Professional Documents

Culture Documents

Chapter9 Ma

Chapter9 Ma

Uploaded by

Lele MaCopyright:

Available Formats

You might also like

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- Acctg 111 Assign3 ReviewerDocument5 pagesAcctg 111 Assign3 ReviewerChris Jay LatibanNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- PA VOCA Funding - Overview of The Victims of Crime Act Funding StreamDocument2 pagesPA VOCA Funding - Overview of The Victims of Crime Act Funding StreamDefendAChildNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Tutorial 17.5Document4 pagesTutorial 17.5نور عفيفهNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Document3 pagesQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923No ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- Lecture On IAS 7 20-03-2024Document10 pagesLecture On IAS 7 20-03-2024Areeba IftikharNo ratings yet

- Sample Illustration Financial StatementDocument3 pagesSample Illustration Financial StatementJuvy Jane DuarteNo ratings yet

- FABM 2 ProjectDocument14 pagesFABM 2 ProjectMilanie Rose Mendoza 11- ABMNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- Final Project-Part 2 - Final - XLSX - Proj - 2ADocument1 pageFinal Project-Part 2 - Final - XLSX - Proj - 2ABlessie Ysavyll SaballeNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Class 1 HomeworkDocument10 pagesClass 1 HomeworkAngel MéndezNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- AsasassaDocument3 pagesAsasassaIden PratamaNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Assignment 03Document7 pagesAssignment 03Nadeera GalagedarageNo ratings yet

- Chap 13 - 1 To 5Document5 pagesChap 13 - 1 To 5Buenaventura, Lara Jane T.No ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Accounting Sharim Final ExamDocument5 pagesAccounting Sharim Final ExamsubhanNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Accounting (08-09-2018) Set-2Document2 pagesAccounting (08-09-2018) Set-2Shakil ShekhNo ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- CH 12 Exhibit 22Document4 pagesCH 12 Exhibit 22ЭниЭ.No ratings yet

- Cash FlowDocument4 pagesCash FlowNathaniel TanNo ratings yet

- Chapter 7: Cash Flow AnalysisDocument2 pagesChapter 7: Cash Flow Analysistrisasmita bisnisNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Course Review Exercise 2Document5 pagesCourse Review Exercise 2Carolina MerinoNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Raine SDocument6 pagesRaine Sapi-664248097No ratings yet

- Nica Company Income Statement As of February 17, 2018 RevenuesDocument10 pagesNica Company Income Statement As of February 17, 2018 RevenuesRoselyn JavierNo ratings yet

- PRBA003 Week 10 Tutorialsolutions 10 EdDocument29 pagesPRBA003 Week 10 Tutorialsolutions 10 EdWang ChoiNo ratings yet

- Janjua CompanyDocument3 pagesJanjua CompanySyed Muhammad Ali OmerNo ratings yet

- Thesis All RightDocument14 pagesThesis All Rightdarodawa100% (1)

- Efficacious Novena To The Sacred Heart of JesusDocument2 pagesEfficacious Novena To The Sacred Heart of JesusSirJohn AlmariegoNo ratings yet

- Is 9259 1979 PDFDocument15 pagesIs 9259 1979 PDFsagarNo ratings yet

- The Persuasive SpeechDocument2 pagesThe Persuasive Speechapi-629326078No ratings yet

- Qliphoth GuideDocument25 pagesQliphoth Guidepaul100% (9)

- BugkalotDocument3 pagesBugkalotADMIN OFFICERNo ratings yet

- (English) Terms and RegulationDocument2 pages(English) Terms and RegulationMuhammad Fauzan Ansari Bin AzizNo ratings yet

- Jafor SadikDocument1 pageJafor SadikTRICK WORLDNo ratings yet

- 9khao Sat Hung Thu Hoc Tap Mon Ngu Van Cua Hoc Sinh Trung Hoc Pho ThongDocument5 pages9khao Sat Hung Thu Hoc Tap Mon Ngu Van Cua Hoc Sinh Trung Hoc Pho ThongNguyễn Ngọc Diệp LinhNo ratings yet

- B.A.Hons - CBCS 4th Sem. 9 Intermediate Macroeconomics II 9.1.2018Document3 pagesB.A.Hons - CBCS 4th Sem. 9 Intermediate Macroeconomics II 9.1.2018Akshara AwasthiNo ratings yet

- Fujitsu M10/SPARC M10 Systems: Product Notes For XCP Version 2353Document320 pagesFujitsu M10/SPARC M10 Systems: Product Notes For XCP Version 2353sonneNo ratings yet

- Air&Space Law 1st AssignmentDocument6 pagesAir&Space Law 1st AssignmentKaran SinhaNo ratings yet

- CV Aylin CALIK Project ManagerDocument1 pageCV Aylin CALIK Project ManagerAnna PeckNo ratings yet

- Topographic Map of Oak Hills NorthDocument1 pageTopographic Map of Oak Hills NorthHistoricalMapsNo ratings yet

- 1.3 How Individuals Make Choices Based On Their Budget ConstraintsDocument7 pages1.3 How Individuals Make Choices Based On Their Budget ConstraintsJerlyn CaseriaNo ratings yet

- Animal Rights Persuasive EssayDocument3 pagesAnimal Rights Persuasive Essayhupkakaeg100% (2)

- Sogie BillDocument4 pagesSogie BillJoy YaaNo ratings yet

- Lesson 1 - PhilosophyDocument47 pagesLesson 1 - PhilosophyKotch LupasiNo ratings yet

- Final Ravi River Scope of Work DevelpmentDocument10 pagesFinal Ravi River Scope of Work DevelpmentAnonymous YBAHVQNo ratings yet

- Poland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepDocument14 pagesPoland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepSuhas PothedarNo ratings yet

- Foundations in Expansive SoilsDocument99 pagesFoundations in Expansive SoilsJosh MunnNo ratings yet

- FL20240125111616552Document1 pageFL20240125111616552mayukh.baraiNo ratings yet

- Creating Oracle BI Publisher Report Using Template Builder: ExploreDocument8 pagesCreating Oracle BI Publisher Report Using Template Builder: ExploreAbebeNo ratings yet

- 12.2 Dybala The Aerzen ConceptDocument18 pages12.2 Dybala The Aerzen ConceptadhyNo ratings yet

- X-Ray Products WarrantyDocument2 pagesX-Ray Products WarrantyEmmanuel RamirezNo ratings yet

- Resume - Azhar FayyazDocument1 pageResume - Azhar FayyazAzhar Fayyaz ParachaNo ratings yet

- Jean-François Lyotard-La Phénoménologie (Que Sais-Je - ) (1999)Document294 pagesJean-François Lyotard-La Phénoménologie (Que Sais-Je - ) (1999)EduardoBragaNo ratings yet

- Witness To SplendourDocument89 pagesWitness To SplendourSani Panhwar100% (3)

- Fees For Grant and Renewal of Fire LicenseDocument6 pagesFees For Grant and Renewal of Fire LicenseParthsarthi PraveenNo ratings yet

Chapter9 Ma

Chapter9 Ma

Uploaded by

Lele MaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter9 Ma

Chapter9 Ma

Uploaded by

Lele MaCopyright:

Available Formats

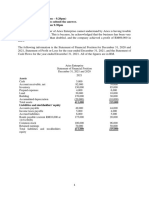

The following balance sheets are taken from the records of Golding Inc.

:

Assets 20X1 20X2

Cash 130,000 150,000

Accounts Receivable 25,000 20,000

Plant and Equipment 50,000 60,000

Accumulated Depreciation (20,000) (25,000)

Land 10,000 10,000

Total Assets 195,000 215,000

Liabilities and Equity

Accounts Payable 10,000 5,000

Bonds Payable 8,000 18,000

Common Stock 120,000 120,000

Retained Earnings 57,000 72,000

Total Liabilities and Equity 195,000 215,000

Additional information is as follows: Equipment costing $10,000 was purchased at year- end. No

equipment was sold. Net income for the year was $25,000, and $10,000 in dividends were

paid.

Required:

Prepare a statement of cash flows using the indirect method.

Solution:

1. Cash flow change: 150,000- 130,000 = 20,000

2. Operating cash flows:

Net income Php 25,000

Add (deduct):

Decrease in accounts receivable 5,000

Depreciation expense 5,000

Decrease in accounts payable (5,000)

Net cash from operating activities Php 30,000

3. Cash from investing activities for purchase of equipment is (10,000)

4. Cash from financing activities:

Payment of dividends Php (10,000)

Issuance of Bonds 10,000

Net cash from financing activities Php 0

Golding Inc.

Statement of Cash Flows

For the Year Ended December 31, 2016

Cash flows from operating activities:

Net income Php 25,000

Add (deduct):

Decrease in accounts receivable 5,000

Depreciation expense 5,000

Decrease in accounts payable (5,000)

Net cash from operating activities Php 30,000

Cash from investing activities:

Purchase of equipment (10,000)

Cash from financing activities:

Payment of dividends Php (10,000)

Issuance of Bonds 10,000

Net cash from financing activities 0

Net increase in cash Php 20,000

You might also like

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- Acctg 111 Assign3 ReviewerDocument5 pagesAcctg 111 Assign3 ReviewerChris Jay LatibanNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- PA VOCA Funding - Overview of The Victims of Crime Act Funding StreamDocument2 pagesPA VOCA Funding - Overview of The Victims of Crime Act Funding StreamDefendAChildNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Tutorial 17.5Document4 pagesTutorial 17.5نور عفيفهNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Document3 pagesQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923No ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- Lecture On IAS 7 20-03-2024Document10 pagesLecture On IAS 7 20-03-2024Areeba IftikharNo ratings yet

- Sample Illustration Financial StatementDocument3 pagesSample Illustration Financial StatementJuvy Jane DuarteNo ratings yet

- FABM 2 ProjectDocument14 pagesFABM 2 ProjectMilanie Rose Mendoza 11- ABMNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- Final Project-Part 2 - Final - XLSX - Proj - 2ADocument1 pageFinal Project-Part 2 - Final - XLSX - Proj - 2ABlessie Ysavyll SaballeNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Class 1 HomeworkDocument10 pagesClass 1 HomeworkAngel MéndezNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- AsasassaDocument3 pagesAsasassaIden PratamaNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Assignment 03Document7 pagesAssignment 03Nadeera GalagedarageNo ratings yet

- Chap 13 - 1 To 5Document5 pagesChap 13 - 1 To 5Buenaventura, Lara Jane T.No ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Accounting Sharim Final ExamDocument5 pagesAccounting Sharim Final ExamsubhanNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Accounting (08-09-2018) Set-2Document2 pagesAccounting (08-09-2018) Set-2Shakil ShekhNo ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- CH 12 Exhibit 22Document4 pagesCH 12 Exhibit 22ЭниЭ.No ratings yet

- Cash FlowDocument4 pagesCash FlowNathaniel TanNo ratings yet

- Chapter 7: Cash Flow AnalysisDocument2 pagesChapter 7: Cash Flow Analysistrisasmita bisnisNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Course Review Exercise 2Document5 pagesCourse Review Exercise 2Carolina MerinoNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Raine SDocument6 pagesRaine Sapi-664248097No ratings yet

- Nica Company Income Statement As of February 17, 2018 RevenuesDocument10 pagesNica Company Income Statement As of February 17, 2018 RevenuesRoselyn JavierNo ratings yet

- PRBA003 Week 10 Tutorialsolutions 10 EdDocument29 pagesPRBA003 Week 10 Tutorialsolutions 10 EdWang ChoiNo ratings yet

- Janjua CompanyDocument3 pagesJanjua CompanySyed Muhammad Ali OmerNo ratings yet

- Thesis All RightDocument14 pagesThesis All Rightdarodawa100% (1)

- Efficacious Novena To The Sacred Heart of JesusDocument2 pagesEfficacious Novena To The Sacred Heart of JesusSirJohn AlmariegoNo ratings yet

- Is 9259 1979 PDFDocument15 pagesIs 9259 1979 PDFsagarNo ratings yet

- The Persuasive SpeechDocument2 pagesThe Persuasive Speechapi-629326078No ratings yet

- Qliphoth GuideDocument25 pagesQliphoth Guidepaul100% (9)

- BugkalotDocument3 pagesBugkalotADMIN OFFICERNo ratings yet

- (English) Terms and RegulationDocument2 pages(English) Terms and RegulationMuhammad Fauzan Ansari Bin AzizNo ratings yet

- Jafor SadikDocument1 pageJafor SadikTRICK WORLDNo ratings yet

- 9khao Sat Hung Thu Hoc Tap Mon Ngu Van Cua Hoc Sinh Trung Hoc Pho ThongDocument5 pages9khao Sat Hung Thu Hoc Tap Mon Ngu Van Cua Hoc Sinh Trung Hoc Pho ThongNguyễn Ngọc Diệp LinhNo ratings yet

- B.A.Hons - CBCS 4th Sem. 9 Intermediate Macroeconomics II 9.1.2018Document3 pagesB.A.Hons - CBCS 4th Sem. 9 Intermediate Macroeconomics II 9.1.2018Akshara AwasthiNo ratings yet

- Fujitsu M10/SPARC M10 Systems: Product Notes For XCP Version 2353Document320 pagesFujitsu M10/SPARC M10 Systems: Product Notes For XCP Version 2353sonneNo ratings yet

- Air&Space Law 1st AssignmentDocument6 pagesAir&Space Law 1st AssignmentKaran SinhaNo ratings yet

- CV Aylin CALIK Project ManagerDocument1 pageCV Aylin CALIK Project ManagerAnna PeckNo ratings yet

- Topographic Map of Oak Hills NorthDocument1 pageTopographic Map of Oak Hills NorthHistoricalMapsNo ratings yet

- 1.3 How Individuals Make Choices Based On Their Budget ConstraintsDocument7 pages1.3 How Individuals Make Choices Based On Their Budget ConstraintsJerlyn CaseriaNo ratings yet

- Animal Rights Persuasive EssayDocument3 pagesAnimal Rights Persuasive Essayhupkakaeg100% (2)

- Sogie BillDocument4 pagesSogie BillJoy YaaNo ratings yet

- Lesson 1 - PhilosophyDocument47 pagesLesson 1 - PhilosophyKotch LupasiNo ratings yet

- Final Ravi River Scope of Work DevelpmentDocument10 pagesFinal Ravi River Scope of Work DevelpmentAnonymous YBAHVQNo ratings yet

- Poland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepDocument14 pagesPoland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepSuhas PothedarNo ratings yet

- Foundations in Expansive SoilsDocument99 pagesFoundations in Expansive SoilsJosh MunnNo ratings yet

- FL20240125111616552Document1 pageFL20240125111616552mayukh.baraiNo ratings yet

- Creating Oracle BI Publisher Report Using Template Builder: ExploreDocument8 pagesCreating Oracle BI Publisher Report Using Template Builder: ExploreAbebeNo ratings yet

- 12.2 Dybala The Aerzen ConceptDocument18 pages12.2 Dybala The Aerzen ConceptadhyNo ratings yet

- X-Ray Products WarrantyDocument2 pagesX-Ray Products WarrantyEmmanuel RamirezNo ratings yet

- Resume - Azhar FayyazDocument1 pageResume - Azhar FayyazAzhar Fayyaz ParachaNo ratings yet

- Jean-François Lyotard-La Phénoménologie (Que Sais-Je - ) (1999)Document294 pagesJean-François Lyotard-La Phénoménologie (Que Sais-Je - ) (1999)EduardoBragaNo ratings yet

- Witness To SplendourDocument89 pagesWitness To SplendourSani Panhwar100% (3)

- Fees For Grant and Renewal of Fire LicenseDocument6 pagesFees For Grant and Renewal of Fire LicenseParthsarthi PraveenNo ratings yet