Professional Documents

Culture Documents

TDS - Cash Withdrawal

TDS - Cash Withdrawal

Uploaded by

Chandra PrakashOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS - Cash Withdrawal

TDS - Cash Withdrawal

Uploaded by

Chandra PrakashCopyright:

Available Formats

If you are unable to view the below e-mailer, please click here

Dear Customer,

Thank you for banking with us. We would like to update you about Tax Deducted at Source

(TDS) on cash withdrawals in excess of specified limits. The threshold, as well as the Rate of

TDS applicable for cash withdrawal will be dependent on submission of proof of filing of your

Income Tax Return to the bank.

TDS on cash withdrawal will be applicable if:

• The total cash withdrawal across all accounts under your PAN exceeds Rs.20 Lakh* / Rs.1

Crore* in a financial year

• TDS will be charged on the amount withdrawn above Rs.20 Lakh* / Rs.1 Crore*

• The cash withdrawal limit for this financial year will be considered from April 1, 2021

• We will consider all your cash withdrawals at the Primary CRN (Customer Relationship

Number) level

• Rate of TDS will be as under:

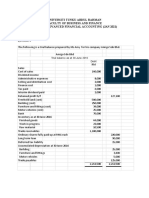

Aggregate cash withdrawals in all Income Tax Return copy Income Tax Return copy

accounts in a Financial Year submitted to bank NOT submitted to bank

Upto Rs.20 Lakh Nil Nil

Rs.20 Lakh to Rs.1 Crore Nil 2%**

In excess of Rs.1 Crore 2%** 5%**

The following entities are exempted from TDS on cash withdrawal:

• State and Central Government accounts

• Banking company or co-operative society engaged in carrying on the business of banking

or a post office

• Any white label automated teller machine operator of a banking company or co-operative

society engaged in carrying on the business of banking, in accordance with the

authorization issued by the Reserve Bank of India

• Business correspondent of a banking company or co-operative society engaged in

carrying on the business of banking

• Such other person(s) as the Central Government may notify

In order to avail higher cash withdrawal threshold for TDS, request you to submit

declaration along with ITR –V (Acknowledgement of filing of Income Tax Return)

pertaining to FY 2019-20, FY 2018-19 or FY 2017-18 to the nearest branch.

We request you to provide the declaration and ITR-V as mentioned above if you wish to avail

higher cash withdrawal threshold for TDS failing which lower threshold of Rs.20 Lakh will be

considered and corresponding TDS rate as mentioned in the above table will be applicable on

cash withdrawals above Rs.20 Lakh.

For any assistance, please feel free to visit the nearest Kotak Mahindra Bank branch.

Assuring you of our best services at all times.

Warm regards,

Team Kotak Mahindra Bank

#Income Tax Act,1961 - section 194N

**If PAN is not updated in the account then TDS deduction @ 20% as per section 206AA of the Income Tax Act

will apply. For foreign companies, foreign partnership firms, Non-residents additional surcharge and health &

education cess will be applicable as per Income Tax law.

*Income Tax Section- 194N requires customer to submit Income Tax returns for any of the earlier 3 years. For

example, For FY 21-22, customer will be required to submit ITR either of FY 2019-20, FY 2018-19 or FY 2017-

18.

Copyright & Disclaimer Privacy Policy

Please do not reply to this mail as this is an automated mail service..

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Cabria Cpa Review Center: Tel. Nos. (043) 980-6659Document2 pagesCabria Cpa Review Center: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Fringe Benefits Test BankDocument12 pagesFringe Benefits Test BankAB Cloyd100% (1)

- CIR V CA, CTA, YMCADocument2 pagesCIR V CA, CTA, YMCAChil Belgira100% (3)

- Udhayakumar Rice MillDocument12 pagesUdhayakumar Rice Millcachandhiran0% (1)

- FAQs On Cash Withdrawal TDSDocument2 pagesFAQs On Cash Withdrawal TDSSuryanarayana DNo ratings yet

- DownloadDocument3 pagesDownloadVansh AroraNo ratings yet

- E CircularDocument3 pagesE Circularkethan kumarNo ratings yet

- IT NotesDocument303 pagesIT NotesPaatrickNo ratings yet

- Tax Collection at Source (TCS) For Foreign Remittance Under Liberalised Remittance SchemeDocument2 pagesTax Collection at Source (TCS) For Foreign Remittance Under Liberalised Remittance SchemectrlshiftdelNo ratings yet

- Unit 5 TaxDocument15 pagesUnit 5 TaxVijay GiriNo ratings yet

- Amity Global Business School, PuneDocument15 pagesAmity Global Business School, PuneChand KalraNo ratings yet

- Intrim Union Budget 2019-20Document12 pagesIntrim Union Budget 2019-20Rukmani GuptaNo ratings yet

- Tds Rate Chart 13 14Document4 pagesTds Rate Chart 13 14rockyrrNo ratings yet

- Check New TDS Rules For PPF, Other Small Savings Schemes: What It CostsDocument1 pageCheck New TDS Rules For PPF, Other Small Savings Schemes: What It Costsdrrmm2sNo ratings yet

- 1.1 FAQ On Tax Collection at Source (TCS) For Remittance and International Debit Card TransactionsDocument6 pages1.1 FAQ On Tax Collection at Source (TCS) For Remittance and International Debit Card Transactionsspyadav25298No ratings yet

- Regd. Off.: ICICI Bank Limited, "Landmark", Race Course Circle, Vadodara - 390007, IndiaDocument2 pagesRegd. Off.: ICICI Bank Limited, "Landmark", Race Course Circle, Vadodara - 390007, Indiasrinureddy2014No ratings yet

- How To File TDS On The Sale of PropertyDocument12 pagesHow To File TDS On The Sale of PropertyManjukesanNo ratings yet

- Insertion of New Provisions in Tcs S&A Knowledge Series: Applicable From 1 OCTOBER 2020Document5 pagesInsertion of New Provisions in Tcs S&A Knowledge Series: Applicable From 1 OCTOBER 2020Shatir LaundaNo ratings yet

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyNo ratings yet

- Eligible Exemption FAQ FY 23-24 - Reference File For Income TaxDocument19 pagesEligible Exemption FAQ FY 23-24 - Reference File For Income Taxdabawa5345No ratings yet

- Tax Deducted at SourceDocument10 pagesTax Deducted at Sourceiamprateekx1No ratings yet

- Income Tax Return For Senior CityzenDocument27 pagesIncome Tax Return For Senior CityzenAbhay Singh100% (1)

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- TDS On Sale of Property by NRI in 2022 Complete GuideDocument7 pagesTDS On Sale of Property by NRI in 2022 Complete Guideoffice201 207No ratings yet

- Summary of Accounts Held Under Cust ID: 534668787 As On March 31, 2014Document2 pagesSummary of Accounts Held Under Cust ID: 534668787 As On March 31, 2014Vijay Prakash SinghNo ratings yet

- Advance Payment of TaxDocument15 pagesAdvance Payment of TaxPrakhar KesharNo ratings yet

- New TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inDocument7 pagesNew TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inCA Ranjan MehtaNo ratings yet

- Income Tax Return QuesDocument3 pagesIncome Tax Return QuesTax AdvisoryNo ratings yet

- Income Tax2022 GuidelinesDocument4 pagesIncome Tax2022 GuidelinesSANDEEP SAHUNo ratings yet

- TaxDocument28 pagesTaxMeenakshi SwaminathanNo ratings yet

- Recent Development of 194QDocument4 pagesRecent Development of 194QnamanojhaNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnganeshzenaNo ratings yet

- Taxguru - in-tDS Implication On Purchase of Property From NRIDocument7 pagesTaxguru - in-tDS Implication On Purchase of Property From NRIP Mathavan RajkumarNo ratings yet

- Portal Investment Proof Verification Guidelines 2022 23Document11 pagesPortal Investment Proof Verification Guidelines 2022 23yfiamataimNo ratings yet

- Income Tax Law & Practice Unit 4Document8 pagesIncome Tax Law & Practice Unit 4MuskanNo ratings yet

- Direct Taxation: CA M. Ram Pavan KumarDocument60 pagesDirect Taxation: CA M. Ram Pavan KumarSravyaNo ratings yet

- GST Presentation 15032019Document113 pagesGST Presentation 15032019Viky AkNo ratings yet

- E Filing Project MaterialDocument4 pagesE Filing Project MaterialMRPRITHWISH NATH.No ratings yet

- Chapter - 1 Computation of Tax LiabilityDocument6 pagesChapter - 1 Computation of Tax LiabilityNitin RajNo ratings yet

- Form 15G & 15H: Save Tds On Interest On FdsDocument6 pagesForm 15G & 15H: Save Tds On Interest On FdsShreekumarNo ratings yet

- GST Word 7Document62 pagesGST Word 7aparna aravamudhanNo ratings yet

- Presentation On Taxation of The Microfinance IndustryDocument23 pagesPresentation On Taxation of The Microfinance IndustryFranco DurantNo ratings yet

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Payment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumDocument1 pagePayment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumMadhan RajNo ratings yet

- Tax Deducted at Source IMPORTANT POINTSDocument2 pagesTax Deducted at Source IMPORTANT POINTSnABSAMNNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Withholding Taxes WHTDocument32 pagesWithholding Taxes WHTAsis KoiralaNo ratings yet

- GST TDSDocument14 pagesGST TDSdhruv MahajanNo ratings yet

- Top 20000 Private Corp. and Top 5000 Individual TaxpayersDocument7 pagesTop 20000 Private Corp. and Top 5000 Individual TaxpayersJolina HenoguinNo ratings yet

- Budget 2019 Key PointsDocument2 pagesBudget 2019 Key Pointsrathishsrk03No ratings yet

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- How To Deal With 206AADocument5 pagesHow To Deal With 206AAnamanojhaNo ratings yet

- Tax Assignment 1Document16 pagesTax Assignment 1Tunvir Islam Faisal100% (2)

- Know How Your Spending Are Traced by Income Tax DeptDocument2 pagesKnow How Your Spending Are Traced by Income Tax DeptAlagar Samy ANo ratings yet

- Income From Other SourcesDocument6 pagesIncome From Other Sourcesanusaya1988No ratings yet

- Account Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountDocument2 pagesAccount Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountKhushbu NanavatiNo ratings yet

- Service Charges, Fees, Terms and Conditions.: Together We ThriveDocument44 pagesService Charges, Fees, Terms and Conditions.: Together We ThriveClaude PassengerNo ratings yet

- Business and Income TaxationDocument58 pagesBusiness and Income TaxationFrancisNo ratings yet

- Reading Material Dec2020Document14 pagesReading Material Dec2020jyottsnaNo ratings yet

- TDSDocument2 pagesTDSGK TrustNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Property Twins Cashflow Spreadsheet - v0.5Document7 pagesProperty Twins Cashflow Spreadsheet - v0.5Vivek HandaNo ratings yet

- Taxation Law NotesDocument3 pagesTaxation Law NotesShivam TiwaryNo ratings yet

- Acc 201 CH 9Document7 pagesAcc 201 CH 9Trickster TwelveNo ratings yet

- Havi ExpressDocument24 pagesHavi Expressghulam hussainNo ratings yet

- Lesson 2 Tax Accounting PrinciplesDocument39 pagesLesson 2 Tax Accounting PrinciplesakpanyapNo ratings yet

- IT Card SaneepDocument4 pagesIT Card Saneephajabarala2008No ratings yet

- Elective II Income Tax LawDocument63 pagesElective II Income Tax Lawprof.jothisNo ratings yet

- Bachelor of Commerce: Bcoc - 136: Income Tax Law & PracticeDocument4 pagesBachelor of Commerce: Bcoc - 136: Income Tax Law & Practicesubhaa DasNo ratings yet

- A - Updated GYC Commercial Aerocity Yamuna Price List 19 11 2020-1Document1 pageA - Updated GYC Commercial Aerocity Yamuna Price List 19 11 2020-1Zama KazmiNo ratings yet

- Miscellaneous Invoice (EU00001032) Passport LifestyleDocument1 pageMiscellaneous Invoice (EU00001032) Passport LifestyleindiatoursNo ratings yet

- 04 Income From Business or Exercise of ProfessionDocument12 pages04 Income From Business or Exercise of ProfessionGabriel Paolo Orcine PilaNo ratings yet

- ACCOUNTANCYDocument176 pagesACCOUNTANCYSUDHA GADADNo ratings yet

- 001 F 1 F 7441653639019Document1 page001 F 1 F 7441653639019Prateeksha MishraNo ratings yet

- Chapter Four AssignmentDocument8 pagesChapter Four AssignmentUrBaN-xGaMeRx TriicKShOtZNo ratings yet

- Accounting - SystemsDocument3 pagesAccounting - Systems2K19/EE/151 MANIKA JAINNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1Document5 pagesUniversiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1KAY PHINE NGNo ratings yet

- Chapter 6 - Time of SupplyDocument7 pagesChapter 6 - Time of SupplyDrafts StorageNo ratings yet

- 2019 John S. and James L. Knight Foundation 990 PF Public DisclosureDocument374 pages2019 John S. and James L. Knight Foundation 990 PF Public DisclosureNatalie Winters0% (1)

- Incometax Automatic Calculator With Form-16 For 2017-18 EDNNET Version 8.3Document30 pagesIncometax Automatic Calculator With Form-16 For 2017-18 EDNNET Version 8.3ragvijNo ratings yet

- Exam On CH 11fswfwrfDocument5 pagesExam On CH 11fswfwrfkareem abozeedNo ratings yet

- Training GuideDocument9 pagesTraining GuideVishal AgarwalNo ratings yet

- Second Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not ADocument2 pagesSecond Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not AAllen KateNo ratings yet

- Sobha Royal Pavilion Wing 16013Document1 pageSobha Royal Pavilion Wing 16013piyush08No ratings yet

- Sec 107 VatDocument3 pagesSec 107 VatPatti Ramos-SysonNo ratings yet

- USLAI Financial SchedulesDocument1 pageUSLAI Financial SchedulesDavid FlowersNo ratings yet

- Income Taxation 2 Bsa 2Document259 pagesIncome Taxation 2 Bsa 2Jaycie Escuadro100% (1)