator and the same is notified under

section 9(5) of the CGST Act. As per section 9(5) of CGST Act, in case of the notified services supplied

through an e-commerce operator, all the provisions shall apply to e-commerce operator as if he is liable to

pay tax in relation to the supply of such services. Here are some scenarios.

I. XYZ (E-commerce operator) has their office in India so they are liable to pay tax as if they are the supplier of

such service

II. XYZ (E-commerce operator) is not in taxable territory but they have a person representing him in taxable

territory who shall be liable to pay tax

III. Neither E-commerce operator nor any person representing him is in taxable territory. So PQR is responsible

to pay tax on behalf of XYZ.

IV. Neither E-commerce operator nor any person representing him is in taxable territory. So XYZ (E-commerce

operator) shall appoint a person in the taxable territory for the purpose of paying tax.

Which of the above is not correct w.r.t tax liability of XYZ (e-commerce operator)?

a) I

b) II

c) III

d) IV

17. Mr. A, registered taxable person, pays Rs. 23,600/- for purchase of capital goods worth Rs. 20,000 with GST

(18%) of Rs. 3600/-. These capital goods are eligible for input tax credit. Mr. A is a proprietor in the trading

firm and is entitled to claim depreciation on the above capital goods. His accountant thinks of the following

entries.

i. He capitalizes the goods at Rs. 20,000 and claims depreciation on the same. For GST amount, he claims

input tax credit of Rs. 3600

ii. He capitalizes the goods at Rs. 20,000 and claims depreciation on the same. For GST amount, he does not

claim input tax credit.

iii. He capitalizes the goods at Rs. 23,600 and claims depreciation on the same. For GST amount he claims

input tax credit of Rs. 1800 (50% since he is claiming depreciation).

iv. He capitalizes the goods at Rs. 23,600 and claims depreciation on the same. For GST amount he does not

claim input tax credit.

Which of the two accounting treatments from the above are correct?

a) i, iv

b) ii, iii

c) iii, iv

d) i, iii

18. Mr. A is providing payroll services to Mr. B without consideration.

© The Institute of Chartered Accountants of India

1) Scenario 1: They are related persons and supply is made for furtherance of business

2) Scenario 2: They are not related persons and supply is made for furtherance of business

3) Scenario 3: They are related persons and supply is not made for furtherance of business

4) Scenario 4: They are not related persons and supply is not made for furtherance of business

Which from the above scenarios will be considered as supply?

a) Scenario 1

b) Scenario 1 and Scenario 3

c) Scenario 2

d) Scenario 2 and Scenario 4

19. Indigo Airlines sells various products like watches, artificial jewellery, packaged foods etc. to its passengers

on board during the flight. The Head Office of Indigo Airlines is In Delhi. In a flight originating from Jaipur,

halting at Mumbai and finally landing in Chennai, such products were boarded in Jaipur and sold to the

passengers on board during this flight. What would be the place of supply of such products?

a) Jaipur

b) Chennai

c) Mumbai

d) Delhi

20. M/s V Ltd., Ahmedabad is an importer of electronic components from China. The goods are imported at

Nhava Sheva port, Maharashtra and transferred to Ahmedabad after custom clearance. Also, he exports

certain finished consumer durables to Jakarta, Indonesia from Ahmedabad, but the final port of export is

Nhava Sheva, Maharashtra. What would be the place of supply in case of import and export?

a) Import – Nhava Sheva, Maharashtra, Export – Nhava Sheva

b) Import – Ahmedabad, Gujarat, Export – Jakarta

c) Import – Ahmedabad, Gujarat, Export – Ahmedabad

d) Import – Nhava Sheva, Export – Ahmedabad

21. In which of the following cases, a tax invoice under GST is not required to be issued by a registered person,

provided the recipient does not require such invoice?

(a) Value of the goods/services/both supplied is less than Rs.200 and recipient is unregistered.

(b) Value of the goods/services/both supplied is less than Rs.200 and recipient is registered.

(c) Value of the goods/services/both supplied is more than Rs.200 and recipient is unregistered.

(d) Value of the goods/services/both supplied is equal to Rs.200 and recipient is unregistered.

22. What is the maximum time limit for passing the demand order in case of short payment of tax for reasons

other than fraud, or wilful misstatement or suppression?

(a) 3 years from the due date of filing of Annual Return for the Financial Year to which the demand pertains.

(b) 2 years and 9 months from the due date of filing of Annual Return for the Financial Year to which the

demand pertains.

(c) 5 years from the due date of filing of Annual Return for the Financial Year to which the demand pertains.

© The Institute of Chartered Accountants of India

(d) 4 years and 9 months from the due date of filing of Annual Return for the Financial Year to which the

demand pertains.

23. What is the maximum time limit for issuance of show cause notice in case of short payment of tax on account

of fraud?

(a) 3 years from the due date of filing of Annual Return for the Financial Year to which the demand pertains.

(b) 2 years and 9 months from the due date of filing of Annual Return for the Financial Year to which the

demand pertains.

(c) 5 years from the due date of filing of Annual Return for the Financial Year to which the demand pertains.

(d) 4 years and 6 months from the due date of filing of Annual Return for the Financial Year to which the

demand pertains.

24. Which of the following statements is not correct with respect to input tax credit?

(a) Input tax credit is allowed on inward supplies charged to tax under composition levy.

(b) Input tax credit is allowed on capital goods

(c) Input tax credit is not allowed on goods/services for personal use.

(d) No input tax credit shall be allowed after GST return has been filed for September following the end of

the financial year to which such invoice pertains or filing of relevant annual return, whichever is earlier.

25. 'Zero rated supply' shall not include the following:

(a) Export of goods or services under bond or LUT.

(b) Export of goods or services on payment of IGST.

(c) Supplies by SEZ unit or SEZ developer.

(d) Supplies to SEZ unit or SEZ developer

26. Mr. Z has an agency of wholesale trading of a particular brand in Gas Stoves for Rajasthan and Gujarat and

has separate proprietorship firms in each of the two States. In Gujarat, Mr. Z additionally trades in shoes

under the same firm from a different Store.

In the context of the above information, which of the following statement is correct?

a) Mr. Z can operate with single registration for Gas Stoves business for Rajasthan and Gujarat. For Shoes

business, he has to compulsorily take separate registration since it is different business segment.

b) Mr. Z will have to mandatorily get separate registrations for each of the States i.e., Rajasthan and Gujarat.

In Gujarat, he has an option to obtain either separate registration for Gas stove Business and Shoes business

or one registration for Gas stove Business and Shoes business.

c) Mr. Z will have to compulsorily take 3 registrations two for Gujarat (Gas Stoves and Shoes separately) and

one for Rajasthan business (Gas stoves).

d) Mr. Z can operate with single registration for Gas Stoves business for Rajasthan and Gujarat and Shoes

business for Gujarat.

27. A new client Mr. Z has recently obtained GST registration and keeps manual accounts. He has got his GSTIN

printed on top of every page of new booklet printed for Tax Invoice. Apart from his principal place of business,

he owns 2 godowns where he keeps stock of his goods and does some wholesale trading. He asks you

whether he needs to display the GSTIN registration and GSTIN at any other places?

© The Institute of Chartered Accountants of India

a) Mr. Z is required to display his certificate of registration in a prominent location at his principal place of

business only. Name board at entry shall display GSTIN at his principal place of business only.

b) Mr. Z has to display his certificate of registration in a prominent location at his place of business and at every

additional place or places of business. Also, he should display GSTIN in the name board exhibited at the

entry of his principal place of business and at every additional place or places of business.

c) The certificate of registration is not required to be displayed. Only name board at entry of principal and

additional places of business shall display GSTIN.

d) The certificate of registration in a prominent location is required to be displayed only at principal place of

business. Name board at entry of principal and additional places of business shall display GSTIN

28. Mr. X is a trader and has opted for composition scheme. He wants to withdraw from composition levy

retrospectively during the year. Can he do so? Does it make any difference to date of withdrawal, if the reason

for withdrawal is voluntary?

a) During the year withdrawal from composition levy is not allowed. It can be done from next financial year

onwards.

b) Yes, withdrawal can be done any time during the year. No, it does not make any difference to the date of

withdrawal, if the reason for withdrawal is voluntary.

c) Yes, withdrawal can be done any time during the year. If the reason for withdrawal is voluntary, then the

date from which withdrawal is sought cannot be a previous date. It can be current or a future date.

d) Yes, withdrawal can be done any time during the year. If the reason for withdrawal is voluntary, then the

date from which withdrawal is sought cannot be a future date. It shall be a date between the date of

registration and the present date.

29. Mr. Z, a job worker of cotton bedsheets, approaches you to know whether he is required to be compulsorily

registered under GST. His job-work is the last stage of work for the product to be a finished product. Can

he dispatch goods from his place directly to the customer on direction of his principal? What would be your

advice from the following options:

a) Mr. Z is supplier of services and is required to obtain compulsory registration under GST. He can supply

goods from his place directly to customer since he is registered.

b) Mr. Z is a supplier of services and is liable to take registration only when his turnover crosses the prescribed

threshold limit of INR 10/20 lakh as applicable. He can supply the goods to customer directly only if he is

registered under GST.

c) Mr. Z is a supplier of services and is liable to take registration only when his turnover crosses the prescribed

threshold limit of INR 10/20 lakh as applicable. He can supply the goods to customer directly if he is registered

under GST or if the principal declares Mr. Z’s place as his additional place of business.

d) Mr. Z is not required to obtain registration under GST. He cannot supply goods from his place directly to

customer since he is not registered.

30. Which of the following is a correct method of serving notice?

(i) By giving it to any adult member of the family residing with the taxable person

(ii) By making it available on the common portal

(iii) By sending a courier to a person regularly employed by him in connection with the business

(iv) By registered post with acknowledgement due to his authorised representative

(v) Affixing a copy on the notice board of the office of the concerned officer who issued such notice

© The Institute of Chartered Accountants of India

(a) (ii), (iv)

(b) (i), (iii), (v)

(c) (i), (ii), (iii), (iv)

(d) (i), (ii), (iii), (iv) and (v)

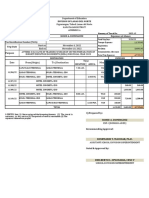

Level 2 answers

Question No. Correct option

1 (d)

2 (d)

3 (c)

4 (b)

5 (a)

6 (a)

7 (c)

8 (a)

9 (c)

10 (c)

11 (a)

12 (a)

13 (a)

14 (a)

15 (b)

16 (c)

17 (a)

18 (a)

19 (a)

20 (b)

21 (a)

22 (b)

23 (d)

© The Institute of Chartered Accountants of India

24 (a)

25 (c)

26 (b)

27 (b)

28 (c)

29 (c)

30 (d)

© The Institute of Chartered Accountants of India

You might also like

- Check Stub 1Document1 pageCheck Stub 1raheemtimo1No ratings yet

- TR2390 Electrical, Optical ConnectorsDocument57 pagesTR2390 Electrical, Optical ConnectorsCandice Williams100% (1)

- High Alert Medication PlanDocument15 pagesHigh Alert Medication PlanNina Morada100% (5)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 2.5 Quiz-ContinuityDocument4 pages2.5 Quiz-Continuitybilal5202050No ratings yet

- Fanuc BasicDocument0 pagesFanuc BasicMarco A. Miranda RamírezNo ratings yet

- Icai 3Document14 pagesIcai 3Raghav TibdewalNo ratings yet

- First GST Full Length May 24 100marksDocument10 pagesFirst GST Full Length May 24 100marksJyoti ManwaniNo ratings yet

- Case ScenarioDocument11 pagesCase Scenariopujitha vegesnaNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- Most Expected GST Questions Part 1 by Ca Vivek GabaDocument25 pagesMost Expected GST Questions Part 1 by Ca Vivek GabaLakshman MurthyNo ratings yet

- Taxguru - in-MCQs On GST For CACMACSDocument14 pagesTaxguru - in-MCQs On GST For CACMACSOm KambleNo ratings yet

- Most Expected Top 50 GST Questions For CA Inter November 2023 ExamsDocument45 pagesMost Expected Top 50 GST Questions For CA Inter November 2023 ExamsmukhiapurvaNo ratings yet

- Costing G10 QuestionDocument6 pagesCosting G10 QuestionVishal Kumar 5504No ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- P18 PDFDocument14 pagesP18 PDFsiva ramanNo ratings yet

- MCQs On Ch9 RegistrationDocument16 pagesMCQs On Ch9 RegistrationAman AgarwalNo ratings yet

- GST TradersDocument11 pagesGST TradersSHAIK AHMEDNo ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- GST-603 Unit-3Document23 pagesGST-603 Unit-3GauharNo ratings yet

- 1idt PDFDocument19 pages1idt PDFShantanuNo ratings yet

- How To File GST Returns in IndiaDocument6 pagesHow To File GST Returns in IndiatechindiaengineeringNo ratings yet

- Input Tax CreditDocument8 pagesInput Tax CreditPranjal AgrawalNo ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- ReturnsDocument4 pagesReturnspujitha vegesnaNo ratings yet

- DT Icai MCQ 4Document5 pagesDT Icai MCQ 4Anshul JainNo ratings yet

- Mock Test Cma Dec 18Document12 pagesMock Test Cma Dec 18amit jangraNo ratings yet

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- GST Full Length QPDocument7 pagesGST Full Length QPJyoti ManwaniNo ratings yet

- GST Law (Set 2)Document4 pagesGST Law (Set 2)studywagishaNo ratings yet

- Registration FaqDocument6 pagesRegistration FaqDiya 000No ratings yet

- RegistrationDocument6 pagesRegistrationpujitha vegesnaNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- 51 GST Flyer Chapter10Document6 pages51 GST Flyer Chapter10Japjyot singhNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- GST Post Q 20 May PDF - 29979560Document4 pagesGST Post Q 20 May PDF - 29979560priya02sharma22No ratings yet

- Payment of Tax @icmaifamilyDocument9 pagesPayment of Tax @icmaifamilypriyababu4701No ratings yet

- CS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFDocument5 pagesCS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFRadhika ChopraNo ratings yet

- Input Tax Credit (GST)Document16 pagesInput Tax Credit (GST)ravi.pansuriya07No ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Transfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Document11 pagesTransfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Vishal DubeyNo ratings yet

- Practical Question Bank: Faculty of Commerce, Osmania UniversityDocument4 pagesPractical Question Bank: Faculty of Commerce, Osmania Universitymekala sailajaNo ratings yet

- AssignmentDocument50 pagesAssignmentAyushi TiwariNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument15 pagesFinal Examination: Suggested Answers To Questionsamit jangraNo ratings yet

- Chpter 1, Scope & Levy, Nat & POS, AllDocument14 pagesChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleNo ratings yet

- Most Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1Document236 pagesMost Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1148salwa HussainNo ratings yet

- Ayush PendDocument62 pagesAyush PendPankaj MahantaNo ratings yet

- Indirect Taxation Finals Question PaperDocument3 pagesIndirect Taxation Finals Question PaperShubham NamdevNo ratings yet

- Indirect Tax-Sample QuestionDocument8 pagesIndirect Tax-Sample Questionantonyashin007No ratings yet

- Steps Involved in Filing GST ReturnsDocument9 pagesSteps Involved in Filing GST ReturnssaranistudyNo ratings yet

- 25-11-2020 Case Studies On RefundsDocument8 pages25-11-2020 Case Studies On Refundsdalip.singhNo ratings yet

- MCQ OF CHAPTER 14 To CHAPTER 17Document8 pagesMCQ OF CHAPTER 14 To CHAPTER 17Aman AgarwalNo ratings yet

- Inu 2216 Idt - Question PaperDocument5 pagesInu 2216 Idt - Question PaperVinil JainNo ratings yet

- TaxationDocument7 pagesTaxationstk2796No ratings yet

- Input Tax CreditDocument12 pagesInput Tax CreditAwesome AngelNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- MCQ For CA-final IDTDocument56 pagesMCQ For CA-final IDTManul jainNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Anno 2070Document16 pagesAnno 207012345zolyNo ratings yet

- Thinkisb ISB GuideDocument19 pagesThinkisb ISB GuideThinkisb MbaNo ratings yet

- Brain ChildDocument8 pagesBrain ChildGabriel PiticasNo ratings yet

- Lesson Plan Spark Plug Removal & ReplacementDocument4 pagesLesson Plan Spark Plug Removal & ReplacementVon MoreNo ratings yet

- Research Paper - SOCS103 C1-3 (Gastilo, Luna, Pante, Sinson, Turiano)Document51 pagesResearch Paper - SOCS103 C1-3 (Gastilo, Luna, Pante, Sinson, Turiano)Dave LunaNo ratings yet

- Concept Note PSD LAB - PHARMA API PLANTDocument17 pagesConcept Note PSD LAB - PHARMA API PLANTRishabh VermaNo ratings yet

- Human Resource ManagementDocument13 pagesHuman Resource ManagementJerom EmmnualNo ratings yet

- IIARF CBOK Interacting With Audit Committees FEB 2016 PDFDocument16 pagesIIARF CBOK Interacting With Audit Committees FEB 2016 PDFArol RakotoNo ratings yet

- United Pulp and Paper Co., Inc., Vs - United Pulp and Paper Chapter-Federation of Free WorkersDocument2 pagesUnited Pulp and Paper Co., Inc., Vs - United Pulp and Paper Chapter-Federation of Free WorkersLiaa Aquino100% (1)

- Introduction To Indirect Taxes Ch.IDocument6 pagesIntroduction To Indirect Taxes Ch.IpravinsankalpNo ratings yet

- BT138FDocument7 pagesBT138FMiloud ChouguiNo ratings yet

- BiometricDocument14 pagesBiometricsriram_adapaNo ratings yet

- Commercial Banking System and Role of RBI - Assignment June 2021Document6 pagesCommercial Banking System and Role of RBI - Assignment June 2021sadiaNo ratings yet

- Comparison of Jute Fiber Over Glass FibeDocument5 pagesComparison of Jute Fiber Over Glass FibeBobby LupangoNo ratings yet

- Duplichecker Plagiarism ReportDocument2 pagesDuplichecker Plagiarism ReportHENRYNo ratings yet

- Hamming CodesDocument31 pagesHamming CodesvolooNo ratings yet

- BQ34Z100 Wide Range Fuel Gauge With Impedance Track™ TechnologyDocument61 pagesBQ34Z100 Wide Range Fuel Gauge With Impedance Track™ TechnologyEddie WitteNo ratings yet

- B1 (2016) : D B I: Natef Task Sheet - Section A.5 D.3,6,8,10 P-1 ISC Rake NspectionDocument1 pageB1 (2016) : D B I: Natef Task Sheet - Section A.5 D.3,6,8,10 P-1 ISC Rake Nspectionabul hussainNo ratings yet

- Main Engine Failure Check List: Company Forms and Check ListsDocument2 pagesMain Engine Failure Check List: Company Forms and Check ListsopytnymoryakNo ratings yet

- INtroduction To ErgonomicsDocument103 pagesINtroduction To Ergonomicsnurjamima96No ratings yet

- School Principal ItineraryDocument3 pagesSchool Principal ItineraryKaren S. RoblesNo ratings yet

- Eticket PDFDocument2 pagesEticket PDFbimal mukhiyaNo ratings yet

- PowerFlex Rack Administration - Instructor GuideDocument241 pagesPowerFlex Rack Administration - Instructor GuideGreivin ArguedasNo ratings yet

- Pybullet Quickstart Guide: Erwin Coumans Yunfei Bai ForumsDocument66 pagesPybullet Quickstart Guide: Erwin Coumans Yunfei Bai ForumsRiyaan BakhdaNo ratings yet

- Tendernotice 1 PDFDocument31 pagesTendernotice 1 PDFkrishna prasadNo ratings yet